“Forbidden” digits of the payment number

The payment order number is a mandatory detail, and in form 0401060 (according to OKUD), field 3 is allocated to reflect it. It takes pride of place between the name of the payment document and the date of its execution.

You can see the completed sample and familiarize yourself with the procedure for filling out a payment order in the material “Filling out a payment order in 2021 - sample.”

Typically, entrepreneurs use accounting or banking programs to process payments, in which numbering occurs automatically, and there is no need to think about this process.

However, there are certain requirements for how the payment document number should look, and “forbidden” numbers in its composition are defined.

Firstly, the maximum number of digits in the payment order number is determined:

- for electronic payments - 6 (Appendix 11 to the Bank of Russia regulation “On the rules for transferring money” dated June 19, 2012 No. 383-P);

- for payment orders issued on paper, the maximum length of the details is not specified, except that the number must be different from 0 (Appendix 1 to Regulation No. 383-P).

Secondly, the last 3 digits of the payment order number should not look like this: 000, since banking programs all numbers of payment documents containing more than 3 digits in their composition are identified by the last 3 digits of the number (letter dated 04/03/2013 No. 59-T).

In 2021, when sending budget payments, you must check the details very carefully, because from January 1 they change and there will be a transition period until May 1. A ready-made solution from ConsultantPlus experts will help you fill out your tax payment form correctly. To use the tips, sign up for free online access to the legal reference system.

Payments with numbers containing more than 3 digits may create certain difficulties for the payer due to the consequences of reflecting these numbers in the details of other documents (for example, invoices).

Basic information about filling out column 5

Information about payment orders in the invoice is recorded according to the following rules:

- The document number and the date of its issue are indicated.

- If there were several advance payments, the details of each are indicated. This is also possible when payment under a contract is received from two or more counterparties (co-customers, commission agent or agent, etc.). In this case, the details are separated by the sign “;”, semicolon.

- In cases established by the resolution of paragraphs. “z” clause 1 of the Filling Rules established by Decree of the Government of the Russian Federation No. 1137 of 2011, it is allowed to put a dash instead of the details.

Cases where a dash or blank line is allowed include the following:

- The delivery was carried out without prepayment, or shipment (using invoices) and payment (using a payment order) took place on the same banking day. In what cases is an invoice required? Read here.

- The supply or provision of services was carried out under a non-cash agreement.

Important. If there are several counterparties who made payments, information about them should be reflected in other columns accordingly.

Payment order number and column 5 of the invoice

The invoice contains information about the payment order number in cases where it is issued for prepayment or for sale (if there are preliminary advance payments). In accordance with clause 5.1 of Art. 169 of the Tax Code of the Russian Federation, the payment order number is reflected in the invoice in column 5 “To the payment and settlement document”.

For more information about the mandatory details of an invoice, read the article “What are the mandatory details of an invoice?” .

If an entrepreneur uses in his activities the numbering of payment documents containing no more than 3 digits, problems with filling out column 5 of the invoice should not arise. But if this number is longer, disagreements may arise with the tax authorities regarding the correctness of the information about the payment order number reflected in the invoice. According to the inspectors, the entrepreneur has no right to claim a VAT deduction on prepayment of an invoice in which column 5 is not filled in or contains false information.

The tax authorities attribute the impossibility of deduction to the fact that for an invoice for prepayment, column 5 is a required detail, errors in which prevent deduction. So, if the buyer has issued payment document No. 7657, and in the statement the recipient sees No. 657 (the last 3 digits of the number) and reflects this information in the invoice, then disputes with the tax authorities are inevitable.

The position of the Russian Ministry of Finance on this issue will help defend the right to deduction (letter dated September 19, 2014 No. 03-07-09/46986). The said letter states that the 3-digit payment order number in column 5 of the invoice does not prevent deduction. Officials justified their point of view by the fact that the abbreviated payment number does not prevent tax officials from identifying the seller, buyer, name of goods, their cost, rate and amount of tax (clause 2 of Article 169 of the Tax Code of the Russian Federation).

If the supplier did not indicate the payment order number at all in the prepayment invoice or reduced its length to 2 or 1 digit, it is possible to prove the right to deduction only in court (Resolution of the Federal Antimonopoly Service of the Moscow District dated August 27, 2012 No. A40-17985/12-140 -80).

The practice of using payment requests-orders in settlements of enterprises

When a company’s request to the buyer of its goods to pay for products delivered in accordance with the agreement is based on the presentation of payment and shipping documents, this is a payment request-order generated by the supplier company. The paying company will consider the possibility of payment and submit the papers to the bank so that the accepted amounts are sent to the seller. If there is a sufficient amount in the account, the credit institution carries out the client’s instructions.

According to the current rules, the payer is obliged to pay the payment request as soon as the required amounts become available.

How is the payment number related to the sales book and purchase book?

Both the purchase book and the sales book contain columns to reflect the number and date of the payment document.

IMPORTANT! The forms of purchase books and sales books are contained in the Government Decree “On the forms and rules for processing documents related to VAT” dated December 26, 2011 No. 1137.

In the purchase book, column 7 is intended to reflect information about the number and date of the document confirming the payment of tax (Appendix 4 to Resolution No. 1137).

The sales book also has a similar column 11 “Number and date of the document confirming payment” (Appendix 5 to Resolution No. 1137).

To learn about when it is necessary to make entries in the books of purchases and sales and how to do it correctly, read the material “The book of purchases and the book of sales: maintenance and registration for VAT calculations .

For example, in accordance with clause 17 of Section II of Annex 4 to Resolution No. 1137, the purchase book must reflect payment documents evidencing payment of VAT at customs (when importing goods into our country). And based on para. 2 clause 23 of section II of Appendix 4 to Resolution No. 1137 in the purchase book it is necessary to reflect the details of payment orders for the transfer of VAT to the budget, issued by tax agents when purchasing the property of bankrupt debtors.

Types of payment and settlement documents

With the help of settlement documents, relationships with suppliers and consumers are quickly and reliably formed. Their main types:

- payment order;

- payment request;

- collection order;

- bank and payment orders.

The list of types of payment (settlement) documents is fixed by the “Regulations on the rules for the transfer of funds” (clause 1.12, Chapter 1). The contents of instructions, orders and demands can be found in detail in the appendices to this Regulation (2, 4, 6, 9).

Field 102 in the payment order

Banking institutions make settlements with payment requests and orders between:

- by your clients;

- client and banking institution;

- credit institutions.

They ensure the transfer of money in non-cash form to individual entrepreneurs and enterprises.

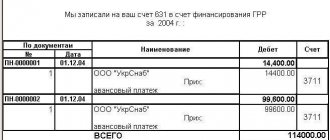

The role of the payment document number in the reconciliation act

Settlements with counterparties are usually confirmed by drawing up bilateral reconciliation reports, from which one can understand when and in what quantities the goods were sold and paid for. The role of this document should not be underestimated. A timely executed reconciliation act helps to reliably reflect receivables and payables in the financial statements - the reliability of these statements and the subsequent punishment for distortion of their lines depend on this.

Read about what punishment an entrepreneur will face if his reporting is distorted in the material “Fine for gross violation of the rules for accounting for income and expenses .

If the reconciliation report is initially drawn up by the buyer, then in the “Bases” column he enters the details of the primary documents for shipment received from the seller and his payment orders, which confirm the fact of payment for the goods received.

If the reconciliation statement is generated by the seller, usually the date of the bank statement for the day the payment was received into his bank account from the buyer is indicated as proof of payment.

If a payment is lost, and the mutual settlement amounts according to the reconciliation report differ between the seller and the buyer, then using the specified payment slip numbers you can quickly restore the chronology of payments and take into account the missed transfer.

For information on how to fill out a payment order without errors, read the article “Main fields of a payment order in 2020-2021 (sample)” .

Three options for posting information about charges for housing and communal services.

When filling out payment documents in the GIS Housing and Communal Services, there are three options for posting information about charges for housing and communal services: 1. Payment in the billing period is equal to the balance at the beginning of the billing month - in this case, the debt for the previous billing period is equal to the opening balance, a positive amount. 2. Payment in the billing month is less than the balance at the beginning of the billing month. 3. Payment in the billing month is greater than the balance at the beginning of the month - if the user has paid more for housing and communal services than accrued, an advance will be received. To begin with, it is important to remember that the balance is the difference between cash receipts and expenditures for a certain period. Here's what you need to know about all three cases in order to correctly fill out the GIS Housing and Communal Services.

The advance is equal to the negative amount of the opening balance. Payment of funds coincides with the payment amount in the billing period.

The amount payable, taking into account the debt and overpayment, is equal to the “opening balance + accruals in the current billing period” and is automatically calculated by the system.

The amount of accrued funds is the amount of accruals in the billing period and is automatically calculated by the system.

Source: RosKvartal® - Internet service No. 1 for management organizations

Results

The payment order number is not only mandatory, but also useful information. Information about it is reflected in many important documents (invoices for advance payments and shipments, books of purchases and sales, acts of reconciliation of mutual settlements).

To ensure that the payment document number does not cause much trouble for the payer and the recipient of the money, it is necessary to follow the basic rules for its formation, which include the presence of no more than 6 characters in its composition and the inadmissibility of indicating the combination 000 in the last 3 digits.

You can find more complete information on the topic in ConsultantPlus . Free trial access to the system for 2 days.

Features of settlements with payment documents

In a company, firm or enterprise, settlement payment documents are payment requests and orders. Both varieties are important.

The payment order is an instruction from the account holder company forwarded to the bank. It involves the transfer of the amount indicated in it to the supplier - the recipient of the funds. This account is opened at any banking institution.

By agreement of business partners, payments are:

- urgent;

- early.

The use of urgent payments is advisable when:

- advance payments made before the goods were delivered;

- partial payments for large transactions.

If there is insufficient funds in the account, the payment will be paid in part. An appropriate note must be made on it.

Requirements are used for payments for the supply of goods, work or services performed. It is used by fund collectors (recipient organizations) to write off money from the payer and transfer it to their account.

When these same enterprises themselves pay their creditors, they do this through the preparation of payment orders. The basis for the preparation of documents are bills presented for payment or legally established obligations (payment of taxes, contributions to the treasury and state funds).

This answers the question of how a payment order differs from a payment request.