In the process of reflecting the facts of economic activity and preparing primary documents, each accountant needs to create accounting registers (Part 5, Article 10 of Law No. 402-FZ). Let's take a closer look at creating and setting up accounting register data in the 1C: Accounting 8 program, ed. 3.0.

- Mandatory details of accounting registers

- Accounting registers in 1C

- Setting up accounting registers

- Signing and saving accounting registers in electronic form

Other calculations

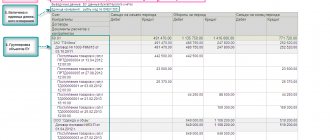

The accumulation register “Other settlements” is intended to account for mutual settlements on wages, taxes and accountable persons for the purposes of the simplified tax system (Fig. 6). The occurrence of receivables in the register is reflected by incoming entries, and the repayment of receivables by expense entries. The occurrence of accounts payable in the register is reflected in expense entries, and the repayment of accounts payable is reflected in receipt entries.

Figure 6.

Register entries are used to control payment and determine the amount of expenses taken into account when determining the tax base for the taxable object “income reduced by the amount of expenses.”

Entries in the accumulation registers of the simplified tax system subsystem are formed when posting documents that record the facts of the economic life of the organization.

Type of registers

According to their purpose, 1C tax accounting registers are divided into groups:

- Business transaction accounting registers are necessary to systematize information about the facts of the activities of an economic entity that lead to the emergence of an object of tax accounting;

- Registers for recording the status of a tax accounting unit exist to collect data on the presence and movement of a specific tax accounting object;

- Registers of intermediate settlements perform an auxiliary function: they are used at the stage of establishing the cost of an object, and also as a primary source of information for filling out registers for creating reporting data;

- Registers for creating reporting data exist to summarize data on recognized income and expenses of the reporting (tax) time, calculate the tax base and decipher some individual income and expenses in the income tax return.

Do you need to select scientific articles for your academic work? Specify a topic and receive a response in 15 minutes get help

Figure 2. Example of a tax register. Author24 - online exchange of student work

Calculation of tax under the simplified tax system

In the information register “Calculation of tax under the simplified tax system,” the program, when performing the same-named regulatory operation of closing the month, saves information about the calculation of the amount of the advance payment for tax under the simplified tax system (for the corresponding reporting period), as well as the amount of tax under the simplified tax system (for the corresponding tax period) (Fig. . 8).

Figure 8.

Submit your application

Dear readers! You can get answers to questions about working with 1C software products on our 1C Consultation Line. We are waiting for your call!

Register requirements

In accordance with Article 313 of the Tax Code of the Russian Federation, taxpayers are required to calculate the tax base at the end of each (tax) reporting period of time on the basis of confirmed tax accounting data.

Note 1

Tax accounting is the systematization of accounting information to establish the tax base for a specific tax based on data from primary documentary acts.

The following are used to confirm the NU data:

- primary accounting documentation;

- analytical registers NU;

- calculation of the tax base.

Analytical registers of NU are consolidated formats for systematizing tax accounting information for each reporting period.

It is mandatory that these forms contain:

Finished works on a similar topic

- Course work Tax accounting registers in 1C 460 rub.

- Abstract Tax accounting registers in 1C 280 rub.

- Test work Tax accounting registers in 1C 200 rub.

Receive completed work or specialist advice on your educational project Find out the cost

- register name;

- date of compilation;

- name of business transactions;

- measures of the operation itself in monetary and physical terms;

- signature and its transcript of the person responsible for drawing up the document. Taxpayers have the right to develop register forms and an algorithm for reflecting analytical tax accounting data in them independently, but must include them in addition to accounting policies for further tax purposes.

Figure 1. Location of tax registers in 1C. Author24 - online exchange of student work

Tab "Cash"

Setting the flag “By cash flow items” adds the subconto “(about) Cash flow items” on the following cash accounting accounts.

- Account 50. Cash desk.

- Account 51. Current accounts.

- Account 52. Currency accounts.

- Account 55. Special bank accounts.

In accordance with the order of the Ministry of Finance of the Russian Federation dated July 22, 2003 N 67n “Cash Flow Report (Form No. 4)” the following organizations may not submit.

- Point 3 . Small businesses that are not required to conduct an audit of the accuracy of their accounting records.

- Clause 4, para. 1 . Non-profit organizations.

- Clause 4, para. 3 . Public organizations (associations) that do not carry out entrepreneurial activities and, apart from disposed property, do not have turnover in the sale of goods (works, services), as part of their financial statements.

All other organizations are required to submit a “Cash Flow Statement (Form No. 4).”

In the 1C Accounting 8 program, it can be generated if the “By cash flow items” flag is set. Attention . Even if your organization does not report on Form No. 4, still check the box in the “Cash” detail. This will greatly help both the accountant and the director when analyzing cash flows.

Tab “Activities”

At first glance, this bookmark does not raise any questions. But it is precisely on it that a time bomb is laid.

However, let's take things in order. The tab clearly displays two types of activities.

- Flag “Production of products, performance of work, provision of services.”

- Flag "Retail".

Someone may be surprised, where is the wholesale trade?

There is no need to specifically set the presence of wholesale trade in the accounting parameters, and then in the accounting policy. This type of activity is already specified in the configuration by default. Therefore, regardless of the state of these flags, any organization of the enterprise can engage in wholesale trade. Flag “Production of products, performance of work, provision of services.”

The guidelines state that this flag should be set if at least one of the enterprise organizations is engaged in the production of products, performance of work or provision of services. After setting the flag, another bookmark will be displayed. This is the "Production" tab. It is necessary to indicate the type of price that will play the role of the planned cost for the products (works, services).

Flag "Retail".

The flag should be set if at least one of the enterprise's organizations is engaged in retail trade. After setting the flag, another bookmark will be displayed. This is the “Retail Products” tab. On it you can specify additional analytics for accounting for goods sold at retail through a manual point of sale (NTP).

Displaying the “Retail Products” tab may provoke a false conclusion. It’s as if the “Retail trade” flag should be set only if an organization wants to set up additional analytics for retail trade via NTT. Not only! The state of the flag is very important for determining the accounting policy of the organization.

Setting these flags has variable effects. So, if in the form “Setting up accounting parameters”, the flag “Production of products, performance of work, provision of services” is set, then in the information register “Accounting policies of organizations” for any organization it will be possible to either confirm or refuse to conduct production activities (works, services). The same applies to the Retail flag.

On the contrary, clearing these flags has an unconditional effect on accounting policy. In this case, the program will not allow any organization to indicate such types of activities as retail trade or production activities in the “Accounting Policies of Organizations” information register.

In order to properly conduct manufacturing and retail activities, it is very important to remember the following.

Attention . The state of the flags “Production of products, performance of work, provision of services does not prohibit the conduct of production activities and activities related to retail trade in the program. And it's very bad.

This state of affairs can lead to serious accounting errors. For example, if the “Production of products, performance of work, provision of services” flag is cleared, the program does not block the documents “Request-invoice” and “Production report for the shift.” It allows you to arrange and carry them out.

Therefore, if an accountant conducts production activities without indicating it in the accounting policy, then when closing the month there will be errors in the process. In turn, this will lead to incorrect calculation of the actual cost of finished products and adjustments to output. Cost accounts will not be closed correctly.

A similar situation will arise if the accounting policy does not specify the type of activity “Retail trade”, but the accountant nevertheless registers retail transactions.

Attention . Accounting policy provisions are used in month-end closing regulations.

Of course, it would be better if the program could block transactions that do not comply with accounting policies. Unfortunately, this is not provided everywhere. How to be?

No need to be smart . If the organization conducts production activities, be sure to set the flag “Production of products, performance of work, provision of services.” The same applies to retail.

It can be assumed that the presence of the “Types of Activities” tab is due to the possibility of multi-company accounting in one information base. And, probably, because even for single-company accounting there can be organizations with a very large amount of information.

These circumstances can lead to a noticeable increase in the closing time for the month. However, in the overwhelming majority of cases, there is no meaningful need for multi-company accounting. Also, a huge number of organizations have quite small information databases.

For such organizations, in order to protect themselves, it is advisable to set the flags “Production of products, performance of work, provision of . Regardless of whether or not the organization has production activities and retail trade.

“Production” tab

The “Production” tab is displayed if the “Production of products, performance of work, rendering” flag is set on the “Types of Activities” tab

. production is carried out only at planned prices. Therefore, on the “Production” tab, you should specify the price type that will play the role of the planned price.

Let me explain. A specific product can be manufactured, say, in the middle of the month and sent to the finished goods warehouse, debit account 43 “Finished goods”. This account has a mandatory sub-account “Nomenclature”. Quantitative and total accounting is carried out on this sub-account. This means that when writing off finished products to a warehouse, you must indicate not only the name of the finished product, but also its price.

However, the actual price at the time of product release is usually unknown. It will be known only at the end of the month. When all direct and indirect costs are written off to account 20 “Main production”, to the product group that includes these products.

And since the actual price is unknown, it means that some other price must be used. Since the actual price during the month is unknown, the standard configuration of 1C Accounting 8 records finished products only at planned prices. At this price, finished products are delivered to the finished goods warehouse. How to calculate the target price is a matter for the planning department of the enterprise.

All price types used at the enterprise are described by the user in the “Item Price Types” directory.

Formally, any element of this directory can be used as a planned price. Of course, the name doesn't matter. Meaningfulness matters.

The products manufactured, the work performed and the production services provided are described in the “Nomenclature” directory. For these items, using the “Setting Item Prices” document for the planned price type, it is advisable to assign specific price values.

After these settings, the values of planned prices (products, works, services) will be automatically inserted into the documents “Production Report for the Shift” and “Certificate of Provision of Production Services”. Otherwise, you will have to enter them manually each time.

Tab “Retail Products”

The “Retail Goods” tab is displayed if the “Retail Trade” flag is set on the “Types of Activities” tab.

First of all, please note that this tab does not detail all retail trade, but only trade through manual retail outlets (NTPs). The following accounts are used for trading via NTT.

- Account 41.12 “Goods in retail trade (in NTT at sales value).”

- Account 42.02 “Trade margins in non-automated retail outlets.”

Analytical accounting of goods under these accounts is always carried out by warehouse.

That is, if you disable warehouse accounting on the “Inventory” tab, then the “Warehouses” subaccount will still remain on these accounts. On the “Retail Goods” tab, you can connect additional analytics, subconto to accounts 41.12 and 42.02.

- Flag “By nomenclature (revolutions)” . Setting the flag will lead to the fact that in account 41.12 “Goods in retail trade (in NTT at sales value)” the subaccount “(about) Nomenclature” is connected. This will allow, for example, in the “Turnover Balance Sheet” report to view debit turnover for this account with detail down to item items. However, since the subconto is negotiable, the report will not show information about the balance of the item in the NTT.

- Flag “At VAT rates” . If this flag is set, then the sub-account “VAT Rates” is connected to accounts 41.12 “Goods in retail trade (in NTT at sales price)” and 41.02 “Trade margin in non-automated retail outlets”.

It is advisable to set this flag if retail trade of goods is carried out with different VAT rates (10% and 18%).

Any state of these flags certainly applies to all organizations of the enterprise. The chart of accounts is general.

The “Retail Products” tab displays settings only for trading via NTT. This leads to a false conclusion. If organizations conduct wholesale trade and retail trade, but only through ATT, then the “Retail trade” flag does not seem to have to be set. This is wrong!

Attention . If at least one organization of the enterprise conducts any type of retail trade (through ATT and/or NTT), be sure to set the “Retail trade” flag.

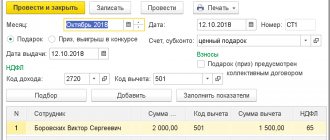

Settings affecting the calculation of personal income tax

Setting up registration in the INFS of an organization and separate divisions

To correctly generate personal income tax reporting, it is necessary to indicate the registration data of the organization and its separate divisions with the tax authority (IFTS), since regulated reporting 6-NDFL and 2-NDFL is generated based on this information.

Registration with the Federal Tax Service of the organization

The organization's registration data with the tax authority (IFTS) is indicated in the organization's card on the Main using the link Change registration data :

The form must indicate the organization’s checkpoint, tax authority code, its short and full name, OKTMO and OKATO codes. Also in the Registration information field is valid from, you must indicate the month from which the registration data will be considered current in 1C 8.3 ZUP. You should be careful when filling out the last details, because... Incorrect indication of the start month of registration may make it impossible to automatically fill out personal income tax reports.

Using the Select from known registrations , you can go to the list of the Registrations with a tax authority to select a registration from the list of information about registration with a tax authority already created in the program.

In the list that opens, you can also create a new registration by clicking the Create .

By clicking on the link History of registration changes, you can view the history of registration changes:

Creation of a separate division in 1C: ZUP, allocated to a separate balance sheet

Separate divisions allocated to a separate balance sheet are registered in the Organization with the This is a branch (separate division) . After checking the box, you must select the parent organization in the Branch's parent organization .

When entering registration data for a separate division, it is recommended to select this data from among the created registrations. This will prevent you from accidentally “overwriting” the organization’s registration data. To do this, you must first follow the link Change registration data :

In the Registration with a tax authority the Select from known registrations link and select the line with pre-entered registration data or create a new element using the Create :

Filling out the registration details for a separate division with the Federal Tax Service is similar to filling out the registration data for the Organization .

Creation of a separate division in 1C: ZUP, not allocated to a separate balance sheet

Separate divisions that are not allocated to a separate balance sheet are registered in the Divisions (Settings - Divisions) with the This is a separate division . You can set up registration with the Federal Tax Service of such a division in the division card using the Change next to the Tax registration field. organ :

Otherwise, the algorithm for filling out registration with the Federal Tax Service is similar to filling out registration data for a separate division allocated to a separate balance sheet.

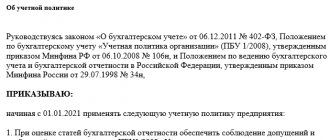

Setting up an organization's accounting policy

The organization's accounting policy settings are opened by clicking the Accounting Policy on the Accounting Policy and other settings of the Organization directory (Settings - Organizations).

The accounting policy has several settings related to the calculation of personal income tax:

Let's take a closer look at them.

Withholding personal income tax when paying interpayment accruals in advance

setting when paying intersettlement accruals in advance can take the following values:

- Withhold tax (recommended);

- Indicate in the document the need to withhold tax when paying in advance.

This setting appeared in version 3.1.8. The setting solves the problem when, when paying a Business Trip in advance, the withheld tax on the Business Trip is registered on the date of payment of the advance, with the deadline for its transfer being the next day after payment. However, since Business Travel is income under code 2000 (wages), the employer does not have the obligation to transfer personal income tax when paying it for the first half of the month.

Setting up Personal income tax withholding when paying interpayment accruals with an advance allows you not to register personal income tax withholding when paying a Business trip with an advance. If the switch is set to the position Indicate in the document the need to withhold tax when paying in advance , then when specifying the payment method With advance in the document Business trip the Transfer tax field appears , allowing you to choose when to transfer personal income tax: When paying along with the advance or When paying wages after the final calculation _

Applying the standard deduction

The Application of standard deductions setting determines how deductions will be applied in months in which the taxpayer’s income turned out to be less than the deduction due to him:

- On an accrual basis during the tax period - means that the deduction will be applied taking into account income and previously applied deductions during the year on an accrual basis. In this case, the calculated tax can be calculated with a minus.

- Within the limits of the taxpayer’s monthly income - means that the deduction will be applied in an amount not exceeding the accrued income during the month. Thus, personal income tax for the month will not be calculated less than 0.

From a legal point of view, it is more correct to apply the deduction on an accrual basis throughout the year.

Setting up Accruals for personal income tax accounting purposes

Setting up personal income tax assessment for various accruals occurs in the Accruals (Settings - Accruals).

personal income tax code column can be seen already in the list of accruals.

You can adjust the personal income tax taxation settings for calculation on the Taxes, contributions, accounting in the personal income tax .

For personal income tax accruals, you must set the Income Code . The income category is not available for editing for all income codes. For example, by code 2000 the income category is always Remuneration , but by code 2002 the category can be adjusted.

By clicking the Setting up personal income tax, average earnings, etc. , you can view in the list which accruals are subject to personal income tax and which are not, and also adjust the income code:

Entering information about a taxpayer's tax status

Information about an employee's tax status can be specified in the employee card using the Income Tax .

The default status is Resident .

Statuses are selected from a predefined list of values:

You should not forget to fill out the details Installed with . This is important when changing taxpayer status:

Entering information about personal income tax deductions due to employees

You can enter an application for deductions from the employee’s card using the Income Tax :

Another option for entering data on deductions is through the Applications for Deductions (Taxes and contributions - Applications for deductions).

Application for standard deductions

In the employee’s card in the Income Tax , using the link Enter a new application for standard deductions, a new document is created : Application for personal income tax deductions :

In the header of the document you should indicate the month from which standard deductions will apply:

The tabular section contains data on standard deductions for children. Data can be entered into the table after checking the Change deductions for children :

Types of deductions are selected from a predefined list:

In the column Provided by (inclusive) the month for which the deduction will be applied is indicated. In the Document confirming the right to deduction , enter the child’s birth certificate or certificate from the place of study.

Please note that for each child who is eligible for a deduction, a separate line is entered in the tabular section. For example, a statement from an employee who has four minor children would look like this:

Data for applying a personal deduction is entered at the bottom of the form. You should check the Change personal deduction and select the personal deduction code in the Code :

In the Document confirming the right to personal deduction , enter the data of the confirming document.

Notification of the tax authority about the right to property and social deductions

In the employee’s card in the Income tax , follow the link Enter a new cash notification. authority for deductions, a new document is created Notification of the non-commercial organization about the right to deductions :

The header of the document indicates the Tax period in which deductions must be provided, as well as the month from which deductions begin to be applied in the Apply deductions from :

In the Notification of the right to deduction , you should indicate the notification details: Number , Date , as well as the Federal Tax Service :

Information on deductions for the construction and purchase of housing, interest on loans and interest on on-lending is indicated on the Property deductions :

Information about social deductions, such as expenses for your own education and for the education of children, medical expenses, etc. can be specified on the Social deductions :

Entering information about income from a previous job

Information about income from a previous place of employment is necessary to correctly calculate the limit for providing standard deductions to employees hired not from the beginning of the year. You can enter them from the employee’s card using the Income Tax . Information is entered through a special form, which opens by clicking the link Income from previous place of work :

Signing and saving accounting registers in electronic form

To create an accounting register in electronic form, you must click on the “Accounting register”

and select

“Sign electronic signature and save”

.

To save the accounting register (without signature), you must click on the “Accounting register”

and select

“Save”

, so this register will be electronically placed in the Archive of Accounting Registers, and later it can be printed and signed.