Deadline for payment of transport tax

The organization pays transport tax for each car registered to it. This obligation remains until the car is deregistered with the traffic police, even if you do not use it (clause 1 of article 358 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of the Russian Federation dated February 18, 2016 No. 03-05-06-04/9050).

The tax on a car registered for a separate subdivision is paid at the location of the OP (clause 1 of Article 363 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of the Russian Federation dated October 29, 2013 No. 03-05-04-04/45850).

The tax is transferred at the end of the year, and in some regions there are quarterly advances.

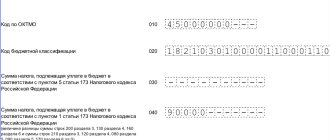

KBK - 182 1 0600 110.

Transport tax is regional, therefore:

- tax rate within the limits established by Ch. 28 Tax Code of the Russian Federation;

- procedure and deadlines for tax payment;

- tax benefits and the grounds for their use are determined by the laws of the constituent entities of the Russian Federation in whose territory the car is registered.

Zero report

The procedure for filling out the transport tax return for 2021, approved by the Federal Tax Service, implies filling out all its components:

- title page;

- Section 1 – the amount of tax to be transferred to the budget;

- Section 2 – tax calculation for each vehicle.

Let us remind you that filling out a tax return for transport tax is regulated by the order of the Federal Tax Service dated February 20, 2012 No. ММВ-7-11/99. This is a kind of instruction for filling out a transport tax return.

The rule has long been established that there is no need to file a zero transport tax return if:

- transport is not registered to the company;

- The transport is registered with the company, which, by virtue of Art. 358 of the Tax Code of the Russian Federation, it is not classified as subject to this tax.

If there are no objects for transport tax, then the organization is not one of its payers. It is important that the Ministry of Finance fully supports this approach (letter dated 03/04/2008 No. 03-05-04-02/14). Of course, the fine for failure to submit a transport tax return in this case will be illegal.

Procedure for calculating transport tax

According to Art. 362 of the Tax Code of the Russian Federation, organizations calculate the tax amount independently.

The tax period is a calendar year.

The tax is calculated for the year for each car registered to the organization (clause 1, clause 1, article 359 of the Tax Code of the Russian Federation).

Car tax = engine power in hp. x tax rate.

Engine power is taken from the title or registration certificate. If the power is indicated in kW, it should be converted to horsepower by multiplying by 1.35962. The result is rounded to the second decimal place. For example, 150 kW is 203.94 hp. (150 kW x 1.35962) (clause 19 of the Methodological recommendations for the application of Chapter 28 of the Tax Code of the Russian Federation).

Rates are established by the law of the subject of the Russian Federation in which the car is registered (clause 1 of Article 361 of the Tax Code of the Russian Federation).

If the rate depends on the age of the car, then it must be calculated from the year following the year of manufacture (clause 3 of Article 361 of the Tax Code of the Russian Federation). For example, the year of manufacture of a car is 2021. Then in 2021 it is 0 years old, in 2017 it is 1 year old, etc.

If the car was not used for a whole year, the tax should be adjusted by the coefficient Kv. The value of the coefficient is determined accurate to the 4th decimal place using the formula (clause 5.15 of the Procedure for filling out the declaration):

Kv coefficient = number of full months of vehicle operation / 12.

The month of purchase is included in the calculation if the car is registered before the 15th day inclusive. And the month of disposal of the car - if it is deregistered after the 15th (clause 3 of Article 362 of the Tax Code of the Russian Federation).

Having calculated the tax for each car, the results are summarized. Thus, the calculated tax for the year is obtained. If there are no advance payments in your region, this amount must be paid to the budget. If you paid advance payments, at the end of the year you will pay the difference between the calculated tax for the year and the advances.

Sample declaration for a vehicle

We will tell you in general terms how to fill out a transport tax return. Please note: each example of filling out a transport tax return must meet certain requirements of the Federal Tax Service.

- All cost values are given in rubles: up to 50 kopecks are not taken into account, but from 50 kopecks are considered 1 ruble.

- Continuous numbering, starting from the first sheet: 00001, 00010, etc.

- You cannot use correctors and similar products.

- Double-sided printing is prohibited.

- You cannot fasten sheets with a stapler.

- When filling out the fields of the Declaration form, black, purple or blue ink must be used.

- If any indicator is missing, dashes are placed in all places in the corresponding field.

- All characters are CAPITAL PRINTED only.

- When printing the transport tax return for 2021, use Courier New font 16 – 18 point.

For the example of a tax return for transport tax, we introduce the following conditions. Truck ZIL 432930 was registered with Guru LLC on March 10, 2021. The place of its tax registration is the Federal Tax Service Inspectorate No. 18 of Moscow (OKTMO Sokolniki district). According to the Moscow Law of July 9, 2008 No. 33 “On Transport Tax,” the company is not entitled to benefits and exemptions for this transport.

The tax base for the truck is 136 hp. The rate according to Moscow law is 26 rubles. for every horsepower. The number of full months of vehicle ownership in 2021 is 10 (January and February are excluded).

Also see “Transport tax rates by region in 2021: table.”

I quarter: 136 hp ×26 rub. × 1/4 = 884. However, the number of months of ownership in this quarter: 1: 3 = 0.3333. Therefore: 884 × 0.3333 ≈ 295 rubles.

II quarter: 136 hp ×26 rub. × 1/4 = 884 rub.

III quarter: 136 hp ×26 rub. × 1/4 = 884 rub.

The calculated tax will be: 136 hp. × 26 rub. × 0.8333 (Sq., p. 130) ≈ 2947 rub.

As a result, the amount of transport tax payable for the year will be: 2947 – (295,884,884) = 884 rubles. (page 030).

The following shows an example of filling out a transport tax return for 2021 by the accounting department of Guru LLC.

In what cases is it not necessary to pay transport tax?

There is no need to pay transport tax if the vehicle is registered and deregistered:

- in the period from the 1st to the 15th of the month;

- from the 16th to the 30th of the month;

- when registering after the 15th of one month and deregistering before the 15th of the next month;

- one day.

Such clarifications are given in the letter of the Federal Tax Service of the Russian Federation dated June 19, 2017 No. BS-4-21/ [email protected]

In addition, no tax is paid in case of car theft (letter of the Ministry of Finance of the Russian Federation dated October 3, 2017 No. 03-05-06-04/64192).

The agency explained which documents can exempt the owner of a car from paying transport tax if it is stolen.

According to paragraphs. 7 paragraph 2 art. 358 of the Tax Code of the Russian Federation, a vehicle will not be taxed provided that supporting documents from law enforcement agencies are provided to the Federal Tax Service. They may be:

- certificate of theft;

- resolution to initiate a criminal case.

In addition, the department reminded that a lost car can be deregistered with the State Traffic Safety Inspectorate (Order of the Ministry of Internal Affairs of the Russian Federation dated November 24, 2008 No. 1001). To do this, the owner will need to send an application to the appropriate traffic police department.

Let us note that Art. 85 of the Tax Code of the Russian Federation obliges the traffic police to independently, without the participation of the owner of the vehicle, report to the Federal Tax Service the fact of deregistration of a stolen car. This is done within 10 days. If a stolen car is found, it can be registered again.

Transport tax when using the Platon system

Organizations can reduce the transport tax calculated at the end of the year in relation to each 12-ton truck registered in Platon by the amount paid for such a truck to compensate for damage to highways during the year (clause 2 of Article 362 of the Tax Code of the Russian Federation). Preferences apply to legal relations arising from January 1, 2021.

In addition, transport tax is a regional tax. When introducing it into effect in the territory of their region, legislative (representative) bodies of a constituent entity of the Russian Federation can establish differentiated tax rates for each category of vehicles, as well as taking into account the number of years that have passed since the year of production of vehicles and (or) their environmental class. Additional tax benefits may also be provided to owners of heavy trucks.

Letter of the Ministry of Finance of the Russian Federation dated 05/03/2017 No. 03-05-06-04/27086

Editor's note:

To confirm the right to deduct transport tax on heavy vehicles, you can use a special report that the owner of the car receives by accessing his personalized record in the Platon system (letter of the Federal Tax Service of the Russian Federation dated August 26, 2016 No. BS-4-11/15777).

How to apply an increasing coefficient for transport tax

The list of passenger cars with an average cost of 3 million rubles, subject to use in the next tax period, is posted no later than March 1 of the next tax period on the official website of the Ministry of Industry and Trade of the Russian Federation on the Internet. This follows from paragraph 2 of Art. 362 Tax Code of the Russian Federation. The cost of the car and the moment of its registration do not play a role.

Particular attention should be paid to the last column of the list, which indicates the age of the car, which is calculated from the year of manufacture. For example, a car that was released in 2021 is 1 year old in 2016, 2 years old in 2021, etc. (letter of the Ministry of Finance of the Russian Federation dated May 18, 2017 No. 03-05-04/30334, Federal Tax Service of the Russian Federation dated March 2, 2015 No. BS-4-11 / [email protected] ).

If there is a car on the list, but its age is different, the increasing factor is not applied (letter of the Federal Tax Service of the Russian Federation dated January 11, 2017 No. BS-4-21/149).

If your car is on the list, then for 2021 you will pay tax with an increasing coefficient.

| Group of cars according to the list | Year of car manufacture | Kp coefficient |

| From 3 to 5 million rubles. | 2017 | 1,5 |

| 2016 | 1,3 | |

| 2015 | 1,1 | |

| Over 5 to 10 million rubles. | 2013 and later | 2 |

| Over 10 to 15 million rubles. | 2008 and later | 3 |

| Over 15 million rubles. | 1998 and later |

Features of some details

Please note that the procedure for filling out a transport tax return speaks about the individual details of this report.

The tax base

One of the main indicators for calculations in the transport tax return is the tax base. It is reflected in lines 070 and 080 of the second section of the report.

What is considered the tax base is set out in Art. 359 of the Tax Code of the Russian Federation. In the vast majority of cases, a vehicle with an engine is registered to the organization. This means that in line 070 it is necessary to reflect its power in horsepower.

The next indicator - the unit of measurement of the tax base (field 080) - is taken from the All-Russian Classifier of Units of Measure OK 015-94 (MK 002-97). It was adopted by Decree of the State Standard of Russia dated December 26, 1994 No. 366. And again: in most cases we are talking about horsepower. Therefore, the code for this field will be 251.

Also see “Transport tax rates in Russia”.

Months of ownership

The number of full months of ownership of a specific vehicle is shown in line 110 of the transport tax return.

In practice, filling out this field is usually difficult. In addition, from January 1, 2021, Federal Law No. 396-FZ dated December 29, 2015 changed the procedure for recording the month of registration and deregistration of a vehicle (clause 3 of Article 362 of the Tax Code of the Russian Federation).

Let’s dot all the “e”s. When calculating full months, proceed from 4 basic rules (see table).

| How to count line 110 | ||

| № | Situation | Solution |

| 1 | The vehicle is registered until the 15th day of the month inclusive | The month of registration is a full month |

| 2 | The vehicle was deregistered/registered after the 15th day of the month | The month of deregistration is a full month |

| 3 | The vehicle was registered after the 15th day of the month | The month of registration is not taken into account |

| 4 | The vehicle was deregistered until the 15th day of the month inclusive | The month of deregistration is not taken into account |

Line 130 of the transport tax return has a special character. It is derived from other quantities, but it is quite simple to calculate.

Kv = Line 110/12

The resulting value will most likely not be an integer, so the entire fraction is indicated in its entirety with four decimal places (periods).

Organizations that have passenger cars with an approximate average cost of 3 million rubles, in addition to multiplying the tax base by the rate, apply the Kp coefficient. In the transport tax return, field 150 is reserved for it.

This increasing coefficient has a value from 1.1 to 3 (clause 2 of Article 362 of the Tax Code of the Russian Federation). It depends on the price of the car and its year of manufacture.

If you are in doubt whether your company should apply this tax-increasing coefficient, take a look at the information from the Russian Ministry of Industry and Trade dated February 26, 2021. It contains a List of passenger cars with an average cost of 3 million rubles for the 2016 tax period. Officials update it annually on March 1.

For more information, see “Increasing coefficients for transport tax.”

The transport tax return for 2021 must be submitted using a new form

Order of the Federal Tax Service of the Russian Federation dated December 5, 2016 No. ММВ-7-21/ [email protected] approved a new form, format for submitting a transport tax declaration in electronic form, as well as the procedure for filling it out.

Starting with the report for the tax period 2021, the already updated version of the declaration must be used.

What has changed in the declaration:

- Section 2 “Calculation of the tax amount for each vehicle”: new lines have appeared (070, 080, 130) to reflect the date of registration of the vehicle, the date of termination of registration and the year of manufacture of the vehicle;

- for owners of heavy trucks who pay a fee for damage to roads, the updated declaration provides special lines (280 and 290) to reflect the tax deduction code and the amount of the deduction calculated in rubles;

In connection with these innovations, the Federal Tax Service of the Russian Federation has developed control ratios with which you can check the correctness of filling out reports. In particular, a new control link has appeared between the tax deduction (p. 290) and data obtained from the register of the toll collection system to compensate for the damage caused by heavy trucks to highways (letter of the Federal Tax Service of the Russian Federation dated March 3, 2017 No. BS-4-21 / [email protected ] ).

Previously, taxpayers reported on transport tax in the form approved by Order of the Federal Tax Service of the Russian Federation dated February 20, 2012 No. ММВ-7-11/ [email protected]

Responsibility

Please note that failure to submit a transport tax return on time (even by 1 day) is highly undesirable, since liability under Art. 119 of the Tax Code.

This article provides for only one type of liability - a fine for failure to submit a transport tax return of 1,000 rubles. Its final amount will depend on the amount of transport tax that the company had to declare on time. Or more precisely: from 5 to 30% of it.

Procedure for filling out the declaration

First, section 2 of the declaration is completed for each vehicle. The vehicle type code (line 030) is indicated in the appendix to the procedure for filling out the declaration. Data about the car - identification number (VIN), make, registration number, registration date, year of manufacture are taken from the title or registration certificate. The registration termination date (line 080) is indicated only for vehicles that were deregistered in the reporting year.

The tax base (line 090) is the engine power in horsepower. Line 100 indicates the horsepower code - 251.

The environmental class (line 110) is reflected in the PTS. If it is not there, a dash is placed in line 110.

Line 120 is filled in only if the tax rate depends on the number of years from the year of manufacture of the car.

Line 140 indicates the number of full months of car ownership during the reporting year, and line 160 indicates the Kv coefficient. If you owned the car all year, put 12 in line 140, and 1 in line 160.

Line 150 places 1/1.

The Kp coefficient (line 180) is indicated only for expensive cars.

Lines 190 and 300 reflect the calculated tax.

Lines 200–290 are filled in if benefits are used.

After filling out section 2 for all cars, you can move on to section 1.

Lines 021 and 030 display the total tax amount for all cars if advances are not paid.

If advances are paid, they should be indicated in lines 023–027, and in line 030 - the tax payable at the end of the year.