Depositing personal funds into the LLC current account

Any person has the right to deposit personal money into the company’s account. To prevent them from being considered trade revenue, a loan agreement must be concluded - then you will not have to pay extra taxes. The agreement must reflect the amount, term of the loan and its conditions.

We recommend reading: Where to open a current account for individual entrepreneurs and LLCs: comparison of tariffs and reviews.

BSO after July 1

We are a pawnshop. When issuing a loan, we write out a BSO to the client. What about July 1?

That's right, before July 1st you issue BSO bail tickets. The use of CCT is not required. After this date, the deposit ticket must be issued on a special BSO-KKT . But instead, you can use a regular cash register by including the additional details you need in the check. This procedure applies to transactions related to the issuance of loans secured by material assets. If the pawnshop issues a regular consumer loan, then there is no need to use a cash register or issue a BSO.

Can a budget institution apply the BSO approved by Order of the Ministry of Culture No. 257 of December 12, 2008?

Maybe, but only until July 1, 2021. Next, you will have to purchase either an automated system for printing BSO (BSO CCP), or usually a cash register. We mentioned above that BSO-KKT is not yet in the Federal Tax Service register and it is unknown whether they will appear by July. Therefore, for now it is advisable to rely on the cash register.

An individual entrepreneur provides online training services; there are no employees. Should he apply CCP from July 1?

From the context of the question it follows that payment for services is also accepted online. In other words, the client is charged through electronic means of payment . If this is the case, then you need to use the cash register starting July 1, 2021.

Individual entrepreneur, no employees, engaged in the production of metal gratings. Is it possible not to put a cash register?

Individual entrepreneurs on a patent who are engaged in the production of installation, electrical, plumbing and welding works and production services may not use CCP. If you have acquired a patent to provide such services, you can work without a cash register.

Individual entrepreneur on UTII, no employees, engaged in transport services. Clients are individuals and legal entities. Money is accepted to the current account and to the personal card of the entrepreneur (as an individual). For what transactions do you need to issue checks?

In this case, for everything except for accepting transfers from legal entities and individual entrepreneurs to the current account of the entrepreneur.

LLC on Vmenenka is engaged in shoe repair. Is it possible to work without a cash register after July 1? Or does this benefit apply only to individual entrepreneurs?

Shoe repair and painting is mentioned in Article 2 of Law 54-FZ among the exceptions, that is, it refers to activities for which it is not necessary to use a cash register. So, regardless of the form of business organization, you can work without a cash register.

An entrepreneur on UTII is engaged in repairs and tailoring. Do I need to install a cash register from July 1? For now we are working for BSO.

From July 1, it will not be possible to work with BSO; you will have to install a cash register . However, if you go patent, you can avoid this. Individual entrepreneurs on PSN carrying out the mentioned activities are exempt from the obligation to use cash register equipment.

Individual entrepreneur on PSN, type of activity - vehicle maintenance and repair. Do I need to use a cash register?

Yes, from July 1, 2021 you will have to install a cash register.

Old BSOs are valid until July 1, but BSO-KKT is not on sale yet. What to do? What is the chance that they will delay the use of BSO-KKT and allow the continued use of paper forms?

You are not obligated to purchase BSO-KKT. Instead, you can purchase a regular cash register and issue receipts. Cash receipt and BSO are equivalent for those who provide services to the public.

A simplified individual entrepreneur works with citizens and makes translations for legal entities. What if there is any option to avoid installing a CCP?

As for tutoring, there is an opportunity - you need to switch from the simplified tax system to the PSN. IP on a patent may not be used for the provision of training and tutoring services. In settlements with legal entities, you can avoid installing a cash register under any tax regime if you accept payment into your current account.

Individual entrepreneur on the simplified tax system, dental services. When should you use the cash register?

If an entrepreneur issues a BSO, then this order can be maintained until July 1. Then you will need a cash register. If the BSO is not issued, then the obligation to use the cash register on the simplified tax system arose from July 1, 2021.

A budgetary institution from the social sphere receives money for accommodation from elderly people. Do you need a cash register from July 1st?

It is likely that your activities fall under the exceptions prescribed in paragraph 2 of Article 2 of Law 54-FZ. That is the activity of supervising and caring for children, the sick, the elderly and the disabled. If this is the case, then CCT may not be used. But to be on the safe side, it is better to make an official request to the Federal Tax Service.

Should a lawyer accept the use of CCT from July 1?

The activity of a lawyer is not entrepreneurial , since it is not related to the sale of goods, works or services. A lawyer provides services, but the purpose of this is to protect the rights and freedoms of the client. You can read more about this in the letter of the Ministry of Finance dated April 20, 2018 No. 03-01-15/26739. However, if legal services are provided along with advocacy, then the cash register must be used.

The entrepreneur performs cadastral work. Should he apply CCP from July 1?

Depends on who the services are provided to and how payment is accepted. If clients are individuals , then CCP will have to be used. If legal , then they can pay for the entrepreneur’s services by transfer to his current account. In this case, there is no need to use the cash register.

In which of the following situations should CCP be used:

- Individual entrepreneur on PSN, repair and tailoring, no employees.

- Individual entrepreneur on the simplified tax system, repair and tailoring, no employees.

- Individual entrepreneur on PSN, repair and sewing of clothes plus sale of goods for sewing, no employees.

- Individual entrepreneur on the simplified tax system, repair and sewing of clothes, plus sales of goods for sewing, no employees.

- No cash register needed. Entrepreneurs with a patent may not use CCT when repairing and sewing garments.

- If a BSO is issued, then until July 1 you can work without a cash register. Next you will have to issue checks. If BSO is not prescribed, then CCP should be applied now.

- From July 1, operations for the sale of sewing goods will need to be carried out through the cash register. The provision of services is described in paragraph 1.

- When selling goods, cash register systems must be used from July 1, 2021. The provision of services is described in paragraph 2.

Thus, the use of CCT can be completely avoided only if the individual entrepreneur acquires a patent for repairing and sewing clothes and does not simultaneously sell goods for sewing.

Continue reading the questions in the next article.

How to deposit money into a current account from the founder of a legal entity. faces

The founder can deposit money into the LLC's current account at bank cash desks or by transfer from a personal card. In order to correctly replenish the account, it is necessary to indicate that the founding capital is being paid or the money is being deposited under an interest-free loan agreement.

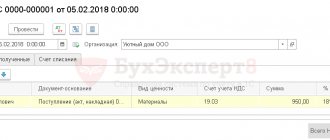

How to top up your account through the cash register

To replenish the LLC's current account with cash, you need to come to the bank branch with your passport, the decision of the meeting of participants and the loan agreement and draw up a receipt document for the cash deposit. After checking the documents, the operator will credit the money.

We recommend reading: Rating of banks for small businesses with profitable cash settlement services for individual entrepreneurs and LLCs.

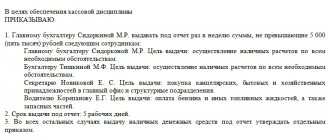

Payments by employees and owners

Is it necessary to use cash if dividends are paid to the owners of the organization?

No no need. From the point of view of 54-FZ, this operation is not a calculation.

It turns out that any transactions with employees and founders are not included in the concept of settlement for the purposes of applying 54-FZ? That is, CCT is not used?

It depends on what kind of operation is being performed. For example, issuing an accountable amount to an employee is not a calculation, nor is the payment of dividends. The same applies to the situation when the founder gives a loan to the organization - when receiving and repaying it, the cash register is not applied (letter of the Ministry of Finance of Russia dated December 4, 2018 No. 03-01-15/87766). But there are situations when it is necessary to use a cash register. For example, if an organization sells some goods or services to its employees. The general rule is that if the amounts received and issued are not related to goods, works or services, then this is not a settlement.

A certain amount is deducted from the employee's salary every month as repayment of an interest-free loan. The salary is transferred to the card. Do I need to generate checks when making deductions?

It is important here what kind of loan it is - targeted or not. If it is not intended , then there is no need to use the cash register. If an organization issued a targeted loan to an employee in order to purchase some property or pay for, for example, treatment, training, repairs (or any others), then CCT is needed. Until July, you don’t have to issue checks only when issuing a loan; for repayment, this will be necessary from mid-2021. From the middle of this year, it will be necessary to print checks both when issuing and when repaying targeted loans.

The organization provided the employee with a loan, but the contract did not indicate its purpose. Do I need to issue a check when redeeming it?

No, since such a loan is considered non-targeted.

If a legal entity receives a loan to pay for goods, is it necessary to issue a receipt upon return?

When issuing or repaying a loan, cash register equipment is used only by the person who issues it. If an organization acts as a loan recipient, it does not need to use cash registers.

Other ways to top up your current account

You can deposit money into your current account at an ATM using a corporate card, transfer money from one account to another through an online bank, or take the payment to a bank branch. All these operations are carried out by the bank without charging a commission.

Self-collection

Self-collection allows you not to store cash in the office, but to deposit funds into your account at the end of the working day. You can do this in the terminal by following these steps:

- insert a corporate card into the device;

- go to the “Payments” section and select “Self-collection”;

- dial an individual code;

- select your account;

- enter payment description;

- indicate the card as the source of the contribution;

- put money into a bill acceptor;

- wait for payment to be processed;

- receive a check.

Transfer via bank

To transfer from one account to another through a bank branch, you need to:

- draw up a payment order in triplicate;

- sign and stamp on the first sheet;

- take the payment to the nearest bank branch;

- wait for it to be checked by the operator;

- take a copy with a bank mark.

We recommend reading: Banks with the cheapest opening and maintenance of a current account for individual entrepreneurs and LLCs.

How to top up a legal entity's current account via the Internet

The account can also be topped up via online payment from a second company account. To do this, you need to log into the online bank using your username and password and make a payment. Your company will be the payer and recipient - only the invoices will be different. In the purpose of payment you need to write that there is a redistribution of your own funds. The payment must be signed and sent to the bank.

Agents work

Individual entrepreneur under an agency agreement with an insurance company. Does he need to use a cash register?

Until July 1, instead of a check, you can issue a strict reporting form - receipt No. A7. This rule applies to insurance organizations, individual entrepreneurs and insurance brokers only when providing services to individuals. But from July 1, it is mandatory to use the cash register.

A legal entity is a trading agent and acts at the expense of the principal. From the funds received to the current account from buyers, a remuneration is withheld, the remaining amount is transferred to the principal. Is it necessary to use CCT? If yes, what amount should I charge?

If an agent acts on behalf and at the expense of the principal , then, in accordance with the explanations of the Ministry of Finance, he should not use cash registers. This obligation arises on the principal. For more information about this, you can read the letter dated 09/04/2017 No. 03-01-15/56619. However, there are still no clear recommendations regarding such operations.

The company is an agent in the provision of communication services and works on behalf of the principal. Is it necessary to use cash register if money for communication services is transferred from the buyer’s current account to the agent’s current account?

This depends on whether the company is a regular or paying agent. If it is a payment method, then according to Law 103-FZ, you need to use cash register equipment. If the company is an ordinary agent, then no - the principal must issue the check.

Several years ago, an organization (educational institution) entered into an agreement with a bank to accept payments from individuals. Payment is made through bank terminals. Citizens present receipts from the terminal - this serves as confirmation of payment. Should our organization use cash in this situation?

It is important to know who owns the terminal. It could be:

- Bank . Banks do not use cash registers - they are exempt from this by law. In this case, after payment, clients will not have a receipt in their hands, but a regular receipt from the terminal (slip). The responsibility to print the check rests with the organization that provides the services (in this example, the educational institution).

- Payment agent. If the terminal is owned by an agent, this must be indicated on the receipt. In this case, the check is printed by the agent, and the service provider is exempt from this. On this issue there is a letter from the Ministry of Finance dated October 3, 2017 No. 03-01-15/64345.

The individual entrepreneur provides real estate agent services, works without employees and issues BSO to clients. Should he use cash register?

Until July 1, you can use BSOs issued by the printing house, after which you will need to use cash register equipment. In general, a cash receipt and a strict reporting form have equal validity and differ only in the equipment on which they are generated. To print a check, you need cash register equipment, and to print the BSO, you need a special automated system . Such systems are available in printing houses. However, from July 1, 2021, it will be necessary to apply the systems of the new plan - the so-called BSO CCP. They must be individual. That is, everyone who is going to work with BSO must purchase such equipment. However, instead, he can purchase a regular cash register and print checks. There are now many models of cash registers on sale in different price categories. But there are no BSO KKT models approved for sale yet.

The most secure form

The most secure form of non-cash payment is payment through a letter of credit. It represents an inconvenience for the payer, since it requires a separate opening of a letter of credit, even if this bank already has a current account, but all this is for the sake of security.

The payer must transfer a certain amount for goods or services to an open account and oblige the bank to pay them to the recipient only if certain conditions are met. That is, until the recipient gives the credit institution confirmation that he has fully fulfilled his obligations under the transaction, he will not receive the money. In this case, the bank acts as an uninterested third party and guarantees the legality of the transaction.

Regulation of non-cash payments

Payment by bank transfer is subject to only three regulatory documents that fully control their implementation. The main one is the Civil Code of the Russian Federation, Chapter 46 of which describes all the basic requirements for permitted non-cash forms of money circulation.

Further, the bank transfer obeys:

- regulations on the issue of payment cards;

- Regulations on the rules for making money transfers.

The first document was approved by the Central Bank on December 24, 2004 and reveals the procedure for the legal implementation of acquiring. This concept defines the non-cash payment for services or goods that is familiar to many ordinary citizens.

The second document was approved only on June 19, 2012 by the Bank of Russia and contains all the necessary detailed descriptions of possible forms of non-cash payments and requirements for them. Everything contained in the provision fully complies with the norms of the Civil Code.

Any payment by bank transfer must be carried out in strict compliance with all of the listed regulatory documents, but such control is not an obstacle to the growing popularity of non-cash money circulation among the entire population.

Cash-non-cash payment

Conventionally, cash/non-cash payment determines settlements through checkbooks, since after debiting funds from the drawer’s account, it may imply issuing them in cash or transferring them to a bank account. This form of payment is more common in Europe and the USA and is carried out only after confirming the identity of the bearer of the check and receiving information about the presence of an amount sufficient for the transfer in the drawer’s account, and, of course, after confirming the authenticity of the check.

Another form of non-cash payment is a transfer through collection or collection order. It is carried out only when the recipient of the funds provides the bank with confirmation of the account owner’s monetary obligations to it. In essence, this is debt collection and it occurs even without timely notification to the account owner. As a rule, the debtor learns about the withdrawal after the transfer has been made.

Types of bank transfer payments for individuals

Ordinary citizens may think that bank transfers are only transfers between accounts, but in fact there are 6 types of them. Most are available only to legal entities and organizations and are controlled by the same regulatory documents.

The most common form of payment available to civilians is in the form of an electronic transfer. It represents the transfer of funds from the payer’s personal bank account to the recipient’s account through a banking operator. The recipient can be an individual or an organization, the main thing is that such a right is described in the agreement between the account holder and the bank. The payer can only be a private person.

Another form of payment, which, like the previous one, is regulated by the law “On the National Payment System” is direct debit. It represents the debiting of funds from the owner’s account at the request of the recipient, but only if this is permitted by the agreement between the account owner and the credit institution. Most often, such payments are mandatory fees for servicing a bank card or account.

Select payment method

Cashless payments.

Individual entrepreneurs or legal entities have a special current account for the organization. A self-employed person is not an organization, but an individual, and instead of a current account he has a bank card.

A business cannot transfer money to a self-employed person using a card number - such a payment will not go through the accounting department. To make a transfer, you need to ask the self-employed for full details:

- Receiver name

- Current account number

- Name of the bank

- BIC

- Correspondent account

- Bank branch code and address

The self-employed can obtain these details from the bank.

Cashless payments have one drawback. The bank sees that the payment goes to an individual, and not to an individual entrepreneur or legal entity, but you do not pay taxes and fees for it. This seems suspicious and the bank may temporarily block the account.

Usually the blocking is easy to remove: just say that you are paying the self-employed and show the bank the agreement. But the account will remain blocked for several days.

Cash.

If you work with a self-employed person not remotely, but in person, it is more convenient to pay him in cash. The main thing is not to forget to enter this operation into the accounting department and ask for a check from the self-employed person. If this is not done, the self-employed can say that there was no payment and demand it again - according to the law, he will be right.

When paying in cash, a self-employed person

can be paid without a contract. To do this, the transaction must be immediate. For example, you, as a legal entity, buy handmade products from a self-employed person and immediately pay for them in cash.

Advantages of non-cash payments

First of all, payment by bank transfer requires minimal documents in comparison with regular cash payments between organizations. Many companies choose this form of payment because it makes it possible to avoid large fines due to errors in registering cash discipline and using cash registers.

Large organizations are also increasingly invoicing their clients by bank transfer, instead of taking cash from them. This allows companies to save significantly, since servicing such operations is much cheaper.

The obvious benefit of such calculations for ordinary citizens is the convenience of transactions. The fact is that you can carry them out simply by having a payment bank card and the ability to access the Internet, and commissions for money transfers between accounts are not always charged or amount to minimal losses.

Such virtual settlements also have benefits for the state, because it allows you to constantly monitor all cash flows in real time. In addition, a decrease in the turnover of the living money supply reduces the possibility of inflation in the country.

In general, the advantages of non-cash payments are clearly visible to everyone, and most importantly, they can be carried out at any time of the day, on any day of the week and completely regardless of the geography of the transfer.

Types of accounts

Any non-cash payment is permissible only if you have a bank account with the required amount on it. The only exception is payment by means of a payment order, which is permitted by law and can be carried out even in the absence of a bank account, but only by individuals. To conduct business, you must have a bank account.

There are several varieties of them:

- Current account. Available for use by ordinary citizens and has no relation to business activities.

- Deposit. Allows individuals and organizations to receive income from their own funds.

- Checking account. Opens for commercial activities of citizens, entrepreneurs or organizations, except for credit.

- Budget. Used only by legal entities for the distribution of budget funds.

- Special accounts. These include clearing, collateral, letters of credit and other accounts. They can open to everyone.

- Correspondents. Available only to credit institutions.