All taxpayers must maintain tax records for income tax in special registers. Tax accounting is organized on its own, and the procedure for maintaining it is fixed in the tax accounting policy (Article 313 of the Tax Code of the Russian Federation). Tax registers in which accounting is kept are also developed independently, since tax authorities do not have the right to establish mandatory accounting forms. In this article we will look at what tax registers are, how they are maintained, and provide examples of filling them out.

Development of a form for tax accounting registers

The Tax Code of the Russian Federation does not contain a list of tax registers necessary to form a tax base. Each organization develops registers itself, so they can look completely different. As a rule, these are tables whose contents make it clear how the company forms the tax base. Tax accounting registers can be maintained electronically in the form of Excel tables, in a special accounting program or on paper.

When developing registers, you can take accounting registers as a basis and supplement them with everything necessary, or create tax registers from scratch. In any case, they must contain all the lines and columns necessary to display the data.

The taxpayer himself decides what data the registers contain, but there are also mandatory details that must be included in any type of analytical registers for tax accounting of an enterprise. These include (Article 313 of the Tax Code of the Russian Federation):

- Name;

- date of compilation or period,

- monetary value of the operation, and if possible, then in kind,

- name of business operations,

- signature (with transcript) of the person responsible for compiling the register.

As a template when developing tax accounting documents, you can also use tax accounting registers, a list of which was recommended by the tax service to help taxpayers back in 2001 (Recommendations of the Ministry of Taxes of the Russian Federation for calculating profits in accordance with Chapter 25 of the Tax Code of the Russian Federation, published on December 19, 2001).

There is no need to create a separate register for each line of the income tax return. The number of tax registers is determined by the company's accounting policy, provided that they fully justify the data specified in the declaration. Tax authorities can be held accountable for the absence of only those registers that the company needs to maintain in accordance with its accounting policies (see, for example, Resolution of the Federal Antimonopoly Service of the Volga District dated July 14, 2009 No. A65-27027/2007).

Prepare your accounting policies more carefully

Since we have already touched upon the issue of securing the registers used in the accounting policy, let’s dwell on this in more detail. Let us say right away that the Tax Code does not establish any sanctions for the fact that an organization uses registers not mentioned in the accounting policy. Likewise, there are no penalties for the fact that the accounting policy does not indicate at all which registers the organization uses and which it does not.

However, we would not advise neglecting to consolidate the list of tax accounting registers in the accounting policy. After all, this can help the taxpayer himself in the event of a conflict with the tax authorities. Thus, in the case described above, the court prohibited the request from the organization of those registers that, according to its accounting policy, should not be maintained.

Note that this is not the only case. For example, the Federal Arbitration Court of another district - Povolzhsky, considering a similar case, indicated that the taxpayer, in accordance with Articles 313 and 314 of the Tax Code of the Russian Federation, organizes it independently, reflecting it in the accounting policy. Therefore, tax authorities cannot establish mandatory forms of tax accounting documents for taxpayers, nor require those tax accounting documents that are not provided for by the Tax Code of the Russian Federation or the accounting policy of the organization itself (Resolution No. A57-17061/05-26 dated June 1, 2006).

So accounting policy is a fairly powerful weapon in a dispute with inspectors over the issue of which tax accounting registers an organization should have and which should not. True, like any weapon, it also has “recoil”. If you have already fixed the register in the accounting policy, then please ensure that it is actually maintained. Otherwise - a fine. And completely legal.

Requirements of the Tax Code of the Russian Federation for tax registers

Forms of analytical tax accounting registers, which are annex to the accounting policy of the enterprise, serve to confirm data on a par with primary documents and calculation of the tax base (Article 313 of the Tax Code of the Russian Federation). The requirements that tax legislation places on them are as follows:

- It is unacceptable to enter data into the register without observing chronological order and continuity;

- analytical accounting of tax data in registers should reveal the procedure for forming the tax base;

- registers should be stored in such a way as to prevent unauthorized correction of data in them;

- the persons who compose them are responsible for the correct reflection of business transactions in registers; Each correction of errors entered into the tax register must be confirmed by the signature of the responsible person, with a justification for the correction and indicating the date;

- tax accounting data, including registers, constitute a tax secret; persons who have access to them are responsible for disclosing tax secrets in accordance with the law.

What should the register look like?

The Tax Code of the Russian Federation contains practically no information regarding the type of register. The Code contains general information only. That is, the task of preparing documents is assigned to organizations.

But Article 313 of the Tax Code of the Russian Federation specifies mandatory information that must be included in the register. In particular, these are the following points:

- Name.

- Period.

- The name of the operation performed.

- Results of the operation in rubles.

The document is certified by the signature of the responsible employee. The signature is accompanied by a transcript.

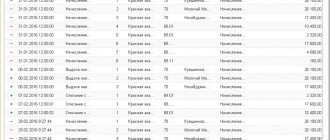

If this is a personal income tax register, it includes this information:

- Type of income.

- Personal income tax benefits that reduce the tax base.

- Payment amounts.

- Payment dates.

- Amount of calculated tax.

- Tax withholding date.

- Information about payment slips that confirm tax payment.

The rules relating to tax registers are almost identical to the rules relating to primary accounting. Therefore, some experts have a question about the possibility of replacing registers with accounting documentation. There are no prohibitions regarding this in the Tax Code of the Russian Federation. Moreover, Article 313 of the Tax Code of the Russian Federation provides indirect permission for this. But the same article states that if accounting data is insufficient, it needs to be supplemented. Based on the results of the additions, the register is formed.

ATTENTION! Registers are maintained in both paper and electronic form. Electronic documentation is simply printed if there is a need for this (for example, a tax requirement).

Tax accounting registers: minimum list

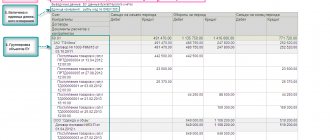

What registers will a company need to account for income taxes? Since the tax object is profit, in order to determine its size, one must know the amount of income and expenses of the taxpayer, which means that in any case tax accounting registers must be present:

- “Proceeds from sales”;

- “Expenses that reduce sales income”;

- “Non-operating income”;

- "Non-operating expenses."

Tax accounting registers, a sample of which can be downloaded below, are filled out according to accounting data for accounts 20, 26, 40, 43, 44, 90, 91, etc., taking into account the provisions of Chapter 25 of the Tax Code of the Russian Federation. It must be remembered that not all income and expense accounting transactions are taken into account in tax accounting, which means they are not entered into tax registers. Sales income does not include VAT. Some expenses cannot be accepted for tax purposes in full, but only within the established norms.

The need to fill out other tax accounting registers may arise if an enterprise conducts several types of activities, or carries out transactions that are taxed in a special manner.

Storage periods for tax registers

The tax authorities’ request for the submission of documents often contains a list of NU registers according to the number of completed declaration lines. The fine for each document not submitted is 200 rubles (Article 126 of the Tax Code of the Russian Federation). They also have the right to apply Art. 120 of the Tax Code of the Russian Federation for a gross violation of the rules of the NU.

Expenses can be applied to reduce income only if they are justified and primary documents are available for confirmation (clause 1 of Article 252 of the Tax Code of the Russian Federation).

Accordingly, for 4 years (3 years of a possible on-site inspection + current year), it is necessary to ensure the safety of documents showing the receipt of income, expenses and payment of taxes (subclause 6, clause 1, article 23 of the Tax Code of the Russian Federation).

Not long ago, the Ministry of Finance reminded that this period begins at the end of the period in which this document was last used when preparing tax reporting (letter dated July 19, 2017 No. 03-07-11/45829).

Thus, documents confirming the amount of loss, in the event of its transfer in order to reduce the tax base over several subsequent years (clause 4 of Article 283 of the Tax Code of the Russian Federation), are stored after completion of the transfer of this loss for 4 years (letter of the Ministry of Finance of the Russian Federation dated May 25 .2012 No. 03-03-06/1/278).

Documents confirming the formation of the initial cost of a depreciable asset begin to count their 4-year shelf life only after depreciation is completed (letter of the Ministry of Finance dated February 12, 2016 No. 03-03-06/1/7604).

It is clear that the corresponding NU registers are stored according to the same rules.

Every taxpayer must have tax registers for NP, since the Federal Tax Service has the right to request them during its regular audits of reporting.

It is important to understand what NU registers are and how to fill them out correctly so as not to expose your company to unwanted fines for unsubmitted documents or flagrant violation of NU rules.

The article shows samples of tax registers for income tax that will help fulfill the requirements of tax authorities for their registration.

Balance registers and turnover registers

There are two types of accumulation registers:

- balance accumulation registers (stores the final values of resources - balances);

- revolution accumulation registers (stores only changes in these resources - revolutions).

The existence of a register for accumulating turnover is due to the fact that when automating economic activities, there are a large number of situations when it is only necessary to accumulate turnover, and the values of the balances do not make sense. A typical example of using a turnover accumulation register is the “Revenue and Cost of Sales” register, which stores information about sales volumes.

Since the turnover accumulation register does not accumulate resource balances, the “direction” of resource movement (income or expense) does not make sense for it; Only the amount of change in resources is accumulated. Therefore, all entries in the revolution accumulation register are marked with the same icons.

Units of registers for accumulating revolutions

For circulating accumulation registers, the platform supports a special aggregate mechanism, which can significantly speed up the retrieval of data from registers containing a large number of records - hundreds of thousands and millions of records.

Aggregates are a special mechanism implemented in circulating accumulation registers that can significantly reduce the time it takes to generate reports.

Each aggregate is a specialized storage containing aggregated register data in various sections, convenient for generating reports in this information base. The system automatically evaluates the intensity of users’ work with certain sections of information and, based on accumulated statistics, selects the optimal composition of supported aggregates.

The use of aggregates allows analysts and managers to analyze available information by switching between different viewing views with a short system response time. At the same time, the system uses accumulated aggregated data and always ensures that the reports received are up to date.

Multiple aggregates can be created for any register.

The platform contains a special aggregate designer, with which you can change the composition of aggregates and customize their use.

The aggregate designer can be called from the window for editing the circulating accumulation register (the “Data” tab).

How to Design a Form

It does not matter which form of register a particular company uses. There are no strict requirements for the structure of documentation. Therefore, every economic entity has the right:

- Develop a form from scratch. For example, come up with a special table that is suitable for recording tax accounting information.

- Finalize journals and accounting orders. For example, convert a payslip into a personal income tax register by adding certain data to the form.

Moreover, the format of maintaining such documentation does not matter. That is, fiscal accounting data can be recorded in documentation by hand. For example, on paper, and a specialist systematically enters information into it.

Or cash. records are kept in Excel spreadsheets. This approach is more convenient and allows you to automate calculations. Another option is to use specialized accounting programs. For example, the accounting journal is converted to RNU. The program automatically generates the requested information for the required period. This format of managing NU is recognized as the most optimal and effective.

IMPORTANT!

Regardless of the option for developing documentation forms, tax accounting registers, their list and forms must be approved at the local level. For example, approve the structure of documents in a separate management order. Or attach it in the appendices to the accounting policy regarding the organization and maintenance of NU.

Results

Tax accounting registers are developed by the taxpayer himself, and their form is approved as an annex to the tax accounting policy. They can be compiled electronically or on paper - it doesn't matter. The main thing is that they contain the mandatory details established by the Tax Code of the Russian Federation. There is a basic requirement for information reflected in registers: all entries must be justified and reliable, and from the contents of the register it must be clear how the tax base is formed.

Sources

- https://assistentus.ru/nalog-na-pribyil/formirovanie-registrov/

- https://nalog-nalog.ru/nalog_na_pribyl/nalogovaya_baza_nalog_na_pribyl/kak_vesti_registry_nalogovogo_ucheta_obrazec/

- https://www.klerk.ru/buh/articles/480329/

- https://www.berator.ru/enc/np/30/20/90/

Responsibility for absence

For those who have not filled out the tax register forms, it is important to know what penalties are expected when passing the audit.

Turns out:

- the list of gross violations does not contain such a rule for violation of records as maintaining registers;

- there are no established forms among those required for reporting, so there will be no request for their provision either;

- if the lack of documents led to incorrect tax deductions, the fine will be calculated precisely for the underpayment, and not for the lack of these documents.

Even the declaration does not oblige you to indicate all the lines in the tax registers. Therefore, it is possible to attract an organization only for failure to maintain registers specified in the accounting policy. If they do not comply with VAT, the issue of punishment does not arise at all.

List form and record set form of the 1C object “Accumulation registers”

In order for the user to view the data contained in the accumulation register, the system supports the following forms of presentation of the accumulation register:

- accumulation register list form - allows you to sort and select the displayed information according to several criteria; the system can automatically generate this form;

- form of a set of accumulation register records - allows you to add, change and delete records of the information register.

Along with this, the developer has the opportunity to create his own (custom) forms, which the system will use instead of the default form.

Drawing

[collapse]

7.1. Basic requirements for analytical tax accounting registers

As established by Art. 313 of the Tax Code of the Russian Federation, if the accounting registers contain insufficient information to determine the tax base in accordance with the requirements of Chapter. 25 of the Tax Code of the Russian Federation, the taxpayer has the right to independently supplement the applicable accounting registers with additional details, thereby forming tax accounting registers, or maintain independent tax accounting registers. Accordingly, when maintaining tax accounting, a taxpayer can: • if the accounting procedure does not differ from the tax accounting procedure, use accounting data to carry out tax accounting; • if the accounting procedure differs slightly from the tax accounting procedure, supplement the accounting registers with additional details and thereby create tax accounting registers; • if the accounting procedure differs significantly from the tax accounting procedure, maintain independent tax accounting registers. Article 313 of the Tax Code of the Russian Federation, prohibiting tax and other authorities from establishing mandatory forms of tax accounting documents for taxpayers, contains a provision that the forms of analytical tax accounting registers for determining the tax base, which are documents for tax accounting, must necessarily contain the following details: • register name; • period (date) of compilation; • transaction meters in physical (if possible) and monetary terms; • name of business transactions; • signature (deciphering the signature) of the person responsible for compiling the specified registers. General provisions on analytical tax accounting registers are contained in Art. 314 of the Tax Code of the Russian Federation (it is easy to notice that these provisions are in many ways similar to the provisions of Article 10 of the Federal Law “On Accounting” on accounting registers). Article 314 of the Tax Code of the Russian Federation defines that analytical tax accounting registers are consolidated forms of systematization of tax accounting data for the reporting (tax) period, grouped in accordance with the requirements of Chapter. 25 of the Tax Code of the Russian Federation, without distribution (reflection) among accounting accounts. It is stated that tax accounting data is data that is taken into account in development tables, accountant’s certificates and other taxpayer documents that group information about taxable objects. Article 314 of the Tax Code of the Russian Federation also establishes the following: • the formation of tax accounting data presupposes the continuity of reflection in chronological order of accounting objects for tax purposes (including transactions, the results of which are taken into account in several reporting periods or are postponed for a number of years). At the same time, analytical accounting of tax accounting data must be organized by the taxpayer in such a way that it reveals the procedure for forming the tax base; • analytical tax accounting registers are designed to systematize and accumulate information contained in primary documents accepted for accounting, analytical tax accounting data for reflection in the calculation of the tax base. The most significant difference between analytical tax accounting registers and accounting registers is the absence of double entry. This means that the additional details that the taxpayer uses in accordance with Art. 313 of the Tax Code of the Russian Federation has the right to independently supplement the applicable accounting registers for the formation of tax accounting registers; they should not provide for double entry. The formal difference between analytical tax accounting registers and accounting registers is the sources of their maintenance. Analytical tax accounting registers systematize the data contained in development tables, accountant's certificates and other taxpayer documents that group information about taxable objects; in accounting registers - data from primary documents accepted for accounting. The above difference is formal because, based on what is given in Art. 313 of the Tax Code of the Russian Federation, the classification of documents that confirm tax accounting data, development tables and accountant’s certificates can only be classified as primary tax accounting documents. Tax accounting registers are maintained in the form of special forms on paper, electronically and (or) any computer media. According to clause I of Art. 10 of the Federal Law “On Accounting”, accounting registers are kept in special books (magazines), on separate sheets and cards, in the form of machine diagrams obtained using computer technology, as well as on magnetic tapes, disks, floppy disks and other computer media. Clause 1 9 of the Regulations on Accounting and Financial Reporting in the Russian Federation establishes that when maintaining accounting registers on computer storage media, it must be possible to output them to paper storage media. According to Art. 314 of the Tax Code of the Russian Federation, the forms of tax accounting registers and the procedure for reflecting in them analytical data of tax accounting, data from primary accounting documents are developed by the taxpayer independently and are established by appendices to the accounting policy of the organization for tax purposes. Tax accounting registers are formed for all transactions that are taken into account in one way or another for tax purposes. It also states that if the procedure for grouping and recording objects and business transactions for tax purposes corresponds to the procedure for grouping and reflecting in accounting, then the accounting registers can be declared by the taxpayer as tax accounting registers and, therefore, the objects recorded in such registers will be taken into account for calculating the tax base in the amounts and manner provided for both in accounting and in the legislation on taxes and fees. The taxpayer analyzes the business transactions that arise in the course of his activities and independently determines for which accounting objects he must develop and approve forms of tax accounting registers, which must provide the totality of all the data necessary for the correct determination of the indicators of the tax return for corporate income tax , based on the requirements of Ch. 25 of the Tax Code of the Russian Federation on the issue of accounting for relevant income and expenses. The correct reflection of business transactions in tax accounting registers is ensured by the persons who compiled and signed them. A completely similar provision is contained in clause 2 of Art. 10 of the Federal Law “On Accounting” in relation to accounting registers. When storing tax registers in accordance with Art. 314 of the Tax Code of the Russian Federation must ensure their protection from unauthorized corrections. Correction of an error in the tax accounting register must be justified and confirmed by the signature of the responsible person who made the correction, indicating the date and justification for the correction made. Almost similar provisions regarding accounting registers are contained in paragraph 3 of Art. 10 of the Federal Law “On Accounting”. The difference is that, according to the addition made to Art. 314 of the Tax Code of the Russian Federation by Federal Law No. 57-FZ of May 29, 2002, correction of an error in the tax accounting register must be justified and confirmed by the signature of not just the person who made the correction, but the responsible person (apparently, this addition implies that corrections in the register tax records can only be entered by the persons who compiled and signed this register). In addition, when making a correction to the accounting register, the Federal Law “On Accounting” does not provide (but, obviously, it implies) indicating in the register the justification for the correction made.

| Forward |

Required details

The lack of unified formats does not give taxpayers absolute freedom in creating registers. Thus, officials have provided a number of mandatory details, in the absence of which the document cannot be considered RNU. These include:

- Name of accounting documentation. For example, a company decided to use a payslip as the RNU for personal income tax. Therefore, the name of the document “payroll” cannot be left. The form must be adjusted by changing the name, otherwise the document cannot be considered a NU register.

- Compilation date and period. These details should be determined without difficulty. A document that is generated over an indefinite period of time cannot be considered accounting documentation. The date of creation (formation, compilation) must also have a specific meaning.

- Monetary or in-kind expression of transactions. That is, the RNU must necessarily contain information about the expression in which a specific operation was performed. For example, an employee’s income is accrued in rubles or received in kind.

- Name of the business transaction. Any fact of the entity’s economic activity must be reflected in accounting, and therefore, the operation must have a specific name. For example, income is accrued, a deduction is provided, tax is withheld, an insurance premium is transferred, and so on.

- Information about the responsible executor, his full name, position and signature. Forms of analytical tax accounting registers must be prepared accordingly, and also certified by the signature (with transcript) of the responsible person.

Consequently, analytical RNU are consolidated (generalized) forms of fiscal accounting, the data of which are systematized and grouped accordingly (Chapter 25 of the Tax Code of the Russian Federation) for a certain period of time (reporting period), without division into accounting accounts.

Structure of the 1C object “Accumulation registers”

Information in the accumulation register is stored in the form of records, each of which contains:

- measurement values (describe the sections in which information is stored);

- the corresponding resource values (accumulate the necessary numerical quantitative data).

Figure "Measurements and Resources"

[collapse]

An accounting section can be, for example, warehouse, item, product characteristics, product series, quality.

By specifying the measurements we are interested in, we can obtain the quantity—resource—at any time.

In the context of different dimensions, in the future, for example, you can obtain balances for a specific date.

Design features of the accumulation register:

- Above all, it is necessary to put the measurements that will be most often requested in the system;

- The “Index” property of accumulation register dimensions must be set to dimensions in cases where it is planned to frequently apply selections for the dimension when receiving data and this dimension can have a large number of value options. For example, we have a register “ProductsInWarehouses” (dimensions “Warehouse, Nomenclature”, resource - “Quantity”). It is more correct to index the “Nomenclature”, but the “Warehouse” field should not be indexed, since the number of warehouses in the system, as a rule, is not significant.

Examples

Examples

For example, for the “Free balances” register, which has the following structure:

records that change register resources in the database will look like this:

[collapse]

Accumulation Register Entry Set

An accumulation register record set is a collection of its rows (records) that exists in computer memory.

A set of records is always tied to a specific recorder document (i.e., determined by the recorder document), since there cannot be independent accumulation registers. Operating with a set of records, you can read this data from the database, delete it, change it, and add it under certain conditions. When writing, it usually replaces all records available in the database for a given condition with the records contained in the set. If records are not replaced, then the set is cleared after the write is completed.

The maximum number of records in a set is 999,999,999.

A set of accumulation register entries can be used:

- to change accumulation register entries for a specific registrar;

- to add accumulation register entries for a specific registrar;

- to delete accumulation register entries for a specific registrar;

- to read a set of records for a specific recorder.

If you try to read data into a set of records of the accumulation register with selection set by recorder and measurement , an error will be generated when trying to set selection by measurement, because selection is possible only by registrar.

Important! Selection can only be based on equality.

Since the accumulation register is used to accumulate numeric values, each entry performs a change in the stored resources - a movement . Movements, in general, can either add some increments to stored resources or subtract them:

- receipt movement (“+”) - if an increase in stored resources should be performed;

- flow movement (“-“) - if a decrease in stored resources should be performed.

Along with each entry in the accumulation register, additional arbitrary information can be stored. The accumulation register details are used for this purpose.