What are the advantages of entrepreneurs switching to a simplified taxation system? Who is allowed to pay taxes to the state budget at minimum rates and what are the pitfalls of their application?

The simplified tax system makes tax reporting easier for individual entrepreneurs () and legal entities. Instead of having a large variety of taxes collected from people doing business, there is only one that is required to be paid. Moreover, the interest rate at which the amount transferred to the state budget is determined can be adjusted to the needs of the enterprise.

Merchants who switched to a simplified system in 2021 are provided with 2 methods of settlement with the state:

- Based on the profit received during the reporting year, the rate will be 6%.

- When the tax base is obtained by subtracting expenses incurred in business activities from the enterprise's profit received for the current reporting period. In this case, the amount of tax levied is in the range of 5–15%.

The last point is vague. To specify the tax rate, they look at the characteristics of the products manufactured by the enterprise. The region in which it operates also has a great influence.

The minimum amount of tax transferred under the simplified system is 1%. However, not every company that switches to such taxation pays the lowest rate. Who might be among the lucky ones?

What is the minimum tax under the simplified tax system “income minus expenses”

The minimum tax is determined and paid only when simplified with the object “income minus expenses”.

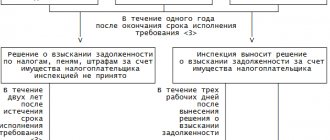

However, it is paid only in cases where its amount turns out to be greater than the amount of tax calculated in the general manner (at a rate of 15% or another established in the region). The minimum tax under the simplified tax system should be calculated based on the results of the year. In some cases, in the event of an unplanned transition during the year to the general taxation regime with the simplified tax system, the minimum tax may be transferred to the budget at the request of the tax inspectorate. With this approach, the Federal Tax Service of Russia equates the last reporting period to the tax period. However, such circumstances occur very rarely.

To learn about what taxes you will have to pay when working on the simplified tax system, read the article “What taxes and how do you need to pay under the simplified tax system?” .

Payment of the minimum tax is made within the same time frame and in the same manner as the tax calculated at the basic rate.

However, a payment order for the minimum tax still differs from the regular tax. Want to know which ones? Get free access to ConsultantPlus, see a sample of filling out such a payment form and find out whether you compiled it correctly.

The procedure for recognizing additional expenses for customs payments under the simplified tax system in 1C 8.3

Customs payments are taken into account as expenses (clause 11, clause 1, article 346.16 of the Tax Code of the Russian Federation), and are also separately taken into account in the organization’s KUDiR under the simplified tax system.

In 1C 8.3 section “Customs payments” there is an item “Goods written off”. This paragraph was introduced because the Federal Tax Service gave its explanations and their position is quite strict. The position of the Federal Tax Service is that customs payments should be included in the KUDiR as goods are sold, subject to payment to the seller.

In order to reflect customs payments in KUDiR and include them in expenses, the following conditions must be met:

- the import of goods has been formalized;

- customs duties must be paid;

- goods sold.

Thus, if in 1C 8.3 in the last paragraph “Goods written off” the checkbox is checked, then customs payments will go to KUDiR at the end of the month, with the document “Write-off of customs payments for the simplified tax system” during regulatory procedures. If there is no checkbox, then the expenses will be reflected when posting the “Customs Customs Declaration for Import” document:

In more detail, how to deal with possible errors associated with accounting for expenses under the simplified tax system, as well as legal requirements under the simplified tax system, was studied in the Master Class: SIMPLIFIED - All changes and Accounting in 1C:8. Theory and practice .

Will be considered:

- Theory “9 Circles Simplified. All changes for 2016." Lecturer: Klimova M.A. Read more >>

- Practice “STS - features and errors of accounting in 1C:8” Lecturer - O.V. Sherst Read more >>

Give your rating to this article: ( 1 ratings, average: 5.00 out of 5)

Registered users have access to more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP

Registered users have access to more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP

I am already registered

After registering, you will receive a link to the specified address to watch more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP 8 (free)

By submitting this form, you agree to the Privacy Policy and consent to the processing of personal data

Login to your account

Forgot your password?

Principles for calculating and paying the minimum tax

Calculating the minimum tax under the simplified tax system is simple. It is made according to the following formula:

Mn = Nb × 1%,

where Nb is the tax base, determined incrementally from the beginning to the end of the tax period.

Note that the tax base for the minimum tax under the simplified tax system is income calculated in accordance with Art. 346.15 Tax Code of the Russian Federation.

It may happen that the taxpayer will combine the simplified tax system “income minus expenses,” for example, with the patent taxation system. Under such circumstances, the amount of the minimum tax under the simplified tax system will depend only on the income received during the simplification. Confirmation of this is contained in the letter of the Ministry of Finance of Russia dated February 13, 2013 No. 03-11-09/3758.

Read about the document in which the data for calculating the simplified tax system is generated in this material.

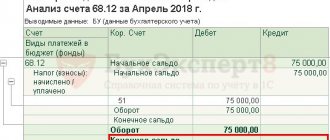

The procedure for recognizing input VAT expenses under the simplified tax system in 1C 8.3

“Input” VAT is included in expenses in accordance with paragraphs. 8 clause 1 art. 346.16 Tax Code of the Russian Federation. At the same time, in KUDiR, “input” VAT must be taken into account as a separate line, simultaneously with the costs of received goods, works, services to which it relates.

In order to reflect input VAT in KUDiR and include it in expenses, the following conditions must be met:

- Expenses for goods, works, and services received must be incurred for tax accounting purposes. That is, KUDiR should include amounts associated with the purchase of goods, materials, works or services of third-party organizations;

- Pay money to the supplier, including input VAT, which he submits in the amount of 100%.

According to the last condition, in the accounting policy setting “Accepted expenses for purchased goods, works, services”, you should check the box. If it is not supplied, then the “input” VAT will be included in KUDiR upon payment and reflection in the 1C 8.3 information base. It is necessary to wait for the VAT to go to KUDiR simultaneously as the second line with the expenses to which it relates:

Calculation example with simplified tax system 15% of the minimum tax

Let us show with an example how to calculate the minimum tax under the simplified tax system.

Example

Omega LLC uses the simplified tax system with the object “income minus expenses” in its activities. The results of work for the year are as follows: income amounted to 250,000 rubles. (including for the 1st quarter 30,000 rubles, for the 2nd quarter 70,000 rubles, for the 3rd quarter 80,000 rubles, for the 4th quarter 70,000 rubles)., expenses - 240,000 rubles. (including for the 1st quarter 32,000 rubles, for the 2nd quarter 65,000 rubles, for the 3rd quarter 72,000 rubles, for the 4th quarter 71,000 rubles). Thus, the tax base is equal to 10,000 rubles. (RUB 250,000 – RUB 240,000). The tax rate applicable in the region of operation is 15%.

Next, the accountant of Omega LLC must perform the following operations.

1. Determine the amount of 15 percent tax based on the received tax base:

10,000 rub. × 15% = 1,500 rub.

2. Calculate the 1 percent tax (minimum). In this case, only income is multiplied by 1% without deducting costs:

250,000 rub. × 1% = 2,500 rub.

3. Compare the obtained values:

1,500 rub. < RUB 2,500

It can be seen that the amount of the minimum tax is more than the 15 percent tax.

4. Pay the tax.

At the end of the year, Omega LLC must pay the minimum tax to the simplified tax system, since its amount is greater than the tax calculated according to the rules of 15%.

NOTE! If advance payments were calculated based on the results of the reporting periods, then the minimum tax must be paid minus the calculated amounts of advance payments (clause 5.10 of the procedure for filling out a declaration under the simplified tax system, approved by order of the Federal Tax Service of Russia dated February 26, 2016 No. ММВ-7-3 / [email protected ] ). Based on the data in our example, the amount of calculated advance payments for 9 months will be 1,650 rubles. ((30,000 + 70,000 + 80,000 – 32,000 – 65,000 – 72,000) × 15%). Therefore, at the end of the year you need to pay a minimum tax of 850 rubles. (2500 rub. – 1650 rub.).

Read about the rules for preparing a payment document for payment of the simplified tax system in this article.

The difference between the amount of the minimum tax and the tax calculated in the usual manner can be taken into account in expenses for calculating tax according to the simplified tax system with the object “income minus expenses” in the following tax (NOT REPORTING!) periods. And in case of receiving a loss, increase it by the amount of this difference and transfer it to the future (clause 6 of Article 346.18 of the Tax Code of the Russian Federation, letters of the Ministry of Finance of Russia dated January 18, 2013 No. 03-11-06/2/03, dated June 15, 2010 No. 03- 11-06/2/92).

In our example, starting next year, the difference that Omega LLC can include in expenses under the simplified tax system (or increase the loss) will be 1,000 rubles. (2500 rubles minimum tax - 1500 rubles tax according to the simplified tax system for the current year).

The procedure for recognizing material expenses under the simplified tax system in 1C 8.3

Material expenses are expenses that are incurred when purchasing materials.

Material expenses are accepted for tax purposes and reflected in KUDiR at the moment when one of the events last occurred:

- The materials have been accepted for accounting;

- Payment for materials has been made (clause 2 of Article 346.17 of the Tax Code of the Russian Federation)

If two conditions are met, then in 1C 8.3 material expenses are included in the income and expenses accounting book (KUDiR) according to the last date of this event.

From January 1, 2009, costs in the form of expenses for raw materials and materials are taken into account immediately after receipt and payment, until they are released into production. Therefore, it is sufficient to fulfill the first two conditions. They were put down by the developers of 1C 8.3 and cannot be changed. And the release of materials into production was before 2009. Now you don't have to wait for this moment:

Results

Using the simplified tax system “income minus expenses”, at the end of the year, check what tax you will need to pay - calculated in the usual manner or the minimum.

If a minimum tax is payable, when paying, do not forget to deduct the calculated advance payments under the simplified tax system from the calculated amount. The difference between the minimum tax and the tax according to the simplified tax system, calculated in the usual manner, can be included in expenses (or the amount of loss can be increased by its amount) in subsequent tax periods. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Conditions of application and procedure for switching to the simplified tax system 15%

To switch to the simplified tax regime “Income minus expenses”, the business owner must submit an application to the tax office that carries out registration. This can be done simultaneously with the submission of documents for registration, within a month after it, or later, during the work process (in this case, the transition will be carried out from January 1 of the next calendar year).

To switch to the simplified tax system, you must prepare and send an application in the prescribed form to the Federal Tax Service. It contains data confirming that the company has the right to apply this tax regime:

- the enterprise’s income for the reporting period is no more than 150 million rubles;

- number of employees - up to 100 people;

- the cost of the organization’s fixed assets is no more than 150 million rubles;

- the share of participation of other legal entities in the business is no more than 25% (relevant for LLCs).

If at least one requirement is not met, the transition is impossible.

Companies applying the simplified tax system of 15% must meet a number of conditions in order not to lose this right. For example, income for 9 months should not exceed 112.5 million rubles. The rest of the conditions are the same as for switching to a simplified version.

simplified tax system "income"

When calculating tax, only revenue is taken into account. The tax office is not interested in your expenses - they do not need to be confirmed, so accounting is a little easier. Regions can set their own tax rate, but not lower than 1%. When operating in St. Petersburg, you will pay 6% on income received.

For example

, you are selling a product worth 100 rubles. Regardless of how much you bought it for resale or how much you spent on production and additional expenses, you will have to pay tax on the proceeds. For St. Petersburg, the tax amount = 6% * 100 rubles. = 6 rub.

Keep in mind that Article 251 of the Tax Code establishes a list of income that is not taken into account when determining the tax base.

What is considered income and expenses in this tax regime?

For LLCs and individual entrepreneurs, the use of the simplified tax system of 15 percent means the obligation to reflect income and expenses in the accounting book (KUDiR). Not all of them are recognized by the Federal Tax Service as determining the tax base.

Income

In accordance with the provisions of the Tax Code of the Russian Federation, the day of receipt of income is considered the day it is received in a bank account or at the cash desk. Income for the simplified tax system of 15% can be considered the receipt of funds:

- from the sale of own products, works or services;

- from the sale of goods purchased for further sale;

- from the implementation of property rights;

- property, work, services or property rights received free of charge;

- fines, penalties and other sanctions for violation by the counterparty of the terms of the agreement (provided that the other party agrees with this violation or there is an appropriate court decision);

- in the form of interest on loans and borrowings provided by the company;

- from equity participation in other organizations;

- from leasing or subleasing property;

- from participation in a simple partnership;

- receipts in foreign currency, which must be recalculated on the day of receipt at the current exchange rate;

- income in kind - at market prices.

The following cannot be classified as income:

- income indicated in;

- income of foreign companies for which the payer of the simplified taxation system pays income tax;

- dividends;

- income from transactions with securities.

Under this taxation regime, income is accounted for on a cash basis, and the date of recognition of income is the date of receipt of funds in the cash register or on the account, as well as the date of receipt of property. It is important to take into account that the amount of income also includes the amount of advance payments or prepayments received for future deliveries of goods and provision of services.

Expenses

The list of expenses that can be taken into account when calculating the simplified tax system of 15% for an individual entrepreneur or LLC is enshrined in the Tax Code. They should be:

- economically justified;

- confirmed by primary documents (acts, invoices, etc.);

- used for the main type of economic activity.

The list of expenses available for inclusion in the database has been determined. This list is exhaustive. If your expense is not in it, then it cannot be indicated in the database

. It is also worth keeping in mind that expenses are taken into account in determining the basis only after they are actually paid.

There are types of expenses that cannot be taken into account when determining the tax base, for example:

- for installation of advertising structures;

- to write off debts that cannot be collected;

- fines, penalties and other payments due to violation of obligations;

- payment for personnel services provided by third parties;

- SOUT services;

- purchasing bottled water for the office;

- subscription to printed publications;

- expenses for cleaning areas from snow and ice, etc.

Expenses must be economically justified. This means that the expenditure has a specific business purpose and is aimed at generating profit. At the same time, in accordance with the legal position of the Constitutional Court of the Russian Federation, expressed in, it is the focus on making a profit from entrepreneurial activity that is important (even if this result has not been achieved).

In addition, each expense must be documented. To do this, you will need at least two documents: proving the operation (waybill, delivery and acceptance certificate, etc.) and confirming payment (for non-cash payments - a payment order, account statement or receipt, for cash - a cash receipt). All documents confirming expenses for the simplified tax system must be kept for three years.

Simplification expenses are taken into account only after their actual tax payment. The amount is reflected in KUDiR on the day when the money was transferred from the account or issued from the cash register. If payment is made by bill of exchange, then the date of recognition of the expense for the simplified tax system will be the day of repayment of the bill of exchange or the day of transfer of the bill of exchange by endorsement.