For tax purposes, the Tax Code of the Russian Federation understands the concept of “income” as income received by a person both in cash and in kind. And although the monetary form of payment predominates, in practice there are often cases when an employee receives income from the employer in the form of goods, payment for services, travel, funding for training, etc. This type of income is also subject to taxation, personal income tax is withheld from it and is included in the calculation of insurance premiums. Find out more about how natural income is taxed in 2021.

Income in kind and “non-natural”

People's income can be represented not only in the form of money, but also in kind. For example, individuals can receive in-kind income in the form of:

- food and personal hygiene products, clothing for those in need;

- products that are grown and produced by personal farming;

- production from hunting, fishing, picking berries and mushrooms in the forest, etc.

Question: A branch employee received income in the form of wages in kind from the parent organization. How to reflect this income in reporting forms 2-NDFL and 6-NDFL and to which budget is the personal income tax transferred? That is, income should be included in reporting at the location of the organization (head office) or at the location of the branch? The branch and head office are located in different regions. View answer

At the same time, the word “natural” is used not so much in the sense of “natural, natural”, but rather “intended not for sale, but for one’s own consumption.”

How to tax income in kind ?

IMPORTANT! From a tax point of view, such income, along with cash income, is also subject to accounting (that is, income tax is paid on it as well). This is written about in the Tax Code (Article 210). There (Article 226) it is established that firms, entrepreneurs, private lawyers and notaries must themselves calculate and pay personal income tax from the payer (most often we are talking about their employee who receives part of the salary in kind).

Reimbursement for food expenses: will there be personal income tax and insurance premiums?

Moreover, existing arbitration practice suggests that judges in many cases recognize an organization and its employees as interdependent persons.

READ MORE: Online apartment insurance calculator, price - calculate apartment insurance and buy a policy

Please also note that there is no material gain in this situation. After all, the employing company transfers products to the employee as payment for wages in accordance with an employment contract, and not a civil law contract.

In this case, the withheld amount of tax cannot exceed 50 percent of the amount of payments due to the employee. If the period during which tax can be withheld exceeds 12 months, then the organization must report this to the tax office at its place of registration and indicate the amount of tax debt.

When wages are paid in kind, there is a compulsory transfer of ownership of the goods. And along with it, the concept of sales of goods arises, the proceeds from which should be subject to income tax and VAT in the generally established manner (VAT benefits are provided only to agricultural producers.

On the other hand, the cost of this product is not paid, as usual, but is repaid by closing part of the salary arrears. The Tax Code allows the entire amount of wages accrued in accordance with the company's wage system, regardless of its form, to be taken into account as expenses when calculating income tax. This generates income and expenses associated with the transfer of products to pay off wage arrears.

As for value added tax, a special rule directly indicates the obligation to charge it when paying for labor in kind. It says that the tax base in this case is determined based on market prices (without including VAT). Consequently, companies can calculate this tax based on the price of products that they set to pay off wage arrears (excluding VAT).

However, there is also an opposite point of view. It is based on the fact that legal relations regarding the payment of wages to employees in kind are regulated not by tax law, but by labor law. Accordingly, the payment of wages in kind cannot be recognized as a sale, and the company is not obliged to pay income tax and VAT to the budget.

Tax base for personal income tax on income received in kind.

The procedure for determining the tax base for income in kind is regulated by the provisions of Article 211 of the Tax Code of the Russian Federation.

According to clause 1 of Article 211 of the Tax Code of the Russian Federation, when a taxpayer receives income from organizations and individual entrepreneurs in kind in the form of:

- goods,

- works,

- services,

- other property,

the tax base is defined as their value calculated on the basis of their market prices.

At the same time, prices are determined in a manner similar to that provided for in Article 105.3 of the Tax Code of the Russian Federation.

Based on clause 1 of Article 105.3 of the Tax Code of the Russian Federation, market prices are considered to be those prices for goods (work, services) that are used in transactions between parties that are not interdependent.

In accordance with clause 3 of Article 105.3 of the Tax Code of the Russian Federation, when determining the tax base taking into account the price of goods (work, services) applied by the parties for tax purposes, the specified price is recognized as market price if:

- Federal Tax Service, the opposite has not been proven,

- the taxpayer did not independently adjust the tax amounts in accordance with clause 6 of Article 105.3 of the Tax Code of the Russian Federation.

The taxpayer has the right to independently apply for tax purposes a price different from the price applied in the specified transaction, if the price actually applied in the specified transaction does not correspond to the market price.

In accordance with clause 6 of Article 105.3 of the Tax Code of the Russian Federation, if the taxpayer uses prices in a transaction between related parties that do not correspond to market prices, if this discrepancy results in an understatement of the personal income tax amount, the taxpayer has the right to independently adjust the tax base and the personal income tax amount after the end of the calendar year.

The amount of arrears identified by the taxpayer independently based on the results of the adjustments made must be repaid no later than the date of payment of personal income tax for the corresponding tax period.

In this case, for the period from the date of occurrence of the arrears to the date of expiration of the established period for its repayment, penalties are not accrued on the amount of the arrears.

In accordance with clause 1 of Article 211 of the Tax Code of the Russian Federation, the cost of goods (work, services) for the purpose of determining the tax base for personal income tax includes the following amounts:

- VAT,

- excise taxes

And

excluded

the amount of partial payment by the taxpayer of the cost:

- goods received by him,

- work performed for him,

- services rendered to him.

At the same time, in accordance with paragraph 3 of paragraph 3 of Article 24 of the Tax Code of the Russian Federation, tax agents

obliged

keep records of accrued and paid income to taxpayers, calculated, withheld and transferred taxes to the budget system of the Russian Federation, including for each taxpayer.

Also, in accordance with clause 1 of Article 230 of the Tax Code of the Russian Federation, tax agents keep records of:

- income received from them by individuals in the tax period,

- tax deductions provided to individuals,

- calculated and withheld taxes in tax registers.

Forms of tax accounting registers and the procedure for reflecting analytical data in them:

- tax accounting,

- primary accounting documents,

are developed by the tax agent independently and must contain information allowing identification of:

- taxpayer

- type of income paid to the taxpayer,

- provided tax deductions in accordance with codes approved by the Federal Tax Service,

- amounts of income and dates of their payment,

- taxpayer status,

- dates of tax withholding and transfer to the budget system of the Russian Federation,

- details of the corresponding payment document.

Are gifts to employees subject to insurance premiums?

Wages are remuneration for work depending on the employee’s qualifications, complexity, quantity, quality and conditions of the work performed, as well as compensation and incentive payments. The right of every citizen to work and remuneration for it without any discrimination, the amount of which must not be lower than the minimum wage established by law, is provided for by the basic law of the Russian Federation - the Constitution of the Russian Federation (Article 37).

When concluding an employment contract, the employer undertakes to pay the full amount of wages due to employees within the terms established by the Labor Code of the Russian Federation (LC RF), the collective agreement, the internal labor regulations of the organization, and employment contracts (Article 21 of the Labor Code of the Russian Federation).

In accordance with Article 131 of the Labor Code of the Russian Federation, payment of wages in organizations must be made in cash in the currency of the Russian Federation (in rubles). But the terms of a collective or labor agreement may also provide for another (non-monetary) form of payment of wages that does not contradict the current legislation of the Russian Federation and international treaties of the Russian Federation.

The terms of these contracts, in accordance with Article 136 of the Labor Code of the Russian Federation, must also establish the place and timing of payment of wages in non-monetary form. Wages must be paid at least every half month. The share of wages paid in non-monetary form cannot exceed 20% of the total wages.

Payment in kind is the issuance of products produced by an organization or other inventories on its balance sheet as wages. In addition, payment in kind is also a service that an organization can provide to its employee in exchange for wages.

It is unacceptable that payment of wages in kind, provided for by national legislation, collective agreements, is made in the form of alcohol, narcotic, toxic, poisonous and harmful substances, weapons, ammunition and other items in respect of which prohibitions or restrictions on their free circulation are established.

Particular attention should be paid to the fact that other (non-monetary) forms of remuneration can only be used with the consent of the employee himself, confirmed by his written application. If the work collective or individual employees refuse to receive the wages due to them in kind (including due to dissatisfaction with the range of goods provided), then the employer is obliged to take other measures to pay wages in cash or change the range of goods offered for which workers can agree on wages.

an employment contract with an employee, internal labor regulations or a collective agreement (they must provide for the possibility of payment in kind);

wage regulations;

bonus regulations;

a document regulating the issues of registration and accounting of the payment of wages in kind, the procedure for setting prices for goods (work, services) issued to employees. Such a document can be drawn up in the form of an organization standard approved by order of the manager.

READ MORE: What does “insurance charges found” mean?

Amounts of personal income tax calculated from wages in kind are withheld by the employer, who is a tax agent, only from funds paid to employees, and the withheld amount of personal income tax cannot exceed 50% of the payment amount (clause 4 Article 226 of the Tax Code of the Russian Federation).

To receive part of the salary in kind, the employee must write an application requesting this (Part 2 of Article 131 of the Labor Code of the Russian Federation).

The application can be drawn up either for a separate payment or for a certain period (quarter, year). In the latter case, by agreement with the administration, the employee has the right to early refuse payment in kind. This is stated in subparagraph “a” of paragraph 54 of the resolution of the Plenum of the Supreme Court of the Russian Federation dated March 17, 2004 No. 2.

- Labor Code of the Russian Federation dated December 30, 2001 N 197-FZ

Article 57. Contents of an employment contract...The following conditions are mandatory for inclusion in an employment contract:......terms of remuneration (including the amount of the tariff rate or salary (official salary) of the employee, additional payments, allowances and incentive payments)...

- Federal Law No. 212 of July 24, 2009 “On INSURANCE CONTRIBUTIONS TO THE PENSION FUND OF THE RUSSIAN FEDERATION, SOCIAL INSURANCE FUND OF THE RUSSIAN FEDERATION, FEDERAL COMPULSORY HEALTH INSURANCE FUND AND TERRITORIAL COMPULSORY FUNDS HEALTH INSURANCE"

Article 9.

Please note: the moment of deduction of personal income tax and transfer to the budget depends on the form in which the gift was issued (Letter of the Federal Tax Service dated August 22, 2014 N SA-4-7/16692):

- if a gift is given to an employee in cash, then the tax must be withheld and transferred to the budget on the day the gift amount is issued from the cash register or transferred to the employee’s personal account;

- if the gift is given in kind, then personal income tax must be withheld and transferred on the nearest day of payment of funds to the employee, for example, on the next day of salary payment. If, after delivering a gift to an employee, no payments will be made until the end of the calendar year, then the employer must, no later than one month from the end of the tax period (year), notify the employee in writing, as well as the tax authority at the place of registration, about the impossibility of withholding personal income tax and the amount of tax not withheld. .

1 tbsp. 7 of the Law of July 24, 2009 N 212-FZ). Especially if, in accordance with the internal documents of the organization, gifts are received by those employees who have achieved certain production indicators. This clearly indicates that the gift is given to the employee for his work.

However, despite all the solemnity of the moment, the presentation of gifts to employees from an accounting point of view is a business transaction that must be properly formalized, reflected in accounting, and taxes and contributions calculated. We’ll look at how to do all this correctly and what an accountant should pay attention to in this article.

What is a gift? A gift to a gift is different. In order to correctly formalize the transfer of a gift to an employee, and then correctly calculate taxes and contributions from this operation, it is necessary to determine how this gift qualifies from the point of view of civil and labor legislation. 1. A gift not related to the employee’s work activity (for anniversaries and holidays, etc.).

- the amount of each gift (including those not exceeding 4,000 rubles) is reflected in the certificate as income with code 2720;

- the amount of the gift that is not subject to personal income tax (i.e. up to 4,000 rubles) is reflected in the certificate as a deduction with code 501.

Insurance premiums on gifts to employees To determine whether insurance premiums are calculated on gifts to employees or not, you need to clearly understand the nature of the payments these gifts relate to. According to Law No. 212-FZ, insurance premiums are levied on payments and other remuneration to employees within the framework of labor relations (Part 1 of Art.

Judicial practice under Article 211 of the Tax Code of the Russian Federation:

- Decision of the Supreme Court: Determination N 34-КГ14-3, Judicial Collegium for Civil Cases, cassation

Under such circumstances, the provisions of Article 211 of the Tax Code of the Russian Federation governing the determination of the tax base when the taxpayer receives income from organizations and individual entrepreneurs in kind, were not subject to application by the court to controversial legal relations in connection with a different subject composition... - Decision of the Supreme Court: Determination N VAS-13747/12, Supreme Arbitration Court, supervision.

Incorrect application by courts of substantive law (in particular, Articles 20, 40, 211 of the Tax Code of the Russian Federation) has not been established... - Decision of the Supreme Court: Determination N VAS-4998/09, Collegium for Administrative Legal Relations, supervision

When resolving the dispute, the courts of appeal and cassation were guided by the provisions of Articles 122, 143, 169, 171, 172, 210, 211, 214.1, 217, 224, 226 , 227, 228, 246, 247, 252, 264 of the Tax Code of the Russian Federation, the actual circumstances of the case...

Normative base

Considering the regulatory framework, we can highlight the following acts and documents currently in force in the legislation:

- Article 207 of the Tax Code of the Russian Federation – stipulates taxation for residents;

- Article 41 of the Tax Code of the Russian Federation - contains information on the distribution of income into in-kind and cash forms;

- Article 211 of the Tax Code of the Russian Federation - includes a list of all types of income in kind on which taxes are calculated;

- Article 212 of the Tax Code of the Russian Federation - contains the concept of the right to income received in kind or material form;

- Article 217 of the Tax Code of the Russian Federation - includes all types of income that are not taxed (the list contains material and in-kind forms).

These are the main points of the regulatory framework used in the issue presented. The work also uses numerous Letters from the Russian Ministry of Finance, which contain information on the types of natural taxes and issues of their correct calculation.

Taxation of personal income tax in natural income

Tax agents are companies and individual entrepreneurs that pay income to individuals. They are obliged to withhold the tax due and transfer it to the budget in accordance with current legislation (Article 226 of the Tax Code of the Russian Federation). The rule does not apply to individual entrepreneurs who receive payment in kind in the course of doing business - they calculate and pay the tax themselves.

Income in kind is subject to personal income tax in accordance with the general procedure. There is no need to withhold tax on expenses made in the interests of the company (for example, payment for advanced training courses in the direction of the enterprise), as well as on payments directly specified in Art. 217 of the Tax Code of the Russian Federation (for example, with material assistance up to 50,000 rubles at the birth of a child, received in kind).

When paying the “in kind” part of the salary to employees who are residents of the Russian Federation, the personal income tax rate is 13%; for non-residents, the rate is 30%.

Types of income in kind.

In accordance with paragraph 2 of Article 211 of the Tax Code of the Russian Federation, to income received by a taxpayer in kind,

in particular

, relate:

- Payment (in whole or in part) for it by organizations or individual entrepreneurs for goods (work, services) or property rights, including:

- utilities,

- nutrition,

- recreation,

- training

in the interests of the taxpayer.

- Goods received by the taxpayer, work performed in the interests of the taxpayer, services rendered in the interests of the taxpayer free of charge or with partial payment.

What is payment in kind?

The law classifies the following income options for individuals as in-kind (clause 2 of Article 211 of the Tax Code):

- issuance of goods, products, other property to an individual, or provision of services to an individual by a company/individual entrepreneur with partial payment or free of charge;

- payment for an individual for goods (work, services), property rights, including the transfer of funds for training, treatment, recreation, utilities and other services and work performed to third-party organizations/individual entrepreneurs in his interests;

- property rights received when an individual leaves the company or property received during its liquidation;

- the right of claim against the company, received with partial payment or free of charge.

In other words, this is the receipt of income (including wages) in non-monetary form.

Who is the tax agent for non-cash income?

Income in kind is subject to income tax. Tax agents for all types of income in kind are (clause 1 of Article 226 of the Tax Code of the Russian Federation):

- legal entities and individual entrepreneurs;

- privately practicing notaries and lawyers;

- separate divisions of foreign organizations operating on the territory of the Russian Federation.

If they paid income in kind to the employee (or the person with whom the GPC agreement was concluded), they are required to pay taxes:

- calculate;

- withhold from the employee’s (taxpayer’s) income;

- transfer to the budget.

If for any reason the agent is unable to withhold personal income tax, he is obliged to notify the taxpayer himself and his Federal Tax Service about this in writing no later than March 1 of the year following the year in which such income was received by the taxpayer. To do this, a 2-NDFL certificate with attribute “2” is submitted to the employee (clause 5 of Article 226 of the Tax Code of the Russian Federation).

Did the individual receive income in kind? Fulfill the duty of a tax agent

What happens if an organization or entrepreneur (in general terms, a tax agent) fails to fulfill its obligations to withhold and transfer personal income tax amounts to the budget from an individual’s in-kind income? In this case, during the next tax audit, the inspection inspectors will assess a fine in the amount of 20% of the amount of tax not withheld and not transferred to the budget (Article 123 of the Tax Code of the Russian Federation). Penalties will also be charged for violating the deadline for paying personal income tax.

Sending a message to the tax office about the impossibility of collecting tax on in-kind income issued to an individual will help you avoid this fine. But this method will help only under one condition: from the moment the income in kind was issued until the end of the current year, no income in cash was transferred to the individual.

The tax agent has the right to report the impossibility of collecting personal income tax on the natural income of an individual even if the due date has been missed (letter of the Federal Tax Service of Russia dated July 16, 2012 No. ED-4-3 / [ email protected] ).

For late submission of a message about the impossibility of withholding personal income tax, a tax agent may incur 2 penalties, the amount of which in most cases is much less than the fine for failure to remit tax:

- A fine of 200 rubles. for each document untimely submitted to the tax authority (clause 1 of Article 126 of the Tax Code of the Russian Federation).

- Penalties for violation of the deadline for payment of personal income tax. This period begins from the date of payment of tax by an individual established by Art. 228 of the Tax Code of the Russian Federation (July 15 of the year following the previous year). And it ends with the date of sending the message we are considering to the tax office (resolution of the Federal Antimonopoly Service of the West Siberian District dated December 30, 2013 in case No. A45-26891/2012).

Read about the new procedure for collecting fines from tax agents starting in 2019 here.

Such a case is described in the Resolution of the Arbitration Court of the Central District dated 04/08/2016 No. F10-914/2016. Firstly, by issuing such gifts, the company entered into gift agreements with employees. Secondly, in local acts the company determined the procedure for making not only payments subject to insurance premiums, but also, separately, cash gifts.

How to determine the amount and date of receipt

The day on which the increase was actually received is recognized as the date for entering into the basic data for the deduction of taxes for individuals. This is fully consistent with the provisions of Art. 223 of the Tax Code of the Russian Federation and has features expressed in subparagraphs and paragraphs in the form:

- financial expression – the day the money transfer is received into a bank account or under a guarantee, credited to proxies;

- issuing wages with the company's products;

- material benefit - time of interest repayment on borrowed funds of the taxpayer;

- upon receipt by the contractor of the object of service, work, resale of goods from persons who are mutually responsible;

- the day of purchasing bonds or shares with the expectation that their prices will rise;

- dates of receipt of profits from a controlled foreign company;

- time of receipt of income at the end of the month for work performed under the contract (agreement);

- payment dates on the last working day upon termination of the employment relationship;

- obtaining funds to employ the unemployed and additional jobs;

- in payment of subsidies;

- income receipts for individual entrepreneurs from the budget system of the Russian Federation.

Another comment on Art. 211 Tax Code of the Russian Federation

Based on Article 211 of the Tax Code, the main condition on the basis of which the object of personal income tax arises is that the goods (work, services) were paid for in the interests of the individual.

For example, payment by an organization for an employee of a ticket with an arrival date later than the end of the business trip indicated in the business trip order is his income received in kind. The cost of the specified ticket is subject to taxation in accordance with the provisions of Article 211 of the Tax Code (see letter of the Ministry of Finance of Russia dated September 22, 2009 N 03-04-06-01/244).

Documenting

To calculate wages in kind, use payroll in form No. T-51 or payroll in form No. T-49. To issue salaries, prepare a separate statement. The payroll in form No. T-53 is intended for issuing wages in cash. Therefore, it is quite difficult to use it to process payments in kind.

For convenience, you can use the unified form No. 415-APK, approved by order of the Ministry of Agriculture of Russia dated May 16, 2003 No. 750. This is a statement of payment in kind provided for organizations of the agro-industrial complex. It is a supporting document for writing off in the organization’s accounting the value of the property transferred as salary.

Payment for employee meals.

Nowadays, it is not uncommon for a company to pay for meals for its employees.

In some organizations it is just tea and coffee, in others it is set daily lunches or buffet meals.

In addition, many companies organize corporate holiday events in which employee refreshments are part of the holiday program.

In all these cases, taxpayers - individuals, have taxable income.

But not in all cases, organizations are required to withhold and pay personal income tax.

Tax does not need to be assessed and paid if the organization does not have the ability to personify and evaluate the economic benefit received by each employee.

This opinion was expressed by the Ministry of Finance in its Letter dated March 6, 2013. No. 03-04-06/6715:

“When acquired by an organization:

- food (tea, coffee, etc.) for its employees,

- as well as during corporate celebrations,

These persons can receive income in kind, as established by Art. 211 of the Code, and the organization providing the specified food (holding corporate events) must perform the functions of a tax agent provided for in Art. 226 of the Code.

For these purposes, the organization must take all possible measures to assess and take into account the economic benefits (income) received by employees.

At the same time, if when employees consume food purchased by an organization (during a corporate holiday event), there is no opportunity to personify and evaluate the economic benefit received by each employee, income subject to personal income tax does not arise .”

A similar opinion is contained in the Letter of the Ministry of Finance dated January 30, 2013. No. 03-04-06/6-29.

However, the department had a different opinion in its Letter dated April 18, 2012. No. 03-04-06/6-117, where we were talking about lunches for employees in the form of a buffet, payment for which is provided for in the current system of remuneration of employees on an ongoing basis:

“According to paragraph 1 of Art. 230 of the Code, a tax agent is obliged to keep records of income received from him by individuals during the tax period.

In this case, the income of each taxpayer can be calculated based on the total cost of meals provided and data from the time sheet or other similar documents.”

Thus, in cases of payment for lunch for employees on an ongoing basis, including in the form of payment for the services of canteens, restaurants, and other public catering establishments, the employer is obliged to keep appropriate records.

This can be done in different ways. For example, by introducing a coupon system, or keeping a log of visits to public catering by employees.

Currently, in modern business centers, tenants are also offered special cards that employees use to pay for lunch.

Such cards are issued to employees and assigned to them, and at the end of the month, the catering service company provides the employing company with a report indicating the amount of expenses spent on each of the cards.

For each such amount, personal income tax will be calculated individually for each employee.

Payout limit

The legislation limits the size of in-kind payments for wages - no more than 20% (Part 2 of Article 131 of the Labor Code of the Russian Federation). The limit applies to the accrued salary amount for one month. The provision for the possibility of such payment must be reflected in the employment or collective agreement.

Payment in kind is made on the basis of a statement written by the employee.

Any employer pays various insurance premiums every month from the payments of its employees. If they work under an employment contract, then these are the contributions:

- to the Pension Fund of Russia (PFR);

- to the Health Insurance Fund (FFOMS);

- for social insurance against illnesses and injuries or maternity (in the Social Insurance Fund).

- in insurance against accidents and occupational diseases (also in the Social Insurance Fund).

Also, contributions are paid from payments made to those employees who are registered with the company under civil contracts.

- to the Pension Fund;

- in FFOMS;

- for social insurance against accidents and occupational diseases, if this is specified in the contract.

We'll talk about contributions for pensions, health insurance, sickness and injury or maternity insurance. They are regulated by Federal Law dated July 24, 2009 N 212-FZ. Read about insurance against accidents and occupational diseases in the Federal Law dated July 24, 1998 N 125-FZ.

Insurance premiums are levied on payments to employees based on labor relations and in accordance with civil contracts for the performance of work, provision of services and copyright orders.

Payments for which contributions are not paid are listed in Art. 9 Federal Law No. 212.

The maximum base for contributions to the Pension Fund in 2021 is 1,021,000 rubles.

When paying contributions at the basic tariff, if this base is exceeded, contributions are paid at a reduced rate - 10%. If the organization is on a reduced tariff, then if it is exceeded, contributions are not paid.

The maximum base for contributions to the Social Insurance Fund in 2021 is 815,000 rubles.

If the base is exceeded, then there is no need to pay contributions.

There is no maximum base for contributions to the FFOMS.

Let's look at the main rates of insurance premiums for employees in 2018:

- Pension Fund - 22%.

- FFOMS - 5.1%.

- Social Insurance Fund - 2.9% (contributions from accidents are not taken into account).

The table shows special reduced contribution rates for certain categories of payers established in 2021.

Pension Fund insurer category, % FFOMS, % FSS, % General tariff, % Pension Fund for amounts above the base, %

| Basic tariff, no benefits | 22 | 5,1 | 2,9 | 30 | 10 |

| Payers of the simplified tax system using benefits for calculating contributions | 20 | 20 | – | ||

| IT organizations | 8 | 4 | 2 | 14 | – |

| Residents of a technology-innovation or tourist-recreational special economic zone | 8 | 4 | 2 | 14 | – |

| Economic societies created by budgetary scientific institutions | 8 | 4 | 2 | 14 | – |

| Participants of the Skolkovo project | 14 | 14 | – | ||

| Payers to ship crew members in relation to payments to ship crew members | – | ||||

| Pharmacies on UTII in relation to employees engaged in pharmaceutical activities | 20 | 20 | – | ||

| Non-profit organizations on the simplified tax system | 20 | 20 | – | ||

| Charitable organizations on the simplified tax system | 20 | 20 | – | ||

| Individual entrepreneurs using the patent tax system | 20 | 20 | – | ||

| Participants of the FEZ Crimea and Sevastopol | 6 | 0,1 | 1,5 | 7,6 | – |

| Residents of the territory of rapid socio-economic development | 6 | 0,1 | 1,5 | 7,6 | – |

Insurance contributions to the funds are transferred every month until the 15th day of the following month. If the last day of payment is a weekend or holiday, then you can pay contributions on the next working day.

Kontur.Accounting expert Natalya Potapkina

Keep records in Kontur.Accounting - a convenient online service for calculating salaries and sending reports to the Federal Tax Service, Pension Fund and Social Insurance Fund. The service is suitable for comfortable collaboration between an accountant and a director.

Try free for 30 days

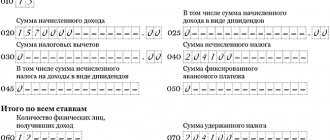

Reflection of natural income in form 6-NDFL

Comments on filling out this form are contained in the letter of the Federal Tax Service dated 08/01/2016 No. BS-4-11/13984. Briefly the rules are:

- on 020 we write the amount of non-cash income received;

- 040 – income tax on this income;

- 070 – income tax on the rest of the salary;

- 100 – date of receipt of the natural part of the salary;

- 110 – date of receipt of the rest;

- 130 – the amount of the natural part of income.

IMPORTANT! Federal Law No. 212 contains a list of non-monetary receipts from which insurance premiums are not charged. These include:

- travel costs to and from work for persons working in the far north;

- costs of training employees in special professional educational programs;

- the amount of costs for uniforms required by law for some employees

- compensation payments to citizens (subsidies for food, utilities, free housing, etc.).

A complete list of what is not subject to insurance premiums

For convenience, we will show which payments are not subject to insurance premiums in 2021, in the form of a table.

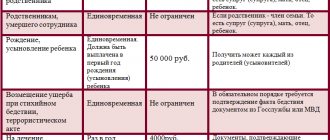

| Type of payment | Explanation |

| State federal, regional and local benefits | This includes unemployment benefits and other amounts required under compulsory social insurance. |

| All types of compensation from the state (within standards) | They may be associated with: • harm from damage to health; • free provision of housing, payment for housing and communal services, food, fuel or their cash equivalent; • issuing products or money in exchange; • payment for some sports nutrition and other attributes for professional sports; • dismissal (exception: a) compensation for unclaimed leave; b) severance pay and average monthly salary over 3 times the amount (six times in the northern territories); c) compensation to the manager, his deputies and the chief accountant in excess of three times the average monthly salary); • training, retraining and advanced training of personnel; • costs of the contractor under a civil agreement; • employment of those laid off due to layoffs, in connection with the reorganization or closure of an organization, individual entrepreneur, notary, lawyer, etc. • performance of labor duties, including moving to another place (exception: money for negative labor factors), compensation for dairy products , for unclaimed leave (when not related to dismissal). |

| Disposable mat. help | • people due to natural disasters or other emergencies for compensation for material damage or harm to their health, as well as victims of terrorist attacks in the Russian Federation; • an employee whose family member has died; • employees at the birth (adoption) of a child (including guardianship) in the first year. Limit: up to 50 tr. for each child. |

| Income of indigenous peoples from their traditional trade | Exception: wages |

| Amounts of insurance contributions | Includes: • contributions for compulsory personnel insurance; • contributions under contracts of voluntary personal insurance of employees with a period of 1 year for medical payments. expenses; • contributions under medical contracts. services to employees for a period of 1 year with licensed honey. organizations; • contributions under voluntary personal insurance contracts in the event of one's death/or harm to health; • pension contributions under non-state pension agreements. |

| Additional employer contributions to funded pension | Up to 12 tr. per year per employee |

| The cost of travel for workers from the northern territories to the place of vacation and back and baggage allowance up to 30 kg kilograms | If you are on vacation abroad, then the cost of travel or flights (incl. luggage up to 30 kg) is not taxed. |

| Payments from election commissions, referendum commissions, from election funds | To positions elected in the Russian Federation: from the President of the Russian Federation to the local level |

| Cost of uniforms and uniforms | Issued by force of law, as well as to civil servants. Free or with partial payment. Remains for personal use. |

| Cost of travel benefits | Provided by law to certain categories of workers |

| Mat. assistance to employees | Up to 4000 rub. per person per billing period |

| Payment for employee training | For basic and additional professional educational programs |

| Amounts to employees to pay interest on loans and credits | This means that the loan was taken for the purchase and/or construction of housing |

| Cash allowance, provision of food and things | Applies to the military, police department, fire service, heads of federal courier communications, employees of the penal system, customs authorities |

| Payments and other remuneration under labor and civil law contracts (including author’s orders) in favor of foreigners, stateless persons temporarily staying in the Russian Federation | Exception: when such persons are recognized as insured under Russian law |

Note that in many of the cases listed above, an employment agreement or a civil law contract allows you to issue not only money, but also some kind of bonus. Which insurance premiums are not subject to will be clear from the type of contract (agreement) with the person. In other cases, there are no premiums that are not subject to insurance contributions.

Income in kind: insurance premiums

Income in kind is subject to mandatory insurance contributions on an equal basis with cash payments if it is received within the framework of labor relations, under GPC agreements for the performance of work, provision of services, author's order agreements, licensing agreements (clause 1 of Article 420 of the Tax Code of the Russian Federation).

The basis for calculating insurance premiums for the “in-kind” income of employees is the cost of goods transferred to him, work, services provided to him (including VAT, excise taxes) minus the partial payment made by the employee himself (clause 7 of Article 421 of the Tax Code of the Russian Federation).

Thus, insurance premiums will be charged when part of the earnings is paid in products manufactured by the enterprise, or when part of the salary is paid for any services, travel, etc. If partial payment in kind is fixed in the employment contract, the employee’s salary will actually include cash and “in kind” parts included in the base for calculating insurance premiums.

In this case, it is necessary to take into account the exceptions given in the list of Art. 422 of the Tax Code of the Russian Federation, and contributions are not taxed. These include, in particular: compensation payments established by law related to the provision of free housing, payment of utilities, food, food, fuel, provision of allowances in kind, reimbursement of expenses for professional training and advanced training of employees. If such compensations are established by a local act of the company, and not by federal or regional law, they are not exempt from insurance premiums (Letter of the Ministry of Finance of Russia dated May 10, 2018 No. 03-04-07/31223).

Considering the above example of calculating personal income tax on the non-cash income of an employee for whom the employer paid for training, it should be borne in mind that this type of income will not be subject to insurance premiums on the basis of clause 12, clause 1, article 422 of the Tax Code of the Russian Federation.

Let's look at an example when an employee's natural income is not included in the list of exceptions not subject to insurance contributions.

Example

The employee's accrued wages for January 2021 amounted to RUB 41,569. According to the employment contract, part of the salary is paid in food vouchers in the industrial canteen. In January, food vouchers for this employee were issued for 3,012 rubles.

Thus, the salary in cash amounted to 38,557 rubles. (41569 – 3012), in kind – 3012 rubles.

The employee's income subject to insurance premiums will be:

38,557 + 3,012 = 41,569 rubles.

Amounts of insurance premiums for January:

41,569 x 22% = 9,145.18 rubles. (PFR)

41,569 x 2.9% = 1,205.50 rubles. (FSS)

41,569 x 5.1% = 2,120.02 rubles. (compulsory medical insurance)

41,569 x 0.2% = 83.14 rubles. (“trauma”)

Total insurance premiums: 9,145.18 + 1,205.50 + 2,120.02 + 83.14 = 12,553.84 rubles.

Personal income tax will be withheld from the entire salary amount in the amount of:

41569 x 13% = 5404 rub.

In each specific case, regarding the issue of taxation of insurance premiums, it is necessary to check the current version of Art. 422 of the Tax Code of the Russian Federation.

As before, in 2021, taxable income in kind must be included in the “Calculation of insurance premiums.” Income in kind, subject to contributions for “injury”, should also be included in the section for calculating the base for contributions in the calculation of 4-FSS.

Thus, if an employee received income in kind, taxation of such income is carried out on a general basis - the tax agent is obliged to withhold personal income tax from him. If “in kind” income is paid within the framework of labor relations or under GPC contracts for the performance of work and services (and is not included in the list of Article 422 of the Tax Code of the Russian Federation), insurance premiums must also be calculated on it.

Where to look for what is not subject to insurance premiums

In 2021, to understand what income is not subject to insurance premiums, you need to refer to Article 422 of the Tax Code. This article contains a closed list of positions. And this is important. Let us explain why. If you suddenly wonder what accruals are not subject to insurance contributions and in Art. 422 of the Tax Code of the Russian Federation did not find any mention of the corresponding amounts from your case, which means that contributions will still have to be calculated on them.

Please note that tax authorities extremely do not like broad interpretations of closed lists by the persons they check in their favor. So, be prepared to defend your position if you think that in your case the amounts are not subject to insurance premiums.

Let’s say right away that there have been no global changes regarding payments that are not subject to insurance premiums. Their composition is quite uniform across different companies and individual entrepreneurs, so they almost mirrored the transition from the Law on Insurance Contributions No. 212-FZ to the new Chapter 34 “Insurance Premiums” of the Tax Code of the Russian Federation.

Also see “New chapter on insurance contributions to the Tax Code of the Russian Federation since 2017.”

Discounts on education at a state educational institution.

If a student is provided with a discount on tuition under an agreement for the provision of educational services at a state educational institution:

- based on the results of entrance examinations,

- for success in learning,

in accordance with the provisions on providing discounts to students of relevant universities, the amounts of such discounts will not be subject to personal income tax if the discounts are not of an individual nature and are provided exclusively according to objective criteria.

This opinion was expressed by the Ministry of Finance in its Letter dated February 28, 2013. No. 03-04-05/9-158

“A reduction in tuition fees by an educational institution depending on the results of entrance examinations, as well as on learning outcomes, made on the basis of an order from an educational institution, cannot be considered as income (economic benefit) received in kind if the possibility of reducing the cost of tuition is provided for students who have achieved the appropriate results of entrance tests and (or) educational results, that is, it does not have the nature of an individual benefit.”