When counterparties violate their obligations, the resulting debt, especially with long overdue periods, creates a lot of problems for the accountant: either auditors demand to “calculate” reserves, or tax inspectors want to include penalties in income, even if it was decided not to accrue them. Innovation can help in such a situation. The possibility of terminating an obligation by novation is enshrined in paragraph 1 of Article 414 of the Civil Code of the Russian Federation. Novation of a debt is an agreement to replace the original obligation with another.

In practice, most often debts arising in the course of current activities (under sales and purchase agreements, lease of property, performance of work) are converted into loans. The admissibility of such operations is directly enshrined in Article 818 of the Civil Code of the Russian Federation. It is important to remember that the main feature characterizing a transaction as a “novation of debt” is the termination of the original obligation. For example, the Presidium of the Supreme Arbitration Court of the Russian Federation, in resolution No. 13096/12 dated February 12, 2013, considered the situation when the amount of payment for goods was declared a loan, but the supplier’s counter-obligations for the supply of goods did not cease. The court's conclusion was clear: such a transaction is not recognized as a innovation. But the above does not mean that partial novation of the debt is impossible: the contract will continue to be valid, and the buyer’s debt for products already delivered under a separate invoice will be novation into a loan. This right is enshrined in Article 407 of the Civil Code of the Russian Federation.

Novation - what is it?

The word itself suggests the meaning of this legal instrument - renewal. In this context, the update concerns obligations.

In the “debtor-creditor” relationship model, a real situation occurs when the debtor is in difficulty and cannot fulfill the requirements set by the creditor. To avoid conflict, the parties to the relationship agree to replace the existing obligation with a new obligation. This is the meaning of innovation. Sometimes the situation develops in such a way that the debtor is already able to fulfill his obligations better and/or faster and is ready to do so, but in return wants to receive some concessions from the creditor. This situation is also a reason for innovation.

Innovation procedures are regulated by the Civil Code of the Russian Federation (Articles 414, 818), and are explained by information letter No. 103 of the Presidium of the Supreme Arbitration Court of the Russian Federation.

Examples:

- The client applied for and received a consumer loan for a certain period. After some time, his financial situation has deteriorated so much that he cannot pay the amounts established by the contract every month. The way out of this situation is to contact the bank and renew the agreement for a longer period, thereby reducing monthly payments.

Taxation

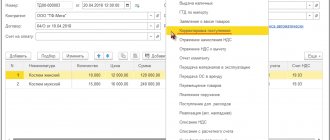

This agreement must be reflected in both accounting and tax records. For example, in the original agreement, the supplier of the goods received an advance for goods against future delivery. This amount of money was not taken into account in the supplier's income, and was also not reflected in the buyer's expenses.

Features of debt innovation. Photo: myshared.ru

Since the shipment was not made, both parties did not receive any income or expenses, so an adjustment must be made to each company's tax base. Novation into a loan obligation is accompanied by the payment of interest, which leads to the receipt of income by one party and expenses by the other.

After signing the novation agreement, the advance paid by the buyer becomes a loan to the seller of the goods. The loan cannot be taken into account as income, so the supplier's tax base is reduced by certain interest on the loan.

The buyer in this situation becomes the lender receiving interest on the loan. Therefore, these percentages are classified as non-operating income of the company.

Innovation in civil law

Novation occurs when:

- there is an obligation between the debtor and the creditor;

- the debtor's position has changed;

- Negotiations have been held - mutual agreement has been reached to replace the existing obligation with another;

- a new obligation has been defined and there is an intention of the participants to update the existing one - this is a necessary condition for the innovation to take place;

- this replacement is acceptable.

Examples of situations when innovation is acceptable:

- obligations with an expired statute of limitations (stagnant) can be novated;

- non-contractual obligations (for example, it is permissible to novate an obligation due to damage to property).

Transaction regulations

The structure of the template is drawn up taking into account the requirements of civil law and aspects of the initial agreement. The form of the obligation must necessarily change; the participants in the relationship remain the same. To eliminate possible disputes and disagreements in the future, it is necessary to provide direct links to the base contract.

The innovation can be applied at any stage of settlements between counterparties. It is not prohibited to reach a settlement agreement during the trial and decide to terminate the debt by novation into a loan.

For example, let’s imagine that the Master company did not pay the Tools company for the supply of components. The creditor files a lawsuit.

The debtor, having assessed the potential costs, the risk of loss of property, bankruptcy, invites the creditor to compromise and replace the monetary obligation with a loan at interest. The addressee of the appeal will satisfy the request, since in addition to the principal debt he will receive additional profit.

What is a novation agreement

Suppose the debtor's position has changed, and he has proposed to the creditor to change (novate) the existing obligation. During the negotiations, the parties came to a decision to replace the existing obligation with another, and all the conditions for changing the obligations were agreed upon. The agreement reached must be formalized in order for it to be legally binding if, for any reason, legal proceedings are required.

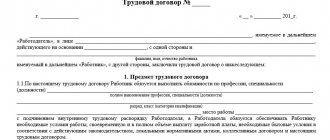

The agreement is drawn up in the form of a contract and is called a “Novation Agreement”. Special requirements for this document are established by law only in the case of replacing an existing obligation with a borrowed one - the form of the novation agreement must correspond to the form of the loan agreement (Article 818 of the Civil Code of the Russian Federation).

In other cases, the law does not impose strict requirements for a novation agreement. When drawing it up, they are guided by the norms of the legislation of the Russian Federation on contracts and transactions.

Thus, a novation agreement is a formal agreement between the parties to replace an existing obligation with a new one that has legal force and terminates the original obligation.

Features of the bill

Bill documentation is relevant in a number of cases:

- in the case of expiration of the bill of exchange and the absence of a controversial situation between the parties to the relationship;

- when creating a new contract, taking into account the obligations of the participants and a different repayment period;

- when revising and supplementing the amount of financial debt, interest rates and other conditions;

- if the debt is not expressed in the form of financial assets, but by mutual agreement of the parties to the relationship is restructured into obligations under promissory notes. The borrower repays the debt not financially, but using bills of exchange for the total amount of the debt.

Novation is a multilateral transaction that provides for the application of rules and conditions under which the contract can be considered concluded. Documentation must be drawn up in the form required by law, otherwise it may be considered invalid or unlawful.

The difference between a contract and an agreement

In the case of innovation, the terms “agreement” and “contract” are used in all documents as synonyms.

But it is logical to consider the agreement and contract as successive stages of the novation procedure:

- first, the parties decide to replace the original obligation with a new one, all the nuances are discussed - an agreement arises;

- the agreement is formalized in the form of a contract called a “Novation Agreement.”

When the parties have signed a novation agreement, the previous obligation is considered invalid. At this point, a new obligation comes into force.

The meaning of the event

Debt may be generated by a company for a paid advance for the upcoming supply of goods, provision of services, or performance of work. A receivable is formed by the supplier at the time of shipment of materials in favor of the counterparty, transfer of property for rent and other relationships.

It is not always possible for the debtor to fulfill the terms of the contract in full and within the established time frame.

In practice, there are often cases when the defaulter is unable to complete the work, pay for materials, etc.

It is in such a situation that the optimal solution is to replace one type of obligation with another. Debt novation is a procedure that provides for the preservation of mutual settlements between counterparties, but in a different form.

The debt itself continues to exist in value terms, but the terms of the transaction change.

The original agreement can be valid between individuals and legal entities, so the new contract is concluded between them. That is, there are no new participants in the innovation relationship. The essence of updating the contract is to replace the subject of the agreement.

For example, under a supply agreement, the supplier was unable to ship materials to the buyer for a certain amount due to the absence of the object of the transaction. Since the consumer is interested in returning the previously listed advance, he compromises and accepts the counterparty’s offer to convert the subject of the transaction into borrowing.

The borrower does not actually receive money on loan from the lender. The previous agreement had a cost dimension, which is translated into a lending agreement on new terms. It is likely that the debtor will have to pay interest on the loan amount in order to interest the customer in the feasibility and profitability of the transaction.

How to draw up a novation agreement

The novation agreement specifies the content of the existing obligation, then indicates that the parties have agreed to replace (novate) the obligation with another obligation. The following outlines the essence of the new obligation.

The novation agreement is concluded between the same parties who are bound by the original obligation - this is a legal requirement. One obligation can be converted into several. The fulfillment of several obligations can be replaced by one.

To avoid the negative consequences of a situation in which a company or individual finds itself when it cannot fulfill its obligations to banks or other creditors, innovation can be applied. Drawing up an agreement to replace obligations (novation) will allow you to move on to more convenient relationships with creditors that will suit both them and you, while allowing you to overcome the difficulties that have arisen.

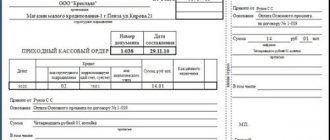

What documents are needed?

To carry out the novation of a debt into a loan obligation, various documentation may be required. As a rule, to conclude a deal it is enough to have:

- a previously concluded agreement, which after signing a new agreement loses legal force;

- constituent documentation of legal entities or a passport of an individual are required to enter information about the parties to the agreement;

- If, as part of a new transaction, any property is transferred as collateral, then in addition it is necessary to provide the title documents for this property.

Important: taking into account the new subject of the transaction, the list of required documentation may be expanded.

As a result, it is worth clarifying that novation cannot be performed on debts that arose as a result of transactions affecting the personal interests of the participants. It is not allowed to substitute obligations if the debt was formed due to non-payment of compensation payments due for causing property, moral or physical harm to a person. The same applies to the reformatting of debts for alimony payments and other amounts under writs of execution.

After signing a new contract, the previous transaction becomes invalid. In order for the new document to be drawn up legally correctly, several points should be taken into account:

- The contract must stipulate that the debt will be repaid not through the transfer of property (goods), but by the payment of a certain amount of money.

- The document may contain a pledge condition for specific items that will be held by the creditor until the debt is fully repaid.

- For the legitimacy of a new transaction, all important terms of the previous agreement must be included in the text of the agreement.

- If one of the parties is a legal entity, then its financial statements must include information about each new document (information is entered in the reporting period when drawing up contracts for obligations).

- The price of the item stated in the new contract must be similar to the price of the item being replaced.

- In general, a novation agreement must be written in accordance with the rules for drawing up business papers, using appropriate legal structures.

Debt novation today is a very popular type of transaction, since it allows you to maintain partnerships between companies, eliminating the possibility of debt formation. Also, in the future, the creditor will avoid the need to go to court with a claim for debt collection, since he will resolve this issue with the debtor peacefully.