In the latest issue of accounting educational program, Alexey Ivanov explains why a balance sheet is needed, what can be seen in it, and why being able to read a balance sheet is important not only for an accountant. At the end of the article there is an example of constructing a balance sheet that will be understandable even to a reader who is very far from accounting.

Hi all! Alexey Ivanov is with you, the knowledge director of the online accounting “My Business” and the author of the telegram channel “Accounting Translator”. Every Friday on our blog on Klerke.ru I talk about accounting. I started with the basics, then I will move on to more complex matters. For those who are just preparing to become an accountant, this will help them get to know the profession better. Seasoned chief accountants should look at familiar categories from a different angle.

Why do you need a balance sheet?

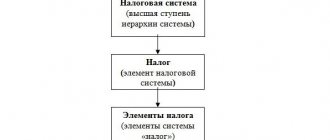

For three months in a row I talked about certain types of assets and liabilities that accounting deals with. It's time to collect them into a useful tool for the director, business owner, financier, economist and anyone who wants to assess the financial position of the company. This tool is called a balance sheet. It contains information about what assets the company has and where they came from.

The balance sheet and income statement are the two main forms of financial statements that banks, investors, creditors and counterparties study to determine whether they are worth doing business with. The form of the Russian balance sheet is approved by Order of the Ministry of Finance of Russia dated July 2, 2010 N 66n, but its essence is the same in Russia, the USA, Zimbabwe and any other country.

The balance sheet is based on the statement on which all accounting has been built for more than five hundred years. The amount of assets must be equal to the amount of liabilities. Violation of this equality would mean that you have an asset from nowhere or a source of nothing - failure to comply with the law of conservation of matter in a single company. The conservation law for accounting is described by the capital equation:

Assets = Capital Liabilities.

Such an entry means that any asset is financed either by its own or borrowed liabilities. There is nowhere else for assets to come from. If you bought an asset, there will be accounts payable that will need to be paid. If received from the founders, the amount of the authorized capital will increase. Even if the asset was received as a gift, its value will be recorded as profit in the liability.

Analysis of the balance sheet allows you to understand the structure and liquidity of the company’s assets, the provision of own and borrowed funds, solvency, financial stability and other important characteristics of the business. I’ll tell you how to do this in the next issues of educational program.

Borrowed capital as a source of property formation

While developing, almost every company is faced with the need to attract borrowed resources.

This is often a profitable undertaking, since the return on “other people’s” money invested in production turns out to be higher than the fee for attracting them. The profitability of “native” funds increases, the organization increases the pace of development. In addition, interest on loans reduces the income tax base.

But there are, of course, risks of losing financial stability and reducing liquidity due to too high fees for loans compared to their return.

Loan capital usually includes:

- bank loans (and loans from other lenders);

- issue and sale of bonds (allows you to attract funds from a large circle of people);

- leasing is a procedure in which the lender purchases the equipment necessary for the borrower and provides it for his use for an agreed fee.

An example of constructing a balance sheet

LLC "Horns and Hooves" as of January 1, 2021, has the following assets and liabilities:

- intangible assets - 100 thousand rubles;

- fixed assets - 200 thousand rubles;

- stocks of materials and goods - 300 thousand rubles;

- accounts receivable from customers - 250 thousand rubles;

- money in current accounts and at the cash desk - 150 thousand rubles;

- authorized capital - 400 thousand rubles;

- retained earnings - 50 thousand rubles;

- long-term loan debt - 200 thousand rubles;

- accounts payable - 350 thousand rubles.

The balance sheet of Horns and Hooves LLC looks like this.

By the way, in the online accounting “My Business” the balance sheet is generated automatically based on the balances of the accounting accounts. At the same time, the system checks control ratios and compliance of data for previous years with submitted reports. If something doesn’t add up, she will alert the accountant about it. Try it - it's convenient and saves a lot of time!

Classification of enterprise property

The company's property is classified depending on the sources of its creation. These are resources formed on the basis of own or borrowed funds.

Take our proprietary course on choosing stocks on the stock market → training course

Own sources include:

- authorized capital - funds contributed by the founders of the company during its formation and periodically replenished (or vice versa);

- reserve funds - funds intended to support the operation of an enterprise in an unfavorable situation; for joint-stock companies their creation is an obligation (the amount of deductions is also regulated - at least 5% of profits annually), for entities of other forms it is a right;

- additional fund - is formed mainly by increasing the value of fixed assets subject to depreciation as a result of their revaluation (Article 256 of the Tax Code of the Russian Federation);

- retained earnings - part of the financial result, consisting of profits received from the main work, other income and income related to emergency incidents (floods, fires, nationalization, hurricanes, etc.); the resource is not distributed among the owners and forms savings, which can then be used for various needs;

- reserves for future expenses - are formed for future payments of funds for employee vacations and long-service payments.

Borrowed sources of a company's property (they are also called liabilities) are divided into long-term and short-term.

Long-term loans include received loans whose repayment period exceeds a year.

The composition of short-term borrowed sources is somewhat broader:

- funds borrowed and loans that must be repaid within a year;

- accounts payable – goods from suppliers that have not yet been paid for, accrued wages that have not yet been paid at the time of drawing up the report, etc.;

- deferred income - income that actually occurred in this period, but they will be accrued (and, accordingly, will affect the financial result) in the next year.

Analysis of the organization's property structure

Analysis of the composition of the resources of any company helps to determine the level of its financial stability, operational efficiency, and possible risks. Also, based on its results, important conclusions are drawn regarding ways to improve production and eliminate the influence of negative factors on it.

“The source of information for the financial analysis of a company’s property is, first of all, the balance sheet.”

Ph.D. Serebryakova E.A.

Stages of analysis of the organization's property structure

At the first stage of analysis, the composition of the organization's resources is always determined. The following analytical procedures are then carried out:

- studying the dynamics in absolute terms of both the entire property of the company and its components;

- studying trends in changes in the composition of funds;

- detailed analysis of all items that make up the property structure;

- study of qualitative changes in the property status of the company.

Composition of enterprise assets

The analysis usually begins with studying the composition of the company's assets. For this purpose, they are classified according to various criteria.

Types of assets depending on the degree of exposure to inflation processes

Based on this criterion, the company’s resources are divided into 2 groups:

- Monetary – assets that are accounted for in monetary terms and do not require revaluation. This includes money in cash and bank accounts, short-term financial investments, and funds in settlements.

- Non-monetary - part of the property that is subject to revaluation over time. Such assets include equipment (and other fixed assets), goods for sale, inventories, work in progress, etc.

Assets by form of operation

The following types of assets are distinguished:

- material - having a physical embodiment (materials, fixed assets, finished products, etc.);

- intangible - resources that do not have physical form, but generate income (mainly various rights and patents);

- financial – funds in the form of money and other financial instruments (first of all, this is money in the cash register and in bank accounts).

Assets by nature of participation in the production cycle

Based on this criterion, the following types of assets are distinguished:

- working capital - those that are completely consumed during one production cycle (i.e., maximum per year) (materials, money, supplies, etc.);

- non-current - those that participate in the production process many times, until their value is gradually transferred completely to the released goods (fixed assets and some other items).

By degree of liquidity

Classification on this basis is very important for the financial analysis of the company’s activities:

- assets with absolute liquidity (cash);

- assets with high liquidity (financial investments and receivables for up to a year);

- property with average liquidity (inventories of finished goods, accounts receivable, etc.);

- low-liquidity property (fixed assets, financial investments for a period of more than a year);

- illiquid assets (for example, accounts receivable, the collection of which is impossible).

Composition of the enterprise's liabilities (sources of own and borrowed funds)

The liability of an enterprise is usually analyzed and studied in terms of sources of its own and externally attracted resources.

Own funds include:

- authorized capital;

- Extra capital;

- reserve fund;

- profit not distributed among participants (or uncovered loss).

Resources generated from attracted sources include:

- loans and borrowed funds whose repayment period exceeds one year;

- loans and borrowed funds that must be repaid within a year;

- debt to creditors, which may be suppliers, employees, tax authorities, etc. (these are accrued obligations that for some reason have not yet been paid);

- other liabilities.

What is the purpose of analyzing the property of an enterprise?

Survival in the modern economy requires a regular systematic analysis of the company’s assets (and the sources of its formation).

The main goal of such monitoring is the timely identification of factors that impede the most efficient functioning of the organization and the search for ways to improve the situation.

During the analysis, reserves for increasing liquidity and profitability are sought, possible financial risks are assessed, and development forecasts are made. This is one of the most important tools that contribute to the prosperity of a company.

Difference between equity and debt capital

It is more convenient to consider these differences in the table.

| Comparison sign | Type of company property | |

| Own | Borrowed | |

| The right to make management decisions and to participate in planning the company’s development strategy | Suggests this moment | Does not imply such powers |

| Impact on financial risk | Increasing your own assets minimizes the risk of financial instability | An increase in borrowed funds in the property structure significantly increases financial risks |

| Queue to pay part of the profit in the form of income | Residual priority principle | Get your income first |

| Place in line for reimbursement of contributions in the event of bankruptcy of an organization | Residual principle | First of all |

| Terms of return of invested funds | Not clearly stated | Unambiguously stated in agreements and contracts when providing loans |

| Objects of financing (most) | Long term facilities | Short term objects |

| Impact on the amount of income tax | Does not affect the amount of tax in any way | Reduces tax by accounting for interest on loans as expenses |

| Sources of formation | Internal and external | External only |

| The mutual influence of the income of the owner of capital and the profitability of the company | Direct communication | No connection |

Analysis of the structure and dynamics of assets

When conducting such an analysis of property, economists pay attention to the following points:

- what types of resources (own or borrowed) take the lead in the formation of the company's assets: a significant share of equity capital indicates the stability of the company, but if the structure is dominated by liabilities (especially short-term), the financial stability of the organization is in big question;

- trends in changes in own property (an increase indicates an increase in financial stability);

- trends in changes in attracted assets (an increase in their share indicates an increase in financial dependence on creditors);

- changes in the size of profits and reserves (a decrease in profits, and, even more so, the formation of losses means the ineffective functioning of the company and its instability in financial terms);

- the composition of the liabilities of the passive part of the property (the validity of the amount of borrowed funds is studied, since within reasonable limits they can have a positive impact on the development of the company, but their excessive growth can reduce its liquidity and deprive it of independence);

- trends in changes in long-term liabilities (their growth is assessed as generally positive);

- trends in changes in short-term liabilities (studied by creditors: employees, budget funds, lenders, suppliers, etc.);

- the difference between two types of debts: accounts payable and accounts receivable (the prevalence of accounts payable is assessed positively, while a significant share of debts from debtors indicates that capital, which could be used to develop production, is not used effectively).

Main indicators of the property status of an enterprise

Analysis of the property status involves studying the solvency of the company, its ability to timely pay obligations to the budget, suppliers, creditors, employees, etc.

Indicators for assessing property status include:

- the amount of funds available to the company;

- share of active fixed assets;

- depreciation, renewal and disposal rates of fixed assets;

- share of current assets in the overall structure of funds.

What indicators determine the solvency of an enterprise

During the analysis, indicators that determine the solvency of a business entity are necessarily calculated.

One of the most important coefficients is the value of total solvency (COP), which is calculated as follows:

Co.p. = A/O, where

A are the assets of the company, and O are its liabilities.

This indicator is compared with the standard (should not be less than 1) and studied over time (growth is assessed positively).

Example. In OJSC Sfera, balance sheet assets amount to 357,068 thousand rubles, and liabilities – 173,865 thousand rubles. The total solvency ratio is calculated as follows: 357,068/173,865 = 2.05. The standard is far exceeded, which characterizes the company as a reliable partner.

The indicator of long-term solvency (Kl.p.) allows you to draw conclusions about the solvency of the company in the long term and even identify signs of possible bankruptcy long before the crisis. It is calculated like this:

Kd.p. = Kz/Ks, where

Кз – borrowed capital;

Kc – equity capital.

The higher the ratio, the lower the estimated long-term solvency of the research object. The prevalence of borrowed funds is fraught with financial risks.

Liquidity ratios and purposes of their calculation

The purpose of calculating liquidity ratios is to assess the ability of a company's assets to quickly turn into cash. High values and growth of these indicators are assessed positively and indicate solvency.

Kt.l. = AO/OK

, Where

Kt.l. – current liquidity ratio (shows the company’s ability to pay current obligations using only current assets),

JSC – current assets,

OK – short-term liabilities.

Kb.l. = (Z.k. + Vf.k. + Dsr)/FROM

, Where

Kb.l. – quick liquidity ratio (demonstrates the ability to pay off current liabilities with highly liquid assets),

Zd.k. – debts of debtors for a period of up to a year,

Vf.k. – short-term financial investments,

Dsr - cash,

OT – current obligations.

Ka.l = (Dsr + Vf.k.)/OT

, Where

Ka.l. – absolute liquidity ratio (shows the ability to pay current expenses with assets with absolute liquidity),

Dsr - cash,

Vf.k. – short-term financial investments.

One more run

Let's run another production cycle, but with different parameters:

- Since there is no money, we will borrow 400 thousand rubles from the founders of the company to pay salaries.

- Let's sign a contract for a million.

- We will receive an advance payment of 400 thousand.

- We will spend 600 thousand on salaries and support.

- We will collect the remaining payment from the new client - 600 thousand.

- And we will also collect from the first client the 400 thousand that he owed us.

Let's look at the balance:

There is a lot of money in business, but let's pay back the loan:

We have a profit of 660 thousand rubles. The founders decide to pay themselves 150 thousand dividends, 300 in total. The payment of dividends is considered as a distribution of profit, that is, profit in liabilities is reduced by this amount:

Assessment of financial stability (coefficients of autonomy, dependence, agility)

Financial stability is usually assessed using the following indicators:

Autonomy ratio = equity/assets

The specific value depends on the industry of the company. Its normal limits are 0.5 - 0.7.

The indicator demonstrates the share of the company's own funds in the property and, accordingly, the degree of its independence from external sources.

Dependency ratio = liabilities/assets

The ratio shows the share of borrowed sources in the composition of all assets and indicates the level of dependence on external creditors. Its optimal value is 0.5. Exceeding the threshold of 0.8 is already regarded as a risk.

Agility ratio = working capital/equity capital

The indicator indicates the degree of involvement in the turnover of current assets. The preferred option is a value in the range of 0.2-0.5.