Why do you need an explanatory note to the financial statements?

Drawing up annual financial statements, including for small and medium-sized businesses, is a mandatory procedure. The only exceptions are budgetary and public organizations that are not engaged in entrepreneurial activities. Reporting documents do not always make it possible to fully illuminate the financial situation of an enterprise; this is precisely why an explanatory note is drawn up. It is called explanatory because it explains other reporting documents. It only supplements the data from the main accounting reports.

The explanatory note to the organization's financial statements describes all the key events that occurred over a specified period of time with a description of the financial position at the end of the year.

You need to draw up an explanatory note carefully, since if the information from the report does not correspond to reality, problems may arise.

Definition

An explanatory note (EP) is the text part of the course work, which describes the main results and progress of the research of the entire project. When drawing up a PP, it is necessary to be guided by strictly established standards. It presents the following:

- logically structured information on the course topic;

- explanations for specific sections and individual parts of the study;

- conclusions regarding the studies conducted;

- description of the achieved results of the course work.

The preparation of an explanatory note should be taken as seriously as possible, since it is the basis for issuing a final grade for the entire work as a whole.

The final version of the explanatory note must certainly be agreed upon with the supervisor to whom the student was initially assigned.

How to correctly write an explanatory note to financial statements?

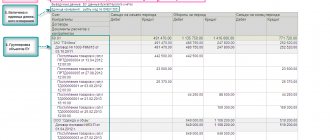

There are no clear rules according to which it is necessary to draw up an explanatory note. Each enterprise independently determines the volume and form of presentation of information. Since the main purpose of the explanatory note is not the correctness of the structure, but the most understandable detail of the accounting statements. A document can contain not only text, but also graphs, tables, charts, diagrams, etc.

The explanatory note to the annual financial statements must give a true and in-depth idea of the financial position of the organization and the results of its activities. It should include information:

- About the enterprise (its structure and areas of activity);

- About changes in accounting policies. Here it is necessary to indicate the reason for the changes and describe the possible consequences;

- About the factors influencing the results of the enterprise's activities. Factors that did not have a strong impact on overall financial performance should not be included in the explanatory note.

Since the note is drawn up in any form, to describe the financial condition of the enterprise, you can indicate both general information and a detailed explanation of individual financial indicators.

Structure

The PP for course work must be drawn up extremely carefully, following all the recommendations and established rules for design. Let's look at each component of the note in more detail.

Title page

The first page plays an important role, since it is the face of the entire course work. Looking at its design, the teacher will get a first impression of the work. The title page is drawn up according to the template adopted by the educational institution.

Exercise

This section is usually missing from standard coursework. But if its presence is dictated by the norms, then the topic of the course project is placed here without abbreviations, as well as the initial data.

annotation

This section contains a brief but succinct summary of basic information on the topic of the work, as well as a description of recommendations for its application in practice. The main objectives of the annotation are as follows:

- show the novelty of the research;

- Briefly outline the key points of the project.

Table of contents or contents

This section briefly reveals the structure of the course work with all its chapters, paragraphs and subsections. The content is placed on a separate page, and its design has its own nuances and subtleties.

Introduction

The introduction must describe the following:

- general information about course work;

- specific research goals, object and subject;

- list of assigned tasks;

- relevance of the course topic.

Main part

This is the main and main section of the explanatory note. It describes the following information:

- analysis of all possible options for solving assigned problems;

- choosing a technique that will help achieve the goal;

- stages of the study;

- analysis of work results and conclusions.

Conclusion

This section provides the following information:

- final conclusions are stated;

- recommendations are provided for further application of the final results of the work in practice;

- prospects for continued research are proposed.

Bibliography

This section lists the sources that were used by the student while writing the course work.

The sources used should be numbered and listed in this order:

- first, regulatory documents are indicated;

- then - periodicals;

- The last ones are electronic resources and Internet sites.

First of all, it is necessary to place Russian-language sources, and then foreign ones.

Application

This section is present only when necessary. The application contains materials that are necessary for more detailed coverage of the content of the course project. The section includes the following:

- volumetric graphics;

- large drawings;

- long calculations;

- complex drawings;

- large tables;

- other large-sized images that do not fit on an A4 sheet.

What to check in the annual balance sheet before submitting it to the GIR BO: disclosure of information in the explanations

The general rules for the formation of reporting indicators are set out in PBU 4/99 “Accounting statements of an organization”. In the annual “Recommendations to Auditors...” the Ministry of Finance updates the procedure for presenting information on current events affecting reporting data.

The composition of the annual financial statements is disclosed in the Law “On Accounting” (Part 1, Article 14 of Law No. 402-FZ): balance sheet, statement of financial results and appendices thereto.

The appendices are a statement of changes in equity; cash flow statement; report on the intended use of funds; explanations in tabular or text form. All these forms are approved by Order of the Ministry of Finance of the Russian Federation dated 07/02/10 No. 66n (as amended), and these forms are recommended, i.e. the organization independently chooses the amount of information presented in the explanations.

Previously (before the adoption of Law No. 402-FZ “On Accounting”), the reporting also included an explanatory note, where the organization informed its users the most important facts of economic life from its point of view, which had an impact on the results of the past year and future periods. However, the explanatory note was subsequently excluded from the mandatory forms.

Moreover, in the “Recommendations for auditors ... on conducting an audit of the annual financial statements of organizations for 2012” (letter of the Ministry of Finance dated 01/09/2013 No. 07-02-18/01), the Ministry of Finance explained the difference between an explanatory note and explanations.

So, what information should be in the explanations (Section VI PBU 4/99):

—

Disclosure of balance sheet or income statement numbers. For example, the Ministry of Finance proposes to provide users with information in the explanations about how the composition of the main assets and liabilities of the balance sheet (fixed assets, intangible assets, inventories, accounts receivable and payable, etc.) changed during the reporting year: balance on beginning, receipt, disposal, balance at the end).

—

Information on the dynamics of the composition of production costs of the reporting organization (compared to the previous year), on the volumes of received and returned government assistance.

—

Changes in accounting policies that affected the reporting (section 2 of the statement of changes in capital).

When deciding what to present in the explanations, pay attention to the requirement of the current PBU and FSBU: each of these documents has a section called “Information Disclosure”.

An explanatory note is information accompanying the financial statements (section VШ of PBU 4/99). The Accounting Methodological Center, as a non-state accounting regulator, in its Recommendation R-34/2013-KpR “Explanations in the financial statements” also speaks of the explanatory note as a separate document.

Related information may include a description of energy saving measures, the organization’s development plans, internal control, business risks, etc.

When selecting information to disclose for 2020, be sure to consider the impact of COVID-19 conditions.

During 2021, the Ministry of Finance drew the attention of reporting preparers to these facts.

Thus, in the Protocol of absentee voting of the Council on Auditing Activities dated December 18, 2020 No. 56, auditors were given recommendations for auditing annual reporting.

The extent of the impact of COVID-19 conditions on financial statements depends on many factors:

—

whether the organization’s activities have been recognized as affected by the pandemic;

—

whether deterioration in the capital, commodity and foreign exchange markets has affected the financial position of the preparers;

—

the extent to which the organization is able to continue as a going concern in the face of COVID-19;

—

whether the organization’s assets, especially non-financial ones (property), have depreciated;

—

whether there was any downtime in the use of fixed assets;

—

are the estimated values (reserves, etc.), including the fair value of assets, reasonable;

—

whether government assistance is correctly reflected if it was received;

—

whether events after the reporting date are taken into account;

When preparing an explanatory note, study the documents posted on the official website of the Ministry of Finance of Russia www.minfin.gov.ru:

—

PZ-14/2020 “On the practice of generating information in accounting in the context of the spread of a new coronavirus infection” (dated 07/15/2020);

—

“Selected issues in the preparation of consolidated financial statements of organizations related to operating conditions in 2020.” (dated June 23, 2020).

Decor

1. The text materials of the explanatory note are typed on a computer and then printed on a printer. Printing is done on A4 sheets.

2. All pages must be numbered. The only exception is the title page.

3. License plates are placed at the bottom or top of the sheet, depending on the requirements of the educational institution. Numbering is placed in the center of the page.

4. Text material is printed exclusively on one side of the sheet.

5. The font size of the PP text should not be less than 12 and no more than 14.

6. The distance between lines does not exceed one and a half units, and the deviation from the paragraph is 1.5 cm.

7. The test material is aligned to the width of the sheet.

8. It is prohibited to put a period at the end of headings. The only exception may be a title of several sentences.

9. You should not hyphenate words in chapter titles or topic titles.

10. Each chapter must begin on a new page, and sections must be printed on a red line.

11. The main text of the PP is printed in Times New Roman font.

12. Quotes must be placed in quotation marks and a link to the source must be indicated.