When starting their own business, entrepreneurs do not always pay due attention to the issue of accounting. Some have heard that accounting for individual entrepreneurs is not required by law, others consider this issue to be of secondary importance, and still others say that there is nothing complicated here, and you can handle the accounting yourself.

In fact, setting up individual entrepreneur accounting from scratch is necessary already at the stage of planning business activities. There are several reasons for this:

- A competent choice of taxation system will allow you to choose the minimum possible tax burden. To ensure that you do not unknowingly fall under the definition of illegal tax schemes, practical tax planning for your business should be carried out by specialists, not dubious advisers.

- The composition of reporting, the timing of tax payment, and the possibility of obtaining tax benefits depend on the chosen regime.

- Violation of deadlines for submitting reports, accounting procedures, payment of tax and non-tax payments will lead to unpleasant sanctions in the form of fines, disputes with the tax service, and problems with counterparties.

- After registering an individual entrepreneur, you have very little time to choose a tax regime. So, to switch to the simplified tax system it is only 30 days after receiving the certificate. If you do not choose a tax system right away, you will work on OSNO. In most cases, this is the most unprofitable and difficult option for a beginning entrepreneur.

Is it necessary to keep accounting for individual entrepreneurs using a simplified 6 percent individual entrepreneur?

Based on paragraph 2 of Art. 6 of Federal Law No. 402-FZ of December 6, 2011, entrepreneurs may not keep accounting records if tax legislation obliges them to take into account income (costs) received within the framework of their business.

At the same time, individual entrepreneurs under the simplified tax regime with the object “Income” must keep records of their revenue. This follows from Article 346.24 of the Tax Code of the Russian Federation, which states that in order to determine the tax base, simplifiers are required to keep records of income and expenses. This is done in the book of income and expenses, the form and procedure for filling out which are approved by Order of the Ministry of Finance of the Russian Federation dated October 22, 2012 No. 135n.

The book can be kept both on paper and electronically. You need to start a new book every year. At the end of the year, the electronic book must be reproduced on paper (clause 1.4 of the order).

A paper copy of the book is laced, numbered, and the number of pages is recorded on the last page, which is certified by the individual entrepreneur’s signature and seal, if available.

Correction of errors in the book must also be confirmed by the signature and seal of the businessman, if any.

Simplified people with the “Income” object fill in the following in the book:

- title page;

- Title II regarding income;

- Section IV regarding expenses for insurance premiums, contributions under DLS agreements, hospital benefits, which reduce tax;

- Section V if a trade fee is paid.

Let us note that the Ministry of Finance of the Russian Federation, in a letter dated July 24, 2013 No. 03-11-06/2/29385, indicated that in the simplified book of income and expenses, all indicators should be reflected in full rubles.

How to do accounting for an individual entrepreneur

- Make a preliminary calculation of the expected income and expenses of your business. You will need this data when calculating your tax burden.

- Select tax regime. Here we will only list them: the main taxation system (OSNO) and special tax regimes (USN, Unified Agricultural Tax, PSN) . The tax burden of individual entrepreneurs directly depends on the choice of taxation system. The amounts that you must pay to the budget may vary significantly in different modes. If you do not know how to calculate your tax burden, we recommend that you get a free tax consultation.

- Review the tax reporting for the selected regime. You can find current reporting forms on the Federal Tax Service website tax.ru.

- Decide whether you will hire workers. How can an individual entrepreneur keep accounting records for an employee? Employers' reporting can be called quite complex, and its composition does not depend on the chosen tax regime and the number of employees. Several types of reporting are submitted for employees: to the Pension Fund of the Russian Federation, to the Social Insurance Fund and to the tax office. For example, by January 20, all individual entrepreneurs with employees must submit information on the average number of employees. In addition, employers must maintain and store personnel records.

- Study your regime's tax calendar. Failure to comply with the deadlines for submitting reports and paying taxes will lead to fines, penalties and arrears, blocking of the current account and other unpleasant consequences.

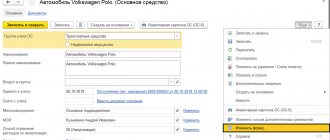

- Decide on the type of accounting service. In simple modes, such as the simplified tax system 6% (Income), UTII, PSN, even if you have employees, you can conduct accounting for individual entrepreneurs yourself. Your main assistant in this case will be specialized online services, such as 1C Entrepreneur. But for OSNO and simplified taxation system Income minus expenses, as well as with a large number of business transactions, it is more reasonable to outsource accounting for individual entrepreneurs.

- Maintain and save all documents related to the business: contracts with counterparties, documents confirming expenses, bank statements, personnel documents, BSO, cash register reporting, primary documents, incoming information, etc. The tax inspectorate can check documents on the activities of an individual entrepreneur even within three years after deregistration.

What taxes should individual entrepreneurs pay in 2021?

The use of a simplified system exempts entrepreneurs from paying:

- PFDL on income received from business (with certain exceptions);

- property tax for individuals on those objects that are used in business (with certain exceptions);

- VAT (with certain exceptions).

Thus, simplifiers pay the following taxes (clause 3 of Article 346.11 of the Tax Code of the Russian Federation):

- tax according to the simplified tax system from the object “Income”;

- VAT when importing goods, when issuing an invoice, if the duties of a tax agent for VAT arise and in some other cases;

- Personal income tax on dividends and income taxed at rates of 9.35 percent, as well as personal income tax as a tax agent if there are employees (clause 1 of article 226 of the Tax Code of the Russian Federation);

- income tax as a tax agent when paying income to a foreign company (Clause 1, Article 310 of the Tax Code of the Russian Federation);

- water tax (clause 1 of article 333.8 of the Tax Code of the Russian Federation);

- property tax for individuals on real estate not used in business, as well as on objects from the cadastral list;

- transport tax (Article 357 of the Tax Code of the Russian Federation);

- land tax (clause 1 of article 388 of the Tax Code of the Russian Federation);

- insurance premiums for yourself and from payments to employees (clause 1 of article 419 of the Tax Code of the Russian Federation, clause 1 of article 430 of the Tax Code of the Russian Federation).

What is included in closing documents for individual entrepreneur accounting

When agreeing on the supply of goods or the provision of services, you enter into a written agreement with the other party (organization or individual entrepreneur), which must stipulate all the essential terms of the transaction:

- names of the parties;

- requisites;

- subject of the contract (name, characteristics, quantity of goods supplied or description of services);

- price;

- terms of payment;

- deadlines.

The contract usually specifies the type of document that will confirm compliance with the terms of the contract. For one-time small transactions for the provision of services, an invoice or invoice-offer is sometimes used instead of a contract. To do this, add brief information about the essential terms of the contract. Payment can be made by invoice or agreement.

The main closing documents include:

- invoices;

- acts of provision of services (or performance of work);

- invoice;

- UPD (universal transfer document);

- BSO (strict reporting form);

- sales receipt.

You can develop the forms of the invoice and acts yourself, including the necessary details. These forms must be issued as an appendix to the order on accounting policies. It is more convenient to use the standard form of the TORG-12 invoice and the act, available in any accounting program.

To issue an invoice, only a unified form is used. To reduce paperwork, you can use UPD, which combines a delivery note and an invoice.

We recommend reading: How to properly conduct accounting for an individual entrepreneur yourself - step-by-step instructions.

On what income should individual entrepreneurs pay tax on the simplified tax system at 6 percent?

The Tax Code does not establish a special list of income taken into account by simplifiers. According to Article 346.15 of the Code, within the framework of the simplified tax system, income is determined according to the rules of paragraphs 1 and 2 of Art. 248 of the Tax Code of the Russian Federation, that is, the same as for paying income tax. Thus, individual entrepreneurs on the simplified tax system of 6 percent take into account sales and non-sales income.

Sales revenue is income from the sale of goods of own production and purchased for resale (property rights), income from the provision of services, and performance of work. Sales revenue is recognized as all money or payment in kind received in the settlement of goods (work, services) sold.

Non-operating revenue is:

- revenue from exchange rate differences;

- amounts of damages, losses, fines, and other sanctions recognized by the debtor or won in court for violation of contracts;

- rental payments, if this is non-operating income;

- interest on loans, bank deposits;

- other income.

According to paragraph 1 of Art. 250 of the Tax Code of the Russian Federation, non-operating income is revenue not included in the sales article. 249 of the Tax Code of the Russian Federation. Accordingly, the list of non-operating income is open.

It should be taken into account that certain income is not subject to inclusion in the base under the simplified regime. In accordance with paragraph 1.1 of Art. 346.15 of the Tax Code of the Russian Federation these include:

- income from the list of Art. 251 of the Tax Code of the Russian Federation, not taken into account in the income tax base. Despite the fact that advances in Art. 251 of the Tax Code of the Russian Federation are given, they still need to be taken into account in the database according to the simplified tax system. This is due to the fact that in the income tax base, advances are not taken into account by taxpayers who determine income using the accrual method, while under the simplified tax system, income is determined using the cash method;

- income subject to personal income tax at rates of 9 and 35 percent;

- dividends - according to clause 3 of Art. 346.11 of the Tax Code of the Russian Federation, personal income tax is paid from them;

- income on which tax is paid under the patent system.

Revenue accounting under the simplified system is carried out using the cash method (clause 1 of Article 346.17 of the Tax Code of the Russian Federation). This means that money is counted on the date it is credited to a bank account, received at the cash register, or the debt is repaid in another way (receiving goods as payment, signing an offset act).

In letter dated 02/10/2020 No. 03-11-11/8398, the Ministry of Finance of the Russian Federation explained that when paying for goods with a plastic card, income is accounted for precisely at the moment the money is credited to the current account. Accordingly, if the moment of direct payment for goods by card does not coincide with the moment the money arrives in the account, the payment must be taken into account only when the money is credited.

Regarding the commission that the bank can withhold from the buyer’s payment, in letter dated September 19, 2016 No. 03-11-11/54526, the Ministry of Finance reported that when paying for goods through the terminal, the seller’s income will be the entire amount received, without reducing it for any expenses , including bank commission.

All income, including those received in kind, must be expressed in money. This requirement is enshrined in paragraph 1 of Art. 346.18 Tax Code of the Russian Federation. Revenue in kind is converted into money based on market prices (clause 4 of article 346.18 of the Tax Code of the Russian Federation).

Features of individual entrepreneur accounting

For individual entrepreneurs, according to civil law, property is not legally divided into what is related to entrepreneurial activity and what is not. Like an ordinary citizen, an entrepreneur is liable for his obligations with all his property, with the exception of vital property from the list of Part 1 of Art. 446 of the Code of Civil Procedure of the Russian Federation (Article 24 of the Civil Code of the Russian Federation).

But for accounting purposes, such a division will have to be carried out initially and then constantly done. After all, one of the requirements when forming an accounting policy is the priority of economic content over the legal form (clause 6 of PBU 1/2008).

Accordingly, all property, property rights and debts of debtors to the individual entrepreneur, which are related to his business activities, constitute the assets of the individual entrepreneur’s balance sheet and are reflected in the corresponding accounting accounts.

For example, if an individual entrepreneur uses part of his house for business activities, he must estimate the value of this part and reflect it on account 01 “Fixed Assets” and in the balance sheet asset.

But we do not recommend splitting funds in a personal bank account. For entrepreneurial activities, an individual entrepreneur must have a separate bank account for both taxation and accounting purposes.

All obligations of an individual entrepreneur related to entrepreneurial activities form the sections of long-term and short-term liabilities of the balance sheet.

Individual entrepreneurs do not include such accounting accounts as 80 “Authorized capital”, 82 “Reserve capital”, 83 “Additional capital” and the corresponding balance sheet items. Therefore, the difference between the balance sheet asset and the balance sheet liability forms the profit of the individual entrepreneur (account 84 “Retained earnings (uncovered loss)”). When approving reporting forms, it is better to leave only the indicator of undistributed profit in the balance sheet in the “Capital and Reserves” section.

Calculation of the payment amount for individual entrepreneurs using simplified terms 6 percent

Individual entrepreneurs using the simplified tax system must pay tax advances and tax for the year (Article 346.19 of the Tax Code of the Russian Federation). Advances are transferred based on the results of the first quarter, 6 months and 9 months before the 25th day of the month following the expired reporting period. The tax for the billing period in the amount of a year is paid before the deadline for submitting the declaration (clause 7 of Article 346.21 of the Tax Code of the Russian Federation). Individual entrepreneurs submit the declaration by April 30 of the year following the reporting year (Clause 1, Article 346.23 of the Tax Code of the Russian Federation). Therefore, the annual payment must be made before the specified date. For the purpose of calculating the tax base, income is determined on an accrual basis from the beginning of the year (clause 4 of Article 346.18 of the Tax Code of the Russian Federation).

An individual entrepreneur without employees can reduce advances and taxes by the entire amount of fixed contributions (clause 3.1 of Article 346.21 of the Tax Code of the Russian Federation). If you have staff, the advance can be reduced by contributions for yourself, contributions for employees, the amount of sick leave benefits, contributions under DLS agreements, but with restrictions. The amount of advance payment (tax) is reduced only by half (clause 3.1 of Article 346.21 of the Tax Code of the Russian Federation).

An example of calculating advances and taxes for the year (Article 346.21 of the Tax Code of the Russian Federation).

Advance payment (tax for the year) = income since the beginning of the year x 6 percent - advances paid - amounts by which tax is reduced.

An entrepreneur without employees earned:

- in the first quarter - 100 thousand rubles, did not pay contributions;

down payment: 100,000×6 percent = 6,000;

- in the six months - 300 thousand rubles on an accrual basis, did not pay contributions;

down payment: 300,000 x 6 percent - 6,000 = 12,000;

- for 9 months - 450 thousand rubles on an accrual basis, did not pay contributions;

down payment: 450,000 x 6 percent - 6,000 - 12,000 = 9,000;

- for the year: 600,000, paid fixed contributions of 40,874 rubles;

600,000×6 percent - 6,000 - 12,000 - 9,000 - 40,874 = - 31,874 rubles.

Thus, the amount of tax payable was a negative number, and therefore the amount of tax is zero.

If, from the beginning of the year, the income of a simplified employee exceeded 150 million rubles, but did not exceed 200 million rubles, or the number of employees exceeded 100 people, but did not exceed 130, then from the quarter in which this happened, an increased rate of 8 percent is applied (clause 1.1 Article 346.20 of the Tax Code of the Russian Federation).

This rate will apply to the portion of the base relating to the period from the beginning of the quarter in which the excess occurred.

Example 1.

The individual entrepreneur's income for the first quarter amounted to 50 million rubles, for the first half of the year - 70 million rubles, for 9 months - 160 million rubles, for the year - 205 million rubles. The tax at an increased rate will be calculated from the third quarter.

Advance for the first quarter: 50 million x 6 percent = 3 million rubles for half a year: 70 million x 6 percent - 3 million = 1.2 million rubles, for 9 months: (70 million x 6 percent) (160 million - 70 million) x 8 percent) - 3 million - 1.2 million = 7.2 million rubles. The annual income exceeded the upper limit of 200 million rubles, and therefore the individual entrepreneur lost the right to the simplified tax system.

Example 2.

The individual entrepreneur's income for the first quarter amounted to 151 million rubles, for 6 months - 160 million rubles, for 9 months - 175 million rubles, for the year - 190 million rubles. The tax at a rate of 8 percent must be calculated from the beginning of the year - .190 million x 8 percent = 15.2 million rubles.

Insurance premiums for individual entrepreneurs on the simplified tax system 6 percent in 2021

In accordance with Article 419 of the Tax Code of the Russian Federation, individual entrepreneurs pay insurance premiums for their employees, as well as for themselves, in a fixed amount and in the amount of 1 percent on income exceeding 300 thousand rubles.

Contributions for yourself

Fixed insurance premiums for individual entrepreneurs in 2021 are (Article 430 of the Tax Code of the Russian Federation):

- For pension insurance - 32,448 rubles, 1 percent of income exceeding 300 thousand rubles per year.

There is a limitation on the maximum amount of pension contributions - their amount cannot exceed 8 fixed amounts. Accordingly, the largest payment for mandatory pension insurance contributions that an individual entrepreneur can pay this year is: 8 × 32,448 = 259,584 rubles.

- For medical insurance - 8,426 rubles.

As the tax authorities explained in letter No. BS-4-11/12211 dated June 24, 2019, if an entrepreneur also has another status, for example, an appraiser, a mediator, then he pays fixed contributions for compulsory health insurance and compulsory health insurance once. And the one percent contribution is calculated on the total income from all types of private activities carried out.

Fixed contributions must be transferred to the budget before December 31 of the current year. A one-percent contribution to compulsory pension insurance is paid before July 1 of the next year (clause 2 of Article 432 of the Tax Code of the Russian Federation).

Insurance premiums for personnel (clause 2 of article 425 of the Tax Code of the Russian Federation)

For payments made to employees within the framework of an employment relationship, the entrepreneur must pay the following types of contributions:

- for pension insurance - 22 percent until payments to employees reach the maximum base for calculating contributions, and 10 percent after payments reach the specified limit. The limit applies to payments made by each individual.

This year, the maximum base for pension contributions is 1,465,000 rubles (Resolution of the Government of the Russian Federation dated November 26, 2020 No. 1935).

- For cases of employee disability or maternity - 2.9 percent within the maximum base value, which this year is 966 thousand rubles. Once the employee's payments reach this level, contributions are not accrued.

- For health insurance - 5.1 percent.

In accordance with subclause 17, clause 1 and clause 2.1 of Art. 427 of the Tax Code of the Russian Federation, entrepreneurs from among SMEs with payments to employees exceeding the minimum wage pay contributions at reduced rates:

- for OPS - 10 percent within the base and above;

- at VNiM - 0 percent;

- for compulsory medical insurance - 5 percent.

In addition, entrepreneurs and employees also pay contributions for cases of possible work-related injuries (clause 2, clause 2, article 17 of the Federal Law of July 24, 1998 No. 125-FZ).

All contributions are transferred to the budgets of the funds monthly until the 15th day of the next month (clause 3 of article 431 of the Tax Code of the Russian Federation, clause 9 of article 22.1 of law No. 125-FZ).

Where to pay taxes for individual entrepreneurs using the simplified tax system 6 percent

Tax according to the simplified tax system “Income”

By virtue of paragraph 6 of Art. 346.21 of the Tax Code of the Russian Federation, tax according to the simplified tax system and advances are paid at the place of residence of the entrepreneur.

Taking into account the rules for indicating information in the details of payment slips for state payments, approved by Order of the Ministry of Finance of the Russian Federation dated November 12, 2013 No. 107n, payment slips for tax payments according to the simplified tax system with the object “Income” should be filled out, taking into account the following features:

- in field 101, code 09 is indicated, corresponding to the payer - individual entrepreneur;

- field 8 reflects full name. and in brackets the status is “IP”, the sign “//” is indicated before and after the information about the registration address;

- the TIN is entered in field 60;

- in field 102 - 0 due to the absence of a checkpoint;

- in field 104 - KBK.

Advance payments and tax for the year are transferred to one BCC - 182 1 0500 110.

Insurance premiums for yourself

According to paragraph 2 of Art. 432 of the Tax Code of the Russian Federation, contributions for oneself for compulsory health insurance and compulsory medical insurance are calculated separately. Deductions are made to the inspectorate at the place of residence (clauses 1, 3, Article 83 of the Tax Code of the Russian Federation).

The following BCCs are indicated in the payments:

- contributions to compulsory pension insurance (fixed and one percent) - 182 1 0210 160;

- contributions for compulsory medical insurance - 182 1 0213 160.

Insurance premiums for employees

Deductions for mandatory medical insurance, compulsory medical insurance and VNIM are made to the Federal Tax Service at the place of residence (clauses 1, 3, article 83 of the Tax Code of the Russian Federation). Contributions for injuries are also transferred at the place of residence, but to the territorial branch of the Social Insurance Fund of the Russian Federation (clauses 3, 4, clause 1, article 6 of Law No. 125-FZ).

The following BCCs are indicated in the payments:

- for OPS - 182 1 0210 160;

- for compulsory medical insurance - 182 1 0213 160;

- at VNiM - 182 1 0210 160;

- for injuries - 393 1 0200 160.

Deadlines for submitting individual entrepreneur reports in 2021

Simplified tax returnees submit a tax return under the simplified tax system by April 30 of the following year (clause 2, clause 1, article 346.23 of the Tax Code of the Russian Federation). If the right to a special regime is lost, the report is submitted before the 25th day of the month following the quarter in which the “failure” with the simplified tax system occurred (clause 3 of Article 346.23 of the Tax Code of the Russian Federation). If the individual entrepreneur has ceased to use the simplified tax system, then the declaration must be submitted by the 25th day of the month following the month of refusal from the “simplified tax system” (clause 2 of article 346.23 of the Tax Code of the Russian Federation).

Payments for insurance premiums for personnel are submitted by the 30th day of the month following the reporting quarter: by April 30, by July 30, by October 30, by January 30 of the following year (Clause 7 of Article 431 of the Tax Code of the Russian Federation).

4-FSS for contributions for injuries is submitted electronically to the FSS before the 25th day of the month following the reporting quarter, and on paper - before the 20th (Clause 1, Article 24 of Law No. 125-FZ).

Also, before the 15th day of each month, a report in the SZV-M form is submitted to the Pension Fund at the place of registration (Article 11 of the law on persuance). This report is needed to ensure the pension rights of employed persons.

What does the accounting documentation of an individual entrepreneur depend on?

The document flow of a business owner is related to the tax regime, economic activity codes, and place of registration. Example. Selling flowers or shawarma in a small store for cash with a hired salesman. According to the new law No. 54 Federal Law, you will have to buy an online cash register or maintain strict reporting forms (SSR). If you sell yourself without hired employees, you don’t have to worry about online checkout until 2021. From July 1, 2021, you will need to print BSO on a special device. For home lessons or makeup services, you do not need to register an individual entrepreneur. Pay taxes as an individual. There is no need to keep books. But if you still want to register as an individual entrepreneur, you can open an account here.