At what point should insurance premiums be charged for payments under the GPA?

For an employing company, it may be more profitable to attract workers under civil contracts than to hire them as staff. After all, remuneration under the GPA is subject only to contributions to compulsory pension insurance and contributions to compulsory health insurance. This is a well-known way to save on insurance premiums. The main thing is to accrue them at the right time. But some employers sometimes have difficulty with this. Let's look at examples.

Procedure for paying taxes under a GPC agreement

In accordance with the norms of the Tax Code of the Russian Federation and other legislative acts, payments under civil contracts are recognized as the income of the performer (as a rule, this is an individual), and therefore are included in the tax base for personal income tax. This rule applies only if the performer is not registered as an individual entrepreneur. In such a situation, the customer company is recognized as a tax agent, and therefore is obliged to accrue, withhold and transfer the amount of personal income tax to the budget when paying remuneration. Therefore, it is recommended to set the amount of payments under the agreement taking into account the planned transfer of tax to the budget.

Note!

Refusal of the obligation to perform the functions of a tax agent and shifting it to the executor is a violation of tax legislation, and appropriate punishment is provided for it. It will also be considered a violation to pay personal income tax at the expense of the customer organization’s own resources.

Ways to optimize taxes and contributions when applying GPC agreements

Personal income tax is charged on the entire amount of the performer’s remuneration. Insurance premiums for GPA in 2021 are affected by the taxation system that the organization applies, the characteristics of its activities and a number of other factors.

Using the standard and professional tax deduction

Professional tax deduction refers to all expenses that the contractor had to incur to complete the list of works specified in the contract. A mandatory requirement of the Tax Code of the Russian Federation and the Civil Code of the Russian Federation is documentary evidence of expenses incurred. Providing a professional personal income tax deduction is usually made on the basis of an application from the performer. It is compiled in any form. The main thing is that it must be accompanied by documents that confirm the fact of the costs. Examples of such documents are invoices for the supply of goods, cash or sales receipts, travel documents, hotel invoices, and so on. The key requirement for documents is confirmation of their necessity to fulfill obligations under the GPC agreement. Example 1: The company entered into a GPC agreement with the contractor for the provision of services for the translation of technical documentation into Russian. The cost of work is 5000 rubles. The company applies a special tax regime - UTII. The work was completed by the contractor on time with the required level of quality. Based on the results of the work, a work acceptance certificate was drawn up, in which the parties recorded the absence of claims against each other. The performer attached a statement to the act in which he asked to be provided with a professional tax deduction in the amount of 1,100 rubles, accompanied by a cash receipt from a store selling technical literature (the performer spent this amount on purchasing books that he used when performing translation work). Based on the data obtained, the personal income tax amount is calculated as follows: • The tax base is 5000 – 1100 = 3900 rubles. • Personal income tax is 3900 * 13% = 507 rubles. This amount is subject to transfer by the tax agent to the budget. • The amount payable to the performer will be 5,000 – 507 = 4,493 rubles. A standard tax deduction is provided to an individual contractor under a GPC agreement only if he has minor children. To receive it, you also need to provide an application and birth certificates of your children. When calculating personal income tax, you should remember that the performer has the right to a standard tax deduction only until the income reaches 350 thousand rubles. At the same time, the customer does not have information about the contractor’s income, so a standard deduction should be provided, but in this case, responsibility for incorrect calculation of personal income tax will lie with the taxpayer. The standard tax deduction should be provided for the same number of months as the work lasted, regardless of the moment of payment of remuneration (monthly, in advance or based on the results of the work). Example 2: The company entered into a GPC agreement with the contractor for the provision of services for the translation of technical documentation into Russian. The cost of work is 5000 rubles. The company applies a special tax regime - UTII. The performer has a child who is 12 years old. To receive a standard deduction, the contractor provided the customer with a statement in which he indicated that he did not have a main place of work, and the amount of annual income at the time of filing the application was less than 350 thousand rubles. In addition to the application, the contractor provided a copy of the child's birth certificate, which listed him as the child's father. The customer did not receive an application for a professional deduction. The procedure for calculating personal income tax in this case is as follows: • Taxable income is equal to 3,600 rubles (5,000 – 1,400). • Personal income tax is 468 rubles (3600 * 13%). • Amount to be issued in person – 5000 – 468 = 4532 rubles.

Personal income tax on income under NAP

Part 8 of Article 2 of the Federal Law of November 27, 2018 No. 422-FZ establishes that self-employed payers of personal income tax are exempt from personal income tax in relation to income subject to taxation of personal income tax. This rule applies to all self-employed people - both entrepreneurs and ordinary citizens without entrepreneurial status.

This means that counterparties of the self-employed under GP agreements, which are considered tax agents for personal income tax, do not calculate or withhold income tax on remunerations paid to the self-employed (letters of the Ministry of Finance of Russia dated 02/17/2020 No. 24-03-08/10748, dated 03/11/2019 No. 03- 11-11/15357). Accordingly, a self-employed person does not have the right to receive personal income tax deductions from his income taxed under the NAP (letter of the Ministry of Finance of Russia dated November 20, 2020 No. 03-11-11/101167, dated September 24, 2019 No. 03-11-11/73352).

What insurance premiums are subject to a civil contract?

The most significant difference between the calculation of contributions under GPC agreements and employment contracts is the absence of the need to transfer funds to the Federal Social Insurance Fund of the Russian Federation for accident insurance in the absence of such an obligation in the agreement. This allows the customer to save money. However, such savings should not violate the rights of the performer. If regulations establish that the assigned work will be performed in difficult or dangerous conditions, contributions to the Social Insurance Fund of the Russian Federation must be mandatory. Otherwise, the executor may require the inclusion of such a clause in court. The Tax Code of the Russian Federation stipulates that GPC agreements are subject to insurance premiums only if their subject is the performance of any work or the transfer of copyright (execution of copyright orders). In 2018, pension and health insurance contributions are charged on remuneration paid under such contracts. The interest rate on the basis of which the amount of contributions is determined is the same as in labor relations (22% in the Pension Fund of the Russian Federation and 5.1% in the Federal Compulsory Medical Insurance Fund of the Russian Federation). Contributions under civil law contracts must be calculated on the same day as the payment of remuneration. As a rule, one of the following options is used: • The day the advance is issued to the contractor; • The day of signing the work acceptance certificate, which reflects the absence of claims by the parties against each other.

Contract agreement with an individual: taxation of insurance premiums in 2018–2019

In addition to employment contracts, companies often enter into civil contracts with individuals and individual entrepreneurs.

In what cases it is necessary to pay contributions and personal income tax, and whether such employees should be reflected in timesheets and reporting, we will consider in the article. In fact, the taxpayer’s choice in this case will be formalized by his application for such a tax deduction. — Property tax deduction Property tax deduction in connection with the purchase of housing can only be provided by employers. It can be received either at the end of the tax period or during the tax period through the employer. As part of a civil contract, the customer does not have the right to provide such deductions to the contractor, even if he is a tax agent (clause

8 tbsp. 220 of the Tax Code of the Russian Federation). Keep personnel records and calculate salaries without problems via the Internet. Find out more Insurance contributions to funds Norm clause 1 of Art.

Individual entrepreneurs under special tax regimes (USN, UTII) do not pay personal income tax on income received from business activities. From paragraph 3 of Art. 346.11 and paragraph 4 of Art. 346.26 of the Tax Code of the Russian Federation it follows that taxes paid in accordance with these special regimes replace personal income tax on income received from business activities.

Then the inspectors will not have questions about why the tax was not withheld, and the amount of remuneration was transferred to the counterparty in full. Tax deductions Ch. 23 of the Tax Code, which regulates the rules for calculating and paying personal income tax, provides taxpayers with the opportunity to receive certain tax deductions.

The amount of contributions in case of temporary disability and in connection with maternity, payable to the Federal Social Insurance Fund of the Russian Federation, is subject to reduction by the amount of expenses incurred by payers for the payment of compulsory insurance coverage for this type of compulsory social insurance. Within the billing period, the payer has the right to set off the amount of excess costs for the payment of compulsory insurance coverage for insurance in case of temporary disability and in connection with maternity over the amount of accrued insurance premiums for the specified type of insurance against upcoming payments (clause introduced by the Federal Law of December 8, 2010 N 339- Federal Law).

If an organization has entered into a contract with an individual, then taxation of insurance premiums in 2018–2019 will not differ from taxation in previous years.

Thus, under contract agreements with an individual, contributions for compulsory pension insurance are charged (clause 1, article 7 of the law “On compulsory pension insurance in the Russian Federation” dated December 15, 2001 No. 167-FZ, clause 1, article 420 of the Tax Code of the Russian Federation).

In addition, contributions for compulsory medical insurance are charged (Article 10 of the Law “On Compulsory Medical Insurance in the Russian Federation” dated November 29, 2010 No. 326-FZ, paragraph 1 of Article 420 of the Tax Code of the Russian Federation).

Payments under a work contract are not subject to contributions for compulsory insurance in case of temporary disability and maternity (subclause 2, clause 3, article 422 of the Tax Code of the Russian Federation).

Contributions for insurance against occupational diseases and occupational accidents under civil contracts are accrued only if this is provided for by the terms of the agreement (Clause 1, Article 5 of the Law “On Compulsory Social Insurance against Occupational Accidents and Occupational Diseases” dated July 24. 1998 No. 125-FZ).

The legislation provides for cases when insurance premiums for a contract are not assessed not only by the Social Insurance Fund, but also by the Pension Fund of the Russian Federation and the Compulsory Medical Insurance Fund. Such cases include:

- Conclusion of an agreement with persons registered as individual entrepreneurs. Individual entrepreneurs are required to independently transfer all insurance premiums for themselves in accordance with the tariffs established by law (subparagraph 2, paragraph 1, article 419, article 420 of the Tax Code of the Russian Federation).

- Concluding an agreement with foreigners or stateless persons temporarily staying in the Russian Federation (subclause 15, clause 1, article 422 of the Tax Code of the Russian Federation).

- Transactions under contract agreements with full-time students in higher educational institutions of the Russian Federation within the framework of student teams, which are exempt from paying insurance contributions to the Pension Fund of the Russian Federation (subclause 1, clause 3, article 422 of the Tax Code of the Russian Federation).

For information about what premiums an individual entrepreneur charges and pays for himself, read the article “What insurance premiums does an individual entrepreneur pay in 2018-2019?”

Before concluding a work contract, it is necessary to carefully analyze its content to determine whether there are any controversial issues that would allow it to be interpreted as a labor contract.

Judicial practice confirms that the FSS often turns to the courts and tries to challenge contract agreements. If the text of the agreement reveals signs of the existence of an employment relationship between the employer and the employee, additional contributions to the fund (both for disability and injury) will be assessed for the amount of the agreement at the current rates, as well as fines and penalties.

Nuances that are important to reflect in the contract:

- the text must clearly indicate the period during which the work must be completed;

- the amount of remuneration must be reflected for the entire scope of work and not divided by time periods;

- the contract should not contain references to job descriptions or the operating mode of the enterprise;

- the fact that the full scope of work has been completed must be confirmed by an acceptance certificate for completed work, signed by both parties;

- the work must be one-time in nature, and after the entire scope has been completed, the relationship between the parties must cease.

To learn how a work contract will be reflected in quarterly personal income tax reporting, read the material “How to correctly reflect a work contract in 6-personal income tax?”

The main rates of insurance premiums applied in 2018–2019 and established for the period 2017–2020 are given in Art. 426 Tax Code of the Russian Federation. In general situations, employers on income due to employees pay insurance premiums for compulsory health insurance at a rate of 22% of payments subject to taxation, and for compulsory medical insurance at a rate of 5.1%.

The conditions for the application of reduced tariffs for insurance premiums and the meaning of these tariffs are reflected in Art. 427 Tax Code of the Russian Federation. Of these, with regard to the taxation of work contracts (remember that they are not subject to contributions for disability and maternity insurance, therefore we do not calculate the values of reduced tariffs for them) the following are of interest:

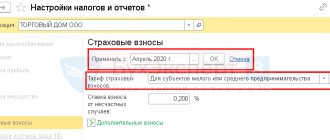

- During 2018–2019, organizations and individual entrepreneurs specified in subparagraph. 5–9 p. 1 art. 427 of the Tax Code of the Russian Federation, apply reduced tariffs for compulsory medical insurance in the amount of 20%, for compulsory medical insurance - 0% (such organizations include enterprises and individual entrepreneurs under special tax regimes, operating in accordance with the OKVED list specified by law; pharmacy organizations and individual entrepreneurs on UTII having a pharmaceutical license, non-profit organizations on the simplified tax system operating in the field of social services, culture, art, mass sports, scientific research and development, individual entrepreneurs on the patent tax system, charitable organizations on the simplified tax system).

- Enterprises that have the status of participants in the Skolkovo scientific and technical project pay only insurance contributions to the Pension Fund of the Russian Federation in the amount of 14%.

- Organizations operating in a free economic zone - on the territory of the Republic of Crimea and the city of Sevastopol - make contributions to compulsory health insurance in the amount of 6%, to compulsory medical insurance - 0.1%. Residents of the priority development territory and the free port of Vladivostok and (from 2021) some enterprises of the Kaliningrad region pay insurance premiums at the same rates.

- During 2017–2023, IT companies pay 8% compulsory health insurance contributions and 4% compulsory medical insurance contributions.

- For business entities that apply or implement the results of intellectual activity, the exclusive rights to which belong to their founders, budgetary autonomous institutions, as well as for residents of technology-innovative, industrial-production and tourist-recreational special economic zones, the fee rate for OPS is 13%, for compulsory medical insurance - 5.1%.

For more information about the existing premium rates, read the article “What are the insurance premium rates for 2017-2018?”

Application of additional tariffs when calculating insurance premiums under GPC agreements

Increased contributions under the GPC agreement in 2021 are paid subject to two conditions: • Is accrued and paid income included in the base for calculating contributions; • Work performed under a contract is classified as hazardous. The list of such types of activities is contained in Article 30 of the Federal Law “On Insurance Pensions”.

The executor of the contract is not an employee of the customer company

In the absence of an employment relationship between the contractor and the customer, all issues must be set out in the GPC agreement, on the basis of which the contractor performs any one-time work. The priority for the customer, in this case, will be the final result from the implementation of activities under the GPC agreement. At the same time, he may not evaluate working conditions, and is not obliged to provide the performer with personal protective equipment. Often the customer grants the contractor the right to engage subcontractors to perform certain works. In such a situation, the customer does not have the obligation to calculate and pay insurance premiums for GPC in 2021 at an increased rate. Example 3: A company ordered a special metal grating from an individual under a GPC agreement, which will be used in the reinforcement shop. The text of the contract does not contain requirements for working conditions, place of work, and there is an indication of the possibility of involving third parties. During the manufacturing process of the grille, the contractor developed a drawing and agreed it with the customer. The remuneration amount is 23 thousand rubles. Working conditions in the customer's reinforcement shop were found to be harmful. However, the activity of manufacturing gratings does not require constant presence on site, and therefore does not relate to the work specified in Article 30 of the Federal Law “On Social Pensions”. Thus, there are no grounds for applying an additional tariff on insurance premiums. Accruals will be made at standard rates: • For compulsory pension insurance – 23,000 * 22% = 5,060 rubles. • In the Federal Compulsory Medical Insurance Fund of the Russian Federation – 23,000 * 5.1% = 1,173 rubles. Due to the absence of a corresponding clause in the agreement, contributions to the Social Insurance Fund of the Russian Federation are not accrued or paid.

The contractor has an employment relationship with the customer

Normative acts do not prohibit an employee from performing different jobs under an employment and civil law contract under the same working conditions. If the conditions at his main place of work are considered harmful, then contributions under the GPC agreement will have to be calculated at an increased rate. This position is not only enshrined in the Federal Law “On Social Pensions”, but also in regulations of the Ministry of Labor and Social Development of the Russian Federation. Example 4: An installer of steel and reinforced concrete structures performs his duties in a company under an employment contract. This position is included in the list of works contained in Article 30 of the Federal Law “On Social Pensions”. In addition, based on the results of a special assessment of working conditions, the employee’s place of work was classified as hazardous. The installer's salary is 42,000 rubles. This employee was involved in repair work in the reinforcement shop, the working conditions in which were also recognized as harmful. The employee agreed to fulfill them under the GPC agreement, the remuneration for which will be 23,000 rubles. Despite the fact that SOUT is not required for work performed under a GPC agreement, an increased tariff will be applied when calculating insurance premiums in 2021. This is due to the fact that the employee’s main workplace is classified as hazardous. As a result, the company has an obligation to accrue contributions to the Pension Fund of the Russian Federation in the amount of 4% in addition to the standard 22%. The entire amount of remuneration paid to the employee is subject to additional contributions (23,000 + 42,000 = 65,000 rubles).

Professional income tax

Individuals, including officially registered entrepreneurs who receive proceeds, have the right to pay NPT:

- from the use of property;

- from other activities in which they do not have an employer and do not hire workers under employment contracts.

To pay NAP, an individual only needs to not conduct types of business prohibited under NAP and register with the tax office using the “My Tax” mobile application. Through this application, the self-employed person submits an application for registration, information from his passport and his photograph to the inspectorate. In addition, he can seek assistance in registering from a bank branch. In any case, the date of registration of a self-employed person as an NAP payer is considered to be the date of submission of his application to the inspectorate.

Features of paying taxes and contributions for advance payments

In the event that the GPC agreement provides for the payment of an advance to the contractor, insurance premiums must also be charged on it. There are certain nuances regarding personal income tax.

Accrual and payment of personal income tax

The transfer of tax to the budget for full-time employees and third parties when concluding a GPC agreement is significantly different. If the performer does not work for the company, then personal income tax should be withheld at the time of transfer of the advance. This requirement is established by the Tax Code of the Russian Federation, and the Ministry of Finance of the Russian Federation has repeatedly pointed out to it in its letters and clarifications. The regulatory authorities note that advances paid are fully included in the income of the contractor in the period in which the payment was made. The moment of completion of the work and signing of the acceptance certificate does not affect this in any way. If there is an employment relationship with the contractor and he is entrusted with performing certain work in the GPC agreement, personal income tax is withheld on the last day of the month. This is due to the fact that the employee’s main income is salary, and tax is withheld from it on the last day of the period, as required by the Tax Code of the Russian Federation. There may be cases when an organization cannot perform the functions of a tax agent. In such a situation, she is obliged no later than a month after the end of the year to notify the executor under the GPC agreement and the supervisory authority. This fact is reported using Form 2 of the personal income tax.

Calculation and payment of insurance premiums

In accordance with the norms of the Civil Code of the Russian Federation, the form of payment under a civil process agreement can be any: installments, prepayment, payment in full upon completion of work, and so on. The Tax Code of the Russian Federation does not provide any nuances regarding the inclusion of remuneration amounts in the base for calculating contributions. Consequently, the organization, in the case of paying an advance to the contractor, is obliged to charge insurance premiums for this amount. The calculation of the amount of contributions to be paid is made on the last day of the month when the remuneration was accrued. If the contractor returns the advance amount, the company will have an overpayment of insurance premiums, which should be reflected in the declarations. This will reduce the next payment.

Peculiarities of taxation of fees for compulsory medical insurance and compulsory medical insurance of contract agreements

Sometimes, by agreement between the contractor and the customer, in addition to direct remuneration for labor, payment to the contractor under the GPC is provided for reimbursement of expenses incurred by him related to the fulfillment of obligations. These may be costs for tools, raw materials, materials, and even travel to the place of work - everything that the contract itself provides for; There is no need to pay contributions for these amounts, as stated in paragraphs. 2 clause 1 of article 422 of the Tax Code of the Russian Federation. But personal income tax is still withheld from these amounts.

Moreover, all expenses of this kind must be supported by documents. This is necessary so that when conducting an audit, organizations do not charge additional insurance premiums for these amounts paid in favor of an individual.

Legal documents

- Article 779 of the Civil Code of the Russian Federation. Contract for paid services

- Article 702 of the Civil Code of the Russian Federation. Work agreement

- Article 1288 of the Civil Code of the Russian Federation. Author's order agreement

- Article 226 of the Tax Code of the Russian Federation. Features of tax calculation by tax agents. Procedure and deadlines for tax payment by tax agents

- Article 420 of the Tax Code of the Russian Federation. Object of taxation of insurance premiums

- Article 422 of the Tax Code of the Russian Federation. Amounts not subject to insurance premiums

- Federal Law of July 24, 1998 N 125-FZ

- Article 422 of the Tax Code of the Russian Federation. Amounts not subject to insurance premiums

Reflection of payments under GPC agreements in accounting

When working using contracts of this type, the following entries are generated in accounting: • Accrual of remuneration to the contractor: Debit 26 (44) Credit 60 (76). The basis for posting is the contract and the work acceptance certificate. • Calculation of insurance premiums: Debit 26 (44) Credit 69. The basis document is a calculation certificate prepared by an accountant. • Personal income tax withholding: Debit 60 (76) Credit 68. The performer’s tax card is used as the basis. • Payment of remuneration: Debit 60 (76) Credit 50. Payment is made on the basis of an expense cash order. • Transfer of personal income tax to the budget: Debit 68 Credit 51. Basis - bank statement on transactions on the current account. • Transfer of insurance premiums: Debit 69 Credit 51. The basis is similar to the previous paragraph.