- How to apply for a 2-NDFL certificate

- What does an application for 2-NDFL look like? Sample for accounting

- Can they refuse to issue a certificate?

Tax returns are traditionally prepared in the accounting departments of hiring organizations for the purpose of submitting them to the Federal Tax Service. This is how firms and enterprises report for withholding taxes from the salaries of their employees in the past year. However, there are circumstances in which tax reporting is requested in person, and for this the employee must fill out an application for a 2-NDFL certificate. Let's look at what this document is and how to prepare it.

Why fill out 2-NDFL?

Organizations submit Form 2-NDFL to tax authorities, information from which allows you to determine the salary, available tax deductions and deductions made for a specific employee.

Such a document is issued for each employee. The certificate is signed by the manager or the person to whom he has instructed to do this. In addition to the Federal Tax Service, this form is also in demand in other situations. They may be:

- obtaining a loan from a banking institution;

- receiving a deduction for personal income tax when paying for studies and expensive treatment, when purchasing medicines, purchasing real estate;

- employment for another job;

- calculation of vacation and sick pay;

- visa application;

- buying a home with a mortgage.

The company is required to prepare a certificate, since it is a source of information for tax authorities.

Where to get a 2-NDFL for a non-working citizen, find out from the article “Where can I get (get) a 2-NDFL certificate?”

In what cases is a certificate needed?

The demand for the document under code 2-NDFL is quite high, because it confirms the receipt of official income by an individual.

Most often, a certificate is asked to provide in the following cases:

- when receiving credit finance from banking institutions;

- for a mortgage (when drawing up an agreement to borrow funds for the purchase of residential premises);

- during employment at a new enterprise;

- when applying for a tax deduction in the following circumstances: payment for studies; acquisition of living space; receiving paid treatment; other expenses.

| Where is it served? | Legal basis | Procedure for providing a certificate |

| To the tax authorities for each citizen who received profit during the past tax period | Reporting standards are set out in clause 2 of Article 230 of the Tax Code of the Russian Federation | The maximum filing deadline is March 31 (inclusive) of the following year following the end of the reporting period. |

| It is provided to the tax service for those persons from whose income personal income tax was not withheld | According to the text set out in paragraph 5 of Article 226 of the Tax Code of the Russian Federation. | Within a month from the date of occurrence of obligations |

| To the taxpayer at his request | Personal written or oral request from an employee (including former employees) | The document must be issued within 3 working days from the date of receipt of the application |

Sample of personal income tax certificate 2 for 2021

Certificate 2-NDFL for 2021, a sample of which you can download on our website, is filled out according to the form approved by order of the Federal Tax Service of Russia dated 10/02/2018 No. ММВ-7-11/ [email protected] A sample of filling out 2-NDFL for 2020 will help find out in which columns it is necessary to indicate certain incomes.

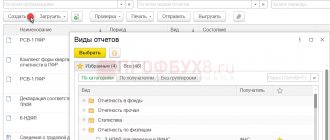

From reporting for the 1st quarter of 2021, officials combined 6-personal income tax and 2-personal income tax. The latter became an appendix to the report on form 6-NDFL. The new report was reviewed by ConsultantPlus experts. Get trial demo access to the K+ system and study the material for free.

Taxpayers themselves, counting on receiving a property deduction, can submit a 3-NDFL declaration and accompanying documents, including a 2-NDFL certificate, to their tax office at any time throughout the calendar year.

The materials in the section “Return of personal income tax when buying an apartment - application and procedure” will help you understand the nuances of obtaining a property deduction.

2-NDFL salary certificates of the 2021 sample are prepared by employers for each employee.

When must an employer issue an income certificate to an employee?

Form 2-NDFL is an official tax reporting document. The employer must provide a document of the specified nature to the inspectorate at the place of registration of the company for each reporting period. This need is regulated at the legislative level. In particular, this fact is regulated by Article 230 of the Tax Code of the Russian Federation. The main information to be reflected in the certificate is the amount of income and tax withholdings.

If the need arises, the employee can contact management with a request to issue and issue a 2-NDFL certificate. An employee can use this opportunity an unlimited number of times. The number of certificates received at a time is also not established.

The document may be needed in the following cases:

- obtaining a loan or mortgage;

- registration of benefits of various types, including financial assistance;

- preparation of documentation for travel to foreign countries, etc.

In addition, 2-NDFL is issued to the employee upon dismissal. In this case, the employee does not need to fill out an application for this - the document will be provided without a request. The list of circumstances under which an employee may need a certificate of income and tax withholdings is unlimited. The employer cannot have any grounds for refusing to provide a certificate. Therefore, he has no right to refuse the employee’s request.

The document can be issued provided that the employee needs a certificate for the last 4 years of his work in the company. This is justified by the fact that the employer stores such information for precisely this time. Therefore, providing historical data becomes impossible.

An employee can apply to the company management to issue a 2-NDFL certificate even after he is fired. It may even take some time since the termination of the employment relationship. The former employee’s request will be granted if no more than 4 years have passed since the dismissal.

The employer has 3 days from the date of receipt of the corresponding request from the employee, drawn up in the form of an application, to complete and issue the certificate.

Each copy of the certificate (if there are several) has the same legal force.

When requesting information about income in 2021 for 2021, the employer issues a certificate in form 2-NDFL. For 2021, information is provided in a new form approved by Order of the Federal Tax Service of Russia dated October 15, 2020 N ED-7-11/ [email protected]

Read more about the certificate confirming income and the procedure for issuing it in 2021 in this article.

How to write an application for the issuance of form 2-NDFL?

In order to receive form 2-NDFL for a certain period of time, the employee must fill out and submit a corresponding application to the management of the organization.

The current labor legislation does not establish a uniform form for drawing up a document of this nature. A citizen has the right to draw up an application in free form.

The application must contain the following information:

- name of the company, initials and position of the recipient (chief executive of the company);

- the initials and position of the applicant, the name of the structural unit in which he works (if the applicant is a current employee of the company);

- document's name;

- text of the direct appeal with reference to the legislative act regulating the process of issuing 2-NDFL certificates. In this case, this is the Tax Code of the Russian Federation, in particular - Article 230;

- indication of the period for which it is necessary to provide data on the employee’s income and tax withholdings;

- date of application;

- applicant's signature with transcript.

Companies may develop their own sample form, which should be used when completing such applications. There are no restrictions in this regard. The main thing is to follow the basic rules of document flow in the enterprise.

There is no exact period during which the employer must provide the employee with 2-NDFL. It is important to take into account that in such circumstances Article 62 of the Labor Code of the Russian Federation applies. According to the information indicated therein, the manager is obliged to provide documentation related to work activities to the employee within 3 days from the date of receipt of the relevant application from him.

Sample application for issuing a 2-NDFL certificate in 2021.

Issuance of certificate 2-NDFL

The certificate is filled out in accordance with the provisions of Chapter. 23 Tax Code and Art. 62 TK. To receive it, the employee must fill out an application. He must receive a certified certificate no more than 3 working days from the date of submission of the application. If the certificate is not received on time, the applicant can file a complaint by sending it to the labor inspectorate, court or prosecutor's office.

According to existing legislation, refusal to issue a certificate is considered a violation. Most organizations issue a certificate upon dismissal of an employee.

Let's consider the possibilities of obtaining help in non-traditional situations:

- If an employee has changed several jobs and then cannot find one or more organizations, he needs to obtain information from the tax authorities at his place of residence by filling out an application in any form.

- If the company does not exist, the certificate can be obtained through your personal account on the Internet from the Federal Tax Service website.

- If there is no data in the Federal Tax Service, then when applying for employment in another organization, you can write a statement about the impossibility of obtaining a certificate due to the liquidation of the company. Then the employer submits a request to the Pension Fund and tax authorities about the need to obtain all data on the salary of the incoming employee.

Find out how to get a 2-NDFL certificate without an application from the message.

Where to go if your employer has ceased operations

If the organization has already ceased its activities at the time of the need to send a request for a certificate, you should contact the territorial tax office directly. If for some reason it is impossible to contact the tax office, then the employee has the right to submit an application at a new place of work, justifying why obtaining the document is impossible in another way. The organization will send a request to the Pension Fund and provide a certificate based on the information received.

Results

An application for issuing a 2-NDFL certificate is submitted to the employer in any form (if the company has not developed a special application form).

It is necessary to indicate information about the applicant (full name, passport data, address, etc.), as well as for which years the 2-NDFL certificate is needed and the number of its copies. The application is completed by the personal signature of the applicant and the date of its preparation. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Where can an unemployed person or a pensioner get a certificate?

An unemployed person can receive a certificate of income received in the form of unemployment benefits at the employment center. All you have to do is submit an application and then pick up the completed certificate. But this will not be Form 2-NDFL. If an individual has not worked for more than three years and is not registered with the employment center, then there is simply nowhere for him to get a certificate of income, because officially there was none.

If a non-working person had income from other sources, it is necessary to report them by indicating in the 3-NDFL declaration. In addition, you will need to calculate the tax yourself and transfer it to the budget. In this case, evidence of income received and taxes paid on it will be a copy of the tax return.

Pensioners receiving payments from non-state pension funds can request 2-NDFL from the local branch of their fund. But disabled citizens who receive state pensions will not be able to obtain such a certificate from the Pension Fund of the Russian Federation, since such pensions are not subject to personal income tax.

Correction of data for reference

If inaccuracies are discovered (during a tax or independent audit), the tax agent must provide an updated version of the certificate to the Federal Tax Service. And do this as soon as possible so as not to become liable for distortion of information submitted to the Federal Tax Service (Article 126.1 of the Tax Code of the Russian Federation). Corrections made before the violation is discovered by the tax authority will relieve liability.

In addition, the correct version of the certificate must be given to the employee.

Non-taxable income should not be included in the certificate. If a mistake was made when preparing the original certificate, the employer should correct this violation.

If the changes are related to the recalculation of personal income tax in the direction of increasing tax liabilities, then the amended certificate does not indicate the tax overpaid by the tax agent, but not withheld from the employee, since the Federal Tax Service of Russia does not consider such an overpayment as tax.

If the previous certificate indicated the tax withheld in excess from the employee, and it was subsequently returned to the individual, then the correct amount must be indicated in the new certificate. After discovering an error in the form of excessively withheld personal income tax, the refund must be made within 3 months.

For information on how refunds are made, read the article “How to return excessively withheld personal income tax to an employee.”

Why is it better to get a loan with 2-personal income tax?

If you have the opportunity to bring this document to apply for a loan, do not ignore it. Only if you have a complete set of documentation can you count on good lending conditions.

The benefits of having a certificate are as follows:

- increased bank loyalty. The level of trust in such clients is definitely higher, so the likelihood of a positive response will also be more serious;

- opportunity to get a decent amount. Without certificates, borrowers receive a maximum of 80,000-100,000 rubles. Without them, you can borrow even 1,000,000 rubles. But here, in any case, everything will depend on the level of solvency of the citizen. They still won’t give out more than he can afford;

- reduced rate. The certificate reduces the bank’s credit risks, so it will set low interest rates under the program.

The only negative aspect of applying for a loan with a 2-NDFL certificate is that the process is more drawn out. You need to order a certificate and wait for it. Review of applications for such loans usually takes 2-3 business days. That is, you won’t get a loan quickly. Without any certificates, you can take it in literally 1 hour.

Many banks allow you to replace 2-NDFL with other forms of income confirmation. This may be a certificate in the form of a bank or obtaining information from the Pension Fund of the Russian Federation, if the client has access to State Services. The second option is generally the most convenient of all methods of confirming the borrower’s income level.

about the author

Irina Rusanova - higher education at the International East European University in the direction of "Banking". Graduated with honors from the Russian Economic Institute named after G.V. Plekhanov with a major in Finance and Credit. Ten years of experience in leading Russian banks: Alfa-Bank, Renaissance Credit, Home Credit Bank, Delta Credit, ATB, Svyaznoy (closed). He is an analyst and expert of the Brobank service on banking and financial stability. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

What's new in the procedure for obtaining a certificate

As mentioned above, starting from 2021, 2-NDFL is issued on a new form. Or rather, on two forms:

- The first - it is now called 2-NDFL - is used for submission to the Federal Tax Service.

It has a new structure: it consists of some kind of title page, three sections and one appendix. At the very beginning of the document, information about the tax agent is provided, in section 1 - information about the individual in respect of whom the certificate is being filled out, in section 2 - information about the total amount of income, tax base and personal income tax, in section 3 - deductions provided by the agent: standard, social and property, and the appendix provides a breakdown of income and deductions by month.

- The second form, which is issued to the employee, is simply called “Certificate of income and tax amounts of an individual” (without the usual “2-NDFL”). It almost completely repeats the previous form (from the order of the Federal Tax Service dated October 30, 2015 No. ММВ-7-11/ [email protected] ).