A unit of equity participation in a company can be with or without par value. If the capital is expressed in shares with a par value (par value), then the corporation's charter establishes the par value (par value) that is indicated on the shares when they are printed. The face value can be equal to 10, 1, 5, 100 or any other amount determined by the founders of the corporation. The par value of an ordinary share is usually less than the par value of a preferred share.

In most countries, the par value (face value) of a share is the amount of each share that is reflected in the share capital accounts and constitutes the authorized capital of the corporation. A corporation cannot declare dividends that would cause its shareholders' equity to be less than its authorized capital stock. Therefore, par (face value) is the minimum part of capital that guarantees payment to creditors. Amounts received from issuing shares in excess of their par value are called share premium and form part of the company's share capital.

Shares without par value are shares of a company that do not have a par value (par value). There are several reasons for issuing such shares. The first is that investors sometimes confuse the market value of a stock with its par value, which is essentially an arbitrary value. Another reason is that most countries do not allow the initial issue of shares below their par value, which deprives the company of a certain amount of flexibility in raising capital.

Shares without par value may be issued with or without a stated value. In most countries, the law obliges the board of directors of a corporation to set a stated price for such shares when issuing shares without par value. The declared value can be any number set by the board of directors, although some countries impose a minimum declared value. The declared value may be assigned before or after the issue of shares, unless otherwise provided by law.

If a corporation issues shares of stock without par value without a stated value, the proceeds from the issue are recorded in the Stockholders' Equity account. This amount is included in the authorized capital of the corporation, unless the legislation of the country provides otherwise. Since additional shares can be issued at different values, the amount of credit to the Share Capital account will not always be constant. This is one of the differences in accounting for the issue of shares with a par value from shares without a par value with a declared value.

When shares without par value but with stated value are issued, the shares are recorded in the share capital account at stated value. Any amounts received in excess of the declared value are recorded in the share premium account. The excess over the stated value represents a portion of the company's share capital. As a rule, the declared value of the shares is considered in this case as the authorized capital of the corporation.

Increase the authorized capital

An increase in the authorized capital due to an additional issue of securities can be carried out both by attracting third-party funds and by using the assets of the issuer.

In the second case, the following can be used for this:

- retained earnings received in previous years;

- Extra capital;

- unspent portion of special purpose funds.

The procedure for increasing the number of company shares consists of 6 stages, which follow each other in the manner regulated by law.

Placement decision

The decision to issue additional shares becomes the first step in this process. It must be adopted at a meeting of shareholders or the board of directors. At the same time, the volume by which the existing stock of securities will be increased is determined. It must exceed a quarter of what is already in circulation.

Permission to place shares.

Such a decision is a document drawn up according to a regulated template.

In addition to the number of shares issued in addition to existing ones, it indicates:

- type (privileged or not);

- placement method;

- placement costs and method for determining them;

- features of payments when placing by subscription;

- additional conditions.

The cost does not have to be specified in this document. It can be fixed later. The securities must be declared at a par price no lower than that of the original issue. An increase in this parameter is allowed, and the company’s resulting income is not taxed.

Only participants of the joint stock company whose net asset value exceeds the size of the authorized capital can make such a decision.

Negative consequences of additional share issue

Most of all, an additional issue harms the interests of holders of relatively small shares of the company's shares - minority shareholders. Ordinary holders of small blocks of shares often have no real opportunity to prevent this process. Although the decision is made at the general meeting of shareholders (unless otherwise stated in the company's charter), due to the blurring of shares and uncoordinated actions of minority shareholders, the majority of the shareholders' votes have the main weight here. And majority shareholders, as mentioned above, often act not so much in the interests of the company as they look after their own selfish interests (and the interests of the company do not always coincide with the interests of individual majority shareholders).

What happens to the company's existing shares when they are issued additionally? It's simple. Let's say you own ten shares worth 1,500 rubles each. At the same time, you are the owner of a certain share in the business of the issuing company (with a total number of shares of 100,000 pieces, your share in the company will be (10/100,000) x 100% = 0.01%) and, accordingly, you can count on the corresponding share in profit (in the form of dividends).

And after an additional issue of shares is carried out (let another 20,000 shares be issued), the following changes will occur:

- The share of the business per share will decrease. If previously it was 0.001% ((1/100000)x100%), now it will be equal to 0.0008% ((1/120000)x100%);

- Accordingly, the amount of dividends paid per share will decrease;

- All this will naturally lead to a decrease in the market value of shares; it will decrease in proportion to the amount that was re-issued. That is, in our case, if the number of shares has increased by 1.2 times, then their price will also decrease by about 1.2 times and will be around 1,250 rubles**.

As you can see, for ordinary shareholders of a company who own small shares in it, an additional issue is a very unpleasant procedure since it can significantly reduce the value of their share and the amount of dividends received.

Therefore, in order to reduce, as far as possible, the negative consequences of an additional issue of shares and protect the rights of minority shareholders, Russian legislation introduces a number of rules and restrictions applicable to this procedure.

** It should be understood here that the market value of shares depends on many factors, and therefore its value, as a rule, always differs from that calculated in this way.

State registration of additional issue

This procedure is primarily regulated by Law No. 39-FZ.

It must be made no later than 3 months from the moment it was decided to increase the number of shares of the company.

The body responsible for registering securities is the Central Bank of the Russian Federation. To pass it, you need to provide its territorial office with a set of documents regulated by the Regulations on Emission Standards.

Rules for additional issue of shares.

It includes:

- society questionnaire;

- extract from the Unified State Register of Legal Entities;

- a copy of the company's charter;

- a copy of the release decision;

- calculation of net asset value;

- confirmation of payment of the duty.

Documents occupying several sheets must be bound together. An inventory is prepared for the package.

After the expiration of the period established by the same standard, the representative of the joint-stock company is issued supporting documents. This procedure may take up to 30 days.

A set of securities may be registered simultaneously with the issue; in some cases, when placed by subscription, it is mandatory. When using it, each step of the process must involve disclosure.

Legislative regulation

Additional issue of shares in the Russian Federation must be carried out in strict accordance with the provisions set out in the following legislative acts:

- Federal Law of December 26, 1995 N 208-FZ (as amended on November 4, 2019) “On Joint Stock Companies”;

- Federal Law of April 22, 1996 N 39-FZ (as amended on July 26, 2019) “On the securities market.”

Here is an excerpt from Article 28 of Federal Law No. 208-FZ:

And here is what Article 40 of the same law says:

Placement of shares

The decision on placement is made within 6 months after it was decided to issue additional shares. You can begin placement after registering the additional issue.

If it is distributed to the current owners of previously issued shares, then this action is reduced to standard accounting entries. In this case, each co-owner receives the type of papers that he already has.

Placement by subscription is alienation. In this form, assets are transferred to third parties who previously had no share in the property. This step involves payment, conclusion of contracts, etc. Its main disadvantage is the reduction of the share of previous owners in the business and the profit from dividends.

The nature of the way shares are placed.

Guidelines for disclosing information on earnings per share

9. The amount of diluted earnings (loss) per share shows the maximum possible degree of decrease in profit (increase in loss) per one ordinary share of a joint-stock company in the following cases:

conversion of all convertible securities of a joint stock company into ordinary shares (hereinafter referred to as convertible securities);

upon execution of all purchase and sale agreements of ordinary shares from the issuer at a price below their market value.

Convertible securities include preferred shares of certain types or other securities that give their owners the right to demand their conversion into ordinary shares within the period established by the terms of issue.

Profit dilution means its decrease (increase in loss) per one ordinary share as a result of a possible future issue of additional ordinary shares without a corresponding increase in the company’s assets, except for the cases provided for in paragraph of these Methodological Recommendations.

10. When determining diluted earnings (loss) per share, the values of basic earnings and the weighted average number of ordinary shares outstanding, used in the reporting period when calculating basic earnings per share, are adjusted to the corresponding amounts of the possible increase in these values due to conversion into ordinary shares all convertible securities of the joint stock company and execution of contracts specified in paragraph 9 of these Methodological Recommendations.

The adjustment is made by increasing the numerator and denominator used in calculating basic earnings per share by the amounts of the possible increase, respectively, in basic earnings and the weighted average number of ordinary shares in circulation in the event of conversion of securities and execution of contracts specified in paragraph 9 of these Methodological Recommendations.

The possible increase in profit and the possible increase in the weighted average number of ordinary shares in circulation are calculated:

for each type and issue of convertible securities;

for each agreement specified in paragraph of these Methodological Recommendations, or several agreements, if they provide for the same conditions for the placement of ordinary shares.

11. When determining a possible increase in profit, all expenses (income) related to the above-mentioned convertible securities and contracts that the joint-stock company will cease to carry out (receive) are taken into account in the event of conversion of all convertible securities into ordinary shares and execution of the contracts specified in paragraph of these Methodological Recommendations.

Expenses related to convertible securities may include: dividends due on preferred shares, which, in accordance with the terms of their issue, can be converted into ordinary shares; interest paid on its own convertible bonds; the amount of write-off of the difference between the placement price of convertible securities and the par value, if they were placed at a price below the par value; other similar expenses.

Income related to convertible securities may be: the amount of write-off of the difference between the placement price of convertible securities and the par value, if they were placed at a price higher than the par value; other similar income.

When calculating the possible increase in profit for the purpose of determining diluted profit (loss), the amount of the above expenses is reduced by the amount of the above income.

12. When determining the possible increase in the weighted average number of ordinary shares in circulation in cases of conversion of securities, all additional ordinary shares that will be placed as a result of such conversion are taken into account.

In case of execution of the contracts specified in paragraph 9 of these Methodological Recommendations, additional ordinary shares are placed at a price below their market value. Accordingly, for purposes of calculating diluted earnings (loss), it is assumed that a portion of the common shares issued under such an agreement will be paid at market value and the remainder will be issued without payment. Thus, when calculating the possible increase in the weighted average number of ordinary shares outstanding, only those that will be placed without payment are taken into account.

A possible increase in the number of ordinary shares in circulation without a corresponding increase in the company's assets is determined as follows:

(RS* - CR) x KA* RS* where РС* is the market value of one ordinary share, determined as the weighted average market value during the reporting period;

CR - the placement price of one ordinary share in accordance with the conditions specified in the agreement;

KA* is the total number of ordinary shares under the acquisition agreement.

A possible increase in the number of ordinary shares is taken into account in calculating the weighted average number of ordinary shares in circulation:

from the beginning of the reporting period;

from the date of issue of convertible securities or conclusion of an acquisition agreement, if these events occurred during the reporting period.

If, during the reporting period, the contracts specified in paragraph of these Methodological Recommendations are terminated, or convertible securities are canceled, as well as their conversion into ordinary shares, the possible increase in the weighted average number of ordinary shares in circulation is calculated for the period during which the convertible securities ( the agreements specified in paragraph of these Methodological Recommendations) were in circulation (were in force).

If the agreement specified in paragraph of these Methodological Recommendations is executed during the reporting period, the calculation of the possible increase in the weighted average number of ordinary shares in circulation is made for the period from the beginning of the reporting period (from the date of conclusion of the specified agreement) to the date of placement of securities, that is, the emergence of rights to ordinary shares from their original owners.

13. Based on the data calculated in accordance with the paragraphs of these Methodological Recommendations, the ratio of the possible increase in profit to the possible increase in the weighted average number of ordinary shares in circulation for each type and issue of convertible securities and contracts specified in the paragraph of these Methodological Recommendations is determined.

The obtained values should be arranged in ascending order: from the smallest value to the largest.

Basic earnings (numerator), in accordance with the specified sequence, increases by the amount of the possible increase in earnings, and the weighted average number of ordinary shares outstanding (denominator) increases by the amount of the possible increase in the weighted average number of ordinary shares outstanding.

14. Diluted earnings (loss) per share

represents the ratio of basic profit (loss), adjusted by the amount of its possible increase, to the weighted average number of ordinary shares in circulation, adjusted by the amount of possible increase in their number as a result of the conversion of securities into ordinary shares and the execution of contracts specified in paragraph of these Methodological recommendations.

To calculate diluted earnings per share, those convertible securities (contracts specified in paragraph of these Guidelines) are selected, the conversion of which into ordinary shares (execution) leads to a decrease in basic earnings (increase in loss) per share. For these purposes, it is necessary to analyze the values obtained as a result of calculations made in accordance with the paragraph of these Guidelines. If any of these values is greater than the previous one, i.e. leads to an increase in earnings per share of common stock outstanding, the relevant type (issue) of convertible securities or agreement has an anti-dilutive effect and is not included in the calculation of diluted earnings per share. If the obtained values are arranged in descending order, this means that all convertible securities and contracts available to the company, specified in paragraph of these Methodological Recommendations, have a dilutive effect.

15. For the purposes of calculating diluted earnings per share, the values of the numerator and denominator in the calculation of basic earnings per share are increased by the corresponding amounts of the possible increase in earnings and the weighted average number of ordinary shares outstanding and securities and the execution of contracts specified in the paragraph of these Guidelines that have a dilutive effect . The result obtained is an indicator of the maximum possible degree of dilution of earnings per share and is reflected in the financial statements of the joint-stock company.

Example 4:

Calculation of diluted earnings per share

Net profit of joint stock company "X" for 2000, reduced by the amount of dividends on preferred shares 64640 rub. Weighted average number of common shares outstanding during 2000 3232 pcs. Basic earnings per share 64640 : 3232 = 20 rub. Weighted average market value of one ordinary share 10 rub. The joint stock company placed before the reporting period:

convertible preferred shares with dividends in the amount of 4 rubles. per share, each of which is convertible into 2 ordinary shares1000 pcs. 20% bonds convertible into common shares, par value 500, each convertible into 5 common shares 1000 pcs. The joint stock company entered into an agreement giving the right to purchase ordinary shares from the joint stock company at a price of 9 rubles. 100 pieces. Calculation of the possible increase in profit and the possible increase in the weighted average number of shares in circulation

I. Convertible preferred shares Possible profit increase 4 x 1000 = 4000 rub. Additional number of shares 2 x 1000 = 2000 pcs. Possible increase in earnings per additional share 4000 : 2000 = 2 II. Convertible bonds Possible increase in profit due to savings on interest paid on bonds 500,000 x 0.2 = 100,000 rub. Possible increase in income tax expenses if the amount of interest paid reduces the tax base (rate 30%) 100,000 x 0.3 = 30,000 rub. Possible increase in profit minus possible increase in income tax amounts 100,000 - 30,000 = 70,000 rub. Additional number of shares 5 x 1000 = 5000 Possible increase in earnings per additional share 70000 : 5000 = 14 III. When executing the contract Possible profit increase 0 Additional shares without a corresponding increase in assets (10 - 9) x 100: 10 = 10 Possible increase in earnings per additional share 0 Calculation of diluted earnings per share

Name Numerator Denominator Earnings per share Execution of the contract 64640 + 0 = 64640 3232 + 10 = 3242 64640 : 3242 = 19.94 has a dilutive effect Convertible preferred shares 64640 + 4000 = 68640 3242 + 2000 = 5242 68640 : 5242 = 13.09 has a dilutive effect Convertible bonds 68640 + 70000 = 138640 5242 + 5000 = 10242 138640 : 10242 = 13.54 has an anti-dilution effect Diluted earnings per share 13,09

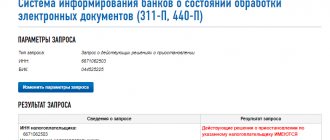

Registering a report

A report on the results of the additional issue is registered with the Central Bank of the Russian Federation after full implementation or after the end of the period allotted in the decision on the issue.

It is submitted no later than 30 days from the date of the earlier event. The procedure takes 2 weeks.

In addition to the report itself, you must submit for registration:

- statement;

- a copy of the protocol on the release decision;

- confirmation of the fact of disclosure of information;

- receipt of payment of the fee.

Change of charter

An increase in the number of shares is possible only if the establishing document contains clauses allowing this step. If they are missing, then the text of the Charter must be revised. The decision to release a new volume can be made only after approval of the new edition.

Upon completion of the placement, the Articles of Association are amended again. They are approved at a new meeting of shareholders. This is the last, sixth, stage of the process of increasing the mass of shares. Based on its results, form P13001, a sheet with a list of changes, or a new edition of the document are prepared.

These papers, together with copies of all protocols and the results of the issue, after payment of the fee, are transferred to the Federal Tax Service or the MFC.