Income tax return 2021: form and composition

The form of the document was approved by order of the Federal Tax Service on October 19, 2016 No. ММВ-7-3/ [email protected] You can download the income tax return for 2021 below. This multi-page, universal report is used by enterprises in various industries. The following pages are required to be completed:

- Title page;

- Section 1, which indicates the amount of tax payable;

- Tax calculation on sheet 02 (with appendices to it, which contain all information about the company’s income and expenses for the reporting or tax period).

The remaining pages of the new 2018 income tax return are included in it and are completed only if the company has information to include in them.

New reporting forms in 2019

The first months of the new year are the busiest time for an accountant, as preparations are underway for submitting reports for the past year.

Not only is it necessary to draw up correct reports, you must also meet the deadlines established by law and check whether new forms have been approved. When preparing reports for the year, the timing of its submission to regulatory authorities must be checked with particular care, since fines for failure to submit annual declarations are higher than advance payments that are prepared during the year.

For failure to submit a declaration within 10 days from the deadline, the tax authorities may block transactions on all current accounts of the taxpayer.

For violating the deadlines for filing declarations and paying insurance premiums, an official may be fined in the amount of 300 to 500 rubles.

The fine for violating the deadlines for submitting annual reports to statistics ranges from 20 thousand to 70 thousand rubles. for legal entities and from 10 thousand to 20 thousand rubles. for officials.

Now, in order for the submission of reports for 2021 to proceed without violations, we will describe in detail what the reporting deadlines for 2021 are for each taxation system, as well as for taxes paid regardless of the taxation system.

NPD and PSN

These two types can only be used by individual entrepreneurs and do not require the submission of any types of reporting.

The UTII declaration must be submitted quarterly by the 20th day of the month following the reporting period. The deadline for the 4th quarter of 2021 falls on Sunday, so it has been postponed to 01/21/2019.

An updated form of this declaration was provided for downloading at the beginning of the article.

When applying the simplified taxation system, it is necessary to submit a declaration to the tax office based on the results of the tax period - the calendar year. The simplified tax system has two different objects of taxation: income and income minus expenses. The taxpayer chooses which one to use independently. The declaration form is the same for both cases, but different sheets are filled out depending on the object of taxation.

Deadlines for submitting reports for 2021 according to the simplified tax system:

- for organizations, the deadline for submitting a declaration is 04/01/2019 (since 03/31/2018 is Sunday);

- for individual entrepreneurs the deadline is 04/30/2019.

The general taxation system involves submitting the following reports to the tax office:

- VAT declarations. It is presented for the quarter by both organizations and entrepreneurs.

- Income tax returns. It can be submitted either monthly or quarterly, depending on the method of payment of advance payments for income tax. The composition of the declaration also depends on this. Only available to organizations.

- Personal income tax returns in form 3-NDFL. Rented by individual entrepreneurs on the general taxation system and by individuals in certain cases.

And also the forms of these declarations:

- VAT declaration form.

- Income tax return form.

- Form for the updated 3-NDFL declaration (given at the beginning of the article).

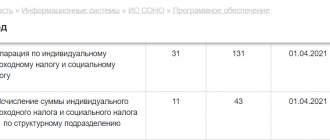

If an organization or individual entrepreneur has hired employees working under employment or civil law contracts, then it becomes necessary to report on employees’ personal income tax and insurance contributions, as well as submit other reports to the Pension Fund and Social Security.

As tax agents for personal income tax, individual entrepreneurs and organizations at the end of 2021 must report to the tax office within the following deadlines:

- Certificates in form 2-NDFL about the impossibility of withholding tax by a tax agent - until 03/01/2019. The updated form is given at the beginning of the article.

- Certificates in form 2-NDFL on income and tax amounts for individuals - until 04/01/2019.

- Calculation of tax amounts according to form 6-NDFL - until 04/01/2019 (03/31/2019 - Sunday).

There is also a single simplified declaration (USD), which can be submitted to the tax authority by individual entrepreneurs or organizations if they do not have an object of taxation according to the simplified tax system (USN, OSNO, VAT) and do not have cash flows through the cash desk or current account in the reporting period.

EUDs are submitted instead of declarations for those taxes for which there is no object of taxation.

The deadline for submission for the 4th quarter of 2021 is 01/21/2019.

Accounting statements for 2021 must be submitted before 04/01/2019 inclusive to both the tax office and the statistical authorities.

As of the end of March 2021, no legislative changes regarding the filing of income tax returns have been officially published.

The current form of the profit declaration was approved by order of the Federal Tax Service of Russia dated October 19, 2021 No. MMV

| Never worked in VLSI? Choose your discount! For users of Kontur-Extern, Argos and other programs |

The new form of the income tax return was approved by order of the Federal Tax Service dated October 19, 2016 No. ММВ-7-3/572 “On approval of the form of the tax return for the income tax of organizations, the procedure for filling it out, as well as the format for submitting the tax return for the income tax of organizations in electronic form."

This new declaration form came into force on December 28, 2016. In 2021, organizations must submit a declaration using this form. That is, for all the periods of 2021, which you can see in the tables above, you need to use this particular income tax return form.

If reporting is submitted quarterly (Article 285, paragraph 3 of Article 289 of the Tax Code of the Russian Federation), a declaration on NP must be submitted before the 28th day after the end of the next quarter. The deadlines for submitting quarterly income tax reports in 2021 are as follows:

- for the 1st quarter - until April 28, 2018 (Saturday, April 28, 2021, working day);

- for the six months - until July 30, 2018 (July 28 - Saturday);

- for 9 months - until October 29, 2018 (October 28 - Sunday).

In turn, the deadline for submitting quarterly income tax reports in 2021 will be:

- for the 1st quarter - until April 29, 2019 (April 28 - Sunday);

- for the six months - until July 29, 2019 (July 28 - Sunday);

- for 9 months - until October 28, 2019.

If the company’s average quarterly income for the last four quarters is above 15 million rubles, it must switch to monthly payments under the NP, while remaining subject to quarterly reporting.

The company has the right, if desired, from the beginning of the next tax period to switch to monthly submission of income tax reports on actual profit (clause 2 of Article 286 of the Tax Code) with monthly transfer of advances. To do this, you need to report this to the Federal Tax Service by the end of the year.

| Reporting period | Deadline for submitting the NP declaration in 2021 | Deadline for submitting the NP declaration in 2021 |

| 1 month | 28.02.2018 | 28.02.2019 |

| 2 months | 28.03.2018 | 28.03.2019 |

| 3 months | 04/28/2018 (Saturday, April 28 – working day) | 04/29/2019 (April 28 - Sunday) |

| 4 months | 28.05.2018 | 28.05.2019 |

| 5 months | 28.06.2018 | 28.06.2019 |

| 6 months | 07/30/2018 (July 28 - Saturday) | 07/29/2019 (July 28 - Sunday) |

| 7 months | 28.08.2018 | 28.08.2019 |

| 8 months | 28.09.2018 | 09/30/2019 (September 28 - Saturday) |

| 9 months | 10/29/2018 (October 28 - Sunday) | 28.10.2019 |

| 10 months | 28.11.2018 | 28.11.2019 |

| 11 months | 28.12.2018 | 12/30/2019 (December 28 - Saturday) |

Late submission of accounting and/or tax reporting in Russia is considered a tax and administrative offense (Article 106 of the Tax Code of the Russian Federation, Article 2.1 of the Code of Administrative Offenses of the Russian Federation).

This definition also applies to violation of deadlines for filing income tax returns in 2021. In such a case, sanctions are regulated by Art. 119 of the Tax Code of the Russian Federation. Both taxpayers and tax agents for this tax are punished for this.

The penalty for late submission of a tax return report is calculated at 5% of the amount of tax payable from section 1 of the late declaration for each full and partial month from the date of violation of the deadline. The minimum fine is 1 thousand rubles, the maximum is 30% of the amount of non-payment. If the NP was paid on time, then the fine will be 1 thousand rubles. If the tax is not paid in full within the prescribed period, then a fine is charged on the missing amount. This rule applies to the annual report on NP.

If the delay occurred with interim reporting, then the fine is 200 rubles (Article 126 of the Tax Code of the Russian Federation).

In addition to the fine for being late in submitting a declaration for more than 10 days, tax authorities have the right to seize the company’s bank account (clause 3 of Article 176 of the Tax Code of the Russian Federation).

In addition, the court, at the request of the Federal Tax Service, may impose sanctions on company officials - a warning or a fine in the amount of 300 to 500 rubles under Art. 15.5 Code of Administrative Offenses of the Russian Federation.

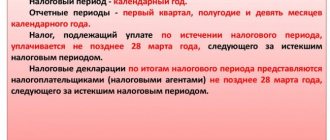

The annual IR return must be sent by March 28 of the following year after the end of the reporting year - to all taxpayers and IR agents.

The interim report on NP is submitted to the tax office by the 28th day of the month following the reporting period by those who submit quarterly or monthly reports.

If the deadline for submitting the IR report falls on a weekend on the calendar, it is moved to the next working day after the weekend.

Rules for filling out income tax returns

Along with the approval of the income tax return form, Order No. ММВ-7-3/ [email protected] also established the rules for entering information into it, which covers the composition of the document, general requirements for filling out and the procedure for filling out. The instructions given in Appendix 2 offer step-by-step guidance in drawing up a document on how to fill out an income tax return.

Usually, drawing up a document according to the instructions of the Federal Tax Service does not raise any questions, but there are several nuances that are worth mentioning. For example, page 210 (amount of accrued advances) of sheet 02 of the declaration for the year is filled out differently depending on how the company pays advances:

- if the transfer of monthly advances is carried out before the 28th day, then the amount recorded in lines 180 and 290 of the tax return for the organization’s income tax for 9 months is entered on page 210 of the declaration for the year;

- if the company pays advances on a monthly basis on the actual profit received, then on page 210 indicate the amount of tax on line 180 for 11 months;

- when transferring payments quarterly, page 210 contains information corresponding to the data in line 180 of the income tax return for 9 months.

Filling out the income tax return is carried out on the basis of the company’s financial statements. We invite you to familiarize yourself with the algorithm for drawing up a document using a simple example that demonstrates a step-by-step calculation procedure in accordance with the requirements of tax authorities.

Filling out the declaration, line 210

Filling out declaration forms is a mandatory procedure for taxpayers. In each situation, different persons will enter information, be they individuals or entire companies.

Why fill out line 210?

In the case of income tax, the responsibility for filling out reporting documentation falls on the shoulders of companies playing the role of payers of this fee. Of course, it is not the head of the organization, nor every employee participating in its work, who enters the information. This work is regularly performed by representatives of the organization’s accounting departments who have appropriate education and experience in the area under discussion.

Completing the declaration form requires compliance with many different rules and regulations. Not only do they all need to be memorized and constantly kept in mind, it is also necessary to perform settlement operations related to determining the amount of tax deductions in favor of the state budget, without making any errors in the calculation.

Of course, it is impossible to remember all the nuances at once. This is especially true for young professionals who have recently worked in the field. Filling out any tax reporting often raises some questions for them. In particular, this applies to the organization’s profit declaration. Problems especially often arise with filling out line 210 of the document. Let's move on to consider the patterns of entering information into it.

In a special article we look at income tax, consider what features the income declaration has, and provide instructions for filling it out.

What is line 210 for?

Let's figure out what data is reflected in the article under discussion. So, the required column serves to enter information regarding the total amount of advance payments made by the company, the accrual of which was made for a specific tax period.

The type of information entered in the searched line, as well as its semantic load, will depend on the method of paying advance payments that was previously chosen by a particular organization. This rule was established by one of the orders of the Federal Tax Service, dated October 19, 2021.

Filling methods

Let's move on to consider ways to fill out the required line. If the company makes advance payments every quarter, that is, in 3 months, six, nine and twelve, filling out the column we need will be done in the following way, described in detail in the table.

| How long does it take to submit a declaration form for verification? | What needs to be entered |

| If the line is filled out for the first three months of the company’s operation in the current annual period. | There is nothing to write yet inside the column we are interested in; instead of specific information, just enter a dash. |

| When data for the working half-year of the organization is entered into the line. | Find in the declaration form submitted for verification for the first three months of the company’s operation in the current year, information from line number 180 and enter it into the paper for the current period. |

| When the column is filled in with information for the past nine-month period in the current tax period. | Take the declaration for the last reporting period, that is, half a year, and rewrite the data from line 180 in the column of interest to us, number 210. |

| Filling out line 120 in the declaration for a period of one year, that is, the entire reporting period. | As in previous cases, you need to find the declaration that has already been submitted for verification and take the value from line 180 to enter it into line 210 of the new form. |

If the company makes advance payments every thirty-day period, and there are also quarterly additional payments of funds, entering data into the line will be a little more difficult. How much, see the table below.

| How long does it take to submit a declaration form for verification? | What needs to be entered |

| If the declaration is submitted for the first working quarter of the year. | Find the declaration form submitted for verification to the tax office based on the results of nine months of the company’s operation last year, and transfer the information to line 210 from column 320 of the old document. |

| If the paper is submitted for verification six months in advance. | It is necessary to open the declaration for the first three working months of the current year, find lines 180 and 290 there, summarize the indicators presented in them and enter them in column 210 of the sheet to be filled out. |

| The declaration document is submitted for verification within a nine-month period. | Find the previous declaration form for six months of the company’s operation, and rewrite the total value of the data from the columns:

|

| The annual declaration is submitted to the Federal Tax Service for verification. | Following the example of past completions, we take out the completed declaration form for the previous reporting period, summarize the information entered in lines 290 and 180 and enter the resulting value into the column to be filled out. |

Now we will consider the situation with filling out the line we need if the company makes advance payments according to the amount of profit actually received.

The method of filling out the line under discussion repeats the procedure for filling out companies that make only quarterly advance payments. Let's look at what we mean in detail in the table.

| How long does it take to submit a declaration form for verification? | What needs to be entered |

| If the form is filled out for the first month of the current tax period. | In the line we are interested in, it is necessary to put a dash, since in fact there is simply no information to provide. |

| The documentation is completed in the first two months. | It is necessary to open the January declaration and enter the information from its line number 180 in the column of interest to us in the new declaration. |

| Submission of the declaration for the first three months. | It is necessary to transfer information from the declaration submitted earlier for the past two months. |

| The paper is filled out and submitted for the period from January to April. | In the same way, we find line 180 in the March declaration form and rewrite the information entered in it into column 210 of the current documentation. |

| The reporting period conveyed in the documents is from January to May. | As before, we find information from the above line in the old declaration and transfer it to the new one, in paragraph 210. |

| Filling is carried out from the first month of the year to the sixth, that is, June. | In the same way as we did earlier, we search for the necessary information and enter it into the current documentation. |

| After the company operates from January to July, we submit the declaration form for verification. | Line 210 is filled out in the same way: by transferring information from line 180 of the form previously given for verification. |

| Reporting has reached the last summer month – August. | The July Declaration is the source of information for entry into article 210, to be more precise, its line 180. |

| The form is submitted for verification for the period from January to September. | We repeat the procedure described above and submit the form for verification. |

| In the next autumn month, reports are also submitted for consideration by tax inspectorate specialists. | We repeat the procedure again. |

| The declaration form is submitted for the period from January to November. | We rewrite the information for the past month. |

| The last procedure of the year is to fill out the form and determine it for verification. | We repeat the procedure for the last time in a similar manner to that described earlier and successfully close the year. |

The most common errors in filling out line 210

Accountants of large, medium and small enterprises often submit imperfect declarations. There are different shortcomings, but in this article we will consider the main errors associated with filling out line 210. However, filling out line 210 is incorrect only when other declaration indicators are incorrectly calculated.

Statistics show that often all mistakes made are related to the payment of monthly advance payments. The fact is that when establishing the size of the indicator, the calculation is carried out on the basis of two lines - the amount of monthly advance payments and the amount of accrued and paid taxes in the previous period. Accountants often forget to summarize these indicators. Also, it was previously mentioned that additionally accrued income tax, or rather advance payments, should also be taken into account in this line. If for some reason the report still contains such an error, then it is likely that the tax office will fine you for a violation in the amount of 20% of the amount intentionally unintentionally hidden. Also, based on the results of a desk audit, erroneous information on line 210 may lead to tax authorities demanding additional information, explanations in the form of an explanatory note, as well as documents confirming the amount and timeliness of payment of tax advances.

What amounts do we enter in line 210 quarterly and annually?

On page 210 of sheet 02, record the total amount of all accrued advance payments that should have already been paid since the beginning of the year. These include monthly advances and additional payments/reductions for previous quarters.

ATTENTION! Line 210 reflects accrued, rather than actually paid, advances.

- Payment of advances based on quarterly results.

If advances are quarterly. With this method, data is entered into line 210 as follows:

Thus, organizations that pay only quarterly advance payments do not fill out line 210 in the declaration for the 1st quarter, but in the remaining quarters transfer data from line 180 of Sheet 02 for the previous quarter to it.

2. Payment of advances monthly from actual profits.

For organizations that calculate advances from actual profits, the algorithm for filling out line 210 is similar to the previous one. You just need to remember that when making quarterly calculations, the reporting period is a quarter and the declaration is submitted quarterly, and when calculating from actual profits, the reporting period is a month and the declaration is submitted monthly.

3. Payment of advances monthly with additional payment per quarter

For organizations that calculate advances based on the amounts of previous advances, filling out line 210 will be slightly different:

That is, quarterly and annually the following ratios must be met:

Line 210 value in Q1 2021

In the income tax return on line 210 for the 1st quarter, the inspector must see how much the organization intends to pay in advances for the reporting period in total, without breaking down by budget level.

When paying advances upon receipt of profit, companies are required to declare actual profit on a monthly basis. Accountants usually do not have any difficulties with this. Line 210 for January 1st quarter will remain empty. In line 210, when declaring profits up to February inclusive, the value of the indicator from line 180 of the January declaration is entered. And so on: line 210 in each subsequent declaration during the year will reflect the value of line 180 in the previous one.

Using the quarterly method, there should also be no difficulties when filling out line 210. For the 1st quarter of 2021, line 210 is left blank. In the following quarters, its value will be equal to line 180 of the declaration for the previous quarter, i.e., what was accrued the previous quarter.

And when transferring quarterly payments with advance payment monthly, the value of line 210 for the 1st quarter is not determined by calculation. It will have the same value as the indicator in line 320 “Amount of monthly advance payments payable in the first quarter of the next tax period” of the declaration for 9 months of 2021. For all further reporting periods, the value of line 210 will correspond to the sum of lines 180 and 290 of the previous declaration.

Let's present this in a table:

Note! If, as a result of the audit, additional tax amounts were accrued (or, conversely, reduced), line 210 should be adjusted.

The amount in line 210 is reduced by trade fees offset in the previous period against the advance payment by their payers, as well as by the amount of tax paid outside the Russian Federation and offset in the previous period.

In the income tax return for the 1st quarter of 2021, lines 210 and 290 contain data on accrued advances payable. Moreover, line 210 indicates the amount of accrued advances for the period of report generation, and line 290 for the next one. Both of these values, unlike the indicators of these lines in other periods, were not obtained by calculation. The value for line 210 for 1 quarter is taken from line 320 for 9 months of the previous year, and the value of line 290 for 1 quarter is equivalent to line 180 of the same period.

Check out the new income tax changes for 2020:

- “New form of income tax return from 2020”>;

- “Who will be able to apply a zero rate for income tax in 2020”>;

- “Starting 2021, charge depreciation according to the new rules.”

Income tax: example of filling out a declaration in 2021

Initial data:

Based on the results of the 1st quarter of 2021, the following income was received:

- from sales – 2400 thousand rubles.

- non-operating – 1000 thousand rubles.

Expenses amounted to:

- for sales – 1060 thousand rubles;

- non-operating – 42 thousand rubles.

Tax rate 20%.

Let's calculate the tax: ((2,400,000 + 1,000,000) – (1,060,000 + 42,000)) x 20% = 459,600 rubles. and draw up a declaration.

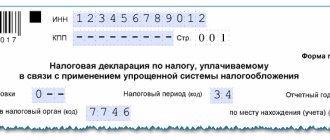

Step 1. Filling out the cover page of the income tax return

Registration of a title means entering all information about the company - basic details and full name. Any form cells that remain unfilled are crossed out. In addition to information about the company, enter:

- Correction number (for the first submission – “0—”, for subsequent submissions – numbered in ascending order – “1—”, “2—”, etc.);

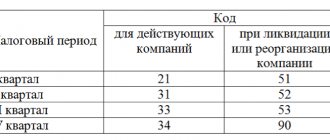

- reporting period code. It depends:

- from the period itself (quarters are encrypted as follows - 21 (1 quarter), 31 (half-year), 33 (9 months), 34 - (year);

- from the payment system. For example, with monthly advance payments, the period code is numbered sequentially from 35 for January to 46 for the year;

- tax office code;

- code at the place of registration. Assigned according to the classification of the company, for example, large companies are coded with the code 213, foreign ones - 245, the majority of domestic companies - 214, etc.;

- OKVED code;

All submitted information is certified by a representative of the taxpayer.

Russians were reminded of the deadline for paying taxes in October

The frequency of reporting for income tax depends on the frequency of payment of advance payments for this tax. In accordance with this, income tax payers are divided into those who:

- pays advance payments based on the results of each quarter plus intra-quarter monthly payments; the declaration is submitted quarterly;

- pays advance payments and submits returns quarterly. This can be done by companies whose sales income over the previous four quarters did not exceed an average of 15 million rubles for each quarter (60 million rubles per year), as well as budgetary, autonomous institutions, non-profit organizations that do not have income from sales;

- makes advance payments based on actual profits and submits a declaration monthly. The application of such a tax payment scheme must be reported to the Federal Tax Service before December 31 of the year preceding the tax period in which the transition to such an advance payment system takes place.

Quarterly payment of tax and submission of income tax returns in 2018

| For what period do we pay and rent? | Deadline |

| for 2021 | 28.03.2018 |

| 1st quarter 2018 | 28.04.2018 |

| 1st half of 2018 | 30.07.2018 |

| 9 months 2018 | 29.10.2018 |

| for 2021 | 28.03.2019 |

The deadline for submitting a profit declaration and paying the corresponding tax is the 28th of the next month.

The transfer rule also applies. Monthly payment of tax and submission of income tax return in 2018

| For what period do we pay and rent? | Deadline |

| January | 28.02.2018 |

| January February | 28.03.2018 |

| January March | 28.04.2018 |

| January - April | 28.05.2018 |

| January - May | 28.06.2019 |

| January June | 30.07.2018 |

| January - July | 28.08.2018 |

| January - August | 28.09.2018 |

| January - September | 29.10.2018 |

| January - October | 28.11.2019 |

| January - November | 28.12.2018 |

| January - December, i.e. for 2021 | 29.01.2019 |

deklaraciya_001-2.jpg

Step 2. Filling out Appendix 1 sheet 02

Despite the fact that the income tax return begins with section 1, in which the tax amount should be entered, it is more convenient to draw up the document from sheet 02, where the tax is calculated. Let's start filling out Appendix 1 of sheet 02 and enter data on income:

In line 010 – total revenue in the amount of 2,400,000 rubles, which consists of

- revenue from sales of manufactured products RUB 2,000,000. (page 011), and

- purchased goods 400,000 rub. (page 012).

Lines 011 to 014 reflect the amounts of revenue by source of income.

Line 040 of the declaration Pr.1 of sheet 02 for income tax is the total for the amount of sales revenue. Next, fill in the lines for the amounts of income from non-operating operations. According to the conditions of the problem, the company received 1,000,000 rubles. as income from previous years (p. 100). Lines 101-106 are intended to decipher income from other activities.

deklaraciya_005-2.jpg

Step 3. Filling out Appendix 2 to sheet 02

Information about expenses (losses) from all types of activities is indicated here. Lines 010-030 reflect the company's direct costs. Lines 040 and 041 are indirect. Line 041 of the income tax return requires special attention. It records costs that are indirectly related to production. It is important to clearly determine whether all of them can be taken into account when calculating income tax (Article 270 of the Tax Code of the Russian Federation).

Lines 200 – 206 are filled in with information about non-operating expenses, and lines 300 – 302 reflect losses equated to non-operating expenses.

deklaraciya_008-2.jpg

Appendix 3 to sheet 02 is drawn up if the company carried out operations to sell property or carried out activities using service industries. It states the revenue generated from the difference between income and costs. There is no such data in the example.

Appendix 4 to sheet 02 is filled out if there are losses from previous years. In the example under consideration there are none, but you should know that the tax base can be reduced by the amount of these losses, but not more than half the original tax base.

Appendix 5 is filled out by companies that have separate divisions in their structure.

Step. 4 Sheet 02 – tax calculation

After filling out the applications for which information is available, we proceed directly to the tax calculation - sheet 02. We will enter:

- in line 010 the amount of sales revenue is RUB 2,400,000.

- in line 020 the amount of non-operating income is 1,000,000 rubles;

- in line 030, the amount of sales expenses is RUB 1,060,000;

- in line 040 the amount of non-operating expenses is 42,000 rubles.

- on page 060 we display the result of the calculations - 2,298,000 rubles.

- There are no specific income excluded from profit in our example, so lines 070 and 080 are crossed out, and the general result is duplicated on page 100;

- there is also no loss reducing the basis, so page 110 is not filled out;

- page 120 reflects the tax base from which the tax is calculated - 2,298,000 rubles.

- lines 140, 150, 160 record the percentage of deductions: 20% - general, 3% - to the federal budget, 17% - to the regional budget;

- line 180 of the income tax return reflects the amount of tax to be transferred - 459,600 rubles, including line 190 - 68,940 rubles. must be listed on FB, on page 200 - 390,660 rubles. This amount is subject to transfer to regional budgets.

deklaraciya_004-2.jpg

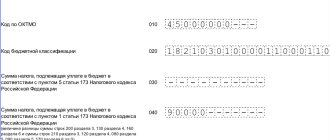

Step 5. Filling out section 1 of the income tax return

After the calculations have been carried out, the final final stage begins. For companies that pay advances quarterly, as in our example, subsection 1.1 is intended. Firms making monthly payments fill out subsection 1.2

This subsection 1.1 indicates the BCC for the corresponding budgets and the amount of accrued tax.

Results

One of the lines with code 210 of the income tax return contains data on tax advances accrued based on the results of the previous reporting period. The data for filling it out must be taken from the declaration for the previous period. It does not matter whether the advances from the previous declaration have been paid in full or not. You need to reflect what was due for payment.

Sources

- https://nalog-expert.com/obraztsy-dokumentov/stroka-210-deklaratsii-po-nalogu-na-pribyl.html

- https://nalog-nalog.ru/nalog_na_pribyl/deklaraciya_po_nalogu_na_pribyl/kakoj_poryadok_zapolneniya_deklaracii_po_nalogu_na_pribyl_primer/

- https://nalog-nalog.ru/nalog_na_pribyl/deklaraciya_po_nalogu_na_pribyl/zapolnenie_deklaracii_po_nalogu_na_pribyl_za_1_kvartal/

- https://www.audit-it.ru/articles/account/tax/a35/927202.html

- https://online-buhuchet.ru/stroka-210-deklaracii-po-nalogu-na-pribyl-kak-zapolnyaetsya-osobennosti-oshibki/

- https://nsovetnik.ru/nalog-na-pribyl/kak-zapolnit-stroku-210-v-deklaracii-po-nalogu-na-pribyl/

- https://nsovetnik.ru/nalog-na-pribyl/zapolnyaem-stroki-210-i-290-v-deklaracii-po-nalogu-na-pribyl-za-pervyj-kvartal/

- https://ppt.ru/nalogi/pribyl/declaraciya

- https://nalog-nalog.ru/nalog_na_pribyl/deklaraciya_po_nalogu_na_pribyl/kak-zapolnit-stroku-210-v-deklaracii-po-nalogu-na-pribyl/

deklaraciya_002.jpg

You can check your income tax return, or more precisely, the amounts included in it, using the financial statements, in particular, the income statement.

Having told how to declare income tax and presented a sample of filling out the declaration, we demonstrated the simplest option, with the goal of showing the sequence of document execution. In real life, when filling out a declaration, an accountant is faced with a lot of additional nuances. Therefore, he will have to familiarize himself in more detail with the instructions approved by the Federal Tax Service in order MMV-7-3/ [email protected]

Income statement

In the financial statements in 2021, profit is displayed not only in the balance sheet, but also in another important document - the income statement. It should indicate the key financial indicators of business activities for a specific period. The deadline for submitting the profit report in 2021 is March 31.

The report consists of tables that display a set of indicators from the beginning of the reporting period: product cost, sales revenue, etc. These indicators in total make up the financial result of the enterprise: net profit or loss. To avoid problems with representatives of the Federal Tax Service in 2021, the profit report should be submitted to the tax office on time.

The document form approved by the Ministry of Finance is presented as a recommendation; business owners can add or remove lines at their discretion. In the 1C: Accounting 7.7 program, profit reporting for 2018 can be prepared automatically, this will save a lot of time for the chief accountant. Stakeholders (investors, creditors, banks) often demand reports on the financial performance of companies, as this helps them determine how efficiently the entity is functioning.