To manage a company, data is required on the quantity and movement of property and liabilities by various groups, names, and types.

A system of accounting accounts is used to collect such information. All transactions performed are reflected in accounting in the form of amounts on accounting accounts.

In this lesson we will figure out what it is and what it is needed for. Let's analyze the structure of accounting accounts and their classification.

We will also consider the table, which briefly and in a convenient form presents the characteristics and decoding of information about all accounting accounts, indicating the number, name, type and purpose.

Concept of accounting accounts

Official concept

An account is a method of current and interconnected reflection and grouping of property and the sources of its formation by composition and location, as well as business transactions according to homogeneous characteristics, expressed in monetary, natural and labor measures.

Definition in simple words

An accounting account is a two-sided table that reflects all transactions performed, grouped by homogeneous properties. The left column of the table is called Debit, the right column is Credit.

A separate account is opened in accounting for each type of property and liability.

Each is assigned an individual number and name, for example, 10 “Materials” or 80 “Authorized Capital”.

By the name you can understand what type of assets or liabilities is taken into account.

For example, on the account. 10 “Materials” takes into account assets - inventories and reflects all transactions related to the movement of this asset.

On the account 80 “Authorized capital”, the liability - the authorized capital - is taken into account and all operations related to its formation or change are reflected.

Appointment briefly

What is the role of accounts in accounting?

They are intended to reflect business transactions and show the amounts of assets and liabilities available to the enterprise.

We also recommend that you study the lesson: What is accounting, where the essence of accounting and the procedure for its organization in an enterprise is explained in simple and understandable language.

Chart of accounts

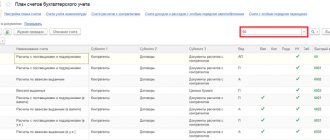

A systematic list of accounting accounts, developed by Order of the Ministry of Finance No. 94n dated October 31, 2000, is called the Chart of Accounts.

The Standard Plan includes:

- a list of balance sheet accounts divided into eight sections;

- list of off-balance sheet accounts.

Off-balance sheet ones are intended for accounting for assets and liabilities that do not belong to the organization (leased property taken for temporary storage, on commission, for installation, BSO, security for assumed or issued obligations).

All major transactions occurring daily at the enterprise are recorded on 99 balance sheet accounts. Of the 99, only 62 are currently in use.

Formation of the Work Plan and a table of all accounts with explanations.

Structure of the Chart of Accounts:

The organization from the Plan selects those accounts that are useful to it for reflecting all transactions performed. Such a list is called the Work Plan; it is enshrined in the Order on the accounting policy of the enterprise.

Basic elements and structure - balance and turnover

The accounting account includes the following parts:

- opening balance (debit or credit) - balance at the beginning of the month;

- turnover (debit and credit) - the sum of transactions for the month recorded as debit or credit;

- ending balance (debit or credit) - the balance at the end of the month.

Learn more about what turnover and account balance are.

Account structure:

When you open an account at the beginning of the month, it has some balance - an opening balance.

During the month, the amounts of all transactions are reflected in debit and credit.

At the end of the month, the sum of debit transactions is calculated - debit turnover and the sum of credit transactions - credit turnover, then the final balance is determined.

| Formula for calculating the ending balance: Sk. = (Sn.d + Od.) - (Sk.k + Ok.),

|

A simple and clear example in numbers of how an account is used for accounting »»»»».

Contents of the balance sheet

According to the location of the asset and liability of the balance, the arch is divided into:

- balance in the figure - to the synchronous location of notes and areas of active and passive;

- balance in the figure of the report - on the alternate location of assets and liabilities (balance sheet).

Types of balance by expression display type:

- the balance sheet is drawn up by counting fragments (remainder), according to the accounts;

- the reverse balance, in addition to fragments (balance), includes information about their movement (debit and credit expressions) and for the past period.

Each accounting code is subject to the following certain conditions: honesty (truthfulness), validity, integrity, continuity, clarity.

It seems true that the balance was drawn up in accordance with the records made on the basis of the information in the papers. The papers, in turn, display the data of the institution’s work for a specific period of time.

The balance sheet, the types of balance sheets discussed above, proves and defines accounting data.

Classification and types

| Classification of accounting accounts | |||

By economic content:

| By type of property taken into account:

| By degree of detail:

| In relation to balance:

|

Active, passive and active-passive

Active accounts are used to record property according to their composition and location.

The indicators taken into account here are included in the assets of the balance sheet. Active:

- are intended to reflect assets,

- they always have a debit balance (beginning and ending),

- the debit shows the increase in the asset,

- for a loan - its reduction.

Examples of active accounts:

⇒ for cash accounting - 50 “Cashier”, 51 “Current account”, 52 “Currency accounts”, 55 “Special accounts in banks”, etc.;

⇒ for property accounting - 01 “Fixed Assets”, 04 “Intangible Assets”, 10 “Materials”, 41 “Goods”, 43 “Finished Products”, etc.;

⇒ for cost accounting - 20 “Main production”, 23 “Auxiliary production”, 44 “Sales expenses”, etc.

Passive accounts are used to reflect the sources of assets for their intended purpose.

The indicators taken into account here are reflected in the liability side of the balance sheet. Passive:

- are intended to reflect liabilities,

- they always have a credit balance,

- the debit reflects the decrease in liabilities,

- for a loan - its increase.

Examples of passive accounts:

⇒ for accounting for depreciation - 02 “Depreciation of fixed assets”, 04 “Depreciation of intangible assets”;

⇒ for credit accounting - 66 “Calculations for short-term credits and borrowings”, 67 “Calculations for long-term credits and borrowings”;

⇒ for capital accounting - 80 “Authorized capital”, 82 “Reserve capital”, 83 “Additional capital”.

Active-passive:

- keep records of both assets and liabilities,

- their balance can be both debit and credit,

- capable of behaving both active and passive, depending on the situation.

Examples of active-passive accounts:

⇒ for accounting of settlements - 60 “Settlements with suppliers”, 62 “Settlements with buyers”, 68 “Calculations for taxes and duties”, etc.;

⇒ for accounting of income and expenses - 90 “Sales”, 91 “Other income and expenses”, 99 “Profits and losses”.

On-balance sheet and off-balance sheet

Balance sheet accounts are designed to reflect information about the assets and liabilities of the enterprise; these are the main accounts on which all transactions in accounting are kept.

The Plan contains 8 sections containing 99 balance sheet accounts, of which 62 are currently in effect.

Balance sheet data allows you to draw up a balance sheet and participates in the formation of annual financial statements.

Examples of balance sheet accounts:

⇒ 01 “Fixed assets”;

⇒ 02 “Depreciation of fixed assets”;

⇒ 03 “Profitable investments in material assets” ... to 99 “Profits and losses”.

Off-balance sheet accounts are intended to reflect property and liabilities that do not belong to the enterprise; the indicators of these accounts are not shown on the balance sheet and are not included in the financial statements.

These indicators are needed exclusively for the accountant, so as not to forget about temporary obligations taken or issued, property accepted for a time (for rent, on commission, for storage, for installation).

Examples of off-balance sheet accounts:

⇒ 001 “Leased fixed assets”;

⇒ 002 “Inventory and materials accepted for safekeeping” ... to 011 “Fixed assets leased out.”

Synthetic and analytical

Also types of accounting accounts are:

- synthetic;

- analytical.

Synthetic accounts (they are also called first-order accounts) are intended for generalized accounting of assets and liabilities in monetary terms. All accounts from the Plan are synthetic.

Subaccounts can be opened for synthetic ones (they are also called second-order accounts), they show the details of the amounts reflected in the synthetic account to which the subaccounts are opened. Accounting for subaccounts is also carried out in cash.

Recommendations on the types and names of subaccounts that can be opened for synthetic accounts are presented in the Plan.

Example:

First-order synthetic account 41 “Goods”, second-order subaccounts can be opened for it:

- 41.1 “Goods in warehouses, depots and vegetable stores”;

- 41.2 “Goods in retail trade”, etc.

Analytical ones are designed for detailed accounting of assets and liabilities with great detail; accounting can be kept both in monetary form and in physical units (pieces, kilograms, kilometers, liters, boxes, etc.).

Indicators of synthetic accounts are used to compile a balance sheet; data from analytical accounts is needed for more convenient and visual accounting and facilitate the work of an accountant.

The enterprise is obliged to keep accounting on synthetic accounts; analytical accounting is carried out if it is necessary for the company.

Example:

The organization sells goods - furniture.

According to the Chart of Accounts, to reflect the availability and movement of furniture, the organization will use a synthetic first-order account 41 “Goods”, on which it will open second-order subaccounts:

- 41.1 “Goods in warehouses, depots and vegetable stores” - for furniture in a wholesale warehouse;

- 41.2 “Goods in retail trade” - for furniture in a retail store.

Analytical accounts for accounts. 41 will be open by type of furniture:

- "Tables";

- "Chairs";

- "Cabinets", etc.

Types of balance sheet currency changes

Currently watching: 9236

We talked about how to read a balance sheet in this article. Today we’ll talk about the types of changes in balance sheet currency.

The balance sheet currency is the final indicator of two sections: assets and liabilities (line 1600 for assets, and 1700 for liabilities)

Different transactions can have different effects on the balance sheet structure. And the balance sheet, we know, is the most important source of information about the financial position of an organization.

But even in the process of economic activity, when there is an increase or decrease in capital and liabilities, these operations do not violate the equality of assets and liabilities. Although in the context of individual items and the balance sheet results themselves, changes may occur.

This is explained by the fact that each operation affects two balance sheet items, namely: the size of the property or the size of the sources of its formation. Moreover, they can be both an asset and a liability at the same time.

So, depending on the nature of changes in balance sheet items, operations can be divided into 4 types:

The first type of change in balance sheet currency - + ASSET - ASSET - is characterized by a change in asset items with a constant balance sheet currency

For example: to pay salaries to the organization’s personnel, cash in the amount of 100,000 rubles was received from the current account to the cash desk. According to this operation, two balance sheet asset items are affected: account 51 “Current accounts”, account 50 – “Cash”. In account 50 “Cash” the amount increases, and in account 51 “Cash accounts” the amount decreases. The postings will be as follows:

Dt 50 Kt 51 – 100,000 rubles

As a result of this operation, the balance sheet currency will not change, but only the amounts within the Asset section will change.

The second type of change in balance sheet currency - + LIABILITY - LIABILITY - is characterized by a change in liability items with a constant balance sheet currency

For example: based on the minutes of the meeting of founders, part of the net profit remaining at the disposal of the organization in the amount of 4,000 thousand rubles is used to increase reserve capital. According to this operation, two liability items in the third section of the balance sheet are affected - “Retained earnings” account 84 downward and “Reserve capital” account 82 upward. The resulting wiring will be as follows:

Dt 84 Kt 82 – 4,000,000 rubles

The third type of change in the balance sheet currency - + ASSET + LIABILITY - causes changes in the asset and liability items upward when the balance sheet currency is equal

For example, materials worth 10,000 rubles were received from suppliers and posted to the organization’s warehouse. According to this operation, the asset balance sheet item “Materials” account 10 and the balance sheet liability item “Settlements with suppliers” account 60 will increase; The balance sheet currency will also increase by this amount. The accounting entry will be as follows:

Dt 10 Kt 60 – 10,000 rubles.

The fourth type of change in the balance sheet currency - - ASSET - LIABILITY - causes changes in the asset and liability items downward when the balance sheet currency is equal

For example, wages were paid to the organization’s personnel in the amount of 100,000 rubles. As a result of this business transaction, balance sheet asset item 50 “Cash” and balance sheet item 70 “Settlements with personnel for wages” are reduced. The balance sheet currency will also decrease by the amount of the business transaction. The wiring will be as follows:

Dt 70 Kt 50 – 100,000 rubles.

An increase in the balance sheet currency may indicate an increase in assets and scaling of the enterprise’s economic activities, while a decrease in the balance sheet currency (in absolute terms), on the contrary, may indicate a decrease in business activity.

But it is impossible to interpret this indicator unambiguously, since the analysis of financial statements and the financial and economic activities of an enterprise is a rather intensive process and requires the analysis of many indicators to establish a conclusion.

If you need to easily learn accounting without memorizing and as a result get exactly an UNDERSTANDING of accounting, I invite you to take the online course “Accounting from Scratch” after studying which you will easily be able to make accounting entries, close accounts, prepare a balance sheet, income statement and losses and even tax returns. You can find out more about this course here.

Explanation in the table

Brief description of all accounts in one table:

| Account number | Name | View | Purpose |

| Section I. _ Fixed assets | |||

| 01 | Fixed assets | Active | Reflection of the presence and movement of OS |

| 02 | Depreciation of fixed assets | Passive | Accrual of depreciation of fixed assets |

| 03 | Profitable investments in material assets | Active | Accounting for fixed assets intended for rental |

| 04 | Intangible assets | Active | Reflection of the presence and movement of intangible assets |

| 05 | Amortization of intangible assets | Passive | Calculation of depreciation of intangible assets |

| 07 | Equipment for installation | Active | Accounting for equipment that requires installation and is intended for installation in facilities under construction. |

| 08 | Investments in non-current assets | Active | Collection of costs for the acquisition or creation of fixed assets and intangible assets |

| 09 | Deferred tax assets | Active | Accounting for part of the income tax, which will reduce the tax payable in future periods |

| Section II . Productive reserves | |||

| 10 | Materials | Active | Accounting for materials, inventories, raw materials, semi-finished products, fuel, etc. |

| 11 | Animals being raised and fattened | Active | Registration of young animals for agricultural enterprises |

| 14 | Reserves for reduction in the value of material assets | Active-passive | Reflection of the difference between the cost of inventories and their market value |

| 15 | Procurement and acquisition of material assets | Active-passive | Accounting for expenses for the acquisition of inventories before their capitalization |

| 16 | Deviation in the cost of material assets | Active-passive | Formation of the difference between the actual cost of inventories and the accounting value |

| 19 | VAT on purchased assets | Active | Reflection of input VAT presented by suppliers |

Continuation of the table with a breakdown of all accounts »»»»».

conclusions

Lesson 3 Summary:

- An accounting account is a two-sided table designed to record all business transactions.

- The left column is debit, the right column is credit.

- Transactions are reflected in monetary terms.

- There are a total of 99 balance sheet accounts and 11 off-balance sheet accounts, which are reflected in a ledger called the Chart of Accounts.

- The organization creates a Work Plan from those accounts that are useful in the work.

- All accounts are divided into: active, passive and active-passive; synthetic and analytical; on-balance sheet and off-balance sheet.

The full course “Accounting from scratch” can be purchased at this link »»».

Until April 30, 2021 there is a 25% discount.