Probably everyone knows about the need to use cash register equipment (CCT) when making cash payments. We are all buyers of goods and consumers of services, and it is the cash receipt that serves as confirmation of the fact of payment for the goods, work or service. If something happens, it is the cash receipt that allows us to defend our consumer rights and receive after-sale or warranty service.

But let's look at the cash register from the point of view of the business owner; he is hardly happy about the need to use cash registers, so let's figure it out - is it possible to do without cash register equipment when accepting cash? And if you still need a cash register, then understand how to select it and register it?

In what cases is a cash register used?

The need to mandatory use a cash register on the territory of the Russian Federation by all organizations and individual entrepreneurs when making cash payments or using payment cards is established by Article 2 of the Federal Law of May 22, 2003 No. 54-FZ “On the use of cash register systems.”

At the same time, you can often observe how trade or provision of services is carried out without a cash register. Are all these entrepreneurs breaking the law? No, they do not violate, but simply know about their right not to use a cash register in some cases when paying in cash or with a payment card. And there are several such possibilities.

- Until July 1, 2021, imputed tax payers (organizations and individual entrepreneurs), as well as individual entrepreneurs working on the patent tax system , have the right to accept payment in cash without using a cash register (Article 2.1 of Law No. 54-FZ). If the buyer or client requires a document to confirm the fact of payment, then a sales receipt or receipt must be issued instead of a cash receipt.

- Until July 1, 2021, organizations and individual entrepreneurs may not use a cash register, regardless of the taxation regime, if they provide services to the public (Article 2 of Law No. 54-FZ). In this case, it is mandatory, and not at the request of the client, to issue a strict reporting form (SRF). The procedure for registration and issuance of BSO is given in Decree of the Government of the Russian Federation of May 6, 2008 N 359. Examples of strict reporting forms include transport tickets, receipts, movie tickets, subscriptions, work orders, coupons, tourist and excursion vouchers, etc.

- Organizations and individual entrepreneurs, due to the specifics of their activities or location, can make payments in cash or payment cards without using a cash register when carrying out the following types of activities:

- sales of newspapers, magazines and related products in special kiosks, while the share of the sale of newspapers and magazines in their turnover must be at least 50 percent, and the range of related products must be approved by the local government;

- sales of travel tickets and coupons for travel on city public transport;

- sales of securities and lottery tickets;

- providing meals to students and employees of educational organizations implementing basic general education programs (that is, in kindergartens and schools);

- selling ice cream and soft drinks on tap at kiosks;

- trade from tanks in beer, kvass, milk, vegetable oil, live fish, kerosene, waddling vegetables and melons;

- peddling small retail trade in food and non-food products;

- organizations and individual entrepreneurs located in remote or hard-to-reach areas (with the exception of cities, regional centers, urban-type settlements) specified in the list approved by the local government, etc.

For a complete list of such activities, see Article 3 of Law No. 54-FZ.

An important innovation for online stores - from July 1, 2021, it will be necessary to use cash registers in cases of online payment by card or through services such as Yandex Cashier. In this case, the buyer receives only an electronic receipt. Previously there was no such requirement.

Read more: New law on cash registers from 2021

Please note: From 31 March 2021, all retailers selling alcohol, including beer, must operate a cash register. The requirement also applies to those selling beer in public catering.

What should payers of UTII and individual entrepreneurs working on a patent pay attention to? Retail trade in these modes does not include the sale of food and beverages in public catering establishments. There are known court cases where organizations on UTII selling food and drinks in catering establishments were fined 30,000 rubles for trading without issuing documents confirming payment, because they believed that they had the right not to use a cash register, as imputed tax payers. The law equates sales in public catering establishments to services to the public, therefore each client (buyer) must be issued a BSO or cash receipt.

| Read more: Cash registers from 2021 for individual entrepreneurs on UTII |

How to submit individual information to separate departments

We opened a separate division at three addresses in the city of Severodvinsk, the Federal Tax Service was informed at the place of registration - Arkhangelsk. The Severodvinsk Federal Tax Service sent a notification about the assignment of new checkpoints for separate divisions. The question is the following: if there was no notification (message) from the Pension Fund of Severodvinsk about the assignment of Reg numbers for separate divisions, does the organization have the right to submit IP (individual information) under RSV-1 in a single form - for employees working in Arkhangelsk and employees working in separate departments - together? Will there be a fine for failure to submit IP for employees of separate divisions in the Pension Fund of Severodvinsk and RSV-1 separately in this case? Clarification of question 383766 We have centralized accounting

A separate division must independently submit the RSV-1 Pension Fund form for its employees if it simultaneously meets the following criteria: * 1) has a separate balance sheet; 2) has a separate current (personal) account; 3) independently calculates remuneration for employees.

What should a cash register be like?

From February 1, 2021, registration of old-style cash registers that do not have Internet connection functions will cease. Until July 1, 2021, all sellers already working with cash register systems must upgrade their equipment, if possible, and re-register with the tax office. If the existing cash register does not allow for modernization, then you need to purchase a new online cash register and register it. The requirements for a cash register are given in Article 4 of the Law of May 22, 2003 N 54-FZ “On Cash Registers”.

Cash register equipment must:

- have a case with a serial number;

- there must be a real time clock inside the case;

- have a device for printing fiscal documents (internal or external);

- provide the ability to install a fiscal drive inside the case;

- transfer data to a fiscal drive installed inside the case;

- ensure the formation of fiscal documents in electronic form and their transfer to the operator immediately after entering the data into the fiscal storage device;

- ensure printing of fiscal documents with a two-dimensional bar code (QR code no less than 20 x 20 mm in size);

- receive confirmation from the operator of receipt of data or information about the absence of such confirmation;

- provide the ability to read fiscal data recorded and stored in memory for five years from the end of operation.

We also draw your attention to the fact that the so-called check printing machines (CHMs) are not recognized as a cash register for registration with the tax office. Only payers of UTII and PSN can use such devices in order to issue the buyer a document confirming the receipt of funds for the purchased goods.

You can purchase new cash registers only from the cash register register published on the official website of the Federal Tax Service. The cost of a new cash register with an Internet connection averages from 25 to 45 thousand rubles, tariffs for the services of fiscal data operators - from 3,000 rubles per year.

Since 2021, fines for not using cash registers for cash payments, using a cash register that does not meet the requirements established by law, as well as for violating the conditions for registration and use of cash register equipment are (Article 14.5 of the Code of Administrative Offenses of the Russian Federation):

Failure to use a cash register if it should be used:

- from ¼ to ½ of the purchase amount, but not less than 10,000 rubles for individual entrepreneurs and heads of organizations;

- from ¾ to the full purchase amount, but not less than 30,000 rubles for legal entities;

Use of old cash registers or violation of the procedure for their registration/re-registration:

- warning or fine from 1,500 to 3,000 rubles for individual entrepreneurs and heads of organizations;

- warning or fine from 5,000 to 10,000 rubles for legal entities.

Refusal to issue a paper or electronic check to the buyer:

- warning or fine of 2,000 rubles for individual entrepreneurs and heads of organizations;

- warning or fine of 10,000 rubles for legal entities.

Checkpoint of a separate unit

It is important to remember that the checkpoint of the main organization and the checkpoint of its structural unit will not be the same. The difference in such indicators is determined precisely by the reason for registering the organization and structural unit.

This conclusion follows from the analysis of the “Procedure and conditions for assigning, applying, as well as changing the taxpayer identification number when registering, deregistering legal entities and individuals” (hereinafter referred to as the Procedure), approved by Order of the Ministry of Taxes and Duties of Russia dated 03.03.2004 No. BG-3-09/178.

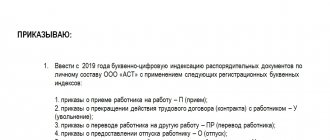

Registering a cash register

Registration of cash registers is regulated by special Administrative Regulations, approved by Order of the Ministry of Finance dated June 29, 2012 No. 94n. Appendix No. 2 to this regulation provides a flowchart for the provision of public services for registration, re-registration and deregistration of a cash register. The block diagram below can be enlarged by clicking on it.

Individual entrepreneurs register a cash register with the tax office at their place of registration, and organizations - at their legal address. If the cash register is not located at the legal address of the organization, then you will have to create a separate division at the place of trade or provision of services, and the cash register registration will take place at this address.

In cases where an organization has several separate divisions (for example, stores), subordinate to different tax inspectorates, but located in the same municipality, all cash registers can be registered with one tax office at the taxpayer’s choice.

Documents for registration of cash registers are submitted according to the list given in Article 25 of the Administrative Regulations:

a) an application in the form approved by order of the Federal Tax Service of Russia dated April 9, 2008 No. MM-3-2/ [email protected] );

b) passport of cash register equipment;

c) a technical support agreement concluded with the supplier or technical service center (TSC), an authorized supplier to provide technical support for the registered model of cash register equipment.

This list is exhaustive, but in practice the tax office may additionally request a number of documents, for example, such as:

- a lease agreement for the premises where the cash register will be located, or a certificate of registration of the right to the premises, if it is owned;

- journal of the cashier-operator according to the KM-4 form;

- logbook for calling technical specialists in the KM-8 form;

- documents confirming the fact of purchase of the cash register.

These requirements can be disputed, but you can also take these documents with you. And, of course, if the cash register is not registered personally by an individual entrepreneur or the head of an organization, then a power of attorney will be required to carry out registration actions. After accepting the documents, the tax inspector agrees on the date, time and place of inspection of the cash register, and if it is bulky, then it is quite possible to go to the location of the cash register.

Inspection and verification of the cash register is carried out by a tax inspector in the presence of a representative of the taxpayer (individual entrepreneur, head of the organization or authorized representative) and a specialist from the central service center. The tax inspector checks the taxpayer's data, which the service center employee enters into the cash register. The cash receipt must contain mandatory details, such as the full name of the individual entrepreneur (name of the organization), TIN, serial number of the device, date, time and cost of purchase, serial number of the receipt.

Next, the cash register is fiscalized, that is, it is transferred to the fiscal mode of operation. The tax inspector enters a special digital code that protects the fiscal memory from hacking, after which the central service specialist installs a seal on the cash register. The tax inspector must make sure that the cash register is in good working order, then registers the device in the accounting book, makes notes in the passport and academic certificate, certifies the cashier-operator’s log and issues a cash register registration card. The cash register is ready for use and can be used.

In what cases may it be necessary to re-register a cash register? These grounds are given in paragraph 75 of the Administrative Regulations:

- replacement of fiscal memory or fiscal memory storage device (EFS);

- changing the address of the location where the cash register is installed;

- changes in the full name of an individual entrepreneur or the name of an organization;

- CTO changes.

To re-register a cash register, you must contact the tax office where the cash register is registered, with an application in the form approved by Order of the Federal Tax Service of Russia dated 04/09/2008 No. MM-3-2/ [email protected] , a cash register passport and its registration card. When replacing EKLZ, you must also attach to these documents the conclusion of the Central Technical Service (if available).

Re-registration of a cash register is carried out during a personal inspection of the device by a tax inspector for serviceability, integrity of the case, presence of seals and the “Service” sign. Just as during the initial registration, the presence of a specialist from the central service center and the taxpayer is required. Re-registration notes are included in the passport and cash register registration card.

Sample notification of a new checkpoint of a separate subdivision

Filling out forms To facilitate the process of preparing an application, you can download a free form in form C-09-3-1 with KND code 1111053. The form must indicate the code of the tax authority at the location of the head enterprise. In the approved form, information is entered in accordance with the requirements of the fiscal authority established by a separate order of the Federal Tax Service. However, a completed sample notification form has not yet been officially published. Each page of the application must contain information about the organization’s tax identification number and checkpoint. Appendix No. 13, issued in addition to the order of the Federal Tax Service, contains information on the rules for filling out each individual column. A special feature of registering several divisions is that there is no need to prepare several applications at the location of the head office.

The application to the Federal Tax Service requires a round seal of the organization. If the manager cannot personally sign the document, he is endorsed by a representative, with the obligatory provision of a document giving the right to sign such documents (power of attorney).

We recommend reading: Application to the Court for Exclusion from the Apartment

Action plan for registering a cash register

- Select a cash register from the models listed in the state register.

- Contact the general supplier or the central service center to purchase the CCP.

- Submit documents for registration to the tax office at the place of residence of the individual entrepreneur, at the legal address of the organization or the address of a separate division (if the cash register is not located at the legal address of the LLC).

- Ensure inspection and fiscalization of the registered cash register by a tax inspector in the presence of a central service center specialist.

- Do not forget about the need to re-register CCP when replacing EKLZ and other grounds established by law.

Checkpoint of a separate unit: how to find out and receive

Companies, in accordance with the Civil Code of the Russian Federation, can be created to conduct business activities in general or perform certain tasks. In this they are no different from other entities engaged in economic activities.

Information about such structural divisions as branches and representative offices is displayed in the Unified State Register of Legal Entities (other types of EP do not appear in it). Tax officers transmit all checkpoint numbers of existing separate divisions to the inspectorate at the head office address.

How to find out the checkpoint of an organization - the main reasons for registration

Then all banks and counterparties are sent a corresponding notification about the change of legal address. The tax service must promptly notify other registration authorities of a change in the company's legal address, but it would be useful to monitor this process independently.

The registration reason code is a mandatory requisite when filling out all kinds of documents, but individual entrepreneurs do not have it. This allows individual entrepreneurs to simply indicate 0 or a dash in the checkpoint column when filling out declarations.