Reflection in accounting of the results of inventory of fixed assets

If, as a result of the inventory, unaccounted for fixed assets were identified, then they are accounted for at market value on the date of the inventory. At the same time, income for the same amount is recognized in accounting (clause 28 of the Regulations, approved by Order of the Ministry of Finance dated July 29, 1998 No. 34n).

If a shortage of fixed assets is identified, then it is necessary to check whether there are persons responsible for this. If they are not found (or there are guilty parties, but the court refused to recover damages from them), then the residual value of the object is written off as expenses. If the guilty persons are found, they are ready to compensate for the damage (or the court confirmed the legality of collecting damages from the guilty persons), then the cost of the missing OS is recovered at the expense of the guilty persons (clause 28 of the Regulations, approved by Order of the Ministry of Finance dated July 29, 1998 No. 34n). In this case, receiving compensation from the guilty party is reflected as other income, and the residual value of the object is reflected as other expense.

If during the inventory, fixed assets are identified that are not subject to further use due to obsolescence or damage, then such objects are written off as expenses.

All inventory results are reflected in the period to which the date as of which the inventory was carried out relates (Part 4 of Article 11 of the Law of December 6, 2011 No. 402-FZ).

Note that if the missing fixed asset was previously revalued (reflecting the corresponding amounts as part of additional capital), now the revaluation must be written off from account 83 to the credit of account 84 “Retained earnings (uncovered loss)” (clause 15 of PBU 6/01).

Accounting for regrading

Regrading is considered one of the most common circumstances under which unrecorded assets discovered during inventory are usually accounted for.

It often appears if, during a scheduled check, deficiencies are identified along with surplus OS. Such regrading often allows for the offset of identified shortages and found surpluses.

Thus, if the cost of the identified shortage turns out to be higher than the cost of the recorded surplus, the difference, as an option, can be recovered from the guilty entities.

If such persons are absent or, for example, not identified, the corresponding difference is simply written off to the periodic financial result - debit of account 91 (under subaccount 91-2).

In addition, if the shortage did not arise through the fault of entities with financial responsibility, comprehensive explanations are provided regarding this difference in the inventory documentation.

Thus, it is necessary to justify why this difference is not compensated by the guilty parties.

The opposite situation is that the actual cost of the missing fixed assets turns out to be lower than the cost of the surplus found for the same group of assets. In this case, the value difference between the shortage and surplus is attributed to other income.

Accounting in the absence of shortage

If during the inspection no shortages are identified in fixed assets, the surpluses found are transferred to the financial result.

Moreover, they are accounted for on the date of the inventory at the cost that corresponds to the current market valuation.

Such a reflection is carried out on the credit of the “Other income” account (designated 91-1), which corresponds with the debit of the active account corresponding to the detected surplus (namely 01).

As for the tax accounting of fixed assets found during inventory, in this aspect the surpluses relate to non-operating income.

Example

Initial data:

During the inspection, a previously unaccounted for asset was found - a hydraulic pump. Its market value is 45,000 rubles.

It is necessary to capitalize this surplus according to accounting rules.

The main transactions are in the table:

| Operation | Amount, rubles | Account debit | Account credit |

| The object is accounted for | 45 000 | 08 | 91-1 |

| The facility was put into operation | 45 000 | 01 | 08 |

Implementation

If an organization decides to sell an asset previously identified by inventory as surplus, then this operation is also subject to accounting.

Example

Initial data:

During the inventory carried out at the enterprise, an unaccounted asset was found - a garage. Its market value is 210,000 rubles.

The discovered garage (surplus) was capitalized in November 2021, and on December 23, 2021, this property was sold at a price of 247,800 rubles, while the VAT included in the sale amount was 37,800 rubles.

On the date of sale of this object, depreciation of 4,000 rubles was accrued in accounting.

The main transactions carried out under such circumstances are presented in the table:

| Operation | Amount, rubles | Account debit | Account credit |

| Depreciation calculation | 4000 | 20 | 02 |

| The primary cost of the object is written off | 210 000 | 01 (sub-account for disposal of fixed assets) | 01 |

| Accrued depreciation is written off | 4000 | 02 | 01 (sub-account for disposal of fixed assets) |

| The residual value of the asset is reflected in other costs | 206 000 | 91-2 | 01 (sub-account for disposal of fixed assets) |

| Sales income is recorded | 247 800 | 62 | 91-1 |

| Calculation of sales VAT | 37 800 | 91-2 | 68 |

Tasks of inventory of fixed assets

The frequency and sequence of inventory of fixed assets at the enterprise is enshrined in its accounting policy. It is carried out by an inventory commission specially appointed by the head of the enterprise. During this process the following goals should be achieved:

- monitoring the correctness of the preparation of primary documentation on the movement of fixed assets;

- establishing the presence of the organization’s property at the places of operation and storage, as well as its condition;

- detection of unused, missing or unaccounted for objects;

- control of the correct determination of the value of property in accounting and their reflection in the balance sheet of the organization.

Inventory surplus: postings

If during the audit, unaccounted for material assets, which are usually called surplus, were identified, they must be registered or capitalized. The accountant must do this at the market value on the date of the inventory. Commercial organizations include this amount in their financial results, while non-profit organizations increase their income with it. For these purposes, passive synthetic account 91-1 “Other income” is used. In order to correctly display surpluses in accounting, we have collected the transactions in one table.

| Type of assets being capitalized | Debit | Credit |

| Cash in the cash register | 50 "Cashier" | 91-1 “Other income” |

| Fixed assets | 08 “Investments in non-current assets” | 91-1 “Other income” |

| Materials | 10 "Materials" | 91-1 “Other income” |

| Goods | 41 "Products" | 91-1 “Other income” |

Sub-accounts, accounting statements and other documents are used for analytics. Fixed assets registered in this way are subject to depreciation in the usual manner.

What is it - an inventory of fixed assets (fixed assets) at an enterprise

First of all, this is a recalculation of the assets that the company has. With this action, it becomes possible to keep the company's property unharmed. Its main task is to compare real and virtual balances by checking the data specified in the accounting records. This is how money, equipment, buildings, debt obligations and much more are considered.

Using the census, you can monitor the correctness of information reflected in the organization’s accounts. Corrections are made as necessary to keep the reporting current.

What is this concept?

The procedure for inventorying company assets involves the sequential implementation of the following activities:

- Determination of regulations for the upcoming inventory. The composition of the executive commission is formed, deadlines are set, and the reasons and grounds for conducting an inventory of existing objects are specified. All these points must be reflected in a written order, which is specially issued by the management of the organization.

- Direct inventory of groups of objects of interest. The commission determines the actual quantity and actual condition of the property being inspected. The results of the actions taken are reflected in the inventory documentation, which includes an inventory of assets.

- Comparison of received and initial information. At this stage, the results of the audit are compared with accounting data. The information is clarified - identified surpluses are credited, detected shortages are written off. Comparison statements are generated and the final results of the inventory are documented. The company's management is taking appropriate administrative measures.

Reflection of surpluses for accounting purposes

In accounting, discovered surpluses of fixed assets are classified as other income of the enterprise. Based on information about the discovered fixed assets in the inventory records, it is necessary to draw up an accounting statement that reflects the following entries:

- Dt 08 Kt 91/1 - for the cost of surpluses discovered during the inventory. The identified property can be used by the economic entity in the future in its activities;

- Dt 01 Kt 08 – a fixed asset item discovered during the inventory was put into operation.

Example. During an inventory of the enterprise's property carried out on October 15, 2021, a new monitor that was not previously taken into account was discovered. There are no primary documents for it. It has been established that the market value of a similar model is 60,000 rubles. The commission determined the useful life of the monitor to be 50 months.

The following entries should be made in accounting:

Dt 08 Kt 91/1 = 60000 – for the cost of property discovered during the inventory;

Dt 01 Kt 08 = 60000 – the detected object is put into operation;

Dt 20, 44 Kt 02 = 60000/50 = 1200 - monthly from November 2021 for the amount of accrued depreciation.

How to capitalize identified fixed asset objects that are not included in accounting

Company GARANT

The organization that used the simplified tax system switched to a general taxation system. We identified fixed assets (pavilions, a railway dead end) for which there are no acquisition documents and, since the simplified tax system was used, there are no property tax deductions. How to capitalize these objects and at what cost?

Having considered the issue, we came to the following conclusion:

Unaccounted for fixed assets can be taken into account only based on the results of the inventory.

Rationale for the conclusion:

Accounting

According to paragraph 1 of Art. 12 of the Federal Law of November 21, 1996 N 129-FZ “On Accounting” (hereinafter referred to as Law N 129-FZ), to ensure the reliability of accounting data and financial statements, organizations are required to conduct an inventory of property and liabilities, during which they are checked and documented presence, condition and assessment.

Surplus property (including fixed assets) not accepted for accounting is identified based on the results of an inventory.

Thus, an organization can take into account discovered unaccounted for fixed assets only as a result of an inventory. The procedure for conducting an inventory of an organization's property and recording its results is established by the Methodological Instructions for the Inventory of Property and Financial Liabilities, approved by Order of the Ministry of Finance of Russia dated June 13, 1995 N 49 (hereinafter referred to as the Methodological Instructions N 49).

The inventory results must be documented in the appropriate primary documents in the following forms: N INV-1 - Inventory list of fixed assets, N INV-18 - Comparison statement of the results of the inventory of fixed assets, intangible assets (approved by Rosstat Resolution No. 88 of August 18, 1998), N INV- 26 - Statement of records of results identified by inventory (approved by Rosstat Resolution No. 26 dated March 27, 2000).

In accordance with paragraph 3 of Art. 12 of Law N 129-FZ, clause 5.1 of Methodological Instructions N 49 and clause 28 of the Regulations on accounting and financial reporting in the Russian Federation, approved by order of the Ministry of Finance of Russia dated July 29, 1998 N 34n, surplus property identified during inventory is accounted for at market value on the date of inventory and the corresponding amount is credited to the commercial organization for financial results.

According to clauses 29 and 36 of the Methodological Instructions for Accounting of Fixed Assets, approved by Order of the Ministry of Finance of Russia dated October 13, 2003 N 91n (hereinafter referred to as Methodological Instructions N 91n), unaccounted items of fixed assets identified during an organization’s inventory of assets and liabilities are accepted for accounting purposes. accounting at current market value and are reflected in the debit of the fixed assets account in correspondence with the profit and loss account as other income. The current market value is understood as the amount of cash that can be received as a result of the sale of the specified asset on the date of acceptance for accounting.

When determining the current market value, the following can be used:

— data on prices for similar fixed assets received in writing from manufacturing organizations;

— information on the price level available from state statistics bodies, trade inspectorates, as well as in the media and specialized literature;

— expert opinions (for example, appraisers) on the cost of individual fixed assets.

Fixed assets identified during the inventory must be reflected in the accounting and reporting of the month in which the documents for the inventory and identification of surpluses, assessment of the identified asset (for example, an expert’s opinion on the market value of the object and its useful life), an acceptance certificate will be drawn up - transfer of fixed assets in form N OS-1 (approved by Resolution of the State Statistics Committee of Russia dated January 21, 2003 N 7). And for the annual inventory - in the annual accounting report (clause 5.5 of Methodological Instructions No. 49).

Thus, when taking into account fixed assets identified during the inventory, the following entry will be made in accounting:

Debit 01 Credit 91, subaccount “Other income” - surplus fixed assets identified during the inventory are accepted as part of fixed assets at market value.

It should be noted that PBU 6/01 “Accounting for fixed assets” does not contain special rules regarding the calculation of depreciation on fixed assets identified as surplus during inventory. Thus, depreciation on these objects is calculated in the general manner established by clause 21 of PBU 6/01 “Accounting for fixed assets”, namely starting from the 1st day of the month following the month in which these objects were accepted for accounting.

According to clause 5 of PBU 6/01, fixed assets valued within the limit established in the organization’s accounting policies, but not more than 40,000 rubles. per unit, can be reflected in accounting and financial statements as part of the inventory. Accounting for such “low-value” assets is carried out in accordance with PBU 5/01 “Accounting for inventories”.

Tax accounting

According to paragraph 20 of Art. 250 of the Tax Code of the Russian Federation, the value of surplus property identified during the inventory is recognized as part of non-operating income. Based on clause 5 of Art. 274 of the Tax Code of the Russian Federation, non-operating income received in kind is taken into account when determining the tax base based on the transaction price, taking into account the provisions of Art. 40 Tax Code of the Russian Federation.

Clause 6 of Art. 274 of the Tax Code of the Russian Federation establishes that when determining the tax base for income tax, market prices are determined in a manner similar to the procedure for determining market prices established by paragraph 2, paragraph 3, as well as paragraphs. 4-11 tbsp. 40 of the Tax Code of the Russian Federation, at the time of implementation or performance of non-sales transactions (without including value added tax and excise tax).

The market price of the product (work, service) in accordance with clause 4 of Art. 40 of the Tax Code of the Russian Federation recognizes the price established by the interaction of supply and demand on the market of identical (and in their absence, homogeneous) goods (works, services) under comparable economic (commercial) conditions. Definitions of identical and homogeneous goods (works, services) are given in paragraphs. 6-7 tbsp. 40 Tax Code of the Russian Federation.

In accordance with paragraph 9 of Art. 40 of the Tax Code of the Russian Federation, when determining the market prices of a product, work or service, information on transactions concluded at the time of sale of this product, work or service with identical (homogeneous) goods, work or services under comparable conditions is taken into account. In particular, such terms of transactions as the quantity (volume) of goods supplied (for example, the volume of a consignment), deadlines for fulfilling obligations, payment terms usually applied in transactions of this type, as well as other reasonable conditions that may affect prices are taken into account.

When determining and recognizing the market price of a product, work or service, official sources of information on market prices for goods, work or services and stock exchange quotations are used (Clause 11, Article 40 of the Tax Code of the Russian Federation). A similar opinion was expressed by the Russian Ministry of Finance in letter dated July 2, 2008 N 03-02-07/1-243.

However, the Presidium of the Supreme Arbitration Court of the Russian Federation, in its resolution dated January 18, 2005 N 11583/04, noted that official sources of information cannot be used without taking into account the provisions of paragraphs. 4-11 tbsp. 40 of the Tax Code of the Russian Federation, that is, they must contain data on the market price of identical (homogeneous) goods (works, services) sold under comparable conditions in a certain period of time.

In the absence of transactions on identical (homogeneous) goods, works, services in the relevant market for goods, works or services, or due to the lack of supply of such goods, works or services in this market, as well as in the impossibility of determining the appropriate prices due to the absence or inaccessibility of information sources to determine the market price, the subsequent sale price method is used, in which the market price of goods, works or services sold by the seller is determined as the difference in the price at which such goods, works or services are sold to buyers of these goods, works or services during their subsequent sale (resale ), and the usual costs in such cases incurred by this buyer during resale (without taking into account the price at which goods, works or services were purchased by the specified buyer from the seller) and promotion to the market of goods, works or services purchased from the buyer, as well as usual for this area of activity of the buyer’s profit (paragraph 1, clause 10, article 40 of the Tax Code of the Russian Federation).

If it is impossible to apply the subsequent price method, the method specified in paragraph 2 of clause 10 of Art. 40 of the Tax Code of the Russian Federation is a cost method in which the market price of goods, work or services sold by the seller is determined as the sum of the costs incurred and the profit usual for a given field of activity.

This method takes into account the usual direct and indirect costs in such cases for the production (purchase) and (or) sale of goods, works or services, the usual costs for transportation, storage, insurance and other similar costs in such cases. It should be noted that when using the cost method, it is difficult to document the size of these components and justify their calculation.

In addition, the need to determine the market price using a cost method must be justified (see, for example, the determination of the Supreme Arbitration Court of the Russian Federation dated May 11, 2010 N VAS-5462/10, the resolution of the Federal Antimonopoly Service of the North Caucasus District dated May 22, 2007 N F08-2894/07-1190A, FAS Volga-Vyatka District dated April 24, 2006 N A82-10885/2004-15).

In other words, the organization needs to determine the market value of the property identified during the inventory using one of the specified methods.

It should be borne in mind that in accordance with paragraph 1 of Art. 256 of the Tax Code of the Russian Federation, depreciable property is recognized as property, results of intellectual activity and other objects of intellectual property that are owned by the taxpayer (unless otherwise provided by Chapter 25 of the Tax Code of the Russian Federation), are used by him to generate income and the cost of which is repaid by calculating depreciation.

According to paragraph 1 of Art. 256 of the Tax Code of the Russian Federation, depreciable property is property, results of intellectual activity and other objects of intellectual property that are owned by the taxpayer and are used by him to generate income and the cost of which is repaid by calculating depreciation. Depreciable property is property with a useful life of more than 12 months and an original cost of more than 40,000 rubles.

Thus, property identified during the inventory will be considered depreciable in tax accounting if its original cost exceeds 40,000 rubles, its useful life is more than 12 months, and it is used to generate income.

Objects costing less than RUB 40,000. are included in material costs based on paragraphs. 3 p. 1 art. 254 of the Tax Code of the Russian Federation at the time of transfer to operation (clause 2 of Article 272 of the Tax Code of the Russian Federation).

For your information:

Due to the fact that in the Tax Code of the Russian Federation the procedure for determining the market price of property is discussed in more detail, we believe that if it is difficult to assess the value of a fixed asset for accounting purposes using the methods recommended by Methodological Instructions N 91n, the organization can use the procedure for determining the market price of property applied in tax accounting, which will avoid the difference between accounting and tax accounting.

Answer prepared by: Expert of the Legal Consulting Service GARANT, professional accountant Molchanov Valery

Response quality control: Reviewer of the Legal Consulting Service GARANT, professional accountant Svetlana Myagkova

Surplus during inventory of inventories and operating systems 1C: Accounting 8 edition 3.0

In accordance with paragraphs. 26-28 Regulations on accounting and financial reporting in the Russian Federation, to ensure the reliability of accounting data and financial reporting, organizations are required to conduct an inventory of property and liabilities, during which their presence, condition and valuation are checked and documented. The number of inventories in the reporting year, the dates of their conduct, the list of inspected property and liabilities are determined by the head of the organization, with the exception of cases when an inventory is required. Discrepancies identified during the inventory between the actual availability of property and the data in the accounting registers are reflected in the accounting accounts.

In this article, we will use a specific example to look at how, in the 1C: Accounting 8 edition 3.0 program, to correctly capitalize excess inventories and equipment identified based on inventory results.

Let's look at an example. The organization "Rassvet" applies the general taxation regime - the accrual method and PBU 18/02 "Accounting for calculations of corporate income tax." The organization is a VAT payer. In September 2021, due to a change in the financially responsible person, the organization carried out an inventory of property. As a result of the inventory, surpluses were identified: purchased goods Women's suit 1 piece (book value 3,000 rubles), material Woolen material 4 meters (book value of one meter 1,000 rubles) and a Dell laptop (market value at the time of inventory 125,000 rubles).

Due to the specifics of the program, we will have to split our example into two parts. First, we will conduct an inventory of inventories, and then an inventory of fixed assets.

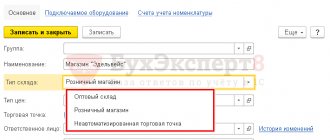

To carry out an inventory of inventories, the program uses the Inventory of Goods document.

The header of the document indicates the warehouse (storage location) and the responsible person. The tabular part on the Products tab is filled in automatically, when you click the corresponding button, with the items listed in the accounting records at the corresponding warehouse. Fill in the average cost, accounting quantity, actual quantity and amounts. Moreover, initially, the actual quantity and amount correspond to the accounting ones. On the Inventory bookmark, the inventory period, the number and date of the inventory order, and the reason for the inventory are indicated. On the Inventory Commission tab, the composition of the commission is indicated. Then the Inventory List of Goods (INV-3) is printed and the inventory is carried out directly - checking whether the actual availability of inventories corresponds to the accounting data. Based on the inventory results, corrections are manually made to the tabular section on the Products tab. The actual quantity column is adjusted. Thus, deviations are recorded in the document: shortages and surpluses. An example of filling out the document Inventory of goods with identified deviations is shown in Fig. 1.

Picture 1.

The matching statement compiled based on the inventory results is presented in Fig. 2.

Figure 2.

When posted, the Goods Inventory document does not generate any postings. This document is needed only for conducting inventory, printing inventories and statements. But based on it, you can create documents that write off shortages and incoming surpluses.

In accordance with clause 28 of the Regulations on accounting and financial reporting, excess property is accounted for at market value on the date of the inventory, and the corresponding amount is credited to the financial results. Current market value refers to the amount of money that can be received from the sale of a property. Other income is recognized as a financial result. Moreover, the market value of property accepted for accounting, recognized as other income, is determined without taking into account the amount of VAT.

Thus, for our example, the excess material should be accounted for in the debit of account 10.01 “Raw materials and materials”, the excess of purchased goods - in the debit of account 41.01 “Goods in warehouses” in correspondence with the credit of account 91.01 “Other income”.

For profit tax purposes, in accordance with paragraph 2 of Art. 254 of the Tax Code of the Russian Federation, the cost of inventories and other property in the form of surpluses identified during the inventory is determined as the amount of income recorded by the taxpayer in the manner prescribed by paragraph 20 of Article 250 of this Code. Article 250 of the Tax Code of the Russian Federation is non-operating income. In accordance with paragraph 5 of Art. 274 of the Tax Code of the Russian Federation, non-operating income received in kind is taken into account when determining the tax base, based on the transaction price, taking into account the provisions of Article 105.3 of this Code, that is, based on the market value of the property.

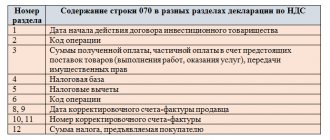

In order for the received non-operating income to be correctly reflected in the income tax return, it is necessary to use the item of other income and expenses with the correct type of item - Surplus of goods identified as a result of inventory. This type of article appeared in the program quite recently.

An example of the item of other income and expenses we use is presented in Fig. 3.

Figure 3.

To capitalize excess inventories, we will use the Goods Inventory document (the document can be created based on the Goods Inventory document). In the “header” of the document, select the inventory document and the corresponding item of other income. The tabular part of the document is filled in automatically based on the inventory document. The Price column contains the accounting value of inventories. If the accounting price does not correspond to the market value, then the market value of the property must be indicated in the column. In our example, the book price corresponds to the market value. When carried out, the document in accounting and tax accounting records the surplus on the debit of accounts 10.01 and 41.01 in correspondence with the credit of account 91.01 with analytics (item of other income and expenses) Surplus goods identified as a result of inventory.

An example of filling out the Goods Receipt document and the result of its implementation are presented in Fig. 4.

Figure 4.

The document has a printed form, which is shown in Fig. 5.

Figure 5.

Now let's move on to the inventory of fixed assets. During the inventory process, a new (not used) Dell laptop was discovered that was not included in the accounting records. The current market value of the property is 125,000 rubles. The laptop was accepted for accounting as an object of fixed assets and put into operation in the Directorate division. The object belongs to the second depreciation group. The useful life is set in accordance with OKOF equal to 25 months. Depreciation is calculated using the straight-line method.

To carry out an inventory of fixed assets, the program uses the OS Inventory document.

The header of the document indicates the department and the financially responsible person. The tabular part on the Fixed Assets tab is automatically filled in with fixed asset objects listed in the department of the given financially responsible person. For each object, its inventory number and book value are filled in. The Availability according to accounting data and Actual availability checkboxes are enabled. The Inventory bookmarks and Inventory commission bookmarks are similar to the bookmarks in the Goods Inventory document.

Based on the inventory results, it is necessary to manually make corrections (if there are deviations) in the tabular section on the Fixed Assets tab. If there is a shortage, you just need to turn off the Actual availability checkbox. If there are surpluses, you need to add lines, create the corresponding elements for the identified surpluses in the Fixed Assets directory, select them, indicate the market value and enable the Actual availability checkbox.

An example of filling out the OS Inventory document with identified surpluses is shown in Fig. 6.

Figure 6.

The matching statement compiled based on the results of the inventory of fixed assets is presented in Fig. 7.

Figure 7.

To reflect the fact of acceptance for accounting and commissioning of a fixed asset item identified as a result of the inventory, the program uses the document Acceptance for accounting of fixed assets with the type of operation According to the results of the inventory (can be created based on the document Inventory of fixed assets).

The header of the document indicates the financially responsible person, the location of the fixed asset and the event Acceptance for accounting with commissioning. On the Non-current asset tab, the method of receipt of the fixed asset item is indicated (only Other is suitable), the required item of other income is selected and the market value of the item is indicated for accounting and tax accounting. In the tabular part, on the Fixed Assets tab, select the corresponding element of the Fixed Assets directory. On the Accounting tab, the accounting account is indicated - 01.01 “Fixed assets in the organization”, the accounting procedure is Depreciation, the depreciation account is 02.01 “Depreciation of fixed assets accounted for on account 01”, the method of calculating depreciation, the method of reflecting depreciation expenses and the useful life use. On the Tax Accounting tab, the procedure for including costs in expenses and the useful life are indicated. When carrying out the document in accounting and tax accounting, it is capitalized on the debit of account 01.01 at the market value of the fixed asset object in correspondence with the credit of account 91.01 with analytics (item of other income and expenses) Surplus goods identified as a result of inventory and will generate entries in many special registers of information on OS accounting.

An example of filling out the document Acceptance for accounting of fixed assets and the result of its implementation are shown in Fig. 8.

Figure 8.

The cost of fixed assets is repaid through depreciation. Depreciation on a fixed asset item begins on the first day of the month following the month in which this item was accepted for accounting.

For tax purposes, depreciation calculation for depreciable property objects begins on the 1st day of the month following the month in which this object was put into operation. Consequently, in October, depreciation in accounting and tax accounting will begin to accrue on the fixed asset item accepted for accounting.

With the linear method of calculating depreciation, the monthly amount of depreciation in accounting and for profit tax purposes is calculated using the following formula:

Am = STp / SPI = 125,000 rubles / 25 months = 5,000 rubles

Posting of the routine operation Depreciation and depreciation of fixed assets for October 2021 is presented in Fig. 9.

Figure 9.

Other income received by the organization from the capitalization of surplus property identified as a result of the inventory is reflected in the Statement of Financial Results.

A fragment of the organization's financial performance report is presented in Fig. 10.

Figure 10.

For profit tax purposes, non-operating income in the form of the value of surplus inventories and other property, which are identified as a result of the inventory, is reflected in Line 104 of Appendix 1 to sheet 02 of the Income Tax Declaration.

A fragment of the Income Tax Declaration is presented in Fig. eleven.

Figure 11.

Unaccounted for property

It happens that some of the company’s property is not capitalized on time. This can be caused by various reasons: the accountant “forgot” to register the valuables, the supplier’s documents were “lost” irretrievably, the things were purchased by the director with his own money, etc. But sooner or later such property will have to be reflected on the balance sheet. What's the best way to do this? There are several ways.

Y. Nikerova, expert of the “Modern Tax Encyclopedia” berator Whichever one suits you, use it. In this case, the procedure for paperwork, accounting and taxation will be different for each case. So, the property can be reflected as:

- additional contribution of the founder-citizen;

- “purchase” from an employee;

- “rent” from an employee;

- personal property of the employee for the use of which compensation is due;

- “received free of charge” from a citizen;

- “identified” during inventory.

Let’s make a reservation right away: no matter which of the listed options you choose, there can be no question of any offset of input VAT. There's probably no need to explain why. After all, the main condition for obtaining a VAT deduction is the presence of an invoice (Clause 1, Article 172 of the Tax Code of the Russian Federation). But you won’t have exactly these documents. Since in the first five cases the value will be given to you by a person. And people, as you know, are not VAT payers, so they do not issue invoices (Article 143 of the Tax Code of the Russian Federation). Due to the absence of an invoice, there will be no input tax on property “identified” during the inventory. After all, the supplier from whom the company could once purchase this property and receive purchase documents (including an invoice) can no longer be found. Now let's look at each of the options in more detail.

Additional founder contribution

If your company is a limited liability company, and among the founders there are individuals, then this option is for you. The authorized capital of a company can be increased through additional contributions from its participants. Let this contribution be your unaccounted property.

Before increasing the authorized capital, you need to make changes to the constituent documents. This takes time and effort, so companies don’t do this often. But, in our opinion, it is completely in vain. After all, the size of the authorized capital indicates the “solidity” of the company and the capitalization of its assets. In addition, a company with a turnover of millions of rubles and an authorized capital of 10,000 rubles will cause confusion, for example, among a foreign investor. And some types of activities cannot be carried out if the authorized capital is below a certain minimum. In particular, it is impossible to produce alcoholic products if the company’s authorized capital is less than 10 million rubles. Thus, increasing the authorized capital is, although labor-intensive, but by no means useless.

So, at the general meeting of the company’s participants, you need to make a decision to increase the authorized capital through additional contributions. To determine the value of the deposit at which it needs to be reflected in accounting, evaluate your “unaccounted for” property. But it is best if an independent appraiser does this.

Please note: if the item is expensive, then the “help” of an independent appraiser is required!

As for tax accounting, the Tax Code (Article 277 of the Tax Code of the Russian Federation) requires you to act as follows. If the founder is a citizen, then you need the “former” owner to give you the documents for the property. These “papers” must indicate the cost of the item. Then you need to subtract the amount of depreciation from this cost. Moreover, the code does not say anything about how to determine this wear. But whatever the value of the property on the “papers” and the amount of depreciation, it is possible to reflect the object in tax accounting at a price not exceeding the market price. And this market price must be confirmed by an independent appraiser. If the founder does not have documents for the property (which applies to our case), then the received item will have to be reflected in tax accounting “at a cost equal to zero.” This means that the company will not be able to expense depreciation charges on such property.

Now let's look at the valuation of the founders' shares. Of course, if the share of the founder - an individual in the authorized capital of the company is equal to 100 percent, then with an increase in the authorized capital this share will remain unchanged. Only its nominal value will increase.

But what if there are several participants? After all, each of them has their own share. For example, a company has three founders, whose shares in the authorized capital are 50 percent, 25 percent and 25 percent. In this case, two options are possible:

- increase the authorized capital, leaving the ratio of shares unchanged;

- increase the authorized capital with a change in the ratio of shares of participants.

The corresponding decision must be made at a general meeting of the company.

To obtain a certificate of registration of changes in the constituent documents, you need to submit for state registration the “papers” listed in Article 19 of the Federal Law of February 8, 1998 No. 14-FZ “On Limited Liability Companies”.

In accounting, this transaction is reflected in the following entries:

Debit 08 (04, 10, 41) Credit 75-1 - property received as the founder’s contribution to the authorized capital is reflected;

Debit 75-1 Credit 80 - reflects the increase in the authorized capital after registration of changes in the constituent documents.

In tax accounting, property received as a contribution to the authorized capital is not included in taxable income (subclause 3, clause 1, article 251 of the Tax Code of the Russian Federation).

Note: this option is labor-intensive, time-consuming, but not too expensive. You will only have to pay for the work of the appraiser and the state fee for registering changes in the constituent documents.

How to reflect the services of an appraiser in tax accounting?

These expenses (as additional expenses for the deposit) can be included in the cost of the item contributed to the authorized capital (Article 277 of the Tax Code of the Russian Federation) if three conditions are met:

- these costs were borne by the transferring party (that is, the founder);

- they are part of the contribution to the authorized capital;

- the transferring party (founder) is a Russian company.

In other words, firstly, the founder must pay for the work of the appraiser, therefore all documents from the appraisal company must be issued to him. Secondly, the constituent documents must state that the authorized capital increases not only by the cost of the contributed property, but also by the cost of the appraiser’s services. And thirdly, these rules apply if the founder who contributes the property is a Russian company. Our case is different (the founder is a citizen). And if values are contributed by a person or a foreign company, then, according to financiers, this procedure does not apply (letter of the Ministry of Finance of Russia dated November 16, 2005 No. 03-03-04/1/371).

Thus, in our case, it is impossible to take into account additional expenses (appraisal services) in the cost of the received property. It will not be possible to attribute them to “tax” expenses and under any other item.

As for the state duty, subparagraph 1 of paragraph 1 of Article 264 of the Tax Code allows it to be attributed to other “tax” expenses.

“Purchase” from an employee

To put unaccounted property on your balance sheet, for which there are no documents, you can “buy” it from your employee. To do this, you need to issue a purchase act. You can compose it in any form. A procurement act in form No. OP-5 (approved by Resolution of the State Statistics Committee dated December 25, 1998 No. 132)* is suitable as a sample. Just remember to approve its form in your accounting policy.

Please note: the act drawn up by you must contain the following mandatory details (Article 9 of the Federal Law of November 21, 1996 No. 129-FZ “On Accounting”):

- Title of the document;

- date of document preparation;

- the name of the company on behalf of which the document was drawn up;

- content of a business transaction;

- measuring business transactions in physical and monetary terms;

- the names of the positions of those responsible for carrying out this operation;

- personal signatures of these employees.

In addition to the required details, indicate in the act information about the employee: his address and passport details, TIN, number of the insurance certificate in the Pension Fund.

The company can pay an employee for the property “purchased” from him in cash (through the cash register using an expense cash order). At the same time, the limit on cash payments (60,000 rubles per transaction) does not apply in this case. This rule applies only to cash payments between companies.

Make the following entries in your accounting:

Debit 08 (04, 10, 41) Credit 76 - reflects the cost of property purchased from an employee;

Debit 76 Credit 50 - cash was given to the employee for property purchased from him.

This option is suitable if, for example, you were going to give one of your employees a bonus or financial assistance. The amount of the premium is the cost of the “purchase”.

You do not need to withhold and pay personal income tax to the budget from such a payment, because in this case you are not a tax agent (clause 2 of Article 226 of the Tax Code of the Russian Federation). The person who “sold” you “his property” will pay this tax himself (Clause 1, Article 228 of the Tax Code of the Russian Federation).

By April 30 of the next year, your employee must submit a personal income tax return to his tax office. Together with the declaration, the employee submits an application for a property tax deduction (Article 220 of the Tax Code of the Russian Federation). This deduction is provided to a person not by the tax agent (employer), but by the tax office.

In addition, before April 1 of the next year, the accountant will have to submit information about this employee to the tax office using Form 2-NDFL.

Please note: it is often unsafe for the latter to “buy” property from the same employee. Tax authorities may decide that he is conducting business without registering as an individual entrepreneur. And for this there is a fine - 10 percent of the income received, but not less than 20,000 rubles (Article 117 of the Tax Code of the Russian Federation).

The money you pay to an employee for property purchased from him is not subject to the single social tax. After all, these will be payments within the framework of a civil contract, the subject of which is the transfer of ownership of things. And such payments of the Unified Social Tax are not subject to taxation (clause 1 of Article 236 of the Tax Code of the Russian Federation). As for contributions to compulsory pension insurance, they are calculated on the same payments as the Unified Social Tax (Clause 2, Article 10 of the Federal Law of December 15, 2001 No. 167-FZ). And since there is no base for calculating the unified social tax, it means there is no base for “pension” contributions.

If the item you are “buying” is a primary item, pay attention to the following important points.

As a general rule, having purchased a “used” object, a company can reduce its useful life by the number of years (months) of operation by the former owner (Clause 12, Article 259 of the Tax Code of the Russian Federation). And, accordingly, calculate “tax” depreciation on a used item based on the reduced service life. However, for our case this order is not suitable.

The fact is that your employee does not have documents not only for the acquisition of this property, but also papers confirming the period of its useful use and operation. Therefore, the rate and amount of depreciation will have to be determined based on the entire service life of the object. On the value of fixed assets determined according to accounting rules, you will need to pay property tax (Clause 1, Article 374 of the Tax Code of the Russian Federation).

"Rent" from an employee

You can enter into a lease agreement with an employee for “unaccounted for” property. But by and large, you can only rent fixed assets, intangible assets and inexpensive items (costing less than 20,000 rubles) with a long service life.

Agree that goods, raw materials and materials cannot be “rented”. It is impossible to even imagine how to use this property as a rental property. Apparently, only as exhibits in a store window.

If we are talking about fixed assets, then the advantage of the “rental” option over the first two is that you do not have to pay property tax on the rented items.

There is no need to accrue payments under the lease agreement and unified social tax. After all, a lease agreement refers to civil contracts related to the transfer of property for use. And payments under such agreements are not subject to social tax (Clause 1, Article 236 of the Tax Code of the Russian Federation).

Since you don’t need to accrue unified social tax on rent, you don’t need to pay pension contributions either. After all, they are accrued on the same payments for which the Unified Social Tax is accrued (clause 2 of Article 10 of the Federal Law of December 15, 2001 No. 167-FZ).

The full amount of the rent will reduce taxable profit (subclause 10, clause 1, article 264 of the Tax Code of the Russian Federation). But at the same time it will increase the employee’s total income. Therefore, from the amounts paid, the company will have to withhold and transfer personal income tax to the budget (clause 2 of Article 226 of the Tax Code of the Russian Federation) at a rate of 13 percent.

Make the following entries in your accounting:

Debit 26 (25, 44) Credit 73 - rent has been accrued for the use of employee property;

Debit 73 Credit 68 subaccount “Calculations for personal income tax” - personal income tax (13 percent) is withheld from rental payments to an employee;

Debit 73 Credit 50 - rent was paid to the employee.

Compensation for the use of personal property

You can assign an employee monthly compensation for his use of personal property for business purposes (Article 188 of the Labor Code of the Russian Federation). The need to use this particular thing in work can be confirmed by any documents: an employment contract, job description, orders, local regulations.

True, as in the previous case, personal property in the form of goods, raw materials and supplies is not suitable for use for business purposes. The reason is the same: they cannot be objects of long-term use.

Agree on the amount of compensation with the employee and fix it in the agreement on the use of the employee’s personal property in the interests of the company. It is better to formalize this agreement as an annex to the employment contract.

Compensation payments for the use of personal property are not subject to personal income tax (clause 3 of Article 217 of the Tax Code of the Russian Federation), the unified social tax (subclause 2 of clause 1 of Article 238 of the Tax Code of the Russian Federation) and, accordingly, “pension” contributions. This was also emphasized by financiers (letter of the Russian Ministry of Finance dated March 2, 2006 No. 03-05-01-04/43).

In our opinion, compensation can be taken into account as part of the company’s “other tax” expenses (subparagraph 49, paragraph 1, article 264 of the Tax Code of the Russian Federation). After all, the list of other expenses given in Article 264 of the Tax Code is open, which means that any reasonable expenses can be included here. The main thing is that, in accordance with Article 252 of the Tax Code, these expenses are:

- economically justified;

- documented;

- aimed at generating income.

Note that in this case we are talking about any property other than the employee’s personal car. After all, compensation for its use reduces taxable profit only within the limits of the norms (subclause 11 clause 1 of Article 264 of the Tax Code of the Russian Federation), which were approved by Decree of the Government of the Russian Federation of February 8, 2002 No. 92.

So, economic justification. As mentioned above, the amount of compensation is agreed upon by the head of the company with the employee, whose personal property will be used in the interests of the company. The Tax Code does not limit the amount of such compensation. But financiers believe: for the amount of compensation to be “economically justified”, it must be equal to the amount of depreciation on this property (letter of the Ministry of Finance of Russia dated December 31, 2004 No. 03-03-01-04/1/194). But how can you find out the amount of depreciation if this item is not and will never be on the company’s balance sheet? According to the Ministry of Finance, for this you need to refer to the Classification of fixed assets included in depreciation groups. That is, the company should act like this:

- determine which depreciation group the employee’s property belongs to, find out its service life and calculate the monthly depreciation rate (as a percentage);

- determine the value of this property. True, financiers do not explain how to do this. You should probably take the market price;

- Calculate the monthly depreciation amount by multiplying the cost of the property by the depreciation rate. The result obtained is the amount of monthly compensation.

If the employee’s property is not indicated in depreciation groups, then its useful life is determined in accordance with the technical conditions or recommendations of the manufacturing organizations.

If this data is not available (as in our case), then the company can itself determine the period of actual use of the item.

There is logic in these arguments. After all, compensation is intended to compensate the employee for the wear and tear of his property. Therefore, payments to an employee must be commensurate with the amount of “possible” depreciation of his belongings.

As for documentary evidence, as we have already said, the fact of use of personal property and the amount of compensation for this must be reflected in the employment contract and annex to it. “Papers” confirming your employee’s ownership of the property may also be needed. For example, they may be required by tax authorities. Naturally, your employee does not have such documents. But inspectors will also not be able to prove that your employee is not the owner of the property. In this case, the absence of “ownership” documents, in our opinion, will not be an obstacle to including the entire amount of compensation in “tax” expenses.

Options with rent or compensation are suitable if you are going to increase the employee’s salary. Then the amount of the increase is the amount of rent or compensation.

"Received" for free

You can “receive” property from a citizen for free by concluding a gift agreement with him. Such property must be valued at market value. It is better if you invite an independent appraiser to do this.

Make the following entry in your accounting:

Debit 08 (04, 10, 41) Credit 98-2 - property received free of charge.

In tax accounting, property received free of charge is classified as non-operating income (clause 8 of Article 250 of the Tax Code of the Russian Federation). You will have to charge and pay income tax to the budget from its market price. This must be done based on the results of the period in which the property was received.

But, if an item is donated by a citizen founder who has a share of more than 50 percent in the authorized capital of your company, then its value is not subject to income tax. True, in order to take advantage of this benefit, it will not be possible to transfer the “gift” to third parties during the year (sub-clause 11, clause 1, article 251 of the Tax Code of the Russian Federation).

In addition, you will pay property tax on the “donated” item if, according to accounting rules, it is included in fixed assets (Clause 1, Article 374 of the Tax Code of the Russian Federation).

“Revealed” during inventory

Formally, property identified as a result of an inventory is not received free of charge. After all, gratuitous transfer requires the presence of two parties: the transmitter and the recipient. And when surplus property is identified as a result of inventory, there is no transferring party. However, there are some similarities in the accounting of both properties.

In accounting, values identified during an inventory are recorded at market value on the date of the inventory. Surplus property identified during inventory is reflected by posting:

Debit 08 (04, 10, 41) Credit 91-1 - property identified during inventory was capitalized (at market prices).

In tax accounting, the value of such property is included in non-operating income (Clause 20, Article 250 of the Tax Code of the Russian Federation). The amount of income is determined in the same way as in accounting, based on the market value of the identified surplus (subclauses 5, 6 of Article 274 of the Tax Code of the Russian Federation). Profit tax will need to be calculated and paid to the budget on the market price.

Please note: The Code does not define a list of official sources of information on market prices. When determining the market price you can use:

- data from Rosstat, trade inspections;

- publications in the media (for example, the magazine “Products and Prices”);

- data on prices for similar property received in writing from manufacturers.

In addition, you can involve experts and specialists, including independent appraisers.

Let us remind you that in order to conduct an inventory, the manager must issue an order (form INV-22). This order is registered in a special journal (Form INV-23).

The results of the inventory are drawn up in documents according to the forms approved by Decree of the State Statistics Committee of Russia dated August 18, 1998 No. 88.

Please note: if you “identify” a fixed asset during inventory, then, as in the previous case, you will have to include its value in the taxable base for property tax (clause 1 of Article 374 of the Tax Code of the Russian Federation).

In addition, if you later decide to transfer into production the excess materials identified during the inventory, you will be able to write off only 24 percent of their market value as “tax” costs (clause 2 of Article 254 of the Tax Code of the Russian Federation). By the way, the same write-off procedure is used for materials obtained as a result of dismantling a fixed asset.

Example

During the inventory, the company identified and capitalized excess materials in the amount of 50,000 rubles. After two months, part of the surplus in the amount of 30,000 rubles. transferred to production. Having written off materials for production, the company will include the amount of 7,200 rubles in “tax” expenses. (RUB 30,000 x 24%).

In accounting, unlike tax accounting, materials identified during inventory, as well as those obtained during the dismantling of fixed assets, are written off in full. As a result, discrepancies will arise between accounting and tax accounting data. Therefore, you will have to apply PBU 18/02 “Accounting for income tax calculations”.

Let's turn to the law

Federal Law of February 8, 1998 No. 14-FZ “On Limited Liability Companies”:“If the nominal value (increase in nominal value) of the share of a company participant in the authorized capital of the company, paid for by a non-monetary contribution, is more than two hundred minimum wages, ..... such a contribution must be assessed by an independent appraiser. The nominal value (increase in the nominal value) of the share of a company participant, paid for by such a non-monetary contribution, cannot exceed the amount of the assessment of the specified contribution, determined by an independent appraiser.”

opinion of

N. Vasiltsev, berator expert “income tax from A to Z”:“The Tax Code allows the cost of services of appraisal companies to be included in other costs of production and sales. But only if we are talking about real estate valuation (subclause 40, clause 1, article 264 of the Tax Code of the Russian Federation). This does not apply to the situation discussed in this article. After all, you will agree, it is difficult to imagine that an accountant suddenly accidentally discovered a warehouse building that was not accounted for on the balance sheet. And yet no one has any documents for this building.”

advice

A person who sells his property has the right to receive a property tax deduction for personal income tax. The deduction amount is the cost of the items sold, that is, the amount of money that the citizen received for his property. However, if the item was used for a relatively short time, then the maximum amount of property tax deduction is limited. So, if a person sells property (except real estate) that he has owned for less than three years, then the deduction cannot exceed 125,000 rubles per year. And if we are talking about the sale of a house (apartment, dacha) that was owned by a citizen for less than three years, then the deduction cannot be more than 1 million rubles per year.

This is important

Only the employee himself should use his property. It is this circumstance that distinguishes compensation from rent, in which the employee’s personal property can be used by both himself and other employees of the company.

* More detailed information can be found on page 59 of “PB” No. 8 for 2006.

How to capitalize a fixed asset identified during inventory

It is possible that a fixed asset item identified during the inventory is the result of an old error when capitalizing the item or during its further accounting. Then you need to find the error and fix it.

If the identified fixed asset was not previously registered, then it must be capitalized at market value. In this case, you need to make the following wiring.

| Contents of operation | Account debit | Account credit |

| A fixed asset ready for operation has been accepted for accounting (does not require additional investments) | 01 | 91-1 |

| Capital investments in fixed assets that require improvement (not ready for operation) have been accepted for accounting. | 08 | 91-1 |

Shortage: wiring

Shortage, unfortunately, is the most common result of inventory, especially in trading companies and warehouses. This is due to various factors:

- careless storage;

- theft by employees or clients;

- natural decline (so-called “shrinkage”, “decay”, etc.);

- other factors.

It is allowed to write off painlessly only shortfalls within the limits of natural loss norms. Such standards are established for each type of product, material and raw material and are officially enshrined in the accounting policy. The rest of the shortage is written off to the perpetrators, and only if they could not be identified is it written off. A step-by-step algorithm for accounting for identified shortages by an accountant.

Step 1. First, you need to attribute the cost of all missing assets to account 94 “Shortages and losses from damage to valuables” using the following entries:

- Dt 94 Kt 10 (07, 08, 41, 43) - shortage of materials (equipment, investments in non-current assets, goods);

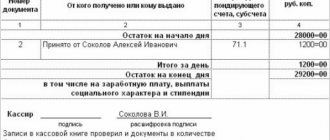

- Dt 94 Kt 50 - lack of money in the cash register.

If there is a shortage of fixed assets or intangible assets, several entries will have to be made, since it is necessary to take into account not only the residual value, but also the depreciation accrued over the period of their operation. They will look like this:

- Dt 02 Kt 01 - depreciation of missing fixed assets;

- Dt 05 Kt 04 - depreciation of missing intangible assets;

- Dt 94 Kt 01 (04) - residual value of missing fixed assets or intangible assets.

Step 2. If there are not enough materials or raw materials within the limits of natural loss, then they can be immediately written off to expense accounts. In order for the accountant to have the right to make such entries, the head of the company issues an order based on the results of the inventory. When all formalities are completed, the postings will look like this:

Dt 20 (44) Kt 94.

Step 3. If there is a shortage of more valuables than the established standards, the shortage must be attributed to the persons responsible for it. To do this, there must be a corresponding conclusion of the commission and an order from management. After completing all these documents, the following entry is made in the accounting registers:

Dt 73 Kt 94.

For account 73, analytical accounting is required in the context of all culprits with the corresponding entries.

Step 4. If the perpetrators could not be identified or they were able to defend in court the impossibility of compensating the company for losses, the amount of the shortfall is included in other expenses. The wiring looks like this:

Dt 91-2 Kt 94.

Business Solutions

- shops clothing, shoes, groceries, toys, cosmetics, appliances Read more

- warehouses

material, in-production, sales and transport organizations Read more

- marking

tobacco, shoes, consumer goods, medicines Read more

- production

meat, procurement, machining, assembly and installation Read more

- rfid

radio frequency identification of inventory items More details

- egais

automation of accounting operations with alcoholic beverages Read more

During the inventory, determine:

- are there actually objects that are indicated on paper and in the program;

- How correctly are inventory numbers assigned?

- Are accounting records maintained correctly?

- volumes of shortages/surpluses.

Terms, rules, frequency of inventory of fixed assets

According to the law, an inspection should be carried out at least once every 3 years at the enterprise. Library collections will not have to be counted and checked so often - once every five years. This is established on the basis of the Methodological Instructions.

Each company determines specific data for itself. This is usually done before the start of the annual report. But according to the law, there are cases when this should be done more often:

- as a result of an emergency;

- if reorganization or liquidation has begun;

- the property is going to be rented out or completely sold;

- The MOL or manager will change soon;

- annual reporting will be prepared soon;

- facts of theft, damage to property or abuse of authority were identified.

It is worth noting that if team members demand, then such a reconciliation is also carried out in the case when more than half of all participants in the contract leave.

By order of the owner or director of the organization, this can happen suddenly, at any time. There is a continuous inventory, when everything that is in the company is counted, and a selective inventory, when they count the assets in one division, branch or even office.

How to draw up the minutes that are drawn up at the final meeting

After the inventory is completed and all documents are filled out, the last council is assembled to sum up the results. A report on the work done is brought to the manager. This is not a mandatory process, but the record of its maintenance can become real evidence in court if a claim is filed for damage to the enterprise.

During the meeting, all changes, shortages, surpluses are read out, explanations from the MOL and expert opinions are listened to.

Finally, documentation is prepared that includes:

- results of the procedure performed;

- reasons why incorrect data was indicated in accounting;

- conclusions adopted by the commission;

- suggestions - how to eliminate all shortcomings and correct errors.

Everyone present signs it, then it is handed over to the manager so that he can make a final decision on all inaccuracies and inconsistencies.

Re-grading: postings

Sometimes it happens that during the inspection, both surplus and missing goods or materials were identified. This is a re-sort, but only if the material assets are of the same type or they were in the custody of one person. In this case, it is allowed to carry out the so-called re-offset in accounting. That is, to cover the shortage with surpluses. There are different wiring for this.

Example 1. The cost of missing assets turned out to be higher than the cost of unaccounted for assets that were in surplus. For example, during a warehouse audit, 100 kg of rice were found instead of 150 kg and 200 kg of millet instead of 175 kg. Rice is more expensive than millet and its deficiency in weight is greater than the excess of millet. The accountant made the following entries based on the inventory results:

- Dt 94 Kt 41 subaccount “Rice” - the cost of the missing 50 kg of rice;

- Dt 41 subaccount “Millet” Kt 94 - the cost of an extra 25 kg of millet;

- Dt 41 subaccount “Rice” Kt 41 subaccount “Millet” - offset cost (the difference between the cost of credited millet and the missing rice);

- Dt 94 Kt 41 - the amount of excess of the shortage over the surplus is written off.

In the situation under consideration, the storekeeper turned out to be the culprit for the shortage that arose as a result of offset. The following entry was made for the amount to be collected from him:

Dt 73 Kt 94.

If it is not possible to recover the loss or the court finds the storekeeper not guilty, the accountant will write off the difference as distribution and production costs.

Example 2. Let's consider the same situation, but swap rice and millet, as a result of which we will find that the amount of goods that should be capitalized is greater than what is missing in the warehouse. Postings based on inventory results will look like this:

- Dt 41 sub-account “Millet” Kt 41 sub-account “Rice” - offset cost;

- Dt 41 subaccount “Rice” Kt 94 - cost of extra 50 kg of rice;

- Dt 94 Kt 41 subaccount “Millet” - the cost of the missing 25 kg of millet;

- Dt 41 Kt 91-1 - the remainder of surplus rice.