Starting with reporting for the 1st quarter of 2021, a new form of the Calculation of Insurance Premiums . Let's consider what changes have been made to the new form, the differences of the new DAM form from 2021.

The new form of calculation of insurance premiums was approved by Order of the Federal Tax Service dated September 18, 2019 N ММВ-7-11/ [email protected] and is applied from reporting for the 1st quarter of 2021.

Starting with reporting for 2021, the DAM is due:

- only in electronic form with CEP, if the average number of employees is > 10 people;

- in paper form (optional), if the average number of employees is <= 10 people.

Legal basis and general filling rules

Contributions to extra-budgetary funds from 2021 are controlled by the tax authorities. In this regard, a new reporting form has appeared, submitted to the Federal Tax Service quarterly - calculation of insurance premiums (DAM). We can say that it is a kind of “hybrid” of the RSV-1 report, which was previously submitted to the Pension Fund and forms 4-FSS.

The new report became effective in the 1st quarter of 2021. But his form was, naturally, approved in advance - by order of the Federal Tax Service of the Russian Federation dated October 10, 2016 No. MMV-7-11/551. The same document also approved the procedure for filling out the DAM (hereinafter referred to as the Procedure). A new DAM form for reporting for the 2nd quarter of 2021 was not approved, so you need to fill out the “old” form.

All employers, both legal entities and individuals, are required to fill out the DAM. The latter include not only entrepreneurs, but also those who use the services of hired workers (lawyers, notaries, heads of peasant farms). The report must be submitted even if no activity was carried out during the reporting period and wages were not accrued.

Calculation of insurance premiums: sample filling

Spartak LLC produces sports shoes made of leather. The company employs 16 people. During the first 6 months of 2018, employees did not take sick leave, no one was fired or hired. All members of the workforce are registered under employment contracts and are insured persons in the pension, social and health insurance systems. The company submitted the calculation of insurance premiums for the 2nd quarter to the Federal Tax Service on July 20, 2021. The report was compiled based on the data given in Table 1:

Table 1

| Month | Accrued salary, rub. | Pension insurance contributions rub. | Contributions for insurance in case of temporary disability, rub. | Compulsory medical insurance, rub. |

| 22% | 2,90% | 5,10% | ||

| 1 | 525 450,45 | 115 599,10 | 15 238,06 | 26 797,97 |

| 2 | 600 041,85 | 132 009,21 | 17 401,21 | 30 602,13 |

| 3 | 499 895,45 | 109 977,00 | 14 496,97 | 25 494,67 |

| Total for 1 quarter | 1 625 387,75 | 357 585,3 | 47 136,24 | 82 894,78 |

| 4 | 524 782,33 | 115 452,11 | 15 218,69 | 26 763,90 |

| 5 | 527 458,99 | 116 040,98 | 15 296,31 | 26 900,41 |

| 6 | 522 667,88 | 114 986,93 | 15 157,37 | 26 656,06 |

| Total for the 2nd quarter: | 1 574 909,20 | 346 480,02 | 45 672,37 | 80 320,37 |

| Total for the first half of 2021: | 3 200 296,95 | 704 065,33 | 92 808,61 | 163 215,14 |

Filling out the DAM for the 2nd quarter of 2021 begins with the preparation of the Title Page. It contains the registration codes of TIN and KPP, the code of the tax authority to which the form is submitted. The billing period and type of taxpayer are indicated by special codes:

- code 31 indicates that the information is provided for half a year;

- code 214 means that the report is submitted by the Russian taxpayer at his location.

The name of the enterprise is indicated in the DAM 2018 without abbreviations. Telephone numbers must be entered indicating the operator or city code; between the code and the telephone number there are not brackets, but spaces. The numbering in the document is continuous; only completed sheets are taken into account. Text data is entered in capital block letters; when entering data manually, a pen with black/blue ink is used. The activity code is taken from the OKVED2 directory.

How should the RSV be drawn up - sample filling:

- Section 1 contains summary data on the amounts of accrued insurance premiums (it is advisable to fill out this section last):

- in lines 020, 040, 100, the current KBK codes for each type of insurance premium are entered;

- in column 030 the total amount of contributions to pension insurance is entered from the beginning of the year to the last date of the reporting interval; lines 031-033 provide a monthly breakdown of contributions to pension insurance for the period from April to June;

- total contributions to the Compulsory Medical Insurance Fund are reflected in line 050, the breakdown for recent months is given in cells 051-053;

- the total value of social insurance contributions is recorded in column 110, the details of the amounts for the previous quarter are carried out in lines 111-113.

- In Appendix 1 to the DAM for the 2nd quarter of 2021, it is necessary to enter data by subsection on the calculation bases for different types of contributions and accrued amounts payable (total from the beginning of the year, for the last quarter and with breakdown for the last 3 months). Data on pension contributions are given in subsection 1.1, for the Compulsory Medical Insurance Fund - in subsection 1.2. The number of personnel as of different dates must be included.

- The calculation of insurance premiums (2018) in case of temporary disability is reflected in Appendix 2. Since employees did not have sick leave in the first half of the year, Appendices 3 and 4 do not need to be filled out.

- Section 2 according to the conditions of the example does not need to be filled out - this block of the report is devoted to the obligations of the heads of farms.

- Section 3 of the Calculation of Insurance Premiums for the 2nd Quarter of 2021 will contain personalized accounting data for all employees - insured persons. Information is entered separately for each employee (2 pages of report per person). The company employs 16 people - insured persons, which means that the third section will contain 32 pages.

We will look at an example of entering personalized data into the DAM based on the income of one employee of Spartak LLC, marketer A.S. Dzyuba, shown in Table 2:

table 2

| MONTH | Accrued salary, rub. | Contributions to pension insurance, rub. | Contributions for insurance in case of temporary disability, rub. | Compulsory medical insurance, rub. |

| 22% | 2,90% | 5,10% | ||

| 1 | 33 345,66 | 7 336,05 | 967,02 | 1700,63 |

| 2 | 33 547,88 | 7 380,53 | 972,89 | 1710,94 |

| 3 | 24 589,55 | 5 409,70 | 713,10 | 1254,07 |

| Total for 1st quarter: | 91 483,09 | 20 126,28 | 2653,01 | 4665,64 |

| 4 | 38 457,88 | 8 460,73 | 1 115,28 | 1961,35 |

| 5 | 30 548,44 | 6 720,66 | 885,90 | 1557,97 |

| 6 | 42 522,88 | 9 355,03 | 1 233,16 | 2168,67 |

| Total for the 2nd quarter: | 111 529,20 | 24 536,42 | 3 234,34 | 5687,99 |

| Total for the half year: | 203 012,29 | 44 662,70 | 5 887,35 | 10 353,63 |

Line 040 for the first employee will have the value “1”, for the second “2”, etc. according to the number of completed information in section 3. The employee’s passport details, his SNILS and citizenship are provided. The breakdown of income and calculated contributions is reflected in a monthly breakdown for the last quarter and a total amount for three months.

Composition of the calculation and mandatory composition

The form includes a significant number of sheets. But you are not required to fill out all of them. There are several sections that are mandatory for all employers, and everyone else uses them as needed.

The minimum composition of the report looks like this:

- Title page.

- Sec. 1, containing general information about accrued insurance premiums. There are 10 applications for it, each of which is dedicated to a specific payment calculation option. Only the Appendix must be completed. 1 (subsections 1.1 and 1.2), as well as App. 2 and 3, which relate to the basic options for calculating contributions.

- Sec. 3, which contains personal data of all income recipients.

All other sheets of the report must be completed if they correspond to the status of the employer or the types of payments that it makes.

We will consider the rules for filling out not by numbering the sheets, but in the order of “mandatory” - first the sheets common to all, and then the rest.

A sample of the DAM registration for the 2nd quarter of 2021 can be seen and downloaded here .

Title page

This section of the report contains information about the originator and the form itself:

- The TIN code allows you to identify the report preparer as a taxpayer. For legal entities it consists of 10 characters, for individuals - of 12.

- The KPP code (reason for registration) is assigned only to legal entities. The fact is that organizations can be registered in several divisions of the Federal Tax Service - not only at the place of primary registration, but also where the branch, real estate, etc. are located. The basis for registration in this inspection is indicated by the checkpoint code.

- The correction number indicates whether the submitted report is primary or corrected. For primary, indicate the code 0–, then 1–, 2–, etc.

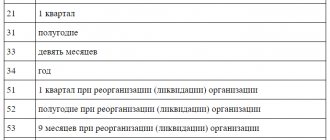

- The billing (reporting period) is indicated by a two-digit code. He is chosen from App. 3 to Order. For the report for the second quarter of 2021 (or rather, for the half-year, since reporting periods are determined on an accrual basis), code 31 is used.

- The calendar year is indicated in four-digit format; for the current year it is 2021.

- Field “Provided to the tax authority” - here the code of the department of the Federal Tax Service of the Russian Federation is given in a four-digit format.

- Field “At location (registration)” - indicate the basis for submitting the form to this inspection. Codes are taken from Appendix. 4 to Order. For example, for a report provided by a Russian organization at the place of registration of the parent company, this is 214, and at the location of the branch - 222.

- Field “Name (full name)” - we provide the full name of the organization (branch) in accordance with the charter. For an individual, you must indicate your full name without abbreviations.

- The code for the type of economic activity is indicated in accordance with the all-Russian classifier OKVED-2.

- The fields “Form of reorganization (liquidation)” and “TIN (KPP) of the reorganized organization” are filled in if the report is submitted by the legal successor. The reorganization form code is selected from Appendix. 2 to Order. In this case, you need to keep in mind that for the successor’s report in App. 3 provides separate codes for reporting periods.

- Contact phone number.

- The number of sheets of the report itself and supporting documents (if any).

- Information about the person who signed the report (full name, signature, date). For an organization, this must be a manager or other person who has the right to sign. The individual signs the report independently. A representative can also sign the form on behalf of the payer; in this case, in the appropriate field, you must indicate the representative code - 2 and fill out information about the power of attorney.

Section 1

This section contains general information about insurance premiums of all types that the payer is required to transfer to the funds. It begins with the OKTMO code corresponding to the municipality where the fees are paid.

A separate block is dedicated to each type of contribution. The first four of them are filled out according to the same rules, so let’s look at them using the example of pension contributions (lines 020-033):

- On page 020 the BCC for this type of contribution is indicated.

- On page 030, the total amount payable for the billing period is given (in this case, for the 1st half of 2021)

- Pages 031-033 separately show the insurance premiums that must be paid for the last three months of the period (April, May, June).

Similarly, fill out the blocks for the following types of contributions:

- For compulsory health insurance (pp. 040-053)

- For compulsory pension insurance at an additional tariff (p. 060-073).

- For additional social security (pp. 080-093).

According to special rules, fill out part of section. 1, dedicated to social insurance in case of illness or in connection with pregnancy and childbirth. This block consists of two parts, since the employer can independently make social expenses (pay sick leave or maternity benefits).

It starts on page 100, in which the BCC for this type of contribution should be entered. Further, if the amount of contributions accrued for the period is greater than the employer’s social payments, then fill in the following lines:

- Page 110 - the total amount of contributions payable for the reporting period, taking into account the employer’s expenses.

- Page 111-113 - amounts payable for the last three months of the period.

If expenses on social payments exceed the amount of accrued contributions, then the excess amount is entered on pp. 120-123 according to a similar principle.

It is clear that in each case only one of the corresponding lines should be filled in, i.e. lines 110 and 120, 111 and 121, 112 and 122, 113 and 123 cannot be filled in simultaneously.

Calculation of contributions for yourself and the procedure for paying them

What are the contributions paid for individual entrepreneurs in the 3rd quarter of 2020?

Their value depends on the amount of the entrepreneur’s annual income and is established in fixed amounts payable for the entire calendar year, if this income does not exceed 300 thousand rubles. (Article 430 of the Tax Code of the Russian Federation). For 2021 these amounts are:

- for OPS - 32,448 rubles;

- for compulsory medical insurance - 8426 rubles.

Individual entrepreneurs are required to transfer fixed amounts of contributions to the budget no later than December 31 of the year for which they should be paid (clause 2 of Article 432 of the Tax Code of the Russian Federation). There is no other breakdown of terms for such payments, i.e. the individual entrepreneur has the right to choose how he will make transfers: in a single amount or by dividing it into parts. Moreover, the division is also not regulated in any way, so it is not a fact that the issue of paying fixed contributions for individual entrepreneurs in the third quarter will be relevant.

Individual entrepreneurs with an annual income of more than 300 thousand rubles, in addition to the fixed amount, pay an additional 1% of the amount of income exceeding 300 thousand rubles. At the same time, the total amount of payments for the compulsory pension insurance cannot be more than 8 times the fixed amount (subclause 1, clause 1, article 430 of the Tax Code of the Russian Federation). For 2021, this value will be 8 × 32,448 = 259,584 rubles. The additional payment is made at the end of the accounting year no later than July 1 of the following year (Clause 2 of Article 432 of the Tax Code of the Russian Federation).

If the individual entrepreneur’s year is not fully worked out, then the accrued amounts are subject to reduction in a proportion that takes into account the number of months of being in the status of an entrepreneur during the calendar year, and for an incomplete month - the number of similar days. The same rule applies when an individual entrepreneur uses the opportunity to be exempt from insurance payments.

Individual entrepreneurs do not prepare reports on contributions paid for themselves. The exception here is the heads of peasant farms, who are responsible for the annual preparation of such a report with a deadline for its submission no later than January 30 in the coming reporting year.

Appendix 3 to Section 1

It deciphers the insurer's expenses for the purposes of compulsory social insurance. Each line can include up to four indicators:

- Number of cases of payments or their recipients.

- Number of payment days.

- The amount of payments.

- Including paid from the federal budget (if this category of payments provides for this possibility).

Lines Adj. 3 correspond to the types of benefits paid:

- On page 010, the amounts of sick leave are given without taking into account payments to foreign citizens and stateless persons, but including citizens of the states of the Eurasian Economic Union (EAEU).

- On page 011 of them, payments are allocated for external part-time workers.

- Line 020 reflects sick leave paid to foreigners and stateless persons, excluding citizens of the EAEU states.

- On page 021, information on external part-time workers is highlighted, similar to page 011.

- Line 030 reflects payments of maternity benefits.

- On page 031 of them, payments for external part-time workers are allocated.

- On page 040, the amounts of one-time benefits for early registration of pregnant women are indicated.

- On page 050, information is provided on payments of a one-time benefit for the birth of a child.

- On page 060 indicate the amount of monthly child care benefits.

- On page 061 of them, payments for the first child are allocated.

- On page 062 - payments for caring for the second and subsequent children.

- On page 070, they provide payment for additional days to care for disabled children.

- Line 080 reflects insurance premiums accrued for payment from line 070.

- On page 090 they show the amount of the funeral benefit.

- On page 100, all the above types of payments are summed up.

- On page 110 from page 100, unpaid benefits are allocated.

Correct filling of the RSV

In order to avoid errors and inconsistencies in the calculation of insurance premiums, you should check the correctness of its completion using Control Ratios. They were sent by Letters of the Federal Tax Service of Russia dated December 13, 2017 N GD-4-11/25417 and dated December 29, 2017 N GD-4-11/ [email protected] , and are also given in the Appendix to the Letter of the Federal Tax Service of the Russian Federation dated June 15, 2017 N 02- 09-11/04-03-13313.

The calculation is completed correctly if all the equalities listed in the control ratios are met.

The check can be carried out through the “Legal Taxpayer” program. It allows you to detect, among other things, those errors in which the calculation will be considered unsubmitted and will need to be resubmitted.

Section 3 - Personalized Data

This part of the report contains personal information about the insured persons, each of which is dedicated to a separate block:

- On pages 010, 020, 030 indicate the adjustment number, reporting period and year, similar to the title page.

- On pages 040, 050, the serial number of the information and the date of its compilation are given.

- On page 060-150 the personal data of the insured person is provided:

- TIN (line 060),

- SNILS (page 070),

- Full name (page 080-100),

- date of birth (page 110),

- country code (page 120),

- floor (page 130),

- ID document code (page 140),

- details of this document (page 150).

- Lines 160-180 contain the sign of registration of a person in the pension, medical and social insurance systems (1 - registered, 2 - not registered).

- Sec. 3.2.1 (Pages 190-250) contains information on payments in favor of an individual, the base for calculating pension contributions and their amount for the last three months:

- Page 190 - month number (1, 2 or 3).

- Page 200 - letter code of the insured person; he is chosen from Adj. 8 to the Procedure and shows the possibility of using a special mechanism for calculating contributions. The “standard” code for hired workers is “NR”.

- Page 210 - amount of payments.

- Page 220 is the base for calculating pension contributions (within the limit).

- Page 230 - payments under civil contracts are allocated from the base.

- Page 240 - the amount of accrued contributions.

- On page 250, all indicators on pages 210-240 for three months are added up.

- Sec. 3.2.2 is devoted to pension contributions paid at an additional tariff for harmful or dangerous working conditions (Article 428 of the Labor Code of the Russian Federation). Indicators, similar to Sect. 3.2.1, fill out for three months on a monthly basis and in total:

- page 260 - month number;

- page 270 - tariff code selected from Appendix. 5 to the Order and showing the category of the payer;

- line 280 - the amount of payments taxed at the additional tariff;

- line 290 - amount of accrued contributions;

- page 300 - indicators of accrued payments and contributions, summed up for three months.

Filling out the RSV form. Section 3

Fill it out separately for each employee. Please specify:

- in field 040 - a serial number that you define yourself. This can be either the number of personalized information in order (1, 2, 3, etc.) or the employee’s personnel number (Letter of the Federal Tax Service dated January 10, 2017 N BS-4-11 / [email protected] );

- in field 050 - the date of payment;

- in line 120 - for a Russian employee the code is “643”, for a foreigner - the code of his country from OKSM;

- in line 140 - code of the type of document identifying the employee. If it is a Russian passport, write “21”;

The category code of the insured person (column 200) for citizens of the Russian Federation is “NR”. Codes for foreigners: temporarily staying - VPNR, temporarily residing - VZHNR. If you pay contributions at reduced rates on the simplified tax system, the codes will be different: citizens of the Russian Federation - PNED, temporarily staying foreigners - VPED, temporarily residing foreigners - VZhED.

In columns 210 - 250, show payments to the employee and accrued contributions to compulsory pension insurance from a base not exceeding the limit for the 2nd quarter - monthly and in total.

Section 3 must be completed for all insured persons for the last three months of the billing (reporting) period, including persons in whose favor payments were accrued during the reporting period within the framework of employment relationships and contracts listed in clause 22.1 of the Procedure for filling out the calculation of insurance premiums .

The procedure for filling out the details in section. 3 explained by the Federal Tax Service of Russia in Letter dated December 21, 2017 N GD-4-11/ [email protected]

In subsection 3.1 section. 3 indicates the personal data of the individual who is the recipient of the income: full name, tax identification number, SNILS, etc. (clauses 22.8 - 22.19 of the Procedure for filling out the calculation of insurance premiums).

the SZV-M form , which was accepted by the Pension Fund of Russia (Letter of the Federal Tax Service of Russia dated October 31, 2017 N GD-4-11/22115).

If an individual has not reported the TIN, you can use the online service “Find out TIN” on the website of the Federal Tax Service of Russia. When there is no information about the TIN, on page 060 section. 3 calculations are marked with a dash. The tax authority will accept such a calculation (Letter of the Federal Tax Service of Russia dated November 16, 2017 N GD-4-11 / [email protected] , clause 2.20 of the Procedure for filling out calculations for insurance premiums).

In subsection 3.2 section. 3 indicates information about the amounts of payments calculated in favor of an individual, as well as information about accrued insurance premiums for compulsory health insurance (clauses 22.20 - 22.36 of the Procedure for filling out calculations for insurance premiums).

For persons who did not receive payments for the last three months of the reporting (calculation) period, subsection 3.2 section. 3 does not need to be filled out (clause 22.2 of the Procedure for filling out the calculation of insurance premiums).

Additional report sheets

Not all payers fill out the parts of the form discussed below. The need to include them in the report is related to certain characteristics of the insured (organizational and legal form, type of activity, taxation system, eligibility for various benefits, etc.).

The sheet “Information about an individual who is not an individual entrepreneur”, if necessary, serves as an addition to the title page. It is filled out if the form is submitted by an individual who has not indicated his TIN. The personal data this sheet contains allows you to identify such a report submitter:

- Date and place of birth.

- Citizenship.

- Details of the identity document

- Residence address in the Russian Federation (for foreigners you can indicate the address of business).

Other 1.3 App. 1 to section 1 is devoted to the calculation of pension insurance contributions at an additional tariff for insured persons working in harmful or dangerous working conditions (Article 428 of the Tax Code of the Russian Federation). The number of such persons, the basis for applying the tariff, the amount of payments, the basis for calculation and the amount of the additional contributions themselves are indicated.

Other 1.4 adj. 1 to section 1 contains the calculation of additional social contributions to provide for civilian pilots and coal miners. The category and number of such persons, the amount of payments, the basis for calculation and the amount of contributions are indicated.

Adj. 4 to section 1 is filled with information about excess payments of social benefits at the expense of the federal budget to citizens affected by radiation disasters (Chernobyl Nuclear Power Plant, Mayak Production Association and Semipalatinsk Test Site). Payments are shown separately for each accident and by type of benefit.

Adj. 5 to section 1 applies only to organizations operating in the field of information technology. In accordance with sub. 3 clause 1 and clause 5 art. 427 of the Tax Code of the Russian Federation, these companies have the right to apply reduced insurance rates. This application indicates the average number of employees (must be more than 7 people) and calculates the share of income from preferential activities in its total amount (must be more than 90%). Information about the company’s state accreditation is also indicated here.

Adj. 6 to section 1 applies to simplifiers who are engaged in certain types of activities listed in subparagraph. 5 p. 1 art. 427 Tax Code of the Russian Federation. Here the share of income from preferential types in the total income of the payer is calculated (must be at least 70%).

Adj. 7 to section 1 applies to non-profit organizations operating on the simplified tax system and engaged in socially significant activities (subclause 7, clause 1, article 427 of the Tax Code of the Russian Federation). They can apply a benefit on contributions if the income from these types of activities, as well as from grants and targeted income, totals at least 70% of the revenue. To confirm this, fill out the Appendix. 7.

Adj. 8 to section 1 is used to confirm the right to benefits by entrepreneurs working in the patent system (subclause 7, clause 1, article 427 of the Tax Code of the Russian Federation). It contains information about the patent and the amount of payments to individuals engaged in the activities specified in the patent.

Adj. 9 to section 1 contains information for the application of a special tariff of social insurance contributions for foreign workers (with the exception of highly qualified specialists and citizens of EAEU member states). Indicate the full name, INN, SNILS, citizenship and amount of payments for each such employee.

Adj. 10 to section 1 is necessary to confirm the right to exemption from insurance premiums for payments to students for work in student teams (subclause 1, clause 3, article 422 of the Tax Code of the Russian Federation). Indicate the amount of payments, full names of students, documents confirming the facts of membership in the detachment and full-time study. In addition, to apply the benefit, the detachment must be included in the state register. Information from it is also indicated in Appendix. 10.

Sec. 2 is filled out only by the heads of peasant farms. It contains personal data of each member of the peasant farm and the amount of accrued contributions: both for the peasant farm as a whole, and for each participant individually.

Filling out the RSV form. What to fill out and what not to fill out

The calculation of insurance premiums must be filled out in the form approved by Order of the Federal Tax Service of Russia dated October 10, 2016 N ММВ-7-11 / [email protected] , in accordance with the Procedure given in Appendix No. 2 to this Order.

The list of structural units that the calculation includes is given in clause 2.1 of the Procedure for filling out the calculation of insurance premiums.

Organizations and individual entrepreneurs making payments to individuals must include in the calculation of insurance premiums (clauses 2.2, 2.4 of the Procedure for filling out the calculation of insurance premiums):

- 1) title page;

- 2) section 1;

- 3) subsections 1.1 and 1.2 of Appendix 1 to section 1;

- 4) Appendix 2 to section 1;

- 5) section 3.

Payers of insurance premiums submit calculations in the specified composition, regardless of the activity being carried out (Letters of the Federal Tax Service of Russia dated 04/02/2018 N GD-4-11 / [email protected] , dated 04/12/2017 N BS-4-11/ [email protected] ).

If you accrued and paid benefits at the expense of the Social Insurance Fund, also fill out Appendix 3 to Section. 1.

Additionally, you need to fill out (clauses 2.6, 2.7 of the Procedure for filling out the calculation):

- Subsections 1.3.1 - 1.3.2, if you calculated contributions to the compulsory pension insurance at additional tariffs;

- Appendix 5 to section. 1, if you are an IT organization that charges contributions at reduced rates;

- Appendix 6 to section. 1, if you are charging contributions at reduced rates using the simplified tax system;

- Appendix 9 to section. 1, if you employ temporary foreigners.

Section 2 and Appendix 1 to this section are included in the calculation of insurance premiums of the head of the peasant farm (clause 2.5 of the Procedure for filling out the calculation of insurance premiums).

If there are no indicators, then when drawing up the calculation you should take into account the rules of clause 2.20 of the Procedure for filling out the calculation of insurance premiums:

- when there is no quantitative or summary indicator, you need to indicate the value “0” (“zero”);

- in other cases, a dash is placed in all familiar places in the corresponding field.

In practice, it happens that insurance premium payers submit a “zero” calculation, in which all quantitative and total indicators are filled in with the value “0” (“zero”). If an organization does not conduct financial and economic activities, this does not affect its obligation to submit calculations for insurance premiums. For periods in which it did not make payments and other remuneration in favor of individuals, it is necessary to fill out and submit a calculation with zero indicators (Letters of the Ministry of Finance of Russia dated 03/24/2017 N 03-15-07/17273, Federal Tax Service of Russia dated 04/02/2018 N ГД -4-11/ [email protected] , dated 04/12/2017 N BS-4-11/ [email protected] ).

For payments not subject to insurance premiums , the following rules apply:

- the amounts of payments and other remuneration that are not recognized as the object of taxation are not given in the calculation;

- amounts of payments that must be subject to contributions, but according to paragraphs 1, 2 of Art. 422 of the Tax Code of the Russian Federation are exempt from taxation and are included in the calculation.

Thus, the base for calculating insurance premiums is defined as the difference between the amount of payments and other remunerations subject to insurance premiums and the amount not subject to taxation in accordance with Art. 422 Tax Code of the Russian Federation . Reason - Letter of the Federal Tax Service of Russia dated 08.08.2017 N GD-4-11/ [email protected]

Procedure for submitting a report and sanctions for violations

The deadline for the DAM form for the reporting period is no later than the 30th day of the month following the reporting period (clause 7 of Article 431 of the Tax Code of the Russian Federation). Thus, the report on insurance premiums for the 2nd quarter of 2018 must be submitted no later than July 30, 2018.

Sanctions for violation of deadlines for submitting a report are provided for in paragraph 1 of Art. 119 of the Tax Code of the Russian Federation. The fine is 5% of the amount of unpaid contributions for each month of delay (including incomplete ones). A maximum fine (30% of the amount of arrears) and a minimum fine (1,000 rubles) have also been established. Thus, if the report is submitted in violation of the deadlines, but all contributions are paid on time, then the fine will be fixed - 1,000 rubles.

Tax authorities cannot block an invoice for failure to submit calculations for insurance premiums for the reporting period, since it is not a tax return (letter of the Ministry of Finance dated April 21, 2017 No. 03-02-07/2/24123).

Who, where, when and in what form submit RSV

Who should submit insurance premium payments?

Filling out the RSV form. Let's start first with who submits the Calculation of Insurance Premiums:

- persons making payments to individuals : organizations, individual entrepreneurs, individuals who are not individual entrepreneurs. The exception is individuals who make payments specified in paragraphs. 3 p. 3 art. 422 of the Tax Code of the Russian Federation (clause 1, clause 1, article 419, clause 7, article 431 of the Tax Code of the Russian Federation);

- heads of peasant farms (clause 3 of article 432 of the Tax Code of the Russian Federation).

Where should I submit my insurance premium payments?

Persons making payments to individuals submit calculations of insurance premiums to the tax authority:

- organizations - at their location and at the location of separate divisions that pay payments to individuals. If a separate division is located outside the Russian Federation, then the organization submits the calculation for such division to the tax authority at its location (clauses 7, 11, 14 of Article 431 of the Tax Code of the Russian Federation);

- individuals (including individual entrepreneurs) - at the place of residence (Clause 7, Article 431 of the Tax Code of the Russian Federation).

The heads of peasant farms submit calculations for insurance premiums to the tax authority at the place of their registration (clause 3 of Article 432 of the Tax Code of the Russian Federation).