Source: Journal “Government Institutions: Accounting and Taxation”

In the activities of government institutions, situations may arise when the institution suffers damage, expressed in the form of shortages that occurred in excess of the norms of natural loss, theft and other circumstances, as well as damage as a result of inappropriate use of property. In this article we will look at the features of reflecting calculations for damage and other income in budget accounting.

Accounts for settlements of damages and other income

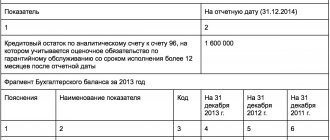

According to the updated (as amended by Order of the Ministry of Finance of the Russian Federation dated August 29, 2014 No. 89n ) Instruction No. 157n, account 1,209,00,000 is used to record calculations for damage and other income .

Analytical accounting for the specified account is kept in the card for accounting for funds and settlements (f. 0504051) in the context of persons responsible for compensation for damage caused (perpetrators), types of property and amounts of damage, including identified thefts and shortages ( clause 222 of the Instructions No. 157n ).

In accordance with clause 221 of Instruction No. 157n, the grouping of settlements for damage and other income is carried out on the following accounts of accounting objects:

a) 1 209 30 000 “Calculations for compensation of costs”;

b) 1,209,40,000 “Calculations for forced seizure amounts”;

c) 1,209,70,000 “Calculations for damage to non-financial assets”:

– 1 209 71 000 “Calculations for damage to fixed assets”;

– 1 209 72 000 “Calculations for damage to intangible assets”;

– 1 209 73 000 “Calculations for damage to non-produced assets”;

– 1 209 74 000 “Calculations for damage to inventories”;

d) 1 209 80 000 “Calculations for other income”:

– 1 209 81 000 “Calculations for cash shortages”;

– 1 209 82 000 “Calculations for shortages of other financial assets”;

– 1 209 83 000 “Calculations for other income.”

If the dispute is won

A won lawsuit leads to the creation of “income” for the organization, which should be reflected in the accounting records. The state fee for the court, according to the Tax Code of the Russian Federation (Articles 13-10), is a federal fee. Article 265-1 (clause 4) allows the amount of state duty to be included in non-operating expenses; the same position is contained in the letter of the Ministry of Finance No. 03-03-06/1/597 dated 20-09-10 and a number of similar ones.

Non-operating expenses in the form of taxes and mandatory payments are recognized in accordance with Art. 272-7(1) of the Tax Code of the Russian Federation, as of the accrual date. State duty is payment for claims in court, the date of its recognition should be considered the day the claim was filed with the judicial authorities (explanations are given in the letter of the Ministry of Finance No. 03-03-06/2/176 dated 22-12-08).

Attention! Regardless of the fact of subsequent recovery from the losing party to the dispute, state duties are included in income tax expenses (registered by the Federal Antimonopoly Service of the North-West District, case No. A56-24492/2007 dated 07/21/08).

A “positive” court decision that has entered into force is the basis for including the amounts of penalties, legal costs and other amounts of sanctions received from the losing party into non-operating income (Article 350 of the Tax Code of the Russian Federation).

At the same time, the debt that has become the subject of legal proceedings is not included in income for the purposes of NU, based on the meaning of the articles of Art. 249, 39 of the Tax Code of the Russian Federation and subsequent clarifications of the Ministry of Finance (letter No. 03-03-06/1/597 dated 2-09-10). However, this issue still remains controversial, and the organization must be ready to provide explanations to the tax service regarding the specified amount or defend its position in court.

With regard to the amount of the debt and the accrual of VAT on it, the question remains open, since the fact of sale of goods, work, or services in this case is absent (Article 146 of the Tax Code of the Russian Federation).

As already mentioned above, amounts related to the court decision are posted through account 91, state duties to the court through account 68 (accrual by credit, transfer to the budget by debit). To settle with a debtor under a court decision, as a rule, they use account 76, opening a “Settlements on claims” subaccount for it. Analytical accounting is organized by debtors and individual claims.

Postings:

- Dt 51 Kt 76 – receipt of money from the counterparty.

- Dt 76 Kt 91 – reimbursed by the state. fees and damages for legal proceedings.

The debtor’s debt (repaid) can be posted internally to the Kt subaccount “Settlements for claims” of account 76 or similarly using account 60 to Kt 76. The repayment must be recorded by posting Dt 51 Kt 76.

The outstanding debt is written off.

Valuation of damage caused

If it is discovered that damage has been caused to an institution, the amount of damage caused should be assessed.

In this case, when determining the amount of damage caused by shortages or theft, one should proceed from the current replacement cost of material assets on the day the damage was discovered. The current replacement cost is understood as the amount of money that is necessary to restore the specified assets ( clause 220 of Instruction No. 157n ).

Please note that before the changes were made by Order of the Ministry of Finance of the Russian Federation No. 89n to Instruction No. 157n, when determining the amount of damage caused to an institution due to loss, damage, or theft of property, one should proceed from the market value of the property on the day the damage was discovered ( clause 220 of Instruction No. 157n ).

Based on the provisions of Art. 246 of the Labor Code of the Russian Federation, the amount of damage caused by an employee is determined by actual losses, calculated from market prices prevailing in the area on the day the damage was caused, but not lower than the value of the property according to accounting data, taking into account the degree of wear and tear.

Thus, the amount of damage caused by an employee cannot be lower than the value of the property (taking into account its depreciation) according to budget accounting data. In addition, federal law may establish a special procedure for determining the amount of damage subject to compensation caused to the employer by theft, intentional damage, shortage or loss of certain types of property and other valuables, as well as in cases where its actual amount exceeds the nominal amount.

Before making a decision on compensation for damage by specific employees, the employer is obliged to conduct an inspection to establish the amount of damage caused and the reasons for its occurrence. To conduct such a check, the employer has the right to create a commission with the participation of relevant specialists.

Requiring a written explanation from the employee to establish the cause of the damage is mandatory. In case of refusal or evasion of the employee from providing the specified explanation, a corresponding act is drawn up.

Reflection in postings of surpluses and shortages in the cash register

According to paragraph 5.1 of the Methodological Instructions, loss rates can be applied only when actual shortages are identified. It is unacceptable to write off certain values based only on loss rates alone without checking their actual presence.

The book value of missing inventories within the limits of natural loss norms is included in the current expenses of the institution.

But taking an inventory is half the battle; you still need to properly document and reflect the inventory results in accounting. Since in this case the period of damage is not determined, we believe that initially the amount of damage should be reflected in deferred income using account 0 401 40 172 (clause 301 of Instruction No. 157n).

Compensation for damage

Based on the provisions of Art. 238 of the Labor Code of the Russian Federation , the employee is obliged to compensate the employer for direct actual damage caused to him, except for the cases specified in Art. 239 of the Labor Code of the Russian Federation , namely if the damage arose as a result of:

- force majeure;

- normal economic risk;

- extreme necessity;

- necessary defense;

- failure by the employer to fulfill the obligation to provide appropriate conditions for storing property entrusted to the employee.

Direct actual damage is understood as a real decrease in the employer’s available property or deterioration in the condition of said property (including property of third parties located at the employer, if the employer is responsible for the safety of this property), as well as the need for the employer to make costs or excessive payments for the acquisition, restoration of property or compensation for damage caused by the employee to third parties ( Article 238 of the Labor Code of the Russian Federation ).

For damage caused, the employee bears financial responsibility within the limits of his average monthly earnings ( Article 241 of the Labor Code of the Russian Federation ).

According to the provisions of Art. 248 of the Labor Code of the Russian Federation, recovery from the guilty employee of the amount of damage caused, not exceeding the average monthly earnings, is carried out by order of the employer. The order can be made no later than one month from the date of final determination by the employer of the amount of damage caused by the employee.

If the month period has expired or the employee does not agree to voluntarily compensate for the damage caused to the employer, and the amount of damage caused to be recovered from the employee exceeds his average monthly earnings, then recovery can only be carried out by the court.

If an agreement on full financial liability has been concluded with an employee, he is obliged to compensate the damage caused to the employer in full ( Article 243 of the Labor Code of the Russian Federation ).

Financial liability in the full amount of damage caused is assigned to the employee in the following cases:

- imposing, in accordance with the Labor Code of the Russian Federation or other federal laws, on the employee financial liability in full for damage caused to the employer during the performance of the employee’s job duties;

- shortage of valuables entrusted to him on the basis of a special written agreement or received by him under a one-time document;

- intentional causing of damage;

- causing damage while under the influence of alcohol, drugs or other toxic substances;

- causing damage as a result of the employee’s criminal actions established by a court verdict;

- causing damage as a result of an administrative violation, if established by the relevant government body;

- disclosure of information constituting a secret protected by law (state, official, commercial or other), if provided for by federal laws;

- causing damage not while the employee was performing his job duties.

If facts of theft, abuse or damage to property are detected in an institution, an inventory must be carried out ( clause 1.5 of the Guidelines for the inventory of property and financial obligations , approved by Order of the Ministry of Finance of the Russian Federation of June 13, 1995 No. 49 , clause 3 of Article 11 of the Federal Law dated December 6, 2011 No. 402-FZ “On Accounting” ).

Compensation for damage can be made in different ways: in cash, by deduction from wages at the request of the employee, through the bailiff service, in kind by providing the institution with similar property in agreement with the manager.

Deductions from an employee’s salary must be made taking into account the restrictions established by Art. 137 , 138 Labor Code of the Russian Federation .

Accounting entries for fixed assets in budgetary organizations

You will learn about current changes in the Constitutional Court by becoming a participant in the program developed jointly with Sberbank-AST CJSC. Students who successfully complete the program are issued certificates of the established form.

For example, taking an inventory of fixed assets is a labor-intensive process, so it is better to carry it out in November or December.

Example 2. Budgetary institution in the fourth quarter. 2014 carried out an inventory of material reserves. Raw materials are used to carry out income-generating activities. The inventory ended on December 24th. As a result, according to accounting data, a shortage of materials in the amount of 8,500 rubles was identified.

If at least one member of the commission is absent, the inventory results may be declared invalid (paragraph 4, clause 2.3 of the instructions, approved by Order of the Ministry of Finance of Russia dated June 13, 1995 No. 49).

The guilty person deposited 9,000 rubles into the institution’s cash desk. Based on the results of the inventory as of December 24, the accountant recorded the following entries: D-t account. 240110172 Set of accounts. 210536440 — 8500 rub. — the cost of missing materials is written off; 220974560 Set of accounts. 240110172 — 9000 rub.

This amount is less than the carrying amount of the missing non-financial assets. The guilty person will compensate for the damage in cash to the institution’s personal account. How is the financial result of the institution closed in this case? What accounting records should be used to reflect the shortage of inventories and fixed assets?

Deduction from wages posting

Occurs in case of damage or loss of property (Debit 70 Credit 73.2), debt on accountable amounts (Debit 70 Credit 71). The employer can also deduct part of the funds from the employee’s salary to repay a previously issued loan (Debit 70 Credit 73.1).

Another situation: an employee took full paid leave, but quit before the end of the period for which it was taken. Amounts of vacation pay for those days to which the employee is not entitled are withheld (Debit 70 Credit 73).

Rule 2. Create an inventory schedule

If, based on the results of the inventory, unaccounted for items of non-financial assets are identified, this should be reflected in the following entry: Debit of the corresponding analytical accounts of account 10000000 “Non-financial assets” - credit of account 40110180 “Other income”.

The material was prepared on the basis of individual written consultation provided as part of the Legal Consulting service.

He introduces the concept of “horizontal subsidies”. They can be directed from region to region or from municipality to municipality.

During the inventory process carried out at the institution before preparing annual financial statements, a missing computer was discovered. It is a particularly valuable property and was previously acquired using funds from income-generating activities. The initial cost of the computer is 54,000 rubles. Depreciation was accrued on it in the amount of 14,000 rubles.

Accrual of penalties for transactions with a budgetary institution in 2021

The shortage is reflected in the accounting accounts in the month in which the inventory was completed (as of the date of drawing up the act of the inventory commission) (clause 5.5 of Methodological Instructions No. 49).

The shortage and damage to material reserves (valuables) within the limits of natural loss must be written off as expenses of the current financial year based on the order (order) of the head of the budgetary institution and acts according to f. 0504230 “Act on write-off of inventories” and 0504143 “Act on write-off of soft and household inventory”.

We are always ready to help in legal matters for all categories of the population. Post your questions, we will quickly advise you. Constant updating of information.

During the inventory, it may be revealed that certain parts of the fixed asset are missing as a result of their damage or theft. For example, monitors for computers. Thus, the use of the basic tool itself becomes impossible. What to do in this situation? There are two options.

There are also more complex situations that should also be classified as shortages: when the actual balance of material assets corresponds to the accounting data, but the accounting data themselves are incorrect. In this case, you should first correct the accounting data and only then compare the actual balance with the accounting data. And if the balance according to accounting data exceeds the actual availability, this will be a shortage.

In the accounting of a public sector organization, the cost of inventories identified as a result of shortages is debited to account 0 401 10 172 “Income from transactions with assets.” The same principle applies to property. Does the founder give the property? This means we reflect it using code “4”. Is the property given by another legal entity or individual? Since this is not the founder, it means that we reflect it using the type of financial security code “2”, even if the property comes from a budget institution created by the same founder.

Updates on the site bino.ru

Buy publications and articles individually!

Now on our website you can purchase individual electronic publications in the “Editions 2013” section and individual articles in the “Articles 2013” section.

Pay online!

You can pay for your subscription online (by card, electronic money) and get instant access.

Subscription

Subscription continues for the second half of 2014 through post offices, the Publishing House and alternative subscription agencies: https://bino.ru/Podpiska.

We are glad to offer you more flexible subscription options for print publications! Now you can subscribe to the publisher not only for a year, but also for six months, with or without an application.

We remind you that in 2014 the magazine “BiNO: Nonprofit Organizations” will be published only in electronic form.

Get to know BiNO magazines

Now, before purchasing a subscription to the electronic version of BiNO magazines, you can familiarize yourself with the composition of the topics discussed and their content. To do this, in the “About Journals” section https://bino.ru/Info_o_Jornal in the “Topics of Issues” area, read the list of topics and the content of any topic you are interested in by clicking on its title.

For the manager

The site has a manager’s section, which presents the first topic “Purchasing expensive equipment.” The topic is in the public domain: https://bino.ru/razdel_rukovoditelya. We invite all managers to look at the topic and write their reviews and suggestions on

Life with taste

In the section “Life with taste” you will learn about proven recipes for filling life with taste; about improving your attitude through the joy of discovering something new, through simplifying complex tasks, through daily enjoyment of the process and the result: https://bino.ru/life_with_taste

Electronic magazines

For subscribers of electronic versions of publications, the magazine “BiNO: Budgetary Institutions” No. 6/2014, “BiNO: Government Institutions” No. 2/2014, “BiNO: Autonomous Institutions” No. 1/2014 and “BiNO: Non-profit Organizations” No. 1/2014 are available : https://bino.ru/Elektronniy_Journal.

On the website bino.ru, sections of electronic versions of magazines provide convenient navigation by year.

Free sample of an electronic journal with the topic “Creating an organization’s website” https://bino.ru/Sample_journal_bino.

Archive of BiNO articles

The article archive contains about 100 materials published in our journals in 2008–2011: https://bino.ru/Arhiv_statey. Articles are in the public domain!

Reflections on a painting

Kubarev V.G. At the old well: https://bino.ru/kubarev_u_starogo_kolodtsa.