Proper documentation of conservation is a prerequisite for recognizing the costs of its implementation when calculating corporate income tax. Such a decision is formalized by order of the head of the company. The document must indicate the conservation period and list the activities that need to be carried out (clause 63 of the Guidelines for accounting for assets). After all these operations have been carried out, a corresponding act should be drawn up. There is no unified form, so the document is drawn up in any form. The act is signed by the members of the commission and approved by the head. Do not forget to indicate in the document the economic feasibility of conservation. In addition, the act must indicate: the name of the OS itself, transferred to conservation; the date of the transfer, the measures that were taken to “freeze” the funds, and the amount of costs incurred.

The completed primary document will be the basis for taking into account conservation costs in expenses, as well as suspending depreciation on the fixed asset.

Depreciation

Let me remind you that depreciation refers to expenses for ordinary activities, regardless of the results of the organization’s work and is reflected in the accounting records of the reporting period in which it is accrued (clause 5, paragraph 5, clause 8, clause 16 of PBU 10/99). For fixed assets mothballed for three months or less, depreciation during the idle period is accrued in the usual manner. If the asset is “frozen” for a period of more than three months (clause 23 of PBU 6/01, clause 63 of Methodological Instructions No. 91n dated October 13, 2003), then from the first day of the month following the month of transfer to conservation, depreciation is calculated stops.

Decor

Proper documentation of conservation is a prerequisite for recognizing the costs of its implementation when calculating corporate income tax.

The decision on conservation is formalized by order of the head of the organization.

In this order, it is necessary to indicate the conservation period and list the measures that need to be taken to transfer the OS to conservation (clause 63 of the Guidelines for accounting for OS).

After these activities have been carried out, an act on transferring the OS to conservation should be drawn up.

There is no unified form of the act on the transfer of fixed assets for conservation, so it is drawn up in any form.

The act is signed by the members of the commission and approved by the head of the organization. The act reflects the economic feasibility of mothballing a fixed asset object.

The act must indicate:

- OS transferred to conservation;

- date of transfer of the OS for conservation;

- activities that were carried out to transfer the OS to conservation;

- the costs of carrying out these activities.

This act, approved by the head of the organization, will be the primary document in order to:

- take into account conservation costs in expenses;

- suspend the accrual of depreciation on fixed assets transferred to conservation for more than three months.

Maintenance costs

Keep in mind: the costs of maintaining a fixed asset during the period of suspension of its operation do not increase the initial cost of the fixed asset, this follows from paragraph 14 of PBU 6/01. These expenses relate to the period when the facility is not involved in production activities. Consequently, they are not taken into account when determining the cost of production. In addition, these expenses are recognized as other expenses and are reflected in accounting in the month they are incurred in the debit of account 91, subaccount 91-2 “Other expenses”. Postings for conservation of fixed assets will be as follows:

Debit 01 subaccount “Fixed assets in conservation” Credit 01 subaccount “Fixed assets in operation”

— OS is “frozen”;

Debit 91/2 Credit 10 (60, 70, 69)

— conservation costs are reflected;

Debit 01 subaccount “Fixed assets in operation” Credit 01 subaccount “Fixed assets in conservation”

— The OS has been reactivated.

Accounting

After the manager signs the order and approves the act of transferring fixed assets to conservation, the fixed assets are transferred to conservation.

At the same time, in accounting, the object transferred for conservation continues to be included in the OS.

Fixed assets under conservation, along with fixed assets in operation, should be accounted for separately on account 01 “Fixed Assets”.

Therefore, in the organization’s chart of accounts, it is necessary to provide for account 01 “Fixed Assets” a subaccount “Fixed Assets for Conservation”.

Income tax

According to subparagraph 9 of paragraph 1 of Article 265 of the Tax Code, to calculate income tax, the following costs are taken into account in non-operating expenses: conservation (as of the date of approval by the head of the organization of the act of “freezing” the fixed assets), maintenance of the mothballed fixed assets (including repairs and security - as of last the date of the month in which these costs are incurred); for re-preservation (as of the date of approval by the head of the organization of the act on re-preservation of the OS).

The above rules were announced by the Ministry of Finance in letter dated September 15, 2010 No. 03-03-06/1/590. Property tax calculated on the cost of mothballed fixed assets is taken into account in other expenses (clause 1, clause 1, article 264 of the Tax Code of the Russian Federation). The Federal Tax Service reported this in a letter dated August 22, 2012 No. ED-4-3/ [email protected]

Sale of a mothballed fixed asset item at a loss

If the property is sold at a loss, the following features are taken into account.

According to paragraph 2 of Art. 268 of the Tax Code of the Russian Federation, if the purchase price of a product, taking into account the costs associated with its sale, exceeds the proceeds from its sale, the difference between these values is recognized as a taxpayer’s loss, taken into account for tax purposes.

Paragraph 3 of this article provides that if the residual value of depreciable property, taking into account the costs associated with its sale, exceeds the proceeds from its sale, the difference between these values is a taxpayer’s loss, taken into account for tax purposes in the following order:

The resulting loss is included in the taxpayer's other expenses in equal shares over a period defined as the difference between the useful life of this property and the actual period of its operation until the moment of sale.

And only if the remaining SPI is equal to zero or a negative number, then the amount of the resulting loss is recognized by the organization as part of other expenses in full in the month in which the sale occurred (see Letters of the Ministry of Finance dated July 12, 2011 N 03-03-06/ 1/417, dated May 12, 2005 N 03-03-01-04/1/253, etc.).

When selling fixed assets, the taxpayer has the right to reduce income from the said operation by the residual value of these objects.

With simplified tax system

The costs of conservation, re-preservation, as well as the maintenance of the operating system are not taken into account in the tax expenses of the “simplified people”. If an asset is transferred to “freeze” for a period of more than three months, the cost of which has not yet been fully taken into account in expenses, then the inclusion in expenses of the cost of acquiring this asset is suspended for the period of conservation (letter of the Federal Tax Service of Russia dated December 14, 2006 No. 02-6-10 / [email protected] , Federal Tax Service for Moscow dated January 18, 2007 No. 18-03/3/ [email protected] ).

EXAMPLE

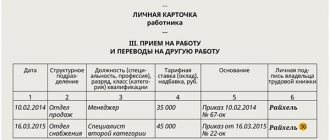

An organization acquired production equipment under a purchase and sale agreement and put it into operation in May 2021.

Its contractual cost is 944,000 rubles. (including VAT RUB 144,000). The equipment belongs to the third depreciation group. The useful life is 38 months (based on the Classification of fixed assets included in depreciation groups, approved by Decree of the Government of the Russian Federation of January 1, 2002 No. 1). Due to a temporary decrease in orders at the end of May 2021, the asset was transferred by decision of the manager for conservation lasting more than three months from June 1 to September 30, 2016. Depreciation is calculated using the straight-line method. Income and expenses are determined using the accrual method. Then, based on the established useful life (38 months), the monthly amount of depreciation charges will be 21,052.63 rubles. (RUB 800,000 / 38 months). Accrual begins on the first day of the month following the month the object was accepted for accounting, in this case, June. At the same time, the accrual of depreciation charges when transferring an asset by decision of the manager to conservation for a period of more than three months is suspended. In this case, by decision, the object was mothballed from June 1 to September 30, 2021. Therefore, no depreciation is charged for the period June–September 2021. And starting from October, depreciation on fixed assets is accrued in the generally established manner. The accountant should make the following entries in the accounting: In May 2021: Debit 08 Credit 60

- 800,000 rubles, expenses for the purchase of equipment are reflected;

Debit 19 Credit 60

- 144,000 rubles, VAT presented by the equipment supplier is reflected;

Debit 68-VAT Credit 19

- 144,000 rubles, accepted for deduction of VAT presented by the equipment supplier;

Debit 01 “OS in operation” Credit 08

- 800,000 rubles, purchased equipment is reflected as part of fixed assets;

Debit 60 Credit 51

- 944,000 rubles, payment for equipment was transferred to the supplier.

In June 2021: Debit 01 “OS on conservation” Credit 01 “OS in operation”

- 800,000 rubles, reflects the initial cost of equipment transferred to conservation.

Upon completion of conservation: Debit “Assets in operation” Credit 01 “Assets in operation”

- 800,000 rubles, the initial cost of the equipment is reflected as part of the fixed asset in operation.

Starting from October 2021 for 38 months: Debit 20 (26.44) Credit 02

- 21,052.63 rubles, depreciation on equipment has been accrued.

How to calculate a loss if the property was mothballed

According to paragraph 3 of Art.

256 of the Tax Code of the Russian Federation, fixed assets transferred by decision of the organization’s management for conservation for a period of more than three months are excluded from depreciable property for the purpose of calculating income tax. When an object of fixed assets is re-mothballed, depreciation is accrued on it in the manner in force before its mothballing, and the useful life is extended for the period that the object is mothballed.

If a taxpayer sells at a loss a fixed asset that, for one reason or another, has been mothballed for more than three months, then when determining the actual service life of this object (on the basis of which the period for writing off the loss is calculated), the mothballing period is not taken into account.

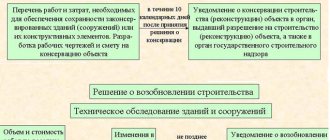

Sequence of operations

The conservation procedure occurs in a certain sequence.

First of all, a decision is made to carry out this procedure by the body of the enterprise that has all the necessary powers for this. After a decision is made, an order is issued that it is necessary to create a commission that deals with conservation issues. The head of this commission should be the head of the enterprise. After the order is issued, it is necessary to create a report stating that the use of fixed assets is impossible. The creation of a report must be approached from a technical and economic perspective.

At the end, an act is created indicating that fixed assets are temporarily removed from the circulation and it is advisable to mothball them. The creation of a commission and the preparation of all documents are optional procedures. In this case, it will be sufficient to provide a decision on conservation.

Fixed assets that have undergone conservation cannot be used by the enterprise. Compliance with this rule is mandatory. It is not recommended to violate it, because the funds that have been preserved are not ready for use. If you ignore this rule, then there is a risk of causing damage to these products by subjecting them to breakage.

If an enterprise has decided to sell or transfer objects that have been mothballed, then in this case it is not necessary to re-mothball them. That is, they can be sold or transferred in the form in which they are located.

About the foundation with a basement

In this case, quite serious problems arise. Preservation of a building requires that the temporary shelter be secure. After all, if water leaks, it can tear the entire structure. In this case, there is one popular method: you need to throw plastic bottles, one-third filled with water, into the basement. Then, when the water freezes, most of the expansion forces will be taken on by bottles immersed in the volume of ice and more susceptible to compression, and the basement will not be damaged. This method allows you to ensure the safety of the structure, but it is desirable to have 3-4 large containers per square meter.

Application of PBU 18/02

As a result of the sale of an fixed asset, an organization forms a deductible temporary difference (DTD) due to the different order of recognition in accounting and tax accounting of a loss from the sale of fixed assets (the loss is recognized at a time in accounting and evenly over a period defined as the difference between its useful life and the actual period of its operation until the moment of sale in tax accounting).

This IVR corresponds to a deferred tax asset (DTA) (clauses 11, 14 of the Accounting Regulations “Accounting for calculations of corporate income tax” PBU 18/02, approved by Order of the Ministry of Finance of Russia dated November 19, 2002 N 114n).

During the period defined as the difference between its useful life and the actual life of its operation until the moment of sale of months (as the loss from the sale of an fixed asset is recognized in tax accounting), the named IVR and ONA are reduced (repaid) (clause 17 of PBU 18/02 ).

Example

Let’s use the data from the above example with the only difference that the fixed asset, which was being preserved, was sold at a price of 531,000 rubles. (including VAT – 81,000 rubles).

For tax purposes, income from sales amounted to 450,000 rubles.0).

When selling a mothballed fixed asset, the organization has the right to reduce the income from this operation by the residual value of this object.

The loss from the sale of property is 150,000 rubles. (450,000 - 600,000).

From the moment equipment depreciation began (March 2012) to the month of its sale (August 2021), 54 months passed.

The period during which the property was conserved (4 months) is excluded from this period.

In fact, the equipment was operated for 50 months (54 - 4).

Therefore, in accordance with paragraph 3 of Art. 268 of the Tax Code of the Russian Federation, the taxpayer will reflect the loss in other expenses for 30 months (80 - 50).

The amount of loss recognized in tax accounting monthly will be 5,000 rubles. (RUB 150,000 / 30 months).

The amount of this loss will be included in other expenses starting in September 2021.

In accounting, the operation of accrual and repayment of IT must be reflected as follows:

Debit 09 Credit 68 “Calculations for corporate income tax” - 30,000 rubles. - ONA accrued (RUB 150,000 x 20%);

Within 30 months:

Debit 68 “Calculations for corporate income tax” Credit 09 – 1,000 rubles. – reduced (repaid) OTA (RUB 30,000 / 30 months).

ORDER

| Developer's name | ||||

| Name of construction | ||||

| LIST OF UNMOUNTED EQUIPMENT, STRUCTURES AND MATERIALS SUBJECT TO PRESERVATION | ||||

| Name of equipment, materials and structures | Unit | Quantity | Unit cost | Total cost (in rubles) |

| 1 | 2 | 3 | 4 | 5 |

| Head of the developer (customer) organization | ||||

| (seal) | (signature) | |||

| Head of contracting construction organization | ||||

| (seal) | (signature) |

| Developer's name | ||

| Name of construction | ||

| LIST OF WORK AND COSTS NECESSARY TO ENSURE THE SAFETY OF CONTACTED BUILDINGS (STRUCTURES) OR THEIR STRUCTURAL ELEMENTS | ||

| Name of objects, structural elements, types of work and costs | Unit | Scope of work to be performed |

| 1 | 2 | 3 |

| Note. One copy of the List is transferred to the design organization that draws up the estimate for carrying out conservation work; The composition and scope of work can be clarified by the design organization in the process of drawing up estimates. | ||

| Head of the developer (customer) organization | ||

| (seal) | (signature) | |

| Head of contracting construction organization | ||

| (seal) | (signature) | |

| Head of the design organization | ||

| (seal) | (signature) |

Introductory information

It doesn’t matter what the reason is - either the approaching winter, or the lack of need for buildings. There should always be a conservation project for buildings and structures. It is also necessary to clearly understand what goals are being pursued and what tasks are facing the people carrying out the process. Let's look at the introductory information from which we will build. Let's assume that a building is being constructed. But there is no way to complete it before the start of the winter period. And according to technology, construction processes must be carried out at above-zero temperatures. Therefore, it became necessary to postpone the entire range of necessary work until a better time. And for this it is necessary to protect the object from precipitation and temperature changes.

What a tenant needs to check in a draft real estate lease agreement

Subject of the agreement

Before concluding a contract, you need to check:

1. description of real estate;

2. area of transferred property;

3. legal title of the lessor (whether the leased object belongs to him);

4. purpose of use of the real estate;

5. possible encumbrances of the leased object.

Description of the rental object

state registration of rights to real estate;

technical accounting of real estate (BTI documents).

Documents of state registration of rights to real estate include an extract from the Unified State Register of Real Estate (USRN) and a certificate of state registration of rights. Until July 15, 2021, Rosreestr issued paper certificates. But from this date, Rosreestr stopped issuing certificates of state registration of rights.

Rights and obligations of the parties

2

The tenant should pay attention to four conditions. Method 2: obtain the landlord’s consent for each sublease of property

This method is less convenient for the tenant. But landlords most often agree to this. It is better to stipulate in the agreement the procedure for the landlord to consider the tenant’s request for the possibility of subletting the premises or part of it. In this case, the procedure for giving consent to sublease will not be indefinite in time.

Method 2

: obtain the consent of the lessor for each transfer of property for sublease. This method is less convenient for the tenant. But landlords most often agree to this. It is better to stipulate in the agreement the procedure for the landlord to consider the tenant’s request for the possibility of subletting the premises or part of it. In this case, the procedure for giving consent to sublease will not be indefinite in time.

An example of the terms of a lease agreement on the procedure for the lessor to give consent to the transfer of property for sublease

“When the Tenant requests to sublease the Premises or part thereof, the Landlord is obliged to notify the Tenant of his decision within 5 (five) working days.”

Landlords often indicate in the agreement that the tenant does not have the right to reimburse the cost of inseparable improvements: “Upon termination of the Agreement, the Tenant undertakes to transfer the premises to the Landlord along with all inseparable improvements made in the premises without reimbursement of their cost.” Such conditions are contrary to the interests of the tenant. Therefore, they must be excluded from the text of the draft agreement.

the tenant properly fulfilled his obligations under the contract;

otherwise is not provided by law or contract.

Thus, the tenant needs to ensure that in the contract:

there was no clause stating that the tenant does not have a pre-emptive right to enter into an agreement for a new term, and

a period was specified during which the tenant could exercise his pre-emptive right to conclude a new contract (for example, no later than 30 calendar days before the end of the lease term).

Alexander Sorokin answers,

Deputy Head of the Operational Control Department of the Federal Tax Service of Russia

Accompanying documents

In addition to the inventory, to formalize the conservation of a building, an act of suspension of construction is required, which is drawn up according to form No. KS-17, approved by Resolution of the State Statistics Committee of the Russian Federation dated November 11, 1999 No. 100 “On approval of unified forms of primary accounting documentation for accounting of work in capital construction and repair- construction work." It reflects:

- Name and purpose of the building/structure whose construction is suspended;

- Construction start date;

- Estimated cost of work under the contract;

- The actual cost of work at the time of closure of the facility;

- Customer expenses;

- Expenses for conservation and security measures.

Based on the act, an estimate of the upcoming work is drawn up.

Based on the results of the calculations, the customer’s accounting department makes payments to the contractor. Specialists work with company accounts and submit reports to supervisory authorities.

BASIS: VAT

When transferring fixed assets for conservation, do not restore input VAT from their residual value. However, during the period when a fixed asset is mothballed or when it is re-mothballed, the organization may have an obligation to restore the input tax. This should be done, for example, in the following cases:

- when transferring a fixed asset to the authorized capital of another organization;

- when switching from the general taxation system to a simplified one or payment of UTII;

- when starting to use the VAT exemption;

- when using a fixed asset after reactivation to perform VAT-free operations.

This procedure follows from paragraph 3 of Article 170 of the Tax Code of the Russian Federation. A similar point of view is reflected in the letter of the Federal Tax Service of Russia dated June 20, 2006 No. ШТ-6-03/614.

Situation: is it possible to deduct VAT on the cost of materials (work, services) purchased for conservation (re-preservation) and maintenance of a mothballed fixed asset?

It is possible if the organization plans to use the fixed asset in the future to perform operations subject to VAT.

This is explained by the fact that the purpose of conservation is to ensure the best preservation of the fixed asset. Therefore, the deduction of input VAT on the cost of these materials (works, services) depends on the purpose of the fixed asset after reactivation. If, after re-preservation, an organization plans to use a fixed asset to perform operations subject to VAT, then the expenses incurred during mothballing are related to the activities of the organization subject to this tax. In this case, deduct input VAT as usual. That is, after registration of the specified materials (works, services) and in the presence of an invoice (clause 1 of Article 172 of the Tax Code of the Russian Federation). If the fixed asset is planned to be used to perform VAT-free operations, then include the input tax in the cost of materials (work, services) used during its conservation (re-preservation) (clauses 1 and 2 of Article 170 of the Tax Code of the Russian Federation).

The correctness of this point of view is confirmed by arbitration practice (see, for example, decisions of the FAS of the North-Western District dated October 16, 2008 No. A05-2658/2008, Central District dated February 15, 2007 No. A09-4610/06-13-16 and dated December 7, 2004 No. A35-2479/02-C2, Moscow District dated October 30, 2006 No. KA-A41/9298-06, Far Eastern District dated February 25, 2004 No. F03-A51/04-2/ 43, Ural District dated October 3, 2006 No. F09-8784/06-S7 and dated March 24, 2005 No. F09-977/05-AK).

However, there is another point of view. One of the main conditions for applying a tax deduction is the use of materials (work, services) to perform operations subject to VAT (clause 2 of Article 171 of the Tax Code of the Russian Federation). Since mothballed fixed assets are not used in activities subject to VAT, the organization has no grounds for applying the deduction. In addition, conservation of fixed assets is the performance of certain work for the organization’s own needs. Costs associated with the conservation of fixed assets reduce taxable profit as non-operating expenses (subclause 9, clause 1, article 265 of the Tax Code of the Russian Federation). The performance of such work is not subject to VAT (subclause 2, clause 1, article 146 of the Tax Code of the Russian Federation), therefore the organization does not have the right to deduct in this case. This conclusion was reached by the Federal Antimonopoly Service of the North-Western District in its resolution dated September 6, 2007 No. A05-13740/2006-13.

What is OS conservation?

Conservation is a set of measures to temporarily stop using one or more fixed assets of an organization. Conservation involves the resumption of operation of the OS after a documented period.

The word itself comes from the Latin conservatio - “preservation”, which indicates the ultimate goal of the entire event - to save both the object itself and part of the funds in the company’s current accounts, by reducing expenses.

The conservation of an object can be compared to the suspended animation of a crocodile, when under unfavorable conditions the animal buries itself in the sand and all its vital functions slow down. Likewise, an object slows down its life inside the enterprise and - the main characteristic - temporarily does not bring economic benefits to its owners. By law, this “hibernation” cannot exceed three years. But practice shows that the conservation period of fixed assets can be extended.