The procedure for determining the VAT rate on an advance payment

When receiving an advance, the VAT rate is determined by calculation. Depending on the basic rate for goods, works, and services produced, it can be calculated as 18/118 or 10/110.

Example 1.

An advance was received against the supplier of goods taxed at a rate of 10%. The advance amount is 200 thousand rubles, it is necessary to calculate VAT.

VAT in this case will be

200 000,00 * 10 / 110 = 18 181,82

Example 2.

An advance payment was received for services taxed at a rate of 18%. The advance amount is 177 thousand rubles, it is necessary to calculate VAT.

VAT in this case will be

177 000,00 * 18 / 118 = 27 000,00

When is it not necessary to charge VAT?

The taxpayer has the right not to charge tax on the advance payment under certain circumstances:

- if an advance was transferred for transactions that are not subject to taxation;

- if the prepaid transaction is carried out outside the Russian Federation;

- if the seller is exempt from paying value added tax, as it belongs to the “special regime” category. SNR are reflected in Art. 18 of the Tax Code of the Russian Federation: for agricultural producers, a simplified system, in the form of a single tax on imputed income, a patent system, on professional income;

- if the seller is exempt from paying value added tax for other reasons. For example, if the amount of revenue for the three previous months did not exceed 2 million rubles, the taxpayer may not pay VAT;

- if the advance is received for transactions for which the VAT rate is 0%. As an example: during expert sales, when using the processing mode in the customs territory, during international freight transport, etc.

There is also no need to charge VAT if the advance payment is made for transactions for which the production cycle is longer than 6 months.

Peculiarities of determining VAT on an advance payment if the advance payment and shipment belong to the same tax period.

Despite the fact that it seems logical in this case to calculate VAT only once, from shipment, regulatory authorities insist otherwise.

According to the regulatory authorities, VAT must be charged first on the advance received, then on the sale. And accordingly, issue two invoices - for the advance received and for the sale.

Then, when filling out the purchase ledger, you must record the VAT on the advance payment as a tax deduction.

The VAT Declaration must reflect both cases of VAT calculation - both from the advance received and from the sale, as well as the VAT deduction.

Courts often take the opposite point of view and believe that there is no need to charge VAT on advances received if both the advance and the sale fall within the same tax period.

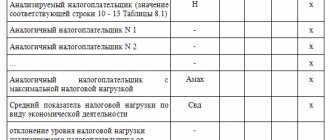

Table 1 shows the documents for each case.

Table 1.

| No. | VAT on the advance, if the advance and sale are in the same tax period | Document |

| 1 | VAT is charged, an invoice needs to be issued | Letter from the Ministry of Finance of the Russian Federation dated 10/12/2011 No. 03-07-14/99, Letters from the Federal Tax Service of the Russian Federation dated July 20, 2011 No. ED-4-3/11684, dated March 10, 2011 No. KE-4-3/3790, dated 02/15/2011 No. KE-3-3/ [email protected] , Resolution of the Federal Antimonopoly Service of the North Caucasus District dated 06/28/2012 No. A32-13441/2010. |

| 2 | There is no need to charge VAT | Determination of the Supreme Arbitration Court of the Russian Federation dated September 19, 2008 No. 11691/08, Resolutions: FAS of the North Caucasus District dated May 25, 2012 No. A32-16839/2011, FAS Volga District dated September 7, 2011 No. A57-14658/2010 |

Value added tax (VAT) in Russia

In economic terms, VAT is an indirect tax that is included in the price of goods and is paid by the buyer to the seller. The latter is to transfer the tax amount to the government. But legally, it is the seller, not the buyer, who is considered the VAT payer (that is, the one who is legally responsible for paying it).

Taxpayers for VAT purposes are all Russian legal entities and individual entrepreneurs with certain exceptions, which we will consider below.

Foreign legal entities are required to register as taxpayers in Russia when their presence in the country meets certain criteria. It should be noted, however, that a foreign legal entity may also be required to pay VAT even without a Russian presence in cases where their activities are subject to tax under the supply rules. In this case, if a foreign legal entity has several units in Russia in different cities or municipalities, then it may choose to submit its VAT compliance reports and pay taxes for all units through one of them. The local tax office in each location must be notified in writing of the election (Article 174).

Features of issuing an invoice when receiving an advance

Upon receipt of the invoice, the seller must issue an invoice for the advance received.

The procedure for issuing an invoice for an advance payment is defined in Decree of the Government of the Russian Federation of December 26, 2011 N 1137.

The period for issuing such an invoice is 5 calendar days, because the same as when issuing a regular invoice.

The invoice is issued in two copies, one of which is transferred to the buyer.

For an advance invoice, it is important to indicate in line 5 the details of the payment document for the advance received.

When indicating the names of goods, works, services, you can use their generic name, which allows you to identify goods, works, services.

Filling out the columns begins with column 7, which indicates the estimated rate of 10/110 or 18/118 (

Property

You should be careful with deposits in real estate transactions. This is especially important if the property is purchased at auction.

These comments only apply to the purchase of property on which VAT is charged (taxable commercial property). If a deposit is paid to an interested party, solicitor's account or escrow account (usually on an exchange) and the seller does not have access to that money until completion, no tax point will be created.

Otherwise, any advance payment is processed in the same way as above and creates a tax point where the output tax depends on the amount of the contribution. Auction sellers may get these rules wrong. If no other tax point has been created, the income tax must be completed.

Transfer money to the casino

As you understand, the most important element in the scheme is the intermediate link to which one person transfers money and from where another person withdraws it. Our whole life is a game! With this in mind, we turn to the gaming site www.loto.ru. Anyone can anonymously register in it and receive their own gaming account, to which money can be transferred in various ways, including using postal and telegraphic transfers. With a small commission, it is possible to transfer money from one player to another, that is, from one account to another.

There are several types of accounts in the system, including those in which interest is charged for storing money. Withdrawal of money is possible (with different fees) to a bank account (free) or by postal transfer. Foreign casinos can also be used as intermediaries for anonymous transfer of money. A person deposits money into his gaming account and then transfers it to another player, who uses it as he wishes. You can try to play in a casino, by chance increasing or decreasing the amount, or you can immediately withdraw the money as your winnings. There are a great variety of online casinos on the Internet. For example, one of them is www.kiwicasino.com. By accessing this site, you can order a free CD with gaming software, which (also free) will be delivered to the address you specify.

Anonymous money transfers via the Internet

Many programmers and designers are faced with a situation where, under the terms of their contract with their employer, they do not have the right to work for a third-party company. And sometimes the customer from this third-party company does not want to demonstrate their relationship with a well-known developer in a narrow circle. In such cases, the question arises about anonymous transfer of money...

You have to pay extra to ensure anonymity, so such money transfers are more expensive than regular ones. An anonymous transfer is made using one or more intermediate links that hide information about the sender or recipient, and sometimes about both at the same time. Concealing complete information about the participants in the operation at certain stages does not prevent the money from successfully making its way.

Let's consider the existing possibilities: the traditional way to transfer money within the country from person to person is by postal or telegraphic transfer. For the success of the operation, it is necessary to know the exact address of the person to whom the money is going, his last name and first name or last name, first name and post office address if the transfer is sent post restante. The sender of the transfer must provide personal information.

One of the realities of the Internet is that you can often cooperate with a person knowing only his pseudonym and established reputation on the Internet.

Plastic cards "Cirrus i"

At all times, there were people who did not want to attract unnecessary attention to themselves and their money. Previously, secret belts, body bags, and internal pockets were used. At the end of the 20th century, new opportunities to pay for goods and services using payment cards appeared, but the problem of confidentiality remained.

Today, to solve this problem, banks around the world offer to use an international debit card with an increased level of confidentiality “Cirrus I”. The direct purpose of the Cirrus I card is to provide cash withdrawals from automated teller machines (ATMs) around the world. The Cirrus I card has no cash withdrawal limits - the amount of money that can be withdrawn from the account in a certain period is limited only by your resources. All Eurocard or Cirrus branded ATMs are at your service (more than 601,000 ATMs worldwide).

The advantage of the Cirrus I card is anonymity - the user name is not indicated on the card. It can only be used by a person who knows the PIN code; authorization of withdrawal operations occurs without using a username. You can also get a “Cirrus INTELLIGENCE” card, the annual fee for using the bank’s services is $50. There is a 1.5% fee for cash advances (minimum $3).

Electronic payment systems

Now in Russia there is the only anonymous electronic payment system, PayCash - www.paycash.ru To open an anonymous account in PayCash, you must download special software from the server. After installing it, by connecting to the Internet, you create one or more accounts of the type EcomBank 410012380020 (RUB). “PayCash” actually consists of several networks operating according to the same standard and operating in rubles, dollars, hryvnia and lats. They can be exchanged for one of three types of currencies or purchased goods in online stores that accept payments in this electronic currency. The conversion rate is set in the PayCash exchanger every Friday at the calculation: the value of the Central Bank on Saturday minus 3% and is valid for a week (in the future, PayCash employees plan to more quickly monitor rate changes and reduce the “margin”).

Users can transfer money from one e-wallet to another, but for someone who wants to make a one-time anonymous payment, fiddling with installing the software may seem unnecessarily tedious. In addition, when transferring money, 1% of the transferred amount is charged. Therefore, the easiest way is to immediately indicate your account number in the payment system.

Knowing the account number, they will be able to send you a postal or telegraphic transfer, without knowing either your place of residence or your first and last name. The cost of withdrawing money from PayCash is 1% of the withdrawn amount directly to the system itself and the interest transferred to the transfer agent, if used.

For example, when withdrawing electronic money from the system, you can send a postal transfer to yourself, then the commission of the transfer agent, which the post office will act as, will be 8%. Transfer to the account of any commercial bank in Russia is free (only 1% due to PayCash is retained). According to the results of observations, the best way to withdraw money is to transfer it to an account associated with a plastic card of a commercial bank.

Choosing a bank is, by and large, a matter of your personal taste. If you are going to immediately withdraw money transferred to the card, it is best to use the bank whose branch or ATM is most convenient to get to. When withdrawing money from ATMs of the bank where the card was issued, commissions for this operation are either not charged at all or are minimal. Money kept in a bank account, as opposed to saving it in the form of electronic cash "PayCash", earns interest. Given this, I don't see the point in saving a lot of money in the form of electronic cash, unless, of course, you regularly make large purchases in electronic stores. PayCash is the only anonymous electronic payment system, but using it is not the only way to make them.

Withdrawing money from an account in a foreign bank

Receiving money from abroad, earned through participation in affiliate Internet programs or in the field of personal work, is fraught with many difficulties. Basically, these are not technical difficulties, but problems generated by the imperfection of the laws of the Russian Federation. Anyone who is familiar with web page layout and the basics of e-commerce can open their own resource on the Internet and start making a little money from it. For example, an amateur site with erotic photographs of you and your girlfriend will allow you to get a hundred or two bucks from the credit cards of rich bourgeoisie. But try to register your company specializing in making money on the Internet (let’s just call it “Photofact: Me and Masha on Vacation”), and you will see from personal experience that the money earned will not be enough to register, and the registration process is so tedious that it will be successful Only a very persistent person can pass it.

You can simply order a check for yourself without registering a company, but the process of cashing it in a bank in your home country may result in getting acquainted with the tax office with all the ensuing consequences. Let's talk in more detail about accounts abroad, especially since they have recently been officially allowed to open. However, their existence should be reported to the tax office, and I hope that when opening foreign accounts for yourself, you will act like law-abiding citizens. You can open a foreign currency account and get a plastic card for withdrawing money from it in banks in those countries of the world where they are not afraid of dealing with Russians - and, unfortunately, there are very few of them...

Opening a bank account in the USA without using the services of intermediaries is almost impossible. Having received a plastic card from a foreign bank, you can transfer money received abroad to its account and receive it at the nearest ATM. Any ATM located in Russia will be foreign to you, which means you will have to pay a higher commission. When choosing a foreign bank, you should pay attention to three factors:

Country of registration of the bank. Banks registered in offshore zones provide the most attractive terms of service, but the degree of trust in them, for obvious reasons, is less.

The cost of opening an account, the cost of annual maintenance, the amount of the initial deposit (the amount of money deposited into your account upon opening) and the method of crediting money for opening an account.

Possibility of receiving account statements online. It is especially good if full-fledged Internet banking is possible, that is, full account management with access via the Internet.

Considering the contradiction of these conditions to each other, it is difficult to give recommendations on choosing the best bank.

Other options

Concluding the topic of anonymous payments, we note that in the USA and other countries there are special companies specializing in check cashing. By registering with such a company, you can immediately indicate its address instead of your own. The check will be sent there by the foreign partner. The company's employees, most often our former compatriots, will take the trouble of cashing your check and then, after deducting a certain amount, transfer the money to you using one of the electronic payment systems. Since check cashing activities are semi-legal (the client is represented as an employee of this company), local authorities can close the company for violating the law.

There is a second aspect to the problem. By submitting a check for collection to the bank, you can be sure that you will receive money for it, having previously signed a paper stating that you are responsible for possible violations of currency laws yourself. By submitting a check for cashing to the mentioned company, you can complete the transaction anonymously. But if the company suddenly disappears, you won't be able to get your money back because the check was made out to them. Therefore, the issue of choosing a foreign partner should be approached with the utmost caution.

“Anonymous money transfers via the Internet” Igor Ananchenko, “Internet World”, No. 3 March 2002