Almost any organization uses cash to pay for necessary products, provide services, or pay its employees. After all cash control operations are carried out and reports are taken at the end of the shift, in each specific case a certain amount of money remains.

The largest allowable amount of such a balance is the cash limit, that is, an amount larger than this cannot be stored.

All cash in excess of the approved limit should be immediately transferred to the bank. Below we will consider in detail how commercial organizations and private enterprises can calculate the cash limit for 2021, how to correctly draw up an order and, if necessary, fill out an annex to it, who needs to limit the balance of funds, and who can work without it.

We'll tell you which cash register from our catalog is suitable for your business.

Leave a request and receive a consultation within 5 minutes.

Which form was used before and why?

On October 12, 2011, Regulation No. 343-P of the Bank of Russia was adopted. It provided that every institution dealing with cash registers of any variety had to provide instructions on establishing a cash limit.

The latter implies daily accounting of revenue and reconciliation with the norm. If the norm is exceeded, a visit to the bank is required in order to deposit cash into the organization’s bank account.

Moreover, if the organization has several divisions in different cities, then only the top manager, and not the heads of divisions, should sign orders to set the cash limit. This applied to any organizations, including individual entrepreneurs, micro-enterprises and small businesses.

When to place an order for a cash balance limit

The last step after calculating the cash balance will be the issuance of an order approving the cash cash limit. The text of the order must contain information about the amount of the established limit, the beginning of its application and the period of validity. Please note that to calculate the cash balance limit, a form is not required - the calculation of the limit is also given in the text of the order.

You can change the accepted cash limit at any time by issuing an order to cancel the old one and introduce a new limit. If the indicators used in the calculation change over time, there is no need to recalculate the limit using a new one (letter of the Central Bank of the Russian Federation dated February 15, 2012 No. 36-3/25).

Last changes

Practice has shown that such a system is not very effective for small businesses and individual entrepreneurs. The application of this provision is not always possible in existing life circumstances. A large number of organizations have been fined for not complying with the provisions. Perhaps they did not have this opportunity.

It was decided to change the conditions to make business more convenient. Therefore, in 2014, Bank of Russia Directive No. 3210-U was adopted, which significantly softened the conditions for keeping money in the cash register.

Now legal entities whose staff does not exceed 100 people, related to small enterprises and individual entrepreneurs, have the right not to set this limit and not to issue orders in this regard.

By the way, in 2015, the range of enterprises that can classify themselves as small expanded considerably due to changes in the law. Now companies with a level of up to 800 million rubles are considered small. revenue per year (and not 400, as before). There were no changes in other points regarding the recognition of “smallness” (number of people on staff, share of third-party organizations). Moreover, individual entrepreneurs can use this right regardless of the chosen form of taxation.

In what cases is it permissible to exceed the limit?

According to Bank of Russia Directive No. 3210-U, all cash from the cash desk in excess of the established limit that remains at the end of the day must be stored exclusively in bank accounts. The following cases may be exceptions:

- When cash is needed to pay salaries and other payments to employees (scholarships, social benefits, etc.). Moreover, this cash can be on the territory of the organization for no more than 5 days (according to clause 6 of the mentioned Instructions No. 3210-U).

- Weekend. At this time, the company's income and expenditure operations may be carried out, and the bank may be closed. In this case, it is permissible to exceed the cash register limit without consequences in the form of fines.

- Cases of inspections by regulatory authorities at an enterprise. Moreover, these checks must directly relate to financial activities.

When to take cash to the bank

The time frame within which cash in excess of the limit must reach the organization’s current account (at the nearest bank branch) is determined by internal documents, but is clearly regulated. All transactions must be completed within seven days.

The exception is institutions located in remote areas where there are no bank branches. In this case, the period is increased to 14 days. But such an indulgence requires documented permission.

Important! If a company has several branches, then each one separately sets the amount of cash, after exceeding which the employee is obliged to hand over the money to the bank.

But calculations should be made based on the same figures as in other departments. So, if it is necessary to draw up this document, it makes sense to request a similar paper from your colleagues from another department and draw up a new one on its basis. These rules do not in any way apply to amounts to be paid to employees as wages, stipends, benefits or other benefits.

How to calculate the cash balance limit at the cash register

The enterprise determines its cash limit independently, guided by the Appendix to the Directive of the Central Bank of the Russian Federation No. 3210-U, and taking into account that the amount of the limit is influenced by the nature of the company’s activities, the volume of receipts and cash issuance. Newly created companies must take into account the expected volume of their revenues and payments when calculating.

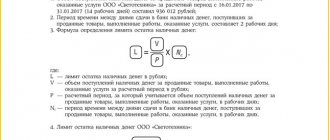

The Appendix to the Central Bank Directive contains two options for calculating the cash balance limit at the cash desk.

Option 1

This method is based on the company’s revenue (actual or planned), and is more suitable for those who often sell goods or provide services for cash.

Cash balance limit formula:

- L = V/P x Nс

Let's decipher:

- L – cash limit;

- V – the amount of cash revenue received for goods, services or work during the billing period;

- P – settlement period of no more than 92 working days of the legal entity; it can take into account “peak” volumes of receipts, as well as the dynamics of cash receipts in similar periods of previous years;

- Nс – time period in working days, between the days of depositing incoming “cash” to the bank (for example, to calculate the cash balance limit when depositing money once every 5 days, Nс = 5). This period cannot last more than 7 working days, and in areas where there is no bank - more than 14 working days.

An example of calculating the cash limit for 2021 from revenue:

The receipt of cash proceeds to the cash desk of Almaz LLC in the 4th quarter of 2017 amounted to: in October 200,500 rubles; in November - 306,000 rubles, in December - 415,500 rubles. Cash is deposited at the bank every day. How to calculate the cash balance limit?

Let's calculate the limit using the above formula:

(200,500 rub. + 306,000 rub. + 415,500 rub.) / (22 days + 21 days + 21 days) x 1 = 14,406 rub.

The resulting limit should be rounded to whole rubles, as required by the rounding rules and the Federal Tax Service in its letter dated 03/06/2014 No. ED-4-2/4116.

Option 2

If, mainly paying for the purchase of goods, provision of services, etc. (or planning to do this), then the second option for calculating the establishment of a cash balance limit for the enterprise is more suitable for her.

The formula for it is as follows:

- L = R/P x Nn

Here:

- R – the amount of cash issued during the billing period, excluding salaries, stipends and other payments to employees. If y, it is necessary to take into account the cash that is stored with them, except in the case of establishing a separate limit for the balance of cash in the cash desk for separate divisions;

- P – billing period for which the issuance of “cash” is taken into account (the requirements for it are similar to the first option);

- Nn is the time period between the days of receiving cash from the bank, not counting the receipt of money for salaries, scholarships and other payments to employees. The restrictions on its duration are the same as for the Nc indicator in the first option.

An example of calculating the cash balance limit for 2021 from the volume of cash expenses:

Granit LLC in the 4th quarter of 2021 issued “cash” to its employees to account for payment for goods and services in the following amount: October - 20,000 rubles; November – 16,000 rubles, December – 56,000 rubles). Money was withdrawn from the current account once every 4 working days. What cash balance limit is set in this case?

(20,000 rub. + 16,000 rub. + 56,000 rub.) / (22 days + 21 days + 21 days) x 4 = 5,750 rub.

How to draw up an order to cancel the cash limit

The order should consist of two or three points:

- The first must contain the date from which the cash register limit is considered canceled, and the number of the order (with dating) that established it.

- The second paragraph should highlight the reason why the restriction may be lifted. For example, the organization is classified as a small business.

- At the bottom of the document there must be a signature of the manager with a transcript.

How to calculate the cash limit for 2021

The upper limit of the volume available for storage in an organization can be determined using one of the formulas established by the Central Bank and given in the appendix to Directive No. 3210-U. When making calculations, you should be guided not only by the document presented, but also by assessing the nature of the business activity, as well as the amount of incoming and paid cash.

The Central Bank of the Russian Federation offers both entrepreneurs and large companies two ways to calculate the allowable balance. But during a tax audit, you will most likely have to justify your choice to the inspector.

For comfort

There may be one more item in the order. It is optional, but will be useful if the manager needs to replenish the current account with cash from the cash register without issuing written orders. This is very convenient, but many companies lose sight of this nuance and then face the problem of withdrawal.

This paragraph might sound like this:

“I order the cashier of LLC “______” (or full name) to hand over the proceeds in cash to the bank “____” by oral order if it is necessary to replenish the current account.”

Storing excess amounts

In a standard situation, at the end of the working day, the company should not have cash in excess of the established minimum amount. But the law provides for exceptions. Exceeding is permitted:

- on paydays;

- if funds were received from the bank for settlements on weekends (holidays);

- on days of social payments and scholarships.

Attention! Money is transferred from the bank only when it is really needed on holidays (weekends).

If there is no order to cancel

Initially, the cash limit of each organization is considered zero. If funds accumulate in the cash register, but do not appear within a week in the company’s bank account, then the institution will face administrative liability in the form of a fine in accordance with clause 1 of Art. 15 Code of Administrative Offenses of the Russian Federation.

Even if the previous order establishing a limit referred to an old document (Regulation No. 343-P of the Bank of Russia of 2011) or did not have an appendix, it is still considered the main one when deciding whether an organization has a cash limit or not.

Moreover, if specific deadlines are not specified there, then the paper is considered valid all the time, until cancelled.

Thus, even for those organizations that did not issue the order of establishment, the order of cancellation will be necessary.

Cash limit: basic rules

If you do not document the required amount of the balance, then by default it will be zero, that is, any cash will already exceed the norm. If funds are kept for salaries, bonuses, travel allowances or scholarships, then this is not considered a violation.

Also, exceeding the approved balance is allowed on weekends and public holidays provided for by law, if the institution continues to operate during this period.

1. Ask our specialist a question at the end of the article. 2. Get detailed advice and a full description of the nuances! 3. Or find a ready-made answer in the comments of our readers.

Overestimating or underestimating the amount when calculating the cash limit

In rare cases, companies, in order to achieve their own goals, indicate underestimated or overestimated acceptable amounts for storage. Both options have a negative impact on the business processes of the enterprise.

An understatement of the cash balance will lead to the fact that trustees will have to more often take excess funds to the bank, and this will require extra work time to carry out transactions and money to pay bank commissions.

Exceeding the established limit entails penalties: for the head of an enterprise, fines reach 5 thousand rubles, for an organization - 50 thousand rubles.

Exceeding the cash limit

If the previously approved balance has been exceeded, it is recommended to issue the extra money on account. Moreover, the amount of this amount is not limited by law. The only condition is a completed application or administrative document for the issuance of cash (clause 6.3 of the Central Bank Directive No. 3210-U).

An accountable person has the right to take money in excess of the established limit for cash payments of 100 thousand rubles, but the employee does not have the right to deposit it into the cash desk of a third-party institution, acting on behalf of a legal entity.

Registration with the Federal Tax Service in just 1 day without visiting the tax office!

Leave a request and receive a consultation within 5 minutes.

Conducting cash transactions

In accordance with Directive No. 3210-U, “legal entities and individual entrepreneurs can conduct cash transactions electronically. Cash transactions are formalized by incoming cash orders 0310001, outgoing cash orders 0310002 (hereinafter referred to as cash documents).

Cash documents can be drawn up:

- Chief accountants, bookkeepers, or other officials with whom an agreement for accounting has been concluded, as well as managers (in the absence of a chief accountant and accountant).

- Cash documents are signed by the chief accountant or accountant (in their absence by the manager), as well as by the cashier.

- The cashier is provided with a seal (stamp) containing details confirming the cash transaction, as well as sample signatures of authorized persons.

Cash received at the cash register and cash issued from the cash register are recorded in cash book 0310004.

Responsibility for conducting cash transactions

The absence of primary documents or registers of accounting or tax accounting is qualified by the tax code “as a gross violation of the rules for accounting for income and expenses and objects of taxation.” Article 120 of the Tax Code of the Russian Federation provides for liability for this violation in the form of a fine in the amount of 10,000 rubles for a violation in one tax period, 30,000 rubles if the violations were committed during more than one tax period. The same acts that resulted in an understatement of the tax base entail a fine in the amount of 20% of the amount of unpaid tax, but not less than 40,000 rubles.

Right to refuse cash limit

For individual entrepreneurs, as well as certain categories of organizations and enterprises, the law provides the right to refuse to maintain the maximum established financial indicator at the cash desk.

Those commercial organizations that belong to the small business sector can take advantage of this right. This right also applies to all individual entrepreneurs, regardless of the tax regime they use.

The right to refuse a cash limit does not imply any special rules or actions; simple compliance with certain parameters is quite sufficient:

- the marginal income indicator should be no more than 800 thousand rubles excluding VAT for goods sold or services rendered;

- limited number of employees (over the last calendar year, the number of employees in the organization should not exceed 100 people);

- No more than a quarter of the share of other legal entities should participate in the authorized capital.

If a company meets these requirements, it can keep an unlimited amount of funds on hand.

In situations where the right to no cash limit arises not from the very moment of registration of the company, but directly in the course of its activities, then in order to exercise this right, the management of the enterprise will need to take the following steps:

- cancel in a written resolution the previously issued order establishing a cash limit;

- issue a new order with the stated condition that there is no cash limit (from what date).

Results

The figure corresponding to the amount above which the cash balance in the legal entity’s operating cash desk at the end of the working day cannot be exceeded should be determined by the legal entity itself, using a legally established formula. The formula has 2 outwardly identical options, which differ fundamentally in the characteristics of the volume of cash money involved in the calculation: this is either the volume of sales or the volume of payments for a certain period. Other indicators included in the formula are similar in meaning, but their meanings depend on what specific (sales or payments) volume of cash is taken as the basis for the calculation.

Sources

- https://assistentus.ru/kassa/limit/

- https://buh-aktiv.ru/limit-kassy-soblyudat-ili-otkazatsya/

- https://twojbuhgalter.ru/limit-ostatka-denezhnyx-sredstv-v-kasse-ustanavlivaetsya/

- https://ZnayDelo.ru/buhgalteriya/raschet-limita-kassy.html

- https://praktibuh.ru/buhuchet/denezhnye-sredstva/nalichnye/uchet/limit-ostatka-kassy.html

- https://nalogovaya.ru/article/bukhgalterskiy-uchet/limit-kassy

- https://spravochnick.ru/buhgalterskiy_uchet_i_audit/gornye_iskopaemye_resursy/prevyshenie_limita_kassy/

- https://nalog-nalog.ru/buhgalterskij_uchet/vedenie_buhgalterskogo_ucheta/kassovaya_disciplina_limit_ostatka_kassy/