Vladimir Ilyukov

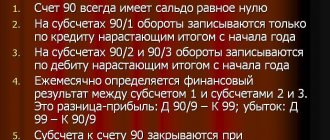

From January 1, 2021, the algorithm for closing account 26 “General business expenses” in the 1C: Accounting 8 program has changed. The change is due to the entry into force of the federal accounting standard FSBU 5/2019 “Inventories” from January 1, 2021. But first, a little background.

According to Instruction 94n, account 26 “General expenses” is intended to summarize information on expenses for management needs and for needs not directly related, that is, directly, to production. In other words, it was possible to accumulate both administrative and management expenses and indirect production costs on this account. The same instructions recommended that production organizations have a choice of two methods of closing accounts 26 “General business expenses.”

- Distribute . Distribute to the debit of cost accounts 20 “Main production”, 23 “Auxiliary production” and 29 “Service production and facilities”.

- Write off . Write them off as semi-fixed expenses and write them off to the financial result in the debit of account 90 “Sales”. Rent costs, administration salaries, depreciation, etc. can act as semi-fixed costs.

In manufacturing organizations, the choice of any method of closing account 26 “General expenses” led to a noticeable distortion of the actual cost of finished products (GP).

- Increase in the cost of GP . When distributing general business expenses among item groups of account 20 “Main production,” the actual cost of the enterprise increases. This occurs due to the fact that all costs accumulated on account 26, including administrative and managerial ones that are not related to production, are allocated to account 20 “Main production”.

- Reducing the cost of GP . When general business expenses are written off to the financial result, on the contrary, the actual cost of the enterprise decreases. This occurs due to the fact that all costs accumulated on account 26 are written off to account 90 “Sales”, including costs indirectly related to production.

Document FSBU 5/2019, which came into force on January 1, 2021, allows you to more accurately formulate the actual cost of finished products. Indeed, clause 26 of FSBU 5/2019 establishes a list of costs that are expressly prohibited from being included in the actual cost of GP and WIP. Here are some of them.

- Administrative expenses, except for cases when they are directly related to the production of products, performance of work, provision of services;

- Storage costs, except for cases where storage is part of the production technology (performance of work, provision of services);

- Advertising and product promotion expenses.

Previously, these expenses were taken into account on account 26 “General expenses” and in production organizations they distorted the actual cost of finished products. The above list is open. It can be expanded by other costs, the implementation of which is not necessary for the production of products, performance of work, or provision of services. That is, now purely administrative expenses and expenses that are in no way related to production cannot be written off to expense accounts.

To satisfy this requirement, the developers of the 1C: Accounting 8 program changed the algorithm for distributing and closing accounts 26 “General business expenses” and 25 “General production expenses”.

Let's consider a new technology for closing these accounts using the example of a production and non-production organization. This technology is not used for trade organizations. The fact is that trade organizations, instead of account 26 “General business expenses,” must use account 44 “Sales expenses”: Instruction 94n.

Collection and distribution accounts

Collection and distribution accounts are intended for the collection and subsequent distribution of costs at individual stages of production and sale of finished products.

The following active accounts are classified as collection and distribution accounts:

25 “General production expenses”; 26 “General business expenses”; 44 “Sales expenses”.

The structure of accounts 25 and 26 has some features that distinguish them from other active accounts. These accounts do not have a balance because they are closed at the end of each month. In this regard, accounts 25 and 26 are not reflected in the balance sheet.

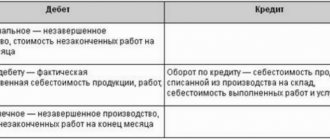

Chart of accounts 25 “General production expenses” and 26 “General business expenses”

| Debit | Credit |

| Have no balance | |

| Turnover by debit - costs associated with the maintenance and management of main production are reflected | Loan turnover - at the end of the reporting period, the amount of all costs is written off to the cost of production in the debit of account 20 “Main production” |

Account 25 “General production expenses” records general production costs that are associated with servicing the main production, for example, workshop costs for the maintenance and operation of equipment, salaries for equipment adjusters, depreciation and repair of fixed assets for general production purposes, etc.

d.

Account 26 “General business expenses” records general business expenses associated with enterprise management, i.e. maintenance of administration, accounting, office, payment for various legal, information, auditing services, etc.

These expenses are collected during the month on the debit of accounts 25 and 26, and at the end of the month they are ultimately written off to account 20, i.e., included in the cost of production. Expenses on accounts 25 and 26 are called indirect, since they are not directly related to the production of specific products.

Account 44 “Sales expenses” reflects the costs associated with the sale of products. Such expenses include the costs of containers, packaging, transportation, advertising of finished products, etc.

Example 4.7. Keeping records on collection and distribution accounts 25 and 26.

During the month, indirect expenses are reflected, shown in table. 4.5.

Incorrect reflection of services

20 the account is not closed when the Subconto column in the reflection of the sale of services in the document Sales of goods and services on the Services tab is not filled in. To check whether the Subconto column is filled, you need to look at the records of the accumulation register Sales of services and check whether the Nomenclature group column is filled.

When closing expense accounts 20, 23, 25, 26, the following message may be displayed: “The item group for the issue is incorrectly specified.” The same item group cannot be used in the documents “Sales of goods and services” on the Services tab in the Subconto column and in the documents “Act on the provision of production services” and “Production report for the shift”

In order to check the correctness of the specified nomenclature groups for product output, it is necessary to compare the entries in the accumulation register “Product output at planned prices (accounting)” in the Nomenclature group column, as well as in the accumulation register “Sales of services in the Nomenclature group column”.

Collection and distribution accounts

Exercise. Determine the amount of write-off of general production and general business expenses for accounts 25 and 26 at the end of the month.

Table 4.5

| Contents of operation | Amount, rub. | Debit | Credit |

| 1 . Salary accrued: a) accounting workers b) equipment adjusters | 10000 15000 | 26 25 | 70 70 |

| 2. Social tax (35.6%) is charged on wages: a) accounting workers b) equipment adjusters | 3560 5340 | 26 25 | 69 69 |

| 3. Postal expenses for the office were paid from the cash register. | |||

| 4. Inventory written off to the HR department | |||

| 5. Spare parts written off for equipment repairs | |||

| 6. The invoice for legal services has been accepted and paid | |||

| 7. Depreciation of the freight elevator has been calculated | |||

| 8. The invoice for the installation of the alarm system has been accepted and paid. | |||

| 9. At the end of the month, overhead costs were written off as production costs. | ? | ||

| 10. At the end of the month, general business expenses are written off as production costs | ? |

To solve the problem, it is necessary to collect and close accounts 25 and 26.

| Account 25 “General production expenses” |

| Debit | Credit |

16) 15000 26) 5340 5) 1 000 7) 360  1 500 1 500 | 9) 23200 |

| Od = 23200 | Ok = 23200 |

The amount of general production costs for the month was 23,200 rubles, and the amount of general business expenses was 15,900 rubles.

At the end of the month, accounts 25 and 26 are closed. To do this, the amount of debit turnover in the same amount is written off from the credit of these accounts to the debit of account 20. Since the turnover on accounts 25 and 26 will be equal, these accounts will not have a balance.

Cost account in accounting 25 26

Account 25 “General production expenses” displays all the organization’s costs aimed at servicing main and auxiliary production, subject to distribution. Separate display of information on production costs makes it possible to analyze costs more deeply in order to minimize them and accurately attribute them to specific manufactured products.

25 account in accounting is a collective summary of information about all funds spent aimed at servicing production and subject to subsequent distribution. Turnovers for the current period display important information:

- Salaries of employees (with the exception of enterprise management bodies);

- Equipment costs (rent payments for fixed assets accepted for temporary use, repair work);

- Depreciation of fixed assets and intangible assets;

- Cost of materials and spare mechanisms purchased for servicing main production equipment;

- Transport services, etc.

That is, the account displays expenses common throughout the organization that directly affect the production process, but are subject to further distribution by type of activity performed. Subsequent division of costs gives a more in-depth assessment of the cost of each type of product produced in various production departments.

Account 25 in accounting is active, that is, the debit shows the incurred general production costs, for example, writing off used inventory items for the purpose of servicing the activities being carried out, and the credit corresponds with production accounts to include the money spent in the cost of manufactured products.

Attention! Account 25 is closed monthly by transferring amounts to cost items for inclusion in the cost of production of main or auxiliary production. The distribution method is determined by enterprises independently (must be reflected in the accounting policies)

The order of divisions is not established

If the operations of closing cost accounts are determined manually (Accounting policy, tab Release of products, services), then this sequence must be specified. To do this, you need to create a document “Setting the order of departments for closing cost accounts.” If such a document has already been created, it may contain irrelevant data. In order to correct this error, you need to create a new document with the current date, automatically filling out the document using the “fill” button

Basic business operations

- Depreciation calculation

Dt 25 Kr 02 – for equipment intended for industrial activities;Dt 25 Kr 05 – for intangible assets

- Transfer of purchased inventory and household equipment for maintenance and repair of equipment

- Carrying out calculations for wages of industrial departments with the exception of administrative personnel

Dt 25 Kr 70 – employee wages;Dt 25 Kr 69 – calculation of mandatory contributions to social funds from the amounts of accrued wages

- Write-off of overhead costs for inclusion in the cost of manufactured products, depending on the type of activity performed

Dt 20 Kr 25 – main production;Dt 23 Kr 25 – auxiliary production;

Dt 29 Kr 25 – service production.

Lyudmila Poberezhnykh, 2017-01-03

Reference materials on the topic

Save the article to social networks:

When maintaining account 20, corresponding subaccounts are opened for it, and, as a rule, the cost of work performed by subcontractors is accounted for in a separate subaccount of account 20.

Sales revenue for a construction organization is the volume of construction and installation work completed and accepted by the customer. Data on the work performed, its composition, name, volume and cost are indicated in the act on the cost of work performed - form KS-2. The basis for reflecting proceeds from the sale of construction and installation works in accounting are primary accounting documents drawn up in compliance with the established procedure.

Information on the organization’s income and expenses related to its normal activities, according to the Chart of Accounts for the financial and economic activities of organizations, is summarized on account 90 “Sales”.

The amount of revenue received from construction and installation work is reflected in the accounting records as follows:

Debit 62 Credit 90-1

— the amount of revenue is reflected based on accounting documents.

Account 62 “Settlements with buyers and customers” is credited in correspondence with the accounts for accounting for cash and settlements for the amounts of received payments.

The amounts of received advances and prepayments in accordance with the terms of construction contracts are taken into account by contractors (subcontractors) in a separate subaccount to account 62 “Settlements with buyers and customers”.

Debit 90-3 Credit 76 (sub-account “VAT calculations for completed but unpaid work”)

Debit 90-3 Credit 68 (sub-account “Calculations with the budget for VAT”)

— is accepted for accounting for VAT as part of the amount presented for payment for completed construction and installation work (if the organization’s accounting policy establishes the definition of revenue from sales as settlement documents are completed and presented for payment - revenue “on shipment”);

Debit 90-2 Credit 20 (sub-account “Actual cost of work performed in-house”).

Determination of the financial result from the delivery of construction and installation works is carried out in accounting by postings:

Debit 90-9 Credit 99.

To reflect such business transactions in accounting for the delivery of objects as a whole, the following entries are used.

Debit 20 (sub-account “Construction and installation work performed by subcontractors”) Credit 60 (sub-account “Settlements with subcontractors”)

— the cost of accepted contract work excluding VAT;

Debit 19 (sub-account “VAT on contract work” (in terms of unpaid work) Credit 60 “Settlements with suppliers and contractors” (sub-account “Settlements with contractors”)

— the amount of value added tax in the cost of accepted subcontract work.

Advances and prepayments for business transactions related to settlements for marketable products (works, services) are taxable for value added tax, regardless of the accounting policy chosen for accounting or taxation purposes.

Funds received from customers should be considered as advance payments or prepayment and recorded as follows:

Debit 51 Credit 62 (sub-account “Calculations for advances received”).

Debit 62 (sub-account “Calculations for advances received”) Credit 68 (sub-account “Calculations with the budget for value added tax”).

When completing individual stages of construction and installation work or the facility as a whole, it is necessary to offset previously accrued amounts of value added tax from advances and prepayments received:

Debit 68 (sub-account “Calculations for VAT”) Credit 62 (sub-account “VAT”)

— the amount of previously accrued VAT on the advance received is reflected, but not more than the amount of value added tax reflected in the credit of account 68 from the implementation of construction and installation work, for the implementation of which an advance was previously received;

Debit 62 Credit 62 (sub-account “Calculations for advances received”)

— for the full amount of the advance, including VAT.

These postings eliminate the repetition of VAT accrual on finished products and advances received, and also make it possible to determine the customer’s debt in the final settlement, taking into account previously issued advances as the balance on account 62 “Settlements with buyers and customers.”

1.2.Features of accounting for production costs of a construction organization and formation of costs

The Month End Assistant allows you to perform the following operations, such as:

- establish the correct sequence of operations when closing the month;

- partial closure of the month;

- canceling the month end;

- partial cancellation of the month closing operation;

- refuse to close the month in the current period;

- generate reports explaining calculations and reflecting the results of performing routine operations;

- viewing the results of performing a routine operation;

- draw up a detailed report on the completion of all operations related to the closing of the month.

When closing expense accounts 20, 23, 25, 26, the correct reflection of business transactions is checked. As a result of this check, incorrect turnovers and balances in production cost accounts and incorrect data in registers may be detected. In this situation, the closing of cost accounts cannot be carried out, hence error messages appear. Below are the most common errors that occur when trying to perform the “end month” operation.

1.2.1 Cost accounting for a construction contractor.

The object of accounting under a construction contract with a contractor in accordance with clause 3 of PBU 2/94 is the costs incurred when performing certain types of work on objects built under one project or contract. Upon concluding a construction contract, the contractor undertakes to perform specific construction and installation work or build a specific facility within a certain period of time, and the customer will create the conditions necessary for the performance of these works, accept and pay for them. The fact of delivery and acceptance of contract work means that the customer has received a finished result from the contractor, which can be evaluated and paid for.

Reflection of costs and profits using an example

We will reflect the cost accounting for the production of finished products in the “Shift Production Report”. In this case, item groups will act as subaccounts of cost accounts.

After we produce finished products and sell them, or our cutting services, product groups will also participate in postings as subcontos.

In order to obtain analytics in the context of product groups, for example, the production of wood products, the corresponding product group must be indicated both when reflecting costs and when reflecting profits. Otherwise, there is no point in keeping records on them, since the data obtained will still be incorrect.

Reflection of production costs

Let's look at an example of filling out the document “Production Report for a Shift”, which is located in the “Production” section of the 1C: Accounting 3.0 program. As an example, we will reflect the costs of making a carved chair.

Due to the fact that we have previously added the item “Carved chair” to the product group “Wood products”, when adding it to this document, this data will be entered automatically.

Now let's go to the "Materials" tab of this document and click "Fill". The figure below shows that all the components for the specification of a carved chair were included in the document with the nomenclature group already filled out.

After posting this document in the postings, you can see that the product group “Wood Products” is displayed as a sub-account when writing off the costs of materials.

Sales of finished products

In the “Sales” section we will create a new document “Sales (acts, invoices)”. In it we will indicate that we are selling our newly produced carved chair to the Hooves LLC organization. When you select a product item in the tabular part of the document, the product group “Wood Products” will also be entered automatically.

As a result of this document, all its movements have a subconto, reflecting the same nomenclature group that was in the production report for the shift. It is very important that they match.

In the 1C Accounting 3.0 program there are many different standard reports that display accounting by item groups. For example, a balance sheet for an account, certificates of cost calculations at the end of the month, etc.