How do general rules and regional specifics relate?

The rules for calculating and paying transport tax are enshrined in Chapter 28 of the Tax Code. The provisions of this chapter are the same for all subjects of the Russian Federation, but regional authorities have the right to establish some differences within the framework of general rules.

Thus, the law of a particular subject can approve its tax rates, but these rates in general should not differ more than ten times from the values given in the Tax Code of the Russian Federation. In addition, the region has the right to set its own tax payment deadline for taxpayer organizations (provided that the deadline for transferring the tax amount occurs no earlier than that determined by the Tax Code). Regional authorities do not have the right to set a tax payment deadline for individuals, since this deadline is directly enshrined in the Tax Code. Finally, regional authorities may, at their discretion, introduce transport tax benefits, as well as establish (or not establish) reporting periods within the tax period.

What is a transport fee?

After you register your car, you need to pay tax. Citizens need to report once a year, and organizations submit a report once a quarter.

Tax rates are different for each region. The sizes are determined by local authorities.

4 conditions for payment set by local authorities:

- when to make a contribution;

- payment amount;

- privileges;

- forms of certificates for submission to the Federal Tax Service.

Organizations decide for themselves how cars should be taxed. The inspectorate sends notifications to individuals. The tax office itself sends out notifications about taxable cars to citizens.

Who pays transport tax

Organizations and individuals, including individual entrepreneurs, to whom the vehicle (hereinafter referred to as the vehicle) is registered. If the vehicle is leased, the tax is paid by the lessor. If a vehicle is leased, then the taxpayer is either the lessor or the lessee. It depends on whose balance sheet the vehicle is registered on. When there is a change of ownership (sale, gift, etc.), the new owner of the vehicle becomes the taxpayer, and the previous owner stops paying tax.

Taxpayers

Transport tax is paid by companies and entrepreneurs with registered vehicles.

Difficulties in determining the taxpayer may arise if a vehicle registered in the name of an individual is transferred to another person on the basis of a power of attorney. In this case, two situations may arise:

- if the power of attorney was issued before July 30, 2002 (the date of official publication of Chapter 28 “Transport Tax”), then the tax will be paid by the person indicated in the power of attorney;

- if the power of attorney was issued after July 30, 2002, then the tax will be paid by the previous owner of the vehicle.

Moreover, in the first case, citizens to whom vehicles are registered must notify the tax office at their place of residence about the transfer of these vehicles by proxy.

On July 1, 2002, the entrepreneur bought a Gazelle minibus and a Volga car.

On July 15, he transferred the Gazelle to the company by proxy. Therefore, the company will pay the transport tax for the Gazelle.

On August 30, the entrepreneur transferred the same by proxy. Since the transfer of the car by proxy occurred after July 30, 2002, the transport tax for the Volga will be paid by the entrepreneur.

Tax rates

The rate depends on the physical indicator characterizing a particular vehicle. For cars, this indicator is engine power in horsepower, for most aircraft - the nameplate static thrust of a jet engine, for a number of towed water vehicles - gross tonnage in registered tons.

Rates are set per unit of indicator: one horsepower, one kilogram of traction force and one register ton, respectively. For example, for a passenger car with an engine power of more than 250 hp. the rate given in the Tax Code is 15 rubles. per hp*. Let us remind you that regional authorities have the right to reduce or increase the rate, but no more than 10 times. This means that the law of a particular entity can set the rate for a passenger car with an engine power of more than 250 hp. ranging from 1.5 to 150 rubles per hp.

Subjects of the Russian Federation have the right to unlimitedly reduce the rate for cars with an engine power of less than 150 hp. Thus, for a given type of vehicle, regions can set a rate that, for example, is 15 or 20 times less than that specified in the Tax Code of the Russian Federation.

Subjects of the Russian Federation can also differentiate rates for each category of vehicles, taking into account the environmental class and the number of years that have passed since the year of manufacture of the vehicle.

Object of taxation

Vehicles that are subject to tax can be divided into three groups:

- motor transport

(cars, motorcycles, scooters, buses and other self-propelled machines and mechanisms on pneumatic and caterpillar tracks); - water

(motor ships, yachts, sailing ships, boats, motor boats, towed vessels, etc.); - air

(planes, helicopters, etc.).

All these vehicles must be registered in accordance with the established procedure.

The following are not subject to taxation:

- rowing boats and motor boats with an engine of no more than 5 horsepower;

- passenger cars specially equipped for use by disabled people;

- •passenger cars with an engine power of up to 100 horsepower, received through social protection authorities;

- fishing sea and river vessels;

- passenger and cargo sea, river and aircraft owned by organizations whose main activity is passenger and cargo transportation;

- •tractors, self-propelled combines, special vehicles registered to agricultural producers;

- vehicles belonging to federal executive authorities, where military and equivalent service is provided;

- wanted vehicles;

- airplanes and helicopters of air ambulance and medical services;

- vessels according to the Russian International Register.

How to calculate transport tax

You need to determine the tax base and multiply it by the tax rate. The tax amount is calculated separately for each vehicle.

The tax base in the general case is the value of the physical indicator characterizing the vehicle: the number of horsepower, the number of kilograms of traction force and the number of registered tons.

The base must be determined and the tax calculated based on the results of the tax period, which is equal to one calendar year. Let's give an example. Let’s say that a taxpayer owned a passenger car with an engine power of 81 hp for the entire year, the transport tax rate for such vehicles in a given region is 7 rubles. per hp This means that the tax amount for this year will be 567 rubles. (7 rubles x 81 hp).

If the vehicle is registered or deregistered in the middle of the year, then the tax amount must be calculated taking into account the coefficient. It is equal to the number of full months during which the vehicle was registered to the taxpayer, divided by the number of calendar months in a year.

If the vehicle is registered on or before the 15th, the month of registration is counted as a full month. If the vehicle is registered after the 15th day, then the month of registration is not taken into account at all. When deregistering a vehicle, a “mirror” rule applies: if deregistration occurred on the 15th or earlier, the corresponding month is not taken into account. If the withdrawal occurred after the 15th day, then the corresponding month is taken as a full month.

Let's clarify with an example. Suppose a taxpayer registered a passenger car with an engine power of 81 hp on March 1, and deregistered the car on June 1 of the same year. The tax rate is 7 rubles. per hp It turns out that the taxpayer owned the car for three full months (March, April, May). This means that the coefficient is 0.25 (3 months: 12 months), and the tax amount for this year will be 141.75 rubles (0.25 x 7 rubles x 81 hp).

Transport tax for passenger cars costing more than 3,000,000 rubles is calculated using increasing factors. A total of five coefficients have been established depending on the average cost of the car and the number of years that have passed since the year of its manufacture. In particular, the amount of transport tax for cars with an average cost of 3 to 5 million rubles, the year of which no more than one year has passed, must be multiplied by a factor of 1.5. The procedure for determining the average cost of cars and lists of expensive cars are published annually on the website of the Ministry of Industry and Trade of Russia.

Organizations must calculate advance payments for transport tax taking into account the increasing coefficients established for expensive cars (clauses 2 and 2.1 of Article 362 of the Tax Code of the Russian Federation).

Regional benefits

In each region of Russia (region, territory, etc.) tax benefits may be established for certain categories of citizens. The list of beneficiaries is approved by the laws of the constituent entities of the Russian Federation (region, territory, republic). This follows from paragraph 3 of Article 12, Articles 14 and 356 of the Tax Code of the Russian Federation.

For example, transport tax benefits for Moscow residents are approved by Article 4 of Moscow Law No. 33 of July 9, 2008. For a list, see the table.

Transport tax benefits for residents of the Moscow region were approved by the Law of the Moscow Region of November 24, 2004 No. 151/2004-OZ. See the table for their list.

If you are entitled to a benefit, then to receive it, submit an application to the inspectorate using the standard form given in the letter of the Federal Tax Service of Russia dated November 16, 2015 No. BS-4-11/19976.

Situation: do you need to pay transport tax if the car was purchased on credit? Is the car registered with the traffic police?

Yes need.

A person is obliged to pay transport tax on a vehicle registered to him (paragraph 1, article 357 of the Tax Code of the Russian Federation).

The following cases are exceptions:

- the owner of the vehicle is a beneficiary;

- the vehicle is exempt from transport tax.

This follows from paragraph 3 of Article 356 and paragraph 2 of Article 358 of the Tax Code of the Russian Federation.

However, the law does not provide for benefits for cars purchased on credit. According to the Tax Code of the Russian Federation, the obligation to pay transport tax does not depend on the funds with which the owner purchased the vehicle: his own or borrowed funds.

Thus, from the moment a person registers a car in his name with the State Traffic Safety Inspectorate, he becomes obligated to pay transport tax (paragraph 1 of Article 357 of the Tax Code of the Russian Federation).

Situation: is it necessary to pay transport tax on a car that is evidence in a criminal case? The car is not actually used.

The answer to this question, first of all, depends on whether the car is registered with the traffic police or not.

If the car is not registered, then you will not have to pay tax (Article 357 of the Tax Code of the Russian Federation). In this case, the tax inspectorate will not have the data to calculate the tax and send the owner a notice to pay the transport tax (Article 362, paragraph 3 of Article 363 and paragraph 4 of Article 57 of the Tax Code of the Russian Federation).

If the car is registered, you will have to pay tax. The obligation to pay tax arises from the moment the vehicle is registered. This follows from Article 357 of the Tax Code of the Russian Federation.

The following cases are exceptions:

- the owner of the vehicle is a beneficiary;

- the vehicle is exempt from transport tax.

This follows from paragraph 3 of Article 356 and paragraph 2 of Article 358 of the Tax Code of the Russian Federation.

At the same time, the law does not provide for a benefit for cars handed over as evidence in a criminal case.

The tax department adheres to a similar position (see, for example, letter of the Federal Tax Service of Russia for Moscow dated March 3, 2008 No. 18-08/4/020096).

Situation: do I need to pay transport tax on a rented car?

No no need.

Transport tax is required to be paid by the person in whose name the vehicle subject to this tax is registered (paragraph 1 of Article 357 of the Tax Code of the Russian Federation).

The owner can register a vehicle (clause 20 of the Rules approved by order of the Ministry of Internal Affairs of Russia dated November 24, 2008 No. 1001, clause 4 of the Methodological Recommendations approved by order of the Ministry of Taxes of Russia dated April 9, 2003 No. BG-3-21/177) .

The law provides for a number of exceptions to this rule. Including registration of a vehicle leased under a leasing agreement. Such a vehicle can be registered both to the lessor (lessor) and to the lessee (tenant). This is stated in paragraphs 22 and 48.1 of the Rules, approved by order of the Ministry of Internal Affairs of Russia dated November 24, 2008 No. 1001.

However, leasing agreements, as a rule, are concluded in the field of entrepreneurial activity (paragraph 1 of the Law of October 29, 1998 No. 164-FZ).

A person (not an entrepreneur) who rents a car enters into a lease or rental agreement with the lessor (Articles 632, 642 and 627 of the Civil Code of the Russian Federation). For such a transaction, no exceptions are provided for in the vehicle registration rules. It is registered in the name of the owner (lessor).

Thus, the car renter does not need to pay transport tax.

Situation: is it necessary to pay transport tax if the owner rents out a car?

Yes need.

A person is obliged to pay transport tax on a vehicle registered to him (paragraph 1 of Article 357 and Article 358 of the Tax Code of the Russian Federation).

The owner can register a vehicle (clause 20 of the Rules approved by order of the Ministry of Internal Affairs of Russia dated November 24, 2008 No. 1001, clause 4 of the Methodological Recommendations approved by order of the Ministry of Taxes of Russia dated April 9, 2003 No. BG-3-21/177) .

The law provides for a number of exceptions to this rule. Including registration of a vehicle leased under a leasing agreement. Such a vehicle can be registered both to the lessor (lessor) and to the lessee (lessee). This is stated in paragraphs 22 and 48.1 of the Rules, approved by order of the Ministry of Internal Affairs of Russia dated November 24, 2008 No. 1001.

However, leasing agreements, as a rule, are concluded in the field of entrepreneurial activity (paragraph 1 of the Law of October 29, 1998 No. 164-FZ).

A person (not an entrepreneur) who rents out a car enters into a lease or rental agreement with the lessee (Articles 632, 642 and 627 of the Civil Code of the Russian Federation). For such a transaction, no exceptions are provided for in the vehicle registration rules. It is registered in the name of the owner (lessor).

Thus, the owner-lessor must pay transport tax on the rental car.

The following cases are exceptions:

- the owner of the vehicle is a beneficiary;

- the vehicle is exempt from transport tax.

This follows from paragraph 3 of Article 356 and paragraph 2 of Article 358 of the Tax Code of the Russian Federation.

Situation: do I need to pay transport tax on a seized car? Is the car registered with the traffic police?

Yes need.

A person is obliged to pay transport tax on a vehicle registered to him (paragraph 1 of Article 357 and Article 358 of the Tax Code of the Russian Federation).

The following cases are exceptions:

- the owner of the vehicle is a beneficiary;

- the vehicle is exempt from transport tax.

This follows from paragraph 3 of Article 356 and paragraph 2 of Article 358 of the Tax Code of the Russian Federation.

At the same time, the law does not provide for a benefit for vehicles that are seized.

In addition, the seizure of property does not provide for the owner to be permanently deprived of ownership rights. Seizure of property may temporarily restrict the right to dispose (in some cases, use) of this property. This follows from paragraph 2 of Article 1 and paragraph 2 of Article 235 of the Civil Code of the Russian Federation.

Thus, as long as the vehicle is registered to a person, he must pay transport tax. Regardless of whether this property is seized or not.

This conclusion is confirmed by the letter of the Federal Tax Service of Russia dated April 6, 2010 No. 3-3-06/468.

Situation: is it necessary to pay transport tax on a car purchased for use as spare parts? The car is registered with the traffic police.

Yes need.

A person is obliged to pay transport tax on a vehicle registered to him (paragraph 1 of Article 357 and Article 358 of the Tax Code of the Russian Federation).

The following cases are exceptions:

- the owner of the vehicle is a beneficiary;

- the vehicle is exempt from transport tax.

This follows from paragraph 3 of Article 356 and paragraph 2 of Article 358 of the Tax Code of the Russian Federation.

However, the law does not provide for a benefit for vehicles purchased for use as spare parts.

A similar point of view is reflected in the letter of the Ministry of Finance of Russia dated May 6, 2006 No. 03-06-04-04/15. The obligation to pay transport tax will cease after the vehicle is deregistered (Article 357, paragraph 3 of Article 362 of the Tax Code of the Russian Federation).

Advice : in order not to pay transport tax on cars that were purchased for use as spare parts, do not register them with the traffic police.

The owner is obliged to register with the traffic police only those vehicles that are intended for driving on public roads. This is stated in paragraph 1 of the Rules, approved by order of the Ministry of Internal Affairs of Russia dated November 24, 2008 No. 1001. If the car was originally purchased for use as spare parts, then it is not necessary to register it. After all, in this case it will not be used as a vehicle. And there is no need to pay transport tax on an unregistered car (Clause 1, Article 358 of the Tax Code of the Russian Federation).

Situation: is it necessary to pay transport tax on cars that have been undergoing lengthy repairs for several months after an accident? The car is registered with the traffic police.

Yes need.

A person is obliged to pay transport tax on a vehicle registered to him (paragraph 1 of Article 357 and Article 358 of the Tax Code of the Russian Federation).

The following cases are exceptions:

- the owner of the vehicle is a beneficiary;

- the vehicle is exempt from transport tax.

This follows from paragraph 3 of Article 356 and paragraph 2 of Article 358 of the Tax Code of the Russian Federation.

However, the law does not provide for benefits for vehicles that are under repair.

A similar point of view was expressed in letters of the Ministry of Finance of Russia dated August 31, 2011 No. 03-05-06-04/269, dated July 3, 2008 No. 03-05-06-04/39.

Situation: is it necessary to pay transport tax on a water vehicle that is operated only in the summer?

Yes need.

Water vehicles are recognized as an object of taxation by transport tax (clause 1 of article 358 of the Tax Code of the Russian Federation, paragraph 9 of clause 2 of the Methodological recommendations approved by order of the Ministry of Taxes and Taxes of Russia dated April 9, 2003 No. BG-3-21/177).

A person is required to pay transport tax on a registered vehicle (paragraph 1 of Article 357 and Article 358 of the Tax Code of the Russian Federation).

The following cases are exceptions:

- the owner of the vehicle is a beneficiary;

- the vehicle is exempt from transport tax.

This follows from paragraph 3 of Article 356 and paragraph 2 of Article 358 of the Tax Code of the Russian Federation.

At the same time, the law does not provide for benefits for vehicles, including water vehicles, the operation of which depends on the season. Consequently, the transport tax in this case must be paid in full for the entire calendar year, regardless of the time of actual use of the vehicle.

A similar point of view was expressed in the letter of the Federal Tax Service of Russia dated January 27, 2012 No. BS-3-11/241.

Situation: is it necessary to pay transport tax on a car that was sold but not deregistered with the traffic police?

Yes need.

Transport tax is required to be paid by the person in whose name the vehicle subject to this tax is registered (paragraph 1 of Article 357 and Article 358 of the Tax Code of the Russian Federation). Therefore, if the owner who sold the car did not deregister it, he will pay transport tax.

The tax inspectorate calculates the transport tax on cars based on data received from the State Traffic Safety Inspectorate (Article 362 of the Tax Code of the Russian Federation and clause 2 of the Decree of the Government of the Russian Federation of August 12, 1994 No. 938).

Therefore, until the vehicle is deregistered, the tax office will send a person notifications to pay transport tax (Article 357 and paragraph 3 of Article 363 of the Tax Code of the Russian Federation).

In order not to pay tax on a sold car, you need to deregister it with the traffic police. After this, the traffic police will submit updated information to the tax office. And the tax will be paid by the owner who registers the car in his name (Article 357 of the Tax Code of the Russian Federation).

Similar clarifications are contained in the letter of the Ministry of Finance of Russia dated July 5, 2013 No. 03-05-06-04/26030.

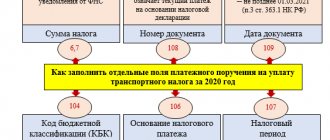

Who is responsible for calculating transport tax?

Until 2021, taxpaying organizations calculated the amount of transport tax independently. Tax for 2021 and later periods is calculated by both organizations and inspectors. The Federal Tax Service sends a message to the company indicating the rate, amount to be paid and other information. In case of disagreement, the company has the right to draw up explanations and attach documents to them (for example, about a benefit), and tax authorities are obliged to consider them.

For individual taxpayers (including individual entrepreneurs), transport tax is calculated by tax inspectors. Information about vehicles and their owners is supplied to tax authorities by the authorities that register vehicles (State Traffic Inspectorate and Gostekhnadzor). The Tax Code obliges these structures to report the registration and deregistration of vehicles within 10 days, and also, by February 1, to provide data on vehicles and their owners as of December 31 of the previous year.

Having received the information, tax authorities calculate the amount of tax and send the individual taxpayer a notification of payment. In this case, employees of the Federal Tax Service have the right to submit taxes for no more than three years preceding the year when the notification was sent. If they include transport tax for earlier periods in the notification, the taxpayer has the right not to transfer the money.

Generate a payment invoice for payment of tax (penalties, fines) in one click based on the request received from the Federal Tax Service

At the same time, in practice it happens that the tax office does not receive information on the acquisition of vehicles by individuals in a timely manner. In this regard, tax notices are not sent and tax is not paid because of this. To resolve this problem, an obligation has been introduced for individuals to report to the inspectorate about objects subject to transport tax, if for the entire period of ownership of the vehicle the individual did not receive notifications and did not pay tax. In addition to the message, it is also required to submit documents confirming the state registration of vehicles. This must be done before December 31 of the year following the expired tax period. Individuals who fail to fulfill this obligation may be fined in the amount of 20% of the unpaid tax amount in relation to a vehicle “hidden” from inspectors.

Self-propelled gun or truck?

There are vehicles that are not intended for use on public roads. These include, for example, excavators, scrapers, dump trucks and other mining equipment. These vehicles are considered to be self-propelled. And, accordingly, lower tax rates apply to them than to freight transport. But tax authorities do not always agree with this. They are trying to classify them as freight transport, which will significantly affect the amount of tax.

You should rely on the relevant written explanations from the authorities.

If the vehicle is not operated on public roads and is registered with Gostekhnadzor, then the tax rate is applied for the category “other self-propelled vehicles” (letter of the Ministry of Finance of Russia dated May 31, 2006 No. 03-06-04-04/21 and the Federal Tax Service of Russia dated July 6, 2007 No. 18-0-09/0204).

Therefore, register your self-propelled vehicle with the Gostekhnadzor authorities, and not with the traffic police.

Let us note that judges in such a situation are most often inclined to side with taxpayers. They argue that, according to the wording of the Tax Code, transport tax is used for the maintenance and sustainable development of public roads (non-urban roads). And if the cars are not intended for movement on public roads, then they are classified as “other self-propelled vehicles” and not as “trucks” (Resolution of the Federal Antimonopoly Service of the Ural District dated March 26, 2007 No. F09-1943 / 07-S3, Federal Antimonopoly Service of the West Siberian District dated March 19, 2007 No. F04-1512/2007(32567-A70-40)).

When to transfer the tax amount

Taxpayers-organizations must remit transport tax no later than the date established by the legislation of the region. According to the provisions of Chapter 28 of the Tax Code of the Russian Federation, such a date cannot be earlier than February 1 of the year following the tax period.

The laws of the constituent entities of the Russian Federation may introduce reporting periods for transport tax. These are the first, second and third quarters, respectively. In regions where reporting periods have been introduced, organizations must make advance payments throughout the year. The size of such a payment is one-fourth of the product of the tax base and rate. Advance payments must be transferred within the period established by the law of the constituent entity of the Russian Federation. When paying the final tax amount, advance payments made during the year must be taken into account. Regions in which reporting periods have been introduced have the right to exempt certain categories of taxpayer organizations from advance payments.

Taxpayers - individuals (including individual entrepreneurs) do not make advance payments for transport tax. They only remit the total tax amount stated in the notice. Individuals are required to pay transport tax no later than December 1 of the year following the expired tax period.

In addition, individuals can voluntarily make the so-called single individual tax payment. To do this, you simply need to transfer a certain amount to the appropriate Federal Treasury account. The money will be written off to fulfill the obligation to pay “property” taxes, including transport tax. The inspection itself will decide how to offset the funds: against upcoming payments or towards payment of arrears.

Re-registration from branch to branch

If your company has several branches located in different regions, then the following situation may arise.

Let's say you re-register a car from one branch to another. How should you pay tax in this case? It turns out that there are two tax inspectorates, and there is only one taxpayer. In this case, the Ministry of Finance explains that there should be no double taxation.

Please note: the first branch pays for the month in which the re-registration was completed. Starting next month, the obligation to pay tax passes to the second branch (letter of the Ministry of Finance of Russia dated March 27, 2007 No. 03-05-06-04/16).

CJSC Aktiv has two branches (branch No. 1 and branch No. 2). Branches are located in different regions of the Russian Federation. In August, Aktiv will re-register the car from one branch to another. Therefore, if branch No. 1 deregisters the car in August, then branch No. 2 begins paying tax in September.

What kind of transport does not pay tax at all?

There are cases that exclude payment of the fee.

7 cases of exemption from the fee:

- the car was stolen;

- the equipment is intended for agriculture;

- power less than 100 horsepower;

- government vehicles;

- vehicles belonging to shipping companies;

- special cars for people with disabilities;

- equipment owned by utility companies. For example, machines for laying asphalt or removing snow.