You can register on the State Services website and use it without a qualified electronic signature (CES). It is enough, for example, to go to the MFC and confirm your identity. But if you represent an individual entrepreneur or a legal entity, then you really need a CEP, without it you simply will not be able to work with the portal. We’ll tell you today what opportunities the use of CEP provides in public services.

A qualified electronic signature makes it possible to use all the advantages of the State Services website. To obtain it, you must contact a certification center .

After the electronic signature has been received, you need to set up a workstation on your computer in order to use it. This can be done in several ways:

- Configure yourself, following the instructions of the certification center;

- Connect remotely to a specialist who will carry out all the settings for you; Taxcom offers a similar service. It is safe and does not require special knowledge; just install the TeamViewer program on your computer;

- Call a specialist to the office . Moreover, he will not only carry out the setup, but also provide advice, answer all your questions, and also draw up documents for the CEP in your office, and you do not have to pick it up yourself.

Here is the signature in your hands and you are ready to work with it. What can be done using the CEP on the portal.

Which electronic signatures will work after July 1, 2021

After July 1, nothing will change for owners of electronic signatures. All signatures will work until they expire.

How to check how long a signature is valid?

Validity period of the electronic signature . Typically the signature is valid for 12 months from the date of receipt. If you took a signature for another period and do not remember it, then find the electronic signature certificate: in the CryptoPro CSP program, on the Service tab - View certificates.... Open the certificate and on the “Properties” tab, check the expiration date in the “Valid until” line.

If the certificate expires after January 1, 2022, then the signature will work until January 1, 2022. If the validity period ends before this date, you will need to obtain a new signature before it expires. We will explain below where to apply for a new signature for the employee and manager.

Validity period of CA accreditation . If a CA’s accreditation has expired, then all electronic signatures issued by it stop working. Check that your CA's accreditation does not expire until January 1, 2022 - then you will not need to renew your signature before that date.

Get an electronic signature in Kontur

Which CAs will no longer be able to issue electronic signatures

From July 2021, it will not be possible to obtain an electronic signature in most CAs - they will not be accredited under the new rules. Signatures that such a CA issues before July 1, 2021 will be valid until January 1, 2022. Of course, if the validity period of the signature or accreditation of the CA does not expire earlier.

In July 2021, it will become known which CAs will remain on the market, that is, will receive accreditation under the new rules. They will be the ones who will be able to issue electronic signatures. What about Contour?

It will be possible to determine the CAs that will receive accreditation under the new rules from the list of accredited CAs - the order for accreditation of such centers will be dated later than July 1, 2021.

It turns out that before July 1 you can update your signature at any CA, and from July 1 - at a CA that has received accreditation under the new rules.

Where to obtain signatures for employees and authorized persons. Electronic powers of attorney

From January 1, 2022, employees of organizations and authorized persons must use their personal signature for both work and personal documents. Such a signature is called an “electronic signature of an individual” - it contains only the full name of the employee and no information about the legal entity in which he works.

Starting from 2022, signatures of individuals will need to be obtained from CAs that are accredited according to the new rules.

It will be possible to use an individual’s signature for organizational documents only together with an electronic power of attorney (the official name is a power of attorney in machine-readable form). It will take time to implement this power of attorney: develop the principles of its operation, approve the necessary regulations, teach information systems and services to accept powers of attorney. Work is already underway, but is unlikely to end before July 1, 2021.

Therefore, before changing your signature to that of an individual, make sure that the system or portal you need accepts electronic powers of attorney. And only after that contact the CA.

The first news about powers of attorney will probably appear towards the end of 2021. To find out about them, follow the news of your information systems (Federal Tax Service, Federal Customs Service, etc.), as well as major EDI and reporting operators.

Basic concepts in law 63-FZ

Qualified certificate (QC) - needed to confirm the compliance of the key, verify the electronic signature and the owner of the certificate. An electronic signature verification key certificate is a document received by the client from a certification authority (CA).

Only accredited CAs or authorized federal authorities have the right to issue such a certificate. The owner of the CC is recognized by law as the one in whose name it is issued.

The electronic digital signature key is a unique order of characters, and the verification key is a sequence of characters confirming the authenticity of the digital signature.

The certification center creates, issues and maintains the operation of the CS. The CA must be accredited. To do this, you need to comply with the requirements of the law, have certain software, devices and competent personnel.

ES tools are a set of cryptographic devices for creating and verifying ES and ES keys.

Participants in electronic interaction are individuals and legal entities, government agencies that exchange information and data.

Where to obtain signatures for managers and individual entrepreneurs

From January 1, 2022, heads of legal entities and individual entrepreneurs will be required to use the signatures of the Federal Tax Service. Managers can receive such a signature as early as July 1, 2021.

To obtain it, you will need to contact the tax office directly or its authorized representatives: CAs accredited according to the new rules and who have passed additional selection. The list of authorized representatives will become known in July 2021 - the Federal Tax Service and the authorized representatives themselves will tell about it. Then the details of receipt will become clear, for example, where to send the application, where to prove your identity.

We recommend waiting for the final list of authorized persons and signature issuance points. This way you can choose the point where it will be most convenient for the manager to get a signature. Perhaps this will be the same CA in which employees will receive their signatures - authorized representatives of the Federal Tax Service will be able to issue signatures to both managers and employees.

At the Federal Tax Service, managers will be able to obtain only one signature per legal entity. All employees who also sign documents on behalf of the company will need their own individual signature and electronic power of attorney.

Get an electronic signature for reporting and doing business

For heads of financial organizations and officials of government agencies, different rules will apply from 2022. They will need to use signatures obtained from the Central Bank and the Treasury, respectively.

Who and how to receive ES from 2022: summary table

| Who signs the document | What is needed for signing | Where to get EP |

| Private individual | EP individual (FL) | Accredited CA (AUC) |

| An employee of the organization or an authorized person | ES of the individual + power of attorney signed by the ES of the legal entity (LE) | AUC |

| Head of a commercial organization | Electronic signature of the legal entity, which indicates the director | Federal Tax Service and authorized representatives |

| Individual entrepreneur (IP) | EP IP | Federal Tax Service and authorized representatives |

| Individual entrepreneur | ES FL + power of attorney signed by ES IP | AUC |

| Notary | ES of a notary | Federal Tax Service and authorized representatives |

| Automatic signing from the organization | EP legal entity without instructions from the manager | Federal Tax Service and authorized representatives |

What is an electronic signature for a legal entity and individual entrepreneur

You can register an LLC or individual entrepreneur without visiting the tax authorities.

Entrepreneurial activity is registered remotely with an electronic signature. After the user receives it, you need to register on the government services portal, confirm your identity, collect and send endorsed documents in electronic format, certifying them with an electronic signature. An electronic digital signature for a legal entity and individual entrepreneur is a unique code obtained by cryptographic data encryption. Documentation signed with a digital key has full legal force. Subsequently, the signature can be used to participate in tenders, send reports to regulatory authorities, electronic document management with counterparties and within the company.

Frequently asked questions about changes

What should I do with an electronic signature?

Until July 1, 2021 Nothing out of the ordinary. Renew at any CA if the validity period has expired.

From July 1, 2021 to January 1, 2022 If you need a new signature, you can now get it only at a CA accredited under the new rules.

Closer to January 1, 2022 Most likely, by this date it will become clear how electronic powers of attorney for employees will work and how managers will be able to obtain a signature from the Federal Tax Service. It can be assumed that you will need to act like this:

- If you are not a manager, obtain the signature of an individual at a CA accredited according to the new rules. But first, check that the services and portals where you work accept electronic power of attorney.

- If you are the head of a legal entity or individual entrepreneur, contact the Federal Tax Service CA or its trusted CAs to obtain an electronic signature of the legal entity.

Why do you need an electronic signature for government services?

First, a little about signatures for individuals; they can also receive a CEP to take advantage of special functions of the portal that are not available even after confirming their identity.

For example, having a CEP, you can:

- Conduct real estate transactions;

- Apply for admission to universities and colleges;

- Send documents to the court;

- Register an individual entrepreneur or organization.

The head of a company can link his organization or even several to an entry on State Services on behalf of an individual.

To register a legal entity account, you need to fill out a special form following the instructions of the portal:

The legal entity's data is verified automatically; after its completion, actions with the organization will become available to you.

By the way, to work with the State Services portal, you can use not only the website, but also a special mobile application “State Services Business”, although it may have limitations for some services, for example, you will not be able to add another organization to the record through it. But you can enter the application with a PIN code from the individual’s application, if you are already using it.

What services are available to legal entities with an electronic signature:

- confirmation of the type of activity in the Social Insurance Fund;

- obtaining permission to transport goods;

- control of detective and security activities;

- submission of documents for payment of insurance premiums;

- payment of traffic police fines;

- information about inspections of the organization;

- filing a complaint and others.

Information about inspections comes from the FSIS Unified Register of Inspections. You will be able to view information about inspections that have already taken place, current ones and those still to come (scheduled and unscheduled), incl. — details of the inspection, its results, identified violations.

If you are not pleased with the results, you can file a complaint, and it will be considered in an accelerated online format, and you can monitor the progress of the review through the portal:

Online lecture New requirements for the issuance of electronic signature certificates in accordance with changes to 63-FZ, which will change for the user . May 12 at 10:00 Moscow time. Hurry up to sign up!

What about Contour?

The Kontur Certification Center meets all the requirements of the law on electronic signatures, and we are now in the process of obtaining accreditation.

When we receive it, we plan to cooperate with the Federal Tax Service Center to become an authorized representative who will help issue electronic signatures to the heads of legal entities and individual entrepreneurs.

Kontur also participates in the development of regulations that regulate the use of electronic powers of attorney. And he plans to participate in the preparation of the system of these powers of attorney. And our services will support the operation of such powers of attorney with all information systems with which they interact.

Receive an electronic signature with automatic configuration and installation in Kontur

My signature expires after January 1, 2022. Will it work in 2022?

If your CA does not receive accreditation according to the new rules, then no - the signature will not work from 2022.

If your CA receives accreditation, then there is currently no direct answer to this question in the legislation. It is only known that the heads of companies and individual entrepreneurs will in any case need to obtain a signature from the Federal Tax Service or its authorized representatives.

How individual employee certificates will work will become clear closer to January 1, 2022, so follow the news from accredited CAs.

Prepared by Olga Kuraeva, editor

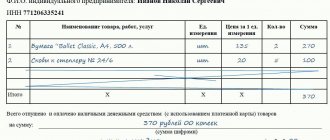

What is needed to issue a CEP?

The main step for a legal entity is to prepare a package of documents and contact a certification center accredited by the Ministry of Communications (or the official representative offices of these CAs).

What documents are needed

— For an individual entrepreneur,

this is usually a passport, TIN, SNILS and a certificate of state registration as an individual entrepreneur (OGRNIP).

— Companies

must provide constituent documents (Charter, decision on the appointment of a director), certificates of state registration (OGRN) and tax registration (TIN).

An important point: choose a certification center a) in your city; b) geographically convenient for you. This is important because you will need to come to the office in person to get an electronic signature.

This cannot be done remotely. And resorting to the help of third parties, trusting at least short-term access to such data, is economically unsafe.