The concept of fixed capital

In general, capital means financial resources invested by an enterprise in its own assets in order to obtain additional profit.

All capital can be divided into two large groups: fixed capital and working capital. OK, in fact, represents the volume of fixed assets and fixed assets of the enterprise, expressed in monetary value.

According to the All-Russian Classification of Fixed Assets (OKOF), approved by Rosstandart Order No. 2018-st dated December 12, 2014, fixed assets should be understood as manufactured assets that are repeatedly used to produce goods or provide services over a long period of time, but not less than 12 months.

OKOF includes the following as fixed assets:

- buildings and premises,

- buildings, structures

- expenses for land improvement,

- equipment (including computer and information equipment),

- household equipment,

- vehicles,

- objects of intellectual property,

- software, etc.

As we see, OK can be presented in both material and intangible forms.

The definition of non-current assets is in many ways similar to the concept of OK. According to the form of the balance sheet approved by Order of the Ministry of Finance dated July 2, 2010 No. 66n, non-current assets also include fixed assets, intangible assets, exploration assets, profitable investments in materiel, financial investments, deferred tax and other non-current assets. To form the OK indicator, as well as the indicator of non-current assets, the data from section 1 of the balance sheet is used.

What are called non-current assets and what documents regulate their accounting, read the article “Non-current assets in the balance sheet (nuances)”.

Why do you need a fixed capital analysis?

Analysis of the state of the organization's quality assurance allows one to assess the level of its technical equipment, draw conclusions about the interest of participants in increasing internal investment resources, and about the reliability, stability and competitiveness of the enterprise as a whole.

A thorough study of the structure of OC reveals hidden opportunities for its more effective use, which results in an increase in the profitability of the organization (in the form of obtaining additional profit, reducing the cost of production, reducing the time spent on work, etc.).

For a full analysis of the state of fixed capital and calculation of the coefficient of effective use of fixed assets, you will also need the information presented in Appendix No. 3 to the balance sheet, and the statistical report of Form No. 11, approved by Rosstat order No. 289 dated June 15, 2016.

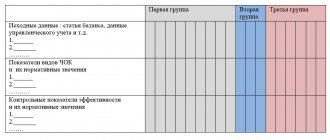

QA analysis includes several stages:

- Study of the dynamics of changes in the OK indicator.

- Monitoring the technical condition of fixed assets, their timely renewal and maintenance.

- Analysis of the efficiency of asset use and identification of circumstances negatively affecting them.

- Search for additional reserves to improve or replenish your own fixed assets.

Second method of determination: formula

Another calculation option involves data on current assets and short-term liabilities (financial). It takes the following form:

SOK = OA – KFO, where

- ОА – amount of current assets (line code 1200)

- KFO – short-term financial liabilities (take line code 1500)

Important! In a situation where the company's equity is financed not only by its short-term but also long-term borrowings, their size must also be subtracted. The formula will be like this:

SOK = OA – KFO – DO

OA constitute Section 2 of the balance sheet and include the following items: inventories, accounts receivable, financial investments (short-term) and the most liquid component - cash. CFOs form Section 5 of the balance sheet.

Information on fixed capital in financial statements

Accounting statements are the main source of information about the state of the enterprise's quality assurance.

To analyze the indicators of its components, the balance sheet is used, Appendix to the balance sheet No. 3 of form 0710005. To study the dynamics of the movement of fixed assets, the statistical annual form No. 11 will also be useful.

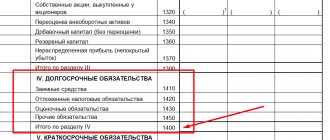

In the balance sheet, information about the enterprise’s assets is reflected in section 1 “Non-current assets” in the context of individual items:

- Line 1110 - serves to reflect the residual value of intangible assets.

- Lines 1120, 1130, 1140 - display research and development results, intangible and tangible exploration assets. The concept of search assets is given in paragraphs. 5–8 PBU 24/2011.

- Line 1150 - the residual value of fixed assets is recorded here. This also includes the costs of unfinished capital investments in fixed assets and the purchase of equipment with a breakdown of this indicator. The justification for this approach is clause 20 of PBU 4/99, according to which “Construction in progress” is included in the “Fixed Assets” group.

The concept of fixed assets, as well as the nuances of displaying their value in the balance sheet, are discussed in more detail in the article “Reflecting fixed assets in the balance sheet.”

- Line 1160 - profitable investments are a form of long-term financial investments, and therefore are included in the fixed capital of the enterprise. This line contains information about the residual value of fixed assets transferred for temporary use for a fee. If the lease agreement provides for the possibility of subsequent redemption of the leased property or its automatic transfer to the tenant at the end of the contract, then the property is accounted for by the tenant as its own fixed assets and is also included in fixed capital.

- Line 1170 - long-term financial investments are reflected.

- Line 1190 - here other non-current assets are taken into account that do not fall under the distribution into the main groups of the 1st section of the balance sheet and at the same time have a significant cost indicator. They may also be included in fixed capital if they are subject to the classification of fixed assets.

Learn more about methods of analyzing the balance sheet from the article “Methodology for analyzing the balance sheet of an enterprise.”

As we see, despite the similarity of the concepts of OK and non-current assets, there are still differences in their structure and value terms. Thus, the OK does not include data from line 1180 with information about deferred tax assets. This indicator forms the amount of additional capital (clause 68 of Order of the Ministry of Finance dated July 29, 1998 No. 34n).

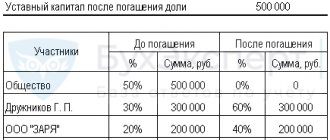

A good example

Let's look at an example of calculation using specific numbers. To do this, we provide conditional data for reporting that does not exist as of December 31, 2016 (thousand rubles):

- 97 415 – VNA

- 103 480 – OA

- 61,500 – UK

- 65 103 – BEFORE

- 74 292 – KFO

Calculation examples

We check that the amount of assets and liabilities in the company’s balance sheet is equal:

97 415 + 103 480 = 61 500 +65 103 + 74 292 = 200 895

Let's calculate the value of SOC as of the reporting date in two versions.

Option 1. Let's assume that long-term loans and credits are aimed at financing the company's BNA, which corresponds to the norm. In this case:

- first method 61,500 – (97,415 – 65,103)

- second method 103,480 – 74,292 = 29,188

It can be seen that according to both formulas the result was the same: 29,188 thousand rubles. If this does not happen, there was an error in the calculations.

The result is a positive number. This means that according to this indicator the company will be considered financially stable. Current assets in the amount of 29,188 thousand rubles. financed from the company's internal sources. VNA in the amount of 65,103 thousand rubles. are formed with the help of attracted external long-term sources, the rest (32,312 thousand rubles) - from their own money.

Option 2. Due to long-term obligations, the enterprise forms an OA, which initially does not correspond to the norm. The calculations are as follows:

- the first way 61,500 – 97,415

- the second way 103,480 – 74,292 – 65,103

As you can see, the indicator is negative and amounts to -35,915 thousand rubles. The company is in a difficult financial situation. The company's own funds are not enough to form an OA; the company is not able to pay off its current debts using only funds in circulation.

The two calculation options considered show that the same balance sheet data can be interpreted differently and lead to opposite results. It is important to correctly evaluate and classify long-term loans and borrowings. Without knowing the purposes and directions of their use, it is impossible to correctly determine the SOC. In reality, the entire volume of long-term borrowings of an enterprise does not have one purpose of use. Therefore, it is necessary to carefully analyze all available loans.

In general, to maintain a normal level of the indicator under consideration, and therefore ensure the financial stability of the company, the following should be done:

- strive to obtain and increase profits

- optimize non-current assets of the enterprise

- monitor the size and quality of accounts receivable

- do not allow the use of long-term liabilities to form current assets

- maintain an optimal balance structure

These measures will help the normal functioning of the enterprise. Using the indicator, you can assess whether a company is able to pay off its short-term debts with liquid funds.

Write your question in the form below

Working capital can be negative if a company's current assets are less than its current liabilities. Working capital is calculated as the difference between the company's current assets and current liabilities. If a company's current assets decrease significantly as a result of a large one-time cash payment or an increase in current liabilities due to a significant increase in credit, resulting in an increase in accounts payable, its working capital may become negative.

Formation of balance sheet assets

In the process of analyzing the sources of asset formation, the actual size of equity and borrowed (borrowed) capital is established, the reasons that caused their changes during the reporting period are identified, and their corresponding assessment is given. The main attention is paid to equity capital, since the stock of sources of equity capital is a margin of financial stability.

It is important to establish the actual size of equity capital, but also to determine its share in the total amount of capital. This indicator in the specialized literature goes by different names (ownership coefficient, independence coefficient, autonomy coefficient), but its essence is the same - it determines how independent an enterprise is of borrowed funds and is able to maneuver its own funds.

The independence coefficient is determined by the ratio of equity capital to the total advanced capital according to the formula:

Knez = Sk / Ak, where:

— Knez — independence coefficient;

— Ск — own capital;

— Ak — advanced capital (total, balance sheet currency, i.e. total amount of financing).

Its growth indicates an increase in the financial independence of the enterprise and a reduction in the risk of financial difficulties in future periods.

The minimum value of this indicator is estimated at 0.5, which ensures that all obligations of the organization are covered with its own funds.

The dependence coefficient is the inverse of the independence coefficient. It is determined by the formula:

Kzav = Pk: Ak or K3 = 1 – Kn, where:

— Kzav — dependence coefficient;

— Pk — attracted capital;

— Ak — advanced capital (total, balance sheet currency).

This ratio characterizes the share of debt in the total amount of advanced capital. The higher this share, the greater the enterprise's dependence on external sources of financing.

The next indicator characterizing the financial stability of an organization is the financing ratio, which is the ratio of equity capital to attracted capital:

Kfin = Sk: Pk, where;

— Kfin — financing coefficient;

— Ск — own capital;

— Pk — attracted capital.

The higher the level of this ratio, the more reliable financing is for banks and investors. The ratio shows what part of the enterprise’s activities is financed from its own funds, and what part from borrowed funds. A situation in which the financing ratio is < 1 (most of the enterprise's property is formed from borrowed funds) may indicate the danger of insolvency and often makes it difficult to obtain a loan.

Debt to equity ratio, which is determined by the ratio of borrowed capital to equity:

Kz/s = Pk / Sk, where:

— Кз/с — ratio of borrowed and equity funds;

— Pk — borrowed funds (raised capital);

— Ск — own funds (equity).

This ratio indicates how much borrowed funds the company attracted per tenge of its own funds invested in assets.

Teacher B.K. Zhakenova

Advance capital is money capital intended for the acquisition of means of production, the implementation of business ideas or the organization of one’s own business. In this case, the investment takes place taking into account the fact that after a certain time period such a decision will bring profit in monetary terms.

Basically, the advanced capital is spent for the purpose of acquiring means of production.

Amplitude of values and their interpretation

The RNS value obtained as a result of the calculation can be positive, negative or equal to zero. Let's figure out what this means:

Difference of indicators

- If the result is zero, it means that the company’s current assets are formed entirely through loans, but the company can pay off all its short-term debts without resorting to the sale of less liquid assets.

- If the figure is greater than zero, part of the own funds is involved in the formation of the OA. This value of the indicator is desirable and corresponds to the state of equilibrium of balance sheet items.

- If the number is negative (i.e. less than zero), it means that the firm lacks internal sources and even its BNA is partially formed by short-term liabilities. This does not correspond to a state of equilibrium of balance. This situation in most sectors of the economy indicates that the company is financially unstable.

As can be seen from the above formulas, the change in the value of the indicator under consideration depends on each line of the balance sheet. So, for example, an increase in retained earnings will also cause an increase in the amount of SOC. Conversely, the acquisition of fixed assets and investment in long-term financial instruments reduce the analyzed indicator.

However, the resulting high numbers may indicate that the company has chosen an ineffective financial strategy: it avoids short-term financing, does not fully utilize accounts payable, and irrationally manages the profits received.

Description of advanced capital in simple words

First of all, this is the money you need to start your own business. Therefore, in other words, we can say that this is the initial capital.

There are receiving and variable capital. In a slightly different interpretation, these terms are means of extracting monetary profit created by using hired labor in the production process. Invested fixed and variable capital is embodied in produced goods.

The advanced capital has several non-identical parts. Moreover, each of them determines a different nature of turnover.

- In one of the cases, the named value is transferred to a product that has just been created and is returned to the investor in cash gradually.

- The other part of the advanced capital is capable of returning completely to the capitalist in the form of money at the end of each capital circulation. In this case, this part also bears the full cost.

Advanced capital is transported into fixed and working capital. Negotiable, in turn, can have a monetary, commodity or productive form. In this case, the commodity form can be in the form of finished products or simply a stock of raw materials. The purpose of its advance is not to obtain a single profit. The main task of the capitalist, who is the owner of these funds, which is assigned to him, is a constant increase in value. For this reason, the movement of the advanced value is constantly renewed and has a cyclical appearance. In a simpler sense, advanced capital is an advance that was invested in capital for the purpose of subsequent profit.

Being the foundation of future production, advanced capital is spent on the acquisition of working and fixed assets, as well as in order to increase labor resources. In the process of organizing production, advanced capital is gradually transported into the main capital, making it the main operating financial force. If invested wisely, the capitalist owner can receive significant profits.

With the help of advanced capital, you can determine the financial strength of the enterprise and its size. He gives a general description. Most often, such borrowed funds are provided by an organization or even by individuals on the terms under which the borrower undertakes to carry out the repayment procedure. Most often, for the fact of owning funds, an interest rate is charged, which increases the cost of debt. All details of the transaction must be specified in the proposed agreement. As a rule, this is where the rights and obligations of the parties are noted, as well as sanctions that may be applicable in the event of non-compliance by one of the parties to the transaction.

The increase in the value of production (surplus or advanced) is most often generated precisely by advanced capital. This phenomenon usually acts as an excess of the cost of a product in relation to the level of cost of the individual components of its production. In some cases, this phenomenon is interpreted as an artificial form of capitalist-type production costs. In this case, the return of the advanced capital occurs from the cost of goods sold. This isolated part includes the costs of an individual entrepreneur for the production and subsequent sale of goods.