Federal law in Russia on minimum wage 2021

Regulated by Federal Law No. 82-FZ of June 19, 2000 “On Minimum Rots”. The new law states that the minimum wage will be set at the beginning of each year on January 1 based on the subsistence level (hereinafter referred to as the subsistence minimum) of the working population in Russia for the 2nd quarter of last year.

Also in the Labor Code, in Article 133 of the Labor Code of the Russian Federation, it is mentioned that the minimum wage should be established simultaneously throughout the country and should be equal to or higher than the subsistence level of the working population. The cost of living is indexed quarterly. It depends on the cost of utilities and the food basket.

In recent years, the minimum wage has increased slightly and has not led to an increase in wages.

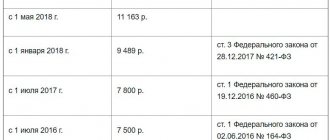

Until 2021, the increase in the minimum wage was less than one thousand rubles and was carried out once a year, not counting 2021, when the increase was in January and July. You can find more details in the table.

Table of minimum wage changes:

| YEAR | Minimum wage, rubles |

| 2012 | 4611 |

| 2013 | 5205 |

| 2014 | 5554 |

| 2015 | 5965 |

| 2016 | 6204 - January, 7500 June |

| 2017 | 7800 |

| 2018 | 9489 - June, 11163 - May |

| 2019 | 11 280 |

| 2020 is already known, according to PM. | 12 130 |

Table of changes in the minimum wage value in the region

| date | Value, rub. | Normative act |

| from 01/01/2021 |

| Art. 1 of the Law of June 19, 2000 No. 82-FZ on the minimum wage. |

| from 01.01.2020 |

| Art. 1 of the Law of June 19, 2000 No. 82-FZ on the minimum wage. |

| from 01/01/2019 |

| Art. 1 of the Law of June 19, 2000 No. 82-FZ on the minimum wage. Agreement between the regional government, the Regional Trade Union Council and the Union of Industrialists and Entrepreneurs of the Murmansk Region for 2019–2021. |

| from 05/01/2018 |

| Art. 1 of the Law of June 19, 2000 No. 82-FZ on the minimum wage. |

| from 01/01/2018 |

| Art. 1 of the Law of June 19, 2000 No. 82-FZ on the minimum wage. Appendix No. 4 to the Agreement on the minimum wage in the Murmansk region. |

| from 01.07.2017 |

| Art. 1 of the Law of June 19, 2000 No. 82-FZ on the minimum wage. |

| from 01.11.2016 |

| Appendix No. 3 dated November 29, 2016 to the agreement on the minimum wage in the Murmansk region for 2015 - 2021 dated November 28, 2014. |

| from 01/01/2016 |

| Agreement of the Government of the Murmansk Region, the Murmansk Regional Trade Union Council, the Union of Industrialists and Entrepreneurs of the Murmansk Region dated December 3, 2015. |

| from 01/01/2015 |

| Agreement on the minimum wage in the Murmansk region for 2015 - 2021 dated November 28, 2014. |

| from 01/01/2014 |

| Agreement on the minimum wage in the Murmansk region for 2011 - 2013. |

FILES

Note to the table: updated minimum wage values for a specific date are highlighted in bold. The values in the Murmansk region for 2014, 2015, 2021, 2021, 2021, 2021, 2021, 2021 are given. These minimum wage values are applied in the cities of: Murmansk, Apatity, Severomorsk, Monchegorsk, Kandalaksha, Kirovsk, Olenegorsk, Kovdor, Polyarny, Zapolyarny and other settlements of the Murmansk region.

See also: - living wage in the Murmansk region - minimum wage in other regions

Features of calculating the minimum wage from January 1, 2021

Depending on the labor relationship, the region in which the company is registered, and the number of working days, the minimum wage calculation will differ.

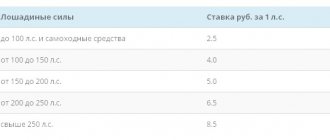

Regional coefficient

According to government decree No. 4-ПВ17 of February 7, 2021, when calculating the minimum wage in areas equated to the Far North and when working in the Far North, the amount of the minimum wage should be increased by the regional coefficient applied in the region.

For example: the national minimum wage is 12,130.00, the regional bonus is 30%. The final minimum wage in the region is 15,769 rubles. Any full-time employee should receive at least 13,719 rubles. This amount arises as a result of the deduction of personal income tax equal to 13% from the regional minimum wage.

If the employer pays an amount less than the minimum wage, the employee must file a complaint with the labor inspectorate to eliminate illegal wages and impose a fine on the organization.

It is worth noting that the minimum wage includes not only the salary for the time actually worked, but also bonuses and incentives specified in the contract, for example: an increase for the amount of work.

Northern coefficient when calculating the minimum wage

An important issue for residents of the regions of the Far North and areas equivalent to its conditions is taking into account the northern coefficient.

The northern coefficient is not constant and depends on the number of years lived and worked in the region. Therefore, it is not used when calculating the minimum wage.

Part-time and part-time work

In cases where an employee works at half the basic rate or combines two rates at the same time, the minimum wage may be lower than the established minimum wage.

For example: a mechanic works three full days a week, that is, 12 days a month. A mechanic works 8 hours every day.

The total working hours in a month are 160, the calculation is based on 5 working days per week, assuming 30 days per month.

In this case, the minimum wage is calculated as follows:

- Let's calculate the cost of 1 hour of work:

12,130/160 hours = 75.8 rub./hour

- Let's calculate the cost of 1 working day:

75.8 × 8 = 606 rubles/day

- Let's calculate monthly earnings:

606 × 12= 7,272 rubles/month

- Let's calculate the amount of money that the locksmith will receive:

7,272 - 13% = 6,327 rubles.

Personal income tax when calculating the minimum wage

Employees of any organization always receive a monthly salary, from which personal income tax is deducted in favor of the state.

Why were they paid less than the minimum wage?

When calculating the minimum wage, personal income tax is not taken into account, that is, it is included in the minimum wage; the employer is a tax agent who needs to deduct personal income tax from each employee. Therefore, when receiving money in hand, any employee of the organization can receive funds in an amount less than 13% than established in the Resolution on increasing the minimum wage.

How to receive compensation for delayed wages?

Regional coefficients

In the Murmansk region there is no single regional coefficient, but various increasing coefficients are established in the amount of 1.4 to 1.8 depending on the region, settlement, type of enterprise activity, etc.

You need to multiply the above minimum wage by these coefficients to get the final value of the minimum wage in the Murmansk region.

It turns out that the minimum wage, taking into account regional coefficients

varies within the following limits:

For all categories of workers

from 17,908.80 ₽ to 23,025.60 ₽

It is best to check with your employer, the local Ministry of Labor or the trade union which coefficient is used in your organization.

If an employee has a percentage increase in wages for work experience in the Far North and equivalent areas, then the minimum wage of such an employee will be even higher.

By the way, according to Article 133_1 of the Labor Code of the Russian Federation, the minimum wage for employees of organizations financed from the federal budget is always equal to the federal minimum wage, i.e. 12,792 ₽. Regional increasing coefficients are also applied for this size.

Table of minimum wages by region from January 1, 2021, taking into account the regional coefficient

The table was formed taking into account the regional coefficient and special conditions of the regions.

Special conditions include tripartite agreements between employees, trade unions and management and resolutions of territorial government executive bodies.

| Region | Regional coefficient | Special conditions | Total amount of minimum wage, rub. |

| Altai region | 1,15 | — | 13 000 |

| Amur region | 1,2 | — | 14 556 |

| Arhangelsk region | 1,4 | — | 16 982 |

| Astrakhan region | — | — | 12 130 |

| Belgorod region | — | — | 12 130 |

| Bryansk region | — | — | 12 130 |

| Vladimir region | — | — | 12 130 |

| Volgograd region | — | — | 12 130 |

| Vologda Region | — | 1.2 from the subsistence level | minimum 12 130 |

| Voronezh region | — | — | 12 130 |

| Jewish Autonomous Region | — | Minimum wage, including regional coefficient 12,000.00 for all employees | 12 130 |

| Transbaikal region | 1,2 | — | 14 556 |

| Koralsky district of Zabaykalsky Krai | 1,2 | — | 14 556 |

| Ivanovo region | — | — | 12 130 |

| Irkutsk region | 1,3 | — | 15 769 |

| Kabardino-Balkarian Republic | — | — | 12 130 |

| Kaliningrad region | — | — | 12 130 |

| Kaluga region | — | — | 12 130 |

| Kamchatka Krai | 1,8 1,6 | — | 21 834 19 408 |

| Captain's Islands | 2 | — | 24 260 |

| Aleutian Islands | 1,8 | The minimum wage, including the regional coefficient, is 21,834 rubles. for all employees | 21 834 |

| Koryak district | 1,8 | Minimum wage, including regional coefficient 19177.00 for all employees | 21 834 |

| Karachay-Cherkess Republic | — | — | 12 130 |

| Kemerovo region | 1,3 | — | 15 769 |

| Kirov region | — | — | 12 130 |

| Kostroma region | — | — | 12 130 |

| Krasnodar region | — | — | 12 130 |

| Krasnoyarsk region | 1,3 | — | 15 769 |

| Norilsk | 1,8 | — | 21 834 |

| Kurgan region | 1,15 | — | 13949,5 |

| Kursk region | — | — | 12 130 |

| Leningrad region | — | 12 130 | |

| Lipetsk region | — | — | 12 130 |

| Magadan Region | 1,7 | — | 20 621 |

| Moscow | — | — | 20 195 |

| Moscow region | — | — | 15 000 |

| Murmansk region | 1,5 | Allowances: Murmansk-140 - 1.8 urban areas. Foggy - 1.7 Rest of the region. — 1.4 | 32751 30931,5 25473 |

| Nenets Autonomous Okrug | 1,8 | Surcharges: north of the Arctic Circle - 1.8; to the south - coefficient 1.7. | 39 301,2 37 117,8 |

| Nizhny Novgorod Region | — | — | 12 130 |

| Novgorod region | — | — | 12 130 |

| Novosibirsk region | 1,25 | — | 15162,5 |

| Omsk region | 1,15 | — | 13949,5 |

| Orenburg region | 1,15 | — | 13949,5 |

| Oryol Region | — | — | 12 130 |

| Penza region | — | — | 12 130 |

| Perm region | 1,15 | — | 13949,5 |

| Primorsky Krai | 1,3 | — | 15 769 |

| Pskov region | — | — | 12 130 |

| Republic of Adygea | — | — | 12 130 |

| Altai Republic | 1,25 | — | 15162,5 |

| Republic of Bashkortostan | 1,15 | — | 13949,5 |

| The Republic of Buryatia | — | — | 12 130 |

| The Republic of Dagestan | — | — | 12 130 |

| The Republic of Ingushetia | — | — | 12 130 |

| Republic of Kalmykia | 1,3 | — | 15 769 |

| Republic of Karelia | 1,15 | — | 13949,5 |

| Komi Republic | 1,2 | — | 13 359,60 |

| Republic of Crimea | — | — | 12 130 |

| Mari El Republic | — | — | 12 130 |

| The Republic of Mordovia | — | — | 12 130 |

| The Republic of Sakha (Yakutia) | depending on the territory 1.4 - 2.0 | According to the law of Yakutia dated May 18, 2005 No. 475-III + from 10-80% salary increase depending on length of service. | 18680,2 — 43668 |

| Republic of North Ossetia–Alania | — | — | 12 130 |

| Republic of Tatarstan | — | — | 12 130 |

| Tyva Republic | 1,4 | — | 16 982 |

| The Republic of Khakassia | 1,3 | — | 15 769 |

| Rostov region | — | — | 12 130 |

| Ryazan Oblast | — | — | 12 130 |

| Samara Region | — | — | 12 130 |

| Saint Petersburg | — | The minimum wage is 17,000 rubles. | 17 000,00 |

| Saratov region | — | — | 12 130 |

| Sakhalin region | 1,6-2,0 | Depending on the region, the maximum premium is 0.5-2.6 | 25473 — 55798 |

| Sverdlovsk region | — | — | 12 130 |

| Sevastopol | — | — | 12 130 |

| Smolensk region | — | — | 12 130 |

| Stavropol region | — | — | 12 130 |

| Tambov Region | — | — | 12 130 |

| Tver region | — | — | 12 130 |

| Tomsk region | 1,3 | — | 15 769 |

| Tula region | — | — | 12 130 |

| Tyumen region | 1,15 | — | 13949,5 |

| Udmurt republic | 1,15 | — | 13949,5 |

| Ulyanovsk region | — | — | 12 130 |

| Khabarovsk region | 1,3 | Minimum wage, including regional coefficient 12,480.00 for all employees | 15 769 |

| Khanty-Mansiysk Autonomous Okrug – Ugra | 1,7 | — | 18 977,10 |

| Chelyabinsk region | 1,15 | — | 13949,5 |

| Chechen Republic | — | — | 12 130 |

| Chuvash Republic | — | — | 12 130 |

| Chukotka Autonomous Okrug | 2 | — | 24260 |

| Yamalo-Nenets Autonomous Okrug | 1,5-1,8 | Supplement from 10-60% depending on residence and length of service | 20014,5 — 34934,4 |

| Yaroslavl region | — | — | 12 130 |

What will the new minimum wage affect?

The new minimum wage level affects not only the minimum wage, but also a number of social benefits, such as:

- benefits assigned for caring for a child under the age of 1.5 years and 3 years (in 2021);

- calculation of payments to an employee on sick leave;

- Maternity benefits will also increase. The increase in benefits will affect only those whose wages are below the minimum wage and who went on maternity leave after January 1, 2021;

- increase in unemployment benefits.

These payments will be calculated based on the minimum wage.

Workers receiving more than the minimum payment will not be affected by the minimum wage increase.