Payment order for penalties in 2021 - 2021 - sample

Depending on what served as the basis for the payment, filling out this field will vary:

- In case of voluntary payment of penalties (the basis of the PP), there will be 0 here, because penalties do not have a frequency of payment, which is inherent in current payments. If you are listing penalties for one specific period (month, quarter), it is worth indicating it, for example, MS.08.2021 - penalties for August 2021.

- When paying at the request of tax authorities (basis of TR) - the period specified in the request.

- When repaying penalties according to the verification report (the basis of the AP), they also put 0.

Read about filling out field 107 in your personal income tax payment form here.

If you pay the fine yourself, enter 0 in fields 108 “Document number” and 109 “Document date”.

In all other cases, in field 108, provide the document number - the basis for the payment (for example, a claim), and do not put the “No” sign.

In field 109, indicate:

- date of requirement of the Federal Tax Service - for the basis of payment TR;

- the date of the decision to bring (refusal to bring) to tax liability - for the basis of an administrative agreement.

The main change concerns individual entrepreneurs, notaries, lawyers and heads of peasant farms. From October 1, 2021, payer status codes “09”, “10”, “11” and “12” will no longer be valid. Instead, the taxpayers listed above will indicate code “13,” which corresponds to individual taxpayers.

Also, some of the codes will be deleted or edited. New codes will be added:

- “29” - for politicians who transfer money to the budget from special election accounts and special referendum fund accounts (except for payments administered by the tax office);

- “30” - for foreign persons who are not registered with the Russian tax authorities, when paying payments administered by customs authorities.

From October 1, the list of payment basis codes will decrease. Codes will disappear:

- “TR” - repayment of debt at the request of the tax authorities;

- “AP” - repayment of debt according to the inspection report;

- “PR” - debt repayment based on a decision to suspend collection;

- "AR" - repayment of debt under a writ of execution.

Instead, you will need to indicate the code “ZD” - repayment of debt for expired periods, including voluntary. Previously, this code was used exclusively for voluntary debt closure.

Also, from October 1, the code “BF” will be removed - the current payment of an individual paid from his own account.

This field indicates the document number that is the basis for the payment. Its completion depends on how field 106 is filled in.

The new code for the basis of payment in the four invalid cases is “ZD”. But despite this, the deleted codes will appear as part of the document number - the first two characters. Fill out the field in the following order:

- “TR0000000000000”—number of the tax office’s request for payment of taxes, fees, and contributions;

- “AP0000000000000” - number of the decision to prosecute for committing a tax offense or to refuse to prosecute;

- “PR0000000000000” - number of the decision to suspend collection;

- “AR0000000000000” – number of the executive document.

For example, “TR0000000000237” - tax payment requirement No. 237.

The procedure for filling out field 109 changes to pay off debts for expired periods. When specifying the “ZD” code, you need to enter in the field the date of one of the documents that is the basis for the payment:

- tax requirements;

- decisions to prosecute for committing a tax offense or to refuse to prosecute;

- decisions to suspend collection;

- writ of execution and initiated enforcement proceedings.

How to pay penalties on taxes

You must pay penalties accrued after you missed the tax payment date using separate payment-type orders.

When drawing up the indicated documents, which are then submitted for verification to the tax service, it is necessary to take into account some nuances. So, for example, in the column in which the basis for making this payment is indicated, you can indicate one of three possible designations.

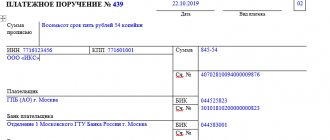

In order for the tax office to accept payment from you, you need to fill out the payment order correctly

Table 2. Designations in the payment order when paying off penalties

| Description of the circumstances | What designation should be specified? |

| If the payment of the penalty accrued to you daily is made on your own, on the basis of documents such as a reconciliation report or a certificate indicating the calculations made. | In this case, the designation “ZD” is used, which must be indicated in the payment order. |

| When a penalty is paid, which is required subsequently after the relevant tax audit decision is made. | In this case, the abbreviation “AP” is used. |

| If a penalty is paid that was requested by the Federal Tax Service inspection. | In this situation, the abbreviation “TR” is entered in the column we need. |

However, the nuances indicated in the table, as well as other characteristics of the transaction for transferring penalties to the state treasury, should be well known to the employees of the accounting department of your company, even though they made a serious mistake by not fulfilling their tax obligations to the state. In this case, we advise you, as a leader, to take control of everything.

The payment order is sent directly to the Federal Tax Service. To transfer funds, you need to use the appropriate details of the organization.

What consequences can an organization face if there is no timely payment of taxes to the state treasury?

In a special article we will tell you what penalties for transport tax are, how much the required financial sanction will be taken from you, and what is the procedure for paying it this year.

Filling out a payment order in 2021: sample

\r\n\r\n

A clear rule will come into effect in the event that the accounting department deducts money from an employee’s salary to pay off debts to the budget. Next, the withheld amount is transferred to the treasury by a separate payment order. In such a payment in the field “TIN of the payer”, from July 17, 2021, it is strictly prohibited to indicate the identification number of the employing company. Instead, you need to put the TIN of the employee himself (amendments made by Order No. 199n).

\r\n\r\n

\r\n\r\n

There are innovations for individuals who pay taxes, fees, insurance and other payments administered by the tax authorities. The changes concern field 101 (the status of the payment originator is entered in it).

\r\n\r\n

Until October 2021, when filling out field 101, these individuals must select one of the following values:

\r\n\r\n

- \r\n\t

- “09” - individual entrepreneur who pays taxes, fees, insurance premiums and other payments administered by the tax authorities;

- “10” - a notary engaged in private practice, paying taxes, fees, insurance premiums and other payments administered by the tax authorities;

- “11” - a lawyer who has established a law office that pays taxes, fees, insurance premiums and other payments administered by the tax authorities;

- “12” is the head of a peasant (farm) enterprise who pays taxes, fees, insurance premiums and other payments administered by the tax authorities.

- “13” is an “ordinary” individual.

\r\n\t

\r\n\t

\r\n\t

\r\n\t

\r\n

\r\n\r\n

Starting in October 2021, the values "09", "10", "11" and "12" will be removed. Instead, the value remains, the same for all individuals (“ordinary”, individual entrepreneurs, lawyers, etc.) - “13”. Changes were made by order No. 199n.

When filling out the recipient's details, you need to take into account changes in two fields. Innovations are associated with the transition to a new treasury service and treasury payment system.

- Field 17: the account number of the territorial body of the Federal Treasury (TOFK) is changed;

- Field 15: starting from January 2021, it is necessary to indicate the account number of the recipient's bank (the number of the bank account included in the single treasury account (STA)). In 2021 and earlier, this field was not filled in when paying taxes and contributions.

A clear rule will come into effect in the event that the accounting department deducts money from an employee’s salary to pay off debts to the budget. Next, the withheld amount is transferred to the treasury by a separate payment order. In such a payment in the field “TIN of the payer”, from July 17, 2021, it is strictly prohibited to indicate the identification number of the employing company. Instead, you need to put the TIN of the employee himself (amendments made by Order No. 199n).

Directory of Payment Orders 2021

There are innovations for individuals who pay taxes, fees, insurance and other payments administered by the tax authorities. The changes concern field 101 (the status of the payment originator is entered in it).

Until October 2021, when filling out field 101, these individuals must select one of the following values:

- “09” - individual entrepreneur who pays taxes, fees, insurance premiums and other payments administered by the tax authorities;

- “10” - a notary engaged in private practice, paying taxes, fees, insurance premiums and other payments administered by the tax authorities;

- “11” - a lawyer who has established a law office that pays taxes, fees, insurance premiums and other payments administered by the tax authorities;

- “12” is the head of a peasant (farm) enterprise who pays taxes, fees, insurance premiums and other payments administered by the tax authorities.

- “13” is an “ordinary” individual.

Starting in October 2021, the values "09", "10", "11" and "12" will be removed. Instead, the value remains, the same for all individuals (“ordinary”, individual entrepreneurs, lawyers, etc.) - “13”. Changes were made by order No. 199n.

- sells goods, provides services or performs work subject to VAT;

- transfers goods, provides work or services free of charge. The tax base for VAT in this case is the market value of goods or services;

- transfers goods (work, services) on the territory of our country for its own needs. These transactions are subject to VAT if the company did not take into account the costs for them when calculating income tax;

- performs construction and installation work for its own needs;

- imports goods.

Special rules will need to be followed in relation to penalties for injury contributions that are paid to the Social Insurance Fund (i.e., use the details of the relevant department of the fund and the KBK, starting with numbers different from the numbers in the KBK for tax payments). Fields 106–109 in such a payment document are always filled with zeros (clauses 5, 6 of Appendix No. 4 to Order of the Ministry of Finance of Russia dated November 12, 2021 No. 107n). If it is necessary to indicate the details of the document on the basis of which the payment is made, information about it is given in the purpose of the payment.

Also, in the 2021 sample payment slip for personal income tax penalties, in addition to the BCC, selected based on who exactly pays the tax, you need to pay attention to the code in field 101 in the upper right corner of the document, which reflects the status of the compiler. In relation to personal income tax, it can be like this:

When generating a sample payment order for 2021 for personal income tax penalties paid in response to a document issued by the Federal Tax Service, you will have to choose a different order of payment, use other codes for the reason for payment and be sure to fill out fields 107–109.

Everything we said above concerns payments for tax penalties. The payment order for penalties in 2021 for insurance premiums will be slightly different. When paying penalties on contributions, zeros are entered in fields 106 “Basis of payment”, 107 “Tax period”, 108 “Document number” and 109 “Document date”. If the payment is drawn up in accordance with a requirement or act, then the details of these documents should be given in the purpose of payment.

If the taxpayer made a mistake in indicating the KBK, Art. 78 and 79 of the Tax Code of the Russian Federation give the right either to return the amounts paid, or to offset them with other taxes if there is arrears on them. Also in paragraph 7 of Art. 45 of the Tax Code of the Russian Federation gives the opportunity to clarify the payment if an error was made in the BCC, but the money was received into the account of the Federal Treasury.

- A complete list of personal data and contacts of the entrepreneur. This includes: TIN, first name, last name and patronymic, contact phone number;

- In the necessary places, coding should be indicated, for example, a code for the type of business activity that the company is engaged in;

- The document must indicate the date when it was submitted to the required government agency, as well as the personal signature of the entrepreneur;

- All specified data is certified by a seal.

Sample pp for payment of VAT penalties in 2021

The number of days can be calculated from the day following the date of the last payment of tax to the budget. The end of accrual of penalties by the tax inspectorate occurs on the day when the arrears were actually paid and their execution occurred. If arrears arise after October 1, 2021, the above formula is applied in the first 30 days. And then (on the 31st day and in the subsequent period), a new increased coefficient is used - 1/150 of the bet.

- Rent property from government agencies and local governments.

- Purchase GWS from foreign companies that sell products on the Russian market, but are not taxpayers to the budget system of the Russian Federation.

- Purchase government-owned property within the territory of the Russian Federation. An exception is objects leased by SMP, starting from 04/01/2021.

- Realize Russian property assets in accordance with a court decision. The owner of such property must be the taxpayer. The exception is the property assets of the bankrupt.

- Intermediate in trade with foreign companies that are not tax residents of the Russian Federation.

Field What is indicated How to fill in 101 Payer status 01 (if the taxpayer is an organization); 09 (if the taxpayer is an individual entrepreneur); 02 (for tax agent) 104 KBK 18210301000011000110 (tax, except for imports from the EAEU); 18210301000012100110 (penalties); 18210301000013000110 (fine) 105 OKTMO OKTMO at the location of the organization (place of residence of the individual entrepreneur) 106 Basis of payment TP - current year payments; ZD – voluntary repayment of debt for expired tax periods in the absence of a requirement for payment; TR – repayment of debt at the request of the tax authority; etc.

The value of the tax period indicator for which tax is paid or additionally paid. Consists of 10 characters. Eight of them have semantic meaning, and two are delimiters and are filled with a dot (“.”).

From January 1, 2021, a change is provided for individual payers who are not individual entrepreneurs. Order of the Ministry of Finance dated September 14, 2021 No. 199n updated the rules approved by Order of the Ministry of Finance dated November 12, 2013 No. 107n.

Previously, in order for inspectors to be able to determine who the payment came from, an individual had to indicate his TIN. Instead of the TIN, you could fill out field 108 “Number of the document that is the basis for the payment”, or enter the UIN in field 22 “Code” (in the absence of a UIN, it was possible to indicate the address of residence or stay).

Now, if you do not have a TIN and UIN, you can indicate the series and number of your passport or SNILS.

From January 1, 2021, new BCCs were introduced for personal income tax calculated on a progressive scale.

By Order No. 236n dated October 12, 2021, the Ministry of Finance added new codes to the KBK list for transferring personal income tax on income exceeding 5 million rubles. in year:

- for tax: 182 1 0100 110

- for stumps: 182 1 0100 110

- for fines: 182 1 0100 110.

KBC for insurance premiums

TABLE: “Budget classification codes for payment of contributions in 2019”

| Payment | KBK for payments on contributions (at basic tariffs) from 2019 |

| Pension | |

| Contributions | 182 1 02 02010 06 1010 160 |

| Penalty | 182 1 02 02010 06 2110 160 |

| Fines | 182 1 02 02010 06 3010 160 |

| Social insurance (VNiM) | |

| Contributions | 182 1 02 02090 07 1010 160 |

| Penalty | 182 1 02 02090 07 2110 160 |

| Fines | 182 1 02 02090 07 3010 160 |

| Medical | |

| Contributions | 182 1 02 02101 08 1013 160 |

| Penalty | 182 1 02 02101 08 2013 160 |

| Fines | 182 1 02 02101 08 3013 160 |

In no time: how to draw up a payment order to pay penalties and fines

From July 17, 2021, the rule for filling out a payment order will come into effect, when the employer deducts money from the employee’s salary to pay off the debt to the budget and transfers the withheld amount to the budget.

In the payment receipt, in the “Payer’s INN” field, you must indicate not the company’s INN, but the employee’s INN. This change is also provided for by Order of the Ministry of Finance dated September 14, 2021 No. 199n.

Repayment of debt for previous periods - fields 106, 108, 109

From October 1, 2021, changes will be introduced to the procedure for providing information when repaying debts for expired periods (also Order of the Ministry of Finance dated September 14, 2021 No. 199n).

Until October 1, 2021, in field 106 “Basis of payment” of the payment order, you can specify one of the following values:

- “TR” - repayment of debt at the request of the tax authority to pay taxes (fees, insurance contributions);

- “PR” - repayment of debt suspended for collection;

- “AP” - repayment of debt according to the inspection report;

- “AR” - repayment of debt under a writ of execution;

- “ZD” is the voluntary repayment of debt for expired tax, settlement (reporting) periods in the absence of a requirement from the tax authority to pay taxes (fees, insurance contributions).

According to the changes, the values “TR”, “PR”, “AP” and “AR” no longer need to be specified in field 106. There remains a single value for all the listed cases, which must be entered in field 106 - “ZD”.

And the codes “TR”, “PR”, “AP” and “AR” go to field 108 “Document number”.

For example, if money is transferred on the basis of a request from a tax authority to pay a tax (fee, insurance premiums), in field 108 write first TP and then, without a space, the request number for 13 acquaintances. If this is a writ of execution (executive proceedings), then in field 108 write AR and the document number, etc., in the same order.

In field 109 “Date of payment basis document” you will need to indicate the dates of the documents on the basis of which the money is transferred (demand, decision, etc.).

| TAX | KBK |

| VAT on goods (work, services) sold on the territory of the Russian Federation | 182 1 03 01000 01 1000 110 |

| VAT on goods imported into the territory of the Russian Federation from countries participating in the Customs Union (from the Republics of Belarus and Kazakhstan) | 182 1 04 01000 01 1000 110 |

| VAT on goods imported into the Russian Federation at customs | 153 1 04 01000 01 1000 110 |

This tax is the main “filler” of the Russian treasury, so entrepreneurs should be especially careful when paying it. It is paid from the sale of goods and/or services, as well as from imported goods sold in Russia. It must also be paid when transferring goods for one’s own needs, if this is not reflected in the tax return. It is also relevant when importing goods.

There were very serious changes to the payment of value added tax a couple of years ago, so for 2021, legislators touched on this tax only in passing to give entrepreneurs the opportunity to adapt.

VAT is a tax that requires quarterly declaration and payment. It is calculated based on the results of each quarter: the difference in the tax base and deductions is multiplied by the tax rate. Thus, the budget receives these tax payments four times a year.

IMPORTANT INFORMATION! If legal deductions exceed the revenue portion of the VAT, then the budget will compensate for the missing share: the amount will be counted toward future payments or to pay off any arrears. In the absence of arrears, the law allows the amount of compensation to be transferred to the bank account of the entrepreneur.

The tax base is considered to be the main characteristic of the goods or services being sold - their value on the day of shipment of the goods or transfer of the service or the day of their payment (the date of the event that occurred earlier).

There are some nuances regarding VAT tax rates:

- same rate – same base;

- if transactions are subject to VAT at different rates, then their base is also calculated separately;

- the cost is always calculated in national currency, revenue from imports is converted into rubles at the current exchange rate.

To transfer VAT, you need to indicate the current BCC on your payment slip:

1. If work, service or goods are sold on the territory of Russia, VAT is paid according to KBK 182 1 0300 110.

- penalties for this tax need KBK 182 1 03 01000 01 2100 110;

- fines for arrears - KBK 182 1 03 01000 01 3000 110;

- interest on VAT must be transferred according to KBK 182 1 0300 110.

2. Are you importing from any country that is part of the customs union? BCC for paying VAT to the tax office on such transactions is 182 1 0400 110.

3. If VAT deductions for imports are related to the customs budget, the BCC will be different: 153 1 0400 110.

| Payment Description | KBK tax | KBK penalties | KBC fines |

| VAT on goods (work, services) sold in Russia | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| VAT on goods imported into Russia (from EAEU countries) | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| VAT on goods imported into Russia (payment administrator – Federal Customs Service of Russia; not EAEU countries) | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

Field 110 in the payment order

Field 109 in the payment order

Numbering of payment orders

Payment order in electronic form

Income code “material assistance” in the payment order

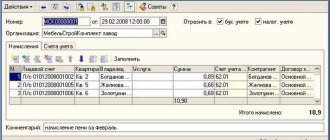

To make non-cash payments to counterparties, pay taxes to the budget and other transfers from their current account, enterprises and individual entrepreneurs use a payment order - a document whose form is approved by the Central Bank. Payment orders must be filled out in compliance with the established rules, indicating all the necessary details strictly in the document fields provided for them. We will tell you about filling out a payment order and provide a breakdown of the fields in the payment order in 2021.

When filling out the payment form, payers should be guided by Regulation No. 383-P, namely, Appendix 1, which provides a list and description of all document details. Let's consider which field in the payment order is intended for what, and how to fill it out.

- Fields 3 and 4 - payment number and date.

Numbers are listed in chronological order and should not contain more than six digits. The date is indicated in the format “DD.MM.YYY”.

- Field 5 “Type of payment”.

It may have the meaning “urgent”, “telegraph”, “mail”, or something else established by the bank, or not be indicated at all. For electronic payments, indicate the code set by the bank.

- Fields 6 “Amount in words” and 7 “Amount”.

In field 6, the amount is indicated in words with a capital letter, without abbreviating the words “ruble” and “kopeck” in the corresponding case. In this case, kopecks are indicated in numbers, for example, “One hundred rubles 21 kopecks.” Field 7 is intended to indicate the amount in numbers, with rubles separated from kopecks by a “dash” (for example, “258-60”). When the amount is expressed in whole rubles, kopecks may not be reflected in field 6, and in field 7 a “=” sign is placed between rubles and kopecks (for example, “258=00”).

In this field you should specify one of the identifiers, consisting of 20-25 digits:

- UIN (unique accrual identifier) - for settlements with the Federal Tax Service and funds for debts, fines, penalties. The code is assigned by the department in the corresponding payment request. If the code is not assigned or the payment to the budget is not made upon request (for example, when paying current taxes), “0” is indicated in the UIN field in the payment order;

- UIP (unique payment identifier) – for settlements of non-budgetary payments. The code is assigned by the organization receiving the payment and is communicated to the payer if such a condition is provided for in the contract. When the UIP is not assigned, the value “0” is also indicated in field 22 in the 2021 payment order.

You cannot leave the code field empty in the 2021 payment order.

- Field 23 “Reserve field” - not filled in.

When they talk about a payment order by decision of the tax authority, they mean the following situation:

- The payer (company/individual entrepreneur) is required by law to independently calculate the tax to be transferred to the treasury and draw up the appropriate payment document.

- The deadline established by law for voluntary repayment of the current tax debt has passed.

- The tax inspectorate received a request to make a tax payment within the deadline specified in it.

It should be noted that to fill out a payment order, by decision of the tax authority, use the same form as for voluntary repayment of current mandatory payments. It is enshrined in the regulation of the Central Bank of Russia dated June 19, 2012 No. 383-P. This form has index 0401060.

When you need to issue a payment order for a fine according to the decision of the Federal Tax Service in 2018, you should remember that in the KBK the numbers from 14 to 17 will be 3000. In addition:

- field 105 – OKTMO of the municipality, where funds from paying fines are accumulated;

- field 106 – “TR”;

- field 107 (“Tax period”) – “0”;

- field 108 – requirement number (the “No” sign does not need to be inserted);

- field 109 – date of the document from field 108 in the format “DD.MM.YYYY”;

- after 110 – do not fill in;

- field 22 (“Code”) – UIN (if it is not in the request, then “0”);

- field 101 – “01” for legal entities and “09” for “individual entrepreneurs”;

- “Payment order” – 5.

Basically, these are all the features of paying a fine to the Federal Tax Service by payment order in 2021.

If you find an error, please select a piece of text and press Ctrl+Enter.

First of all, let us remind you that through penalties the timely payment of mandatory payments is ensured. At the same time, a penalty is not a sanction, but an interim measure.

Read more about tax penalties in this article.

A payment order for penalties has both similarities with a payment order for the main payment (it states the same status of the payer, indicates the same details of the recipient, the same income administrator), and differences. Let's look at the latter in more detail.

The 2nd difference in the payment for penalties is the basis of the payment (field 106). For current payments we put TP here. Regarding penalties, the following options are possible:

- We calculated the penalties ourselves and pay them voluntarily. In this case, the basis for the payment will most likely have a code ZD, that is, voluntary repayment of debt for expired tax, settlement (reporting) periods in the absence of a requirement from the Federal Tax Service, because we, as a rule, transfer penalties not for the current period, but for past ones.

- Payment of penalties at the request of the Federal Tax Service. In this case, the payment basis will have the form TP.

- Transfer of penalties based on the inspection report. This is the basis of payment to AP.

All three of the above cases are discussed in detail in the Ready-made solution from ConsultantPlus. Samples of filling out payment forms are provided for each of them.

Read more about payment details in this article.

Payment order fields in 2021: sample

If you pay the fine yourself, enter 0 in fields 108 “Document number” and 109 “Document date”.

In all other cases, in field 108, provide the document number - the basis for the payment (for example, a claim), and do not put the “No” sign.

In field 109, indicate:

- date of requirement of the Federal Tax Service - for the basis of payment TR;

- the date of the decision to bring (refusal to bring) to tax liability - for the basis of an administrative agreement.

A sample payment order for the payment of penalties in 2019-2020 can be viewed and downloaded on our website:

All of the above-mentioned features of payments for penalties now also apply to the payment of penalties for insurance premiums (except for contributions for injuries), which have become payments to the tax office in 2021.

Learn about the procedure for processing payment orders for insurance premiums from this material.

However, these changes did not affect accident insurance contributions, and penalties for them, as well as these contributions themselves, are still paid to social insurance. When paying both contributions and penalties to the Social Insurance Fund in fields 106 “Basis of payment”, 107 “Tax period”, 108 “Document number” and 109 “Date of document”, enter 0 (clauses 5, 6 of Appendix 4 to the order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n). And if penalties are paid at the request of the fund and according to the inspection report, their details are given in the purpose of payment.

We have prepared video instructions for you on how to fill out a payment form to pay penalties.

First of all, let us remind you that through penalties the timely payment of mandatory payments is ensured. At the same time, a penalty is not a sanction, but an interim measure.

Read more about tax penalties in this article.

A payment order for penalties has both similarities with a payment order for the main payment (it states the same status of the payer, indicates the same details of the recipient, the same income administrator), and differences. Let's look at the latter in more detail.

So, the first difference is KBK (field 104). For tax penalties, there is always a budget classification code, in the 14th–17th digits of which the income subtype code is indicated - 2100. This code is associated with a significant change in filling out payment orders: since 2015, we no longer fill out field 110 “Payment Type” .

Previously, when paying penalties, the penalty code PE was entered in it. Now we leave this field empty, and the fact that this is a penalty can be understood precisely from the KBK.

ATTENTION! Starting from 2021, the procedure for determining the BCC is regulated by a new regulatory legal act - Order of the Ministry of Finance dated 06/08/2018 No. 132n. Order No. 65n dated July 1, 2013 has lost force. But this will not affect the general procedure for assigning penalties to BCC.

The 2nd difference in the payment for penalties is the basis of the payment (field 106). For current payments we put TP here. Regarding penalties, the following options are possible:

- We calculated the penalties ourselves and pay them voluntarily. In this case, the basis for the payment will most likely have a code ZD, that is, voluntary repayment of debt for expired tax, settlement (reporting) periods in the absence of a requirement from the Federal Tax Service, because we, as a rule, transfer penalties not for the current period, but for past ones.

- Payment of penalties at the request of the Federal Tax Service. In this case, the payment basis will have the form TP.

- Transfer of penalties based on the inspection report. This is the basis of payment to AP.

All of the above-mentioned features of payments for penalties now also apply to the payment of penalties for insurance premiums (except for contributions for injuries), which have become payments to the tax office in 2021.

[3]

Learn about the procedure for processing payment orders for insurance premiums from this material.

However, these changes did not affect accident insurance contributions, and penalties for them, as well as these contributions themselves, are still paid to social insurance. When paying both contributions and penalties to the Social Insurance Fund in fields 106 “Basis of payment”, 107 “Tax period”, 108 “Document number” and 109 “Date of document”, enter 0 (clauses 5, 6 of Appendix 4 to the order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n). And if penalties are paid at the request of the fund and according to the inspection report, their details are given in the purpose of payment.

A payment order for the payment of penalties is issued similarly to a payment order for the payment of taxes (the same status of the payer, the same details of the recipient and the same income administrator are indicated).

Payment of penalties by type of taxes and fees is made according to separate BCCs, in categories 14–17 of which the income subtype code is indicated - 2100. In a special order, separate fields of the payment slip for the transfer of penalties (“Basis of payment” and “Tax period” are filled in) ).

Deadlines for payment of insurance premiums

Insurance premiums are paid at the end of each month no later than the 15th day of the following month.

Contributions for compulsory pension, medical insurance, in case of temporary disability and in connection with maternity (VNiM) must be transferred to the tax authorities, and “traumatic” contributions - to the Social Insurance Fund of the Russian Federation. If the payment deadline falls on a weekend or non-working holiday, it is postponed to the next working day. Companies must pay insurance premiums for May, taking into account holidays, no later than June 17, 2019. Remaining deadlines for payment of insurance premiums in 2021:

- for May - 06/17/2019

- for June - 07/15/2019

- for July - 08/15/2019

- for August - 09/16/2019

- for September - 10.15.2019

- for October - 11/15/2019

- for November - 12/16/2019

- for December - 01/15/2020

Voluntary repayment of debt with penalties sample payment form

Penalties are a measure that ensures timely and complete payment of taxes, fees and contributions to a particular budget. If the payer does not transfer the required funds within the time limits established by law, penalties will automatically begin to accrue. Since the state suffers damage if the payer violates the terms or amounts of payment of its obligations to the treasury, an additional payment called a penalty is added to the amount of assessed contributions, fees and taxes. In essence, this is compensation for material losses of the state. Let's look at some features of a payment order with a VAT penalty for the 2021 sample.

Penalties are paid regardless of the accrued/additionally accrued amounts of tax, fee or contribution. In accordance with paragraph 3 of Art. 75 of the Tax Code of the Russian Federation, penalties apply for each day of overdue payment obligation from the day following the day of payment. To calculate penalties, take 1/300 of the current refinancing rate established by the Central Bank on the day the penalties are calculated. And from the 31st day of delay - 1/150 of the rate (for legal entities).

An organization can independently calculate the amount of tax penalties. This calculation can be useful in the following cases:

- in order not to pay a fine when submitting an updated declaration and additional payment of the tax amount;

- to check whether the tax office calculated penalties correctly or not.

It is better to pay penalties at the same time as transferring the tax debt. After all, the faster the payment is made, the smaller the penalties will be. Formally, tax legislation allows the payment of penalties after the payment of tax debts.

The first step is to decide on the amount of the penalty: as a rule, it is set by the tax office, indicating why and on what basis it was calculated, but if you have to calculate it yourself, there is a calculation formula:

SP = N x Kd x 1/300 x SR

SP – amount of penalty;

N – the amount of tax not paid on time;

Kd – number of days of delay;

SR – refinancing rate valid during the period of delay.

According to this formula, the penalty will be calculated until October 1, 2021 for the first thirty days of delay at the rate of 1/300, and then at a rate of 1/150 of the rate of the Central Bank of the Russian Federation, currently it is 7.25%

So, for example, the employee’s salary was supposed to be paid on March 31, 2021, but in fact the employee received it on April 20, 2021, the amount of the salary was 32,000, the delay was 20 days

Penalty=32000*20*1/300*7.25%=154.66 rub.

In total, the company must pay 154.66 rubles to the budget.

1.If you have received a decision in your taxpayer’s personal account to pay a penalty from the tax inspectorate, you must pay it off within the prescribed period

2. In the event of an error in the KBK regarding the penalty, the payment will go to the wrong place and the tax office may issue a decision to block the account, and the bank will be required to write off a penalty from you, and until the money reaches the Federal Tax Service, the account will work or be partially or completely frozen

3.And you will have to go to the inspectorate and find out where your penalty went, write an application to clarify the payment

4. After which, whose penalty will arrive faster, then the decision to block accounts will be canceled

As a rule, failure to pay penalties does not entail complete blocking of the current account. The client has worked and can continue to work. The bank blocks only the amount that it needs to use to pay off the penalty. A complete blocking occurs when the client owes a large amount of money.

1.Question No. 1:

Is it possible to pay a fine at a bank cash desk?

Answer:

Tax legislation does not provide any restrictions on paying taxes and penalties through bank cash desks. However, it will be better if you pay it from your company current account. By filling out a payment order indicating all the necessary details and columns. Namely, the BCC for the penalty of the tax for which it is accrued, OKTMO of the region where the organization is registered, as well as the period and basis, whether you pay on demand or independently.

Conclusion

Tax penalties are an annoying additional expense, which is most often assigned to inattentive fee payers who have missed one or more transfers of funds. We would like to warn you that the tax service will not wait for payment from you forever, sitting with folded hands. Some time after non-payment of the fee, as well as non-payment of penalties, and possibly also a fine, your case will be transferred to the bailiffs, who will visit you until they are convinced that you have fulfilled your financial obligation to the state. By the way, since you are the reason for the forced involvement of bailiffs in the process of receiving money due to the country, subsequently the monetary compensation for their work will also fall on the shoulders of your organization.