The Tax Code of the Russian Federation established the procedure for collecting taxes and the deadlines for their payment. It would seem that if you consistently fulfill the conditions and pay, then there will be no problems. However, questions arise:

- why pay exactly that much?

- Is the payment calculated correctly?

Truth is born in court.

Property on which taxes must be paid:

- transport (clause 3 of Article 363 of the Tax Code);

- land (Article 397 of the Tax Code);

- property (Article 409 of the Tax Code).

How are payments collected from citizens?

A notification to the fiscal authority is sent to collect taxes from citizens.

When must notification be given? The law sets aside 30 days for this before the payment is due (Clause 2, Article 52 of the Tax Code).

To collect taxes from individuals, no more than 3 tax periods are allocated prior to the calendar year in which the notification is sent. Grounds – clause 4 of Art. 357 NK.

Which tax office should I make the payment to?

Pay according to the place where the vehicle, land, house, or other object subject to payment is located - clause 2 of Art. 409 NK.

Collection of tax in court for those who are not entrepreneurs

- The court accepts the statement of claim for the collection of unpaid amounts.

The tax office files a claim to collect debt from individuals. faces. - 6 months is the statute of limitations for collecting taxes from the moment the deadline for fulfilling the requirement to pay debts expires (Clause 2 of Article 48 of the Tax Code).

- Do you owe more than 3 thousand rubles to the budget? A statement of claim for recovery will follow from the inspection in accordance with paragraph. 4 paragraphs 1 art. 48 Tax Code.

Conditions for trial:

- three years have passed since the date on which the earliest requirement to pay the debt had to be fulfilled;

- the amount of debt is above 3 thousand rubles;

- Tax authorities have 6 months from the day when the total amount of unpaid debts exceeded 3 thousand rubles to go to court (paragraph 2, paragraph 2, article 48 of the Tax Code);

The debt did not exceed three thousand rubles. If the debt has not been repaid for three years, a forced tax collection occurs. The condition under which the tax is forcibly collected: the inspectorate files a lawsuit when 6 months have passed since the expiration of the three-year period (paragraph 3, paragraph 2, article 48 of the Tax Code).

FORCED COLLECTION OF TAXES FROM INDIVIDUALS| The material was prepared by Law Firm Logos lawyer Olga Zolotukhina |

The article reveals the procedure for forced collection by the Federal Tax Service of the Russian Federation and the Federal Bailiff Service of the Russian Federation of taxes payable by individuals.

Attention is drawn to the mandatory requirements imposed by the current legislation on the actions and documents of the tax authority for the collection of taxes. Compulsory execution of tax obligations means the activities of specialized government bodies, carried out in accordance with the law, aimed at the most complete and timely fulfillment of the obligation to pay taxes and fees, and also penalties and fines imposed on the debtor.

Enforcement of the obligation to pay taxes and fees in the Russian Federation is carried out by the Federal Tax Service of the Russian Federation and the Federal Bailiff Service of the Russian Federation.

The determining document for forced collection of transport tax, land tax and personal property tax is a tax notice.

The tax authorities must send a tax notice to the taxpayer no later than 30 days before the payment is due. The tax notice must indicate the amount of tax to be paid, the calculation of the tax base, and the deadline for paying the tax. A tax notice may contain information on several taxes payable.

A tax notice can be delivered to an individual (his legal or authorized representative) in person against signature, sent by registered mail or transmitted electronically via telecommunication channels. If a tax notice is sent by registered mail, the tax notice is considered received after six days from the date of sending the registered letter. For all of the above taxes, the obligation to pay tax arises no earlier than the date of receipt of the tax notice.

Based on this, it follows that the volume of the tax obligation to be fulfilled by the taxpayer - an individual for the above taxes is determined in the tax notice. The tax notice determines the amount to be contributed to the budget, and no other document can replace it.

In practice, there are many examples when tax authorities cannot submit a tax notice and submit to the court only a demand for tax payment, which is unlawful.

Another important point for establishing the existence of an obligation to pay the above taxes is the delivery of a tax notice in the ways indicated above. In practice, there are many examples when the tax authority does not provide evidence of delivery of a tax notice. Based on this, it follows that if proof of delivery of a tax notice is not provided, then there is no evidence of the occurrence of an obligation to pay the above property taxes. Establishing the fact of delivery of a tax notice is a legally significant circumstance for the correct resolution of the tax authorities' claims for property taxes paid by individuals.

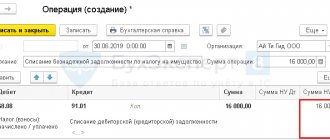

Another important document for implementing the procedure for forced collection of arrears is the requirement to pay taxes, fees, penalties, and fines. A requirement to pay tax is a notification to the taxpayer about the unpaid amount of tax, as well as about the obligation to pay the unpaid amount of tax within the prescribed period. The tax payment request is sent to the taxpayer if he has arrears. The demand for payment of tax must contain information about the amount of tax debt, the amount of penalties accrued at the time of sending the demand, the deadline for paying the tax established by the legislation on taxes and fees, the deadline for fulfilling the demand, as well as measures to collect the tax and ensure the fulfillment of the obligation to pay the tax , which are applied in case of failure to comply with the requirement by the taxpayer. In all cases, the request must contain detailed information about the grounds for levying the tax, as well as a reference to the provisions of the legislation on taxes and fees that establish the taxpayer’s obligation to pay the tax. The demand for payment of tax must be fulfilled within eight days from the date of receipt of the specified demand, unless a longer period of time for paying the tax is specified in this demand.

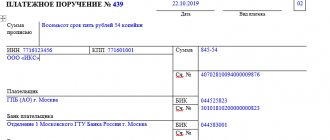

The requirement to pay tax can be submitted to an individual (his legal or authorized representative) in person against signature, sent by registered mail or transmitted electronically via telecommunication channels. If the specified request is sent by registered mail, it is considered received after six days from the date of sending the registered letter.

The requirement to pay the tax must be sent to the taxpayer no later than three months from the date of discovery of the arrears. When identifying arrears, the tax authority draws up a document in a form approved by the federal executive body authorized for control and supervision in the field of taxes and fees. The requirement to pay tax based on the results of a tax audit must be sent to the taxpayer (responsible participant in the consolidated group of taxpayers) within 10 days from the date of entry into force of the relevant decision.

This document defines the following legally significant circumstances for the forced collection of arrears:

- submitting a demand for payment of taxes, fees, penalties, and fines is a mandatory condition prior to filing an application for collection of arrears with the court. Legally, this document defines the out-of-court and pre-trial resolution of disagreements between the tax authority and the taxpayer - an individual. The court cannot accept a statement of claim or an application for the collection of arrears by order without the specified document and proof of its delivery in the ways specified above; — the requirement to pay taxes, fees, penalties, and fines determines the volume of claims submitted by the tax authority to the court. According to Art. 48 of the Tax Code of the Russian Federation, the volume of claims submitted to the court for arrears is determined by the amounts that were indicated in the demand, i.e. the tax authority, in an application for collection of arrears, has no right to demand the collection of amounts greater than those specified in the request for payment of taxes, fees, penalties, fines; — the requirement to pay taxes, fees, penalties, and fines cannot replace a tax notice. There are numerous examples where tax authorities present to the court only demands for the payment of taxes, fees, penalties, fines and do not provide evidence of delivery of tax notices or present only a demand for payment of arrears, should entail only one consequence - refusal to satisfy the applications (refusal to issue court order). Since this indicates that evidence of the occurrence of a tax liability for the taxpayer - an individual for the above property taxes has not been presented. Another legally significant circumstance is the presence of evidence of delivery of the demand for payment of taxes, fees, penalties, fines in the ways indicated earlier. Determining the moment of delivery of the demand is necessary for correctly calculating the time limit for the tax authority to file an application for collection of arrears and correctly establishing the fact of compliance with the deadlines established by Art. 48 Tax Code of the Russian Federation.

A prerequisite for the tax authority to apply for the collection of arrears is to provide evidence of sending a copy of the application for the collection of arrears to the taxpayer - an individual. A copy of the application for collection of arrears in accordance with Art. 48 of the Tax Code of the Russian Federation must be sent to the taxpayer before filing an application with the court.

In this case, the application itself is submitted to the court at the place of residence or place of stay of the taxpayer.

Along with the above documents, evidence of the existence of taxable objects must be attached to the application for collection of arrears, in particular, these are documents that are submitted by authorized bodies to the tax authority for the calculation of property taxes. There are numerous examples when tax authorities make demands for the collection of arrears on transport tax, land tax, and personal property tax for tax periods for which the objects of taxation no longer belonged to the taxpayers. As a consequence, this leads to the issuance of judicial acts for the collection of arrears that cannot exist.

Collection algorithm

- The procedure for forced collection of taxes comes into effect. Bailiffs monitor the execution of the court decision. The actions of bailiffs are described in the Law on Enforcement Proceedings.

- Notify the director of the company that his employees are not paying in good faith. The fiscal authority will help with this. The notification to the employer is aimed at the forced collection of tax debts. The organization where you receive your salary, benefits, and other payments will receive an executive document from the fiscal authority. This procedure for forced collection of taxes is established by letter of the Federal Tax Service No. GD-4-8/ [email protected] dated October 21, 2015. To collect tax arrears, inspectors go to enterprises to meet with the manager and conduct explanatory conversations with employees who evade payment.

Why do tax officials resort to this method to collect tax debts in order to insist on payment of debts? It is believed that the employer's awareness that the employee does not pay the debt will encourage the employee to pay the debts.

What arguments did the organization give in its defense?

In court, the organization indicated that tax officials violated the tax collection procedure.

In her opinion, it should consist of a number of successive interconnected stages.

The beginning of the enforcement process is when the tax authorities issue a demand for tax payment.

After issuing a demand, tax authorities must begin indisputably collecting the debt.

To do this, within 2 months of the expiration of the period for voluntary fulfillment of the requirement, they need to make a decision to collect tax from funds in bank accounts and send a collection order to the bank.

And only if the 2-month deadline for initiating an indisputable collection procedure is missed, tax authorities can go to court. They must do this within 6 months from the date of expiration of the period for voluntary compliance with the requirement to pay the tax.

Previously on the topic:

Suspension of the decision on additional tax assessment does not cancel the requirement to pay

Compliance with the requirement to pay tax does not mean its voluntary payment

How is debt collection from legal entities carried out?

Payments from legal entities are made independently. If contributions from legal entities are not paid, the tax service uses methods of collecting taxes:

- according to Art. 46 of the Tax Code, if the tax is not paid or not paid in full, then payment from legal entities is forcibly collected. A claim is made on the money in the account or electronic money of the enterprise;

- based on the inspectorate’s decision to write off funds from the company’s account to the budget, a tax order is accepted;

- The Code allows two months for making a decision on collection from the moment the period specified in the request to pay the payment expires. Violation of the deadline means that the decision may not be implemented;

- If the deadline for making a decision has expired, the inspectorate files a lawsuit. There are 6 months to file a claim, from the moment the deadline for fulfilling the requirement for payment of tax from legal entities expires (clause 3 of Article 46 of the Tax Code);

- money is debited from the company’s personal accounts if there is not enough money in the current account. You can write off no more than 5 million rubles.

Request for payment

^Back to top of page

A demand for payment of tax is a notice to the taxpayer of an unpaid amount of tax, as well as of the obligation to pay the unpaid amounts when due.

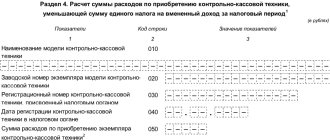

Clause 1 of Article 70 of the Tax Code of the Russian Federation establishes a three-month period for submitting a demand for payment from the date of the DVN. If the amount of arrears is less than 500 rubles - no later than one year from the date of the Tax Inspection, based on the results of a tax audit - within 20 days from the date of entry into force of the relevant decision.

The request for payment is formed in the form approved by order of the Federal Tax Service of Russia dated February 13, 2017 No. ММВ-7-8/ [email protected] (Appendix No. 2).

The deadline is 8 working days from the date of receipt, unless a longer period of time for paying the tax is specified in this requirement (clause 4 of Article 69 of the Tax Code of the Russian Federation).

Delivery methods: delivered in person against signature, sent by registered mail, transmitted electronically via TKS or through the taxpayer’s personal account.

What is the statute of limitations for collecting taxes?

To find out what is the statute of limitations for collecting taxes for legal entities and individuals. persons we refer to the Tax Code. Namely to pp. 4.1 clause 1 art. 59.

Will the bailiff write a decree that the proceedings are completed? The debt will be written off. The bailiff will return the unfulfilled documents to the inspectorate under the Law on Enforcement Proceedings;

The period for collecting tax debt must exceed 5 years from the date of debt formation. The amount of debts is not higher than the claims against the debtor under the Bankruptcy Law.

The decision is made by the tax service in the place where the taxpayer is registered;

When is debt written off for legal entities and citizens? The period for collecting tax debts that have existed for more than 5 years is written off if the court decides to terminate the bankruptcy case, since the funds are required to be reimbursed by the court. expenses are not enough.

What is the procedure for collecting and refunding tax?

We turn to Art. 231 NK. It sets out the procedure for collecting and refunding taxes.

- if the tax agent withheld an excess amount, then it must be returned based on a written application from the payer;

- the period for refund is three months from the date of receipt of the taxpayer’s application;

- the payment is returned from the amount that must be paid by this taxpayer and other tax payers from whose income the payment is withheld;

- Refunds are made non-cash. Every day the return is late, a penalty will be charged;

- if there is no tax agent, the taxpayer submits an application for a refund of payment to the tax office simultaneously with the submission of a tax return for the corresponding period.

Are you having a disagreement with the tax authorities? Please visit the website “33 Yurista.ru”. Experienced lawyers analyze the problem, find the optimal solution in the current situation, help win the dispute, and minimize costs.

Suspension of account transactions

^Back to top of page

Fulfillment of the obligation to pay taxes and fees can be ensured in a number of ways, one of which is the suspension of transactions on accounts.

Simultaneously with making a decision on collection, the tax authority has the right to suspend transactions on the taxpayer’s bank accounts.

Transactions on special election accounts and special referendum fund accounts are not subject to suspension.

Decisions on suspension (cancellation) of suspension are filled out according to the forms approved by Order of the Federal Tax Service of Russia dated February 13, 2017 No. ММВ-7-8 / [email protected] (Appendix No. 14,15).

Suspension of operations on an account means the bank’s cessation of all debit transactions on this account, or within the amount specified in the decision to suspend operations.

If the total amount of a taxpayer’s funds in accounts for which transactions have been suspended on the basis of a decision of the tax authority exceeds the amount specified in this decision, this taxpayer has the right to submit to the tax authority an application to cancel the suspension of transactions on his bank accounts indicating the accounts on which there are sufficient funds to comply with the decision to collect the tax.

We invite you to read: Where to pay land tax 2019

If there is a decision on suspension, banks do not have the right to open taxpayer accounts, deposits, deposits and grant the right to use new corporate electronic means of payment for electronic money transfers, with the exception of special election accounts, special accounts of referendum funds (clause 12 of Article 76 of the Tax Code of the Russian Federation).