Good day! I continue to write articles about changes in business in 2021, and today the next article is about the UTII tax in 2017

.

As you probably already know, UTII taxation has been extended until 2021, which of course is a plus for the UTII special regime.

Before writing the article, out of habit, I went through the sites that are in the TOP5 results of the Yandex search engine and actually nothing surprising. Just as the Internet was a garbage dump, it remains so.

To be honest, I am amazed at the authors who write about the 2017 UTII tax in mid-2021. There are errors in absolutely all articles, starting with the UTII tax return and ending with the size of the K1 coefficient.

I repeat once again, use only official sources. After looking through the articles, I came to the conclusion that they simply copied them from each other.

UTII: the special regime has been extended until 2021

This is probably the most pleasant news for all “imputed” people.

As it was in 2021. The fact is that Federal Law No. 97-FZ dated June 29, 2012 (Part 8, Article 5) set the date for the abolition of UTII - January 1, 2021. And many single tax payers were seriously alarmed. After all, I had a little more than a year left to work at the imputation.

However, Federal Law No. 178-FZ dated June 2, 2016 (Article 2) extended the validity of UTII until January 1, 2021.

How it happened in 2021. This year and the next three ( until the end of 2021 ), you can safely continue to work on the “imputation”.

This might also be useful:

- Do I need to take the zero SZV-M in 2021?

- UST in 2021

- How to make a Z-report at the cash register?

- How to reduce the simplified tax system for insurance premiums?

- Examples of calculating UTII in 2021

- Payment of 1% on income over 300,000 rubles

Is the information useful? Tell your friends and colleagues

Dear readers! The materials on the TBis.ru website are devoted to typical ways to resolve tax and legal issues, but each case is unique.

If you want to find out how to solve your specific issue, please contact the online consultant form. It's fast and free!

UTII: deflator coefficient has not been increased

The deflator coefficient K1 is involved in the calculation of the single tax. It allows you to adjust the taxpayer’s imputed income by the amount of inflation. The size of the coefficient is set annually for the next calendar year (clause 2 of the Order of the Government of the Russian Federation of December 25, 2002 No. 1834-r, paragraph 27, clause 2 of Article 11 of the Tax Code of the Russian Federation):

- by order of the Ministry of Economic Development of Russia no later than November 20 of the previous year;

- in another way (for example, by federal law) after November 20 of the previous year.

As it was in 2021. For the purpose of calculating UTII, Order No. 772 of the Ministry of Economic Development of Russia dated October 20, 2015 (hereinafter referred to as Order No. 772) provided for a deflator coefficient for 2016 equal to 2.083. However, in times of crisis, legislators decided not to increase the tax burden on business. Therefore, by Order of the Ministry of Economic Development of Russia dated November 18, 2015 No. 854, changes were made to Order No. 772, as a result of which K1 remained at the 2015 level - 1.798.

How it happened in 2021. Last year there was a lot of debate about whether K1 should be increased for 2021. The Russian Ministry of Finance even prepared a bill proposing a gradual increase in this indicator over 3 years:

- in 2021 – up to 1,891;

- in 2021 – up to 1,982;

- in 2021 – up to 2,063.

However, the proposal of the Financial Department was never accepted. And the deflator coefficient in 2021 remained the same as it was in 2016 (and in 2015) - 1.798 . The value of K1 was established by Order of the Ministry of Economic Development of Russia dated November 3, 2016 No. 698 and later did not change (Article 11 of the Federal Law dated November 30, 2016 No. 401-FZ).

Coefficients K1 and K2 in the UTII calculation system

Speaking about increasing K1 UTII from 2021, we need to dwell on what other factors influence the formation of a single tax on imputed income. In addition to the deflator coefficient K1, it is also K2 - a correction factor. According to paragraph 4 of Art. 346.29 of the Tax Code of the Russian Federation, they are used to adjust the basic profitability in order to take into account the significant features of its formation, first of all, the influence of various external conditions.

The K2 coefficient is regulated at the local level: on the basis of documents adopted by the representative bodies of urban districts and municipal districts. And for Moscow and St. Petersburg, as cities of federal significance, their legislative (representative) bodies of state power serve as such establishing and corrective bodies.

What does correction factor mean? With the help of K2, an adjustment is made for a number of factors that affect the basic profitability of different types of business. For example, such influencing factors are seasonality and operating hours, the range of goods produced or sold, features of the territory of operation, etc. More details about this can be found in paragraph. 6 tbsp. 346.27 Tax Code of the Russian Federation.

Local authorities have the right to introduce a correction factor for a year or another period at their discretion. It is likely that they may change this indicator in the near future with the implementation of January 2021.

The increase in K1 UTII from 2021 is a necessary consideration of the influence of such factors as inflation over the past year. Its use is specified in paragraph. 5 tbsp. 346.27 Tax Code of the Russian Federation. The deflator coefficient is required to bring imputed income into line with the level of consumer prices for goods, services and work in the past year.

UTII: established a new list of household services

As you know, certain types of business activities listed in clause 2 of Article 346.26 of the Tax Code of the Russian Federation are transferred to UTII. In particular, local authorities can introduce “imputation” on their territory in relation to household services (clause 1, clause 2 and clause 3 of Article 346.26 of the Tax Code of the Russian Federation). But the Tax Code does not specify which types of services are classified as household services. Therefore, a special list is used for these purposes.

By the way, this list is also necessary for regions that are introducing a zero tax rate on their territory for newly registered individual entrepreneurs. The so-called tax holidays. But notice! They do not apply to UTII, only to the simplified tax system and PSN.

As it was in 2021. Last year, types of household services were determined according to the All-Russian Classifier of Services to the Population OK 002-93 (OKUN).

How it happened in 2021. As of this year, OKUN OK 002-93 is no longer valid. Instead, new classifiers were put into operation, approved by order of Rosstandart dated January 31, 2014 No. 14-ST:

- All-Russian Classifier of Types of Economic Activities (OKVED2) OK 029-2014 (NACE Rev. 2);

- All-Russian classifier of products by type of economic activity (OKPD2) OK 034-2014 (KPES 2008).

But they do not include household services in a separate section.

In order for the taxpayer to know exactly whether he has the right to apply UTII for the line of business being carried out, the Government of the Russian Federation, in Order No. 2496-r dated November 24, 2016, listed all activity codes according to OKVED2 and service codes according to OKPD2, which are classified as household.

UTII: clarified the procedure for the transition from UTII to the simplified tax system

The UTII payer can voluntarily switch to the simplified tax system only from the beginning of the new calendar year (clause 1 of article 346.13 of the Tax Code of the Russian Federation). But if within a year he had to refuse the “imputation” due to the fact that:

- local authorities excluded the type of activity being carried out from those subject to UTII;

- local authorities have abolished UTII on their territory;

- the taxpayer stopped conducting an “imputed” type of activity and began working in an area that cannot be transferred to UTII;

- the taxpayer violated the requirements for the use of UTII,

then from the beginning of the month in which the obligation to pay the single tax was terminated, he can switch to the “simplified tax” (paragraph 4, paragraph 2, article 346.13 of the Tax Code of the Russian Federation). In this case, a corresponding notification is submitted to the tax authority.

As it was in 2021. The deadline for filing such a notice was not established by current legislation. Therefore, officials had to explain this point (letter of the Ministry of Finance of Russia dated September 12, 2012 No. 03-11-06/2/123).

How it happened in 2021. The former “imputed” person must submit a notification about the transition to the simplified tax system no later than 30 calendar days from the date of termination of the obligation to pay UTII.

How to calculate the tax base for UTII for less than a month

If any of the months the taxpayer was in the regime discussed in the article was incomplete, the calculation should be made using the following formula:

Tax base of UTII = DB × FP × K1 × K2 × Days of incomplete month spent on UTII / Number of days of the month.

Example

IP Ivanov is engaged in retail trade of food products (except alcohol) in the city of Zheleznodorozhny, Moscow region. For this type of activity, the taxpayer applied UTII. Hall area – 10 sq. m. However, as of May 15, 2017, the individual entrepreneur ceased to carry out activities on UTII.

For the calculation we use the following data:

basic profitability – 1,800 rubles;

K1 – 1.798;

K2 – 0.9 (decision of the Council of Deputies of the Zheleznodorozhny urban district dated October 19, 2011 No. 04/19).

When calculating the tax for the month, the taxpayer should use the coefficient 15/31, where 15 is the number of days in May during which the individual entrepreneur applied UTII, and 31 is the number of days in May.

Thus, the calculation of the tax base for May in this case is as follows:

Tax base UTII = 1800 × 10 × 1.798 × 0.9 × 15/31 = 14,094 rubles.

UTII: allowed individual entrepreneurs to reduce the single tax on excess insurance premiums

All individual entrepreneurs are required to pay insurance premiums “for themselves” (clause 2, clause 1, article 419 of the Tax Code of the Russian Federation, clause 1 of article 430 of the Tax Code of the Russian Federation):

1. for compulsory pension insurance:

- with an income of up to 300,000 rubles. – in the amount calculated based on the minimum wage;

- with income over 300,000 rubles. – in the amount of 1% on income exceeding RUB 300,000;

2. for compulsory health insurance:

- with an income of 300,000 rubles. – in the amount calculated based on the minimum wage.

At the same time, the entrepreneur on UTII reduces the single tax calculated for the tax period - quarter, by contributions in a fixed amount paid before submitting the tax return (paragraph 3, clause 2.1, article 346.32 of the Tax Code of the Russian Federation, article 346.30 of the Tax Code of the Russian Federation, letter from the Ministry of Finance of Russia dated 01/26/2016 No. 03-11-09/2852, letter of the Federal Tax Service of Russia dated 02/19/2016 No. SD-4-3/2691).

As it was in 2021. Tax officials questioned the possibility of reducing UTII by 1% contributions calculated from above-limit income, since only those paid based on the minimum wage were classified as fixed contributions.

How it happened in 2021. Now, clause 1 of Article 430 of the Tax Code of the Russian Federation clearly states that all insurance premiums paid by individual entrepreneurs “for themselves” are fixed. Therefore, businessmen can safely include contributions for their insurance in the calculation of UTII at a rate of 1% on income over 300,000 rubles.

By the way, starting from 2021, insurance premiums must be transferred to the INFS. To learn how to do this correctly, read the article “Payment order for insurance premiums in 2021.”

UTII: allowed individual employers to reduce the single tax on insurance premiums “for themselves”

In accordance with clause 2 of Article 346.32 of the Tax Code of the Russian Federation, UTII payers reduce the amount of calculated tax by paid:

- insurance contributions for compulsory pension, medical, social insurance and contributions for injuries;

- temporary disability benefits (for the first 3 days of illness);

- payments (contributions) under voluntary personal insurance contracts concluded in favor of employees.

As it was in 2021. Individual entrepreneurs could reduce UTII by insurance premiums from payments to employees, but could not reduce personal insurance premiums (“for themselves”). At the same time, it was possible to reduce the tax on payments listed in paragraph 2 of Article 346.32 of the Tax Code of the Russian Federation by a maximum of 50% of its amount (paragraph 2 of paragraph 2.1 of Article 346.32 of the Tax Code of the Russian Federation).

How it happened in 2021. Starting this year, individual entrepreneurs who hire employees have the right to reduce UTII by contributions, including those paid “for themselves” with an income of up to 300,000 rubles. and above (clause 1, clause 2, Article 346.32 of the Tax Code of the Russian Federation as amended by Federal Law No. 178-FZ of June 2, 2016). But the 50% limitation provided for in paragraph 2, clause 2.1, article 346.32 of the Tax Code of the Russian Federation remains.

That is, now an individual entrepreneur can reduce the tax on “contributions for employees” + “contributions for himself,” but by no more than 50% of UTII.

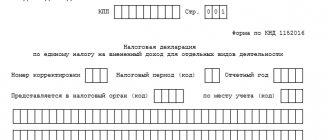

UTII: approved a new tax return

At the end of the tax period (quarter), all “imputed” persons submit a tax return to the Federal Tax Service at the place of registration as a UTII payer (clause 3 of Article 346.32 of the Tax Code of the Russian Federation, Article 346.30 of the Tax Code of the Russian Federation). The deadline is the 20th day of the first month of the next tax period.

As it was in 2021. Last year, companies and individual entrepreneurs reported on UTII in the form approved by Order of the Federal Tax Service of Russia dated July 4, 2014 No. ММВ-7-3/ (as amended by Order of the Federal Tax Service of Russia dated December 22, 2015 No. ММВ-7-3/) .

How it happened in 2021. By Order of the Federal Tax Service of Russia dated October 19, 2016 No. ММВ-7-3/, changes were made to the current tax return form. UTII payers will have to report on the new form for the first quarter of 2021.

How is the old declaration different from the new one?

The amendments are mainly of a purely technical nature. In section 3:

- The barcode of the fields has changed;

- the wording of the line “The amount of insurance contributions paid by an individual entrepreneur to the Pension Fund of the Russian Federation and the Federal Compulsory Medical Insurance Fund in a fixed amount” was replaced with the wording “The amount of insurance contributions paid by an individual entrepreneur in a fixed amount for compulsory pension insurance and compulsory medical insurance”;

- the procedure for calculating the amount of UTII payable in line 040 has changed; Now individual entrepreneurs reduce the calculated tax on insurance premiums for employees and for themselves, but by no more than 50%.

You can download the new UTII tax return form to be used from the reporting campaign for the first quarter of 2021 below.

Title page

At the top of the title page, as well as all sections of the declaration, the TIN and KPP are indicated.

Individual entrepreneurs do not fill out the checkpoint field; a dash is placed in the field. When submitting the initial declaration, 0 is indicated in the “Adjustment number” field; if an updated declaration is submitted, then the adjustment number 1, 2, etc. is entered.

Tax periods are selected from Appendix 1 to the Procedure for filling out the declaration. The 2nd quarter corresponds to code 24.

In the field “at the place of registration” the codes from Appendix 3 of the Procedure are entered. The choice of code depends on whether the UTII taxpayer is registered at the place of business or at the location of the organization (place of residence of the individual entrepreneur). At the location of the organization (place of residence of individual entrepreneurs), they are registered for passenger and cargo transportation, delivery and distribution trade, as well as advertising on transport.

When filling out the “Taxpayer” field, indicate the full name of the organization (including the legal form) or the last name, first name and patronymic (if any) of the entrepreneur.

The OKVED code is usually set to the one by which UTII activities are conducted. If there are several codes, you can select any of them.

Download a sample of filling out the UTII declaration for the 4th quarter of 2021.

Below are fields filled in only by organizations; entrepreneurs put dashes in them.

However, organizations also put dashes if the declaration is not submitted in connection with the reorganization or liquidation of the company. If no documents are attached to the declaration, the corresponding field is also crossed out.

Only one document can be attached to the declaration - a power of attorney, if the declaration is signed by a representative of an organization or individual entrepreneur.

In the section “I confirm the accuracy and completeness of the information specified in this declaration,” the full name of the head of the organization is indicated, but the last name of the individual entrepreneur does not need to be indicated if he signs the declaration himself.

If the declaration is signed by an authorized person, then the full name of the representative (or the name of the representative organization) is indicated.

UTII: online cash registers

Let's tell you a little about the upcoming changes for retailers on UTII.

As it was in 2021. In July 2021, Federal Law No. 290-FZ dated July 3, 2016 (hereinafter referred to as Law No. 290-FZ) came into force, obliging all companies and individual entrepreneurs carrying out cash payments with the population to switch to online cash register systems. The transition date is set for July 1, 2021. If before this date it is still possible to use “old” cash registers, then after it it is necessary to use only modern technology.

For sellers on the “imputation”, Law No. 290-FZ provides for a different transition procedure.

How it will be in 2021. UTII payers currently working without cash register equipment on the basis of Federal Law No. 54-FZ of May 22, 2003 (hereinafter referred to as Law No. 54-FZ) will have to switch to online cash register equipment a year later - from July 1, 2018 ( Clause 7 and Clause 9 of Article 7 of Law No. 290-FZ). An exception is provided for “imputed” persons who:

- are engaged in the types of activities named in paragraph 2 of Article 2 of Law No. 54-FZ (for example, trading in retail markets, fairs, and exhibition complexes);

- are located in remote or hard-to-reach places, the list of which is approved by regional authorities (clause 3 of article 2 of Law No. 54-FZ);

- are pharmacy organizations located in paramedic stations in rural areas (clause 5 of article 2 of Law No. 54-FZ).

They may no longer use cash registers.

Note! From 03/31/2017, all retailers on UTII selling beer and other alcoholic products must work only with the use of cash registers, regardless of the form of sale: store or public catering (clause 10, article 16 of the Federal Law of 07/03/2016 No. 261 -FZ).

By the way, back in 2021, the Russian Ministry of Finance prepared a list of goods that cannot be sold without a cash register at fairs, exhibitions and retail markets. These include:

- carpets and carpet products;

- electrical equipment;

- furniture;

- motor vehicles, trailers and semi-trailers;

- etc.

In total, there are 17 items on the list. However, to date, his fate has not been finally determined.

This year (2017), legislators proposed allowing taxpayers on UTII to work without cash registers until 2021. Currently, the corresponding Draft Law No. 110014-7 is under consideration in the State Duma. We will also monitor the fate of this document.