Paying taxes is one of the main points in human economic activity. The tax residence of individuals may be in favor of a particular country. The concept of resident itself can have different meanings, but in this context it is an individual registered in a certain country who fulfills all the requirements regarding taxation and current legislation.

Thus, a certificate of residence of the Russian Federation means that a person who cooperates with foreign organizations or receives dividends from there should not pay double tax. But there are many nuances here, so you need to know how to draw up a document confirming the status of a tax resident of the Russian Federation. Where to go for this, what you will need to provide and how to save time, nerves and avoid common mistakes.

When is residency required?

Most often, a tax residence certificate is needed when a person is engaged in commercial activities. For example, he has a business in the Russian Federation, but is registered with a tax authority in another country, or if he is registered in Russia, but conducts commercial activities in another state.

But depending on which country a person is registered in, there may be differences:

- in the amount of taxes;

- in the manner and requirements for payment;

- amount of payments.

If a person has residence in one of the countries, international agreements in force between these countries may provide for the absence of the need to pay double tax. To better understand how the situation is, you can read Article 207 of the Tax Code of the Russian Federation.

Article 207 of the Tax Code of the Russian Federation

Application for confirmation of permission

The first step is to apply for a certain certificate. Only the Russian Federal Tax Service is authorized to issue it. The document itself must indicate legality and compliance with legal norms.

When filling out the application, you must provide the following information:

- for legal entities - TIN, address, name;

- for individuals – full name, address, tax identification number;

- the year for which confirmation of status is required;

- the country to which the certificate will be provided to the relevant services;

- documents that must be with the application;

- signature - if this is an individual, it must be signed in person, and if there is an original document confirming the authority of this person, then the head of the organization can sign.

There is no special template for such applications, therefore, if a certain organization is involved in the issue, the application is drawn up on its letterhead, and individuals fill it out arbitrarily.

The application for tax residency in the Russian Federation must be supplemented with copies of certain forms, which must contain the signature of the head and a stamp must be affixed. This is confirmation of possible income from abroad, and the role of a document certifying this fact can be:

- a concluded contract or other form of agreement;

- document on the payment of dividends, this can be adopted at the shareholders' meeting;

- a copy of a passport or other identification document of an individual;

- documents confirming receipt of a foreign pension;

- individuals, except individual entrepreneurs, provide a table in which the time and periods of stay in the Russian Federation are calculated; it should not be less than 183 days throughout the year.

Table calculating the time and periods of stay in the Russian Federation

There are situations when the address of the place of actual residence does not coincide with the official registered address in the Russian Federation. In order to obtain a certificate of residence in the Russian Federation, you must submit a notification document that will notify the tax service that the organization is changing one address to another.

The completed application for a residence certificate can be taken or sent by mail to the branch of the Federal Tax Service of Russia.

Statement

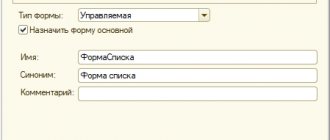

From December 9, 2021, individuals need to submit an application in order to obtain residency using the KND form 1111048. In the document, the applicant indicates:

- Passport details, TIN or other official documents confirming identity. The application must indicate the full name, citizenship, date of receipt and name of the registering organization.

- Permanent residence confirmation period. For example, a tax resident certificate can be obtained for the previous year or for several years.

- Purpose of obtaining the document. The Russian Federation provides residents with a number of tax benefits when they enter into commercial contracts/agreements.

- Duration of stay of an individual in the territory of the state.

- Grounds for the applicant to receive a certificate confirming Russian residency.

Resident Responsibilities

To qualify as a tax resident, you don't need much. You will need to stay in Russia for at least 183 days a year, and traveling abroad for reasons such as study or service will not have a negative impact. However, if within 12 months you have not been in the Russian Federation for the required minimum period of time, then you are subject to the loss of Russian tax residency.

When a legal entity is resident, the income tax will be 20% of income revenue in Russia, for individuals it is 13%, and for persons who do not have a residence certificate, the tax will be 30%.

Tax residents also need to declare controlled foreign companies if the ownership share exceeds 5%. And legal entities need to additionally declare funds and trusts.

In the event that a controlled foreign company has earned a profit exceeding 10 million rubles during the year, according to Russian laws it is necessary to pay a tax of 13 and 20%. Organizations that do business in the countries of the Organization for Economic Cooperation and Development, as well as the FATF, can avoid this need. But the list of states with mandatory taxation is much larger.

It often happens that the holder of tax residency in the Russian Federation also has currency residency, which means that he is additionally required to provide information about his foreign bank accounts and money receipts throughout the year.

Until recently, it was much easier to give up tax residency, since you could be absent from the Russian Federation for the entire year and your status could be returned even with a single visit to the country.

How is tax residency related to the citizenship of an individual?

Based on the provisions of the Tax Code of the Russian Federation, tax residency does not depend on citizenship. So, a citizen of the Russian Federation does not have to be a resident of his country. A foreigner or a stateless person can count on residency. But much depends on the agreements concluded between Russia and other countries.

International agreements regulate residency, establishing rules for confirming status, at the same time in situations where the residence of an individual extends to both contracting countries. Typically, an individual becomes a resident of the country in which he has housing and the right to reside.

The EEC Treaty came into force at the beginning of 2015 and, taking into account the content of Article 73 about the treaty on income taxation of individuals on the income of a resident of the country of the party to the treaty, the tax is 13% of the rate. This is applicable for Kazakhstan and Belarus when hiring for work in the Russian state, from the first day of starting work. A little later, the Republic of Armenia joined the EEC, for which all this is also relevant. This rate is provided for in Article 24 of the Tax Code of the Russian Federation.

“Article 24. Tax agents. Tax Code of the Russian Federation"

It must be taken into account that the residence of the Russian Federation is not automatically recognized for representatives of these countries only if they confirm their presence on the territory of the Russian Federation for the minimum required period of time. So if at the end of the period the proof of residence is not approved, a 30% tax on income cannot be avoided. Data that it is not possible to withhold existing debts from the taxpayer must be provided to the Federal Tax Service. This procedure is provided for by Article 26 of the Tax Code of Russia.

“Article 26. The right to representation in relations regulated by the legislation on taxes and fees. Tax Code of the Russian Federation"

How to avoid problems with a tax residence certificate

If you are entering into a foreign economic transaction, a tax residency certificate will allow you to legally not act as a tax agent.

At your request, the foreign partner provided you with an electronic copy of the paper document. Is it enough for the tax office or do you need the original? The director of the organization of tax consultants “Assistance In Tax” Radmila KARIMOVA answered this question upon request

– The use of tax privileges provided for by international treaties of Uzbekistan by a foreign company is possible only if it has provided a document confirming its permanent location (i.e. it is a tax resident). This is the so-called tax residence certificate/certificate.

The need to confirm the payer’s residence in a foreign country follows from the article of international agreements on the avoidance of double taxation - “Persons to whom the agreement applies.” Only residents of the two contracting states can apply for the provisions of such an agreement. This requirement is also established by Article 6 of the Tax Code.

The residence certificate can be presented in one of the following types:

1) an original certified by the competent (usually tax) authority of a foreign state whose resident is a non-resident. The presentation of such a document is carried out with its consular legalization or with the affixing of an apostille in the manner prescribed by law. Both consular legalization and apostille are carried out in order to determine the authenticity of a document;

2) a notarized copy of the original document that meets the requirements of the previous paragraph (i.e. if the original has consular legalization or has an apostille on it). The notary certifies a copy based on the original document;

3) a paper copy of an electronic document confirming tax residence, posted on the Internet resource of the competent authority of a foreign state.

Thus, the Tax Code provides for the possibility of using:

- a paper document in the original - with consular legalization, apostille or a notarized copy;

- an electronic document posted on the Internet resource of the competent authority of a foreign state.

Let's look at this with examples.

1. The Russian company provided a paper copy of the electronic document in the following form:

To verify the authenticity of the submitted document, you need to follow the link provided in the document: .

When you log in, the following window appears:

When you enter the appropriate verification code specified in the residence certificate and click on the “get certificate” command, an electronic copy of this document opens in PDF format.

In addition, by following the link to the website of the tax service of the Russian Federation, you can familiarize yourself with the current list of sample signatures of officials authorized to sign documents confirming the status of a tax resident of the Russian Federation.

2. The Georgian company provided a paper copy of the residence certificate:

You can check a document confirming your tax resident status in Georgia using the electronic service of the tax service. When you enter the identification number (ID) and barcode (BARCODE) shown in the upper right corner of the certificate, an electronic copy of the original certificate will open in a new window.

3. Local tax authorities of the Czech Republic can issue a tax residence certificate not only on paper, but also in electronic form with an electronic signature.

The Czech company provided the original residence certificate with an apostille:

Czech Post converts such a document from paper into electronic form.

The Internet service, according to the explanations of the tax service, is designed to verify the authenticity of an electronic signature. Verification is carried out by entering the number indicated under the barcode in the document attached to the certificate into the empty field and clicking on the “Ověřit” (“Check”) button.

If the document is in the database, the message is displayed: “Dokument vznikl provedením konverze dokumentů podle zákona č. 300/2008 Sb., o elektronických úkonech a autorizované konverzi dokumentů, v platném znění” (the document was created by converting documents in accordance with Law No. 300/2008 Coll. on electronic acts and authorized conversion of documents, as amended). When you click on the “Zobrazit oveřovací doložku” (“Show verification results”) button, the certificate appears on the screen in electronic form. Its text must match the text of the paper document.

If the certificate is not genuine, when you enter the barcode number and click on the “Ověřit” button, the message appears: “Dokument nevznikl provedením konverze dokumentů podle zákona č. 300/2008 Sb., o elektronických úkonech a autorizované konverzi dokumentů, v platném znění” (the document was not created by converting documents in accordance with Law No. 300/2008 Coll. on electronic acts and authorized conversion of documents, as amended). In this case, the certificate cannot be accepted for the purposes of applying the tax treaty with the Czech Republic.

4. On the website of the Tax Agency of the Kingdom of Spain (in the English version), you need to go to the section Document check using the secure verification code (CSV) – Document check using the secure verification code and enter the control code in the “Datos * Código Seguro de Verificación” field, indicated on the residence certificate.

If the document is genuine, the screen will display an electronic version of the tax residence certificate, registered and stored in the databases of the tax authorities.

5. To verify the authenticity of the electronic residence certificate issued by the tax authorities of the Republic of Belarus, you need to go to the link:

Then enter the security verification code contained in the document provided by the non-resident into the appropriate window. By pressing o, you need to confirm the issued set of numbers in the action confirmation.

Not all foreign tax authorities allow access to their resource for the purpose of verifying the authenticity of a certificate of residence. In particular, in Kazakhstan, access to this service is available only to the applicant himself - a resident. In this case, the Kazakh tax authorities provide the certificate in the original - on paper.

In some countries, the document authentication service is not provided at all. This applies to Great Britain, Israel, Italy, China, France.

Attention If the residence certificate is presented in electronic form, but it cannot be verified on the website of the issuing government agency, it may not be recognized by the tax authorities. In this case, you will have to pay tax to the budget.

Therefore, not all countries provide online verification of the residence of a foreign supplier. But, undoubtedly, their list will expand over time.

Attention

On September 11, 14 and 18 of this year, Radmila KARIMOVA will conduct an online course “How to tax the income of foreigners in 2021.” If you have questions on this topic, you can send them to: [email protected] You will receive an answer during class.

Experts' explanations reflect their opinions and create an information basis for you to make independent decisions.

How is it issued and validity period?

A certificate of tax status is issued to a legal entity, if it is a resident of Russia, it must be in 1 copy, and its validity does not exceed 1 of the current year when it was issued . It may contain data for the past year or time period, if the legal entity that sent the request for the certificate provided such data.

The delivery time varies from person to person, but usually it takes from 4 weeks, sometimes longer.

Based on the legislation, it must be confirmed within 1 month from the date of submission of all the necessary documents to the tax authorities. Organizations from Russia can do this by sending their representative to the Federal Tax Service or sending papers by mail.

Procedure for filling and submitting

An individual fills out the title page and indicates the period of stay in the country. If the applicant does not have a TIN, you will need to additionally enter the details of the identity document. Individuals enclose a package of papers with their applications to the Federal Tax Service for obtaining certificates. The list depends on the specific situation. For example, a residence permit or property ownership documents, a contract/agreement, cash receipts for the payment of dividends, accounting statements, etc. Papers in a foreign language must be translated into Russian and notarized.

An application with a package of documentation can be submitted to the tax office in three ways:

- Send by registered mail. It is important to create an inventory of the contents of the letter.

- Visit the Federal Tax Service Inspectorate in person and hand over the documents to the service officer.

- Submit online through the tax website.

Let's consider the interactive method. In 2021, it is more convenient to obtain your residence confirmation status via the Internet. To do this, a service has been created on the website of the Federal Tax Service, with the help of which applications for issuing a certificate for individuals, companies or individual entrepreneurs can be quickly completed. You can also receive the document itself in PDF format via the Internet.

The online service simplifies the interaction between the service and individuals. A potential resident does not need to send supporting documents to the tax office. All you need to do is log in/register on the website and fill out an application.

We appreciate your time

We are a reliable partner

Professionals with extensive experience

Leaders in fulfilling orders of any complexity

Guarantor of quality for the services provided

Checking Resident Status

If a person is recognized as a Russian resident, then his status will be determined after each payment of taxes. But usually this rule applies if there are grounds for a possible change of residence in the future. The final decision on residency status can be received closer to the end of the year, but more often before the end you can draw conclusions regarding whether the person will remain a resident and make a bet of 13 or 30%.

Checking Resident Status

Once a decision is made on the rate, it will be reflected in income from January 1 of the year, and not from the moment the decision on this issue is made. Recalculation is done only during the period of making changes, and does not apply to the previous tax period.