Any organization deals with certain financial flows - income and expenses. Revenue is what a business receives or earns.

Definition 1

Expenses are what an organization spends on certain functions or on organizing the operation of the enterprise.

Income can include the profit received from the sale of products, and an example of expenses is the cost of purchasing materials, tools for production, wages, and so on.

In turn, costs can be divided into two types: direct costs and indirect costs.

Let's take a closer look at what it is and how they differ. Any organization must keep records of direct and indirect costs. However, a precise definition of all possible options is not given. You'll have to decide for yourself which ones should be included and where. The Tax Code defines indirect expenses as follows.

Finished works on a similar topic

- Coursework Direct and indirect costs in trade 460 rub.

- Abstract Direct and indirect costs in trade 230 rub.

- Test work Direct and indirect costs in trade 230 rub.

Receive completed work or specialist advice on your educational project Find out the cost

Definition 2

Expenses that are used in calculating income tax and are not direct should be considered indirect costs that are associated with the production or sale of the organization's products.

Dividing costs into such types is necessary for calculating corporate income taxes. Direct expenses are distributed among the organization's products at the end of the month, and indirect expenses are expenses of the reporting period and are taken into account when taxing earnings. Different methods of accounting for them require a clear separation of them and following this when calculating enterprise taxes.

The ratio of direct and indirect costs: the position of the Federal Tax Service and the courts

Why might similar precedents related to lawsuits against the Federal Tax Service arise? Most often, it is because tax authorities recognize the company’s inclusion of certain expenses as indirect as unreasonable.

In this case, the Federal Tax Service simply charges additional income tax, as if the corresponding costs were direct, and obliges the company to pay it. However, the taxpayer always has a chance to defend the legality of his actions and the wrongness of the Federal Tax Service in court.

Example 1

There is a known judicial precedent in which the Supreme Arbitration Court of the Russian Federation recognized as legitimate the negative assessment by the courts of previous instances of the approach of the Federal Tax Service to the classification of expenses of one of the companies that produces paper and cardboard (more information about this precedent can be found by reading the determination of the Supreme Arbitration Court of the Russian Federation dated October 19, 2011 No. VAS- 13628/11).

The tax authorities considered that the company did not have the right to include in the structure of indirect costs the costs associated with the production of packaging for the packs of paper it produced. These expenses, as the Federal Tax Service considered, should have been considered direct and could not be used to reduce the tax base in the corresponding period.

However, the arbitrators of the first instance did not agree with the opinion of the Federal Tax Service, since it was established that packaging is not a mandatory component of the production cycle within which the company produces paper. Packaging, as the courts have found, is more of an accompanying component of the delivery, which is not even taken into account when weighing the goods before placing them in the warehouse.

Let us note that in a number of cases the separation of the manufactured product from the packaging may be considered by the court to be not as obvious as in the case discussed above.

Example 2

The Presidium of the Supreme Arbitration Court of the Russian Federation, in resolution No. 8617/10 dated November 2, 2010, established that the costs of purchasing containers, labels, and lids of a plant for the production of alcoholic beverages and food products should be considered as direct expenses. The fact is that the relevant components, as the court considered, cannot be considered as related to the production technology of a particular product of the relevant categories.

Results

So, what should you pay attention to first when determining the list of direct costs of an enterprise:

- Firstly, they must be directly related to the production technology of a particular product. At the same time, the same type of costs, for example those associated with the purchase of packaging, can be considered as a type of direct expense at one enterprise or as an example of indirect costs at another, and this may be due precisely to the technological features of production.

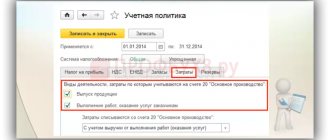

- Secondly, it is undesirable to distinguish between direct expenses in tax and accounting. If the costs on account 20 and the accounts corresponding to it directly form the cost of production and are therefore considered as direct, the corresponding figures should be reflected in the income tax return in the fields intended for them.

- Thirdly, it is extremely undesirable to exclude from direct expenses those that are clearly relevant to those defined at the level of federal regulations. First of all, this is, of course, the list recorded in paragraph 1 of Art. 318 Tax Code of the Russian Federation.

You can study other aspects of the correlation of direct and indirect taxes at an enterprise in the articles:

- “How to divide income tax expenses into direct and indirect?”

- “How to take into account direct and indirect expenses in tax accounting”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.