Why is a collection order necessary?

The role of a collection order is simple: to pay for any services or work without the direct participation of the payer and his prior consent. However, such a procedure is only possible if an appropriate agreement has been concluded between the counterparties (i.e., including a clause on collection payment).

In other words, thanks to this document, the bank of the recipient of the goods or service transfers funds to the bank of the contractor or manufacturer, bypassing the parties to the transaction themselves. Neither the customer nor the contractor may provide the bank with any payment orders or other documents; the only thing that happens is that the payer’s bank notifies its client about the transfer of funds, and the recipient’s bank about their crediting to the account.

- Form and sample

- Free download

- Online viewing

- Expert tested

FILES

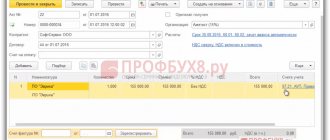

Replenishment of an additional current account for the collection amount

If the tax authority refuses to meet the debtor halfway (and formally the Federal Tax Service has the rights

!), then there is nothing left to do but replenish an additional current account. It can be done:

- by depositing cash into the account;

- by means of non-cash transfer from the main account (if available);

- issuing invoices to counterparties with other details.

But each of the above methods has its disadvantages. Deposit cash

only possible if they actually exist. If the company is in a difficult financial situation, then it is also necessary to find or collect this amount. To do this, proceeds can be withdrawn from the company’s cash desk (if any), or a loan or loan can be issued from the business owner or manager. If the amount of unpaid taxes is large, then it may take a long time to collect the amount to pay the tax. Applying for a loan to a legal entity is a long process. In addition, the company must have large turnover in the account for the previous year.

The second option is to transfer money from the main account

. Most often, if a company failed to pay a tax or fee on time, it means that it does not currently have this amount. Otherwise the tax would have been paid.

It is worth noting that when a decision is made to suspend operations on an account, the collection amount is blocked on all of the company’s accounts and debited from only one. That is, the organization has the right to manage money the amount of which exceeds the blocking.

Example: The Federal Tax Service has blocked transactions on current accounts. The collection amount is 50 thousand rubles. One of the company’s accounts contains 65 thousand rubles. What amount is the LLC entitled to use?

The enterprise has the right to dispose of only 15 thousand rubles, since 50 thousand will be blocked until the collection amount is debited from the current account to which the collection order was issued.

The last option is issuing invoices to counterparties with other details

for payment. The main disadvantages here are time and additional documents. The organization needs to notify the buyer that their details for payment for goods, works or services have changed in a separate letter, which is sent either immediately when the details are changed, or together with a posted invoice for payment.

If in the future the company wants to issue invoices to counterparties using the old details, then you will have to draw up a repeat letter

.

In what cases is this document required?

It cannot be said that the collection order is widespread. However, in some cases it occurs quite often, for example, in the practice of the tax inspectorate, when a collection order is sent to the tax debtor’s bank and debts are automatically written off from his accounts (such collection orders are subject to unconditional execution and cannot be contested). Or in the activities of public utilities, when an agreement is concluded between public utilities and the recipient of the service with the possibility of direct (i.e., not requiring the permission and participation of the direct payer) payments - in this case, the payment from the bank of the recipient of the service to the bank of the utility organization is also transferred by using a collection order.

Organizations sometimes also enter into similar agreements with each other, but this practice is not generally applicable, since it requires one hundred percent trust in relations between counterparties, as well as their indisputable solvency.

What to look for in a payment request

The payment request form has a strictly defined unified form, which is mandatory for use. Usually you need to make 2 copies . One of them, after registration and approval, is transferred to the bank, the second, after completion, is returned to the account owner.

Both copies must be signed by the director and chief accountant of the enterprise (but if the director performs the function of the chief accountant in the company, then one autograph is sufficient).

Today, there is no strict need to certify forms using a seal, since from 2021 legal entities are exempt from the obligation to use stamp products in their work (except in cases where this norm is specified in the company’s internal regulatory documents).

What needs to be done for the “scheme” to work

If enterprises are interested in making payments between them without their direct participation, they need

- conclude an agreement between themselves in which it is required to include a clause on settlements through a collection order;

- submit this agreement to the servicing credit institution.

After the agreement is concluded and the transaction is completed, the supplier’s (seller’s) bank forwards the collection order to the consumer’s (buyer’s) bank. Then the bank notifies the buyer about receipt of the document for payment and, if confirmed, the transfer occurs, then the recipient's bank similarly informs its client about the crediting of funds to the account.

Collection on an additional account: what can be done and how to avoid a repeat situation

So, the Federal Tax Service issued a demand for tax payment, but the organization did not pay it on time. Next, the tax authorities review information on open accounts

legal entity or individual entrepreneur in all banks in Russia.

Information on opening and closing current accounts is provided to the Federal Tax Service

and is updated in a timely manner by financial institutions without the participation of the client himself.

If a company has only one account, there are no problems. The tax authorities send a decision to suspend transactions on the current account to the taxpayer-debtor, and a collection order to the bank. The solution looks like this:

The collection order is not sent to the legal entity (debtor) itself either by the Tax Service or by the bank

. That is, the taxpayer will not be notified about which account the money will be written off from.

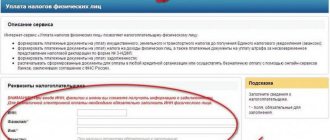

The presence or absence of blocking on the account can be checked

on the website of the Federal Tax Service of Russia at this link. To check, you need to select the “Request for current decisions on suspension” type from the list provided, indicate the TIN of the legal entity and the BIC of the bank (any bank in which the company’s account is opened). The form looks like this:

A controversial situation arises if an enterprise or individual entrepreneur has several open current accounts. In this case, decisions to suspend operations

according to the current account are issued to all accounts, and collection - only to one bank.

And if the collection order was generated for an additional account in which there is no money or there is not enough money for payment on demand, then a controversial situation arises: what to do in this case?

It is worth noting that collection cannot be withdrawn by the tax authorities

, if payment has not been made.

There are only 3 possible solutions:

- contacting the Federal Tax Service to generate a new collection order;

- replenishment of an additional current account for the collection amount;

- payment of the amount of the enterprise's debt by the business owner or other legal entity.

In the future, to avoid such situations, it is better for the company to write an official letter in free form

, in which to indicate which current account of the legal entity is the main one and to which all possible collection orders must be issued. This document can be issued on the official letterhead of the enterprise, if available. The letter must be registered both with the company and with the tax authority, so it is issued in 2 options (one option remains with the Federal Tax Service, the second with a mark of acceptance - with the legal entity). The document is signed by the manager or an authorized person and stamped (if any).

Who is interested in the collection form of payment?

First of all, collection is beneficial to the buyer. This is due to the fact that he always retains the right to transfer the payment or refuse it (this determines the low reliability of these transactions). However, the seller can hedge his bets by pre-stocking certain documents, in the absence of which the buyer will not be able to take possession of the goods legally.

This is important to remember, given that this banking operation is carried out in conjunction with the acceptance of such a payment, which implies the immediate shipment of products under the current contract, regardless of whether funds have been received from the buyer or not. The buyer pays the price of the goods upon receipt of a complete package of payment documents, which must first be checked by the seller to ensure compliance with its cost, quality and quantity with the conditions specified in the contract.

The payment procedure by collection orders has one significant drawback: documents go through banks for quite a long time, so payment may not occur as quickly as we would like. Along with this, there is an advantage: in banks this service is quite cheap.

Rules for registration and preparation of a collection order

The collection order must be drawn up in a certain form. It contains

- information about the parties to the agreement (names of enterprises),

- information about the banks between which direct transfer of funds occurs,

- numbers of current accounts of organizations,

- transfer amount,

- number and date of document preparation.

If there is an undisputed collection of funds from the payer’s account (for example, when writing off tax debts and other reasons), then the collection order must also indicate a reference to the rule of law.

The document is drawn up in four copies :

- the first one remains with the employees of the credit institution and on the basis of it the funds are written off from the payer’s account;

- the second copy is transferred to the receiving bank. In cases where the accounts of both organizations are in the same bank, the second copy of the collection order receives the status of a memorial order when funds are credited to the payee's account;

- the third copy is intended for the account holder himself;

- the fourth copy is certified by a bank employee and the seal of the credit institution and handed over to the client.

With or without acceptance

Money transfers involving a payment request can be made with or without the payer’s acceptance.

Acceptance is the agreement of a company with debts to pay them in full within a certain period of time.

If the payer is ready to pay for the transaction using acceptance, in the “Term of payment” request field, the recipient of the amount must indicate “With acceptance”, and in the line “Term for acceptance” put the number of days (working days) during which the payer undertakes to transfer the required amount.

Typically, the payer’s response is given five days (working days) or the period is specified in the agreement between the parties.

It should be noted that financial transactions using acceptance must be accompanied by statements from both parties.

It happens that a party to a contract, which must pay its monetary obligations using acceptance, refuses to do so - in this situation, it must give the credit institution a written explanation of its position.

There are often situations when organizations collect debts through a bank without acceptance. Most often this happens in court, due to compliance with the law, or when it is specified in the agreement between the parties. In the latter case, the payer is obliged to enter in advance a section on direct debiting of money into the agreement with the credit institution or make additional arrangements with the bank. agreement to the contract.

Also, bank specialists need to provide information about organizations that can issue payments for direct debiting of finances, information about services and products that can be paid for under such conditions, and links to specific contracts indicating their exact sections and clauses.

Sample of filling out a collection order

- First, write the document number and indicate the date it was completed.

- Next, indicate the type of payment and amount (necessarily in words and numbers).

- Then information about the payer is entered into the form: in the required cells put

- TIN and checkpoint numbers,

- full name of the company,

- information about the payer's bank (indicating its BIC).

- Next, in a similar manner, information about the payee and the credit institution in which he is serviced is entered into the collection order form.

- On the right side of the document, the current accounts of all organizations specified in the document are entered, and below:

- type of payment,

- purpose of payment

- and its order (if necessary).

- Then an agreement is entered into the document, according to which it became possible to use this document in settlements between enterprises (number and date of its preparation).

- Finally, the document must be signed by a responsible bank employee.