Payment order-request scheme

1. shipment by the seller of products;

2. transfer of the payment order-demand along with shipping documents to the bank that serves the buyer;

3. moving shipping documents to the bank card file that serves the buyer;

4. transfer of a payment order-demand to the buyer;

5. execution of a payment order-demand by the buyer and transferring it to the bank. He accepts it only when there are funds in the buyer’s accounts;

6. transfer of shipping documents to the buyer;

7. the buyer’s bank debits the payment amount from the buyer’s account;

8. The buyer’s bank sends payment orders-requests to the bank that services the seller;

9. the seller’s bank transfers the payment amount to the seller’s account;

10. The bank issues current account statements to its clients.

How to generate a payment order to the tax office

The tax inspectorate has the option to fill out a payment order online quickly and without errors on the official website of the Federal Tax Service of Russia. The service is free. Here you can prepare a new document, check the accuracy of the already drawn up payment document, or make your own online payment through one of the partner banks that have entered into a cooperation agreement with the Federal Tax Service.

Register to access the service, the process will not take much time. But to make a payment in real time you will have to use an electronic signature.

Sample of filling out a payment order for 2021

Content

1. Filling out a payment order 2. Sample payment order 3. How to fill out an online payment order: sample

Payment order is a standard form of document used for settlements with counterparties.

The provisions of 44-FZ stipulate the following types of security for state and municipal contracts:

1) securing an application for participation;

2) ensuring the execution of the contract.

We will define the distinctive features of the above types of security, and also tell you how to correctly draw up a payment order, a sample for each type.

Want to win a quote request?

Take advantage of our achievements! We will help you win at least a third of the quotes!

Win Quote

Filling out a payment order

All participants in public procurement, starting from July 1, 2019, can provide bid security either by transferring funds to the customer’s bank account or by means of a bank guarantee.

In trading under 223-FZ, except for those conducted with the participation of SMP, the previous regulations have been retained: funds are transferred using a payment order to the account of the trading platform.

To participate in other competitive trading procedures, the participant must first open a special account with a financial institution, then transfer the appropriate amounts to the accounts specified in the draft contract.

We transfer money to a special account

To transfer funds to a special account, you must issue an order to write off money from a regular current account and credit it to a special one. This document will be the payment order.

In this situation, the payer and the recipient will be the same person.

But there is some specificity:

1) the number and date of the document must be established in chronological order;

2) details of the payer (main and additional current accounts);

3) bank details (in this case they will be identical);

4) recipient - the participant himself, his TIN, KPP and name of the enterprise are entered;

5) the recipient's account will be the number of a special account created for crediting the application security for participation in the auction.

6) purpose of payment – replenishment of a special account for the amount of the application security.

Example of a completed payment order Download

Do you want to be guaranteed to win tenders? Send a request and get a whole staff of experts at your disposal with payment for results!

Win the tender

Sample payment order

We have already said that for bidding under 223-FZ with the participation of SMP, the procedure for transferring application security remains the same.

For all other cases, you can use the step-by-step instructions below.

1) We indicate the payment order number and the date of completion (in chronological order). We write the payment amount first in words, then in numbers.

2) Information about the payer: name of the executing enterprise, INN, KPP, current account, bank where the current account is opened, BIC of the bank.

3) Recipient data: filled in identically to the “payer” block, ETP registration data, transaction type “01”, payment priority “5” are added.

4) We indicate the purpose of payment, the electronic auction number (if necessary). IMPORTANT: we write “WITHOUT VAT” or “VAT NOT SUBJECT”.

This payment serves as insurance evidence for the customer that possible damage from a contract executed in bad faith or not performed at all will be at least partially compensated.

The amount of security depends on the price of the contract, but should not be less than the amount of the advance, if, of course, there was one.

The details of the payee must be in the contract documents; if they are not there, a corresponding request is sent to the customer.

Important:

in field 101 “Payer status” when filling out a payment order, the value “01” should be indicated, since this payment is classified as budget funds. The KBK value should be set in the recipient's accounting department; the recipient's OKTMO can be found in the classifier. The value of field 105 according to the institution’s TIN is freely available on the official website of the Federal Tax Service. 106 “Basis of payment”: put “0” everywhere.

We list the contract performance security

How to fill out an online payment order: sample.

1) We write the date and number of the payment in chronological order, indicate the payment amount in numbers and words, then the payer status - “01”, fill in the payment details of the paying company.

2) We provide information about the recipient, indicate the priority and purpose of payment, and the type of operation.

A payment order to the tax office can be issued on the official website of the Federal Tax Service.

Back to list

How to prepare a payment order for personal income tax payment

Let's look at an example of filling out a payment order for the State Budget Educational Institution DoD SDYUSSHOR "ALLUR" by field. The amount of income tax for March was 35,000 rubles.

Field 4. Date of payment. The tax must be paid within the established deadlines. For benefits and vacations, create a payment slip no later than the last day of the month for which payments were made. When transferring wages or other income, set a date no later than the day following the day of payment of income to the employee (paragraphs 1 and 2 of paragraph 6 of Article 226 of the Tax Code of the Russian Federation).

We fill out fields 6 and 7 without kopecks, since the tax is calculated and transferred in rubles: 35,000.00 rubles.

In prop 22 put “0”.

Set the payer status (detail 101) to “02”, since the organization acts as a tax agent for employees receiving salaries.

KBK (detail 104) for personal income tax payment - 182 1 0100 110.

Cell 105. OKTMO for your organization must be clarified with the tax office. Cell 106: basis for payment - TP (current period).

107th field. Tax period: MS.03.2021. If we transfer tax on vacation pay or benefits, write down the month and year for which the transfer occurred. In columns 108 and 109 we enter “0”, since there is no data to fill out. The 110th field is empty.

A fully completed personal income tax payment form looks like this.

Nuances

In most cases, four instructions are drawn up:

- the first is needed to write off money at the payer’s bank and remains there, ending up in daily documents;

- the second is stored in the recipient’s bank and is needed for crediting to the second party’s account;

- the third is used as confirmation of the bank transaction and is attached to the account statement of the second party;

- the fourth is given to the payer with a seal imprint as confirmation of payment.

Attention! The banking organization accepts “payments” even if the balance in the payer’s current account is less than the amount specified in the order. The payment order is executed only in the opposite case.

When the payer contacts a banking organization for information about the execution of orders, they are provided to him on the next business day.

Working with the bank

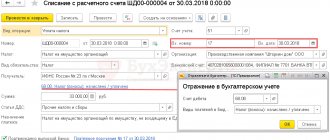

The general scheme of work for a single day with statements in 1C is as follows:

- We download from the bank client into 1C: receipts for yesterday and confirmation of yesterday's outgoing payments (+ commissions)

- We create payment orders that need to be paid today

- We upload them to the client bank

And so every day or any other period.

In the interface, the journal of bank statements is located in the “Bank and Cash Office” section:

How many copies of payment orders need to be issued?

The number of PPs is determined by the number of settlement participants. One remains in the sender's bank, the second - with the client with an acceptance mark, the rest go to the recipient's bank and counterparties. The bank is obliged to accept the PP regardless of whether there is money in the client’s account. If there is not enough money, then the PP is executed later, as soon as funds become available. If an account overdraft agreement has been concluded, the order is processed immediately.

In cases where there are insufficient funds and the bank cannot process the payment, the PP is placed in a special storage facility for orders not paid on time.

The PP has a validity period of 10 days.

How are payment orders processed?

Payments are used to settle accepted obligations and more. The following options are available for public sector employees:

- Payment of obligations to suppliers and contractors, advance payments are acceptable. Indicate the exact details of the accounts and agreement in the assignment. Do not fill in fields 104-110 and 101 and 22. Be sure to indicate VAT in the cost of goods, works, services, and if it is missing, write “Without VAT”.

- Payments for loans and borrowings in banking and financial institutions. Enter the details of the agreement (loan agreement) in field 24. Do not fill in fields 104-110, 101, 22.

- Transfers of wages, advances, vacation pay and benefits to employees of a budgetary institution. Pay attention to filling out the queue (cell 21); for salary, enter “3” (Article 855 of the Civil Code of the Russian Federation). Follow the transfer deadlines specified in the collective agreement. Leave fields 22, 101, 104-110 blank.

- Advances for travel expenses for employees. Indicate the number of the basis document (estimate) in the purpose of payment. Do not fill in the fields to clarify tax payments.

- Transfer of insurance premiums, taxes, fees. Check that the recipient's details and fields 104-110 of the form are filled out correctly. Check the BCC with the Federal Tax Service or the Social Insurance Fund (for payments for injuries).

Let's look at the features of transferring taxes and insurance premiums using an example.