As we know, the object of taxation with insurance premiums is payments and other remuneration in favor of individuals subject to compulsory social insurance, made, in particular, within the framework of civil contracts, the subject of which is the performance of work, provision of services (clause 1, clause 1 Article 420 of the Tax Code of the Russian Federation).

In order to understand whether payments to members of the board of directors are subject to insurance premiums, it is necessary to determine within the framework of which these payments are made, since employment contracts have not been concluded with them. Let us turn to the rulings of the Constitutional Court dated June 6, 2016 N1170-O and N1169-O. Based on them, payments to members of the board of directors, in connection with the fulfillment of the duties assigned to them in managing the activities of the company, are considered to be made within the framework of civil law contracts (hereinafter referred to as the civil law agreement). Consequently, these payments are subject to insurance premiums.

At the same time, we would like to remind you that any remuneration paid to individuals under GPC agreements is not subject to inclusion in the base for calculating insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity (clause 2, clause 3, Article 422 of the Tax Code of the Russian Federation) .

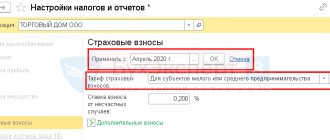

Based on this, when paying remuneration to members of the board of directors, Organizations must accrue insurance contributions for compulsory pension insurance and compulsory medical insurance at the rates established by Article 426 of the Tax Code of the Russian Federation:

- for compulsory pension insurance - 22% within the established maximum value of the base for calculating insurance contributions, above the established maximum value of the base - 10%;

- for compulsory health insurance - 5.1%.

This position is confirmed in letters of the Ministry of Finance of the Russian Federation dated September 4, 2017 N 03-15-06/56601 and dated February 13, 2021 N 03-15-06/7788, N 03-15-06/7792, N 03-15 -06/7794. Thus, from the moment the specified Determinations of the Constitutional Court of the Russian Federation enter into force, remunerations to members of the board of directors are subject to insurance contributions for compulsory pension insurance and compulsory medical insurance.

Can an LLC function without employees?

The organization may not have an accountant, sales manager or other hired employees. But if there are signatures in the company’s contracts and reports, there must be someone who signs them.

Even when registering an LLC, the founders must choose a sole executive body - a director. Even if an LLC is created with a minimum authorized capital, does not have a single employee and has not started operating at all, a director must be elected immediately. Information about it enters the Unified State Register of Legal Entities and is stored there throughout the organization’s operation. If the company is left without a general director, then the register contains incorrect information - they must be immediately replaced with the data of the new executive body; simply crossing out the old information will not work.

It happens that an LLC has one founder, who is also the head of the organization. It is not necessary to conclude an employment contract with him; a decision of the sole participant to appoint himself as a director and an order to assume the position are sufficient (letter of the Ministry of Labor of Russia dated 03/24/2020 No. 14-2/B-293, Rostrud dated 03/06/2013 No. 177-6-1 ). But having an employment contract will help you avoid unnecessary questions from the State Tax Service and the Federal Tax Service. Moreover, judging by judicial practice, the absence of an employment contract with the sole participant director does not mean the absence of labor relations. That is, the founder will still be considered an employee (Decision of the Supreme Court dated October 21, 2019 No. 78-KG19-33, Resolution of the Eighth Court of Cassation dated June 29, 2020 No. 16-3609/2020).

Another important question is whether the founding director should be paid a salary. This will also impact the organization's reporting rate. If there is no employment contract, wages may not be paid. According to the tax authorities, the founder can decide for himself whether he wants to receive money. He can write a statement and refuse the reward (resolution of the Ninth Arbitration Court of Appeal dated December 20, 2018 No. 09 AP-48934/2018). If there is an employment contract and no salary, the State Tax Inspectorate sometimes issues fines, but inspectors practically do not come to such LLCs - the directors do not complain about themselves.

To summarize, the question of the possibility of an LLC existing without employees has not yet been closed. Regulatory authorities and courts periodically have contradictions. But it’s always safer to submit a little more reports and pay a little more money to the budget. This will help avoid problems.

What kind of reporting does an LLC submit to the simplified tax system without employees?

The absence of employees does not exempt organizations using the simplified tax system from submitting reports. All simplifiers submit a declaration under the simplified tax system, accounting and statistical reporting in the standard manner. But some of the employee reports can be replaced with zero ones or filled in only with information about the founder. Let's consider all reports on employees that are required to be submitted.

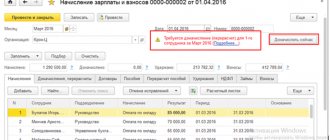

Calculation of insurance premiums

If the organization has no employees, the calculation still needs to be submitted, but it can be filled in with zero indicators. The same is done if there are no payments to individuals for the last three months.

In the zero calculation you need to fill in:

- title page - information about the organization;

- section 1 (without attachments) - enter code “2” in line 001 and enter zeros in the lines “including for the last three months.” Fill out the remaining deadlines in the standard manner;

- subsection 3.1 - provide information about the head of the organization and each individual in whose favor there were no accruals. Place a dash in field 010;

- subsection 3.2 - put dashes along the lines.

The calculation must be submitted to the Federal Tax Service no later than the 30th day of the month following the reporting period.

Information on the average number of employees

Information on the average headcount (ASH) must be submitted by all LLCs to the simplified tax system, regardless of the presence of employees.

Previously, this was a separate report that organizations submitted to the tax office. Starting from the report for 2021, information on the SSC must be submitted as part of the calculation of insurance premiums (DAM) within the same time frame as provided for the DAM. Now the inspectorate will receive information on the number quarterly, rather than once a year.

Information about the insured persons

The Pension Fund regularly waits for information about insured persons and their insurance history. These are the forms SZV-M and SZV-STAZH. There are no zero forms of information. Even if the company only has a general director, who is also the sole founder and does not receive a salary, the SZV must be submitted to him. He is considered an insured person for pension insurance purposes.

Take SZV-STAZH once a year - before March 1. If the director does not receive a salary, enter the code “NEOPL” in the report. Submit the EDV-1 inventory along with the form.

Submit SZV-M monthly - before the 15th day of the month following the reporting month. Fill in the form with information about the founding director.

Calculation 4-FSS

Contributions for injuries must be reported quarterly to the Social Insurance Fund. LLCs without employees submit a zero form, in which only the title page and tables 1, 2 and 5 are filled out. If there are no indicators, it is enough to fill in dashes.

The founding director is included in the average number of employees, even if they did not pay him a salary or enter into an employment contract.

Certificates 2-NDFL and 6-NDFL

If the company does not have hired employees or none of them received income in the period under review, there is no need to submit a 2-NDFL certificate. Tax agents must also report on Form 6-NDFL, but if the organization did not accrue or pay money to individuals, then it does not have such status and does not have the obligation to submit calculations.

Zero 6-NDFL can be submitted on your own initiative, the inspectorate will accept it. It can also be replaced with an official letter to protect yourself from tax claims.

Director is the sole founder and calculation of insurance premiums

The sole founder of the company serves as its director without concluding an employment contract. No payments are made to him. The company has no employees. In a letter dated September 10, 2019 No. BS-4-11/ [email protected], the Federal Tax Service of Russia clarified whether a company in such a situation needs to submit a calculation for insurance premiums.

Payments for insurance premiums1 are required to be submitted by payers of insurance premiums (Clause 7, Article 431 of the Tax Code of the Russian Federation). They are recognized as persons making payments and other remuneration to individuals subject to compulsory social insurance in accordance with federal laws on specific types of compulsory social insurance, in particular within the framework of labor relations (subclause 1, clause 1, article 419, clause 1, art. 420 Tax Code of the Russian Federation).

Among the insured persons under compulsory pension, medical and social insurance are the heads of organizations, who are their only participants (founders), working under an employment contract (Clause 1, Article 7 of the Federal Law of December 15, 2001 No. 167-FZ “On Compulsory Pension Insurance in the Russian Federation", clause 1 of article 10 of the Federal Law of November 29, 2010 No. 326-FZ "On compulsory health insurance in the Russian Federation", subclause 1 of clause 1 of article 2 of the Federal Law of December 29, 2006 No. 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity”).

Since no employment contract was concluded with the director, the sole founder, and the company has no employees, the question arises: is it obliged to submit calculations for insurance premiums?

In Determination No. 6362/09 of 06/05/2009, the Supreme Arbitration Court of the Russian Federation explained that if the head of an organization is its sole founder, then labor relations with the director as an employee are formalized not by an employment contract, but by the decision of a single participant. According to the provisions of Art. 15 of the Labor Code of the Russian Federation, labor relations presuppose that an employee performs a labor function for a fee. In this regard, tax authorities came to the conclusion that the absence of a concluded employment contract with the head of the organization does not mean the absence of labor relations. And payments in favor of the head of the organization, including those who are its sole founder, are considered as payments made within the framework of labor relations.

Regarding the need to submit calculations for insurance premiums, specialists from the Federal Tax Service of Russia indicated the following. The Tax Code does not provide for the exemption of the payer of insurance contributions from the obligation to submit a calculation if during the settlement (reporting) period he did not make payments in favor of persons subject to compulsory social insurance in accordance with federal laws on specific types of compulsory social insurance.

The procedure for filling out the calculation stipulates that all insurance premium payers must complete the following: title page, section 1, subsections 1.1 and 1.2 to section 1, appendix 2 to section 1 and section 3 of the calculation. If there are no quantitative and total indicators for any calculation lines, the value “0” is entered. And in personalized information about insured persons, which does not contain data on the amount of payments and other remuneration accrued in favor of an individual for the last three months of the billing (reporting) period, subsection 3.2 of section 3 of the calculation is not filled out.

Similar explanations are contained in letters from the Ministry of Finance of Russia dated 02/13/2019 No. 03-15-06/10549, Federal Tax Service of Russia dated 07/16/2018 No. BS-4-11/ [email protected] , dated 04/02/2018 No. GD-4-11/ [ email protected] At the same time, officials note that by submitting calculations with zero indicators, the payer declares to the tax authority that in a particular period there were no payments and remunerations in favor of individuals who are subject to insurance premiums, and, accordingly, about the absence of insurance premium amounts, payable for the same period. Such calculations allow tax authorities to separate law violators from bona fide insurance premium payers and not hold the latter liable for failure to submit calculations.

So, regardless of whether an employment contract is concluded with the director, the sole founder, and payments are made to him or not, such a director is an insured person. And in the absence of payments in favor of such a director - the only employee, the company must still submit a calculation of insurance premiums.

Please note that from 2021, a new form of calculation for insurance premiums will be used, approved by order of the Federal Tax Service of Russia dated September 18, 2019 No. ММВ-7-11 / [email protected] (for more information about this, see “EZh-Accountant”, No. 41 , 2019). It stipulates that if there is no activity or there are no payments in favor of individuals, it will be necessary to submit only the title page, section 1 indicating “Taxpayer Type” without attachments and section 3 with zeros and dashes. The Russian Ministry of Finance recalled this in letter dated 10/09/2019 No. 03-15-05/77364.

1 The calculation form and the procedure for filling it out were approved by order of the Federal Tax Service of Russia dated October 10, 2016 No. ММВ-7-11/ [email protected]

Deadlines for submitting reports for LLCs without employees

We have collected the deadlines for submitting all reports for LLCs with a simplified taxation system and without employees in the table:

| Reporting | Where to take it | Deadline |

| Declaration according to the simplified tax system | To the Federal Tax Service at the location | Annually - no later than March 31 |

| Financial statements | To the Federal Tax Service at the location | Annually - no later than March 31 |

| Calculation of insurance premiums | To the Federal Tax Service at the location | Quarterly No later than the 30th day of the month following the reporting period (quarter, half-year, 9 months, year) |

| 4-FSS | Territorial body of the Social Insurance Fund at the place of registration | Quarterly Paper form - no later than the 20th day of the month following the reporting period Electronic form - no later than the 25th day of the month following the reporting period |

| SZV-STAZH | Territorial body of the Pension Fund of Russia | Annually - no later than March 1 of the year following the reporting year |

| SZV-M | Territorial body of the Pension Fund of Russia | Monthly - no later than the 15th day of the month following the reporting month |

What about the tax authorities now?

So, we know that since January 1, 2017, almost all social contributions are handled by the Federal Tax Service and its local territorial divisions.

And they just have the right to use the calculation method. Just remember that this right is somewhat limited. There are several cases for applying the calculation method, namely:

- refusal to allow the inspected person to inspect the premises and territory;

- failure to provide documents for more than two months;

- lack of accounting of income and expenses, the object of taxation or record keeping with violations.

That is why companies have won similar disputes related to personal income tax.

The court cancels the tax assessment based on the conditional amount. For example, the minimum wage or subsistence level (Resolutions of the Federal Antimonopoly Service VSO dated September 23, 2010 No. A58-5012/09, ZSO dated April 27, 2010 No. A81-3998/2009, PO dated March 30, 2009 No. A12-12521/2008, etc.). Arbitration does not recognize the calculation of tax from the minimum wage (Resolutions of the Federal Antimonopoly Service No. KA-A41/9873–10 of August 26, 2010, No. A56-32491/2008 of June 19, 2009, No. F09-1039/09-S2 of March 10, 2009 ). These indicators do not relate to the income received, that is, to the personal income tax base (clause 1 of article 210 of the Tax Code of the Russian Federation).

Similar examples existed under the Unified Social Tax during the period of operation of Chapter 24 of the Tax Code of the Russian Federation. The courts rejected similar claims in relation to the unified social tax and insurance contributions to the Pension Fund (Resolutions of the Federal Antimonopoly Service of Moscow dated 08/26/2010 No. KA-A41/9873–10, ZSO dated 10.30.2008 No. Ф04-6627/2008(15063-А45-25), DO dated 04.10.2006 No. F03-A51/06–2/3285, VSO dated 17.01.2008 No. A19-7573/07-50-F02-9744/07).

Of course, taking into account modern realities in terms of the severe tax pressure exerted on business, it is difficult to predict how the new arbitration practice on insurance premiums will develop with their new administrator on this issue. But let's hope it's similar to the previous experience. But time will tell.

How can an LLC without employees avoid fines?

The law does not provide clear guidance on whether an LLC can operate without employees. Letters and explanations from regulatory authorities contradict each other, and judicial practice does not add clarity. We have sorted out the current situation. An LLC must have at least a founding general director, with whom there is no need to enter into an employment contract or pay a salary. However, he will still be considered an insured person and will be reflected in a number of employee reports.

To avoid fines, carefully monitor changes in laws. The requirements of controllers can change at any time, then you will have to either urgently correct them or pay fines.

The safest option is to employ a director in the LLC according to all the rules and pay him at least the minimum salary. Even one well-trained employee will help avoid conflicts with inspectors.

Also, don't forget about reporting. There are also fines for failure to submit or late submission. Failure to pass SZV-M and SZV-STAZH will cost at least 500 rubles, RSV and 4-FSS - 1000 rubles.

LLC reporting on the simplified tax system in Externa

Extern is a web service for submitting reports to the tax authorities, funds, Rosstat, FSRAR and RPN. Organizations using the simplified tax system without employees will find in the system interface all the forms that they need to submit. The external student will tell you how to generate and submit reports in accordance with the requirements of the law.

To use the service, you will need an electronic signature and registration. All new users and clients who have lost access to Extern and have not used the system for more than a year will be able to take a test drive and try all the features of the service for free. In addition to submitting reports, other functions are available in Externa:

- reconciliation of settlements with counterparties;

- verification of counterparties;

- unlimited number of extracts from the Unified State Register of Legal Entities/Unified State Register of Individual Entrepreneurs;

- reference and legal system;

- educational webinars.

To prepare a report, select the appropriate section and how to create the form - fill it out in the system or download a ready-made report. The external student will give recommendations on how to fill out the report and check it for errors before sending it.

Is it possible, in principle, not to pay the director’s salary?

Situation (until 01/01/2017): auditors from the funds are checking an operating company with about 450 employees.

And everything would be fine, but it turns out that during the inspection period the director of the company performed his duties free of charge. How can this be? The inspectors asked questions to representatives of the organization. And they came up with a verdict: illegal. Result: additional assessment of contributions based on the minimum wage, taking into account the regional coefficient.

Often, business owners occupy top positions in the company. And, as a rule, they are of little interest in wages. They receive income in the form of dividends.

In turn, the legislation does not allow such freedom and, in accordance with the provisions of Art. 133 of the Labor Code of the Russian Federation, the employer is obliged to pay the employee in an amount not less than the established minimum wage. Administrative law is not far behind – Part 1 of Art. 15.27 Code of Administrative Offenses of the Russian Federation - threatens an employer who violates the law with a fine in the amount of 50 thousand rubles. (not so little!).