Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

+7 (499) 938-81-90 (Moscow)

+7 (812) 467-32-77 (Saint Petersburg)

8 (800) 301-79-36 (Regions)

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

Starting a business is not easy. At the initial stage, most entrepreneurs have problems with a lack of cash and a reluctance to increase the authorized capital of the company. The ideal way out of the situation is an interest-free loan from the founder.

In this article, we will consider the main provisions of such borrowing, determine the tax consequences and risks for the organization, and also find out whether or not the founder can limit funds to his enterprise under Russian law.

Who is the founder

The founder can be an individual or a legal entity. The founder creates a new company or organizes a foundation. The founder can be one individual; members of the group of persons that created the enterprise are called co-founders.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

+7 (499) 938-81-90 (Moscow)

+7 (812) 467-32-77 (Saint Petersburg)

8 (800) 301-79-36 (Regions)

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

The founders form a new business entity. In everyday life, such concepts as founder or creator of an organization are common.

Thus, when they say “founder” they usually mean the owner or owner of the company.

What are the responsibilities of the founder:

- creation of a charter for a new organization;

- formation of authorized capital;

- company registration;

- searching for a legal address for an organization;

- registration with the tax authorities;

- production of seals and other company documents;

- obtaining a registration certificate;

- obtaining a tax registration certificate;

- opening a current account in a bank (or several banks);

- depositing the authorized capital into the current account;

- search for personnel units to carry out business activities.

The form of economic activity is also determined by the founder.

How to get an interest-free loan

Interest-free loans from the founder are quite common, and there are several reasons for this. One of them is that the borrowing organization will not have to pay any additional taxes, and since the loan is gratuitous, only the principal amount is repayable.

Interest-free loans from the founder can be short-term (up to one year) and long-term (over a year).

An interest-free long-term loan from the founder is issued in exactly the same way as a short-term loan - in writing. A loan agreement can be concluded for any period; this is not limited by law.

If the date of full repayment of the debt is approaching, but the borrower does not have the money, the contract can be extended.

The agreement will be considered concluded from the moment of direct transfer of money or property. An interest-free loan from the founder of property is not as common as a cash loan, but it also occurs in practice.

A mandatory condition of the loan agreement between the founder and the organization is an indication of the loan amount in the agreement (clause 1 of Article 807 of the Civil Code of the Russian Federation). Without this condition, the contract will be recognized as not concluded (Article 432 of the Civil Code of the Russian Federation).

In addition, the document must clearly state the term of the loan and the procedure for its repayment. In order for the loan to be truly interest-free, this should be written in the agreement.

Without this condition, the loan automatically becomes interest-bearing, and this is an undesirable tax consequence for the parties to the agreement. More details about interest-bearing and interest-free loans are provided in Article 809 of the Civil Code.

In general, when drawing up an interest-free loan agreement from the founder, you should be guided by the general rules for drawing up loan agreements.

However, in this case, you also need to take into account the following features:

- problems may arise if the founder decides to remove debt obligations from the borrower (i.e., organization). There is no special document form for debt forgiveness. Removal of the debt burden can be formalized by concluding an appropriate agreement between the lender and the borrower - a bilateral transaction. You can also draw up a notice of forgiveness (a one-sided transaction) or a gift agreement. The gift agreement may be subsequently qualified as invalid;

- Most often, the founder and director of the company are the same individual. Thus, the same person appears in the agreement, who signs for both the lender and the borrower. This is not prohibited by law, but in practice the document is often signed by the deputy head;

- To ensure that the tax office does not have any unnecessary questions, it is recommended that the loan acceptance certificate and other documents be attached to the agreement.

The loan agreement usually includes additional documents such as:

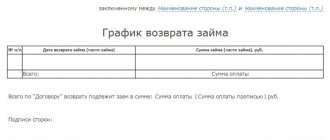

- loan disbursement schedule;

- loan repayment schedule;

- interest payment schedule;

- additional agreement;

- protocol of disagreements;

- Protocol for reconciliation of disagreements.

How the Alfa secured loan service works is described in the article: Alfa Loan. Where to find private loans without deception and without prepayment, find out here.

Interest-free loan option without repayment

The founder understands that all activities of the organization in which funds are invested are ultimately aimed at making a profit and enriching him. Therefore, under some circumstances, you may not require repayment of the debt. What is stipulated in the legislation in this case?

Firstly, the agreement cannot include such a clause as non-refund of funds. Secondly, even if the borrower does not return the funds, and the lender agrees with this, documentary confirmation of such completion of the initial agreement is necessary:

- the founder draws up a notice with the amount of funds transferred, details of the main agreement;

- a separate paragraph indicates the termination of the borrower’s obligations;

- a company that received an interest-free loan with such consequences is legally required to report on the income received.

In this case, a loan is defined as non-operating income, from which at least twenty percent is calculated under the basic taxation system and at least six percent under the simplified system applied. All this is indicated in the enterprise’s reporting, and appropriate tax measures are taken.

Last year did not end well for many, due to difficult economic conditions and other external factors affecting business. 2021, as the beginning of a new financial period, allowed some companies to turn to the founders, or the founders themselves, to provide financial support to the enterprise with an interest-free loan, which has its own tax consequences.

Sample contract

An interest-free loan agreement is drawn up according to the model of a regular loan agreement. The parties to the agreement, conditions, details, etc. are also indicated here. In the case of a loan from the founder, the founder himself acts as the lender, and the organization acts as the borrower.

Loan agreements from the founder include a number of additional conditions that are essential terms of the transaction.

So, for example, it is necessary to indicate that the funds are issued for free use, otherwise interest will be charged on the loan amount; the method of providing the loan (for example, depositing into a current account), the method of repayment, etc. In the loan agreement, specific repayment terms may also be indicated. be not specified.

How to correctly draw up an interest-free loan agreement from a single founder:

- First of all, we indicate the date of conclusion of the contract and the place of its preparation;

- then we write down the names of the parties to the agreement: lender - founder (passport details, registration address), borrower - legal entity (company name, full name of the manager). Here you need to indicate the number and date of the charter;

- in the subject of the agreement we specify the amount of the interest-free loan in rubles, indicate the timing of the provision of funds. It should be noted that there are no fees for using the loan;

- then all other sections of the agreement are filled in: the rights and obligations of the parties, force majeure circumstances, the procedure for amending and terminating the agreement, additional conditions, details of the parties.

A sample interest-free loan agreement from the founder can be found here.

Repayment at the expense of the borrower's property

How and when the funds (property) will be transferred to the lender is one of the main points of the interest-free loan agreement. The return options are:

- non-cash transfer of funds from the borrower's account to the lender's account;

- cash refund through the company's cash desk, with confirmation of receipt;

- goods at the price accepted as the basic one on the current market.

When the subject of the agreement was money, but the return was implied in a different form, it is necessary to transfer the rights to the property. The transferred property must be assessed. At the stage of concluding a contract, this happens if it is agreed in advance that the return will not be made in money.

In the case where, by prior agreement, the borrower pays with valuable items or goods for current obligations (which must be recorded as an option in the agreement), it is necessary to evaluate them. This activity can be carried out either by the parties to the contract or by a third party involved.

If a situation arises when the borrower is unable to repay the debt, or the founder understands all the benefits of developing a business with the loss of his own funds as a necessary necessity, another situation may arise. Debt can be “forgiven.”

How do you receive funds?

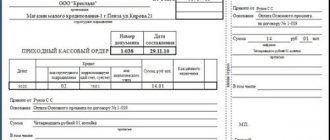

An interest-free loan is provided from the founder through the cash desk, or in the form of a transfer to the company’s current account. There are no specific rules regarding the preparation of primary documents when concluding an agreement.

Payment documents can serve as proof of the issuance of funds: a payment order, a bank statement, a receipt for a cash receipt order, or an act of receipt of financial assistance.

The basis for carrying out a business transaction to receive funds from the founder is the loan agreement itself.

After concluding the agreement, it is necessary to draw up a receipt indicating the loan amount and the date of transfer of money. The agreement is considered concluded from the moment the money is received into the current account, or from the moment it is deposited into the cash register.

Debt repayment

The loan agreement must include terms and methods of repayment. The debt can be paid in equal installments at regular intervals (for example, once a month).

For this method of repaying the loan to the founder, an appendix to the agreement is drawn up - a payment schedule (one copy remains in the hands of the lender, the second is received by the borrower).

In addition, the entire loan amount can be paid in a lump sum within the period specified in the agreement. Failure to repay the debt on time constitutes arrears and leads to interest charges.

To avoid this, the agreement between the founder and the organization is extended (extended). The length of the loan agreement extension can be any; there are no restrictions regarding the number of such extensions.

The loan will be considered fully repaid when funds are received in the current account or when money is transferred in cash. Please note that settlements with the founder cannot be made using proceeds from the cash register.

According to the instructions of the Central Bank of the Russian Federation dated October 7, 2013 No. 3073-U, cash received for goods sold, services provided or work performed can be spent on:

- wages and social benefits for employees;

- repayment of insurance under insurance agreements;

- providing money on account;

- purchase of goods, payment for work and services;

- monetary compensation for previously paid and returned products, or for unperformed work or services.

The presented list does not contain such an item as repaying a loan from the founder. Therefore, you cannot repay the loan using cash from the cash desk. Violation of this rule may lead to the imposition of administrative liability on the company.

Debt repayment is carried out by bank transfer from the company's current account.

It should be noted that violations of cash discipline will not arise if you first withdraw money from the current account, deposit it in the cash register and repay the loan from this money (clause 4 of Bank of Russia Directive No. 3073-U).

When receiving money under an interest-free loan agreement, the founder does not have an obligation to pay personal income tax, since this is not considered income.

Taxation and tax risks

Income received from a loan is not taken into account when determining the tax base. This means that companies operating on a common system will not pay income tax after signing an agreement and receiving financial assistance from the founder.

This also applies to companies operating on a simplified basis. Also, you should not pay VAT, since the loan is in no way related to payment for work and services or sales of products.

The founder simply lends a certain amount of money and nothing more. If the money that the company received under the loan agreement was not returned under the debt forgiveness agreement, it will be classified as gratuitously received funds.

Such funds will be included in non-operating income and will be taken into account when calculating the tax base. For companies operating on a simplified basis, such debt will also be included in non-operating income.

Borrower taxes

With an interest-free loan, the borrower will have to pay 35% of the income he received from saving on interest. In addition, this tax is paid if the loan is interest-bearing, but the interest rate is below 2/3 of the refinancing rate of the Central Bank of the Russian Federation. These conclusions follow from paragraph 2 of Art. 212, paragraph 2 of Art. 224 Tax Code of the Russian Federation. In this regard, it is necessary to consider how beneficial it is to stipulate the condition that the loan is interest-free.

When the debt is forgiven, the borrower will receive income and, accordingly, will have to pay income tax in the amount of 13%. To avoid paying such tax, it is possible to enter into additional agreements on the basis of which the contract period will be extended.

***

Thus, a loan agreement between the organization and its participant may well be concluded. However, you should think about the possible tax consequences for the parties, as well as the nature of the transaction - paid or gratuitous.

Material benefit

Funds under an interest-free loan agreement from the founder are not provided free of charge, since such a loan received by an organization must be returned to the lender upon the arrival of a certain period.

Chapter 25 of the Tax Code does not establish the procedure for determining material benefits and taking them into account when receiving an interest-free loan from the sole founder.

It turns out that the material benefit received by the company from using a gratuitous loan does not affect the size of the tax base for income tax.

Tax on interest that does not exist

Can the founder, if necessary, give an interest-free loan to his organization? Of course, it can, but the situation of refusing interest has its own peculiarities. For example, if a loan is issued to the founder of his company without receiving interest, does he have income?

From an everyday point of view, of course not, because the founder did not receive any financial benefit from this. But the Tax Code interprets this situation differently - I didn’t receive it because I didn’t want to, but I could have made money from it. Accordingly, he could have income, and where there is income, there is taxation. And it’s okay that this income is only estimated, the tax will be real (letter from the Ministry of Finance dated May 25, 2015 No. 03-01-18/29936).

Fortunately, such a specific point of view extends to a rather rare situation - if a transaction has been concluded between related parties that can be considered controlled.

Interest-free loan from a foreign founder

When concluding a loan agreement with a foreign founder of a Russian company, you need to take into account the norms of currency legislation.

According to Federal Law No. 173-FZ of December 10, 2003 “On Currency Regulation and Currency Control,” the provision by a foreign founder of an interest-free loan from the founder in foreign currency is recognized as a foreign exchange transaction.

In this case, a foreign individual acts as a lender, and currency transactions between residents and non-residents related to the provision of a loan can be carried out without restrictions (Article 6 of Federal Law No. 173-FZ).

Instruction of the Central Bank of the Russian Federation No. 117-I states the following: when receiving a loan from a non-resident Russian company, a currency transaction passport should be drawn up.

Such a document is not issued if the loan amount under the agreement does not exceed the equivalent of 5,000 US dollars at the exchange rate established by the Central Bank of the Russian Federation on the date of conclusion of the agreement.

An interest-free loan agreement from the founder is one of the most convenient ways to provide financial assistance to your own company. The agreement must necessarily include conditions such as no interest on the use of funds, terms of the loan and methods of repaying the debt.

A properly executed agreement provides many advantages, namely, exemption of the company from paying income tax.

Applying for a targeted loan for maternity capital at Rosselkhozbank is described in the article: targeted loan for maternity capital. On what conditions you can get a tender loan from Sberbank, read here.

See the table for companies willing to provide a loan on a Maestro card.

Legislation on perpetual loans

An open-ended loan agreement is regulated by civil law, namely the provisions of the Civil Code on loans. In the Civil Code of the Russian Federation, paragraph 1 of Chapter 42 is devoted to loans.

Namely in paragraph 1 of Art. 810 states that if the loan repayment period is not an essential condition for concluding a loan agreement, then this agreement is called unlimited.

In addition, this article states that in this case, the borrower is obliged to repay the entire amount of the debt to the lender within 30 days after receiving the request for repayment.

The request must be sent to the borrower in writing. In addition, the borrower must sign for its receipt. The notice does not have to be delivered personally to the borrower. It can be sent by mail with notification. The main thing is that there is a receipt mark.

If the borrower is late in repaying the loan, this notice will be considered evidence in court.

However, we should not forget about judicial practice on such agreements.

A perpetual loan agreement is not that uncommon these days. It is concluded on the basis of the provisions of paragraph 1 of Chapter 42 of the Civil Code of the Russian Federation. Exactly the same conditions apply to it as to a regular loan agreement, with the exception of one essential condition - the repayment period.

A sample additional agreement to the loan agreement on extending the term is found in the article: additional agreement to the loan agreement. The main provisions of an interest-bearing loan agreement between legal entities are discussed here.

The process of drawing up a cash loan agreement between legal entities is described on the page.