The end of the current year and the beginning of the next for individuals and legal entities is the time to pay budget fees. It’s easier for organizations, private companies, and individual entrepreneurs: there are a huge number of specialized portals that explain the deadlines, the procedure for paying budget fees and explain changes in tax legislation in a timely manner.

It’s more difficult for ordinary citizens: once a year they have to learn the basics of accounting, tax law, and also figure out which year to pay the transport tax in 2021, and when to pay other fees.

Procedure for submitting income tax returns

It is necessary to report profit for 2021 in the form approved by Order of the Federal Tax Service of the Russian Federation dated October 19, 2016 No. ММВ-7-3 / [email protected] If the average number of personnel for the last year did not exceed 100 people, then the declaration can be submitted on paper (clause 3 Article 80 of the Tax Code of the Russian Federation).

The deadline for submitting the annual declaration is the same for all organizations - no later than March 28 of the year following the current one. In this regard, the declaration for 2021 is submitted no later than March 28, 2019 (Clause 4 of Article 289 of the Tax Code of the Russian Federation).

At the same time, the specific deadlines for submitting the declaration for the reporting periods depend on how the advances:

1) monthly, based on actual profit: advance payments are paid and the declaration is submitted monthly until the 28th, the reporting periods in this case will be a month, 2 months, 3 months and so on until the end of the calendar year;

2) quarterly: advance payments are determined based on the results of the quarter, half a year, 9 months; In the current year, the deadlines for filing a declaration and paying quarterly advances are as follows:

- for the first quarter - no later than April 29, 2019 (including weekends);

- for half a year - no later than July 29, 2019 (including weekends);

- for 9 months - no later than October 28, 2019.

Personal income tax on vacation and sick leave benefits

In general, personal income tax must be transferred from wages no later than the day following the date of payment. For example, the employer paid the salary for January 2021 on February 6, 2021. In this case, income was received on January 31. The tax must be withheld on February 6th. And the last date when personal income tax needs to be transferred to the budget is February 7, 2021.

However, personal income tax withheld from temporary disability benefits, benefits for caring for a sick child, as well as from vacation pay must be transferred no later than the last day of the month in which the income was paid. For example, an employee goes on vacation from January 25 to February 15, 2021. Vacation pay was paid to him on January 20. In this case, consider the income received on the date of issuance of vacation pay - January 20. Tax must be withheld from the payment on the same day. And personal income tax must be transferred to the budget no later than January 31, 2018. Below we provide a table with the deadlines for paying personal income tax on vacation and sick leave benefits in 2021.

Deadlines for paying personal income tax on vacation and sick pay in 2018

| For January 2021 | No later than 01/31/2018 |

| For February 2021 | No later than 02/28/2018 |

| For March 2021 | No later than 04/02/2018 |

| For April 2021 | No later than 05/03/2018 |

| For May 2021 | No later than 05/31/2018 |

| For June 2021 | No later than 07/02/2018 |

| For July 2021 | No later than July 31, 2018 |

| For August 2021 | No later than 08/31/2018 |

| For September 2021 | No later than 01.10.2018 |

| For October 2021 | No later than 10/31/2018 |

| For November 2021 | No later than November 30, 2018 |

How to pay advance payments and income taxes

The Tax Code of the Russian Federation provides for 3 methods of paying advances:

- based on the results of the first quarter, half a year and 9 months, plus monthly advance payments within each quarter (the method is common to all organizations);

- based on the results of the first quarter, half a year and 9 months without paying monthly advance payments (clause 3 of Article 286 of the Tax Code of the Russian Federation): it is used by those companies whose sales income over the previous four quarters did not exceed an average of 15 million rubles for each quarter ( 60 million rubles per year), as well as budgetary, autonomous institutions, non-profit organizations that do not have income from sales;

- at the end of each month, based on the actual profit received, the Federal Tax Service must be informed about its application by December 31 of the year preceding the tax period in which the transition to such an advance payment system takes place.

Letter of the Ministry of Finance of the Russian Federation dated March 3, 2017 No. 03-03-07/12170.

How to report if there are separate divisions

As a general rule, a “profitable” declaration is submitted by the organization to the Federal Tax Service at the location of its location and at the location of each separate division (clause 1 of Article 289 of the Tax Code of the Russian Federation).

At the location of the organization, a declaration is submitted, drawn up for the organization as a whole with the distribution of profits among separate divisions (SU). That is, in addition to those declaration sheets that are common to all taxpayers, Appendix No. 5 to sheet 02 of the declaration is filled out in an amount corresponding to the number of existing OPs (including those closed in the current tax period).

If the organization’s divisions are located on the territory of one subject of the Russian Federation, you can decide to pay tax (advance payments) for this group of enterprises through one of them (clause 2 of Article 289 of the Tax Code of the Russian Federation).

Organizations that pay tax (advance payments) for a group of EP through the responsible division submit declarations to the tax authorities at the place of registration of the organization (head office) and at the place of registration of the responsible OP.

If the organization itself (head office) and its subsidiaries are located in the same region, then profits do not need to be distributed to each of them. An organization has the right to pay tax for its OP.

If the parent company pays income tax for its divisions, it has the right to submit a declaration to the Federal Tax Service only at its location.

However, if a company decides to change the tax payment procedure or adjusts the number of structural divisions on the territory of the subject, or other changes occur that affect the tax payment procedure, then this should be reported to the inspectorate.

Letter of the Ministry of Finance of the Russian Federation dated July 3, 2017 No. 03-03-06/1/41778.

Editor's note:

a different procedure for filing declarations is also provided for the largest taxpayers. They submit all declarations, including those regarding OP, to the inspectorate, where they are registered as the largest taxpayers (clause 3 of article 80, clause 1 of article 289 of the Tax Code of the Russian Federation).

In this case, information about the income tax attributable to the OP is reflected in Appendix No. 5 to sheet 02 of the tax return, that is, the procedure for filling out the declaration does not change.

If you haven't received a notification

Where can I find out the tax amount if the tax notice has not arrived and there is no access to the Internet?

Alexey Laschenov, head of the property tax department of the Federal Tax Service of Russia: You can personally contact any tax office, write an application and receive a notification.

Since 2021, a joint project of the Federal Tax Service with multifunctional centers of state municipal services has been implemented. You can apply for notification there. But first you should make sure whether your MFC has concluded an agreement with the tax authorities.

In some cases, tax notices are not sent at all. For example, if a person has a benefit that completely exempts him from paying tax. Or if the payment amount is less than 100 rubles.

To users of the “personal account” on the Federal Tax Service website, tax payment notifications are sent only in electronic form. They are not sent by regular mail.

If you do not have these three exceptions: you are not a beneficiary, do not use a “personal account”, the estimated tax amount is more than 100 rubles, and you, as the owner of an apartment, house, car, have still not received a tax notice, you need to inform in any way about this to the tax inspectorate.

If a minor owns property, does he have to pay tax?

Alexey Laschenov: The obligation to pay tax does not depend on age. If a minor owns real estate or transport, these objects are subject to tax.

The obligation to pay tax for a minor is fulfilled by his legal representative. That is, father or mother, adoptive parent, guardian. He pays the tax according to the notification sent. If it has not arrived, the legal representative must contact the tax office. He can also open a “personal account” for a minor on the Federal Tax Service website. Notifications indicating taxable objects will be sent there, and taxes can be paid there.

What to consider when filling out your income tax return

All companies paying income tax submit a “profitable” declaration at the end of each reporting period and year, which includes:

- title page;

- subsection 1.1 of section 1;

- sheet 02;

- Appendix No. 1 to sheet 02;

- Appendix No. 2 to sheet 02.

In addition, you will have to fill out, in particular:

- subsection 1.2 of section 1 - when paying monthly advance payments within quarters;

- subsection 1.3 of section 1 (with type of payment “1”), sheet 03 (with attribute of ownership “A”) - when paying dividends to other organizations;

- Appendix No. 3 to sheet 02 - including when selling depreciable property;

- Appendix No. 1 to the declaration - including if there are expenses for voluntary health insurance and employee training.

Line 290 of sheet 02 of the declaration is filled out by organizations paying quarterly advance payments plus monthly advance payments within each quarter.

There they show the total amount of monthly advances due in the next quarter. In this line in the declaration:

- for the first quarter: the indicator of line 180 of sheet 02 of the same declaration is indicated;

- for the half-year: the difference between lines 180 of sheet 02 of the declaration for the half-year and the first quarter, which is greater than 0, is entered, in other cases (less than or equal to 0) a dash is entered;

- for 9 months: the difference between lines 180 of sheet 02 of the declaration for 9 months and half a year is shown, if it is more than 0, in other cases - a dash;

- for the year: put a dash.

The amount of loss received at the end of the year is reflected in the declaration for the current year:

- on line 060 of sheet 02;

- according to line 160 of Appendix No. 4 to sheet 02.

Trade tax on the territory of Moscow

The trading fee must be determined and paid every quarter. There are no reporting periods for the trade fee. Transfer the calculated amount of the trading fee to the budget no later than the 25th day of the month following the taxable period (quarter).

Trade tax payment deadlines in 2021

| Deadlines for payment of trade tax in 2018 | |

| For the fourth quarter of 2021 | No later than 01/25/2018 |

| For the first quarter of 2021 | No later than 04/25/2018 |

| For the second quarter of 2021 | No later than July 25, 2018 |

| For the third quarter of 2021 | No later than October 25, 2018 |

How to carry forward losses from previous years

This must be done according to the new rules.

From January 1, 2017 (to December 31, 2020), the procedure for reducing the tax base for losses of previous years has been changed:

- a restriction on such reduction has been introduced: the tax base can be reduced by no more than 50 percent (the restriction does not apply to tax bases to which certain reduced tax rates apply);

- The restriction on the transfer period has been removed (previously it was possible to transfer only within 10 years);

- The new procedure applies to losses received for tax periods starting from January 1, 2007.

Taking this into account, the following line indicators must be filled in the declaration:

- 110 of sheet 02 and 010, 040-130, 150 of Appendix No. 4 thereto: in particular, the amount on line 150 (the amount of loss that reduces the base) cannot be more than 50 percent of the amount on line 140 (tax base);

- 080 sheet 05;

- 460, 470, 500, 510 sheet 06: the sum of lines 470 and 510 (the amount of recognized loss) must be less than or equal to 50 percent of the amount on lines 450 and 490 (tax base from investments).

In the tax return for the profit tax of a foreign organization (form approved by Order of the Ministry of Taxes of the Russian Federation dated January 5, 2004 No. BG-3-23/1), the amount of losses that reduce the tax base for the current period is indicated on line F (code 300) of section 5, taking into account application of new provisions.

Letter of the Federal Tax Service of the Russian Federation dated January 09, 2017 No. SD-4-3/ [email protected] “On changing the procedure for accounting for losses of past tax periods.”

Editor's note:

When a loss is carried forward by its amount, the profit of the reporting (tax) period is reduced, reflected on line 100 of sheet 02 of the declaration and on line 140 of Appendix No. 4 to sheet 02 of the declaration, which is filled out only in the declaration for the first quarter of the year to which the loss is transferred , and for this year.

How to show insurance premiums in your income tax return

The organization independently determines and establishes the list of direct expenses in its accounting policies. In Appendix No. 2 to sheet 02 of the income tax return, line:

- 041 - only contributions to compulsory health insurance, compulsory medical insurance, VNIiM from the salaries of administrative and managerial personnel are reflected;

- 010 - insurance premiums from the salaries of production workers.

Indirect costs are costs associated with the production and sale of products (works, services), which can be included in expenses in the period in which they are incurred.

All costs that are not classified as direct expenses in the accounting policy and are not non-operating expenses are recognized as indirect. In the income tax return, the total amount of indirect expenses is indicated on line 040 of Appendix No. 2 to sheet 02 (clause 7.1 of the Procedure for filling out the income tax return). Such expenses are partially deciphered according to lines 041-055 of Appendix No. 2 to sheet 02.

Line 041 reflects taxes (advance payments for them), fees and insurance premiums taken into account in other expenses (clause 1, clause 1, article 264 of the Tax Code of the Russian Federation, clause 7.1 of the Procedure for filling out the declaration, letter of the Federal Tax Service of the Russian Federation dated 04/11/2017 No. SD -4-3/ [email protected] ). This:

- transport tax;

- property tax (based on both book value and cadastral value);

- land tax;

- restored VAT, which according to the Tax Code is taken into account in other expenses (for example, tax restored when receiving an exemption from VAT under Article 145 of the Tax Code of the Russian Federation (clauses 2, 6, clause 3, Article 170 of the Tax Code of the Russian Federation);

- state duty;

- contributions to compulsory public health insurance;

- compulsory medical insurance contributions;

- contributions to VNiM.

When filling out line 041 of the declaration for the reporting (tax) period, the organization indicates in it the amount of all taxes (advance payments for them) accrued during this period, fees and insurance premiums on an accrual basis, regardless of the date of their payment to the budget (letter of the Ministry of Finance of the Russian Federation dated September 12, 2016 No. 03-03-06/2/53182).

Please note that line 041 of Appendix No. 2 to sheet 02 of the income tax return is not reflected:

1) taxes (advance payments thereon) and other obligatory payments that cannot be taken into account in tax expenses:

- income tax;

- UTII;

- VAT presented to the buyer (purchaser) of goods (works, services);

- payments for emissions of pollutants in excess of standards;

- trade fee;

2) contributions for injuries.

The amounts of insurance premiums are included when generating the indicator for the specified line, starting with the tax return for the first reporting period of 2021. When drawing up a declaration for 2021, they are not included in this indicator (letter of the Federal Tax Service of the Russian Federation dated 04/11/2017 No. SD-4-3 / [email protected] ).

The entire amount indicated on line 041 is then included in line 040 of Appendix No. 2 to sheet 02 of the declaration (that is, in the total amount of indirect expenses).

Direct costs are costs associated with the production of products (works, services), which can be included in expenses only during the period of sale of products (works, services) (clause 2 of Article 318 of the Tax Code of the Russian Federation).

The organization determines and consolidates the list of direct expenses in its accounting policies independently (letter of the Ministry of Finance of the Russian Federation dated March 13, 2017 No. 03-03-06/1/13785).

According to the recommendations of the Ministry of Finance of the Russian Federation and the Federal Tax Service of the Russian Federation, direct expenses include all costs that form the cost of products (works, services) in accounting (letter of the Ministry of Finance of the Russian Federation dated May 14, 2012 No. 03-03-06/1/247, Federal Tax Service of the Russian Federation dated February 24. 2011 No. KE-4-3/ [email protected] ).

Thus, the composition of direct costs in the production of products (works, services) includes at least the following types of costs (clause 1 of Article 318 of the Tax Code of the Russian Federation):

- raw materials and materials that form the basis of products;

- wages of employees directly involved in production, as well as mandatory insurance contributions accrued on it;

- depreciation accrued on fixed assets directly used in the production of products (works, services).

When producing products (works, services), the total amount of direct expenses that are taken into account for profit tax purposes in the reporting (tax) period is reflected in the income tax return on line 010 of Appendix No. 2 to sheet 02 on an accrual basis from the beginning of the year (clause 2.1, 7.1 Procedure for filling out the declaration).

When reporting all expenses on line 010, the organization must keep in mind that it will have to provide all documentation as evidence of the need for the types of expenses incurred.

Thus, according to the income tax return line:

- 041 - only contributions to compulsory health insurance, compulsory medical insurance, VNIiM from the salaries of administrative and managerial personnel are reflected;

- 010 - insurance premiums from the salaries of production workers.

The indicators of lines 010, 020 and 040 of Appendix No. 2 to Sheet 02 are included in the indicator of Line 130 of Appendix No. 2 to Sheet 02, which reflects the expenses recognized by the organization for profit tax purposes. The value of line 130 of Appendix No. 2 to sheet 02 is transferred to line 030 of sheet 02 of the tax return (clause 5.2 of the Procedure for filling out the income tax return).

Tax calendar for 2021: reporting deadlines

We present to your attention the reporting calendar for 2018. For the convenience of visitors, the information is collected in a table. The calendar is very extensive, so for more convenient use, we advise you to select those reports that relate to your activities. The third column indicates which organizations or individual entrepreneurs submit a specific report.

| Deadline for submission | Title of the report and receiving authority | Who rents |

| January 9 | Declaration of mineral extraction tax for December 2021 to the Federal Tax Service | Legal entities - subsoil users |

| January 15 | Report on the generation, use, neutralization and disposal of waste (except for statistical reporting) for 2021 in the Technical Specifications for Natural Resources and Ecology | Legal entities and individual entrepreneurs whose work generates waste |

| January 15 | SZV-M for December 2021 in the Pension Fund of Russia | Legal entities and individual entrepreneurs with employees |

| January 22 | Unified simplified tax return for the 4th quarter of 2021 to the Federal Tax Service | Legal entities and individual entrepreneurs that did not operate during the reporting period |

| January 22 | Information on the average headcount for 2021 at the Federal Tax Service | Legal entities and individual entrepreneurs who hired workers during this period |

| January 22 | Declaration of water tax for 2021 to the Federal Tax Service | Legal entities and individual entrepreneurs using water bodies |

| January 22 | Declaration on UTII for 2021 to the Federal Tax Service | Legal entities and individual entrepreneurs |

| January 22 | DSV-3 for the 4th quarter of 2021 in the Pension Fund of Russia | Legal entities and individual entrepreneurs who pay additional contributions to the funded part of the pension |

| January 22 | Journal of accounting of received and issued invoices for the 4th quarter of 2021 in electronic form in the Federal Tax Service | The following legal entities and individual entrepreneurs:

|

| January 22 | Declaration of indirect taxes for December 2021 to the Federal Tax Service | Legal entities and individual entrepreneurs paying VAT and excise taxes in the process of importing goods into Russia from their EAEU member states |

| January 22 | 4-FSS (paper) for 2021 in the FSS | Legal entities and individual entrepreneurs with hired employees, numbering less than 25 people |

| The 25th of January | 4-FSS (electronic) for 2021 in the FSS | Legal entities and individual entrepreneurs with employees of 25 or more people |

| The 25th of January | VAT return for the 4th quarter of 2021 to the Federal Tax Service | The following legal entities and individual entrepreneurs:

|

| January 30 | Unified calculation of insurance premiums to the Federal Tax Service | Legal entities and individual entrepreneurs with employees |

| January 31 | Declaration of mineral extraction tax for December 2021 to the Federal Tax Service | Legal entities and individual entrepreneurs - subsoil users |

| 1st of February | 2 TP-waste in Rosprirodnadzor technical specifications | Legal entities and individual entrepreneurs involved in waste management |

| 1st of February | Transport tax return for 2021 to the Federal Tax Service | Legal entities to which vehicles are registered |

| 1st of February | Tax return for land tax for 2021 to the Federal Tax Service | Legal entities - owners of land plots |

| February, 15 | SZV-M for January 2021 in the Pension Fund of Russia | Legal entities and individual entrepreneurs with employees |

| February 20th | Declaration of indirect taxes for January 2021 to the Federal Tax Service | Legal entities and individual entrepreneurs paying VAT in connection with the import of products to Russia from EAEU member countries |

| 28th of February | Income tax return for January 2021 to the Federal Tax Service | Legal entities with income of more than 15 million rubles for the last quarter during the last year submit a declaration and pay tax monthly |

| 28th of February | Tax calculation for income tax for January 2021 at the Federal Tax Service | Legal entities-tax agents, calculating monthly advance payments based on actual profit received |

| 28th of February | Declaration on mineral extraction tax for January 2021 to the Federal Tax Service | Legal entities and individual entrepreneurs - subsoil users |

| March 1 | SVZ-STAZH for 2021 in the Federal Tax Service | Legal entities and individual entrepreneurs with employees |

| March 1 | Information about the impossibility of withholding tax, the amount of income from which tax was not withheld, and the amount of tax not withheld for 2017 in the Federal Tax Service | Legal entities and individual entrepreneurs - tax agents for personal income tax |

| 10th of March | Declaration of payment for negative environmental impact for 2021 to Rosprirodnadzor | Legal entities and individual entrepreneurs obligated to pay fees for negative impact on the environment |

| March 15th | SZV-M for February 2021 in the Pension Fund of Russia | Legal entities and individual entrepreneurs with employees |

| 20th of March | Declaration of indirect taxes for February 2021 to the Federal Tax Service | Legal entities and individual entrepreneurs paying VAT in connection with the import of products to Russia from EAEU member countries |

| March 28 | Income tax return for 2021 to the Federal Tax Service | Legal entities, regardless of the procedure for paying advance payments |

| March 28 | Income tax return for February 2021 to the Federal Tax Service | Legal entities paying advance payments based on actual profit received |

| March 28 | Annual report on corporate income tax activities in the Russian Federation for 2021 to the Federal Tax Service | Foreign organizations operating in Russia through a permanent representative office |

| 30th of March | Property tax return for 2021 to the Federal Tax Service | Legal entities - property owners |

| April 2 | Annual financial statements for 2021 to the Federal Tax Service | Legal entities required to maintain accounting records |

| April 2 | Auditor's report along with the annual financial statements for 2021 to the Federal Tax Service | Legal entities subject to mandatory audit |

| April 2 | Declaration under the simplified tax system for 2021 to the Federal Tax Service | Legal entities on the simplified tax system |

| April 2 | Declaration on Unified Agricultural Tax for 2021 to the Federal Tax Service | Legal entities and individual entrepreneurs – agricultural producers |

| April 2 | 6-NDFL for 2021 at the Federal Tax Service | Legal entities and individual entrepreneurs who are tax agents for personal income tax |

| April 2 | 2-NDFL for 2021 at the Federal Tax Service | Legal entities and individual entrepreneurs who are tax agents for personal income tax |

| April 16 | SZV-M for March 2021 in the Pension Fund of Russia | Legal entities and individual entrepreneurs with employees |

| April 16 | Documents confirming the type of activity in the Social Insurance Fund | Legal entities registered in 2021 or earlier |

| 20 April | Declaration of water tax for the 1st quarter of 2021 to the Federal Tax Service | Legal entities that have water bodies |

| 20 April | Declaration on UTII for the 1st quarter of 2021 to the Federal Tax Service | Legal entities and individual entrepreneurs using UTII |

| 20 April | Journal of accounting of received and issued invoices for the 1st quarter of 2021 in electronic form in the Federal Tax Service | Legal entities and individual entrepreneurs of the following categories:

|

| 20 April | Unified simplified tax return for the 1st quarter of 2021 to the Federal Tax Service | Legal entities and individual entrepreneurs that do not have taxable objects |

| 20 April | 4-FSS for the 1st quarter of 2021 on paper in the FSS | Legal entities and individual entrepreneurs employing employees of less than 25 people |

| 25th of April | VAT return for the 1st quarter of 2021 to the Federal Tax Service | Legal entities and individual entrepreneurs, tax agents who are exempt from taxpayer duties or are not payers and organizations selling goods and services exempt from taxation |

| 25th of April | 4-FSS for the 1st quarter of 2021 in electronic form in the FSS | Legal entities and individual entrepreneurs with employees of more than 25 people |

| April 28 | Income tax return for the 1st quarter of 2021 to the Federal Tax Service | Legal entities that report quarterly |

| April 28 | Income tax return for March 2021 to the Federal Tax Service | Legal entities that report monthly |

| April 28 | Tax calculation for income tax for March or 1st quarter of 2018 at the Federal Tax Service | Legal entities that are tax agents for income tax |

| April 30 | Declaration of the simplified tax system for 2021 | Individual entrepreneurs using the simplified tax system |

| May 3 | 6-NDFL for the 1st quarter of 2021 in the Federal Tax Service | Legal entities and individual entrepreneurs - tax agents for personal income tax |

| May 3 | Unified calculation of insurance premiums for the 1st quarter of 2021 at the Federal Tax Service | Legal entities and individual entrepreneurs, with employees |

| May 3 | Calculation of property tax on advance payments for the 1st quarter of 2018 to the Federal Tax Service | Legal entities that are tax payers |

| May 15 | SZV-M for April 2021 in the Pension Fund of Russia | Legal entities and individual entrepreneurs with employees |

| May 21st | Notification of controlled transactions for 2021 to the Federal Tax Service | Legal entities and individual entrepreneurs, if controlled transactions took place |

| May 28 | Income tax return for April 2021 to the Federal Tax Service | Legal entities that report monthly |

| May 28 | Tax calculation for income tax for April 2021 at the Federal Tax Service | Legal entities that are tax agents, calculating monthly advance payments based on actual profit received |

| June 15 | SZV-M for May 2021 in the Pension Fund of Russia | Legal entities and individual entrepreneurs with employees |

| July 15 | SZV-M for June 2021 in the Pension Fund of Russia | Legal entities and individual entrepreneurs with employees |

| July 20 | 4-FSS for the first half of 2021 on paper in the FSS | Legal entities and individual entrepreneurs with employees of less than 25 people |

| July 20 | Declaration of water tax for the 2nd quarter of 2021 to the Federal Tax Service | Legal entities and individual entrepreneurs with water bodies |

| July 20 | Unified simplified tax return for the 2nd quarter of 2021 to the Federal Tax Service | Legal entities and individual entrepreneurs in the absence of taxable objects |

| July 20 | Declaration on UTII for the 2nd quarter of 2021 to the Federal Tax Service | Legal entities and individual entrepreneurs using UTII |

| July 20 | Journal of accounting of received and issued invoices for the 2nd quarter of 2021 in electronic form in the Federal Tax Service | Legal entities and individual entrepreneurs of the following categories:

|

| July 25 | 4-FSS for the first half of 2021 in electronic form in the FSS | Legal entities and individual entrepreneurs with employees of more than 25 people |

| July 25 | VAT return for the 2nd quarter of 2021 to the Federal Tax Service | Legal entities and individual entrepreneurs who are tax agents, companies that are exempt from taxpayer obligations or are not payers and organizations that sell goods and services exempt from taxation |

| July 30 | Income tax return for the 2nd quarter of 2021 to the Federal Tax Service | Legal entities that report quarterly |

| July 30 | Income tax return for June 2021 to the Federal Tax Service | Legal entities that report monthly |

| July 30 | Tax calculation for income tax for June or the 2nd quarter of 2018 at the Federal Tax Service | Legal entities - tax agents for income tax |

| July 30 | Unified calculation of insurance premiums for the first half of 2021 at the Federal Tax Service | Legal entities and individual entrepreneurs with employees |

| July 30 | Calculation of property tax on advance payments for the 2nd quarter of 2018 to the Federal Tax Service | Legal entities that are tax payers |

| July 31 | 6-NDFL for the first half of 2021 at the Federal Tax Service | Legal entities and individual entrepreneurs who are tax agents for personal income tax |

| August 15 | SZV-M for July 2021 in the Pension Fund of Russia | Legal entities and individual entrepreneurs with employees |

| August 28 | Income tax return for July 2021 to the Federal Tax Service | Legal entities that report monthly |

| August 28 | Tax calculation for income tax for July 2021 at the Federal Tax Service | Legal entities that are tax agents for income tax |

| September 15th | SZV-M for August 2021 in the Pension Fund of Russia | Legal entities and individual entrepreneurs using hired labor |

| September 28 | Income tax return for August 2021 to the Federal Tax Service | Legal entities that report monthly |

| September 28 | Tax calculation for income tax for August 2021 at the Federal Tax Service | Legal entities classified as tax agents for income tax |

| October 15 | SZV-M for September 2021 in the Pension Fund of Russia | Legal entities and individual entrepreneurs with employees |

| 22 of October | Unified simplified tax return for the 3rd quarter of 2021 to the Federal Tax Service | Legal entities and individual entrepreneurs that do not have taxable objects |

| 22 of October | Declaration of water tax for the 3rd quarter of 2021 to the Federal Tax Service | Legal entities and individual entrepreneurs who have water bodies |

| 22 of October | Declaration on UTII for the 3rd quarter of 2021 to the Federal Tax Service | Legal entities and individual entrepreneurs using UTII |

| 22 of October | Journal of accounting of received and issued invoices for the 3rd quarter of 2021 in electronic form in the Federal Tax Service | Legal entities and individual entrepreneurs of the following categories:

|

| 22 of October | 4-FSS for 9 months of 2021 on paper in the FSS | Legal entities and individual entrepreneurs with employees of less than 25 people |

| the 25th of October | VAT return for the 3rd quarter of 2021 to the Federal Tax Service | Legal entities and individual entrepreneurs, tax agents, companies that are exempt from taxpayer obligations or are not payers and organizations selling goods and services |

| the 25th of October | 4-FSS for the first half of 2021 in electronic form in the FSS | Legal entities and individual entrepreneurs with employees of more than 25 people |

| 29th of October | Income tax return for September or the 3rd quarter of 2018 to the Federal Tax Service | Legal entities that report monthly |

| 29th of October | Tax calculation for income tax for September or the 3rd quarter of 2018 at the Federal Tax Service | Legal entities - tax agents for income tax |

| October 30 | Unified calculation of insurance premiums for 9 months of 2021 at the Federal Tax Service | Legal entities and individual entrepreneurs with employees |

| October 30 | Calculation of property tax on advance payments for the 3rd quarter of 2018 | Legal entities - tax payers |

| October 31 | 6-NDFL for 9 months of 2021 at the Federal Tax Service | Legal entities and individual entrepreneurs who are tax agents for personal income tax |

| 15th of November | SZV-M for October 2021 in the Pension Fund of Russia | Legal entities and individual entrepreneurs with employees |

| November 28 | Income tax return for October 2021 to the Federal Tax Service | Legal entities that report monthly |

| November 28 | Tax calculation for income tax for October 2021 at the Federal Tax Service | Legal entities - tax agents for income tax |

| December 17 | SZV-M for November 2021 in the Pension Fund of Russia | Legal entities and individual entrepreneurs with employees |

| December 28th | Income tax return for November 2021 to the Federal Tax Service | Legal entities that report monthly |

| December 28th | Tax calculation for income tax for November 2021 at the Federal Tax Service | Legal entities - tax agents for income tax |

How to show symmetrical adjustments in the declaration

When reflecting symmetrical adjustments in sheet 08 of the declaration (provided that code 2 or 3 is indicated in the “Type of adjustment” attribute):

- in column 3 “Attribute” the number 0 is entered if the adjustments made led to a decrease in sales income (line 010 of sheet 08)/non-operating income (line 020 of sheet 08);

- in column 3 “Attribute” the number 1 is entered if the adjustments made led to an increase in expenses that reduce the amount of income from sales (line 030 of sheet 08) / non-operating expenses (line 040).

In this case, in sheet 08 you do not need to enter 0 or 1 in column 3 “Sign” on line 050. On this line you should indicate the total amount of the adjustment without taking into account the sign.

Letter of the Federal Tax Service of the Russian Federation dated October 24, 2017 No. SD-4-3/ [email protected]

How to adjust profits if a transaction is invalid

In 2015, the bank made a real estate sale transaction, which the court later declared invalid.

Due to the recognition of the transaction as invalid in accordance with clause 2 of Art. 167 of the Civil Code of the Russian Federation, the bank was obliged to reimburse the buyer for everything he paid. Consequently, the bank lost profit from the transaction. The bank submitted an update on its profits for 2015. Since Article 81 of the Tax Code gives the right to submit adjusted reports if errors were made in the declaration, which led to an overpayment of tax to the budget.

According to the Federal Tax Service of the Russian Federation, in this case the bank acted lawfully.

Letter of the Federal Tax Service of the Russian Federation dated November 28, 2017 No. SD-4-3/ [email protected]

How to include separate income and expenses in the “profitable” base

The Ministry of Finance of the Russian Federation has published a number of letters explaining the tax accounting procedure for certain income and expenses.

Work records

When purchasing work books, their cost is taken into account in tax and accounting expenses (letter of the Federal Tax Service of the Russian Federation dated June 23, 2015 No. GD-4-3 / [email protected] ).

Income not taken into account when determining the tax base is defined in Art. 251 Tax Code of the Russian Federation. The list of such income is exhaustive. The fee charged to the employee for the provision of work books or inserts is not mentioned in this article. This means that the indicated income is subject to income tax in the generally established manner (letter of the Ministry of Finance of the Russian Federation dated May 19, 2017 No. 03-03-06/1/30818). The amount received from the employee to reimburse the cost of the work book must be taken into account for tax purposes in non-operating income (letter of the Ministry of Finance of the Russian Federation dated May 19, 2017 No. 03-03-06/1/30818).

Salary

The list of labor costs is unlimited

To be recognized for profit tax purposes, expenses must be economically justified, documented, and incurred for activities aimed at generating income. Expenses that do not meet these requirements are not taken into account.

According to Art. 255 of the Tax Code of the Russian Federation, labor costs include any accruals to employees provided for by the legislation of the Russian Federation, labor and (or) collective agreements.

The list of labor costs is open. These, according to paragraph 25 of this article, also include other types of expenses in favor of the employee, provided that they are provided for by the labor and (or) collective agreement.

Therefore, any types of labor costs incurred on the basis of local regulations of the organization can be recognized, subject to compliance with the criteria specified in paragraph 1 of Art. 252 of the Tax Code of the Russian Federation, and provided that such expenses are not specified in Art. 270 of the Tax Code of the Russian Federation (letter of the Ministry of Finance of the Russian Federation dated May 19, 2017 No. 03-03-06/1/30842).

Awards

Bonuses for production results are included in labor costs (clause 2 of Article 255 of the Tax Code of the Russian Federation).

At the same time, as follows from Art. 129 of the Labor Code of the Russian Federation, incentive payments are elements of the remuneration system in an organization, which are established by collective agreements, agreements, and local regulations of the company.

The employer has the right to encourage employees who conscientiously perform their job duties: express gratitude, give a bonus, award a valuable gift, a certificate of honor, nominate them for the title of the best in the profession (Article 191 of the Labor Code of the Russian Federation). Other types of employee incentives for work are determined by a collective agreement or internal labor regulations, as well as charters and discipline regulations.

However, for accounting for such expenses, the restrictions established by Art. 270 Tax Code of the Russian Federation. Thus, remunerations paid to management or employees and not specified in employment contracts, as well as bonuses paid from the company’s net profit, are not taken into account when determining the profit base.

Therefore, bonuses to employees can be taken into account in expenses if the procedure, amount and conditions of payment are provided for by the local regulations of the organization, and are not specified in Art. 270 of the Tax Code of the Russian Federation (letter of the Ministry of Finance of the Russian Federation dated April 17, 2017 No. 03-03-06/2/22717).

Bonuses paid on holidays are not recognized as expenses, since they are not related to the production results of employees (letters of the Ministry of Finance of the Russian Federation dated 07/09/2014 No. 03-03-06/1/33167, dated 04/24/2013 No. 03-03-06/ 1/14283, dated 03/15/2013 No. 03-03-10/7999).

Sport

For income tax purposes, expenses that are economically justified and documented are taken into account. An exception is the expenses listed in Art. 270 Tax Code of the Russian Federation.

If events aimed at developing physical culture and sports in work collectives are carried out outside working hours and are not related to the production activities of employees, these expenses are not taken into account in the tax base (letter of the Ministry of Finance of the Russian Federation dated July 17, 2017 No. 03-03-06/1 /45234).

Foreign taxes

Any expenses are recognized as expenses if they are justified, documented and incurred for activities aimed at generating income.

Article 264 of the Tax Code of the Russian Federation establishes an open list of other expenses. It expressly states only taxes and fees assessed in accordance with Russian legislation. But it is possible to take into account other costs associated with production and sales.

In addition, the list of expenses not taken into account for profit tax purposes is closed and does not include taxes paid on the territory of a foreign state.

Thus, taxes and fees paid in another country can be written off among other expenses in accordance with paragraphs. 49 clause 1 art. 264 of the Tax Code of the Russian Federation (letter of the Ministry of Finance of the Russian Federation dated February 10, 2017 No. 03-03-06/1/7449).

This does not take into account foreign taxes, for which the Tax Code of the Russian Federation directly provides for the procedure for eliminating double taxation by offsetting them when paying the corresponding tax in Russia. For example, this procedure is defined in relation to income tax and property tax of organizations (Articles 311 and 386.1 of the Tax Code of the Russian Federation).

What is the penalty for being late in reporting and paying taxes?

For failure to submit (delay in filing) a “profitable” declaration, the following sanctions are established:

1) for late filing of annual reports, a fine of 5 percent of the amount of tax not paid on time, payable under this declaration, is imposed for each full or partial month that has passed from the day set for submitting the declaration until the day it was submitted. In this case, there cannot be a fine (clause 1 of Article 119 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of the Russian Federation dated August 14, 2015 No. 03-02-08/47033):

- more than 30 percent of the unpaid tax amount due on a late declaration;

- less than 1 thousand rubles (the same fine will be for late submission of a zero declaration).

2) for being late with a declaration for the reporting period (Q1, half-year, 9 months or one month, two months, etc.) you will be fined 200 rubles for each declaration not submitted on time (clause 1 of Article 126 of the Tax Code of the Russian Federation, letter of the Federal Tax Service of the Russian Federation dated August 22, 2014 No. SA-4-7/16692);

3) a company official may be fined in the amount of 300 to 500 rubles (Article 15.5 of the Code of Administrative Offenses of the Russian Federation).

As a general rule, the official is the head of the organization, but it can also be another employee (for example, a chief accountant), who, by virtue of an employment contract or internal regulation, is responsible for submitting tax reports to the Federal Tax Service;

If you are late with your annual declaration within 10 days, your company account may also be blocked. However, such a measure does not apply if the advance payment is submitted late (Determination of the Armed Forces of the Russian Federation dated March 27, 2017 No. 305-KG16-16245, letter of the Federal Tax Service of the Russian Federation dated April 17, 2017 No. SA-4-7 / [email protected] ). Therefore, the Federal Tax Service does not have the right to block an account if the deadline for submitting reports for 9 months is violated.

Penalties are charged for missed deadlines for payment of advance payments and income tax.

If non-payment of tax occurred due to an error that led to an underestimation of the tax base for profits, then in this case the organization faces a fine in the amount of 20 percent of the amount of arrears (clause 1 of Article 122 of the Tax Code of the Russian Federation):

To avoid this fine, you need to submit a “clarification”, but before that you need to pay the arrears and penalties (clause 4 of Article 81 of the Tax Code of the Russian Federation, letters of the Ministry of Finance of the Russian Federation dated September 13, 2016 No. 03-02-07/1/53498, Federal Tax Service of the Russian Federation dated 11/14/2016 No. ED-4-15/ [email protected] ).

Income tax and deadlines for its payment

Income tax is a tax on the personal income of citizens, paid at the rate of 13% for residents of the country and 30% for non-residents.

Income tax is a tax that is paid from the sale of movable or immovable property, from profits received from teaching activities, from fees, from some kind of service, etc., in general, from any source of income, including wages.

Let's take a closer look and consider the most common cases:

The employer collects income tax from wages and pays it independently for us and our participation in payment is not necessary here.

Tax on profits from the sale of securities is usually collected by the broker, so we do not participate here either.

Let's consider the main thing that citizens pay on their own, these are taxes from the sale of a car and real estate, but there are many conditions and often it is not necessary to pay the tax, let's take a closer look:

Tax on car sales

Important: if you are in a situation where you need to pay tax on the sale of a car, do not forget that you can get a tax deduction of up to 250,000 rubles. Read more about this in the article: Do I need to pay tax on the sale of a car?

Tax on the sale of a car must be paid if you owned the car for less than three years, or the amount of its sale was more than what you bought it for, that is, you made a profit. Otherwise, you do not have to pay tax, but you still need to file a declaration on the sale of the car.

Deadline for paying income tax from the sale of a car: the tax return must be submitted by April 30 of the following year from the moment of receipt of income from the sale, and the tax must be paid by July 15, respectively, that is, you sold the apartment in May 2021, you must pay the tax by July 15, 2019 of the year.

Tax on the sale of an apartment

Recently, changes have occurred in the code and now the tax in this situation is paid as follows:

The tax is not paid if you have owned the property for more than five years, or if you have inherited the property, as a gift, through privatization or under a dependency agreement, then after three years of owning this property. In other situations, tax will have to be paid:

Deadline for paying income tax on the sale of an apartment: the tax return must be submitted by April 30 of the following year from the date of receipt of income from the sale, and the tax must be paid by July 15, respectively.

Tax on royalties, royalties (under author's agreement), hack work and other income

With royalties and royalties, this is a separate article, so we’ll omit it and it’s better to write a separate article, but in other cases everything is the same, the declaration is submitted before April 30 of the next year, the tax is paid until July 15 of the next year.

How to submit a “clarification”

An updated declaration must be submitted in two cases:

- if the company discovered an error in a previously submitted declaration that led to incomplete payment of tax - when expenses were overstated or income was understated (clause 1 of Article 81 of the Tax Code of the Russian Federation, letter of the Federal Tax Service of the Russian Federation dated November 14, 2016 No. ED-4-15 / [email protected] );

- upon receiving from the Federal Tax Service a request to provide explanations on the declaration or make corrections to it (clause 3 of Article 88 of the Tax Code of the Russian Federation). If, in the opinion of the company, the declaration is filled out correctly, then instead of “clarification” it is necessary to provide explanations.

An error that led to an overpayment of tax can be corrected in the declaration for the current period.

The “update” is submitted in the same form as the initial declaration. It must be submitted to the Federal Tax Service with which the organization is registered on the day the “clarification” is submitted.

In the updated declaration, all sheets, sections and appendices that were filled out in the primary declaration are filled out, even if there were no errors in them (letter of the Federal Tax Service of the Russian Federation dated June 25, 2015 No. GD-4-3 / [email protected] ).

An updated declaration at the request of the inspectorate when errors are identified during the “camera room” must be submitted to the Federal Tax Service within 5 working days from the date of receipt of the request. If you fail to meet this deadline and do not submit an explanation, the organization will be fined 5 thousand rubles under clause 1 of Art. 129.1 Tax Code of the Russian Federation. For a repeated violation within a calendar year, the fine will be 20 thousand rubles (Clause 1 of Article 129.1 of the Tax Code of the Russian Federation).

The Tax Code of the Russian Federation has not established any other deadlines for filing a “clarification”. However, it's better to hurry up. After all, if the tax payable is underestimated and the inspection is the first to discover this fact, then the company will be fined (20 percent of the amount of arrears, clause 1 of Article 122 of the Tax Code of the Russian Federation).

Provisions of the Tax Code of the Russian Federation on deadlines

The procedure and deadlines for paying insurance premiums are established by Chapter 34 of the Tax Code of the Russian Federation. If in 2021 the deadline for paying insurance premiums falls on a weekend or non-working holiday, then the contributions must be transferred on the next working day. Such an indication is in paragraph 7 of Article 6.1 of the Tax Code of the Russian Federation. You can find out which day falls on a weekend or holiday in Articles 111 and 112 of the Labor Code of the Russian Federation. If holidays coincide with weekends, as a rule, they are moved to other dates.

The Government of the Russian Federation adopted a Resolution on the transfer of days off in 2021 (Resolution of the Government of the Russian Federation dated October 14, 2017 No. 1250). The following weekends will be postponed in 2021:

- Saturday 6 January to Friday 9 March;

- Sunday 7 January to Wednesday 2 May.

Also in 2021, the Government decided to make three working Saturdays:

- April 28. At the same time, Monday April 30 will become a non-working day, and we will rest from April 29 to May 2 inclusive;

- the 9th of June. Due to this, the June holidays will last three days: from June 10 to June 12 inclusive;

- December 29th. Such a postponement will lead to the fact that the New Year holidays 2019 will begin on December 30, 2018.

When last year's mistakes can be corrected in the current period

By virtue of paragraph 1 of Art. 54 of the Tax Code of the Russian Federation, errors or distortions in the calculation of the tax base for past periods discovered in the current period can be corrected during the period of their discovery in two cases:

- if the period of the error is unknown;

- if the error resulted in overpayment of tax.

Thus, this norm is applied when there are distortions in the base for the previous period, for example, when expenses are understated when receiving (discovering) last year’s “primary” from a counterparty in the current period.

However, you will still have to adjust the period of the error if a loss was incurred in the reporting period.

The financiers also recalled the norm of clause 7 of Art. 78 of the Tax Code of the Russian Federation: an application for offset (refund) of the amount of overpaid tax, including due to recalculation of the tax base, can be submitted within 3 years from the date of payment of the specified amount.

Letter of the Ministry of Finance of the Russian Federation dated August 4, 2017 No. 03-03-06/2/50113.

Editor's note:

the day of tax payment is considered the day of presentation to the bank of a payment order for its payment from an account in which there is enough money for payment (clause 1, clause 3, article 45 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of the Russian Federation dated June 27, 2016 No. 03-03- 06/1/37152).

You will have to pay

Who pays for an independent cadastral valuation if the owner decides to go to court and prove that it is overestimated?

Alexey Konevsky, partner at Pepelyaev Group: Judicial practice and the clarification of the Constitutional Court indicate that the owner bears the costs. Even if the court confirms he is right.

The Ministry of Economic Development has developed a bill that changes the procedure for challenging cadastral values. It may be that if they win in court, the owners will receive compensation for the cost of their assessment costs. But for now this is a bill.

In addition, specialized state budgetary institutions are now being created in the regions that will deal with cadastral valuation of real estate on an ongoing basis. It is expected that the quality of assessment will increase. Budgetary institutions will constantly accumulate information on real estate objects. The assessment results based on more complete data will be closer to reality.

As for the existing practice of challenging cadastral values, it is not widespread. The assessment of objects that belong to citizens and are not used in business activities is usually carried out conservatively. When valuation corridors exist, appraisers try to apply lower values to reduce the likelihood of disputes.

What threatens a person if he does not pay taxes on time?

Alexey Konevsky: The last day for paying property taxes this year is December 2. After this, a penalty will be charged on the amount of unpaid tax. It is 1/300 of the Central Bank rate for each day of delay. If we take the current rate (6.5% per annum) as a basis, then this is 0.02%

How to transfer taxes, penalties, fines

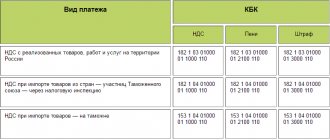

In 2021, the following BCCs are applied for the transfer of:

1) income tax (advance payments):

- to the federal budget - 182 1 01 01011 01 1000 110

- to the regional budget - 182 1 01 01012 02 1000 110

2) penalties for income tax:

- to the federal budget - 182 1 01 01011 01 2100 110

- to the regional budget - 182 1 01 01012 02 2100 110

3) fine for income tax:

- to the federal budget - 182 1 01 01011 01 3000 110

- to the regional budget - 182 1 01 01012 02 3000 110

Property tax

The deadline for paying the property tax of organizations in 2021 and the deadlines for paying advances on this tax are established by the laws of the constituent entities of the Russian Federation. Regional authorities also set deadlines for payment of transport tax/advance payments.

As for the deadlines for paying land tax and advance payments thereon, they are established by local regulations.

Accordingly, if there are objects of taxation for corporate property tax, transport tax and/or land tax, the payer needs to familiarize himself with the relevant law in order to avoid untimely transfer of tax/advance payment.