What to write in an application for deduction from salary

The first issue we will consider is the legality of deducting the cost of goods, work or services directly from employee wages.

As you know, wages are an element of labor relations, which are quite strictly regulated by the Labor Code. And, in particular, it regulates the issues of deductions from wages. Thus, Article 137 of the Labor Code of the Russian Federation states: deductions from an employee’s salary are made only in cases provided for by the Labor Code itself or other federal laws. At the same time, neither the Labor Code of the Russian Federation nor other federal laws state that the employer has the right to withhold any amounts from employees’ wages in payment for goods, works or services transferred to them.

This situation was resolved by Rostrud in a letter dated September 16, 2012 No. PR/7156-6-1. In it, officials indicated that Article 137 of the Labor Code of the Russian Federation deals with deductions from wages by decision of the employer. Therefore, the provisions of Article 137 of the Labor Code of the Russian Federation do not apply to cases where the withholding is made based on the will of the employee. Rostrud believes that an employee who has submitted an application to the accounting department to deduct a certain amount from his salary in payment for goods, work or services received, simply disposes of his salary.

Thus, the employer can withhold from the employee’s salary the cost of the benefits transferred to him if he has received a corresponding application. At the same time, the restrictions on the amount of deductions established by Article 138 of the Labor Code of the Russian Federation do not apply in this case. This means that in payment for goods, works or services received by the employee, more than 50%, and even more than 70% of the salary can be withheld. This will not be a violation of labor laws.

And in order to completely exclude even the hypothetical possibility of applying sanctions to the employer in such situations, it is recommended not to use the term “withholding” in the documents used to formalize this operation. In particular, it will be better if the employee indicates in the application that he is asking to transfer part of his salary to the employer’s bank account to pay for previously received goods, work or services. It is advisable to prepare similar statements for each deduction.

Sample application

To the accounting department of Lancelot LLC from senior mechanic Petrishchev O.G.

STATEMENT

Please transfer part of the salary due to me for October 2021, in the amount of 10,245 (ten thousand two hundred forty-five) rubles 82 kopecks to the account of Lancelot LLC as payment for the purchased Lancelot LLC for me and at my request:

- a subscription to the Mercury sports club for October worth 5,245 (five thousand two hundred and forty-five) rubles;

- theater tickets to the Children's Academic Theater of Rostov on November 3 and 5, with a total cost of 5,000 (five thousand) rubles 82 kopecks.

November 01, 2021 Petrishchev /Petrishchev O.G./

Keep personnel records and calculate salaries in the web service for free

Types of deductions

According to the Labor Code and other regulations of the Russian Federation, there are several types of deductions. These are mandatory deductions, as well as deductions at the initiative of the employee and the employer. Mandatory deductions from wages include income taxes and deductions based on executive documents. Among the executive documents by which deduction can be made are:

- writs of execution;

- court orders;

- agreements on payment of established alimony;

- certificates of labor dispute commissions;

- orders of bailiffs, etc.

Deductions can also be made at the initiative of the employer himself. This is possible only in those cases established in the Labor Code of the Russian Federation. And in addition to this, the employee can write a corresponding application so that the boss begins to deduct the necessary part of the money from the salary. As for the purposes of such deduction, they are contributions for various types of insurance, loan repayments, dues to trade unions, etc.

Author of the article

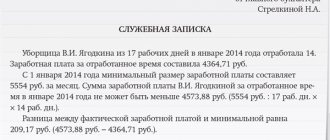

How to reflect deduction on a payslip

Another “personnel” issue that arises in this situation is related to the preparation of pay slips. As you know, Article 136 of the Labor Code of the Russian Federation requires them to be issued when paying wages. At the same time, as stated in paragraph 3 of this article, the payslip must contain information about the amount and reasons for the deductions made. Is it necessary to reflect on the payslip the amounts that are withheld at the request of the employee?

Unfortunately, neither legislation nor regulatory agencies give a clear answer to this question. But from the analysis of judicial practice it follows that the pay slip must also indicate those deductions from wages that are carried out with the consent of the employee (see, for example, the appeal ruling of the Omsk Regional Court dated 05.08.15 in case No. 33-5198/2015). In particular, the pay slip should reflect the deduction, formalized as a deposit into the organization’s cash desk of funds just issued to the employee as a salary (see, for example, the appeal ruling of the Krasnoyarsk Regional Court dated November 24, 2014 in case No. 33-10088).

Thus, regardless of the wording of the employee’s application (whether he asks to withhold money from his salary or transfer it to the organization’s account), this operation must be reflected in the pay slip. It should indicate the basis for the deduction (employee statement) and its amounts.

Calculate your advance and salary for free, taking into account all current indicators

Deduction based on writs of execution

The employer is obliged, and the employee does not have the right, to prevent the employer from withholding from the salary the amounts specified in the writs of execution issued on the basis of a court decision (sentence).

The amount of deductions from wages is calculated from the amount remaining after taxes have been deducted. In this case, the withholding and tax are summed up. Their amount should not exceed 20 (50, 70) percent of earnings.

As an exception to the general rule, the amount of deductions can reach 70% of earnings if:

— the employee serving correctional labor,

- collection of alimony for minor children,

- compensation for harm caused to the health of another person,

- compensation for damage to persons who suffered damage due to the death of the breadwinner,

- compensation for damage caused by the crime.

The employer is prohibited from making deductions from the following payments due to the employee:

- monetary amounts for damages;

- payments in connection with a business trip, transfer, admission or assignment to work in another area;

— payments in connection with the wear and tear of tools belonging to the employee;

- amounts of money paid by the organization in connection with the birth of a child;

- amounts of money paid by the organization in connection with the registration of marriage;

- amounts of money paid by the organization in connection with the death of relatives.

How to calculate personal income tax and from what amount to withhold it

So, an application has been received from the employee, which means that when paying him a salary, the accountant has the right to withhold part of the money to pay for goods, work, or the employee will receive less than accrued. The question arises: on what amount should personal income tax be calculated?

The answer is contained in paragraph 2 of paragraph 1 of Article 210 of the Tax Code of the Russian Federation. This provision states that deductions made from the taxpayer’s income by order do not reduce the tax base for personal income tax. Let's explain with an example. If from the salary accrued to the employee in the amount of 20,000 rubles. the cost of a gym membership will be deducted, personal income tax still needs to be calculated from the full salary (in this case, 20,000 rubles). The retained cost of the subscription is also considered income actually received by the employee, because he disposed of it by asking it to be credited to the employer’s account. This conclusion follows from paragraph 1 of Article 210 and subparagraph 1 of paragraph 1 of Article 223 of the Tax Code of the Russian Federation.

We also add that for the purpose of determining the date of actual receipt of income, in this case there is no need to divide the payment into two parts (salary and payment for a gym membership). After all, from the point of view of the Labor Code of the Russian Federation, the employee receives wages and at the same time manages them, giving a part to the employer. This means that the date of actual receipt of income for personal income tax purposes in the case under consideration for the entire amount (including the withheld part of the salary) is determined according to the rules of paragraph 2 of Article 223 of the Tax Code of the Russian Federation as the last day of the month for which the salary was accrued.

Finally, we must remember that the amount of calculated personal income tax (and it will be calculated, as we found out, from the full salary) must be withheld from the funds paid to the employee. And here another difficulty may await the accountant: what to do if the personal income tax amount is greater than or equal to the remaining part of the salary?

Let us say right away that neither the Tax Code of the Russian Federation nor the Labor Code of the Russian Federation prohibits in this case the withholding of the entire amount paid to the employee (that is, the entire salary remaining after withholding for payment of goods, work or services) for personal income tax. Let us recall that, as a general rule, the amount of all deductions for each payment of wages cannot exceed 20 percent (Article 138 of the Labor Code of the Russian Federation). However, a limit of 20 percent of the amount paid applies to wages remaining after personal income tax withholding (letter of the Ministry of Health and Social Development of Russia dated November 16, 2011 No. 22-2-4852). This means that before the personal income tax amount is withheld, the 20 percent limit does not apply.

The provision of paragraph 4 of Article 226 of the Tax Code of the Russian Federation, which establishes a 50 percent limit on the withholding of personal income tax, is also not applicable here. The fact is that this restriction applies only to tax calculated on income in kind or in the form of financial benefits. And in our case we are talking about income in cash in the form of wages.

Calculate your salary, contributions and personal income tax for free in the web service

In what cases and on whose initiative can part of the salary be withheld?

In case of official employment, withholding of part of the salary by the employer in the form of taxes is a mandatory procedure. But, in addition to tax deductions, there are many situations when an employee is paid an amount less than that stipulated by the terms of the employment agreement.

All legal deductions from wages are regulated by the Labor Code. Art. 137 of the Labor Code includes provisions according to which part of what an employee earns remains with the employer. In Art. 138 of the Labor Code describes the restrictive scope of deductions from wages, since the law does not allow depriving an employee of his entire salary.

Personal income tax is regulated by the head of the Tax Code of the Russian Federation. The procedure for deductions from the earnings of persons in prison is specified in the Code of Criminal Procedure of the Russian Federation. If the court recognizes a citizen as a debtor, then deductions for debt liquidation from his salary are regulated by the Law on Enforcement Proceedings.

What unconditional deductions from salary take place?

In some cases, an employer is required to withhold part of an employee’s salary without his consent. Such cases include:

- personal income tax payment;

- payment of a loan by a court decision;

- alimony withheld within the framework of a written agreement;

- obligations to pay alimony by court order.

Personal income tax payment

Official employment requires payment of income tax in the amount of 13% of salary. Work without an employment contract is paid without paying taxes, but both the employer and the employee in this case violate the law.

Responsibility for calculating and transferring tax payments to the National Tax Service lies with the employer. The employee receives a salary in his hands, taking into account the withheld personal income tax.

Payment of a loan by court decision

Part of the salary must be withheld if the employee has not fulfilled his obligations to repay the loan, and the court has ordered him to pay the debt at the creditor’s claim. The employer transfers funds to the latter after receiving the writ of execution.

Not only banks and microfinance organizations, but also individuals can act as lenders. After a court decision on the forced collection of funds is made, the creditor is given enforcement documents, after which he acquires the status of a collector. When they are transferred to an FSSP employee, enforcement proceedings are initiated. Bailiffs have the right to describe the property, block the debtor's deposits or take other measures. But, if the debtor is officially employed, the issue is resolved more simply and efficiently.

The bailiff sends the employer a resolution to collect the debt from the salary. This document indicates the full amount of the employee’s debt and the percentage of the salary to be withheld. The employer is obliged to comply with the bailiff's order.

For debt amounts up to RUB 100,000. inclusive, the claimant can himself, without contacting the FSSP, transfer enforcement documents to the employer. The start date of deductions is the date of actual receipt of the data by the resolution by the employer. From this time on, the employee will receive a salary taking into account the amounts deducted in favor of the claimant.

The money is transferred to the specified details no later than three days from the date of accrual of the debtor’s salary. Most often, the FSSP current account is indicated, and the bailiffs independently transfer them to one or several collectors, depending on the number of proceedings. Upon receipt of enforcement documents from the claimant in person, the employer transfers the withheld funds directly to him.

The money is held until the debt is fully repaid or until the debtor is fired. If the employment contract with the employee is terminated, the employer notifies the bailiffs or the claimant about this and transfers the enforcement documents to them.

Alimony withheld under a written agreement

Such withholding occurs when an employee who is divorced enters into a written agreement with his former spouse on the obligation to pay alimony in the agreed amount and has it certified by a notary. This agreement acquires the legal force of an executive document.

If the employee paying alimony under such an agreement violates it, then the other party can forcibly recover the money. The document is transferred to the FSSP or the debtor’s employer. The entire amount of alimony specified in the agreement is withheld from the salary. However, it should not be higher than 70% of earnings.

If the amount of alimony is equal to or greater than the official salary of the employee, the employer still cannot withhold more than 70%, according to Art. 138 Labor Code of the Russian Federation. The remaining funds become the payer's debt and can be collected from other sources of his income.

Obligations to pay alimony by court order

Collection of alimony in court is a fairly common practice.

In a simplified procedure, the magistrate, after the alimony recipient applies, issues a court order within a period not exceeding five days. In this case, there is no need for meetings or the presence of the payer. The judge only makes sure that the documents are drawn up correctly. The rendered decision (order) has the same legal force as a writ of execution. On its basis, the recipient has the right to demand withholding of alimony from the payer’s employer directly or through a bailiff.

In some cases, it is impossible to use writ proceedings (the need to confirm paternity, affecting the interests of another child). Also, a court order can easily be canceled at the request of the alimony payer. Then the recipient can file a claim, convey his position in court hearings and, if the claim is satisfied, receive a claim for payment under the writ of execution.

The order and sheet specify the amount of alimony. This can be half, a third, a quarter of the payer's salary or a fixed monthly amount.

Please note: Any deductions from salary on the basis of enforcement documents are carried out strictly from the date of receipt of such acts from the claimant or bailiff, and not from the moment of the issuance of a court decision or receipt of documents by the FSSP employee from the claimant.

The procedure for deductions in the presence of two or more claimants

Often, several enforcement proceedings are initiated against one officially working debtor. This could be two or more unpaid loans, debt for utilities, alimony, damage caused, etc. In this case, a queue of collectors appears.

Deduction of part of the salary for two or more executive documents

When distributing the amount to be withheld from the salary, if there are several collectors, the bailiffs are guided by the degree of priority.

The definition of first-priority debts includes alimony, monetary compensation for various types of damage and injury (moral, health, etc.).

Second-priority debts include the fulfillment of obligations to the personnel of the enterprise (payment by the owner of salary arrears, severance pay upon liquidation of the enterprise).

Third-priority debts are payments to the state (taxes, fines, pension contributions).

All other debts fall into the fourth category.

Debts of the second priority will not be collected until the debts of the first are paid, and the debts of the third until the debts of the second are repaid, etc.

If, for example, an employee has a debt on traffic police fines and a debt on a loan, then the credit institution can count on payments only after the fines have been fully repaid.

Withholding part of the salary for two or more executive documents of equal priority

The share of payments of collectors of one queue depends on the size of the payer’s debt to each of them.

If, for example, an employee owes two credit institutions at the same time, then the percentage of his debt to each creditor of the total amount is mathematically determined. After tax deductions, the employer withholds a portion of the remaining earnings to eliminate debt to creditors (maximum 50%). From these funds, each credit institution will receive as much interest as its share in the employee’s total debt.

Deductions made by the employer on his own initiative

In addition to deductions from earnings in favor of persons recognized by the court as collectors, the employer has the right to withhold a percentage of the employee’s earnings independently.

Funds paid by mistake

The employer may withhold part of the salary due under the employment contract if the employee receives, due to an erroneous calculation (accounting error), a larger amount than that provided for in the employment agreement.

A counting error is defined by Rostrud as an arithmetic miscalculation. In modern practice, such miscalculations include failures in the accounting software used.

An example would be incorrectly multiplying the number of hours worked by the amount paid for 60 minutes of work when paid on an hourly basis. This also includes an error in 1C when calculating the amount of vacation pay.

If in these and similar cases the employee received more than he should have, the difference will be withheld from future earnings. But, without fail, written consent from the employee is required. In the absence of one, the employer will be able to withhold part of the salary based on a court decision by filing a lawsuit and presenting evidence that an error occurred.

Retention of funds paid in advance accountable

The organization is obliged to cover employee expenses caused by business needs, for example, on business trips or when purchasing equipment. Often funds for these purposes are issued in advance, and the employee is required to account for the money received.

The financial report must contain all necessary documentation (checks, travel tickets, receipts, etc.). If the amount indicated in the report is less than the advance payment issued, and the employee has not returned the balance, then the employer has the right to withhold the difference from the employee’s salary on his own initiative, but in compliance with two rules:

- employee consent in writing;

- Less than a month has passed since the mandatory submission of the report.

If the employee disagrees with the deduction or if the month has expired, the employer can withhold the amount of the advance or its part that is not supported by the report by filing a claim in the courts.

Unearned advance and vacation pay upon dismissal

If an employee received money against future earnings and quit without working this amount, the employer can deduct these funds on the day of dismissal with the employee’s consent (written).

Also, according to the Labor Code of the Russian Federation, an employee has the right to receive paid leave after six months of continuous work for a period of 14 days. However, the employer can provide the employee with vacation after 6 months or for a longer period, paying vacation pay for the entire period.

If an employee quits without working for a year, the money he receives for each day of vacation in excess of 14 days is an overpayment. This amount is withheld by the employer from the salary upon dismissal without the consent of the employee.

Compensation for damage caused by an employee

The employer can legally deduct from the employee’s earnings in his favor the amount of damage caused by him.

For this purpose, a commission is formed to determine the culprit and the extent of losses. The employee writes an explanatory note. In case of refusal, the commission records the fact of refusal in writing.

Based on the results of the commission’s activities, the employer, guided by market prices, fixes the exact amount of damage. If equipment fails due to the fault of an employee, the cost of its repair is established. If the equipment cannot be repaired, its current price is fixed.

The employer has the right to withhold the established amount of damage from the salary even without the employee’s consent, but in compliance with two norms:

- the monetary amount of damage is not more than the average employee’s earnings;

- Less than a month has passed since the amount of losses incurred by the company due to the employee’s fault was recorded.

If the damage caused exceeds the average monthly salary of the employee, the employer can withhold part of the salary only with the written consent of the perpetrator or file a lawsuit.

The law provides for the conclusion of an agreement between the parties to cover damage in installments. Also, the guilty employee may offer the employer to independently repair the damaged property or provide an equivalent equivalent.

Deductions in the form of sanctions for violation of labor discipline or failure to fulfill the plan

According to the Labor Code of the Russian Federation, the employer does not have the right to deprive an employee of part of his salary for disciplinary offenses or the absence of certain labor indicators. The salary stipulated by the employment contract must be paid in full, regardless of the employee’s behavior or work achievements.

Violators of labor discipline may be punished with a reprimand, reprimand, or justified dismissal. Deductions from wages for lateness, absenteeism, etc. are illegal.

It’s a different matter if we are talking about a bonus, which is not a fixed part of the salary and is awarded precisely for work efficiency and compliance with certain rules.

The conditions and amount of bonuses are stipulated in the internal regulations of the organization, the employment contract or amendments to it. In these documents, the employer specifies under what conditions the employee is awarded a bonus and in what cases the bonus is deprived. Accordingly, non-payment of a bonus can be considered as a deduction, but from a non-fixed part of the salary.

If an employee violated the conditions entitling him to a bonus (produced less products than agreed upon, made sales for an amount lower than the established one, was systematically late, etc.), then the refusal of a bonus by the employer will be legal. But such an employee must receive his salary in full.

Hold time frames

Current legislation provides for the following periods of deductions from salary:

- tax payments from wages are withheld on the day of its payment and must be transferred to the National Tax Service no later than the next day after the salary is paid;

- tax payments from vacation and sick leave are withheld on the date of payment and must be transferred to the Tax Service until the last date of the current month inclusive;

- deductions for debts to collectors are made on the date of payment of wages, and funds are transferred to the collector or to the FSSP account no later than three days later;

- deductions for accountable funds are made no later than a month from the date of mandatory submission of the report;

- money for unearned vacation pay or advances is deducted on the settlement date upon dismissal;

- overpayments resulting from an accounting error are subject to withholding no later than one month from the date the incorrect amount was issued;

- funds to cover damages are deducted no later than a month from the date the amount of losses is recorded.

Deductions on the personal initiative of an employee

In some cases, the employee himself may contact the employer with a written request to withhold money from wages and transfer it to specified accounts. This may be due to a desire to pay your mortgage or other financial obligations on time.

The employer independently decides whether to satisfy such a request or refuse. If the employer meets the employee halfway, he must take into account that such deductions are interpreted by regulatory authorities in the field of compliance with the Labor Code of the Russian Federation in two ways. The same labor inspector may have a negative attitude towards such deductions and initiate legal proceedings.

This attitude is due to the fact that the Ministry of Labor and Social Protection does not welcome such deductions, guided by articles of the Labor Code, which do not contain a word about the statements of the employee himself. But Rostrud claims that retention at the request of an employee does not contradict the law. And the courts believe that the employee has every right to dispose of his salary at his own discretion. At the same time, the courts point out that the Labor Code is intended to regulate only unconditional deductions, without limiting voluntary ones.

Maximum retention amounts

Regardless of the reason for the deductions, the employer does not have the right to deprive the employee of his entire salary. Each type of lien has limits on how much it can hold.

Employer-initiated deductions

The employer does not have the right to recover in his favor more than 1/5 (20%) of the employee’s salary.

For example, for vacation pay received in advance, from a resigned employee who has not worked out this advance, the employer will be able to withhold only a fifth of the last salary, even if it does not cover the debt. The employee can return the rest at his own request. If refused, the debt will simply be canceled, since the court will refuse to satisfy the claim. In this case, there was an overpayment, but it was not due to an accounting error.

A maximum of 20% applies to all other cases of deductions at the initiative of the employer (unearned advance payment for salary, compensation for damage, etc.).

Personal income tax

The legal amount of deductions for personal income tax for residents of the Russian Federation is 13%. The rate for non-residents is set at 30%.

Deductions in favor of claimants

Based on enforcement documents, the employer can withhold no more than half of the salary. This also applies to cases where several claimants apply for payments at once.

The legislation also provides for exceptional cases when up to 70% is withheld. This applies to the payment of alimony by court decision, compensation for damage caused to health in connection with the death of the breadwinner, as well as damage caused during the commission of a crime.

Alimony by agreement of the parties

If the payer and recipient of alimony have entered into a written agreement with a notary, the employer is obliged to withhold the amount specified in the document. But the amount of deduction should not exceed 70% of wages.

Own wish

If the employee himself initiated the deduction from the salary, then in this case its size is not limited and can be 100% of the salary.

Payments to which the withholding rules do not apply

In addition to salary, employees are also paid other benefits. Some of them are not even deducted the debt under the writs of execution. Such payments include:

- financial assistance for the birth of a child in an employee’s family, marriage, or death of close relatives;

- reimbursement of expenses for business trips;

- compensation for expenses for treatment and recreation in sanatoriums of the Russian Federation;

- compensation for expenses associated with moving to another location for work reasons.

Income tax is not withheld in full if the employee has children. When the first and second births occur, the salary amount subject to personal income tax is reduced by 1,400 rubles; with the birth of each subsequent birth, this amount becomes less by 3,000 rubles.

In addition, the following are not subject to income tax:

- reimbursement of travel expenses and payment for hotels or rented apartments to seconded employees in the presence of tickets, checks, payment receipts;

- daily allowances for seconded employees (700 rubles for business trips within the Russian Federation and 2,500 rubles for foreign ones);

- financial assistance when children appear in an employee’s family, not exceeding 50,000 for each child, accrued per year, from the date of birth;

- financial assistance in case of death of close relatives;

- financial assistance for any needs, not exceeding 4,000 rubles. during a year.

Simultaneous application of different types of deductions

There are no difficulties when creating a deduction algorithm if there are 1-2 of them. But when an employee, for example, in addition to income tax and alimony, has several unpaid loans, fines from the traffic police, and damage caused to the enterprise, then certain difficulties arise. In this case, the employer must adhere to the principle of priority, as well as negotiate.

That is, after deducting personal income tax, funds are withheld from the balance according to enforcement documents (first alimony, then fines, and then loans). As for compensation for damage, the employer will need to negotiate with the employee the voluntary repayment of this debt. Otherwise, if there are so many deductions, money is unlikely to reach the enterprise’s cash desk.

The employer's situation is complicated in that he can collect no more than 20% of the salary from the employee. In addition, deductions in favor of the employer are debts of the fourth stage. In addition to reaching an agreement with the employee, you can, of course, go to court, achieve a positive decision on the claim for damage and become a collector or cancel the debt.

Also, it should be remembered that according to writs of execution, it is permissible to withhold no more than 50% of the salary (in some cases 70%). And if the employee is withheld 70% of alimony (first-priority debt), and the credit institution simultaneously wants to receive funds to cover the debt, then the creditor has no right to claim the remaining 30% of the salary.

Another point concerns the deduction of 100% at the request of an employee if he has, for example, loan debts or alimony. In this case, the employer can only agree to withhold that part of the salary that remains after paying personal income tax and payments under executive documents related to unconditional deductions. If the employer takes the employee’s application as a priority, he will grossly violate the law and incur liability, including criminal liability.

Documentary support of various types of deductions

Preparation of documentation for withholding depends on each specific case. For some types of withholding, written confirmation is not required.

Application for withholding salary or part thereof on the personal initiative of the employee

If an employee wants his salary or some portion of it to be transferred by the employer to a specific account, then he writes a free-form application. The document must indicate the amount of withholding and the details of the organization or person to whom the funds will be transferred.

A verbal agreement is not enough. A written statement, if necessary, provides the legal basis for the lien. It will help the employer prove the legality of transferring wages or part of it in case of questions from a labor inspector or in the case when the employee decides to return the funds, claiming that he did not ask to transfer them to third parties.

Voluntary consent of the employee to deductions, drawn up in writing

There are several points in which deduction is illegal without the employee’s written consent to withhold part of the salary. These include:

- deductions for debt liquidation in the form of funds received on account;

- compensation for damage caused by the employee, provided that the amount of damage is greater than his average monthly earnings;

- refund of amounts overpaid to the employee due to an error in calculating due payments.

The written consent of the employee is primary. Only after receiving it does the employer have the right to issue an order to withhold part of the earnings in its favor.

Order for an enterprise for deductions from earnings

Such a document is issued only when part of the salary is withheld in favor of the employer or at the personal request of the employee. For income tax or payments in favor of creditors, there is no need to issue an order.

Regulations on deductions from an employee’s earnings for accountable funds

The procedure for returning funds issued on account is regulated by the Labor Code of the Russian Federation. No additional internal provisions are required. Drawing up any documents that contradict the legal restrictions on deductible funds is unlawful.

Current legislation allows money to be deducted to pay off accountable amounts only with the employee's written consent. The withholding should not exceed 20% of the salary. If the employer decides on his own initiative, without the written consent of the employee, to withhold an arbitrary part of the salary to pay off accountable amounts, issuing an appropriate order, then he is grossly violating the law. The provisions of the Labor Code have a dominant position in comparison with the internal documents of the enterprise, which worsen the position of the employee.

Issuing orders that contradict the law entails the employer's responsibility when the employee applies to the appropriate authorities (labor inspectorate, court, etc.).

Basic provisions regarding the retention of part of earnings by the employer

All types of deductions from earnings, as well as their amounts, are regulated by current legislation, which states that:

- deducting tax payments and debts to collectors from the earned amount and transferring funds to the appropriate accounts is the direct responsibility of the employer. For such deductions there is no need to obtain the employee’s consent in any form;

- The employer has the right to compensate for damage caused by the employee through deductions from earnings. The latter’s consent is not required, but only when the amount of losses does not exceed his average monthly salary;

- deduction of funds for which a report has not been submitted and overpayments that occurred as a result of a counting error is allowed, but only with the consent of the employee in writing;

- deduction of unearned vacation pay or funds issued on account of wages is made on the date the employee ceases to perform his work duties, even without his consent;

- the employer can withhold from the employee’s earnings in all cases no more than 1/5;

- the deduction of funds in favor of creditors cannot be more than half of the employee’s earnings. The exception is arrears of alimony and payments for compensation of various types of harm. Up to 70% of wages can be withheld for these purposes;

- a number of additional payments are not subject to deductions in favor of creditors and other claimants. These include financial assistance when a child appears in an employee’s family, marriage, funerals of loved ones, compensation for expenses of seconded employees, covering the cost of vouchers to Russian sanatoriums, payments compensating for the costs associated with moving to a new place of work;

- the employee has the right to appeal to supervisory authorities, the prosecutor's office or the court if he believes that the employer is deducting funds in his favor illegally.

all articles

How to avoid material gain when purchasing goods through an employer

The next question that may arise from an accountant of an organization that purchases goods, works or services for employees on account of their salaries is also related to personal income tax. But this time we will talk about the material benefits of saving on interest. Let us recall that material benefits arise from savings on interest for the taxpayer’s use of borrowed (credit) funds received from organizations or individual entrepreneurs with whom the borrower has an employment relationship (subclause 1, clause 1, article 212 of the Tax Code of the Russian Federation).

According to paragraph 1 of Article 808 of the Civil Code of the Russian Federation, in cases where the lender is a legal entity, the loan agreement must be concluded in writing, regardless of the loan amount. In this case, the written form of the agreement is considered to be complied with if, in confirmation of the loan agreement and its terms, a receipt from the borrower or another document is presented certifying the transfer by the lender of a certain amount of money (clause 2 of Article 808 of the Civil Code of the Russian Federation). And by virtue of paragraph 5 of Article 807 of the Civil Code of the Russian Federation, the loan amount transferred to a third party indicated by the borrower is recognized as transferred to the borrower.

Applying these rules to the situation under consideration, we obtain the following conclusion. An application to deduct from wages a certain amount of money that the organization transferred to a third party to pay for goods, work or services for an employee can be regarded as confirmation of a loan agreement concluded between the organization and the employee. And since the employee does not pay interest (only the cost of goods, work or services is deducted from the salary), he receives income in the form of material benefits from saving on interest for the use of borrowed funds (subparagraph 1, paragraph 2, article 212 and subparagraph 7 clause 1 article 223 of the Tax Code of the Russian Federation). Consequently, the lending organization is recognized as a tax agent. Therefore, the accountant needs, as of the last day of each month during the period for which the borrowed funds are provided (i.e. from the moment the company pays for the goods, work or service and until the date of actual deduction of money from the salary), calculate personal income tax on income in the form of material benefits. Matvygoda is calculated based on 2/3 of the refinancing rate of the Central Bank of the Russian Federation (clause 2 of Article 212, clause 3 of Article 226, subclause 7 of clause 1 of Article 223 of the Tax Code of the Russian Federation).

For example, in October the organization paid for swimming pool classes for an employee. Money for these classes is withheld at the employee’s request from the October salary, which is paid in early November. In this case, the company’s accountant will have to calculate and withhold personal income tax on income in the form of financial benefits twice: as of October 31 and as of November 30, based on the number of days the loan was used in each month. This means that in fact, classes in the pool will cost the employee a little more. This can be avoided if you change the procedure for settlements with employees, making it advance payment. The algorithm is as follows. First, the employee writes an application for the transfer of part of his salary as payment for goods, work, and services. Based on this statement, the accountant withholds money from the employee’s salary. And only then the employee receives from the company the corresponding benefit for which he actually paid. In this case, the loan relationship no longer arises. This means there is no material benefit.

Fill out and submit 2‑NDFL certificates using the new form via the Internet Submit for free

Should CCT be used when deducting from wages?

Finally, the final issue that will be discussed in today’s article concerns the use of cash register systems when deducting funds from salaries. Does such an operation fall under the definition of “settlements”, which is given in Article 1.1 of the Federal Law of May 22, 2003 No. 54-FZ on the use of cash register systems?

The answer is found in two letters from regulatory authorities. The letter of the Federal Tax Service of Russia dated August 14, 2018 No. AS-4-20/15707 states that cash registers should be used if deductions from wages are made to repay the employee’s debt to the organization for goods, work or services sold to him. In particular, this method can be used to formalize the sale to employees of “extra” goods for the company (for example, old laptops that are sold in connection with the purchase of new equipment; cell phones purchased in excess quantities for branches; theater tickets originally purchased for representatives of the counterparty who did not come to the meeting, etc.). In other words, if a company first bought goods, work or services for itself, and then sells them to its employee, and the payments are made through salary deduction, then a cash receipt must be issued for the amount of the deduction. Also, CCT will have to be used if the cost of goods (work, services) produced by the employer himself and sold to the employee is deducted from the salary. (Also see “Issuing wages in goods: the Federal Tax Service clarified whether it is necessary to use an online cash register”).

However, the mentioned letter from the Federal Tax Service does not apply to situations where a company purchases goods, work or services from third parties for employees (and at their request), and then withholds part of the salary to pay off the debt on these goods, work or services. For example, a company, at the request of an employee, purchases a laptop for him in a store that works only with legal entities, at a price lower than the retail price, and then transfers it to the employee with the cost of the equipment being deducted from the salary. In this case, the seller is a third party, and the employing organization, in fact, is an intermediary and should not reflect the purchase of such laptops in its accounting. In such cases, when deducting from the salary the amount spent by the organization on the purchase of goods, works or services from third parties for the employee, it is not necessary to use cash registers (letter of the Ministry of Finance of Russia dated 09/04/18 No. 03-01-15/63151). Thus, if we are talking about purchasing various benefits for employees from third parties (and our article today was devoted to such situations), the employing organization should not use a cash register when deducting the cost of goods, work or services from employees’ salaries.