In business practice, returns to the supplier are commonplace. It happens that a defect is discovered, and if an agreement is reached, then a return of a quality product is possible. This is not difficult - it is much more difficult to reflect all this in the accountant’s documentation. The entries that need to be used depend on the reasons for the return, on whether the goods have had time to be “receipted” and other features. Which codes will the supplier use and which will the buyer? What is the procedure for issuing invoices and is it necessary to adjust the income tax? We tell you how to reflect the return of registered goods in accounting without additional improvisations.

If the product is of poor quality

If the buyer returns a defective product, then the accounting for the transaction will depend on whether or not this product is accepted for accounting by the buyer.

Option 1. The buyer does not accept the defective product for registration.

Buyer's account:

When accepting the goods, the buyer must accept the defect for safekeeping and reflect it on the balance sheet in account 002 “Inventory and materials accepted for safekeeping” (Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n). Accordingly, the return of such goods to the supplier will be reflected in the following transactions:

| Operation | Account debit | Account credit |

| Defective goods are written off off-balance sheet | 002 | |

| Received funds for returned goods | 51 “Currency accounts”, 52 “Currency accounts”, etc. | 60 “Settlements with suppliers and contractors” |

Accounting with the seller:

| Operation | Account debit | Account credit |

| Reduced revenue from the sale of low-quality goods (STORNO) | 62 “Settlements with buyers and customers” | 90 “Sales”, sub-account “Revenue” |

| Reduced cost of shipped low-quality goods (STORNO) | 90, subaccount “Cost of sales” | 41 "Products" |

| VAT charged on shipped low-quality goods has been reduced (STORNO) | 90, subaccount “VAT” | 68 “Calculations for taxes and fees” |

| Money was returned to the buyer for returned low-quality goods | 62 | 51, 52, etc. |

Option 2. The defective product is registered by the buyer.

Buyer's account:

Since the goods are registered by the buyer, their return is reflected in synthetic property accounts, and not on the balance sheet:

| Operation | Account debit | Account credit |

| Goods returned to the supplier are written off | 60 | 41 |

| VAT is charged when returning low-quality goods | 60 | 68 |

| The buyer received money returned by the seller for low-quality goods | 51 “Currency accounts”, 52 “Currency accounts”, etc. | 60 |

Accounting with the seller:

The seller's accounting records will be similar to the above accounting entries when returning defective goods that are not accepted for accounting by the buyer.

In both cases, it is necessary to take into account that if the cost of the returned goods is significant for the selling organization and the return of goods from last year’s shipment occurred already this year, but before the date of approval of the financial statements for last year, then adjustment entries are made in December of last year, and if after the date of approval - in the current year and using account 84 “Retained earnings (uncovered loss)” instead of account 90.

An insignificant shipment from the previous year, adjusted in the current year, is reflected in December if the return was made before the date of signing the financial statements for this year. Insignificant last year returns made later are reflected in the current year as profits (losses) of previous years in account 91 “Other income and expenses” (clauses 4-14 of PBU 22/2010).

Accounting: return is provided for in the contract

If, after receipt, the buyer has the right to return the products on the grounds provided for in the contract (for example, when after the expiration of the established period the products are not resold by the buyer), the return occurs in accordance with the terms of the agreement reached (Article 421 of the Civil Code of the Russian Federation). If the contract does not provide for a special transfer of ownership, at the time of return of the products, their owner is the former buyer. Therefore, when the product arrives from the buyer, a reverse transfer of ownership occurs.

In accounting, reflect the receipt of products with the obligation to return previously received money as an independent fact of economic activity.

Receipt of products back from the buyer should be reflected as receipt of goods or materials, depending on the nature of the further use of the returned products. Do this on the basis of shipping documents issued by the buyer of the product (who purchased it at retail or wholesale), for example, on the basis of a delivery note in form No. TORG-12.

In this case, the returned products should not be received at the cost indicated in these documents (the price at which the buyer purchased the product), but at the book value, that is, in the amount of real costs associated with the production of these products (letter from the Ministry of Finance of Russia dated June 16, 2011. No. 03-03-06/1/351, Federal Tax Service of Russia dated July 17, 2009 No. 3-2-06/77).

Reflect the return of products with the following entries:

Debit 10 (41) Credit 60 (76) – reflected in the composition of materials (goods) are finished products returned by the buyer at book value;

Debit 19 Credit 60 (76) – VAT on returned finished products is reflected;

Debit 60 (76) Credit 50 (51) – the cost of the returned products (specified in the contract) was paid to the buyer;

Debit 91-2 Credit 60 (76) - other expenses are recognized between the return amount and the cost of products sold.

This procedure follows from the Instructions for the chart of accounts (accounts 10, 41).

An example of reflecting in accounting the return of finished products by the buyer in cases not provided for by law. Ownership of the product is transferred to the buyer

LLC "Proizvodstvennaya" is engaged in the production of awning materials. The organization uses the accrual method and pays income tax monthly. One of the organization’s clients is Torgovaya LLC. In accordance with the purchase and sale agreement, Master supplies products to Hermes on a monthly basis, while Hermes makes an advance payment towards future deliveries.

In March, in accordance with the agreement, Hermes transferred an advance in the amount of 59,000 rubles. (including VAT – 9000 rubles). On April 15, Master shipped products worth RUB 118,000 to Hermes. (including VAT – 18,000 rubles). Its cost was 65,000 rubles.

By April, some of the products purchased from Master were not sold, as the product was no longer in demand among buyers. Therefore, “Hermes”, in accordance with the terms of the contract, returns it to “Master” on April 22. The cost of the returned goods was 23,600 rubles. (including VAT - 3600 rubles).

Since at the time of return the goods were already the property of Hermes, it registered its return in accounting as a “reverse sale.” At the same time, he issued an invoice in form No. TORG-12 and an invoice, which he handed over along with the returned goods to the “Master”.

The “master” took into account the returned products as goods based on the invoice in form No. TORG-12. The cost of the products that were returned by Hermes is 13,000 rubles. The amount of the advance payment based on the agreement is counted against future payments.

In accounting, the “Master” accountant reflected these transactions as follows.

In March:

Debit 51 Credit 62 subaccount “Advances received” – 59,000 rubles. – an advance was received from Hermes for the upcoming delivery of products;

Debit 76 subaccount “Calculations for VAT on advances received” Credit 68 subaccount “Calculations for VAT” - 9,000 rubles. (RUB 59,000 × 18/118) – VAT is charged on the prepayment amount.

April 15:

Debit 62 Credit 90-1 – 118,000 rub. – revenue from sales of products is reflected;

Debit 90-2 Credit 43 – 65,000 rub. – reflects the cost of finished products sold;

Debit 90-3 Credit 68 subaccount “VAT calculations” – 18,000 rubles. – VAT is charged on sales of products;

Debit 68 subaccount “Calculations for VAT” Credit 76 subaccount “Calculations for VAT from advances received” – 9,000 rubles. – VAT accrued on prepayment is accepted for deduction.

20 April:

Debit 68 subaccount “Calculations for VAT” Credit 51 – 9000 rub. – transferred to the VAT budget.

April 22:

Debit 41 Credit 60 – 13,000 rub. – product returns are reflected;

Debit 19 Credit 60 – 3600 rub. – VAT is reflected on returned products;

Debit 68 subaccount “Calculations for VAT” Credit 19 – 3600 rub. – accepted for deduction of VAT on returned products;

Debit 60 Credit 62 – 23,600 rub. – accounts payable for returned products are offset against Hermes’ accounts receivable for accepted products;

Debit 91-2 Credit 60 – 7000 rub. (RUB 23,600 – RUB 3,600 – RUB 13,000) – other expenses are recognized between the selling price and the cost of finished products sold.

When returning products, the buyer has the right to demand from the seller a refund of the cost of the purchased products, including VAT. However, this right of the buyer does not depend on the terms of the contract. This is explained by the fact that in the case when the seller is a VAT payer, he is obliged to present the amount of tax to the buyer as required by tax legislation (clause 1 of article 146, clause 1 of article 168 of the Tax Code of the Russian Federation). This obligation does not depend on the will of the parties to the transaction. This position is supported by arbitration courts (see, for example, the rulings of the Supreme Arbitration Court of the Russian Federation dated May 27, 2009 No. VAS-3474/09 (submitted for consideration to the Presidium of the Supreme Arbitration Court of the Russian Federation), dated January 26, 2009 No. 17507/08, resolution of the FAS Povolzhsky District dated September 18, 2008 No. A55-12314/2007).

If the product is of high quality

If the buyer returns a quality product to the seller, then the return operations are reflected in the accounting records of the parties as the sale of goods by the buyer and capitalization by the seller. These transactions are recorded in the accounts in the reporting period in which the return actually occurred.

Buyer's account:

| Operation | Account debit | Account credit |

| Revenue from the return of quality goods to the seller is reflected | 60 | 90, subaccount “Revenue” |

| The cost of the returned goods is written off | 90, subaccount “Cost of sales” | 41 "Products" |

| VAT is charged on the cost of the returned goods | 90, subaccount “VAT” | 68 |

| Money was returned to the buyer for returned quality goods | 51, 52 | 60 |

Accounting with the seller:

| Operation | Account debit | Account credit |

| Returned quality goods accepted from the buyer have been capitalized | 41 | 62 |

| VAT charged by the buyer upon return is taken into account | 19 “VAT on purchased assets” | 62 |

| Money was returned to the buyer for returned quality goods | 62 | 51,52, etc. |

Differences

Once again, briefly consider the essence of two operations for the return of valuables. The seller shipped the goods, and after a certain time, received back the entire shipment or only part of it. If the reason is the non-compliance of the values with the terms of the contract in terms of quality, color, configuration, size, etc., then this operation is precisely a return. In the Civil Code of the Russian Federation it is interpreted as failure by the supplier to fulfill obligations. If the buyer has no claims to the values and returns the goods due to the fact that he could not sell it, then this operation is called reverse sale. Both parties reflect it in accounting and accounting records as an ordinary purchase and sale. The buyer issues an invoice to the former supplier and reflects it in the sales book, in the revenue section. In the accounting system, the cost of the returned values is taken into account in account 90. There is no difference in accounting and accounting records. This is what baffles accountants. Although in reality there are no difficulties in completing the operation.

Shortage, defects, assortment: we understand the reasons for the return

The reasons why goods may be returned from the buyer to the supplier are listed in the contract or provided for by law.

The materials on our website will help you understand how to take into account legal requirements in various business situations:

- “How many days before vacation are vacation pay paid by law?”;

- “What is the legal deadline for responding to a claim?”

Possible reasons for returning goods are listed in the figure below:

In the following sections, we will tell you how the accounting procedure is affected by the type of returned goods (whether they are of high quality or defective), as well as the fact that the goods to be returned are reflected in the buyer’s accounting.

Defective goods returned from the buyer: postings from the buyer and seller

A product will be considered defective if it has defects (removable or irreparable) in one or more indicators. For accounting, it does not matter how many product characteristics do not meet quality requirements. But the moment the defect is discovered plays a significant role: before the goods are accepted for registration or after that. Let's look at an example of how to reflect the return of low-quality goods in the accounting of the seller and buyer.

The small retail chain Optima Fabrics purchases a variety of fabrics from the Bolshevichka LLC factory: from ordinary chintz to ultra-modern curtain materials (organza, blackout, flock, etc.). Acceptance of fabrics occurs for each batch of fabric according to all characteristics.

When receiving the next batch of fabrics, rolls with an undyed pattern and a damaged structure were identified. They did not accept such goods. Until the supplier took back the defective fabric, Optima Fabrics LLC took into account its value in off-balance sheet account 002 “Inventory and materials accepted for safekeeping”, since by law it is obliged to ensure the safety of the goods (Clause 1 of Article 514 of the Civil Code of the Russian Federation).

After the supplier picked up the defective batch, the buyer made the following entry in his accounting:

The seller’s chain of transactions when returning goods from the buyer will reflect the correction (reversal) of the records made during shipment:

If the buyer does not discover a defect during acceptance, he records the receipt of goods according to the usual scheme:

| Accounting entries | ||

| Debit | Credit | |

| A batch of fabrics has been received | ||

| VAT allocated | ||

| VAT is accepted for deduction | ||

Once a defect is discovered, the product is returned to the supplier.

Postings for returning goods from the buyer:

| Accounting entries | ||

| Debit | Credit | |

| Records reflecting the receipt of goods were reversed ─ fabric with identified defects was returned to the supplier | ||

| VAT reversed | ||

| VAT previously accepted for deduction has been restored (reversal) | ||

The seller's transactions for returning goods from the buyer will consist of reversing records related to the sale.

Thus, when returning a product that has not been accepted for registration, the original sale is considered void, and the buyer has no obligation to pay for the product. And if the goods have already been paid for, then the buyer has the right to demand a refund from the seller or negotiate the terms of repayment of the debt incurred (for example, offset against payment for the next delivery).

Termination of the contract at the time of filing a claim

If the contract does not provide for a different procedure, it will be considered terminated on the date when the buyer contacted the seller with the corresponding demand (Clause 2 of Article 450.1 of the Civil Code of the Russian Federation). Therefore, even in a situation where the buyer returns previously purchased low-quality products, it is considered that ownership has transferred from the seller. In this case, when low-quality products are received from the buyer, a new transfer of ownership occurs.

Therefore, reflect in accounting the receipt of products with the obligation to return previously received money as an independent business transaction.

Receipt of products back from the buyer should be reflected as receipt of goods or materials, depending on the nature of the further use of the returned products. Do this based on:

- shipping documents issued by the buyer of the product (who purchased it retail or wholesale), for example, on the basis of a consignment note in form No. TORG-12;

- an act that the buyer draws up when identifying defects in the purchased products.

Return products should not be received at the cost indicated in these documents (the price at which the buyer purchased the product), but at book value, that is, in the amount of real costs associated with the production of these products (letter of the Ministry of Finance of Russia dated June 16, 2011 No. 03 -03-06/1/351, Federal Tax Service of Russia dated July 17, 2009 No. 3-2-06/77).

When returning products, the buyer has the right to demand from the seller a refund of the cost of the purchased products, including VAT. However, this right of the buyer does not depend on the terms of the contract. This is explained by the fact that in the case when the seller is a VAT payer, he is obliged to present the amount of tax to the buyer as required by tax legislation (clause 1 of article 146, clause 1 of article 168 of the Tax Code of the Russian Federation). This obligation does not depend on the will of the parties to the transaction. This position is supported by arbitration courts (see, for example, the rulings of the Supreme Arbitration Court of the Russian Federation dated May 27, 2009 No. VAS-3474/09 (submitted for consideration to the Presidium of the Supreme Arbitration Court of the Russian Federation), dated January 26, 2009 No. 17507/08, resolution of the FAS Povolzhsky District dated September 18, 2008 No. A55-12314/2007).

Reflect the return of products with the following entries:

Debit 10 (41) Credit 60 (76) – reflected in the composition of materials (goods) are finished products returned by the buyer at book value;

Debit 19 Credit 60 (76) – VAT on returned finished products is reflected;

Debit 60 (76) Credit 50 (51) – money was transferred to the buyer for the returned products (at the cost specified in the contract);

Debit 91-2 Credit 60 (76) - other expenses are recognized between the return amount and the cost of products sold.

This procedure follows from the Instructions for the chart of accounts (accounts 10, 41).

An example of reflecting in accounting the return of finished products by the buyer in cases provided for by law. Ownership of the product is transferred to the buyer

LLC "Proizvodstvennaya" is engaged in the production of awning materials. On March 15, in accordance with the purchase and sale agreement, “Master” sold finished products to LLC “Torgovaya” in the amount of 118,000 rubles. (including VAT – 18,000 rubles).

After the products were purchased and paid for by Hermes, it turned out that the entire batch of products did not meet the quality characteristics stipulated by the terms of the contract. Therefore, Hermes, in accordance with the terms of the agreement, returned it to the Master on April 22. The cost of the returned products was 118,000 rubles. (including VAT – 18,000 rubles).

Since at the time of return the products were already the property of Hermes, he formalized the return as an independent business transaction. At the same time, he issued an invoice in form No. TORG-12, a statement and an invoice, which he handed over along with the returned products to the “Master”.

The “master” took into account the returned finished products as materials (later they will be used in the production of tent structures for summer cafes) on the basis of an invoice in the form No. TORG-12 and an act. The cost of the products that were sold to Hermes is 90,000 rubles.

In accounting, the “Master” accountant reflected these transactions as follows.

March 15th:

Debit 62 Credit 90-1 – 118,000 rub. – revenue from sales of finished products is reflected;

Debit 90-2 Credit 43 – 90,000 rub. – the cost of production is written off;

Debit 90-3 Credit 68 subaccount “VAT calculations” – 18,000 rubles. – VAT is charged on product sales;

Debit 51 Credit 62 – 118,000 rub. – payment has been received from Hermes for the products.

20 April:

Debit 68 subaccount “Calculations for VAT” Credit 51 – 18,000 rubles. – VAT on the sale of finished products is transferred to the budget.

April 22:

Debit 10 Credit 60 – 90,000 rub. – returned products are taken into account as part of materials;

Debit 19 Credit 60 – 18,000 rub. – VAT on returned products is taken into account;

Debit 68 subaccount “Calculations for VAT” Credit 19 – 18,000 rub. – accepted for deduction of VAT on returned products;

Debit 60 Credit 51 – 118,000 rub. – money was returned to the buyer;

Debit 91-2 Credit 60 – 10,000 rub. (RUB 118,000 – RUB 18,000 – RUB 90,000) – other expenses are recognized between the return amount and the cost of finished products.

Return of quality goods: how to record them

The return of quality goods occurs as part of a normal purchase and sale transaction. In this case, the goods are sold at the cost of acquisition. In this situation, no reversal entries are made.

An example will help us understand the transactions for returning a quality product to a supplier.

Shop No. 7 LLC received a batch of men's suits from the supplier Tekhnologiya LLC. However, it later turned out that the suits were shipped in the wrong size range: instead of the ordered running sizes M and L, all the suits turned out to be size 5XL. The costumes “for giants” had to be returned to the supplier ─ there was no demand for them.

The following entries were made in the accounting of LLC “Magazin No. 7”:

| Accounting entries | ||

| Debit | Credit | |

| A batch of men's suits has been received | ||

| VAT allocated | ||

| VAT is accepted for deduction | ||

| Revenue from the return of quality goods is reflected | ||

| The cost of the returned goods is written off | ||

| VAT is charged on the cost of the returned goods | ||

| Debt to supplier offset | ||

The accounting of the supplier (Technology LLC) will also have two blocks of postings:

- sale of costumes to the buyer;

- receipt of returned suits from the buyer (as part of reverse sales).

How to fill out a return invoice is described in this publication.

Reverse implementation

The coolie sale agreement provides for a condition under which the buyer can return the goods if he does not sell them. Such an operation is formalized not by reversal, but by reverse sale. It occurs with the consent of both parties. Ownership returns to the supplier. The former recipient issues an invoice and registers it in the sales ledger.

| Sum (thousand roubles.) | Debit | Credit | Operation |

| 11,8 | 62 | 90.1 | Revenue received from sales |

| 1,8 | 90.3 | 68 | VAT charged |

| 8 | 90.2 | 41 | Cost written off |

| 10 | 41 | 60 | Purchase returns |

| 1,8 | 19 | 60 | VAT allocated |

| 1,8 | 68 | 19 | The tax is deducted |

| 10 | 60 | 62 | Settlement |

This scheme is unprofitable for the supplier, since a batch of goods is disposed of at a lower price and returned at a higher price (8 thousand rubles were written off as cost, but 10 thousand rubles were capitalized).

Results

The return of goods by the buyer is always accompanied by entries in the accounting accounts. If the item is defective, the buyer's return entries will reflect the item being taken off-balance sheet until the supplier picks it up. In this case, ownership of the defective product does not pass to the buyer, but the law requires its safety to be ensured. If the buyer managed to capitalize the defective goods, then both parties to the transaction need to make reversal entries.

If the buyer returns a quality product, the entries for the goods returned to the supplier reflect the reverse sales transaction.

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Buyer's legal right

Civil legislation establishes an exhaustive list of situations in which the purchasing company has the right to refuse to accept goods. Thus, Chapter 30 of the Civil Code of the Russian Federation establishes that purchased valuables can be returned if they do not meet the stated characteristics, their quality does not meet the terms of the contract, delivery deadlines are violated, the supplier provided valuables in a smaller volume, etc.

However, when registering the return of goods to the supplier, accounting entries are made depending on the reason for returning the products. For example, when returning products that do not meet the stated quality characteristics, reverse accounting entries are generated. But if you have to return a quality product, then the operation is reflected in accounting as a reverse sale.

Let's take a closer look at each case of returning goods from a buyer, and draw up entries for recording in accounting using specific examples.

Accounting: returns are provided for by law

If the buyer has the right to return products on the grounds provided for by law (for example, inadequate quality, lack of staffing, etc.), the contract is terminated unilaterally. In this case:

- the buyer returns the product to the seller;

- the obligation to pay for the products is terminated (if the termination of the contract occurred before payment for the products);

- the right to demand money appears (if the product has already been paid for).

This follows from paragraph 2 of Article 475, Article 309 of the Civil Code of the Russian Federation.

When exactly the contract will be considered terminated is determined depending on its terms or on the conditions contained in the notice of unilateral refusal to fulfill the contract (clause 4 of Article 523 of the Civil Code of the Russian Federation).

We return low-quality products

If the quality of the goods does not correspond to the stated items, then the registration of the return to the supplier by postings will depend on whether the buyer managed to capitalize the purchase or noticed the defect before it was accepted for accounting.

Products are not accepted for accounting

If responsible employees of the purchasing organization discover a defect upon acceptance of the product, then this product must be accepted for safekeeping until the return is made. Defective valuables should be reflected on off-balance sheet account 002 “Inventory and materials accepted for safekeeping.”

Example. Vesna LLC purchased retail equipment in the amount of 500,000 rubles. On the day of delivery, the supply manager of Vesna LLC discovered a defect. The accountant compiled the accounting records:

| Operation | Debit | Credit | Amount, rub. |

| Reflected defective material assets in safekeeping | 500 000 | ||

| The goods were returned, transactions were made when writing off defective inventory items from the balance sheet | 500 000 | ||

| Money for low-quality products was returned to the cash register, to the bank account | 500 000 |

Low-quality products are capitalized

Let’s say that during a visual inspection of the delivered products, it is impossible to detect defects or non-compliance with quality. For example, equipment must be installed and running to determine its suitability. Consequently, it is impossible to identify defects before commissioning or before using raw materials in production.

In this case, inventory items are received in the usual manner. And if a defect is detected, the goods are returned to the supplier; let’s look at the accounting entries using a specific example.

Vesna LLC purchased goods and materials in the amount of 300,000 rubles, including VAT 54,000. The manufacturing defect was identified only at the initial stage of production. Low-quality inventory items were returned to the supplier company in full, the accountant made the following notes:

| Operation | Debit | Credit | Amount, rub. |

| The acquisition of inventory items is reflected | 246 000 | ||

| Input VAT reflected | 54 000 | ||

| Payment for purchased products has been transferred | 300 000 | ||

| The amount of the claim for the return of low-quality goods and materials is reflected | 300 000 | ||

| Return of goods reflected | 246 000 | ||

| VAT reflected on returned inventory items | 54 000 | ||

| Funds have been credited to the bank account for the return to the buyer, posting | 300 000 |

VAT accounting

If the buyer refuses part of the shipment, the seller issues an invoice for a reduction in the value or quantity of the valuables. It is recorded in the purchase ledger. If the buyer refuses the entire shipment, the seller registers his invoice. The recipient does not declare VAT on the goods, but draws up a report and accepts the goods for safekeeping.

We return quality goods

When drawing up a supply agreement, one of the parties can stipulate the conditions under which the return of goods and materials is possible, regardless of quality. For example, if:

- the supplier did not make a full delivery, but only part of the requested values;

- the delivery was not complete;

- there is no packaging, container or their integrity is broken (damaged);

- the selling company did not provide comprehensive information about inventory items.

In such situations, the return of the goods is issued, and accounting entries are formed as a reverse sale.

Typical wiring:

| Operation | Debit | Credit |

| Revenue from the reverse sale (return) of inventory items is reflected in accounting | Sub-account “Revenue” | |

| The cost of goods sold and returned is written off | Sub-account “Revenue” | |

| VAT is charged on the cost of sold inventory items | Sub-account "VAT" | |

| Money for returned goods and materials was credited to the bank account |

Return documents

There are a number of grounds due to which it is possible, within the framework of legal norms, to return purchased raw materials to the supplier. These include the following:

- The supplier did not provide documentation on the product in accordance with the procedure established by the contract.

- The customer's requirements for completing the goods were not fulfilled.

- A sale was made to the buyer of low-quality goods, with certain deformations, damage, and defects. In this case, it is taken into account that the violations cannot be eliminated, or the cost of restoration is too high.

- The range of goods sent by the supplier does not correspond to those specified in the agreement.

In all these cases, any discrepancies identified should be reported to the seller immediately.

This operation is documented in the form of a table, the header of which indicates the following:

- KFP number

- The organization on whose balance sheet the goods are located.

- The counterparty with whom the agreement was concluded.

- Number and name of the agreement (for example, “87 Processing”).

The body of the table contains the following information:

- Product serial number.

- Product nomenclature in accordance with the data specified in the agreement.

- Certain content of the service will either be rejected or recycled.

- Number of goods in a batch to be returned.

- Unit cost.

- Total cost of the entire lot excluding VAT.

- The VAT percentage is indicated separately.

- The VAT amount is also indicated separately.

- The total amount for the consignment of goods to be returned, including VAT.

Sample letter to return material to supplier:

Postings for returning to the supplier in 1C 8.3 and 8.2

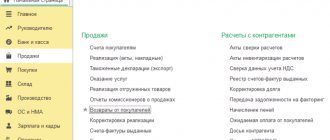

This operation is formalized in 1C with a document of the same name - “Return of goods to supplier”, which is located in the interface on the “Purchases and Sales” tab. The docs look like this:

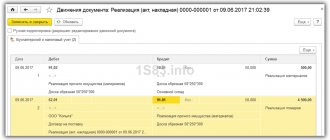

To carry it out, you must indicate in the header which supplier, under which contract and from which warehouse the goods will be returned. In the “Products” tabular section, you must indicate product items, their quantity and return price.

It is also additionally necessary to indicate accounting accounts - items (in the tabular part of goods) and calculations.