What are capital investments in accounting and what are their distinctive characteristics?

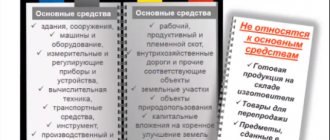

We can find the definition of this concept in Art. 1 of the Law “On Investment Activities...” dated February 25, 1999 No. 39-FZ. The law classifies capital investments as fixed assets, namely the costs of their creation, acquisition, expansion, reconstruction, design and survey work, etc.

If we turn to clause 4 of PBU 6/01, we will see that an important criterion for fixed assets is their long-term use - more than a year. In turn, the definition of long-term investment is given to us by the accounting regulation, approved by letter of the Ministry of Finance of the Russian Federation dated December 30, 1993 No. 160. Long-term investments, clause 1.2 of this regulation includes the costs of creating, purchasing, increasing the size of non-current assets that are used for more than one year. At the same time, an important condition is highlighted - such objects cannot be used for sales.

IMPORTANT! Long-term financial investments in securities (including government securities) and authorized capitals of other companies are not considered long-term investments.

Capital investments in accounting are accounted for at actual costs incurred (clause 2.1 of the regulations on accounting for long-term investments, clause 8 of PBU 6/01).

If a company is constructing an asset, the following breakdown of capital expenditures is recommended to account for capital expenditures incurred:

- for construction work;

- on installation;

- for the purchase of equipment for installation;

- for the purchase of equipment that does not require installation;

- for the purchase of tools and equipment;

- for the purchase of equipment that requires installation, but is intended for permanent stock;

- for other capital expenditures.

In this case, until the completion of construction work, the total amount of the above costs forms the cost of the unfinished construction of the asset.

If the company does not create a property object, but buys it, the situation is simplified: in this case, capital investments in assets will be equal to the amount of actual costs for their acquisition.

Summarizing the nuances we have considered, we can conclude that the defining characteristic of capital investments is their focus on the acquisition (or independent creation) of an investment asset that will be used for more than 12 months. That is why capital investments are not taken into account as part of current expenses, but are included in the initial cost of fixed assets. Moreover, this procedure applies to both accounting and tax accounting.

The final result of the investment is the formation of a fixed asset subject to accounting at its original cost. Therefore, for accounting of capital investments, it is necessary to be guided by the norms of PBU 6/01, which is devoted to a detailed description of the rules for accounting for fixed assets.

You can find out what these assets are from the article “What are the fixed assets of an enterprise?”

Ownership of unfinished construction

The transfer of unfinished construction to a new owner most often occurs under a sales and purchase agreement concluded by the parties to the transaction, under which the seller transfers ownership of the subject of the transaction to the buyer.

The transfer of ownership of unfinished construction, like any other real estate object (Article 130 of the Civil Code of the Russian Federation), requires state registration and occurs at the time of making an entry in the Unified State Register of Real Estate (USRN).

But as the wise boy Uncle Fyodor correctly noted at one time, in order to sell something unnecessary, you first need to buy something unnecessary. That is, in order to transfer the right of ownership, you must first have it - make a record of the registration of ownership of the property under construction in the Unified State Register of Real Estate.

To do this, you must submit to the territorial body of Rosreestr (clause 10, article 40 of the Federal Law of the Federal Law of July 13, 2015 No. 218-FZ “On State Registration of Real Estate”):

- title documents for the land plot;

- building permit.

Without the availability of title documents for a land plot (a certificate of registration of ownership rights to it, or a certificate of registration of a lease agreement), an investor (now just a developer) cannot obtain a building permit. And he cannot begin work on the construction of the facility.

Therefore, the investor should already have these documents.

True, situations are still possible when a construction permit is issued retroactively, simultaneously with the receipt of permission to enter, or even after it. But this is the exception rather than the rule.

In addition, for cadastral registration of an unfinished construction facility, it will also be necessary to provide the following information to Rosreestr (Clause 4, Article 8 of Law No. 218-FZ), in particular:

- type of property, that is, unfinished construction;

- degree of readiness of an unfinished construction project in percentage;

- the designed purpose of a building, structure, the construction of which is not completed.

Information about the degree of readiness of the object, in our opinion, should be taken from the acceptance and transfer certificates of the work result on the date when the investor decided to suspend the construction of the object.

We would like to draw the attention of readers that the subject of the transaction can only be suspended construction. An existing construction site is not considered real estate, and it cannot be sold to another person. This has been repeatedly pointed out by the Supreme Arbitration Court (clause 21 of the Information Letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated 01/24/2000 No. 51 “Review of the practice of resolving disputes under a construction contract”, clause 16 of the Information Letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated 02/16/2001 No. 59 “Review of the practice resolution of disputes related to the application of the Federal Law “On State Registration of Rights to Real Estate and Transactions with It””).

The investor takes into account the actual completed work results and terminates the contract with the contractor (or the technical customer, if the construction contracts were concluded through him).

Accounting for capital investments: applicable accounts in accounting

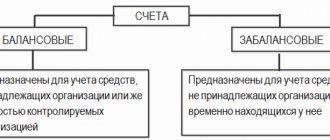

According to the chart of accounts (Order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n), an account is used to reflect information on capital expenditures on objects that will subsequently be accepted for accounting as fixed assets. 08 “Investments in non-current assets”. It is on it that all expenses incurred are collected, forming the initial cost of our asset. This account has several subaccounts for detailed accounting of costs incurred.

Comprehensive information about the account. 08 you will find in our publications:

- “08 accounting account (nuances)”;

- “On which line should account balance 08 be reflected in the balance sheet?”

According to clause 8 of PBU 6/01, the initial cost of purchased fixed assets is formed by the total costs of their acquisition, creation and construction (less VAT and other refundable taxes). In this case, accounting is carried out object by object.

The accounting entry in this case looks like this:

Dt 08 Kt 60.

The rules for forming the initial cost of an asset manufactured by a company independently are given in clause 26 of the guidelines for accounting of fixed assets (Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n). According to the rules, the initial cost of an asset is the actual cost of producing it.

IMPORTANT! The procedure for accounting and forming capital expenditures for the production of fixed assets must correspond to the procedure that is determined for accounting for the costs of the corresponding types of products produced by the company.

The accounting entry for independently created assets will look like this:

Dt 08 Kt 10, 02, 07, 10, 23, 26, 60, 69, 70, 71, 76…

The creation (reconstruction, modernization) of an asset may be associated with the acquisition of equipment that requires its installation, or equipment that cannot be operated without prior installation (classic examples are equipment mounted on a foundation, connecting individual parts of a production line, etc.). Acceptance of such objects for accounting is reflected in the account. 07:

Dt 07 Kt 15, 23, 60, 71, 75, 76, 79, 86, 91.

As property is transferred for installation, it is transferred from the account. 07 on account 08:

Dt 08 Kt 07.

The process of creating a new facility (or reconstructing an existing one) can be very lengthy. This is due, in particular, to the phased method of accepting work, the long-term implementation of trial operation, which is carried out until the planned design parameters are achieved, and many other specific objective factors that take place in construction.

All this may require very large capital expenditures, which can only be accomplished with the help of borrowed funds. Interest on them will increase the book value of capital investments in assets:

Dt 07, 08 Kt 66, 67.

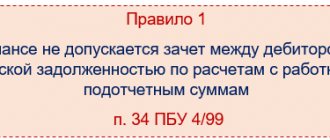

IMPORTANT! This rule applies only to those interests that were accrued before the asset was accepted for accounting. After this event, interest is charged to operating expenses (clause 11 of PBU 10/99).

After all capital costs for the facility are fully collected in the account. 08, it is considered ready for use, and its cost is transferred to the account. 01:

Dt 01 Kt 08.

More details about the account. 01 read the material “01 account in accounting (nuances)”.

How to complete your capex

Most often, CI is completed after the object has been brought into a condition and location where it is suitable for use for its intended purposes. Then the asset goes into the OS category. And the amount of capital investments is written off from account 08 to account 01 “Fixed assets”.

It is permissible to transfer not all ACs into fixed assets, but only part of the facility that began to be used before the other parts.

Also, capital investments are written off in situations where they are not able to bring economic benefits in the future. Examples are the sale of an object, its loss in a fire, etc.

REFERENCE

Expenses and income from write-off of capital investments are recognized in accounting in the period in which it occurred. First, calculate the difference between the book value of capital investments and disposal costs. Receipts from disposal are subtracted from the found figure. If the result is a positive value, then this is an expense. If negative - income.

Task: postings for accounting for capital investments

Quote (MissAlison): Dear accountants, please check the entries I have compiled and point out any errors. Thank you very much in advance! 1. Recognized as part of capital costs is the accounting cost of materials used in the construction of the facility - Dt 08-3 Kt 10 2. Included in capital costs is the amount of depreciation of the tower crane used during construction - Dt 08-3 Kt 02-1 3. Included included in capital costs is the amount of depreciation on the intangible asset used in the construction of the facility - Dt 08-3 Kt 05 4. Equipment requiring installation in the constructed building was commissioned - Dt 08-3 Kt 23 D 08 K 07, account 07 " Equipment for installation (see Chart of Accounts) 5. Depreciation on fixed assets used in the reconstruction or modernization of other fixed assets is included in capital costs - Dt 08-3 Kt 02-1 6. Materials were released from the warehouse to perform work on the reconstruction or modernization of fixed assets — Dt 08-3 Kt 10 7. The amount of deviations in the cost of materials used in long-term investments is taken into account as part of capital costs — Dt 08-5 Kt 16 8. Recognized in accounting. accounting for the costs of auxiliary production associated with the reconstruction of the workshop building - Dt 08-3 Kt 23 9. Suppliers' invoices for purchased lathes were accepted for payment - Dt 08-4 Kt 60 10. Transportation costs for the delivery of lathes were recognized in the amount of accepted invoices — Dt 08-4 Kt 60 11. Wages were accrued to employees involved in the creation of a trademark — Dt 08-5 Kt 70 12. A single social tax was accrued on the wages of employees involved in the creation of a trademark — Dt 08-5 Kt 69 13. By approved advance responses, travel expenses of the accountable person related to the purchase and delivery of vehicles are recognized - Dt 08-4 Kt 71 14. Computers contributed as a founder’s contribution to the authorized capital are accepted for accounting - Dt 08-4 Kt 75 15. The cost is taken into account services provided by third-party organizations for the delivery of computers - Dt 08-4 Kt 76 16. Accepted for accounting of the organization's investments in a land plot - Dt 08-1 Kt 60 17. Accepted for accounting objects of intangible assets assessed at the original (actual) cost - Dt 04 Kt 08-3 18. The environmental facility built by the organization was accepted by the commission according to the acceptance certificate (f. OS-1) - Dt 01 Kt 08-4 19. Lathes purchased from suppliers have been accepted for accounting - Dt 08-4 Kt 60 If I understand correctly, there should be wiring D 01 K 08 here, because the machines were already purchased in operation 9, but here they are taken into account, apparently, as part of OS 20. A land plot intended for rental has been accepted for accounting - Dt 01 Kt 08-1 D 03 K 08, account 03 “Income-generating investments in material values" (see Chart of Accounts) 21. Objects of unfinished construction, disposed of as a result of write-off or partial liquidation, are included in other expenses - Dt 46 Kt 91-2 D91 K 20, account 46 is called “Completed stages of work in progress.” The condition is unfinished construction. Inclusion in expenses is made in the debit of account 91.

Liability balance

An organization's liabilities are the sources of its assets. These include capital, reserves, as well as accounts payable obligations that the organization has incurred in the process of conducting business activities.

Liabilities are divided into:

- Capital and reserves

- Authorized capital

- Own shares purchased from shareholders

- Extra capital

- Reserve capital

- Retained earnings (uncovered loss)

- Loans and credits

- Deferred tax liabilities

- Other long-term liabilities

- Loans and credits

- Accounts payable

- Debt to participants (founders) for payment of income

- revenue of the future periods

- Reserves for future expenses

- Other current liabilities

Retrospective or perspective?

As a general rule, the consequences of changes in accounting policies associated with the start of application of FAS 26/2020 must be reflected retrospectively. That is, in such a way as if the standard had been used since the moment of occurrence of certain capital investments.

But another option is also possible. The organization has the right to choose the future use of the new standard. It implies that according to the new rules, only ICs that appeared after the start of application of FSBU 26/2020 are reflected. All other capital investments should be shown without taking into account the commented standard.