An entrepreneur is an individual who is authorized by the state to conduct business. An individual entrepreneur can freely manage his money, but the tax office and the bank may have questions. In this article we will tell you how to spend and withdraw money from your current account so that everything goes smoothly.

Personal expenses are when an entrepreneur buys groceries in a supermarket, grabs coffee on the way to the office, or pays for kindergarten. Personal means not for business, but for yourself and loved ones. Personal expenses do not reduce taxes.

Business expenses are expenses that keep the business alive and move it forward. If you sew backpacks, you will need a sewing machine, accessories, and material. Business expenses reduce tax only on the simplified tax system “Income minus expenses.”

Why deposit your money into the cash register?

During the period of operation there may be different situations. At the initial stages, not every month can be profitable, and then the question arises about additional financing for your business.

In some cases, an entrepreneur wants to expand the boundaries of his business, in which case personal savings can help.

The law in no way prohibits an individual entrepreneur from managing his current account. You have every right to deposit funds and withdraw funds at any time. This advantage distinguishes the activities of individual entrepreneurs from LLCs.

The only prohibition on withdrawing money from the account may come as a result of tax debt or a court decision.

If at the moment the enterprise needs an additional cash injection, the individual entrepreneur can deposit his own funds into the cash register.

There may be several reasons for this:

- You want to maintain the financial condition of the company;

- Would you like to replenish your current account?

- Pay off some debts;

- Issue wages to hired workers from personal money (if the amount in the cash register is not enough for these purposes).

If the individual entrepreneur has debt and does not have sufficient funds on the balance sheet, depositing personal funds is a way out of this situation. This is especially true if the payment deadline is approaching, and the receipt of income to the individual entrepreneur’s account is not expected within a short time.

In any case, you need to register the deposit of your own funds correctly so that you do not have questions from the tax authority. Each transaction must be documented and correctly reflected in the company’s accounting.

Basics of Cash Payments

The legislation of the Russian Federation does not prohibit settlements between individual entrepreneurs and legal entities or individuals in cash. This norm is presented in Article 861 of the Civil Code of the Russian Federation. In addition, all cash payments between individual entrepreneurs and LLCs or other legal entities are regulated by the Central Bank of Russia, which issued Decree No. 3073-U under the title, which indicates its essence, “On the provision of cash payments” on 10/07/2013. Its standards are also valid in 2021. It includes several points that define the relationship between individual entrepreneurs, LLCs, as well as other individuals, in the process of making cash payments.

But there are exceptions that do not fall under the control of the Central Bank, namely:

- calculations, one of the parties to which is the Central Bank itself;

- when settlements are carried out to ensure banking operations;

- when paying customs duties;

- making wage payments, as well as other social payments;

- issuance of funds to individual entrepreneurs' employees on account;

- withdrawal of cash by an entrepreneur from his account for personal purposes that do not relate to business activities.

Any settlements that an individual entrepreneur makes with individuals are not subject to control. But at the same time, payments between an entrepreneur and an LLC cannot exceed the amount of 100 thousand rubles under one agreement. This rule has been in effect for several years and will continue to be relevant today.

We take into account funds on the balance sheet

Depositing your own money into the individual entrepreneur’s cash register must be carried out in compliance with the requirements of the legislation on accounting and taxes. An important feature is that there is no need to reflect the receipt of personal funds in the book of income and expenses!

These statements show only income related to the results of the company's activities. This includes revenues from sales and non-sales. According to Article 250 of the Tax Code, an entrepreneur’s own amounts are not included as such.

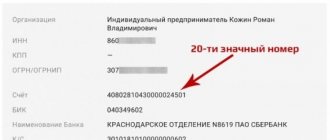

To justify the incoming payment, you need to have a strict reporting form indicating:

- Deposit amounts;

- Current account numbers;

- Account number of the individual from which the transfer was made (that is, yours);

- Operation dates;

- Name of the banking institution;

- Transfer destinations.

On the receipt order there should be a phrase in the purpose of payment approximately as follows: “Replenishment of the current account with personal funds.” This formulation will allow you to avoid problems with the tax authorities in the future.

When depositing personal money, you must be aware that you can only top up your individual entrepreneur’s account. Transferring your own funds to someone else's account is not allowed. The bank will refuse you this operation.

If you transferred your own money to the company’s cash desk to issue earnings to employees, then this operation is also not reflected in the book of income and expenses. In this case, it is necessary to generate strict reporting forms that will confirm the issuance of funds to employees.

To reflect personal funds on the balance sheet of an individual entrepreneur, use account 72. The 50th account will appear in the “Debit” column. If the capitalized funds will be used for settlements with creditors and debtors in the future, then settlements will be carried out using account 76.

For those who use 1C

Postings created using the 1C program will also not reflect the receipt of personal money as company income. When funds are deposited into the cash register, it is necessary to generate a receipt order. Fill out the “Base” and “Attachment” fields, indicating the reason for the contribution and a document confirming the ownership of the funds.

The program will automatically create entries with the amount recorded in debit for account 50 and in credit for account 72. After depositing the funds into the current account, a transaction will be generated with a credit for account 50, and account 51 will be reflected in debit.

If in the future you plan to withdraw funds from your current account for personal needs, then reflect the transactions using the same account 72, as the most suitable for IP payments.

Other accounts - 75 and 84 - are intended to reflect settlement transactions with the founders of the LLC and therefore you should not operate with them in this situation.

Results

An individual entrepreneur has the right to withdraw funds from his own business and invest them in it without restrictions. At the same time, it is not mandatory for individual entrepreneurs to open a current account intended for funds involved in business. But having such an account provides certain advantages.

An individual entrepreneur is not required to keep accounting records.

However, when exercising such a right, he must take into account the funds contributed to the business as an increase in the capital generated during entrepreneurship. When using the double entry method, the posting will look like Dt 51 Kt 84. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Are own funds in the cash register counted as income?

Each transaction on a company account may attract the attention of the tax authority. This is especially true for incoming transactions. When depositing your own funds, it is important to justify them correctly.

If in the purpose of the transfer you indicate that the funds being deposited are your personal savings, then there can be no claims from government agencies against you. The main thing is to save all confirmation forms from banks and keep them for the entire period of the individual entrepreneur’s activity (preferably 4 years).

Do not report your own funds as income in internal reporting. Maintain such income separately from individual entrepreneur operations. This will help avoid confusion and correctly form the tax base.

If, by your own mistake, you do not indicate the correct purpose of the payment in the payment order, then it will be problematic to prove to the tax service that these funds are yours.

If the payment document for depositing funds is completed in compliance with the established requirements, then your money, of course, is not the income of the company. They are not considered a product of the individual entrepreneur’s activities, but only reflect your savings, which should not be taken into account when calculating tax payments.

How do individual entrepreneurs make cash payments?

All transactions that are associated with cash payments between individual entrepreneurs, as well as LLCs or other legal entities, in any case, must be subject to accounting and carried out in accordance with the norms of the legislation of the Russian Federation.

There are several methods for making cash payments:

- using cash register and cash register equipment.

- using BSO, strict reporting forms, which are used instead of cash receipts. But their issuance is allowed only by those individual entrepreneurs who provide services to the population. The BSO itself does not have a strict form, but only a list of details that must be indicated in it. An entrepreneur independently creates his own strict reporting form for use in his business. It is worth noting that they must be developed exclusively in specialized programs and printed using a typographic method. It is prohibited to create BSOs in standard applications.

- without the use of cash register and any documents, which is allowed in exceptional cases for individual entrepreneurs in accordance with the list of clause 2 of article 2 of 54-FZ. These are entrepreneurs who have a special specificity of activity, and are also located in practically inaccessible places.

- without using cash register, which is allowed by individual entrepreneurs who are on UTII or the patent taxation system. They are allowed to issue their clients receipts with all the details of the entrepreneur when paying in cash.

It is these methods that individual entrepreneurs have the right to use to accept cash when making payments to their clients.

Do I need to pay tax

Entrepreneurs often have questions about taxation of their own funds in the cash register. And here it is important to know that such money does not belong to the company’s income. This profit relates to the individual and does not affect the activities of the company.

And since there is no income as such, then you do not have to pay any tax. It is important not to get confused in numerous incoming transactions and calculations. Correctly reflecting the profit of an individual entrepreneur in the final declaration, as well as in the internal documentation of the enterprise, will save you from unnecessary waste of your own funds.

All income transactions must be clearly delineated: you must separate the income from your own investments and the company’s activities. These articles should not overlap. Otherwise, it may turn out that you pay tax on money that you yourself deposited into your current account.

What about taxes?

Typically, an individual entrepreneur who uses the simplified taxation system (STS) deposits funds into his bank account to pay the office landlord. And the question of writing off tax from the payment amount is also very acute for him.

The individual entrepreneur who deposits his funds into the account is not the person forming the tax base. And his own money is not recognized as income, since it is not directly related to the sale of goods or the provision of any services.

An individual entrepreneur has the right to spend any amount for his own needs, including replenishing the company’s current account from his own pocket. But in this case, you need to prepare the appropriate documents. And if the tax office receives a request-claim regarding a specific payment, then send there a document that states all the amounts of funds received and their purpose.