By the end of the next annual period, Russian business will finally switch to new cash register equipment, with a small number of exceptions listed in the Tax Code. The next stage of delays will end on July 1 next year. It will affect merchants using different types of taxation. Among them is a single tax on imputed income. We will tell you more about online cash registers for individual entrepreneurs on UTII in our article.

Online cash register for individual entrepreneurs on UTII

What is an online cash register?

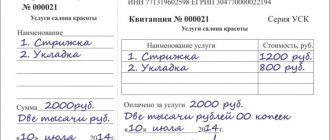

This device is understood as a cash register with a special flash drive - a fiscal drive. The machine is connected to the network. Through it, she contacts the selected fiscal data operator (a company that collects and stores the sent information, which it then sends to the tax office). In addition, the device prints an optical barcode (QR) on the receipt and an active link to the electronic version of the document, which is automatically sent to the buyer and the OFD itself.

The device works simply: the cashier punches the receipt, and the machine sends the data to the operator, who sends the data to the government agency, which sees the following picture: in the “Five” store on Stakhanovskaya Street, 21 people just bought 8 packs of beans for 35 rubles each. The entrepreneur no longer needs to fill out reporting paperwork, for example, keep a log of the cashier-operator, and the receipt itself now has more information, which increases customer confidence in the outlet: name of the product sold, price, value added tax included, information about the store and the Internet device itself. The device may also have the technical ability to send a digital version of the receipt on behalf of the store by e-mail or as an SMS message to the buyer, if he so desires. Both versions of the check, from a legal point of view, are the same.

Article 4.7. Requirements for a cash receipt and strict reporting form (Federal Law No. 54)

There are different types of online cash registers:

- stand-alone devices that have the necessary pre-installed programs and do not require additional equipment;

- A POS complex is a payment terminal along with additional equipment (scanner, cash drawer, card reader of various types, computer, etc.);

- a fiscal recorder that has neither a display nor a keyboard and works only in conjunction with a candy bar or desktop computer.

Each of these types of online cash registers can be used by an individual entrepreneur who is on “imputation”. The choice of a complex does not depend on the chosen taxation system, the novelty of the device (the state allows the installation of updated versions of old cash registers), but is dictated by other factors, primarily, the scope of application of the online device. The software for operating a liquor store will be different from the cash register software package for a bakery. And, in addition, the gadget must also perform additional functions in these industries: when selling alcoholic beverages, the device must be connected to the Unified State Automated Information System, and the sale of meat and dairy requires interaction with the FSIS "Mercury".

EGAIS is a unified state automated information system for recording the volume of production and turnover of ethyl alcohol, alcoholic and alcohol-containing products. With its help, the state controls the alcohol market.

For more information about what an online cash register is and how it works, read the article on our website.

Fiscal storage

Question: If the individual entrepreneur is on the simplified tax system and UTII, what fiscal drive should we use? Answer: For 36 months, if there are no excisable goods. Read more about restrictions when using financial funds with different validity periods in the article.

Question: The organization combines the simplified tax system and UTII. For what period should fiscal accumulators be used for each mode? What if there is only one cash register? Answer: You need a tax fund for 36 months if there are no excisable products. You can use one cash register. The main thing is to specify both modes when registering, and issue checks separately for each taxation system.

Question: We work on the simplified tax system with excisable goods and UTII, what deadlines should fiscal officers have? Answer: For 13 months.

Question: When combining the simplified tax system and UTII, for what period should fiscal accumulators be used? What if there is only one cash register? Answer: A FN for a period of 36 will suit you if there are no excisable goods. It is also needed to work with two aids on one cash register.

Selecting an online cash register

To select a device, you must take into account certain parameters.

Table. Characteristics of online devices

| Criterion | Description |

| Print speed per unit time | The parameter demonstrates how many receipts the device can print in a certain time period. It is usually measured by the number of lines or millimeters per second |

| Mobility and autonomous operation | Mobile machines can be used for courier activities or in restaurants, where waiters can bring the cash register directly to the customer's table. In addition, there are gadgets that can run on batteries for up to three days and access the network via a mobile phone |

| Network connection type | Wireless or cable, a GSM module is also used. The specifics of the business also influence this parameter. |

| Memory capacity and required software package | Cash desks have different numbers of gigabytes of memory; not all support working with flash cards and connecting peripheral devices such as a scanner, etc. It is also worth considering the possibility of interacting with the Excel program and downloading databases. An autonomous terminal may be enough for a small store, but a large retail outlet could benefit from a fiscal registrar, which will make it easier to account for goods. |

| Interface and case design | Among online cash registers you can find both touch and push-button options. In addition, devices can be of different sizes |

| Possibility of official registration on the tax service portal | Without this, the Federal Tax Service will not see the cash register, even if you have the device |

The price of an online cash register and expenses for it depend on several factors: the manufacturer, the characteristics needed by the buyer, the selected data operator, and the availability of after-sales service. Therefore, the cost ranges from 10 thousand rubles for an inexpensive terminal and 50 thousand for a complete system.

Refurbishment of an old cash register

Question: The store is now operating on UTII. We use an Atol FPrint 22 printing device without a fiscal drive. Now we will switch to CCP. Can this device be converted, retrofitted or upgraded to the CCP level? Answer: Check with the supplier whether it is possible to install the FN in this cash register model. In order for the fiscal receipt printer with FN to send data to the tax office, connect to a fiscal data operator, for example, Kontur.OFD. To print the names of goods on a receipt, connect a commodity accounting system, for example, Kontur.Market.

Question: Is it possible to modify old fiscal cash registers, for example, EKR 2102K? Answer: It all depends on the specific model, check this point with your manufacturer.

What should you do before purchasing a cash register?

Before purchasing, you need not only to choose a cash register model, having previously assessed its functionality based on the specifics of the business, but also to perform certain preparatory actions:

- Checking the cash register for compliance with legal regulations (it must print receipts, create their digital versions and send information in real time to the operator, and then to the tax authorities). A list of recommended devices is available on the Tax Service website.

- Selecting a fiscal data operator with whom to sign an agreement. It is usually concluded for a year. The list of OFD companies is also posted on the IFTS portal.

- Purchasing a fiscal drive. It is valid for thirteen, fifteen or thirty-six months (it is the three-year period that is used by individual entrepreneurs on UTII). After its service life has expired, it must be replaced.

- Purchasing an additional software package if the business requires it (alcohol, tobacco, meat and dairy) or the entrepreneur uses several taxation systems.

When an entrepreneur buys a cash register, he must register it with the tax office and with the FD operator. To do this you need to submit an application. After checking the registration information, the tax authorities will send a number, which the businessman then enters into the machine, generates the first fiscal report and sends it to the inspectorate. After confirmation and registration of the registration card, the device is ready for use.

Registration, re-registration of cash registers

Question: An organization has an autonomous cash register without transferring data to the OFD (located in a remote location). How will data be transferred to the Federal Tax Service when replacing the fiscal drive? Is this the responsibility of the Federal Tax Service, as it was before, or the enterprise?

Answer:

The Federal Tax Service of the Russian Federation, in its letter dated February 16, 2018 N AS-4-20/ [email protected] , clarified the procedure for deregistration or re-registration of cash registers, which was used offline, that is, without transmitting fiscal data to the tax authorities.

In this case, the cash register user reads the data from the fiscal drive and provides this information to the tax authorities using any of the following options:

- Through the cash register office, together with an application for deregistration of the cash register or when submitting an application to the tax office for re-registration of cash register equipment in connection with the replacement of the FN.

- When contacting any territorial tax authority in person. The taxman himself reads the data from the drive using a special USB adapter. By the way, inspections must independently purchase such adapters. If there is no adapter, the taxpayer must provide fiscal data himself in electronic form.

How to switch to online cash register cheaper?

It is better to do this gradually, experts advise. You can use the following algorithm:

- In December of this year it is worth purchasing a new device. Until the first of July it can be used as a check printing machine. The device has other bonuses: convenient supervision of sales of any time period, accelerated inventory, the ability to pay with a card of the issuing bank, reduction in the level of various abuses and errors on the part of cashiers, prompt customer service, BSO is no longer needed, and the check itself will contain everything necessary details;

- from January to March, you must add a fiscal accumulator to your shopping list - its cost is from six to eight thousand rubles. Last year there simply weren’t enough of them – we had to stand in line for months;

- Before the end date of the deferment, sign an agreement with the operator and register the device with the Federal Tax Service. It will cost from three to six thousand rubles.

Objectives of introducing new cash registers

First of all, the state is introducing online cash registers to facilitate the identification of violators and tax evaders. The new-style cash register transmits information about all calculations carried out on it to the tax service. This simplifies the process of control by the authorities and reduces tax audits. It is now much easier to identify violators and apply control measures.

An important task is to control the financial flows of not only entrepreneurs and organizations, but also the ordinary population. The receipt format now clearly indicates the name of the product for each item. It becomes possible to create a single product catalog for the entire country and identify the most popular product items. The state accumulates statistics, collecting all possible data.

Another important target is very important for all parties - identifying counterfeit goods. The new cash register will prevent the sale of counterfeit goods, and the imminent introduction of mandatory labeling will make it impossible to sell counterfeit goods.

Also, the introduction of online cash registers creates an opportunity to increase the level of business transparency in the country and control financial flows.

New-style cash register equipment is a powerful tool for controlling and improving the quality of the market. Sounds a little scary? But it's not all that scary. The introduction of cash registers for individual entrepreneurs also brings with it a large number of positive aspects, and we will look into this further.

When are individual entrepreneurs required to buy an online cash register on UTII?

The transition to an online device for this type of businessman is a two-stage process, and the first stage has already been completed.

- First of July two thousand eighteen. Until this moment, all merchants who chose the imputed taxation system and who employed employees were required to install new devices. These are enterprises for the piece sale of goods, the production and sale of culinary products, excise goods stores (alcoholic drinks, cigarettes, etc.), and vending business enterprises.

- First of July two thousand nineteen. New devices are also necessary for those individual entrepreneurs who work without employees in retail trade and catering establishments. In addition, entrepreneurs who were previously subject to a deferment will also be required to install online cash registers. These are “imputed” businessmen related to the following areas of activity (they are indicated in subparagraphs 1–5 and 10–14 of the second paragraph of Article 346.26 of the Tax Code of the Russian Federation):

- repair and maintenance of transport equipment;

- veterinarians;

- household services;

- passenger and cargo transportation;

- paid parking;

- landlords renting out space for shops and catering establishments, as well as land for retail outlets, canteens, restaurants, etc.;

- hostels on an area of no more than five hundred square meters;

- placement and distribution of advertising on banners, in transport and other objects;

- non-mobile retail in retail outlets;

- mobile trade (selling products through vending machines, at fairs and kiosks);

- catering establishments that have not equipped a client room or have one (no more than one hundred and fifty sq.m.);

- retail outlets with a hall not exceeding 150 m2;

- sellers of securities.

Individual entrepreneurs on UTII working in retail and catering are required to purchase an online cash register next year

But in any case, even if they do not have an online device, all of the above entrepreneurs must, at the consumer’s request, issue a paper confirming the receipt of money (receipt, check).

Moment of calculation

Question: We have an individual entrepreneur on the simplified tax system of 10%. Online store. At what point should a cash register check be entered if the client pays to a current account through a mobile bank or online bank? It turns out that we will see the extract only the next day. Answer: As soon as you receive a bank statement, create a check and send it to the buyer. There are recommendations from the Ministry of Finance in letter No. 03-01-15/11618 dated 03/01/2017. The letter says: “When making payments on the Internet using electronic means of payment, the organization is obliged to use cash register systems from the moment of confirmation of the execution of the order to transfer electronic means of payment by the credit organization.”

Question: Our LLC provides training. Sometimes we are paid by an individual into a bank account. How to punch a check in this case and how to see this payment in the bank, because the bank does not immediately show transactions on the account, we see credits only on the next business day. Answer: According to the law, the check must be generated at the time of settlement, but the concept of “moment of settlement” is not fixed in 54-FZ and can be unambiguously interpreted only in offline trading - the moment of transfer of money from the buyer to the seller. In your case, we recommend that you generate a check as soon as you see your bank statement. Justification: letter of the Ministry of Finance 03-01-15/11618 dated 03/01/2017 and the Law on the Protection of Consumer Rights, which states: “... the buyer’s obligations to pay for goods are considered fulfilled... from the moment the transfer of funds is confirmed by the servicing credit institution” (clause 3 of Art. .16.1).

Get a set of cash register equipment from SKB Kontur that is optimal in price and technical capabilities.

Order an online cash register and receive a discount on the Kontur.Market service for working with cash registers and automating goods accounting. Choose a cash register

If an individual entrepreneur has employees on UTII, does the deferment apply?

If the head of an individual enterprise hires at least one more person, then he is obliged to buy and register an online cash register within thirty days after concluding an agreement with the employee, even if before that day there was a deferment for his company. But we note that if an entrepreneur employs salespeople – individual entrepreneurs – they are not formally considered employees, just like employees on civil contracts. In these two cases, the deferment remains: no employment agreement - no CCP.

By the way! Sellers of excise goods install new online devices in any case, even if they are in hard-to-reach places or sell their goods on the market.

Registration and setup

After purchasing an online cash register, a number of further actions follow:

- Concluding an agreement with the OFD - Each online cash register must transfer receipts to the Fiscal Data Operator; if your region is not exempt from the mandatory transfer of OFD data, then you are required to enter into an agreement with the OFD.

- Registration of an online cash register with the Federal Tax Service - Registration of an online cash register takes place through the personal account of the Federal Tax Service (nalog.ru), for this you must have an electronic signature (ECS). You can personally register your online cash register or contact the service center for help. We recommend the latter. If you do not register correctly, you will have to change the Fiscal drive and incur additional costs of at least 6,000 rubles.

- Upload your items to the online cash register —Here, a commodity accounting system or another method supported by your online cash register will help you.

- Connect the cash register to EGAIS - If you have alcohol and/or beer on sale, this step is required for you.

Do you need help selecting an online cash register for UTII?

Don’t waste time, we will provide a free consultation and select an online cash register that suits you.

By contacting our company, you can receive a full range of necessary services:

- Electronic signature for registering an online cash register.

- Connection to OFD

- Registration of an online cash register with the Federal Tax Service

- Connection and support of EGAIS

- Subscriber support for Online cash registers

- Submission of declarations on alcohol and beer to FSRAR.

Will deferments for individual entrepreneurs on UTII be extended?

Members of the federal parliament discussed two bills this year and last proposing to delay the full introduction of the new cash registers until 2021. But none of the potential laws passed. The parliamentarians decided that there was no point in delaying the process of transition to a new type of device; it was enough that there was a delay until the middle of next year.

However, there is also a slight relaxation: individual entrepreneurs on UTII that do not sell excise goods may not indicate the goods sold in receipts and strict reporting forms until February 1, 2021. Thus, small businesses will not have to purchase warehouse accounting programs and attach barcodes to goods yet. The name of the product can also be entered into the receipt manually: now such online cash registers are also sold, in which the seller needs to select the desired product and its quantity from the list. The name of excisable goods will need to be indicated on the receipt starting July 1, 2021.

Deputies decided that a delay until mid-2021 is enough

How to choose a cash register

Question: What equipment is best to use to sell tour packages? Answer: There are several criteria for selecting cash register equipment: the flow of customers (high/low), the number of items in your product range (products or services). Use the equipment page to select cash register equipment and calculate its cost.

Question: Individual entrepreneur on UTII, we sell auto parts and oils. What kind of CCP is needed? Approximately 60 customers per day. Answer: Stores with such an assortment usually have more than a hundred items in their product range. This means you're better off using MSPOS-K if you don't have much space in your retail outlet, or ATOL Sigma.

Question: When selling jewelry, should the receipt include full information about the purchased item, that is, the article number, sample size, weight, or is just the name and price sufficient? Which cash register is better to choose? Answer: The law says that the name on the receipt must allow the buyer to clearly identify the goods purchased. Therefore, simply indicating “earrings” is not very correct. The MSPOS-K online cash register may suit you if you have a small outlet, or the ATOL Sigma monoblock.

Question: Individual entrepreneur on UTII when retailing beer, which cash register model is better to choose? Answer : The entire line of SKB Kontur equipment, except Atol 91F, will allow you to sell beer. But not only this, in Kontur.Market you can exchange documents with EGAIS, generate write-off acts based on the sales log, and also an alcohol declaration based on data from EGAIS. Choose a cash register based on the following criteria: product volume, number of customers per day, budget. This could be MSPOS-K, if there is little space on the counter, or a MultiPOS-X9 POS terminal with an inexpensive Atol 30 F receipt printer, or an Atol Sigma 10 monoblock, which is also well suited for individual entrepreneurs on UTII.

Question: We have 10 thousand items. What do you advise? A cash register with a scanner or a cash register connected to a computer? Answer: Focus on budget and peripherals. If the outlet already has a PC, you can not buy a POS terminal, but connect a fiscal printer to the PC, install the Kontur.Market cash register module on it and start trading. If the store does not have any equipment, a POS terminal with a receipt printer or a candy bar will do, and a computer with the Kontur.Market service installed can be installed separately at a merchandiser or at the home of the business owner. If you have an assortment of 10 thousand items, purchase a scanner; it will help you quickly add products to your receipt.

Question: We sell fresh flowers and bouquets. The flow of customers is small, five retail outlets. What kind of cash register is needed? Answer: MSPOS-K or Atol Sigma 10 monoblock is suitable, this is a more universal device. If there are 5-10 varieties of bouquets, then Atol 91 F may be suitable. For Atol 91 F, you can print a sheet with article numbers and barcodes from Kontur.Market. If there is a scanner, the cashier will be able to quickly add items to the receipt; if there is no scanner, the cashier will enter the item number manually.

Question: What if it’s not convenient to issue receipts both in the store and in the hairdresser at the same time? The store will have a cash register as expected. But the hairdresser is located in a different place, and the flow there is insignificant. Which cash register to choose for a hairdressing salon? Answer: If the hairdressing salon has a limited range of services, and you do not sell related products (shampoo, gel), then Atol 91 F will suit you with a small range of products.

Question: PSN, retail in a stationary store, 15,000 book titles, long titles. What equipment is needed? Answer: It is better for you to purchase a fiscal printer model with a wide ribbon so that the names fit on the receipt. For example, an Atol 25F printer is suitable, and a MultiPOS-X9 POS terminal is suitable for it.

Question: We have a small list of goods and services. But the price is sometimes negotiable and may change during the day depending on the quantity and other various reasons. Which CCP is better to choose? Answer: Almost any cash register can operate in free price mode. This means that the product directory contains only names, and the cashier enters the price manually.

Question: Are the prices for cash register sets the same for all regions? Answer: Yes, cash register sets from SKB Kontur are sold in all regions at the same price.

Question: Individual entrepreneur, hair salon, operates both as a store and provides services. What to do with CCP in this case? Answer: Sales and services can be carried out on one cash register. If they are carried out using different taxation systems, then you need to indicate these systems during registration and generate checks for each SSS separately.

Which individual entrepreneurs do not need online cash registers on UTII?

Several categories of individual items are exempt from registration of cash registers operating in real time. entrepreneurs using the imputed type of tax system.

- Those who locate their retail space in hard-to-reach areas where network traffic is bad. Its quality level is approved by regional authorities, officially documenting this point at the federal level. Whether your city, village, town is included in the register of hard-to-reach places, you need to find out from the municipal administrations.

- Entrepreneurs working in places remote from communication networks also have a small privilege. In such a situation, entrepreneurs can install a cash register without connecting to the World Wide Web.

- For non-cash payments with legal entities and owners of individual enterprises.

- Small businessmen who engage in shoe restoration, key making, or work in markets; They sell printed newspapers peddled and in stalls (although there are certain restrictions), and travel tickets are sold inside buses. There is no need for new equipment and in the canteens of educational institutions. Without a cash register you can sell ice cream, bottled non-alcoholic products, milk and drinking water, kvass from automobile tanks, sell seasonal vegetables by weight, accept glass and raw materials for scrap, care for minors, people with disabilities, the elderly and sick, plow the garden -dacha plots and sawing firewood, carrying luggage at train stations, renting out your home. All exceptions are described in paragraph 2 of the second article of Federal Law No. 54.

By the way! The presence of an acquiring device does not exempt you from using an Internet device. If the consumer pays by card, the merchant issues both paper and electronic receipts.

Devices for mobile acquiring

Situation. Individual entrepreneur Pavlov uses “imputation” and for now can do without an online cash register. The businessman also plans to open an online store. Can he carry out his activities without a new gadget until the first of July? In this case, the deferment does not apply, since trade through the World Wide Web is not a type of business that, in principle, is subject to imputed income and a patent. Therefore, for an Internet point, an individual entrepreneur will have to buy both a cash register and enter into an agreement with the operator. There is also a nuance in how the online store will accept payment. A cash register is required for bank cards, but not for cash on delivery or payment by receipts.

Technical nuances

Question: What is the minimum Internet speed for transmission via OFD? Answer : There are no official figures or restrictions in the law. Technically, transmission is possible even with mobile 3G.

Question: Is it possible to disable printing of tape in Atol Print 22 PTK, which is connected to the online store? Answer: This applies to the software of this particular cash register; you can get the answer from the manufacturer.

Question: So you can purchase a cash register in advance, work on it, learn, and only then register it with the Federal Tax Service? Or do I need to register immediately? What if the cashier makes a mistake and we get a fine? Answer: Until July 1, you do not have the obligation to use a cash register connected to the OFD and tax office. This means that you can purchase a cash register with FN in advance, purchase the necessary software and enter into an agreement with the OFD. But the validity period of the OFD and FN will begin from the moment you register the cash register with the tax office. The law allows you not to register a cash register right now, but to do it closer to July 1, 2021. To do this, you need to remove the FN from your cash register and set the cash register to UTII mode. This mode is also called the non-fiscal mode or the check-printing machine (CHM) mode. In this mode, you will be able to transfer items to the cash register, and the cash register will print receipts with names and prices, but will not send them to the Federal Tax Service. For more details, contact the cash register manufacturer or the retailer from whom you purchased it.

Question: If the buyer pays by card, is it necessary to issue a receipt? Will revenue double? Answer: Yes, a check is required. Revenue will not double. When selling, you indicate the payment method: cash or electronic. The cash register sends this sign to the tax office, so the Federal Tax Service knows which check was processed through the acquiring terminal.

Question: If the Internet disappears during work, what options are possible in these situations? Answer: It’s not scary, the cash register continues to work, the Federal Fund continues to save bounced checks, this can last up to 30 days. Without the Internet, there will be no exchange with the Kontur.Market product accounting system: the service will not be able to receive sales data to build reports, you will not have the opportunity to update the items at the checkout if prices or items have changed. As soon as the Internet appears, the cash register will do everything necessary automatically: send the data to the OFD and Kontur.Market, update the nomenclature. If there is no Internet for more than 30 days. The FN will be automatically blocked, the cash register will not be able to return new checks.

Are cash registers needed for individual entrepreneurs working on “simplified” and “imputed”?

For payments in the area of business where a simplified taxation system operates, a cash register is needed; for activities that are still subject to deferment, receipts do not need to be entered through online technology. But in any case, with a combined taxation system, legislative norms still continue to apply. After the end of the deferment, one cash register working with two tax types will be sufficient in the future. But here it is worth remembering that you cannot enter goods from different systems into one receipt.

What if an individual entrepreneur works without a cash register: fines

Due to the insufficiently serious attitude of entrepreneurs to the transition to new equipment, the state has developed a number of corrective measures for the purpose of coercion and control.

At the moment, there are the following fines for individual entrepreneurs for a cash register:

- Up to half of the proceeds (about 10 thousand rubles) for work without a cash register;

- Repeated violation (work without a cash register) - suspension from work for a period of about 2 years;

- If unaccounted revenue exceeds 2 million rubles. — suspension from work for up to 2 years;

- If the cash register does not comply with the legislation, then a fine of up to 3 thousand rubles is issued;

- For an incorrectly registered cash register, the fine is 3 thousand rubles;

- If the individual entrepreneur does not issue a check or does not send its electronic version upon request - a fine of 2 thousand rubles, or at best - a warning.

Thus, trading without a cash register for an entrepreneur can result in very serious consequences with losses or cessation of work. So it’s better not to postpone the question of purchasing a cash register.

Sanctions for the absence or incorrect use of an online cash register

When an entrepreneur does not send purchase data on time, does not monitor the serviceability of the device and the consistency of the Internet connection, uses equipment that does not comply with the law, or does not register the cash register at all, although federal legislation obliges him to do so, the tax office will charge a fine:

- in the absence of the necessary equipment - from a quarter to half of unrecorded revenue, but not less than ten thousand rubles;

- incorrect use of equipment or installation of a device not included in the list of approved equipment will cost the entrepreneur from 1,500 to 3,000 rubles;

- for failure to issue a receipt to the consumer, the company will simply be warned or charged two thousand rubles.

Who else can count on a pause until 2021

According to Federal Law No. 129, a circle of persons is defined who, when carrying out their activities, may not use cash registers, including without a mandatory receipt. These include:

- Individual entrepreneurs who rent out residential premises and parking spaces, provided that they are their property;

- Individual entrepreneurs engaged in retail trade in shoe covers. In this case, entrepreneurs and legal entities. persons retain the prerogative not to use cash registers, even if vending machines are used for sale.

It should be noted one more category of persons, which, in accordance with paragraph 2 of Art. 2 Federal Law No. 54, indefinitely exempt from CCP. These are individual entrepreneurs, sellers of tickets and theater subscriptions by hand or using a tray. Theaters must have state status or be a municipal institution.

However, if the sale takes place via the Internet, then a cash receipt or BSO must be present - clause 5, 5.3 of Art. 1.2 Federal Law No. 54.

A number of organizations have been granted privileges to not use cash registers if payment for services is made by bank transfer. These include: HOAs, consumer cooperatives, educational and physical education and sports institutions, cultural and leisure centers.

Tax deduction for online cash register for UTII

Individual entrepreneurs using the general imputed tax can return the contributions paid to the budget, but only in the industry that is subject to this type of tax. You can get it if:

- An individual entrepreneur on UTII, operating in any permitted area, with the exception of retail and catering establishments, as well as an “imputed” individual entrepreneur without employees, registered an online device from February 1, two thousand seventeen to July 1, two thousand and nineteen;

- “Substitutes” who work in retail, catering or with hired workers registered an online device before the first of July two thousand and eighteen.

The amount of tax refunded is a maximum of 18 thousand rubles per cash register, regardless of how much it cost (even more than the specified limit). This amount can include expenses for the device itself, the fiscal drive, the purchase of a software package, and the costs of servicing or updating old equipment.

By the way! Deductions can be claimed based on the number of cash register devices purchased. The main thing is to stay within the limit. In addition, they cannot be folded.

You don’t have to write an application for a tax refund - just indicate in the declaration the expenses for the cash register, and the tax office will reduce annual or quarterly payments by this amount in 2018-2019. At the same time, we note that the amount of the cash deduction will be taken into account in the remaining part of the tax base, which was obtained after reducing it by the paid insurance premiums for employees. The balance of the tax cash deduction is transferred to other periods.

There are also other features. They must be taken into account when using a combined type of taxation. For example:

- UTII : if the costs of the online complex were taken into account in another tax system, they cannot be taken into account again. In the event of such fraud, the Federal Tax Service will force the entrepreneur to pay the missing amount;

- patent: when an entrepreneur has several patents, their combined value can be reduced by expenses when purchasing online equipment. But the limits are still the same - eighteen thousand rubles per device. To receive a cash deduction, you need to write an application to the Federal Tax Service: there is even a form. However, you can write arbitrarily: you just need to indicate your data, information about the current patent, the cash register itself and the costs of it.

By the way! The amount of imputed tax and the cost of purchasing a patent made last year cannot be reduced. The law has been in force only since 2018, therefore it takes into account only cash registers registered this year and does not work for calculating tax contributions for past time periods.

A tax deduction for an online cash register can be claimed for each purchased device, but not more than 18 thousand rubles for one

In November of this year, tax authorities, in order of the Federal Tax Service dated June 26 No. ММВ-7-3/414, finally approved the UTII declaration form, which also takes into account the tax deduction for the cash register. Now there is also a column for entering data about the purchase of an online cash register, otherwise there was a deduction, but no one thought about how to include it in the declaration. The use of the sample is permitted from the fourth quarter of this year. The form also specifies the details of filling it out. They also apply to those individual entrepreneurs who did not purchase cash registers or have already received a deduction - the form is the same for everyone.

To summarize the above, we conclude: using an online cash register is mandatory for most individual entrepreneurs on UTII, however, this category of businessmen can also take advantage of the deferment to purchase a new type of cash register equipment or modernize an existing device, and exercise the right to a tax deduction.

Cost of transition to 54‑FZ

Minimum you will have to spend:

— agreement with VLSI OFD from 2,500 rubles. in year; — electronic signature of UC Tensor from 700 rubles; — cash register with fiscal storage:

- autonomous cash register – from 6,250 rubles;

- cash desk with a payment terminal for card payments – from RUB 24,300;

- POS terminal – from RUB 11,900;

- fiscal registrar – from RUB 8,900. (average cost of a cash register computer is 12,000 rubles)

It is more profitable to buy equipment as a set - a fiscal recorder and a cash register computer will cost from 24,490 rubles. Kits with a barcode scanner will be slightly more expensive.

In addition to a control cash register, you will need an inventory system to receive analytics on revenue and average receipt, and control the opening and closing of shifts.

Which cash register for individual entrepreneurs is better to choose?

The choice of cash register equipment directly depends on the type and scale of the entrepreneur’s business, his budget and the required functionality. Today, there is a wide variety of devices of all formats, from compact mobile ones to full-fledged POS systems with a whole range of equipment. Prices for devices vary significantly. How to save money and not make a mistake by purchasing equipment with limited functionality or inappropriate and problematic?

Multikas specialists with extensive experience have been researching the demand and preferences of entrepreneurs throughout Russia for a long time. Both positive aspects of the equipment and disadvantages were identified. Based on statistics, models recommended for various business sectors were identified.

| Large catalog of cash registers for individual entrepreneurs | CHOOSE THE BEST CASH OFFICE |

Business activity code

When submitting an application for the desire to use the UTII regime, the entrepreneur enters the code of the type of entrepreneurial activity in a special form. Often this combination is confused with OKVED, and the Federal Tax Service refuses to accept the document. The main differences are as follows:

- during the application process, only two numbers are indicated, while with OKVED - 4;

- the number of codes for areas of activity is only 22;

- UTII codes are approved by order of the Federal Tax Service, while OKVED codes are approved by the Rosstandart organization.