Various companies are periodically forced to raise borrowed funds for their further development. There are a number of rules for posting loan funds and interest on them in reporting documents. Interest charges are part of operating expenses. They are carried out using the entry - debit 91/2, credit 66. Payment of debt and transfer of interest is reflected in the documents by posting debit 66, credit 51 (52, 53). When preparing financial statements, the accountant must know whether it is necessary to convert all long-term loans into short-term ones.

Long-term and short-term debts

The validity period of a long-term one exceeds one year. For example, the unpaid balance of a long-term lease is a long-term debt.

Short-term debts are repayable within one year. Their categories include accrued wages, annual taxes, bills, interest, and so on.

Current requirements also include any payments in the coming year needed to service long-term debt.

The organization's short-term debt is shown in the report as: “Short-term debt” in section 5 of the balance sheet.

Smart investors use several measures to examine a firm's debt position.

Debt liability is a ratio that gives you an idea of a company's liquidity.

The debt-to-equity ratio is calculated by dividing the owner's equity by total liabilities. The higher the ratio, the more liquid the business is in the long term.

Short-term liquidity plays an equally important role. Its general indicator is the fast ratio. To calculate a quick ratio, subtract a firm's inventory from its current assets. Divide the balance by current liabilities. The resulting ratio tells you how much cash the firm has available to pay non-current payments.

How to reflect the transfer of a loan into short-term debt in reporting documents?

It is important to remember that this procedure is not reflected in synthetic accounting accounts. You should proceed according to this principle, in accordance with the rules and job descriptions:

- If there are analytical accounts, it is necessary to make the corresponding internal entries on the analytical accounts of debts of both categories.

- On the balance sheet, debt that falls into the short-term category according to the repayment period (but is accounted for in account 67) is reflected in the category of short-term liabilities.

- If the reporting policy provides for the form of explanations, then in the statement of financial results and balance sheet this point must be reflected in the appropriate column (transfer from long-term debt). At the same time, data on long-term debt available at the end of the reporting period is reduced, and in the category of short-term liabilities it is increased.

Thus, the solution to the issue must be approached taking into account the reporting policy applied at this enterprise. There is no need to specifically transfer a loan to the short-term category when the repayment period is naturally shortened. Moreover, such an operation will not be entirely correct from the point of view of the rules for keeping records and drawing up reporting documentation.

Methods of settlement

How debt is managed in the short term is very important.

There are many financial management methods. Let's note some of them:

- debt repayment using the company's working capital. Everything is clear here. Any operating unprofitable production of goods or services has working capital from sales or provision of its services. It is at this expense that the debt is repaid;

- developing a strategy for converting debt into capital that works for the organization. This scheme is developed by the financial department of the enterprise, approved by the board of directors and implemented into production. These are rather anti-crisis measures.

During a crisis, the company also uses the following strategies:

- Rank debts by urgency.

- Identify sources for payments of primary importance.

- Renew contracts with company employees in favor of production during the crisis.

- Renew contracts with agents and contractors.

- Short-term lending. It should be noted here: if your business is being sued for non-payment of debts, you cannot count on a loan. They won't give it to you.

Long-term and short-term liabilities of the enterprise

To resolve financial issues, many companies attract internal and third-party sources of financing. In the second case, at a certain stage the company may have so-called long-term and short-term obligations.

If they exist, one of the main tasks of a company or enterprise is timely repayment of debts, while the funds received are not the property of the company, it simply uses them until the time for their repayment comes.

Signs of short-term liabilities

This type of loan has the following features:

- The total amount of borrowed funds largely determines the duration of the enterprise's production cycle. The more significant the short-term obligations of a business entity, the smaller amounts it will attract to use to pay current expenses in the course of the company's operation.

- The company's short-term liabilities replace a free source of borrowed capital.

- The total amount of debt is often determined by how successfully the company sells its products. An actively operating enterprise is forced to constantly spend money, so it often requires borrowed funds.

- When preparing the financial statements of a company, it is worth remembering that short-term liabilities on the balance sheet are “Liabilities”.

- In some cases, debts that are less than 12 months old can be paid off using current assets. These financial resources are used in the planned activities of a business entity, and in order to use them to pay off debts, they must be credited no later than 12 months from the date the debt was created.

- The amount of this type of debt depends on the frequency of payments on it, which makes it possible to quickly work with sources of funds when carrying out production activities.

- The size of short-term liabilities is difficult to estimate in the future; this situation arises from the impossibility of accurately calculating the amount of amounts that form the basis of debt obligations.

Calculation of the coefficient and its meaning

Described debt is expressed using a ratio that shows the proportion of liabilities in relation to total debt. To calculate this coefficient, use the following formula:

Kkz = Ko: (Ko + Do)

Where

- Kkz is the coefficient that needs to be calculated,

- Ko – short-term,

- Until – long-term.

obligations used:

The indicator that will be obtained after the operations performed shows how dependent the business entity is on borrowed financial injections over a 12-month period. If the short-term liabilities ratio is high, this indicates that the company is solvent, respectable and reliable.

Short-term liabilities and their components

When recording debt obligations, all borrowed funds of the company must be taken into account. The company's current liabilities consist of the following components:

- Conditional payment.

- Funds that were borrowed for a long period of time, but part of them must be returned within a period not exceeding a 12-month period.

- Accounts payable.

- Income that the company did not earn.

- Debt obligations on demand.

- Deposits placed for a 12-month period and which will be returned.

- Tax deductions.

- Dividends to be paid to shareholders.

- Loans on bills of exchange with maturities of less than 12 months.

- Debts requiring repayment no later than 12 months.

Types of short-term liabilities

Short-term liabilities can be divided into several subtypes:

- Operating rooms. This type of debt includes: rent payments, advance payments received by a business entity, taxes, current payments to the budget. The group of operational obligations includes the company's debts for materials received that will be used in production, as well as accrued but not yet paid salaries to the company's employees.

- Debts subject to repayment no later than 12 months from the date of reporting.

- Funds required to pay off debts within a 12-month period. This category includes bonus payments, deductions to employees of the company for vacations, bonuses and other short-term obligations.

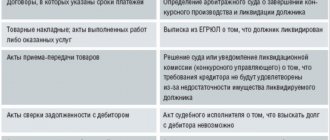

Loan repayment period

If the debt is paid partially and monthly, the corresponding entry reflects this transaction also monthly for the specified amount. All debts are reflected in the financial statements taking into account their repayment period. They are conventionally divided into:

- short-term (with a working period of up to 12 months);

- long-term loans.

In the process of work, an accountant often has a question about the possibility of transferring borrowed funds from the category of long-term to short-term liabilities. This happens, for example, if the commitment period is 366 days.

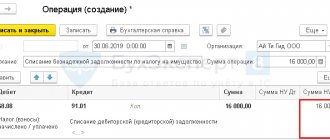

Accounting: with the lender

Debit and credit using examples in the article: what is debit and credit in simple words.

For the creditor, the transfer of debt only means replacing the debtor in the obligation. Therefore, if your organization acts as a creditor, then reflect the transfer of debt in accounting with the following posting:

Debit 62 (58, 76...) “New debtor” Credit 62 (58, 76...) “Original debtor” - reflects the amount of debt transferred by the debtor to another person.

This must be done on the effective date of the debt transfer agreement.

When payment is received from the new debtor (the obligation is repaid), make the following entry in accounting:

Debit 50 (51, 60, 76...) Credit 62 (58, 76...) “New debtor” - payment has been received (offset has been made) to repay the debt under the agreement from the new debtor.

This procedure follows from the Instructions for the chart of accounts (accounts 58, 62, 76).

Taxable temporary difference

When receiving a loan to purchase an investment asset, a taxable temporary difference arises, since in accounting, interest is charged to the cost of the asset, and in tax accounting, it is included as an expense. A difference arises between tax and accounting accounting, therefore, a deferred tax liability is formed in account 77 in accordance with PBU 18/2002.

The write-off of the deferred tax liability will begin as soon as the investment asset is accepted for accounting and begins to be depreciated.

Accounting: with the original debtor

On the date specified in the debt transfer agreement, the original debtor's obligation under the contract ceases. At the same time, he has obligations to the counterparty, who has assumed the obligation to repay the debt. Therefore, if your organization is the original debtor, reflect the write-off of the amount of accounts payable in accounting by posting:

Debit 60 (66, 76...) Credit 76 – the amount of accounts payable transferred to the counterparty with the consent of the creditor is written off.

Reflect the repayment of the obligation to the new debtor by posting:

Debit 76 Credit 50 (51, 60, 62, 76) – payment has been made (offset) of the obligation under the debt transfer agreement.

This procedure follows from the Instructions for the chart of accounts (accounts 60, 76).

An example of reflecting debt transfer transactions in the accounting records of the original debtor

In June, Torgovaya LLC (creditor) sold materials to Alpha LLC (original debtor) for the amount of RUB 590,000. (including VAT - 90,000 rubles) according to the supply agreement. The payment deadline for the goods is July 30. On July 1, Alpha, with the consent of Hermes, transfers the debt to Proizvodstvennaya LLC (counterparty). "Alpha" and "Master" entered into an agreement that, in payment for the finished products received by "Master" from "Alpha", "Master" undertakes the obligation to repay Alpha's debt to "Hermes".

In Alpha's accounting, the accountant made the following entries.

In June:

Debit 10 Credit 60 – 500,000 rub. – materials were received from Torgovaya;

Debit 19 Credit 60 – 90,000 rub. – VAT is reflected for purchased materials;

Debit 68 Credit 19 – 90,000 rub. – accepted for deduction of input VAT on purchased materials.

At the time of shipment of goods to the “Master”:

Debit 62 Credit 90-1 – 590,000 rub. – income from the sale of products to the “Master” is recognized;

Debit 90-3 Credit 68 – 90,000 rub. – VAT is charged on the cost of shipped products.

In July:

Debit 60 Credit 62 – 590,000 rub. – debt transfer obligations are offset against payment for delivered products.

Is it possible to transfer short-term loans to the long-term category?

Such an operation is not provided for, but is permissible in a situation where the parties have reached such an agreement and restructured accounts payable. Accordingly, the loan repayment period has become longer. It is more than 12 months.

This must be reflected in the documentation, in accordance with the basic rules of reporting:

- You will need to make the necessary notes on analytical accounts, provided that the enterprise has analytical accounting. If there is no analytical accounting, then the transfer of debt from one category to another is reflected in the debit of account 66 and in the credit of account 67. The basis for performing this operation is a change in the terms of the loan agreement.

- When preparing the balance sheet, funds are shown in the long-term category, since they are now long-term liabilities.

- The operation of transferring borrowed funds must be indicated in the explanations to the report on the results of the enterprise’s work and the balance sheet. Naturally, the size of long-term liabilities increases, and short-term liabilities decrease by the same amount.

In this situation, the same principle of accounting entries applies as when changing the repayment period of long-term loans.

Accounting: for a new debtor

When your organization assumes obligations from another organization and acts as a new debtor, reflect the recognition of debt to the creditor by posting:

Debit 60 (76) Credit 76 – accounts payable to the original creditor and receivables of the former debtor are reflected.

This must be done on the effective date of the debt transfer agreement.

Repay the debt to the creditor by posting:

Debit 76 Credit 50 (51, 60, 62, 76...) – the debt to the creditor is repaid.

This procedure follows from the Instructions for the chart of accounts (accounts 60, 76).

An example of reflecting debt transfer transactions in the accounting of a new debtor

In June, Torgovaya LLC (creditor) sold materials to Alpha LLC (original debtor) for the amount of RUB 590,000. (including VAT - 90,000 rubles) according to the supply agreement. The payment deadline for the goods is July 30. On July 1, Alpha, with the consent of Hermes, transfers the debt to Proizvodstvennaya LLC (the new debtor). Master has outstanding accounts payable to Alfa in the amount of RUB 1,180,000. "Alpha" and "Master" entered into an agreement to transfer the debt to offset the accounts payable of "Master" to "Alpha".

The Master's accountant made the following entries.

In January:

Debit 10 Credit 60 – 1,000,000 rub. – the receipt of products from Alpha is reflected;

Debit 19 Credit 60 – 180,000 rub. – reflected input VAT on purchased products;

Debit 68 Credit 19 – 180,000 rub. – accepted for deduction of input VAT on purchased products.

In July:

Debit 76 subaccount “Settlements with Alfa LLC” Credit 76 subaccount “Settlements with Trading LLC” - 590,000 rubles. – obligations have been accepted to Torgovaya;

Debit 60 Credit 76 subaccount “Settlements with Alpha LLC” – 590,000 rubles. – offset of accounts payable to Alfa;

Debit 76 subaccount “Settlements with Trading LLC” Credit 51 – 590,000 rub. – the debt to Torgovaya was repaid.

Situation: how can a new buyer reflect in accounting the receipt of a fixed asset when acquiring the right to claim under a purchase and sale agreement? Ownership passes after payment to the seller.

Reflect the receipt of property as part of fixed assets on the date of entry into force of the agreement on the assignment of the right of claim.

In this case, your organization assumes the rights and obligations under the purchase and sale agreement. Namely:

- repay the debt to the seller;

- actually receive property from the former buyer;

- receive ownership of the property after full payment.

As soon as the rights and obligations have transferred to you, the property will immediately be reflected as part of fixed assets. After all, all the conditions for this have been met. The moment of transfer of ownership does not matter (clauses 4 and 5 of PBU 6/01).

Therefore, on the date of entry into force of the agreement on the assignment of the right of claim, make the following entries in accounting:

Debit 08 Credit 76 subaccount “Settlements with the former buyer” - accounts payable to the former buyer are reflected in the amount of money actually transferred by him to the seller for the fixed asset;

Debit 08 Credit 60 – accounts payable to the seller are reflected in the amount of the remaining payment for the equipment;

Debit 01 subaccount “Fixed asset in operation” Credit 08 – the fixed asset was accepted for accounting and put into operation at its original cost.

On the date of repayment of accounts payable to the former buyer, make an entry:

Debit 76 subaccount “Settlements with the former buyer” Credit 50 (51...) – the debt to the former buyer is repaid.

Repay the debt to the seller by posting:

Debit 60 Credit 50 (51...) – the debt to the seller is repaid in the amount of the remaining payment for the equipment.

This procedure follows from the Instructions for the chart of accounts (accounts 01, 08, 60, 76).

Regarding VAT. The new buyer does not have the right to deduct tax. This is due to the fact that he will not have an invoice from either the seller or the former buyer. Firstly, the sale (shipment) of the equipment does not occur in this case, although in the future the ownership will be transferred to it. Secondly, the former buyer took advantage of the right to deduction (clause 2 of Article 171, clause 1 of Article 172 of the Tax Code of the Russian Federation).

BASIC: income tax

For the creditor , replacing the debtor has no meaning. With the accrual method, sales revenue is already taken into account (clauses 1, 3, Article 271 of the Tax Code of the Russian Federation). If the creditor uses the cash method, then income must be recognized on the date of receipt of funds from the debtor's counterparty (new debtor) (clause 2 of Article 273 of the Tax Code of the Russian Federation).

In the accounting of the original debtor, the costs of purchasing goods (work, services) must be reflected in the general manner, despite the fact that the payment debt was transferred to the counterparty (clause 1 of Article 272 of the Tax Code of the Russian Federation). Using the accrual method, recognize the cost of purchased goods as expenses regardless of their payment (clause 1 of Article 271, clause 1 of Article 272 of the Tax Code of the Russian Federation). If you use the cash method, then the goods are considered paid on the date of transfer of the debt (clause 2 of Article 273 of the Tax Code of the Russian Federation).

For a new debtor, the debt transfer operation itself will not be reflected when calculating income tax. That is, such an operation will not affect either income or expenses. After all, he simply participates in the calculations.

Credits and loans - what is the difference

When an organization does not have enough money, for example, to purchase equipment or raw materials, it can obtain a loan or loan. Financial instruments are similar and solve one problem - to provide the company with free money. However, there are a few differences.

Difference No. 1 - The person issuing the loan or loan

An organization can receive a loan only from a credit institution, that is, from a bank. To do this, a loan agreement is concluded, according to which the party issuing money is the lender, and the party receiving money is the borrower.

The loan can be issued by any individual or legal entity. Banks do not provide loans. When lending money, a loan agreement is concluded, under the terms of which one party is the lender, and the other is the borrower.

Difference #2 - Percentages

A loan is always issued at a certain percentage for the use of credit funds. It may vary from bank to bank, but it is never 0%. Interest on loans issued is the bank's income.

The loan, in turn, can be either interest-bearing or interest-free. The legislator leaves this condition at the discretion of the parties (clause 1 of Article 809 of the Civil Code of the Russian Federation).

Important! If the loan agreement is supposed to be interest-free, it must indicate that no fee is charged for the use of borrowed money. Otherwise, the lender has the right to collect interest at the rate of the Central Bank of the Russian Federation in effect at the time the loan agreement was valid (clause 1 of Article 809 of the Civil Code of the Russian Federation).

Difference 3 - Item

The loan is issued only in the form of cash. The bank cannot issue a loan in goods, raw materials or other property.

The loan can be issued in any form. The most popular form of loan is cash, but sometimes goods and other property are loaned, for the use of which interest is also charged.

Difference 4 - Legislative regulation

Credit relations are mainly regulated by regulations of the Central Bank of Russia. Some issues are also enshrined in federal laws and the Civil Code.

The loan agreement is not subject to the regulations of the Central Bank of Russia, therefore it is regulated only by federal laws and the Civil Code.

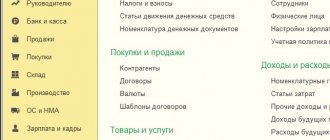

Accounting for short-term and long-term loans and borrowings (account 66 and 67)

In the accounting chart of accounts for accounting for short-term loans, there is account 66 “Calculations for short-term loans and borrowings”; for accounting for long-term loans, account 67 “Calculations for long-term loans and borrowings” is used.

Loans, both short-term and long-term, are issued by credit institutions, that is, banks. They are given for specific purposes, for a limited period, after which the lender undertakes to return the money received.

Accounting for short-term loans

Short-term loans are issued for a period of up to 1 year. The funds received are accounted for on the loan account 66 in correspondence with account 50 "Cash" (if the loan is issued in cash), 51 "Current account" and 52 "Currency account" (corresponding entries D50 K66, D51 K66, D52 K66 ) .

When receiving loans, the organization incurs certain costs. These can be the so-called basic costs, which include interest on the loan, exchange rates, and amount of interest differences. Basic costs are included in operating expenses, and the accounting entry is D91/2 K66 .

In addition to the main expenses, there are also additional expenses associated with obtaining credit money, these include payment for legal and consulting services, copying costs, taxes, examinations, and communication services. These expenses are reflected by posting D91/2 K60.

Repayment of the loan is reflected in the debit of account 66 in correspondence with the accounts for cash and non-cash funds, and accounting for foreign currency funds, depending on how the loan debt is repaid (entries D66 K50, D66 K51, D66 K52).

Accounting for long-term loans

A long-term loan is issued for a period of over 1 year. The funds received, just as in the case of a short-term loan, are accounted for as a credit account. 67 in correspondence with cash accounts. Further, long-term loan accounting can be carried out in two ways:

- On the account 67 before maturity.

- On the account 67 until there are 365 days left until maturity. After this, the loan amount is transferred to the account. 66 by posting D67 K66, that is, long-term debt is transferred to short-term debt.

Postings to accounts 66 and 67

The table below discusses the accounting of credit operations: obtaining long-term and short-term loans and their reflection. ⇓

| Debit | Credit | Operation name |

| 50 (51, 52) | 66 | Received a short-term cash loan (to a current, foreign currency account) |

| 91/2 | 66 | The main costs associated with obtaining a loan amount are taken into account (interest, exchange rate differences) |

| 66 | 50 (51, 52) | Short-term loan repaid |

| 50 (51, 52) | 67 | Received a long-term cash loan (to a current, foreign currency account) |

| 67 | 66 | Long-term loan converted to short-term |

How to reflect the transfer of long-term liabilities to short-term ones in accounting documents?

At the first stage of raising borrowed funds, the accountant should decide on their posting based on the period of repayment of the debt incurred. Either account 66 (for debts with a payment term of less than a year) or 67 is used.

When accounting for debts whose repayment period is limited to 3, 6 or 12 months, account 66 is used. We should not forget to reflect interest payments on these obligations. To indicate the amount of debt, there is a subaccount to account 66 and an additional subaccount for calculating interest.

Raising borrowed funds for a period of 3 or 5 years is reflected in account 67. An additional sub-account is used to calculate interest (the scheme is similar to short-term loans). In addition to account 67, two corresponding sub-accounts should be created.

The period of use of borrowed funds is inevitably reduced. Accordingly, the category of loans based on their repayment period must sooner or later change. But there is no need to display this circumstance in accounting documents. Moreover, such an operation is not provided for by accounting instructions.

To solve this situation, experts recommend creating a separate sub-account in addition to account 67. It will be used directly to record settlements of long-term liabilities.

Indicators of the financial condition of the enterprise

| Index | Meaning of indicators | ||

| without converting long-term debt into short-term | when converting long-term debt into short-term | Recommended value | |

| Liquidity indicators | |||

| Absolute liquidity ratio | 0,13 | 0,11 | 0,2 — 0,3 |

| Intermediate liquidity ratio | 0,88 | 0,75 | 0,7 — 1 |

| Current ratio | 3,48 | 2,99 | 1,5 — 2 |

| Financial stability indicators | |||

| Own working capital, thousand rubles. | 178 778 | 166 778 | |

| Provision ratio of own working capital | 0,71 | 0,66 | 0,1 |

| Equity agility ratio | 0,75 | 0,70 | 0,2 — 0,5 |

| Autonomy coefficient | 0,74 | 0,74 | >=0,5 |

| Financial stability ratio | 0,78 | 0,74 | 0,8 — 0,9 |

A change in the procedure for accounting and reporting of accounts payable leads to a decrease in the values of liquidity indicators and financial stability of the enterprise. With a small amount of transferred long-term debt, the change in indicators is not so significant. However, with large amounts of long-term debt, the analyzed indicators are reduced significantly.

Based on the results of the comparative analysis, it can be stated that a commercial enterprise as a subject of market relations is not interested in introducing this provision into accounting practice, since it causes a decrease in the values of indicators characterizing its financial condition and investment attractiveness, and increases the risk of loss of creditors. At the same time, from the point of view of external users of financial statements, it is justified and necessary. Indicators calculated based on the balance sheet data, taking into account the timing of repayment of accounts payable, more accurately characterize the financial position of the enterprise under study. The information value of financial statements increases, which is determined by the ability of the reporting information to influence the adoption of certain management decisions. For lenders, the risk of non-repayment of provided credits (loans) is reduced, since it becomes possible to objectively assess the solvency of a potential borrower.

At the same time, the requirement of Art. 13 of the Federal Law of December 6, 2011 N 402-FZ “On Accounting” to the extent that accounting (financial) statements must give a reliable picture of the financial position of an economic entity as of the reporting date, the financial result of its activities and cash flows for the reporting period necessary for users of these reports to make economic decisions.

The introduction into the accounting practice of an agricultural enterprise of the provision on the transfer of long-term debt on credits and loans to short-term debts will require the implementation of certain organizational and methodological measures:

- consolidating the provision on the transfer of long-term debt to short-term debt in the order on the accounting policy of the enterprise;

- allocation of a system of subaccounts to the account. 66 “Settlements for short-term loans and borrowings” and 67 “Settlements for long-term loans and borrowings” in order to ensure separate accounting of the principal amount of debt on loans (borrowings) and interest on them;

- determining the working correspondence of accounts for the transfer of the principal amount of debt and accrued interest on borrowed funds from long-term debt to short-term debt;

- development and approval of the form of an accounting certificate on the registration of the relevant fact of economic life.

Information on the transfer of long-term debt on loans and borrowings to short-term debt must be disclosed in the notes to the balance sheet.

Borrowing and credit costs

The list of expenses associated with the fulfillment of obligations under received loans and credits, the new PBU 15/08 includes:

- interest due to the lender (creditor) (including interest (discount) on bills and bonds);

- additional expenses.

Please note that such type of expenses as exchange rate differences on interest are excluded. Why is this done? Currently, there is an accounting regulation “Accounting for assets and liabilities, the value of which is expressed in foreign currency” (PBU 3/2006). It talks in detail about the procedure for recording various exchange rate differences in accounting. Accordingly, there is now no need to duplicate these norms in the PBU dedicated to the accounting of loans and credits.

As for additional expenses on loans, these include expenses that are directly related to obtaining loans, for example, consulting services, funds spent on the examination of contracts, etc. 13. In the new PBU, their composition has become less detailed, but, in essence, has not undergone any changes. At the same time, the condition that the list of these costs is open was preserved.

It should also be noted that according to PBU 15/01, the debt on loans (credits) received was shown taking into account interest. This rule contradicts the chart of accounts, which contains the exact opposite requirement that accrued interest is accounted for separately, that is, in separate sub-accounts. Now this contradiction has been eliminated. The new PBU 15/2008 clearly states that interest on loans is reflected in accounting separately from the principal amount of the obligation for the loan received.

How to properly prepare reports?

According to Order of the Ministry of Finance No. 66 dated 07/02/2010, all debts and assets when accounting are necessarily divided by maturity.

In the event that long-term loans are transferred to the short-term category during their repayment period, they must remain in the same account. However, they should be shown on the balance sheet as part of other short-term debts. This rule also applies to interest payments.

Particular attention must be paid to interest payments accrued but not yet transferred to the lender. Here you need to take into account the payment period. If it does not exceed a calendar year (for example, the loan agreement provides for monthly transfer of interest), then these payments are included in short-term liabilities.

In other words, the balance of account 67 is not always included in full as part of long-term payments, but is divided based on specific circumstances.

Important! For tax reporting, the principal amount of borrowed funds does not matter, since it is not a factor generating the income of the enterprise. As for interest payments, if necessary, they should be recognized as an expense.