Wages are remuneration for labor that was used by the employer to make a profit. In accordance with the Labor Code of the Russian Federation, salaries must be paid at least 2 times a month, and the Ministry of Labor regulates the establishment of a specific payment date. But situations arise when the employer, in order not to violate the law, has to pay wages earlier than the established deadlines. The reasons for such payments may be different, for example, due to long weekends, holidays, at the request of the employee or for no specific reason. But despite the fact that the employee’s rights are not infringed, the employer faces a number of problems. One of which is its reflection in

6-NDFL. Let's consider how early payment should be reflected in this declaration.

Regulatory regulation of wage payments

Section VI of the Labor Code of the Russian Federation regulates the payment of wages.

Letter of the Ministry of Labor of Russia dated 02/03/2016 N 14-1/10/B-660 regulates the size and timing of salary payments.

The Tax Code of the Russian Federation, Part 2 regulates the taxation of wages with personal income tax.

Order of the Federal Tax Service of Russia dated October 14, 2015 N ММВ-7-11/ [email protected] determines the form and completion of 6-NDFL.

Code of Administrative Offenses of the Russian Federation Article 5.27 defines the responsibility of the employer in the field of labor legislation.

Local acts of the organization that do not contradict the legislation in force at the moment, which determine the date (and not the period) of salary payment.

When to withhold personal income tax

Personal income tax from the salary must be withheld directly from the income of an individual upon its actual payment (clause 4 of article 226 of the Tax Code of the Russian Federation). And since at the time of early payment of wages, income in the form of wages is not yet considered received (by analogy with an advance), the tax agent cannot calculate and withhold personal income tax.

This is important to know: Violation of wage payment deadlines: fines and liability in 2021

Therefore, it is necessary to withhold tax on subsequent payments that will be made on the last day of this month or later (Letter of the Federal Tax Service dated April 29, 2016 N BS-4-11/7893).

Basis for timing of salary payment

According to the Labor Code of the Russian Federation, salaries must be paid at least 2 times a month, i.e. is allowed more often, which must be regulated by local acts of the organization. Another important condition is that the accrued salary must be paid no later than 15 days from the date of its accrual, for example, the accrued salary on the 1st must be indicated in the local act no later than the 16th of the same month, a later payment is a violation labor legislation.

The Labor Code of the Russian Federation does not reflect early payment of wages, for example, before a long weekend. Thus, local regulations can provide for early payment before long New Year holidays (on payment of wages if the payment date coincides with a holiday or day off, Article 136 of the Labor Code of the Russian Federation stipulates that it must be paid on the eve of such days), but not payment at the request of the employee .

If the norms of local regulatory acts of an organization of a constituent entity of the Russian Federation contradict the current labor legislation, then these norms are considered invalid.

Deputy Minister of Labor and Social Protection of the Russian Federation L.Yu. Eltsova.

Proportional ratio of advance and counting.

Labor legislation does not provide for maximum amounts of these payments - advance payment and calculation. Therefore, the employer can set the amount of the advance payment independently. Moreover, the Labor Code does not introduce the obligation of the employer to strictly fix the amount of the advance payment in local documents. This means that varying the amount of this payment is permissible. In part 1 of Art. 136 of the Labor Code of the Russian Federation only says that the employer is obliged to inform the employee about the total amount of money to be paid and the components of the salary due to him for the corresponding period.

In practice, the amount of the advance, as a rule, is 50% of the amount of planned income for the month. This is a kind of guarantee for the employer. After all, employees may get sick, go on vacation (including unpaid leave), quit, etc., that is, not fully work out the pay period. And then the employer will have to decide how to return the amount of overpaid income.

Salary payment for tax purposes

Important! The salary payment date (but not the period) must be recorded in one of the local documents, for example, in an employment contract, etc.

Salaries are subject to taxation, in particular personal income tax, which is paid by a tax agent represented by an organization. The day of receiving remuneration in the form of salary under Art. 223 of the Tax Code of the Russian Federation is the last date of the month (except for the case of dismissal of an employee). So, when paying wages earlier than the last date of the month, it is considered ahead of schedule, that is, an advance on which the organization is not obliged to calculate personal income tax.

In the clarifications of the Ministry of Finance of the Russian Federation dated October 27, 2015 No. 03-04-07/61550: personal income tax must be withheld on the last date of the month or in the month following the payment of early salary and until the end of the month the salary cannot be considered received by the taxpayer and the tax cannot be counted. Thus, the salary that is paid before the end of the month is an advance and on the day of payment the organization should not calculate personal income tax and should not withhold it. The tax is calculated only on the last day of the month, and it is withheld only when the next payment is made. Thus, the advance payment is paid taking into account the tax, and the next payment will be deducted, for example, from the advance payment, and the payment to the budget will be made on the next business day.

How should tax be reported?

Income tax is not allowed to be transferred until the end of the month of its deduction. This payment will be regarded as payment at the expense of the business entity. This is enshrined in the Tax Code, Art. 226 clause 9. Calculation of income tax should be performed no later than the working day following the day of payment of earnings, from which the actual deduction will occur (TC Article 226 clause 6 and Article 6.1 clauses 6-7).

Despite the fact that the law does not allow advance calculation of personal income tax, tax authorities do not apply sanctions to organizations if payments arrive to the treasury in the current month ahead of schedule.

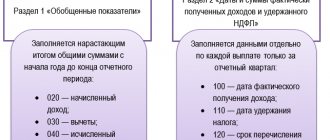

The procedure for filling out 6-NDFL when issuing salaries before the end of the month

Form 6-NDFL is submitted quarterly and organizations that issued wages on the last day of the month must reflect it in the calculation as early wages. For such a salary, the date of personal income tax withholding will be earlier than the date of receipt of income, if personal income tax is withheld from the salary on the day of payment.

Filling procedure

Section 1:

020 – salary, including early payment

030 – standard, property and social deductions in relation to wages

040 – calculated personal income tax from payments: regular salary, and paid ahead of schedule.

070 – withheld personal income tax, despite the fact that if the tax is not withheld, it is not added, for example, if personal income tax is withheld from an early salary in September, and from an advance payment in October, then this tax is not included in the calculation.

Section 2:

Salaries paid ahead of schedule are reflected in section 2 as a separate block.

100 – indicates the last day of the month for which the salary was issued

110 – indicates the date when the tax must be withheld, for example, payment of the next advance)

120 – date of the working day after the date from line 110

130 – accrued salary

140 – withheld personal income tax

If the salary is paid ahead of schedule, how to reflect it in accounting

When a situation arises with early payment of income, the employer should rely on written explanations from the Ministry of Finance and the Federal Tax Service:

- On 02/01/2016, a letter from the Ministry of Finance of the Russian Federation No. 03-04-06/4321 was issued, its provisions are supplemented by letters of the Federal Tax Service dated 04/29/2016 No. BS-4-11/7893 and the Ministry of Finance dated 12/15/2017 No. 03-04-06 /84250;

- letter of the Federal Tax Service dated March 24, 2016 No. BS-4-11/5106.

The first two documents indicate that if the salary is paid ahead of schedule, it acts as an advance payment. Income tax in this situation cannot be withheld from the date of actual payment. Withholding and transfer of personal income tax for the billing month must be made no earlier than the last day of that month. The Ministry of Finance adhered to the same position in a letter dated December 15, 2017 No. ]]>03-04-06/84250]]>, explaining that the tax paid in advance will have to be returned and paid again. In the explanatory letter No. BS-4-11/5106, the Federal Tax Service states that for a tax agent, early payment of income to hired personnel is equivalent to the actual payment of wages. This contradictory position of the tax authorities does not make it possible to formulate a unified methodology by which 6-NDFL will be filled out if the salary is paid ahead of schedule.

According to the norms of the Tax Code of the Russian Federation (clause 2 of Article 223), the date of actual receipt by an employee of income for the time worked coincides with the last day of the billing month. In 6-NDFL, this indicator is indicated in line 100. The letter of the Federal Tax Service, dated May 16, 2021 No. BS-3-11 / [email protected] stipulates that the identification of the date in line 100 is not affected by the fact that this day falls on a weekend or holiday.

If you follow the rule according to which tax is withheld at the time an individual actually receives remuneration for work, then personal income tax must be calculated and withheld from earnings no earlier than the last day of the month. If paid early, the tax cannot be reflected by the tax agent; it is deducted in the accounting registers from the next salary. In this situation, the main risks are associated with the possible dismissal of an employee, as a result of which the income of the next period may not be enough to pay off personal income tax obligations for the previous month.

Error in salary payment dates

Local acts of the organization regulate the following salary payment deadlines: the 20th of the current month and the 5th of the next month. Is it necessary to take into account the 15-day period for issuing salaries if the payment was made due to a weekend earlier than the 20th, for example, the 18th, if there are 31 days in a month, is it necessary to issue it on the 4th?

When setting dates by local acts for the payment of wages, the number of days in a month does not matter. And regardless of the fact that the payment was made on the 18th instead of the 20th, the payment must be paid on the established day - the 5th. 15 calendar days are set as the period during which it must be paid after it is accrued (Part 6 of Article 136 of the Labor Code of the Russian Federation).

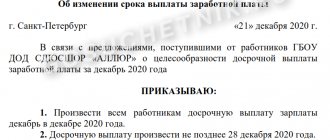

Preliminary result.

Taking into account the above, it turns out that if one of the local acts of the company sets the deadline for payment of the advance as the 30th day of the month (and for the final payment - the 15th day of the next month), then the company has the right to pay (by formalizing its decision by order) almost the entire December wages (for example, 80-85% of the total amount of payments) in advance, and the final payment should be made in January. Accordingly, she must also transfer personal income tax and insurance premiums to the budget in January. We believe that in this case there should be no problems with filling out forms 6-NDFL and 2-NDFL.

Error when reporting pre-paid New Year's salary

Organizations issue December salaries before the new year: December 28 or 29. In this situation, you need to withhold personal income tax from the December salary only with the January advance. The salary for December will be income only on December 31, until which personal income tax cannot be withheld, but only from the advance in January, and the December salary will be paid without deducting personal income tax. In this case, the salary for December is taken into account in section 1 of the 6-NDFL calculation, lines 020 and 040 for the year and in section 2 of the calculation for the first quarter of 2021, line 070.

But in practice, the Federal Tax Service does not fine organizations for the transferred tax before January, so if personal income tax is withheld on December 29, then both the salary and the tax will fall into 6-personal income tax for the year (lines 020, 040 and 070), but the tax must be paid in January and its payment will be reflected in 6-personal income tax for the first quarter, in section 2.

zp_6-ndfl.jpg

Related publications

Early salary in 6-NDFL is reflected without fail. This form must show all accruals in favor of hired personnel. The date of occurrence of actual income can only affect the assignment of payments to a specific reporting interval. The issuance of earnings to employees before the end of the payroll period may occur due to erroneous actions of the accounting department or as a result of deliberate settlement with the staff in advance.

Answers to common questions

Question No. 1 : Salaries are paid on the 25th and 10th. An employee going on vacation on the 9th asks to be paid wages for the days worked before going on vacation. Do I need to pay wages for these days before the start of the vacation?

Answer : The Labor Code of the Russian Federation does not oblige the organization to pay the employee wages for the days worked before the start of the vacation. If the employer pays wages for the days worked before the vacation, before the due date for payment of wages, the employer may be brought to administrative liability under Art. 5.27 of the Code of Administrative Offenses of the Russian Federation for violating the terms of salary payments.

Payment of personal income tax and insurance premiums.

As mentioned earlier, both personal income tax and insurance premiums in this situation must be transferred to the budget in January 2021 (no later than the 16th) (clause 6 of article 226, clause 3 of article 431 of the Tax Code of the Russian Federation).

However, “December” insurance premiums can be transferred to the budget ahead of schedule in December 2021 (by the way, extra-budgetary funds recommend policyholders to do just that). In this case, the payment order must indicate the relevant extra-budgetary fund and KBK as the recipient of insurance premiums. If contributions are transferred in January, then the recipient will be the tax office, and the new BCC should be indicated in the payment slip.

For personal income tax, new BCCs for 2021 have not been established. But early (in December) payment of personal income tax to the budget from the December salary (due date - January 16, 2021) can lead to negative consequences for the tax agent[1].

Summer non-working days: how to reschedule June 24 and July 1

In the summer, two more non-working days were announced for the entire country: the Victory Parade on June 24 and the day of voting on amendments on July 1. If you had payments to employees on June 23 or June 30, then personal income tax should generally be paid the next day.

But non-working days are excluded, so the tax could be transferred no later than June 25 or July 2, respectively. These dates will need to be reflected in line 120 of the 6-NDFL calculation. Payments for which personal income tax is transferred on July 2, enter in section 2 of 6-personal income tax for 9 months. Payments that fell on June 24 are included in the half-year report.