The concept of “penalty” is money collected for each calendar day of delay, based on the amount of the obligation. The basis for accrual is violation of the payment deadline. We are interested in tax penalties and accounting entries that need to be made.

Repayment of fines on time is mandatory, as are the amounts of debt and interest. They are paid either simultaneously with the tax or after. In case of evasion of payment, they are collected in court.

From 10/01/2017 legislation has changed, penalties for limited liability companies have increased.

What are penalties and how are they calculated?

Since 2021, insurance premiums have been divided in relation to the legislative norms establishing the rules for working with them:

- the bulk of contributions (for compulsory health insurance, compulsory medical insurance, compulsory health insurance for disability and maternity) began to be subject to the Tax Code of the Russian Federation and the requirements that apply to tax payments;

- contributions for injuries remained under the provisions of the Law “On Compulsory Social Insurance...” dated July 24, 1998 No. 125-FZ.

However, the requirements for their payment have remained unchanged: insurance premiums must be paid by the payer on time and in full. If due to any circumstances they are not paid or not paid in full, not only the arrears are collected from the payer, but also a sanction for late payment, which is called a penalty.

The basis for payment of penalties (if they are not paid voluntarily) are the requirements presented to the payer by the body supervising the relevant contributions (IFTS or Social Insurance Fund). Thus, penalties are the estimated amount that must be paid by a payer who has violated the deadline for paying contributions. They are calculated as a percentage for each day of delay, starting from the day following the payment deadline, which is established by law.

You can calculate penalties using our calculator .

Read about the specifics of calculating penalties in the material “How to correctly calculate tax penalties (nuances).”

You will always find the KBC for contributions and taxes in ConsultantPlus. Get a free trial and jump into the content.

Calculation of penalties according to the simplified tax system, postings

Those organizations and individual entrepreneurs that are payers of value added tax are required to pay the budget based on the results of the reporting quarter in three equal payments: no later than the 25th day of each of the 3 months following this period. Thus, any violation of dates, as well as an underestimation of the amount of tax that had to be paid in 1 or 2 months, can lead to the accrual of VAT penalties.

Of course, if the payer completes his task in advance, that is, transfers, for example, 2/3 of the due amount in the first month, the remaining third in the second, and does not pay anything in the third, he will not face penalties. However, if a violation of the amounts and terms is committed, then, unfortunately, penalties cannot be avoided.

VAT calculations are reflected in account 68 “Calculations for taxes and fees”. For this tax, as a rule, a subaccount 68-02 is opened. In this case, it would be advisable to allocate penalties to a separate sub-account or reflect them with separate analytics in order to separate them from the main tax amount, as well as from possible fines.

For the accrual of VAT penalties, the posting will be identical: Debit 99, subaccount “penalty” - Credit 68-02.

Paying tax under the simplified tax system involves an advance system, that is, a company or individual entrepreneur is required to make settlements with the budget based on their own data, and quarterly, before April 25, July 25 and October 25. The final calculation for the year is made on the reporting deadline: for companies it is March 31, for individual entrepreneurs it is April 30.

There is an opinion that such a situation makes it possible not to pay advances at all under the simplified tax system. But that's not true. They must be transferred within a strictly specified time frame, and delay, in turn, will lead to the accrual of penalties. Another question is that these sanctions will be imposed only after filing the annual declaration, that is, after the tax office learns about the amounts of accrued quarterly advance payments.

If the company was nevertheless charged with penalties under the simplified tax system, transactions in such a case are drawn up in the same way as in the situation with VAT, that is, according to Debit Account 99, sub-account “penalties” and Credit 68, using a sub-account intended to reflect the simplified tax, as a rule it is 68-12.

The day on which transactions to accrue the amount of penalties should be reflected is selected depending on whether the accountant paid the penalties himself or whether the obligation to pay them was discovered after an audit:

- when the accountant himself corrected the error and paid the penalty, the transactions are posted on the day of their calculation (and the day must be indicated in the calculation certificate);

- if a notice was received to remind you to pay penalties, the accountant makes an entry for the day when the decision to accrue them after the audit came into force.

Methods for collecting penalties and the negative consequences of their late payment

If the payer has neglected the opportunity to voluntarily fulfill the requirement to pay penalties, they are collected using the following methods:

- sending a collection order to the payer’s bank;

To learn about which accounts penalties can be collected, read the article “From which accounts can tax authorities collect penalties?” .

- recovery from property.

In addition, if the terms and completeness of payment of insurance premiums are violated, we are talking not only about sanctions, but also about a violation of the pension rights of the insured persons.

The negative consequences of non-payment of contributions are:

- reducing the possibility of obtaining investment income from investing pension savings;

- reduction in the amount of pension savings when indexing them.

Read about the consequences of non-payment of insurance premiums due to their failure to be reflected in the calculation in the article “What is the liability for non-payment of insurance premiums?”

What to do if your insurance premiums have been reset

Your company is included in the unified register of SMEs and operates in one of the most affected industries.

Read in the berator “Practical Encyclopedia of an Accountant”

A complete list of OKVED industries most affected by coronavirus

By Federal Law No. 172-FZ of June 8, 2021, you received a benefit for the 2nd quarter of 2021 in the form of a zero tariff for all types of insurance premiums.

But you managed to accrue insurance premiums for April and even pay them - at the rates that began to apply in 2020.

In this case, receiving a benefit in the form of a zero tariff means that you need to cancel the accounting entries for the calculation of insurance premiums made on the date of entry into force of this law.

To do this, you can use the reversal method in accounting.

Read in the berator “Practical Encyclopedia of an Accountant”

Reduced insurance premium rates for small and medium-sized businesses

Let's look at an example.

Example. How to cancel accrued insurance premiums in connection with the establishment of a zero tariff Suppose an employee’s salary is 50,000 rubles. In April 2021, the accountant calculated insurance premiums from payments to this employee and made the following entry:

- DEBIT 20 CREDIT 69

RUR 9,319.50 (RUB 12,130 x 30% + (RUB 50,000 - RUB 12,130) x 15%) – insurance premiums for April 2021 have been calculated at a reduced rate.

In accordance with Federal Law No. 172-FZ of June 8, 2021, the company received a benefit in the form of zero insurance premium rates for the 2nd quarter of 2021.

In this regard, the accountant made a reversing entry:

- DEBIT 20 CREDIT 70

RUR 9,319.50 – insurance premiums for April 2020 have been cancelled.

As a result of the reversal, together with the cancellation of previously accrued amounts of insurance premiums, you will receive a reduction in the corresponding costs in your accounting.

Reflection of penalties on insurance premiums in accounting

Clause 7 of PBU 1/2008 states that the enterprise itself has the opportunity to choose the method of reflecting expenses in accounting, if it is not expressly established by law. PBU 10/99 does not specifically specify the reflection of penalties for taxes and fees; it only indicates penalties for violation of the terms of contracts.

Moreover, we draw your attention to the fact that the amounts of taxes and contributions additionally accrued during the audit can be attributed to past periods, and fines and penalties - to the periods when the decision was made on the audit report (court decision). As for the accounts in which they should be taken into account, the Ministry of Finance of Russia in its latest clarifications (letter dated December 28, 2016 No. 07-04-09/78875) recommends that penalties accrued on payments other than income taxes and the simplified tax system be attributed to accounts cost accounting:

Dt 26 (44) Kt 69.

Read more about the latest point of view of the Ministry of Finance in the material “Tax penalties and fines - what is the account in accounting?” .

In earlier recommendations, the Ministry of Finance proposed using account 99 to reflect penalties (letter dated February 15, 2006 No. 07-05-06/31).

In the instructions for using the chart of accounts, approved by order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n, account 99 is used to reflect tax sanctions. Penalties do not apply to tax sanctions, but the instructions say that account 99 can also be used to reflect penalties for violation of deadlines for paying contributions in correspondence with account 69.

In practice, they also use the option of assigning penalties to other expenses:

Dt 91 Kt 69.

The amount of the listed penalties is reflected by the posting: Dt 69 Kt 51.

We also emphasize that the amount of penalties on contributions is not involved in calculating the income tax base (clause 2 of Article 270 of the Tax Code of the Russian Federation), therefore, in relation to them, permanent differences arise between accounting and tax accounting (clause 4 of PBU 18/02). These differences correspond to permanent tax liabilities accrued by posting: Dt 99 Kt 68.

Fine for non-payment of pension contributions of individual entrepreneurs “for themselves”

When reflecting penalties in accounting, the question arises whether they can be taken into account as expenses.

After all, in essence, when transferring these amounts, the organization incurs costs. According to PBU 10/99, they are recognized as other expenses in accounting and are reflected in the debit of account 99 “Profits and losses” and the credit of accounts 68 and 69. These expenses cannot be recognized in tax accounting. In other words, these penalties do not reduce the firm's taxable income. The opinion that the amounts of the listed penalties should be reflected in the debit of account 91 “Other expenses” and credit 68 and 69 has become widespread in accounting practice. If you take into account penalties specifically for this account, a permanent tax liability (PNO) arises, which complicates accounting.

The main argument for reflecting penalties on 91 accounts is the definition of sanctions in the Tax Code, which includes the concept of “fine”. And on account 99 you can reflect tax sanctions. In income tax reporting, such amounts are combined into one category.

Another “pro” in favor of accounting for penalties on account 99 is the reliability of reporting. If the amount falls on 91, the taxable profit base is underestimated, since other expenses are taken into account in expenses. At the same time, the amounts of sanctions on account 99 do not form expenses. This does not contradict the main objective of accounting - the presentation of unconditional and genuine information about the financial performance of the organization.

As mentioned above, penalties should not reduce income taxes. Therefore, it is better to use posting D99 “Tax sanctions” K 68.4 “Income tax”. If the organization decides to account for them on account 91, the posting will look like: D91 “Other expenses” K 68.4.

78540 x (1/300 x 8.25%) x 22 = 475.17 rubles.

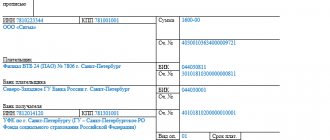

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 99.06 | 68.04.1 | Profit tax penalties accrued | 475,17 | Accounting information |

| 68.04.1 | 51 | The fine is transferred to the budget | 475,17 | Payment order |

| Dt | CT | Wiring Description | Transaction amount | A document base |

| 91.02 | 68.04.1 | Profit tax penalties accrued | 475,17 | Accounting information |

| 99 | 68.04.1 | Reflected PNO | 95,03 | Accounting information |

| 68.04.1 | 51 | Paid to the budget | 475,17 | Payment order |

For VAT, personal income tax and other taxes, the postings will be identical. Only the subaccount for account 68 will change. For VAT it is 68.2, for personal income tax it is 68.1. The method for calculating penalties for all taxes is identical.

39847 x (1/300 x 8.25%) x 25 = 273.95

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 91.02 | 69.02 | Penalties accrued on pension insurance contributions | 273,95 | Accounting information |

| 99 | 68.04.1 | Reflected PNO | 54,79 | Accounting information |

| 69.02 | 51 | Penalties transferred to the budget | 273,95 | Payment order |

The most common budget payments that an employing company faces are contributions to pension, health and social insurance. The deadline for their transfers is until the 15th day of the month following the billing month. Thus, this is a monthly payment, which due to various circumstances may be overdue.

Penalties due to such delay are accrued based on the company's filing of quarterly reports. It contains data on accrued and paid amounts, therefore, the payee has the opportunity to compare the transfer dates and, if they are violated, the company is charged with penalties. Usually, if we are talking about a delay of 1-2 days, for example, due to inconsistencies in the work of the accounting department and the length of the banking day, then the amount of penalties will be quite insignificant.

Account 69.01 - Social insurance payments,

Account 69.02 - Payments for pension insurance,

Account 69.03 - Contributions to the Compulsory Medical Insurance Fund,

Account 69.11 - Calculations for compulsory social insurance against accidents at work and occupational diseases

Consequently, accounting entries for the accrual of penalties on contributions will be broken down into additional subaccounts depending on what kind of delay led to their accrual. It makes sense for an organization to install separate analytics for the 69th account for the calculation of basic payments, as well as penalties and fines, so that using general subaccounts for them, it is possible to track the breakdown of the amount of basic charges and the amount of sanctions.

The recording date for the accrual of penalties will be the number specified in the request for their payment. As a rule, it is not recommended to calculate penalties yourself, even if the accountant is confident in the timing of the delays. It is better to wait for an official document from the appropriate authority. The payment of penalties is formalized by posting to the debit of the corresponding subaccount of account 69 and the credit of account 51. Let us recall that legal entities are required to pay the budget only by non-cash means, therefore a similar posting through account 50 “Cashier” is impossible.

Example: PFR penalties, postings

The situation is different if we are talking about violation of contractual obligations. In this case, the amount of the penalty can be agreed upon by the parties in the terms of the agreement itself, that is, the amount of such sanctions does not have to be tied to the key rate of the Central Bank.

The amount of penalties or fines paid for violation of contractual obligations, based on PBU 10/99 “Expenses of the organization,” approved by order of the Ministry of Finance of Russia dated May 6, 1999 No. ЗЗн is taken into account as part of other expenses. This means that the accrual of penalties involves posting to the debit of account 91-02 “Other expenses”.

Count 99 is not directly used in this case. For the loan, the accrual of penalties under the agreement will be reflected in entry 76 “Settlements with various debtors and creditors”, subaccounts “Settlements on claims”. Penalties under a leasing agreement are reflected in a similar way: the postings in this case will be the same.

Debit 91-02 – Credit 76-2 – accrued amount of claims in connection with violation of obligations under a business agreement,

Debit 76-2 – Credit 51 – the amount of outstanding claims was transferred to the counterparty.

Incomplete payment or non-payment of mandatory contributions to pension, medical and social insurance may become the basis for a fine if it arose due to (Article 122 of the Tax Code of the Russian Federation):

- underestimation of the base for calculating the premium, for example, the policyholder did not take into account the quarterly bonus to the employee as a taxable payment;

- incorrect calculation of the contribution amount, for example, as a result of applying a lower tariff rate than required;

- other unlawful actions/inactions of the policyholder not related to controlled transactions and foreign companies (Articles 129.3, 129.5 of the Tax Code of the Russian Federation).

In case of untimely payment of insurance premiums or their complete or partial non-payment, the policyholder has an arrears, upon discovery of which, the tax authorities will issue a demand for its payment, as well as for the payment of associated penalties and fines.

The fine in the above cases will be 20% of the amount of the arrears on the insurance premium. If it turns out that the policyholder underpaid or did not transfer contributions intentionally, his fine will increase to 40% of the unpaid amount.

It should be taken into account that in the case where the policyholder correctly reflected the amount of insurance premiums in the calculation and submitted it to the Federal Tax Service on time, but was late in paying them, only late fees will be collected from him, but not a fine (clause 19 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 30 .2013 No. 57).

Contributions for “injuries” are still in charge of the Social Insurance Fund, and the fine for non-payment is established by law dated July 24, 1998 No. 125-FZ. The reasons why the policyholder may be fined are similar to those mentioned above: underestimation of the taxable base, incorrect calculation, other actions/inactions of the policyholder (Article 26.29 of Law No. 125-FZ).

The fine also does not differ from that established by tax legislation: 20% of unpaid contributions to the Social Insurance Fund, and if there is intent of the policyholder - 40% of the amount of non-payment.

Penalties for insurance premiums not paid on time are calculated at the rate of 1/300 of the key rate (ref rate) of the Central Bank for each overdue day. If the key rate changes during the period of delay, then penalties are calculated for each rate separately. From October 1, 2021, penalties on insurance premiums have increased. Now they will be counted within 30 days of delay, as before, at 1/300 of the refinancing rate, and if the delay is longer, then from 31 days - in the amount of 1/150 of the refinancing rate for each day of delay.

The period for accrual of penalties begins on the next day after the deadline established for payment of insurance premiums, and ends on the day before the date of actual repayment of arrears on contributions.

Results

Penalties for late payment of insurance premiums that are not repaid within the period specified in the request of the tax authority are collected forcibly from the policyholder’s funds or from his property if there are insufficient funds in the accounts. The policyholder is recommended to independently choose the method of reflecting penalties in accounting and reflect it in the accounting policy.

Sources:

- Tax Code of the Russian Federation

- PBU 10/99, approved. by order of the Ministry of Finance of Russia dated May 6, 1999 N 33n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How to reflect fines for tax offenses and penalties for arrears in accounting and taxation

Based on the results of six months, the following data is reflected in Zvezda’s accounting: – on the loan of subaccount 90-1 – sales revenue in the amount of 11,800,000 rubles; – on the debit of subaccount 90-2 – cost of goods sold in the amount of 7,500,000 rubles; – on the debit of subaccount 90-3 – VAT on sales proceeds in the amount of 1,800,000 rubles.

Tax legislation separates the concepts of “penalty” and “fine”. A penalty is an amount of money that an organization must transfer to the budget in case of untimely fulfillment of its obligation to pay tax (Clause 1, Article 75 of the Tax Code of the Russian Federation). A fine is a tax sanction that is collected from an organization for a tax offense (Article 114 of the Tax Code of the Russian Federation). The amounts of fines for tax offenses are shown in the table.

Concept of penalties

From 2021, payments regarding social insurance are divided, taking into account exactly what legislative norms regulate work with them. For example, most of them, including those that are deducted for compulsory pension insurance, provision of medical support, as well as social guarantees in case of disability and maternity, began to be subject to the Tax Code of the Russian Federation. Thus, the same requirements apply to them as for tax budget transfers.

At the same time, contributions paid in case of injury also remained under the jurisdiction of the law “On Compulsory Social Insurance” under number 125-FZ. True, this does not apply to the requirements for the transfer of funds, because it must still be carried out within the time limits specified by law and only in full. If due to any problems the amount was not paid or was paid only partially, then in the future the arrears will be deducted from the taxpayer, for which a sanction will be assessed.

The most popular penalty is called a penalty; it is a fine that will be charged at a certain percentage for each date when the full amount was not provided. The debt is expected to grow until the taxpayer fulfills its obligations, including the day of settlement. As a rule, arrears arising from contributions are not repaid with the help of overpayments that appeared before 2021.

Additionally, you need to take into account the fact that excess amounts can only be returned to the current account as a result of settlement of arrears. It is best when the penalty is paid voluntarily, but in most cases, requests from the Federal Tax Inspectorate or the Social Security Fund are sent for this. What plays a role here is what subordination a particular contribution has.

Based on this, state penalties are the amount transferred by the party violating the legal deadlines. Typically, the countdown begins on the day following the final date for fulfillment of obligations. If the payer has not sent penalties to the Federal Tax Service or Social Insurance Fund on a voluntary basis, then they will be collected through forced withdrawal of money from accounts or property for its subsequent resale.

Penalty is the percentage of charges for late payment

Also, if the terms and amounts of payment are not respected, then we can talk not only about neglect of the law, but also about a violation of the rights of persons who are insured by the employer and must receive a pension from the funds contributed. As a rule, the consequence of non-transfer of contributions is a significant reduction in the company's rating and a decrease in profit from investing savings. In addition, pension money will be indexed and this will significantly reduce their amount.

How to calculate overpayment for penalties and insurance premiums in transactions

Exactly how these actions occur is stated in the accounting policy for tax purposes. However, the very fact of accrual of income tax and its subsequent payment are reflected in accounting.

Let's look at the legal grounds that are relevant in 2021. All payers of insurance premiums must fulfill their obligations to pay calculated amounts for the necessary types of insurance, submit reports to the authorized bodies and maintain records.

25 Jul 2021 jurist7sib 79

Share this post

- Related Posts

- Temporary Registration for More than 10 Years to Obtain a Social Card

- What kind of money can you get from buying a car?

- At what age do you need to buy a ticket for a child on the Moscow Metro?

- Agreement for Purchase and Sale of an Apartment Pledged to the Bank Sample

How to reflect the transfer of penalties and fines to the Pension Fund and the Social Insurance Fund

milochka 10/30/2021 Hello! According to the accounting rules, fines and penalties are charged to account 91.2, and according to the NU they are not accepted expenses. If you apply PBU 18/2, then you have a constant difference and a permanent tax liability (PNO) of 20% income tax rate is charged on it. In accounting 7.7 PNO is reflected Debit Credit 99.2.3 68.4.2 and affects the calculation of income tax.

IRINATS 10.30.2021 Good afternoon, Elena! I have been working with an organization recently. Out of ignorance or negligence, they did not submit information about the current account to the Pension Fund and incorrectly transferred contributions to the Social Insurance Fund for NS and PZ. Naturally, we ended up with penalties and fines. How to correctly reflect it in 1 C. If I understand correctly, fines and penalties should not reduce taxable profit. This means that these amounts must be sent to the debit of account 99. Which account credit should I use? Is it correct to use 76? I doubt it, because I’m used to working without fines and this is the first time I’ve encountered such a situation. Thanks in advance for your answer.

Reporting

Calculation of insurance premiums, both in paper and electronic form, is submitted to the Federal Tax Service within the time limits established by Chapter. 34 Tax Code of the Russian Federation:

- persons making payments to individuals no later than the 30th day of the month following the quarter (clause 1, clause 1, article 419, clause 7, article 431 of the Tax Code of the Russian Federation);

- heads of peasant and farm enterprises report until January 30 of the calendar year following the reporting year (clause 3 of Article 432 of the Tax Code of the Russian Federation).

In addition, it is necessary to submit accounting reports to the Pension Fund of the Russian Federation.

You must pay contributions for injuries and report in Form 4-FSS to the FSS (Letter dated August 17, 2016 No. 02-09-11/04-03-17282).

We pay penalties

For late payments to the Federal Tax Service and the Social Insurance Fund, controllers will charge penalties and fines. The calculation of penalties for insurance premiums is calculated in the same manner as for all other taxes and fees. The amount of the penalty depends on the length of delay in paying obligations to the budget. For example, if the payment deadline is March 20, and the payment was transferred only on March 29, then the penalty will be calculated for all 9 days.

IMPORTANT! The new rules for calculating penalties are effective from December 28, 2018. Start calculating the duration from the day following the day on which payment is due. For example, from March 21. The day on which the payment was sent to the budget is also included in the calculation of penalties. The amount of penalties calculated for late payment of insurance premiums cannot exceed the amount of the premium itself. Penalties on contributions are charged even for one day of delay. Such norms are enshrined in paragraph 3 of Article 75 of the Tax Code of the Russian Federation, Part 5 of Art. 9 of the Federal Law of November 27, 2018 No. 424-FZ.

For the first 30 days of delay, calculate the penalty in the amount of 1/300 of the key refinancing rate. From the 31st day of delay, a penalty is charged in the amount of 1/150 of the refinancing rate. If the rate has changed during the calculation period, take the changes into account when calculating. For payments due before July 1, 2017, calculate penalties at a rate of 1/300 of the refinancing rate, regardless of the length of the delay.

We calculate penalties for contributions for injuries according to the old rules, in the amount of 1/300 of the refinancing rate for each overdue day, starting from the day after the payment, until the actual payment of the penalty to the Social Insurance Fund.

In June, the Pension Fund issued a demand for the payment of penalties on insurance premiums, the accounting entries will be as follows:

| Operation | Debit | Credit |

| Penalties accrued on insurance premiums, posting | ||

| OPS, penalties | 0 401 20 290 | 0 303 10 730 |

| Penalties for compulsory medical insurance | 0 303 07 730 | |

| VNiM, fine | 0 303 02 730 | |

| Injuries, penalties | 0 303 06 730 | |

| Payment of penalties on SV | 0 303 XX 830 | 0 201 11 610 |

Legislators have developed a system of control measures for the timely payment of taxes and insurance contributions. Since 2021, collection of the bulk of insurance premiums (except for injuries) has become the prerogative of the Federal Tax Service. But the requirements for their payment have remained unchanged: they must be paid on time and in full, and in the absence of payment or part thereof, the payer is subject to the rules of legislative law that dictate the mandatory payment of arrears and penalties, which are considered as penalties for late payment of contributions .

This publication will tell you how to correctly account for the accrual and payment of penalties in a company’s accounting records.

Calculation of FSS penalties in 1s

If all actions were carried out correctly, the program will generate the corresponding changes in the accounting registers. You can check how accurately the accounting of penalties and fines is kept in 1C Accounting using processing that demonstrates the movement of the document. You can also monitor changes in accounts using built-in reports - account analysis or balance sheet.

Penalties and fines for late payment were accrued d76.02 k91.01 = 118 rubles “Operation (accounting and tax accounting)” VAT was accrued for penalties d91.02 k68.02 = 18 rubles “Reflection of VAT accrual” Issuing an invoice for penalties “Invoice issued - Reflection of VAT accrual” Receipt of payment of penalties d51 k76.02 = 118 rubles “Receipt to the current account”

Payment procedure

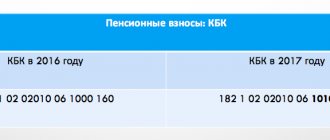

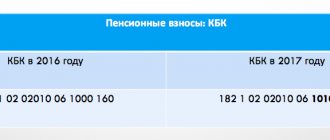

Payments for VNIM (compulsory insurance in case of temporary disability and in connection with maternity), compulsory pension insurance, compulsory medical insurance) are paid according to the details of the Federal Tax Service, each indicating its own BCC. The payment deadlines for all these payments are the same for payers making payments to individuals. For example, in 2021:

- for January - 02/15/2018;

- for February - 03/15/2018;

- for March - 04/16/2018;

- for April - 05/15/2018;

- for May - 06/15/2018;

- for June - 07/16/2018;

- for July - 08/15/2018;

- for August - 09/17/2018;

- for September - 10/15/2018;

- for October - November 15, 2018;

- for November - December 17, 2018;

- for December - 01/15/2019.

For payers who do not make payments to individuals, payment deadlines are different:

- until December 31 of the reporting year - from the amount of income up to 300,000 rubles;

- until 01.07 of the year following the reporting year, from an amount of income exceeding 300,000 rubles.

Postings for accrued penalties and fines under the Social Insurance Fund

The instructions do not establish the procedure for recording the amounts of penalties and fines. In private explanations, employees of the Russian Ministry of Finance (Department of Budget Policy and Methodology) indicate that sanctions (fines, fines) should be reflected in account 0.303.05.000 “Settlements for other payments to the budget.” This is due to the fact that they are not taxes (fees), but relate to other payments credited to the budget.

In accounting for account 0.303.05.000, it is advisable to open sub-accounts (for example, “Penalties (fines) for insurance contributions for compulsory social insurance against industrial accidents and occupational diseases”).

Calculation of insurance premiums: postings

Back in 2021, the insurance coverage of citizens has undergone significant reforms. Thus, the Federal Tax Service became the single administrator of revenues. Let us recall that previously payments for insurance coverage were credited directly to extra-budgetary funds (PFRF, FFOMS, Social Insurance Fund).

We recommend reading: What should an apartment be like so that the bailiffs don’t take it away?

Before moving directly to the rules for compiling accounting records and reflecting deductions for social needs in accounting entries, let’s look at the key aspects regarding insurance coverage for employed citizens.

Formulas for calculating penalties for insurance premiums

From 2021, insurance premiums paid by employers are divided into 2 groups, each of which has its own rules, containing:

- in the Tax Code of the Russian Federation - for payments to compulsory health insurance, compulsory medical insurance and compulsory health insurance for disability and maternity, sent to the accounts of the Federal Tax Service;

- in the Law of July 24, 1998 No. 125-FZ “On Compulsory Social Insurance...” - for contributions for injuries, the curator of which remained the FSS.

The rules for calculating penalties for each of these groups are given, respectively, in the Tax Code of the Russian Federation (clause 4, article 75) and Law No. 125-FZ (clause 6, article 26.11). Both documents establish the amount of penalties accrued in relation to one day of the delay period and link it to the refinancing rate in force during this period (from 2021 it is equal to the key rate).

This share (equal to 1/300) applies to the entire period of delay in the case of contributions subject to:

- Tax Code of the Russian Federation and their payer is an individual or individual entrepreneur;

- Law No. 125-FZ.

Penalties in this case are calculated as follows:

Dz * 1/300 * St,

Where

Dz - the number of days of delay (they will also include the day of payment of the delayed amount);

St is the key rate.

If the rate changes during the period, the calculation will be the sum of two products obtained taking into account the differing rates.

For legal entities in relation to contributions subject to the Tax Code of the Russian Federation, this formula is valid only during the delay period not exceeding 30 calendar days. If it lasts longer, starting from the 31st day, the share of the refinancing rate doubles, and then the formula for calculating penalties will look like this:

Dz * 1/150 * St.

If the refinancing rate remains constant, this will lead to the formation of the amount of penalties by adding two products calculated taking into account different shares of the rate. If the rate changes during the delay period, an additional product will begin to participate in the calculation, taking into account the changed value of the rate.

Tax fines and penalties: accounting and postings

Regardless of the chosen option for reflecting penalties, you must remember that penalties do not reduce profits for tax purposes. In the financial statements, penalties are reflected depending on the selected accounting account. Ultimately, the net profit will be the same for any option for accounting for penalties. If the amount of penalties is significant, it is advisable to disclose information about it in an explanatory note.

We recommend reading: Will a working pensioner receive a lost pension from the pension after leaving work?

An example of calculating penalties. LLC "Spring Wind" sent the VAT return for the fourth quarter of 2021 on 01/30/2021 instead of the established deadline of 01/25/2021. The tax payable according to the declaration is 360,000 rubles. The company paid the due tax only on 03/30/2021. The Federal Tax Service issued requirement No. 4587 dated 04/05/2021, according to which it is necessary to pay a fine in the amount of 5% of the tax amount - 18,000 rubles. The accountant calculated the amount of penalties and reflected all sanctions in postings. Penalties are recorded on account 99. Penalties are also accrued for the day of payment.