Accounts receivable are a common phenomenon that every enterprise has to face in the course of economic activity. The risk group of forced borrowers most often includes those business entities that were the first to perform one of the following actions: shipped goods, provided a service, or performed certain work.

Ideally, after carrying out the above transactions, payment should immediately be received in the seller’s bank account. But in real life everything happens completely differently.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

Definition

As a rule, money for sold goods or services, due to objective reasons, arrives in the current account much later. A written agreement, which must specify the payment procedure and indicate the final payment date, helps to legally resolve such discrepancies.

Nevertheless, the risk of late payment on the part of the buyer or customer for a number of reasons both dependent and independent of them is always present. In such a situation, accounts receivable from the status of normal goes into the category of doubtful , which significantly distorts both the financial and tax indicators of the enterprise.

Doubtful accounts receivable is a debt arising as a result of the buyer’s violation of the payment terms stipulated in the purchase and sale agreement. With each new day of such delay, the seller’s confidence in his return decreases. But in order for a debt incurred by an enterprise through the fault of a debtor to be legally considered doubtful, the seller’s feelings and desires alone are not enough.

It is necessary to simultaneously fulfill three conditions that are legally enshrined in the Tax Code of the Russian Federation:

- the debt was incurred in connection with the sale of material assets, services or work;

- the date for making payment to repay the debt has expired;

- The resulting debt has no guarantors, bank guarantees, and is not secured by cash or property collateral.

It is important to take into account that in accounting, the mechanism for recognizing doubtful debts is regulated by the Accounting Regulations , and, in contrast to the requirements of the Tax Code, is more democratic. Thus, according to this regulatory document, any debt is considered doubtful, regardless of the nature of its occurrence and even the repayment period (clause 70 of the PBU). But at the same time, such debt should not have any guarantees or guarantees.

Algorithm for calculating and using the reserve for doubtful debts in accounting

When creating a reserve for doubtful debts, you can use the following methods.

Interval method.

The amount of contributions to the reserve is calculated quarterly (monthly) as a percentage of the debt amount, depending on the length of the delay, for example, as in tax accounting.

So according to clause 4 of Art. 266 of the Tax Code of the Russian Federation, the amount of the reserve for doubtful debts is accrued depending on the timing of the debtor’s violation of its obligations at the end of the corresponding period (quarter or year) based on the results of the debt inventory.

According to this standard, amounts of receivables are included in the calculation of the reserve as follows:

If the period of violation by the debtor of its obligations at the end of the quarter (six months, 9 months, year) does not exceed 45 days, then a reserve for this debt is not created.

In case of delay from 46 days to 90 days inclusive, 50% of the debt amount is reserved.

If the debtor does not pay for more than 90 days, the reserve increases to the full amount of the debt.

Expert way.

A reserve is created for each doubtful debt in an amount that, in the opinion of the organization, will not be repaid.

If the interval or expert method is used:

- If the debt for which the reserve was created is recognized as uncollectible, it is written off against the reserve. If the reserve amount is insufficient, the part of the debt not covered by the reserve is written off as other expenses;

- When the debt for which the reserve was created is repaid, the amount of the reserve is restored, i.e. included in other income.

Statistical method.

The amount of deductions to the reserve for doubtful debts is determined according to the Organization's data for several years as the share of bad debts in the total amount of receivables of a certain type.

For example, the share of goods not paid for by buyers in the total amount of buyer debt.

On the last day of each quarter (month), the amount of the reserve is determined using the formula:

The amount of the reserve for doubtful debts of a certain type as of the last day of the quarter (month) = The amount of receivables of this type as of the last day of the quarter (month) X The share of bad debts in the total amount of receivables of this type according to the organization.

If the resulting amount of the reserve is greater than the amount of the reserve created on the last day of the previous quarter (month), it is necessary to include the difference between them in other expenses (add additional reserve). If it is less, include the difference between them in other income (restore the reserve).

With the statistical method:

- If a debt of the type for which the reserve was created is considered bad, the debt is written off against the reserve. If the reserve amount is insufficient, the part of the debt not covered by the reserve is written off as other expenses;

- If a debt of a type for which a reserve was not created is recognized as bad, as well as when repaying any debt, the amount of the reserve is not adjusted.

Example.

Creating a reserve for doubtful debts using an expert method and its use According to the company's accounting policy, reserves for doubtful debts are created using an expert method, based on data received by the accounting department from the head of the sales department.

As of the beginning of the second quarter, there were no reserves for doubtful debts. Data on the company's accounts receivable are shown in the table.

| Buyer | Amount of debt, rub. | Payment due date agreement | Probability debt payment, % (department data sales) |

| as of June 30 | |||

| Organization A | 20 000 000 | 15.07 | 100 |

| Organization B | 30 000 000 | 20.06 | 40 |

| Total | 50 000 000 | ||

| as of September 30 | |||

| Organization A | 35 000 000 | 18.10 | 100 |

| Organization B | 30 000 000 | 20.06 | 0 |

| Organization G | 25 000 000 | 25.09 | 80 |

| Total | 90 000 000 | ||

| as of December 30 | |||

| Organization A | 15 000 000 | 25.01 | 100 |

| Organization B | 0 <*> | — | — |

| Organization G | 10 000 000 | 15.01 | 100 |

| Total | 25 000 000 | ||

<*> The debt of Organization B is written off as bad on the basis of an order from the head of the company.

Under given conditions, the creation and use of reserves for doubtful debts occurs as follows.

On June 30, the company creates a reserve for doubtful debt for Organization B in the amount of RUB 18,000,000. (RUB 30,000,000 x (100% - 40%)).

On September 30, the company increases the reserve for doubtful debt for Organization B to 30,000,000 - by 12,000,000 rubles. (RUB 30,000,000 x 100% - RUB 18,000,000), and also creates a reserve for doubtful debt of Gamma LLC in the amount of RUB 5,000,000. (RUB 25,000,000 x (100% - 80%)).

In the fourth quarter, the debt of Organization B is written off against the reserve.

The provision for doubtful debt of Organization D is restored in connection with the payment of the debt.

On December 31, provisions for doubtful debts are not created.

The accounting entries will be as follows:

| Wiring | Operation | Amount, rub. |

| 30 June | ||

| D 91 - K 63 | A reserve for doubtful debt was created for Organization B | 18 000 000 |

| September 30th | ||

| D 91 - K 63 | The provision for doubtful debts for Organization B has been increased | 12 000 000 |

| D 91 - K 63 | A reserve for doubtful debt was created for Organization G | 5 000 000 |

| in the fourth quarter | ||

| D 63 - K 62 | The debt of Organization B is written off from the reserve | 30 000 000 |

| D 63 - K 91 | The reserve for the paid debt of Organization G | 5 000 000 |

In the balance sheet, data on receivables will be reflected in the following amounts:

— as of June 30 — 32,000,000 rubles. (RUB 50,000,000 - RUB 18,000,000);

— as of September 30 — RUB 55,000,000. (90,000,000 rub. - 30,000,000 rub. - 5,000,000 rub.);

— as of December 31 — 25,000,000 rubles.

Example. Creation of a reserve for doubtful debts in a statistical way and its use

According to the organization's data over the previous 3 years, 2% of the cost of shipped goods is not paid at all by buyers, and therefore the organization creates a reserve for doubtful debts to pay for goods.

The company's accounting policy stipulates that the reserve is created statistically.

As of March 31, the outstanding debt for shipped goods amounted to 20,000,000 rubles, the balance of the reserve was 400,000 rubles. (RUB 20,000,000 x 2%).

Data on goods shipped in the 2nd - 4th quarters, on debt repayment and on debts recognized as bad are shown in the table.

| Quarter | Shipped goods, rub. | Repaid debt on payment for goods, rub. | Debts for payment of goods, recognized as hopeless in during the quarter, rub. |

| II | 25 000 000 | 15 000 000 | 0 |

| III | 20 000 000 | 25 000 000 | 0 |

| IV | 20 000 000 | 20 000 000 | 600 000 |

Under given conditions, the creation and use of the reserve will proceed as follows.

As of June 30, outstanding accounts receivable will amount to RUB 30,000,000. (20,000,000 + 25,000,000 rubles - 15,000,000 rubles), and the amount of the required reserve is 600,000 rubles. (RUB 30,000,000 x 2%). Therefore, the organization will make contributions to the reserve in the amount of 200,000 rubles. (600,000 rubles - 400,000 rubles).

As of September 30, outstanding accounts receivable will amount to RUB 25,000,000. (30,000,000 + 20,000,000 rubles - 25,000,000 rubles), and the amount of the required reserve is 500,000 rubles. (RUB 25,000,000 x 2%). Therefore, the organization will restore the reserve in the amount of 100,000 rubles. (600,000 rub. - 500,000 rub.).

In the fourth quarter, the organization will have to write off bad debt in the amount of 600,000 rubles. Since the balance of the reserve is only 500,000 rubles, part of the debt in the amount of 500,000 rubles. will be written off against the reserve, the remaining 100,000 rubles. - included in other expenses.

As of December 31, outstanding accounts receivable will amount to RUB 24,400,000. (RUB 25,000,000 + RUB 20,000,000 - RUB 20,000,000 - RUB 600,000), and the amount of the required reserve is RUB 488,000. (RUB 24,400,000 x 2%). Since there is no reserve balance at the reporting date, the organization will make contributions to the reserve in the amount of RUB 488,000.

The accounting entries will be as follows:

| Wiring | Operation | Amount, rub. |

| 30 June | ||

| D 91 - K 63 | A reserve for doubtful debts has been created | 200 000 |

| September 30th | ||

| D 63 - K 91 | The provision for doubtful debts has been restored | 100 000 |

| during the fourth quarter | ||

| D 63 - K 62 | Bad debt written off against reserve | 500 000 |

| D 91 - K 62 | The part of the bad debt not covered by the reserve | 100 000 |

| 31th of December | ||

| D 91 - K 63 | A reserve for doubtful debts has been created | 488 000 |

In the balance sheet, data on receivables for payment for goods will be reflected in the following amounts:

— as of March 31 — 19,600,000 rubles. (RUB 20,000,000 - RUB 400,000);

— as of June 30 — RUB 29,400,000. (RUB 30,000,000 - RUB 600,000);

— as of September 30 — RUB 24,500,000. (RUB 25,000,000 - RUB 500,000);

— as of December 31 — RUB 23,912,000. (RUB 24,400,000 - RUB 488,000).

Reflection of doubtful accounts receivable in the balance sheet

Every business owner should know what he owns and how much. He receives all this information from the balance sheet F1 , which is an integral part of the annual financial statements. Here, in section II (current assets), line 1230 indicates the total amount of receivables that the enterprise had accumulated as of the balance sheet date.

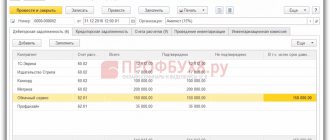

The accountant usually takes the numerical values for the annual report from the balance sheet, where all goods and services sold but not paid are reflected in the debit balance of account 62 (settlements with buyers and customers).

If the company has only current debt, the payment date of which has not yet arrived, then line 1230 of the balance sheet will completely coincide with the debit balance of account 62. But such situations are extremely rare in business activities.

Entrepreneurs more often have to deal with doubtful and even bad debts, the repayment terms of which have long expired. In this case, according to the Accounting Regulations, the enterprise forms a reserve at the expense of its profits.

This adjusting value is reflected in the balance sheet for the credit of account 63. But there is no special position for it in the liabilities side of the balance sheet. However, it is by this amount that the receivables reflected in line 1230 are reduced.

Attention! Doubtful accounts receivable in the balance sheet are recorded as the difference between the debit balance of account 62 (settlements with buyers and customers) and the credit balance of account 63 (reserve for doubtful debts). As a result, the amount of goods shipped but not paid for on time, indicated in the debit of account 62, will not coincide with the balance sheet data.

The concept of doubtful accounts receivable

An organization's receivables are considered doubtful if they have not been repaid or with a high degree of probability will not be repaid within the time limits established by the agreement and are not provided with appropriate guarantees (clause 70 of the Accounting Regulations No. 34n, Letter of the Ministry of Finance dated January 14, 2015 No. 07-01-06 /188, dated January 27, 2012 N 07-02-18/01). This is evidenced, in particular:

- or violation by the debtor of the payment deadline;

- or information about the debtor’s financial problems.

Any receivable can be recognized as a doubtful debt, including those reflected in the debit of accounts 60, 62, 76.

After a doubtful debt is recognized as unrealistic for collection, including due to the expiration of the statute of limitations, it must be written off.

Formula for calculating provision for doubtful debts

The provision for doubtful and bad debts usually begins to be created at the end of the reporting period. For these purposes, the accounting department conducts a complete inventory of analytical accounts on which receivables are stuck. Moreover, this is done in the context of each individual counterparty.

Since the creation of a reserve in accounting is not legally established, the formula for calculating it is usually stipulated by the accounting policy of the enterprise. In this case, any estimated value is taken as a basis, for example, the financial condition of the debtor, the probability of the risk of non-payment or the length of time the debt is overdue. In the latter case, the accounting department can set percentage deductions for the reserve independently, or it can use the calculation formula proposed by the Tax Code of the Russian Federation.

In tax accounting, the requirements for creating a reserve are much stricter. First, the accountant must document that the late payment is truly a doubtful receivable.

The formula for calculating the reserve for such debt is as follows:

COP = SSD x PO , where:

- SOR - the amount of contributions to the reserve;

- SSD - amount of doubtful debt;

- PO - percentage of deductions, which is equal to 0% if payment is overdue up to 45 days, 50% - from 45 to 90 days and 100% - over 90 days.

Attention! The law limits the maximum amount of the reserve created. It cannot exceed 10% of all revenue received from the sale of goods, services and work of the reporting period for which the reserve is formed.

Definitions and purposes of creating a reserve for doubtful debts

The accounting and tax law definitions of doubtful debt are very similar. Such debt should be considered the debt of its counterparty (i.e., receivable) to the organization, which:

- not paid on time or has a high probability of non-payment within the terms specified in the contract and is not provided with guarantees (clause 70 of the PBU on accounting and accounting, approved by order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n);

- not paid within the terms specified in the contract, and does not have security in the form of a pledge, surety, bank guarantee (clause 1 of Article 266 of the Tax Code of the Russian Federation).

There is only one difference in these definitions: accounting allows recognizing as doubtful not only those debts whose payment deadline has already been violated, but also those for which this deadline has not yet arrived, but the likelihood of non-payment is extremely high. Thus, the difference in the approach to creating a reserve in accounting and tax accounting is already laid down at the stage of determining what is classified as doubtful debts.

In both accounts, the created reserve involves the write-off of doubtful debts, which at some point are recognized as bad. But other purposes for creating a reserve for doubtful debts in both systems are different, which is due to the very nature of these accounts, which have different approaches to the interpretation of the same data.

In accounting, the creation of a reserve solves the following issues:

- formation of reliable accounting and reporting figures, which is required by paragraph 1 of Art. 13 Law of the Russian Federation “On Accounting” dated December 6, 2011 No. 402-FZ;

- the possibility of using information from the balance sheet when making economic decisions, in which accounts receivable do not require adjustment, but are already shown in real values that can be obtained.

In tax accounting, the formation of a reserve allows you to take into account in the tax base for profits losses from non-receipt of payment earlier than what happens when a reserve is not created, since the recognition of debt as bad in terms of timing usually occurs much later. The Tax Code of the Russian Federation (clause 2 of Article 266) allows the following debts to be recognized as bad:

- after the expiration of the limitation period (3 years);

- upon receipt from the FSSP of a decision on the impossibility of collection;

- liquidated counterparty;

- when circumstances arise that are independent of the will of the parties (including by virtue of the instructions of an act issued by a public authority), leading to the impossibility of fulfilling payment obligations.

Why do you need a reserve?

In order to understand why a reserve is needed, you need to understand how doubtful debts can affect the reliability of the financial and tax reporting of an enterprise. Do not forget that the most liquid asset of any business entity is accounts receivable . Failure to repay it on time not only drains the enterprise's working capital, but also makes it difficult to fulfill financial and tax obligations to counterparties.

The reserve for doubtful accounts receivable is the financial instrument with which the accountant corrects distortions in accounting and tax reporting, bringing them closer to real indicators.

The rules for creating a reserve for tax and financial accounting differ in a number of positions, namely:

| Accounting | Tax accounting |

| obligation of the enterprise | enterprise law |

| is created regardless of the type of debt | created for debt arising from the sale of material assets, services or work |

| the size is determined based on the accounting policy of the enterprise | size specified by the norms of the Tax Code of the Russian Federation |

| the amount of the reserve is not limited | the maximum amount is stipulated by the terms of the Tax Code of the Russian Federation |

Thus, the amount of the reserve in the two types of accounting will differ due to different approaches to determining the period of delay and divergence in calculation algorithms. But if we are talking about bad debts for which the statute of limitations has expired, then there will be no differences in creating a compensation amount in different types of accounting.

Provision for doubtful debts and financial statements

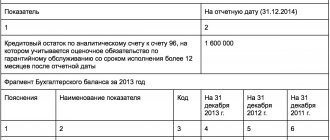

In the financial statements, doubtful debts are reflected on line 1230 of the balance sheet minus the reserve (clause 35 of PBU 4/99), and deductions to the reserve for doubtful debts are reflected on line 2350 “Other expenses” of the income statement (clause 11 of PBU 10/ 99).

Thus, accounting simultaneously reflects:

- and doubtful debts in full;

- and the amount of the created reserve.

On the balance sheet as a result of the creation of a reserve:

- accounts receivable are reduced either by the entire amount of the doubtful debt or by part of it;

- retained earnings decrease by the same amount.

Writing off debts from the reserve does not affect the financial statements.

Accounting for provisions for doubtful debts

Other income and expenses.

Income and expenses not related to the main activity are considered other income and expenses

.

Other income and expenses include:

| Income | Expenses |

| · From the rental of property · Profit received as a result of joint activities · Proceeds from the sale of fixed assets and other assets · Interest received for loans, as well as interest received for placing funds in a bank · Fines, penalties, penalties received for violation terms of contracts · Assets received free of charge · Positive exchange rate difference · Profit of previous years identified in the reporting year · Accounts payable for which the statute of limitations has expired · Amount of additional valuation of assets · Receipts from emergency situations - the cost of the remaining MT | · Expenses for the maintenance of leased property · Losses as a result of joint activities · Expenses associated with the sale, disposal and other write-off of fixed assets and other assets · Interest paid on received loans and borrowings, payment for services for settlement and cash services by the bank · Fines , penalties, penalties, paid · Legal costs · Negative exchange rate difference · Loss from previous years · Accounts receivable for which the statute of limitations has expired · Amount of asset depreciation · Charitable contributions · Expenses for recreation, cultural events · Expenses resulting from emergency situations ( cost of lost property, dismantling) · By the maintenance of mothballed objects · Cost of canceled orders |

Accounting for other income and expenses is carried out on account 91. It has the following sub-accounts:

91/1 – other income

91/2 – other expenses

91/9 – balance of other income and expenses

At the beginning of the year, sub-accounts are opened for account 91. These accounts reflect transactions throughout the year.

Income is reflected on K account 91/1, expenses are reflected on D account 91/2. Comparing the revolutions according to D and K. 91 determines the balance of other income and expenses, which is written off to the account. 99 D 91/9 K 99 (and vice versa)

Sub-accounts are closed with the final entries of December.

Account D of account 99 reflects the loss of ordinary activities and other expenses; K account 99 reflects profit from ordinary activities and other income.

By comparing the turnover according to D and K account 99, profit is determined for income tax purposes.

When calculating income tax: D99 K68/NP

The profit remaining after paying income tax is called net profit and is written off to account 84 “Retained earnings and uncovered loss” in the final entries of December. Reflected in the balance sheet as of December 31 of the reporting year in section 3 of liabilities. Thus, with the final entries of December, sub-accounts to account 90.91, account 99 are closed - this is called balance sheet reformation.

Accounting for profit distribution.

To summarize information about the presence and movement of amounts of retained earnings or uncovered losses, active-passive account 84 “Retained earnings/uncovered losses” is used. The distribution of profits is carried out on the basis of a decision of the general meeting of shareholders of a joint-stock company, a meeting of participants of an LLC or other competent body.

Net profit goes to:

1. payment of dividends;

2. creation and replenishment of reserve capital;

3. covering losses from previous years.

The amount of net profit (net loss) of the reporting year is written off with the final turnover of December D account 99 from account 84 (D account 84 from account 99).

For the amount of accrued income, the founders are debited to account 84 and credited to account 70.75/2.

In accordance with the Tax Code of the Russian Federation, dividends are subject to personal income tax at a rate of 13%. The organization is a tax agent and is obliged to withhold personal income tax when paying income to individuals, transfer it to budget revenue and, at the end of the year, submit information about the income of individuals (2NDFL) to the Federal Tax Service.

If the founders (shareholders) are legal entities, then the income is transferred to them in full, and they must show it as part of other income and take it into account for income tax purposes.

Deductions to reserve capital are reflected according to D account 84 and K account 82.

Direction of net profit to cover losses of the previous year D account 84 and K account 84.

Losses of the reporting year are written off from K account 84 in

D account 82/2 – when writing off a loss at the expense of reserve capital;

D sch.75/2 – when repaying a loss through targeted contributions from the founders of the organization;

80 – when bringing the value of the capital to the value of the organization’s net assets and other accounts.

Accounting for provisions for doubtful debts

In modern conditions, when the probability of bankruptcy of enterprises is quite high, almost every enterprise is faced with the impossibility of receiving payment from debtors, as a result, a repayment debt is formed on the balance sheet of the enterprise, which raises doubts - called doubtful debts.

Accounts receivable are considered doubtful if they are not repaid within the terms established by the contract and are not secured with appropriate guarantees.

In accordance with current legislation, an enterprise can create a reserve for doubtful debts against such debt. The reserve is created at the expense of other expenses and reduces profit for tax purposes.

The reserve is created based on the results of the inventory of receivables. The frequency of inventory and deductions to the reserve is provided for by the organization’s accounting policy (quarterly or once a year).

The amount of the reserve is formed for each doubtful debt depending on the financial condition of the debtor and the assessment of the likelihood of repaying their debt.

A prerequisite for creating a reserve is the expiration of the debt repayment period stipulated by the contract. If the contract does not specify a specific period, then in accordance with the Civil Code of the Russian Federation, the buyer is obliged to make payment immediately before or immediately after the transfer of the goods.

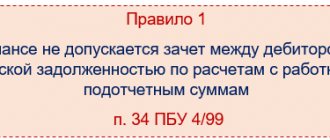

Reserves can be created for debt for products, goods, works, services. It cannot be created for debt on fines, penalties, penalties, on accountable amounts, on loans provided.

Reserves are accounted for in account 63.

Deductions were made to reserves D91/2 K63.

Since the created reserves reduce profits for tax purposes, the Tax Code of the Russian Federation provides for restrictions.

| Debt repayment period | % of the amount of identified debt |

| Over 90 | |

| From 45 to 90 | |

| Up to 45 |

Debt is secured by a surety, bank guarantee, or pledge.

Doubtful debts outstanding by the debtor are written off to reduce the reserve D63 K62 (76).

Debt can be written off to reduce the reserve on the basis of a court decision on the insolvency of an organization, on the basis of an arbitration court in bankruptcy, and upon the expiration of the statute of limitations.

The limitation period for settlements with legal entities is 3 years. The limitation period begins on the next day after the payment deadline stipulated by the contract or from the moment the debtor provides information about confirmation of his debt. Confirmation of the debt is carried out in the form of providing a statement of reconciliation of calculations, a letter of guarantee, etc.

As of December 31 of the reporting year, an inventory of doubtful debts must be carried out and if the balance of the reserve is identified unspent by the end of the year. It should be included in other income D63 K91/1.

In the balance sheet, accounts receivable are reflected minus the amount of the created reserve (i.e., the balance in K account 63).

Provision for doubtful debts. Tax accounting. Application of PBU 18/02. Five examples

Example

An organization, as of September 30 of the current year, conducted an inventory of its debt.

Overdue debts identified:

- organization A for products supplied but not paid for in the amount of RUB 590,000. (payment deadline under the contract is May 15);

- organization B - which received an advance payment in the amount of 708,000 rubles, but did not deliver the goods (delivery date - June 8).

The accounting policy provides for the formation of a reserve for doubtful debts for profit tax purposes.

In the accounting registers, the reserve for doubtful debts is formed according to the same rules as for profit tax purposes (depending on the period of violation by the debtor of its obligations).

Buyer A has not paid for 138 days, and supplier B has defaulted on its obligations by 114 days.

A reserve of 1,298,000 rubles has been accrued in the accounting registers. (RUB 590,000 + RUB 708,000)

The following entry must be made in the organization's records:

Debit 91 “Other income and expenses”, subaccount “Other expenses”, Credit 63 “Provisions for doubtful debts” - RUB 1,298,000. — a reserve for doubtful debts has been formed.

For profit tax purposes, the debt of supplier B is not considered doubtful.

Thus, the costs of accruing a reserve for doubtful debts in the amount of 708,000 rubles are not recognized for profit tax purposes, which will lead to the accrual of a deferred tax asset (DTA) in the amount of 141,600 rubles. (RUB 708,000 x 20%).

The following entry must be made in the organization's records:

Debit 09 “Deferred tax asset”, Credit 68 “Calculations for taxes and fees”, subaccount “Calculations for income tax” - 141,600 rubles. - SHE was credited.

In December, the organization received information that both of its debtors were liquidated.

Debts are recognized as uncollectible, both in accounting registers and for profit tax purposes.

The write-off is reflected in the following entries:

Debit 63 “Provisions for doubtful debts”, Credit 62 “Settlements with buyers and customers” - 590,00 rubles. – the bad debt of buyer A is written off against the reserve for doubtful debts;

Debit 007 “Debt of insolvent debtors written off at a loss” - RUB 590,000. – the written off bad debt of company A is accepted for off-balance sheet accounting.

Supplier B's debt in the amount of RUB 708,000. in accounting registers it is written off in the same way.

However, for profit tax purposes, a reserve for doubtful debts was not created for it, and it should be recognized as non-operating expenses.

Previously accrued deferred tax asset in the amount of RUB 141,600. should be restored by writing:

Debit 68 “Calculations for taxes and fees”, subaccount “Calculations for income tax”, Credit 09 “Deferred tax asset” - 141,600 rubles. - SHE restored.

Example

The reserve for doubtful debts is formed both in the accounting registers and for profit tax purposes.

The organization, as of December 31 of the current year, carried out an inventory of its debt.

Overdue receivables identified:

- organization A for products supplied but not paid for in the amount of RUB 590,000. (payment deadline under the contract is September 23);

- organization B – which received an advance payment in the amount of 708,000 rubles, but did not deliver the goods (delivery date of the goods is November 3).

The procedure for forming a reserve for doubtful debts in the accounting registers is as follows:

The reserve includes 50% of the debt in case of violation of the deadline for fulfillment of obligations from 46 days to 90 days inclusive, and 100% - in case of delay in performance by 91 days or more.

Buyer A has not paid for 99 days (since September 24), and supplier B has defaulted on its obligations for 58 days (since November 4).

A reserve of 944,000 rubles has been accrued in the accounting registers. (RUB 590,000 + RUB 708,000 X 50%)

The following entry must be made in the organization's records:

Debit 91 “Other income and expenses”, subaccount “Other expenses”, Credit 63 “Provisions for doubtful debts” - 944,000 rubles. — a reserve for doubtful debts has been formed.

For profit tax purposes, the debt of supplier B is not considered doubtful.

Thus, expenses for accruing a reserve for doubtful debts in the amount of 354,000 rubles are not recognized for profit tax purposes, which will lead to the accrual of a deferred tax asset (DTA) in the amount of 70,800 rubles. (RUB 354,000 x 20%).

The following entry must be made in the organization's records:

Debit 09 “Deferred tax asset”, Credit 68 “Calculations for taxes and fees”, subaccount “Calculations for income tax” - 70,800 rubles. - SHE was credited.

Next, you should compare the amount of the accrued reserve in tax accounting in the amount of 590,000 rubles. with the income received from sales.

Let’s say that during the current year the company sold goods (works, services) worth 8,000,000 rubles. excluding VAT.

Accordingly, 10% is 800,000 rubles, therefore the entire formed reserve for profit tax purposes can be attributed to non-operating expenses.

But if the income from sales were less than 5,900,000 rubles. (let’s say 5,500,000 rubles), then no more than 550,000 rubles could be recognized as expenses.

In this case, expenses should be reduced by 40,000 rubles. (RUB 590,000 – RUB 550,000) and accrue a deferred tax asset in the amount of RUB 8,000. (RUB 40,000 X 20%).

The following entry must be made in the organization's records:

Debit 09 “Deferred tax asset”, Credit 68 “Calculations for taxes and fees”, subaccount “Calculations for income tax” - 8,000 rubles. - SHE was credited.

What debt of the organization is doubtful?

Doubtful receivables of an organization are debts that have not been repaid or with a high degree of probability will not be repaid within the time limits established by the agreement, and are not provided with appropriate guarantees (clause 70 of the Accounting Regulations, approved by order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n ).

Since accounting (financial) statements must be reliable, the purpose of creating a reserve for doubtful debts is to reflect reliable receivables in the balance sheet.

Doubtful debts are identified through an inventory of payments. Not only the debt for goods, works, and services sold, but also the debt of suppliers for advances issued to them are subject to inventory.

Advanced training courses for accountants and chief accountants on OSNO and USN. All requirements of the professional standard “Accountant” are taken into account. Systematize or update your knowledge, gain practical skills and find answers to your questions.

What is a doubtful debt under PBU and under the Tax Code of the Russian Federation?

Doubtful debt, for which a legal entity forms reserves, is characterized almost identically by both legislation (accounting and tax), referring to it as the debt of the counterparty existing to the legal entity, which turns out to be:

- not paid within the period specified in the contract or has a high probability of non-payment within this period and not secured by guarantees (clause 70 of the Regulations on accounting and financial reporting in the Russian Federation, approved by order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n, hereinafter referred to as the regulation about accounting and accounting);

- not paid within the period established by the contract, and not secured by guarantees in the form of a pledge, surety or bank guarantee (clause 1 of Article 266 of the Tax Code of the Russian Federation).

Thus, accounting legislation, unlike tax legislation, makes it possible to classify as doubtful not only those debts whose payment period has already expired, but also those debts, the payment of which for one reason or another raises reasonable doubts. That is, the concept of doubtful debt in accounting is interpreted more broadly.

Creation of a reserve for doubtful debts

The procedure for creating a reserve should be fixed in the accounting policy. The amount of contributions to the reserve should be set depending on the solvency of the debtor and the degree of probability of repayment of the debt.

The procedure for creating a reserve for doubtful debts in accounting is not established by law. Therefore, the organization is developing a way to create a reserve on its own. For example, it is possible to create a reserve for doubtful debts in accounting using the method proposed in tax accounting, namely in paragraph 74 of Article 266 of the Tax Code. Or, as an option, include the entire amount of the identified debt in the reserve.

Pay attention to paragraph 70 of the Accounting Regulations, approved. by order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n: the amount of the reserve is determined separately for each doubtful debt, depending on the financial condition (solvency) of the debtor and the assessment of the likelihood of repaying the debt in full or in part. For example, if an organization has collectively identified receivables for several counterparties, then a reserve should be created for each. That is, maintaining analytical records is mandatory.

The procedure for reflecting in accounting the creation of a reserve for doubtful debts

The amounts of created reserves for doubtful debts are included in the financial results and are reflected in the debit of account 91 “Other income and expenses” and the credit of account 63 “Provisions for doubtful debts”. The write-off of a bad debt, previously recognized as doubtful in accounting, for which a reserve was formed, is reflected by an accounting entry in the debit of account 63 “Provisions for doubtful debts” in correspondence with account 62 “Settlements with buyers and customers” or account 76 “Settlements with various debtors and creditors." A bad debt in an amount exceeding the reserve created for this debt is written off as a debit to account 91 “Other income and expenses.”

Debt written off after the expiration of the limitation period is reflected in off-balance sheet account 007 “Debt of insolvent debtors written off at a loss” for five years from the date of write-off to monitor the possibility of its recovery in the event of a change in the debtor’s property status.

In the event of receipt of payment for receivables for which reserves were previously formed (or a change in the reliability data of the counterparty in a positive direction), the amounts of reserves are subject to restoration. In accounting, the amounts of restored reserves are reflected in the debit of account 63 “Provisions for doubtful debts” in correspondence with account 91 “Other income and expenses”.

In case of partial payment of receivables, for which reserves for doubtful debts were previously formed, the amount of reserves is charged to the financial result in proportion to the amount of the received partial payment. The amount of reserves for recovery corresponds to the amount of received partial payment, multiplied by a coefficient defined as the ratio of the amount of the previously formed reserve for doubtful debts to the amount of receivables for which the reserve was formed. Then, at the end of the reporting period (month), these receivables should be tested for changes in the probability of their repayment. If this debt is recognized as highly reliable, the reserve for this debt must be restored.

Thus, the reserve for doubtful debts is adjusted monthly up or down, reflecting the objective state of assets in terms of settlements.

It must be remembered that the procedure for creating a reserve for doubtful debts in tax accounting has not changed, so tax differences are inevitable in accounting. Registered with the Ministry of Justice of Russia on February 22, 2011.