Postings to accounting account 79 - On-farm calculations

Accounting account 79 is “Internal business settlements”, it is intended to reflect and summarize economic information in organizations that have branches, representative offices or separate divisions.

If these structural units have a dedicated balance sheet, but are not separate legal entities, an inter-business settlement scheme is used.

This scheme is optimal when consolidating individual balances of all departments, since turnover on account 79 is excluded during consolidation.

Table of types of structural divisions

Subaccounts 79 accounts and reflection of transactions in the head department

79 account is active-passive. Receipts are reflected according to Kt, write-offs - according to Dt of the account. A subaccount is created for each type of transferred assets. The number of these sub-accounts is not limited by law, but it is more logical to arrange transactions according to the scheme proposed by the Chart of Accounts.

Example: transfer of a fixed asset from a branch to the head office

The head division of Progress JSC transferred the garage premises to Delta LLC. The initial cost of the premises is 200,000 rubles, the amount of accrued depreciation is 60,000 rubles.

The accountant of the head division (JSC Progress) made the following entries:

Postings reflecting the transfer to the department:

| Dt | CT | Sum | Type of operation | Document |

| 79.1 | 01 | 200000 | OS transfer | Interbranch advice note1 |

| 02 | 79.1 | 60000 | Write-off of depreciation | Interbranch advice note |

The postings show the disposal of a fixed asset from account 01 of the head department and the write-off of the amount of accumulated depreciation on this fixed asset in correspondence with the intercompany settlements account.

Postings to account 89 reflecting acceptance from the branch

Suppose the branch transfers another fixed asset to the “head”:

| Dt | CT | Sum | Type of operation | Document |

| 01 | 79.01 | 10000 | OS transferred from branch | Interbranch advice note |

| 79.1 | 02 | 2000 | Depreciation cost written off | Interbranch advice note |

Property and assets received from the branch are reflected in the main division on the corresponding accounting accounts. That is, for active accounts it will be a debit, and for passive accounts it will be a credit, in correspondence with the corresponding analytical account 79.

Reflection of business transactions in a separate division

All postings for transactions in the branch are similar to postings in the head office. Transactions on the same transferred assets in the branch and the head office are mirrored.

Example: reflecting the transfer of fixed assets in a branch

The accountant of the separate division of Delta LLC, already known to us, reflected the operation:

- 200,000 rub. – capitalization of fixed assets received from the head office;

- 60,000 rub. – depreciation on the received fixed asset is taken into account.

Postings reflecting the acceptance of fixed assets in the branch

| Dt | CT | Sum | Type of operation | Document |

| 01 | 79.1 | 200000 | OS transfer | Interbranch advice note |

| 79.1 | 02 | 60000 | Depreciation written off | Interbranch advice note |

Closing 79 accounts in the balance sheet

When forming a consolidated balance sheet for the entire enterprise, account 79 should be equal to zero. Inequality means an accounting error. If inter-branch accounting of business transactions is carried out correctly, the debit balance of account 79 at the branch is equal to the credit balance of account 79 at the head office (of course, in the Civil Defense, these calculations are taken by branch).

Likewise for the credit balance.

To identify this error, you need to reconcile all transactions on account 79 in the branch and the head office.

A zero balance on account 79 in a division is possible only in the event of liquidation (closure) of this division.

The most important!

1 Depending on the information system used for accounting, it can exist either in the form of a regular accounting certificate or in the form of a separate document (for example, in 1C).

Source: https://saldovka.com/provodki/drugoe/provodki-po-79-schetu.html

Accounting: 90 account “Sales”

Account 90 “Sales” is used to display all the information necessary to determine the financial results of the company’s activities for ordinary activities

Account 90 in accounting is used by legal entities to collect information on the company’s normal activities, which allows them to determine the financial results of the activity. All income received and costs incurred that are directly related to the normal activities of the company are displayed here (sale of finished products, goods, semi-finished products, provision of services for leasing premises, freight forwarding services, etc.).

A count of 90 is considered active-passive. To exercise control over activities and calculate financial results, additional sub-accounts are opened:

- 90.01. Revenue – receipts from customers for goods sold, work performed, services rendered. The subaccount is passive: the loan shows the amount of revenue received in correspondence with the account for mutual settlements with customers. Note from the author! According to PBU, when maintaining accounting records, the company independently determines whether the resulting income relates to ordinary activities or is it other income. Revenue is recorded in monetary terms and is equal to the assets received from the buyer and (or) the amount of the resulting receivables (for example, in case of incomplete payment for goods or when selling goods and services on deferred payment basis). Note from the author! Separate accounting of revenue is provided under OSN and under special taxation systems. To recognize revenue, the following conditions must be met: there is confirmation of the company’s right to receive this revenue (the existence of an agreement); the full amount of revenue can be determined; there is confidence in the company’s receipt of economic benefits from this operation: assets have been received in payment or there is confidence in their receipt in the future; ownership of the sold products has transferred to the buyer (work has been completed and there is confirmation, for example, an act has been signed); costs associated with this operation can be calculated.

- 90.02. Cost of sales is an active subaccount. Transactions on this account are displayed simultaneously with the posting of revenue in correspondence with the accounts for assets sold to the buyer (43,41,44,20, etc.). For enterprises engaged in agriculture: when selling products according to Dt90, the planned cost of products during the reporting period is recorded, as well as the resulting difference between the planned and actual cost at the end of the year. For retailers and those accounting for goods in sales prices: in the debit of the account. 90, the accounting price of products sold is recorded. At the same time, the reversal of the amounts of discounts provided (accrued mark-ups on goods) that were related to goods sold in correspondence with account 42 is carried out.

Case Study

Solnyshko LLC purchased 30 phones from a supplier (the purchase price of the goods was 9.5 thousand rubles per unit, including VAT) for subsequent resale. Accounting for LLC goods is carried out at purchase prices. The selling price of the phone is 11 thousand rubles. per piece This product was purchased for the first time and was fully sold within a month. Reflection of business transactions: Dt41 Kt60 - 241.5 thousand rubles - receipt of telephones from the supplier. Dt19.03 Kt60 - 43.5 thousand rubles - accounting for input VAT. Dt50 Kt90.1 – 330 thousand rubles. – revenue received from the sale of telephones. Dt90.3 Kt68 – 50.3 thousand rubles. – VAT payable to the Federal Tax Service. Dt90.02 Kt41 – 241.5 thousand rubles. – write-off of the accounting value of goods sold.

ANALYSIS OF SCH.90

Start Start 50,3241,5 330 291,8 330 Skon. Scon.38.2 Analysis of invoice 90 showed that this markup is enough to cover expenses and make a profit from the sale of phones (More details about calculating the markup in the video).

- 90.03. VAT: this subaccount records information about value added tax, which the seller must receive from the customer and subsequently transfer to the Federal Tax Service. Note from the author! When filling out a VAT return and calculating the tax payable, the following data compliance must be observed: 90.01 * 18/118 = 90.03 (when selling goods, works, services at a rate of 18%).

- 90.04. To reflect information about the amount of excise taxes that is included in the price of sold assets.

- 90.05. Amounts of duties on export of products.

- 90.09. This subaccount is the calculated financial result for the company’s normal activities. It is active-passive: the debit balance reflects the company’s loss in the current period, the credit balance reflects the profit received.

Determination of financial result

Information on sub-accounts for accounting for revenue, cost, VAT and excise taxes is recorded cumulatively during the reporting period. Every month, the debit balance (cost, excise taxes, VAT) is compared to the credit balance (revenue).

The result obtained - the financial result of the activity - data from all sub-accounts will be reflected in one amount on sub-account 90.09. At the end of the month (closing operation) the financial result of the organization’s work from subaccount 90.

09 is transferred to the debit or credit of account 99, respectively.

Analytical monitoring

Analytical monitoring of accounting account 90 is organized in the company for each type of goods or services sold in a given reporting period (organization nomenclature). Also, for more detailed management accounting, analytics can be carried out by sales geography, company divisions and other areas.

Normative base

The use of account 90 to summarize the information necessary when calculating the financial results of an enterprise for ordinary activities is carried out in accordance with the current Chart of Accounts, approved by Order of the Ministry of Finance dated October 31, 2000 No. 94 and other legally approved documentation (for example, PBU 9/99 for determining the organization's revenue).

You can view the current chart of accounts here.

Accounting entries for main business transactions with account 90

- Receipt of funds from the buyer for sold products, works, services:

Dt50 Kt90.01 – cash payment;Dt51 Kt90.01 – through a current account;

Dt52 Kt90.01 – receipts in foreign currency;

- Display of sales revenue:

- Cost display:

Dt90.02 Kt20 – cost of work, services;Dt90.02 Kt41 – accounting price of goods.

- Reversal of trade margins at retail enterprises:

- VAT and excise taxes included in the cost of goods sold:

Dt90.03 Kt68 – VAT;Dt90.04 Kt68 – excise taxes.

- Financial result for ordinary activities:

Dt99 Kt90.09 – loss;Dt90.09 Kt99 – profit.

to the Moneymaker Factory channel in Yandex.Zen

Questions and answers on the topic

No questions have been asked about the material yet, you have the opportunity to be the first to do so

Source: https://moneymakerfactory.ru/articles/90-schet-prodaji/

According to the account dt what is it

The financial budget of a large company or any Russian family consists of income, that is, cash receipts, and expenses, the cost of paying for services and purchasing goods. In accounting, these transactions are called debits and credits. In the article we will look at the key concepts of these operations, and also define what a debit account means.

Account "Debit" and account "Credit" in accounting

All business operations of an economic entity have two directions:

- Profitable, that is, those facts of economic activity that lead to an increase in financial indicators, an increase in the material and technical base, an increase in the solvency and profitability of the enterprise.

- Expenses that are aimed at purchasing goods, works or services necessary to ensure the life of the enterprise as a whole.

For example, payment of utilities, payroll of staff, purchase of material and technical assets, fuel and lubricants and raw materials for production.

Consequently, the debit of the account is all income (receipt) transactions and facts of the economic activity of an economic entity, be it an ordinary citizen, a family or a company. A loan, accordingly, is an expense.

These concepts are widely used in accounting and are inextricably linked. Thus, the main method of maintaining accounting is to reflect business transactions using the double entry method.

In simple terms, one specific business transaction in the life of an economic entity is registered in the accounting system simultaneously as a debit to one account and a credit to another.

That is, the double entry method is the procedure for compiling accounting records - postings.

What entries are used to make accounting reversals?

Content:

Accounting does not tolerate inaccuracies - this can lead to distortion of accounting registers and reporting indicators. What to do if a mistake was made?

What is a reversal?

To correct detected errors, a method called reversal or “red reversal” is used.

The essence of this method is that the erroneous wiring is written down again, but only with a “-” sign, highlighted in red or red ink (hence the name).

This action cancels the erroneous operation (posting). This method was invented back in 1886 by a Russian accountant. With the help of reversals, you can adjust the accounting data for individual accounts.

Note!

Example 1: An erroneous entry was made in accounting

Dt 20 Kt 70 RUR 38,000 instead of Dt 26 Kt 70 RUB 38,000. Using the red reversal method, we get the following entries:

Dt 20 Kt 70 RUR 38,000 (wrong wiring)

Dt 20 Kt 70 -38000 rub. (reverse)

Dt 26 Kt 70 RUR 38,000 (correct wiring)

Example 2: An extra entry was discovered in the accounting records

Dt 20 Kt 70 RUR 38,000 In order to cancel this posting, we reverse it:

Dt 20 Kt 70 RUR 38,000

Dt 20 Kt 70 -38000 rub.

Thus, without making corrections to the wiring itself, we got the desired result.

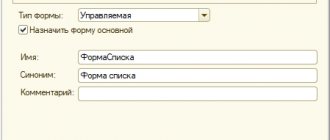

Reversal in 1C

Often, 1C 8 users have questions about reversing transactions in the program. In order to reverse an incorrect transaction in 1C, you must use the document “Operations entered manually.” In the “Filling method” field, select “Reversal of document movements” and select the document in which we want to reverse the posting.

When to use the reversal method?

Correction of errors, both by the reversal method and by any other, occurs in the following order: - an error discovered in the reporting period before the reporting is submitted is corrected on the last day of the quarter;

— an error identified in previous periods is corrected (reversed) on the day of discovery.

Many accountants neglect the “red reversal” method, preferring to make reverse entries.

Example : An extra entry was found in accounting

Dt 20 Kt 70 RUR 38,000 In order to cancel this posting, reverse posting is done:

Dt 20 Kt 70 RUR 38,000

Dt 70 Kt 20 RUR 38,000

This is not true! This method leads to the appearance of additional records that have no documentary basis (not tied to primary documents).

As you can see, the red reversal method is quite simple. It will help you correctly make corrections to the accounting registers. accounting.

Source: https://blog.ksio.ru/prochee/storno