What tax is paid to which budget in the country?

- federal, having a national character;

- regional, which include taxes and fees within the constituent entities of the federation, republics that are part of the Russian Federation;

- local ones, which are established by authorities at the municipal level, while acting within the framework of the current legislation of the Russian Federation, as well as acts of the constituent entities of the federation.

It is worth remembering that in all cases, the taxpayer bears responsibility for the adequacy of calculations and timely payment of payments. In this case, priority is given to federal taxes, which constitute a significant part of the total burden on business entities, enterprises and organizations. In second place in priority are local taxes on income, after which other types of payments are calculated and paid.

To what budget are insurance premiums paid? Federal or regional?

- fines for offenses and state duties (some are credited to the federal budget, others to the regional budget);

- excise taxes: on alcohol-containing and alcoholic products (paid partly to the federal budget, partly to the regional budget), on tobacco (paid to the federal budget), gasoline and diesel fuel (12% is paid to the federal budget, 88% to the regional budget);

- customs duties and recycling fees (included in the price of the car) are credited to the federal budget.

Accrual and transfer of insurance contributions to state extra-budgetary funds Regional taxes and fees are those established by the Tax Code of the Russian Federation and the laws of the constituent entities of the Russian Federation, put into effect in accordance with the Tax Code of the Russian Federation by the laws of the constituent entities of the Russian Federation and mandatory for payment in the territories of the corresponding constituent entities of the Russian Federation. When establishing a regional tax, the legislative (representative) bodies of the constituent entities of the Russian Federation determine the following elements of taxation: tax rates within the limits established by the Tax Code of the Russian Federation, the procedure and deadlines for paying the tax, as well as reporting forms for this regional tax.

Topic 17. LOCAL TAXES AND FEES

- 17.1. Property tax for individuals

- 17.2. Land tax

The main regulatory act providing legal regulation of the payment of property taxes for individuals in 2004 was the Law on Taxes on Property of Individuals.

Tax payers

the property of individuals is recognized as individuals - owners of property recognized as an object of taxation. If property recognized as an object of taxation is in the common shared ownership of several individuals, each of the individuals is recognized as a taxpayer in relation to this property in proportion to its share in this property. Taxpayers are determined in a similar manner if the property is in common shared ownership of individuals and enterprises (organizations). If property recognized as an object of taxation is in the common joint ownership of several individuals, they bear equal responsibility for the fulfillment of tax obligations. The taxpayer may be one of these persons, determined by agreement between them.

Objects of taxation

Residential buildings, apartments, dachas, garages and other buildings, premises and structures are recognized.

Tax rates

for buildings, premises and structures are established by regulatory legal acts of representative bodies of local government, depending on the total inventory value.

Representative bodies of local self-government can determine the differentiation of rates within established limits depending on the total inventory value, type of use and other criteria. Tax rates are set within the limits specified in table. 17.1. Table 17.1 Property tax rates for individuals

Tax benefits.

The categories of citizens named in Art. 4 of the Law on Personal Property Taxes.

Local governments have the right to establish tax breaks on taxes and the grounds for their use by taxpayers.

Tax calculation procedure.

Taxes are calculated by the tax authorities. The tax is established on the basis of data on the inventory value of property of individuals as of January 1 of each year.

Persons entitled to benefits independently submit the necessary documents to the tax authorities. If the right to a benefit arises during a calendar year, the tax is recalculated from the month in which this right arose. In case of untimely application for tax benefits, the amount of taxes will be recalculated for no more than three years upon a written application from the taxpayer.

Tax payment notices are handed over to payers by tax authorities annually no later than August 1.

Procedure and deadlines for tax payment.

The tax is paid by owners in equal shares within two deadlines - no later than September 15 and November 15.

For new buildings, premises and structures, the tax is paid from the beginning of the year following their construction or acquisition.

For buildings, premises and structures passed by inheritance, tax is levied on the heirs from the moment the inheritance is opened. For buildings, premises and structures that are in the common shared ownership of several owners, the tax is paid by each of the owners in proportion to their share in these buildings, premises and structures. For buildings, premises and structures that are in common joint ownership of several owners without determining shares, the tax is paid by one of the indicated owners by agreement between them. In case of inconsistency, the tax is paid by each owner in equal shares.

When transferring ownership of a building, premises, structure from one owner to another during a calendar year, the tax is paid by the original owner from January 1 of this year until the beginning of the month in which he lost ownership of the specified property, and by the new owner - starting from the month , in which the latter acquired ownership rights.

In the event of destruction or complete destruction of a building, premises, or structures, the collection of taxes ceases starting from the month in which they were destroyed or completely destroyed.

The use of land in the Russian Federation is paid. The forms of payment for the use of land are land tax (before the introduction of real estate tax) and rent.

Land tax from January 1, 2005 is established by the Tax Code (Section 9 “Local Taxes”, Chapter 31 “Land Tax”) and regulatory legal acts of representative bodies of municipalities, comes into force and ceases to operate in accordance with the Tax Code and regulatory legal acts of representative bodies of municipalities and is obligatory for payment in the territories of these municipalities.

Taxpayers of land tax

organizations and individuals who own land plots on the right of ownership, the right of permanent (perpetual) use or lifelong inheritable possession are recognized. Organizations and individuals are not recognized as taxpayers in relation to land plots held by them under the right of gratuitous fixed-term use or transferred to them under a lease agreement.

Object of taxation

land plots located within a municipality (including the federal cities of Moscow and St. Petersburg) on whose territory the tax has been introduced are recognized.

The following are not recognized as objects of taxation:

– land plots withdrawn from circulation;

– some land plots limited in circulation (their list contains clauses 2, 3, 5 of Article 389 of the Tax Code);

– land plots from the forest fund lands.

The tax base

is defined as the cadastral value of land plots recognized as an object of taxation as of January 1 of the year, which is the tax period. The cost of a land plot is determined in accordance with the land legislation of the Russian Federation.

Taxpayer organizations determine the tax base independently on the basis of information from the state land cadastre about each land plot owned by them by right of ownership or right of permanent (perpetual) use.

Individual entrepreneurs determine the tax base independently in relation to land plots used by them in business activities, based on information from the state land cadastre about each land plot owned by them by right of ownership, right of permanent (perpetual) use or lifelong inheritable possession.

For other taxpayers who are individuals, the tax base is determined by the tax authorities on the basis of information provided by the authorities:

– carrying out maintenance of the state land cadastre;

– carrying out registration of rights to real estate and transactions with it;

– municipalities.

Tax period

The calendar year is recognized.

Reporting periods for taxpayer organizations and individuals who are individual entrepreneurs are recognized as the first quarter, second quarter and third quarter of the calendar year. When establishing a tax, the representative body of a municipality has the right not to establish a reporting period.

Tax rates

cannot exceed:

– 0.3% for land plots:

– classified as agricultural lands or lands within agricultural use zones in settlements and used for agricultural production;

– occupied by the housing stock and engineering infrastructure facilities of the housing and communal services complex (except for the share in the right to a land plot attributable to an object not related to the housing stock and engineering infrastructure facilities of the housing and communal services complex) or acquired (provided) for housing construction;

– purchased (provided) for personal subsidiary farming, gardening, vegetable gardening or livestock farming, as well as summer cottage farming;

– 1.5% for other land plots.

It is allowed to establish differentiated tax rates depending on the categories of land and (or) the permitted use of the land plot.

The procedure for calculating and paying tax. By

As a general rule, the amount of tax is calculated at the end of the tax period as a percentage of the tax base corresponding to the tax rate. The amount of tax payable to the budget at the end of the tax period is determined as the difference between the calculated amount of tax and the amounts of advance tax payments payable during the tax period.

Taxpaying organizations calculate the amount of tax and advance payments on it independently.

Individual entrepreneurs calculate the amount of tax and advance payments on it independently in relation to land plots used by them in business activities.

In other cases, the amount of tax and advance payments thereon is calculated by the tax authorities and paid by the taxpayer on the basis of a notification sent to him.

Organizations and individual entrepreneurs submit a tax return to the tax authority at the location of the land plot no later than February 1 of the expired tax period.

Taxpayers entitled to tax benefits must submit documents confirming this right to the tax authorities at the location of the land plot recognized as the object of taxation.

The tax and advance payments thereon are subject to payment by taxpayers in the manner and within the time limits established by the regulatory legal acts of the representative bodies of municipalities (laws of the federal cities of Moscow and St. Petersburg).

Table of contents

To what budget are insurance premiums paid? Federal or regional?

The tax rate is divided into two parts: the rate for the federal budget and the rate for the regional budget. After an organization calculates the total amount of corporate income tax, it must divide it into two unequal parts and pay them to different budgets.

Among the federal, regional and local taxes and fees in force in Russia, one can highlight the trade tax. Its peculiarity is that the code establishes a “territorial” restriction for this mandatory payment. At the moment, only three cities of the Russian Federation can introduce this fee on their territory: Moscow, St. Petersburg and Sevastopol (and in practice it has been introduced only in Moscow).

To what budget do taxpayer insurance contributions go?

Federal taxes are payable throughout the Russian Federation. And these include: - value added tax - a tax that is included by the manufacturer in the cost of the product, so the tax is paid by the buyer; - excise taxes - tax on socially dangerous goods: alcohol, tobacco, cigarettes, etc.; - tax on income of individuals, as the name implies, this tax is payable if an individual receives any profit - wages, dividends, etc.; - unified social tax, includes payments to the federal budget, FFOMS (Federal Mandatory Medical Fund) education), TFOMS, FSS (Social Insurance Fund); - corporate income tax; - mineral extraction tax; - water tax; - fees for the use of wildlife and for the use of aquatic biological resources; - state duty.

We recommend reading: Benefits for parents of military personnel

Local taxes and fees are those established by the Tax Code of the Russian Federation and regulatory legal acts of representative bodies of local self-government, put into effect in accordance with the Tax Code by regulatory legal acts of representative bodies of local self-government and mandatory for payment in the territories of the relevant municipalities. When establishing a local tax, representative bodies of local self-government define the following elements of taxation in regulatory legal acts: tax rates within the limits established by the Tax Code of the Russian Federation, the procedure and deadlines for paying the tax, as well as reporting forms for this local tax. Accrual and transfer of insurance contributions to state extra-budgetary funds Insurance contributions are payments to extra-budgetary funds that are assessed and paid by the employer from the income of his employees.

Approved by order of the Ministry of Finance of the Russian Federation dated January 15, 2001. Zn

P R A V ?p L A

crediting contributions paid as part of the unified social tax (contribution) to the accounts of the federal treasury bodies of the Ministry of Finance of the Russian Federation and transferring these funds to the budgets of state social extra-budgetary funds, as well as crediting arrears, penalties and ?/traffic on insurance contributions to state social extra-budgetary funds funds (including the State Employment Fund of the Russian Federation), formed on January 1, 2001, to these accounts and transfers of these funds to the budgets of state social extra-budgetary funds and the federal budget.

These Rules have been developed in order to implement the provisions of Chapter 24 of Part Two of the Tax Code of the Russian Federation (Collected Legislation of the Russian Federation, 2000, 32, Art. 3340), in accordance with the order of the Government of the Russian Federation of October 16, 2000 1462-r (Collected Legislation of the Russian Federation Federation, 2000, 43, Art. 4273) and establish the procedure for crediting contributions paid as part of the unified social tax (contribution) to the accounts of the federal treasury bodies of the Ministry of Finance of the Russian Federation and transferring these funds to the budgets of state social extra-budgetary funds, as well as for crediting arrears , penalties and ?/traffic on insurance contributions to state social extra-budgetary funds (including the State Employment Fund of the Russian Federation), formed?/them as of January 1, 2001, to these accounts and transfers of these funds to the budgets of state social extra-budgetary funds and the federal budget.

1. Insurance contributions and other payments to state social extra-budgetary funds - the Pension Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund, territorial compulsory medical insurance funds, the Social Insurance Fund of the Russian Federation, are transferred by taxpayers to the current accounts of these funds until January 15, 2001 inclusive.

2. Transit accounts opened in institutions of the Central Bank of the Russian Federation or, in the event of their absence in the relevant territory or the impossibility of them performing the functions of servicing budget accounts - in credit institutions (hereinafter referred to as banks) to the Pension Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund and territorial compulsory funds medical insurance on balance sheet accounts 40401 Pension Fund of the Russian Federation, 40403 Federal Compulsory Medical Insurance Fund of the Russian Federation and 40404 Territorial Compulsory Medical Insurance Funds are closed on January 16, 2001 in the manner established by the Central Bank of the Russian Federation.

Transit accounts on the balance sheet account 40402 of the Social Insurance Fund of the Russian Federation are retained to carry out operations on compulsory social insurance against industrial accidents and occupational diseases.

The transfer of funds from January 16, 2001 for the payment of the unified social tax (contribution), as well as the amounts of arrears, penalties and?/traffic, formed as of January 1, 2001 for payments to you?/the specified state social extra-budgetary funds, is carried out in in the manner established by these Rules.

3. Taxpayers submit payment orders to the bank for the transfer of funds for payment of the unified social tax (contribution) (hereinafter referred to as the tax), as well as the amount of arrears, penalties and fines (hereinafter referred to as arrears), formed as of January 1, 2001 for payments to state social extra-budgetary funds, separately for each specified state social extra-budgetary fund to the personal accounts of the federal treasury bodies of the Ministry of Finance of the Russian Federation (hereinafter referred to as the federal treasury bodies), previously opened in banks on balance sheet account 40101 Income distributed by the federal treasury bodies between levels of the budget system of the Russian Federation.

4. The federal treasury authorities keep records of tax amounts received in the accounts specified in paragraph 3 of these Rules, as well as arrears of insurance contributions to you?/the named state social extra-budgetary funds formed as of January 1, 2001, according to the following codes for classification of budget revenues of the Russian Federation:

1010510 Unified social tax (contribution), credited to the Pension Fund of the Russian Federation;

1010520 Unified social tax (contribution), credited to the Social Insurance Fund of the Russian Federation;

1010530 Unified social tax (contribution), credited to the Federal Compulsory Health Insurance Fund;

1010540 Unified social tax (contribution), credited to territorial compulsory health insurance funds;

1400305 Debt from previous years for the payment of insurance premiums, penalties and fines to the State Employment Fund of the Russian Federation, as well as funds from the Employment Fund returned by organizations in accordance with previously concluded agreements (agreements);

1400310 Debt on insurance premiums, penalties and ?/traffic charges credited to the Pension Fund of the Russian Federation;

1400311 Debt on insurance contributions, penalties and ?/traffic charges credited to the Social Insurance Fund of the Russian Federation;

1400312 Debt on insurance premiums, penalties and fees credited to the Federal Compulsory Medical Insurance Fund;

1400313 Debt on insurance premiums, penalties and fees credited to territorial compulsory health insurance funds.

At the same time, the codes 1010510, 1010520, 1010530, 1010540 also take into account the amounts credited to the repayment of debts, penalties and fines (except for debts, penalties and fines formed as of January 1, 2001), and according to codes 1400305, 1400310, 1400311, 1400312, 1400313, the amounts credited to the repayment of debts, penalties and fines, formed as of January 1, 2001, are taken into account.

5. In the Payer field of the payment order, the taxpayer indicates: his identification number (?pNN) and the reason for registration code (KPP); name of company.

In the field Recipient of the payment order, the taxpayer indicates: tax authority identification number (?pNN),

exercising control over the receipt of payment; the name of the federal treasury body (?nN of the federal treasury body is not affixed); name of the tax authority exercising control over the receipt of payment (put in brackets).

When transferring tax using codes 1010510, 1010520, 1010530, 1010540, the taxpayer in the Purpose of payment field of the payment order indicates: code for the classification of budget income of the Russian Federation (in parentheses); unified social tax (current payments, penalties or ?/traffic) in - (name of the state social extra-budgetary fund); registration number in the state social extra-budgetary fund (in brackets); the period for which the tax is paid.

When transferring funds to pay off debt on payments to state social extra-budgetary funds using codes 1400305, 1400310, 1400311, 1400312, 1400313, the taxpayer in the Purpose of payment field of the payment order indicates: code for the classification of budget income of the Russian Federation (in parentheses); type of debt (arrears, fines, ?/traff) in - (name of the state social extra-budgetary fund); registration number in the state extra-budgetary fund (in brackets); the period for which the debt is transferred (arrears, penalties, ?/traff).

6. Federal Treasury authorities, no later than the day following the day of receipt of personal account statements from the bank, transfer funds received to the personal accounts specified in paragraph 3 of these Rules to accounts previously opened in banks by the relevant authorities of state social extra-budgetary funds for accounting of these funds:

regional branches of the Pension Fund of the Russian Federation - to personal accounts with sign O 1 in the 15th and 16th digits of the personal account number opened on balance sheet account 40401 Pension Fund of the Russian Federation;

regional branches of the Social Insurance Fund of the Russian Federation - to personal accounts opened on balance sheet account 40402 Social Insurance Fund of the Russian Federation;

Federal Compulsory Medical Insurance Fund - to personal accounts with attribute 01 in the 15th and 16th digits of the personal account number opened on balance sheet account 40403 Federal Compulsory Medical Insurance Fund in OPERU-1 under the Bank of Russia. Account details of the Federal Compulsory Medical Insurance Fund will be additionally sent to the federal treasury authorities;

territorial compulsory health insurance funds - to personal accounts with sign 01 in the 15th and 16th digits of the personal account number opened on the balance sheet account 40404 Territorial compulsory health insurance funds.

Expenditure by state social extra-budgetary funds of funds credited to you/not specified personal accounts opened on balance sheet accounts 40401, 40402, 40403, 40404 is carried out by these funds in the prescribed manner in accordance with the legislation of the Russian Federation.

to the personal accounts specified in paragraph 3 of these Rules, under code 1400305 Debt of previous years for the payment of insurance premiums, penalties and ?/traffic charges to the State Employment Fund of the Russian Federation, as well as funds of the Employment Fund returned by organizations in accordance with previously concluded agreements ( agreements) are transferred by federal treasury authorities to accounts for recording federal budget revenues.

8. Bodies of state social extra-budgetary funds inform the federal treasury bodies of information about the details of accounts opened by them in banks for the transfer of tax amounts and arrears to their budgets.

Tax authorities inform payers of insurance contributions to state social extra-budgetary funds the details of the account of the federal treasury body to which the tax is to be credited, as well as the amount of arrears in accordance with the budget classification codes of the Russian Federation specified in paragraph 4 of these Rules.

9. The federal treasury authorities refund (offset) excess/unpaid or collected tax by payment orders based on the conclusion of the tax authority in the manner established by legislative and other regulatory legal acts.

10. The federal treasury authorities daily transfer: to the tax authorities - a copy of the consolidated register in accordance with Appendix 2 to the instructions on the procedure for keeping records of federal budget revenues and distribution in the manner of regulating income between budgets of different levels of the budget system of the Russian Federation, approved by order of the Ministry of Finance of Russia dated December 14, 1999 . 91n (registered with the Ministry of Justice of the Russian Federation on December 14, 1999, registration number 2022) (hereinafter referred to as “instructions”) with the attachment of payment documents, and for the bodies of state social extra-budgetary funds - extracts from the specified consolidated register according to the corresponding classification codes of budget income of the Russian Federation (according to as tax payments and arrears are received). Extracts from the register using codes 1010530 and 1400312 are transferred by the federal treasury authorities to the territorial compulsory health insurance funds. Full-format electronic payment documents received by the federal treasury authorities from the bank are subject to transmission to the tax authorities in electronic form or a copy of them on paper, printed and certified by the federal treasury authority. Electronic payment documents must contain all the details established in paragraph 5 of these Rules, taking into account the size of the fields established by the regulations of the Bank of Russia.

11. The federal treasury authorities and tax authorities carry out a monthly reconciliation of tax receipts/their amounts in accordance with the instructions specified in paragraph 10 of these Rules. If discrepancies are identified in the reporting data, the reasons are determined and measures are taken to eliminate them.

12. Federal treasury bodies and territorial bodies of state social extra-budgetary funds carry out a monthly reconciliation of the amounts transferred to the budget of the funds from the personal accounts of the federal treasury bodies opened on balance sheet account 40101.

13. The federal treasury authorities carry out accounting and prepare reports on received and transferred tax amounts in the manner established by the Ministry of Finance of the Russian Federation.

Insurance premiums

The smallest share consists of payments remaining in the budgets of the municipal level - these are local taxes

.

The rules for their calculation, rates and payment terms are determined by legislators of local administrations. True, as for regional and federal taxes

, the Tax Code of the Russian Federation defines the main principles and framework that cannot be exceeded.

The fact that taxes are federal, regional and local determines the differences in the order of their enactment, application and repeal. For example, local taxes established by the Tax Code of the Russian Federation and legal acts of municipalities or laws of cities of federal significance are obligatory for payment in the territories of the corresponding municipalities or cities of federal significance (clause 4 of Article 12 of the Tax Code of the Russian Federation).

Law, theory and concept of law

Before the entry into force of the chapter “Property Tax for Individuals” of Section X “Local Taxes and Fees” of Part Two of the Tax Code of the Russian Federation, this tax is levied on the basis of: the provisions of Part One of the Tax Code of the Russian Federation; the current version of the Law of the Russian Federation “On the Fundamentals of the Tax System in the Russian Federation” dated December 27, 1991 No. 2118-1 (as amended as of July 24, 2002); Law of the Russian Federation “On taxes on property of individuals” dated 09.12.91 No. 2003-1 (as amended as of 17.07.99) and the regulatory legal act of the representative body of local government on the introduction of a tax on the territory of the corresponding municipality. For the purpose of methodological assistance in the development, adoption and application of such an act, in 1999, the Instruction of the Ministry of Taxes of the Russian Federation “On the application of the Law of the Russian Federation “On taxes on property of individuals” dated 02.11.99 No. 54, which is advisory in nature, was published. In accordance with the law, taxpayers of property tax for individuals are individuals - owners of property recognized as the object of taxation. In cases where the property recognized as an object of taxation is: • in the common shared ownership of several individuals, each of these individuals is recognized as a taxpayer in relation to this property in proportion to its share in this property. Taxpayers are determined in a similar manner if such property is in the common shared ownership of individuals and organizations; common joint property of several individuals - they bear equal responsibility for the fulfillment of tax obligations. In this case, the taxpayer may be one of these persons, determined by agreement between them. The object of taxation is two types of property: real estate - residential buildings, apartments, dachas, garages and other buildings, premises and structures located on the territory of the Russian Federation; movable - airplanes, helicopters, motor ships, yachts, boats, motor sleds, motor boats and other water-air vehicles (except for rowing boats), regardless of the national or legal status of their owners.

The tax base for this tax is determined on the basis of the value of the real estate subject to taxation or the engine power, capacity and other similar characteristics of vehicles. The tax rate for each type of property recognized as an object of taxation under this tax is established separately. In relation to real estate, tax rates are established by regulatory legal acts of representative bodies of local government, depending on the total inventory value. In this case, tax rates are set within the following limits:

Property value

Tax rate

up to 300 thousand rubles.

before 0,1%

from 300 thousand rubles. up to 500 thousand rubles.

from 0.1 to 0.3%

over 500 thousand rubles.

from 0.3 to 2.0%

In relation to movable property (vehicles), tax rates are also established by regulatory legal acts of representative bodies of local self-government, depending on the qualitative characteristics of these objects of taxation. At the same time, tax rates cannot exceed the minimum amounts established by law, which are determined for various types of taxable objects. Tax benefits for this tax are primarily social in nature. Thus, the following categories of citizens are exempt from paying property taxes on individuals: Heroes of the Soviet Union and Heroes of the Russian Federation, as well as persons awarded the Order of Glory of three degrees; disabled people of groups I and II, disabled since childhood; participants in the Civil and Great Patriotic Wars, other military operations to defend the USSR from among military personnel who served in military units, headquarters and institutions that were part of the active army, and former partisans; civilian personnel of the Soviet Army, Navy, internal affairs and state security bodies holding regular positions in military units, headquarters and institutions that were part of the active army during the Great Patriotic War, or persons who were in cities during this period, participation in the defense of which these persons are counted towards their length of service for the purpose of granting a pension on preferential terms established for military personnel of active army units; persons receiving benefits in accordance with the Law of the RSFSR “On the social protection of citizens exposed to radiation due to the disaster at the Chernobyl nuclear power plant”, as well as persons specified in articles 2, 3, 5, 6 of the Law of the Russian Federation “On the social protection of citizens exposed to radiation” radiation due to the accident in 1957 at the Mayak production association and the discharge of radioactive waste into the Techa River; military personnel, as well as citizens discharged from military service upon reaching the age limit for military service, health conditions, or in connection with organizational and staffing events with a total duration of military service of 20 years or more;

persons who were directly involved as part of special risk units in testing nuclear and thermonuclear weapons, eliminating accidents of nuclear installations at weapons and military facilities; • family members of military personnel who have lost their breadwinner. In addition, the tax on buildings, premises and structures is not hidden: by pensioners receiving pensions assigned in the manner established by the pension legislation of the Russian Federation;

citizens discharged from military service or called up for military training, performing international duty in Afghanistan and other countries in which hostilities took place; parents and spouses of military personnel and government employees who died in the line of duty; from specially equipped structures, buildings, premises (including housing) owned by cultural figures, artists and folk craftsmen and used exclusively as creative workshops, ateliers, studios, as well as from living space used to organize non-state museums open to the public , galleries, libraries and other cultural organizations, for the period of such use; from residential buildings with a living area of up to 50 square meters located on plots in gardening and dacha non-profit associations of citizens. m and utility buildings and structures with a total area of up to 50 sq. m.

Owners of motor boats with an engine power of no more than 10 hp are exempt from paying vehicle tax. With. or 7.4 kW. The tax period for personal property tax is a calendar year. The procedure for calculating and paying tax. The tax is calculated by the tax authorities. In order to ensure this obligation, bodies that register rights to real estate and transactions with it, as well as technical inventory bodies and organizations that register vehicles, are obliged annually before March 1 to submit to the tax authority the information necessary for calculating taxes, as of on January 1 of the current year, as well as report about real estate located on the territory under their jurisdiction or about registered vehicles and their owners within 10 days after registering the property. Tax authorities calculate the amount of tax payable and annually, no later than August 1, send a tax notice to the taxpayer. Tax payment is made in equal installments in two terms - no later than September 15 and November 15. Since the tax is local, the tax amount is credited to the budget of the municipality at the location (registration) of the taxable object.

To what budget are insurance premiums paid to the federal or local

Starting from January 1, 2021, all insurance premiums, with the exception of FSS contributions for “injuries,” must be transferred to your tax office: to entrepreneurs at their place of residence, and to organizations at their location. This applies not only to insurance premiums accrued in 2021, but also to those paid for previous reporting periods before 01/01/2021. For example, insurance premiums for December 2021 in January 2021 must be paid to the Federal Tax Service under the new BCC, despite that contributions for 2021 still need to be submitted to the funds.

Taxes are credited to the budget of the appropriate level or state extra-budgetary funds and, as a rule, are depersonalized in them. This distinguishes taxes from fees that are levied for specific purposes or are a payment for providing the payer with any legally significant actions.

What taxes and to what budgets do we pay?

As is known in Russia, the three-level budget system is the federal, regional and municipal budgets. The tax system includes the same levels, which are supplemented by corresponding taxes and fees.

We recommend reading: Invoice dates do not match and KS3 invoice has an earlier date

- value added tax - a tax that is included by the manufacturer in the price of the product, so the buyer pays the tax; — excise taxes — a tax on socially dangerous goods: alcohol, tobacco, cigarettes, etc.; - personal income tax, as the name implies, this tax is payable if an individual receives any profit - wages, dividends, etc.; — unified social tax, includes payments to the federal budget, FFOMS (Federal Fund for Compulsory Medical Education), TFOMS, FSS (Social Insurance Fund); — corporate income tax; — mineral extraction tax; — water tax; — fees for the use of objects of the animal world and for the use of objects of aquatic biological resources; - National tax.

How to create a tax budget

04/06/2016 # CFC and amnesty - publications Retail trade - industries Oil and gas industry | "KAMERTON-AK" Information technology - industries "KAMERTON-AK" Construction - industries Pharmaceuticals - industries

Rasim Nazarov - Head of Tax Practice, Managing Partner. Head of Tax Practice.

Taking into account the growing tax burden on business and the improvement of the work of fiscal authorities in tax administration, the importance of the tax budget cannot be underestimated.

Tax budgeting is, so to speak, the cherry on top of the entire budgeting process. To draw up a tax budget, the entire budgeting process must be streamlined, the financial structure of the company must be clearly defined with the definition of centers of financial responsibility. The budget is formed based on the company’s goals, and the company’s goals are still the desired vision of reality, and for its implementation it is necessary to work, with In this case, the external environment or force majeure may make their own adjustments. Budget formation can allow you to proactively respond to possible tax problems in the future.

Since in order to draw up a tax budget it is necessary to understand the specifics of calculating taxes and insurance premiums, the preparation of this budget must be entrusted to the most competent and qualified employee in this area, in our case this is the chief accountant, but in some companies there are positions of tax managers and, perhaps, this is exactly he should be entrusted with this task. Which center of financial responsibility this employee or department will be is a debatable issue. Some companies will consider this a cost center, some an accounting center, and perhaps, for various taxes, both. It all depends on how the company understands the possibilities of influencing the amount of taxes.

In our case, we have defined this Central Federal District as an accounting center, but at the same time we have set targets for the tax burden and tax risks to control the execution of the tax function. This is due to the fact that the chief accountant cannot influence the calculation of any taxes, for example, salary taxes, since the amount of wages is determined by the top management of the company. But, for example, in the case of income tax, the chief accountant can to some extent influence the amount of tax, using legal methods of tax optimization in the form of accumulated losses, depreciation bonus, creation of reserves, etc.

Now let's take a closer look at significant taxes.

VAT

Since VAT payable to the budget is defined as the amount of calculated VAT reduced by the amount of tax deductions and increased by the amount of restored VAT (clause 1 of Article 173 of the Tax Code of the Russian Federation), to calculate the VAT budget it is necessary to understand the structure of revenue and costs subject to VAT, since revenue forms calculated VAT, and costs form VAT deductions. Accordingly, we plan revenue and expenses based on VAT-taxable and VAT-exempt transactions, where possible. Yes, in fact, discrepancies arise, because due to insignificant costs we cannot plan which supplier we will buy from and, accordingly, what taxation system it will apply.

Companies carrying out both VAT-taxable and tax-exempt transactions must predict the structure of such income, because depending on the structure of taxable and non-taxable income, Art. 170 of the Tax Code of the Russian Federation provides for the rules for accounting for “input” VAT: it can be deducted in whole or in part, taken into account in the value of the asset (clause 4 of Article 170 of the Tax Code of the Russian Federation) or restored (in relation to assets and transactions specified in clause 3 of Art. 170 of the Tax Code of the Russian Federation). The presence of such features necessitates the need to maintain a forecast register for both VAT-taxable and tax-exempt transactions.

In addition, to calculate VAT, the employee responsible for preparing the tax budget needs to know the amounts of incoming and outgoing cash flows associated with settlements with counterparties for operating activities. This is due to the fact that upon receipt of payment, partial payment for upcoming deliveries of goods (work, services), property rights, the company must calculate VAT (paragraph 2, paragraph 1, article 154 of the Tax Code of the Russian Federation, paragraph 1, article 166 of the Tax Code of the Russian Federation ), and upon shipment take it for deduction (clause 8 of Article 171 of the Tax Code of the Russian Federation, clause 6 of Article 172 of the Tax Code of the Russian Federation). At the same time, the company has the right to deduct VAT on the amount of payment, partial payment transferred on account of upcoming deliveries of goods (performance of work, provision of services), transfer of property rights if the documents provided for by the Tax Code of the Russian Federation are available (clause 12 of Article 171 of the Tax Code of the Russian Federation, clause 9, Article 172 of the Tax Code of the Russian Federation).

It is especially important to forecast VAT on cash flow for companies acting as general contractors under long-term contracts; we try to agree on the transfer of prepayment at the beginning of the month or quarter in order to also have time to transfer it to our suppliers. If the work is not delivered by us within the quarter, this allows us not to freeze the money for calculating VAT on the prepayment.

In general cases, VAT is calculated in one quarter and paid in equal installments no later than the 25th day of each of the three months of the next quarter (clause 1 of Article 174 of the Tax Code of the Russian Federation). Accordingly, the impact of the budget on taxes in terms of VAT will be as follows: in the BDR, the amounts of income and expenses will be indicated without VAT, except for the cases indicated above, and in the BDR the amounts of VAT payable will be indicated as the deadlines stipulated by the Tax Code of the Russian Federation arrive.

Income tax

The peculiarities of income tax are that it is determined based on tax accounting data, and budgeting is carried out on the basis of management accounting data. Income tax calculated based on management accounting data will most likely differ from the amount of actual income tax. And this is due to the different goals and, accordingly, the methodology of these types of accounting.

In our practice, to prepare the income tax budget, we use tax register forms provided for by accounting policies for tax purposes. The need for such an approach is due to the fact that in the forecast period we planned capital investments, and according to paragraph 2 of clause 9 of Art. 258 of the Tax Code of the Russian Federation, the taxpayer has the right to include in the expenses of the reporting (tax) period expenses for capital investments in the amount of no more than 10 percent (no more than 30 percent in relation to fixed assets belonging to the third - seventh depreciation groups) of the original cost of fixed assets (for with the exception of fixed assets received free of charge), as well as no more than 10 percent (no more than 30 percent in relation to fixed assets belonging to the third to seventh depreciation groups) of expenses incurred in cases of completion, additional equipment, reconstruction, modernization, technical re-equipment, partial liquidation of fixed assets and the amounts of which are determined in accordance with Article 257 of the Tax Code.

Since this possibility is not provided for by other accounting systems, we made a separate tax register for these expenses. The differences between tax, accounting and management accounting will be in the recognition of income and expenses, at the moment of recognition of income and expenses, so we decided to make forecasts for significant amounts. tax registers.

This above applies to the reflection of amounts in the BDR; from the point of view of the BDD, the following features exist. The company must pay the amount of income tax and the amount of advance tax payments, while paragraph 2 of Art. 286 of the Tax Code of the Russian Federation provides the opportunity to choose the order of transfer of advance payments:

- payment of monthly advance payments based on actual profit;

- payment of monthly advance payments during the reporting period;

According to para. 8 paragraph 2 art. 286 of the Tax Code of the Russian Federation, the taxpayer has the right to switch to paying monthly advance payments based on actual profits by notifying the tax authority no later than December 31 of the year preceding the tax period in which the transition to this advance payment system takes place. At the same time, the system for making advance payments cannot be changed by the taxpayer during the tax period. The procedure specified in this paragraph also applies in the case of a transition from paying monthly advance payments based on actual profit to paying monthly advance payments during the reporting period.

When paying monthly advance payments during the reporting period, the calculation is more complex and is carried out as follows:

- for the 1st quarter, the amount of the monthly advance payment is equal to the monthly advance payments for the 4th quarter of the previous year;

- for the 2nd quarter, the amount of the monthly advance payment is equal to 1/3 of the amount of advance payments for the 1st quarter

- for the 3rd quarter, the amount of the monthly advance payment is equal to 1/3 * (the amount of the advance payment for 6 months minus the amount of the advance payment for the 1st quarter)

- for the 4th quarter, the amount of the monthly advance payment is equal to 1/3 * (the amount of the advance payment for 9 months minus the amount of the advance payment for 6 months).

Each option has its own advantages and disadvantages, for example, paying advance payments from actual profits allows you to clearly predict the relationship between the profit of the reporting period and the tax, and when paying advance payments during the reporting period, the amount of the advance payment may be less than if the tax paid based on actual profits.

Let us remind you that the tax amounts in accordance with clause 1 of Art. 287 of the Tax Code of the Russian Federation are paid as follows:

- annual tax no later than March 28 of the following year;

- monthly advance payments due during the reporting period are paid no later than the 28th day of each month of this reporting period.

- monthly advance payments based on actual profit no later than the 28th day of the month following the month based on the results of which the tax is calculated.

Calculation of advance payments for income taxes once again confirms the need for tax budgeting by the most competent employees in the field of finance and taxation. And drawing up a tax budget for the next year in advance will allow you to analyze the possibility of switching to one or another method of calculating advance payments, based on projected financial indicators.

Property tax and land tax

Property tax is calculated based on the book value of property in relation to movable property and the cadastral value of property in relation to real estate (Article 375 of the Tax Code of the Russian Federation). To calculate the projected property tax on existing fixed assets, it is enough to extrapolate the data on the book and cadastral value for the forecast period, correctly applying the depreciation rate and tax rate. With regard to real estate, it is necessary to understand whether government agencies will have the opportunity to revise the cadastral value in the forecast period. At the same time, property may be acquired in the forecast period, and to calculate the tax on this property, an investment budget is required, broken down by the type of property acquired.

In relation to land tax, the same logic will apply as in relation to property tax, since the tax is calculated based on the cadastral value (Article 390 of the Tax Code of the Russian Federation).

Personal income tax and insurance premiums

For personal income tax and insurance contributions, the budget will be calculated based on data on upcoming salaries. In our company, we have employees whose wages are calculated based on their salary, and there are employees with piecework wages. If with regard to “salaries” everything is quite simple: you need to understand the size of the salary and rotation. The calculation of taxes for “piece-rate workers” directly depends on the implementation of the sales plan and production plan. Here, the initial information on wages comes from the income center and cost center.

Considering that insurance premiums are calculated taking into account the maximum base value, we divide employees by income groups in order to more accurately calculate the amount of insurance premiums.

When calculating personal income tax, the company acts as a tax agent, and tax calculation obligations arise on the date of actual transfer to the employee; in our company, we reflect these tax amounts separately next to the salary line in the BDDR and BDDS.

Based on the results of all these calculations, information on individual taxes is generated into the general tax budget, which in turn is reflected in the BDR, BDDS.

If a company generates a report based on a balance sheet, then it is necessary to create registers for calculating permanent and temporary differences. We don't do this in our company.

If the obligation to pay tax must be fulfilled later than its accrual, then the tax accrual information (BDR) will fall on the current forecast period, and the payment information (BDDS) will go over to the period of fulfillment of the obligation. As indicated in the examples above, the moment of accrual and obligations tax payment is not the same, with the exception of personal income tax.

An important aspect of preparing a tax budget is predicting the occurrence of possible tax risks. From experience I can say that, as a rule, qualified chief accountants are aware of their tax risks. If an on-site tax audit is expected to be carried out in the forecast period, then in the budget forms adopted by the company, it is necessary to take into account the possible amounts of additional taxes, fines and penalties, or, if the company appeals the decisions of the tax authorities, then take this into account in the following forecast periods.

In a plan-fact analysis of budget execution, taxes can serve as a litmus test, since failure to meet targets for operating and investment activities will affect the amount of taxes payable.

But at the same time, it is necessary to clearly set the task of safe optimization to the employees responsible for executing the tax budget. Our company is gradually developing the habit of a more conscious approach to the opportunities offered by the Tax Code of the Russian Federation. To all publications

Calculation and transfer of insurance premiums to state extra-budgetary funds

Regional taxes and fees are those established by the Tax Code of the Russian Federation and the laws of the constituent entities of the Russian Federation, put into effect in accordance with the Tax Code of the Russian Federation by the laws of the constituent entities of the Russian Federation and obligatory for payment in the territories of the corresponding constituent entities of the Russian Federation. When establishing a regional tax, the legislative (representative) bodies of the constituent entities of the Russian Federation determine the following elements of taxation: tax rates within the limits established by the Tax Code of the Russian Federation, the procedure and deadlines for paying the tax, as well as reporting forms for this regional tax. Other elements of taxation are established by the Tax Code of the Russian Federation. When establishing a regional tax, the legislative (representative) bodies of the constituent entities of the Russian Federation may also provide for tax benefits and grounds for their use by the taxpayer.

The concept of “tax system” is broader than the concept of “system of taxes and fees”. The tax system is characterized not only by the system of taxes and fees, but also by the principles of its construction, enshrined in the essential conditions of taxation. The tax system is determined by the procedure for establishing, introducing, amending, canceling taxes and fees, the procedure for distributing taxes and fees between budgets of different levels, the rights and obligations of taxpayers (payers of fees), the organization of reporting and tax control, the responsibility of subjects of tax legal relations, etc.

INSURANCE TAX ESSS, RSV to the TAX INSPECTION OF THE FTS

Like regional taxes, local fees are established based on the provisions of federal legislation, and specific payment rates are regulated by local authorities.

Control over their completeness and timely payment, as in the case of other types of taxes, rests with the tax service departments. In addition to these taxes and fees, some local mandatory fees are of a specific nature, such as resort fees. There are also fees such as a tax on dog owners, on the resale of cars, computer equipment and components, fees for parking vehicles, for filming and video filming, for the right to use local symbols, for participation in races at hippodromes, and so on. All these payments go to local budgets.

https://www.youtube.com/watch?v=ytpress

Where are insurance premiums paid in 2019-2018? Contributions regulated by the Tax Code of the Russian Federation should be paid to the budget at the location of the taxpayer, and if he has separate structural units that calculate and pay wages, then at the location of such structural units. Payment documents, as before, are issued separately for the payment intended for each of the funds, but in accordance with the requirements valid for tax payments.

In November 2021, the Tax Code of the Russian Federation introduced a provision on the admissibility of paying tax payments for a third party. Since 2021, this possibility has also been applied to the payment of insurance premiums, which have begun to comply with the rules of the Tax Code of the Russian Federation. The payer status indicated for such payment must correspond to the status of the person for whom the payment is made.

payment of the insurance amount is made for pension, medical contributions, as well as contributions for insurance in case of temporary disability and in connection with maternity, the dates of the month following the month for which the payment is calculated are transferred. Thus, the monthly payment for January must be transferred no later than February 15, the payment for February - no later than March 15, etc.

This means that if gross violations of the rules for accounting for objects subject to insurance premiums result in an underestimation of the premium base, the policyholder faces a fine in the amount of unpaid insurance premiums, but not less than rubles. A gross violation is considered to be the absence of primary documents or accounting/tax registers, as well as systematic (twice or more times during a calendar year) untimely or incorrect reflection of transactions in accounting, tax accounting registers and reporting.

For insurance against injuries at work, contributions are transferred every month within the deadlines established for receiving wages from the bank for the previous month. When transferring contributions, the employer must not make mistakes in the BCC, in the name of the company and the bank. Otherwise, the obligation to make insurance payments will not be considered fulfilled.

Each employer must keep records for each employee individually. This is important not only from the point of view of the correct amounts of contributions to the funds. The employee must know how much the employer pays for him. This is due to the fact that the specified contribution rates apply to certain limits of the salary accrued to the employee.

Theoretically, a taxpayer engaged in several types of activities can apply two or even three tax regimes in parallel. But at the same time, he will need to keep separate records of income and expenses by type of activity, which will significantly add to the hassle.

Regional and local authorities are interested in creating a favorable tax climate in their territories: the lower the rates of regional and local taxes, the better the development of regional and local business and the more attractive their territory is for businessmen from other regions and from abroad. In the future, all this will lead to an increase in cash receipts to the regional and local budgets.

Taxes are credited to the budget of the appropriate level or state extra-budgetary funds and, as a rule, are depersonalized in them. This distinguishes taxes from fees that are levied for specific purposes or are a payment for providing the payer with any legally significant actions.

Budget institutions are required to make monthly advance payments. Based on the results of the reporting period, the difference is calculated between the amount of insurance premiums calculated on the basis of the base for calculating insurance premiums, determined from the beginning of the billing period, including the current reporting period, and the amount of advance payments paid for the reporting period.

All economic entities, in addition to taxes, are required to pay contributions to the Social Insurance Fund (FSS), the pension fund (hereinafter referred to as the Pension Fund) and compulsory health insurance (hereinafter referred to as the FFOMS) for themselves and for employees, if any. Today we will talk about tariffs for 2021 and find out if there are any changes in the new reporting period.

https://www.youtube.com/watch?v=https:tv.youtube.com

The procedure and deadlines for paying insurance premiums are established by Chapter 34 of the Tax Code of the Russian Federation. If in 2021 the deadline for paying insurance premiums falls on a weekend or non-working holiday, then the contributions must be transferred on the next working day. Such an indication is in paragraph 7 of Article 6.1 of the Tax Code of the Russian Federation.

For the month of July, employees of the State Budgetary Educational Institution DoD SDYUSSHOR "ALLUR" were accrued wages and vacation pay in the amount of 1,500,000 rubles. There are no non-taxable income in the accrued amount. Electricity taxation is carried out according to generally established tariffs. Let's calculate the amount of payments to the budget:

- during the billing (reporting) period based on the results of each calendar month;

- based on the amount of payments and other remunerations accrued from the beginning of the billing period until the end of the corresponding calendar month, and the tariffs of insurance premiums;

- minus the amounts of monthly mandatory payments calculated from the beginning of the billing period to the previous calendar month inclusive.

Contributions to the Compulsory Medical Insurance Fund are paid by any organization that has at least one legally employed employee. Due to the fact that the newly created organization must include a director of the company, it also submits reports on insurance premiums. However, there is a situation where a newly created organization is not yet engaged in any type of activity, does not receive income and does not pay wages to anyone, although there is a general director on the staff list. What to do in such a situation?

In 2021, insurance premiums must be paid at the following rates:

- For pension insurance (PIP) – 22%.

- For health insurance (CHI) – 5.1%.

- For social insurance (OSS) – 2.9% (excluding accident contributions).

At the same time, some individual entrepreneurs and organizations have the right to apply reduced tariffs (see table below).

In 2021, the limits for calculating contributions have changed:

- for OPS – RUB 1,150,000. (in case of excess, contributions are paid at a reduced rate - 10%);

- for OSS – 865,000 rubles. (if exceeded, contributions are no longer paid);

- for compulsory medical insurance – the limit has been abolished.

Please note that in 2021, benefits on insurance premiums were canceled for most individual entrepreneurs and organizations. In particular, this affected individual entrepreneurs with a patent, as well as representatives of SMEs working in the social and industrial spheres and using the simplified tax system. Reduced tariffs were left only for NGOs and charitable organizations. More details on insurance premium rates can be found in the table below.

| Payer category | OPS | Compulsory medical insurance | OSS | Total |

| Organizations and individual entrepreneurs on OSN, simplified tax system, UTII, PSN and Unified Agricultural Tax, with the exception of beneficiaries | 22% | 5,1% | 2,9% | 30% |

| If the limit of 865,000 rubles is exceeded | 22% | 5,1% | — | 27,1% |

| If the limit of 1,150,000 rubles is exceeded | 10% | 5,1% | — | 15,1% |

| Payer category | Pension Fund | FFOMS | FSS | Total |

| NPOs on the simplified tax system, conducting activities in the field of social services. services, science, education, healthcare, sports, culture and art | 20% | — | — | 20% |

| Charitable organizations on the simplified tax system | ||||

| Participants of the free economic zone in Crimea and Sevastopol | 6% | 0,1% | 1,5% | 7,6% |

| Organizations and individual entrepreneurs engaged in technical innovation and tourism and recreational activities in special economic zones | 20% | 5,1% | 2,9% | 28% |

| Business companies and partnerships operating in the field of IT technologies and meeting the conditions of paragraphs 1 and 2 of Art. 427 Tax Code of the Russian Federation | ||||

| Organizations that have received the status of a participant in the Skolkovo project | 14% | — | — | 14% |

| Organizations and individual entrepreneurs making payments to crew members of ships registered in the Russian International Register of Ships | — | — | — | 0% |

| Organizations in the field of IT (provided that the income from this activity at the end of 9 months is at least 90%, and the number of employees is at least 7 people | 8% | 4% | 2% | 14% |

Note: for beneficiaries, in case of exceeding the limits of 1,150,000 and 865,000 rubles. There is no need to make social and pension insurance contributions.

| Payer category | Pension Fund | FFOMS | FSS | Total |

| Payers specified in paragraphs. 1 clause 1 art. 419 of Law No. 400-FZ in relation to payments to individuals named in paragraph 1 of paragraph 1 of Art. 30 of this law | 9% | — | — | 9% |

| Payers specified in paragraphs. 1 clause 1 art. 419 of Law No. 400-FZ in relation to payments to individuals named in paragraphs 2-18 of paragraph 1 of Art. 30 of this law | 6% | — | — | 6% |

Note: additional contributions are paid regardless of the limits of 1,150,000 and 865,000. However, companies that have assessed working conditions can pay additional fees. contributions to pension insurance at special rates (clause 3 of Article 428 of the Tax Code of the Russian Federation).

The concept of “tax system” is broader than the concept of “system of taxes and fees”. The tax system is characterized not only by the system of taxes and fees, but also by the principles of its construction, enshrined in the essential conditions of taxation. The tax system is determined by the procedure for establishing, introducing, amending, canceling taxes and fees, the procedure for distributing taxes and fees between budgets of different levels, the rights and obligations of taxpayers (payers of fees), the organization of reporting and tax control, the responsibility of subjects of tax legal relations, etc.

Thirdly, from next year you will have to report to the Social Insurance Fund only on contributions “for injuries”. The deadlines for submission will be the same as for 4-FSS: in the case of electronic reporting - no later than the 25th day of the month following the reporting one, and in the case of “paper” reporting - no later than the 20th day of the month following the reporting one.

As now, policyholders with an average number of more than 25 people will be required to report electronically via the Internet, all others will be able to submit reports on paper (new edition of paragraph 1 of Article 24 of the Law on Compulsory Social Insurance against Accidents at Work).

- payment of insurance premiums established by the Tax Code of the Russian Federation;

- keeping records of objects subject to insurance premiums, the amounts of calculated insurance premiums for each individual in whose favor payments and other remuneration were made;

- submission to the tax authority at the place where insurance premium payments are recorded;

- submission to the tax authorities of documents necessary for the calculation and payment of insurance premiums;

- submission to the tax authorities, in cases and in the manner provided for by the Tax Code of the Russian Federation, information about insured persons in the individual (personalized) accounting system;

- ensuring for six years the safety of documents necessary for the calculation and payment of insurance premiums;

- notification to the tax authority at the location of the Russian organization that pays insurance premiums about vesting a separate division with the authority to accrue payments and rewards in favor of individuals within one month from the date of vesting it with the corresponding powers;

- other duties provided for by the legislation of the Russian Federation on taxes and fees.

- Organizations and individual entrepreneurs that pay remuneration to individuals under an employment contract and GPA;

- Individual entrepreneurs and other persons who work “for themselves” (notaries, appraisers, lawyers, etc.);

- Individuals not registered as individual entrepreneurs who pay remuneration to individuals.

Federal, regional and local taxes in 2021 - 2021

The effect of local taxes is regulated by the Tax Code of the Russian Federation and regulations drawn up at the municipal level. These taxes include land tax and personal property tax. And from 2021, a trade tax has been introduced into this group (law dated November 29, 2021 No. 382-FZ).

Regional taxes, which include transport tax, taxes on gambling and property of organizations, can be regulated both by the Tax Code of the Russian Federation and by laws issued by the authorities of the country's regions, in contrast to federal taxes. The laws of the constituent entities determine the meaning of rates, as well as the availability of certain benefits, specify the terms of payments and submission of declarations.

Background

Even a person far from taxation problems has heard that it is planned to switch from a personal property tax and land tax to a real estate tax.

Both the media and representatives of the Ministry of Finance spoke about this a lot. As stated in the Main Directions of Tax Policy of the Russian Federation for 2014 and for the planning period of 2015 and 2016 , approved by the Government of the Russian Federation on May 30, 2013 : a draft amendment to the draft Federal Law No. 51763‑4 “On Amendments to Part Two of the Tax Code” has now been prepared Code of the Russian Federation and some other legislative acts of the Russian Federation", providing for the inclusion of real estate tax in the tax system of the Russian Federation. We are talking about the very bill that eventually became Federal Law No. 284-FZ .

Federal Law No. 284-FZ was not born easily: it was introduced into the State Duma on May 11, 2004. And for 10 long years no decision was made on it. It was only in June 2014 that a new review began.

Let us note that while Federal Law No. 284-FZ has acquired its final form, it has changed radically, starting from the name and ending with the essence of the issue.

As stated in the explanatory note to this bill, it is aimed at creating tax conditions for the formation of an affordable housing market. The main purpose of the bill is to establish a local tax on residential property and determine the procedure for introducing this tax.

Initially, it was planned to introduce a tax for legal entities and individuals who are owners of residential real estate (apartments, residential buildings, dachas), garages owned by individuals, garages and garage-building cooperatives, homeowners' associations and other homeowners' associations, and also land plots on which the specified real estate objects are located or which are provided for their construction. This local property tax was supposed to replace for the relevant payers (individuals and legal entities) taxes on property of individuals, property of organizations and land tax in terms of taxation of established objects.

The establishment of a local real estate tax and the determination of its main elements by adopting the corresponding chapter of the Tax Code was supposed to ensure the implementation of real estate taxation reform throughout the Russian Federation through its gradual, as soon as it is ready, introduction by decisions of representative bodies of local self-government in the period before January 1, 2007.

The original version of the bill, presented at the first reading in the State Duma, provided for the addition of the Tax Code of the Russian Federation Ch. 31 “Local real estate tax” also included such a concept as “estimated value of real estate objects”; the objects of taxation included land plots on which real estate objects are located and allocated for the construction of these objects.

But by the second reading, which took place in 2014, the bill took on a form close to the one that was actually adopted. And instead of the local property tax, Chapter was introduced into the Tax Code of the Russian Federation. 32 “Property tax for individuals” .

In what budget is personal income tax for individuals credited in 2021?

- salary for official employment;

- payment for work performed under GPC contracts;

- dividends;

- insurance payments;

- income received from the disposal of property;

- income from the sale of real estate or other valuable assets;

- other income received from activities in Russia or abroad (for residents).

Personal income tax is one of the list of mandatory fees. The main purpose of such taxation is to replenish the state treasury. But to which budget will personal income tax be credited in 2021?

We recommend reading: Restrictions on withdrawing cash from a current account at VTB

Consolidated budget of the Russian Federation 2021 income and expenses (Table)

The consolidated budget of the Russian Federation is formed by the federal budget and the consolidated budgets of the constituent entities of the Russian Federation (without taking into account interbudgetary transfers between these budgets).

The consolidated budget of a constituent entity of the Russian Federation is formed by the budget of a constituent entity of the Russian Federation and the set of budgets of municipalities that are part of the constituent entity of the Russian Federation (without taking into account interbudgetary transfers between these budgets).

Budget revenues are funds received by the budget, with the exception of funds that, in accordance with the Budget Code of the Russian Federation, are sources of financing the budget deficit.

Budget expenditures are funds paid from the budget, with the exception of funds that, in accordance with the Budget Code of the Russian Federation, are sources of financing the budget deficit.

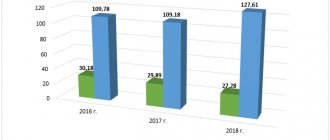

The graph below shows the surplus and deficit (-) of the consolidated and federal budgets of the Russian Federation (as a percentage of GDP).

Consolidated budget of the Russian Federation in 2021 table

Consolidated budget of the Russian Federation and budgets of state extra-budgetary funds in 2021, according to the Federal Treasury.

Values are given in billions of rubles.

| Budget income and expenses | Consolidated budget of the Russian Federation and budgets of state extra-budgetary funds | out of him: | |

| federal budget, billion rubles | consolidated budgets of the constituent entities of the Russian Federation | ||

| INCOME - total | 37320,3 | 19454,4 | 12392,5 |

| OF THEM: | |||

| corporate income tax | 4100,2 | 995,5 | 3104,7 |

| personal income tax | 3654,2 | — | 3654,2 |

| insurance contributions for compulsory social insurance | 7476,9 | — | — |

| Value added tax: | |||

| for goods (work, services) sold on the territory of the Russian Federation | 3574,8 | 3574,6 | 0,2 |

| for goods imported into the territory of the Russian Federation | 2442,2 | 2442,1 | 0,1 |

| excise taxes on excisable goods (products): | |||

| produced on the territory of the Russian Federation | 1493,2 | 860,7 | 632,4 |

| imported into the territory of the Russian Federation | 96,3 | 96,3 | 0,0 |

| taxes on gross income | 520,5 | — | 520,5 |

| property taxes | 1397,0 | — | 1397,0 |

| taxes, fees and regular payments for the use of natural resources | 6178,5 | 6106,9 | 71,6 |

| income from foreign economic activities | 3708,8 | 3708,8 | — |

| income from the use of property in state and municipal ownership | 1021,7 | 551,8 | 404,6 |

| payments for the use of natural resources | 376,2 | 344,4 | 31,7 |

| income from the provision of paid services (work) and compensation of state costs | 213,0 | 143,3 | 62,1 |

| income from the sale of tangible and intangible assets | 277,6 | 136,2 | 141,4 |

| gratuitous receipts | 126,7 | 53,4 | 2170,2 |

| COSTS - total | 34284,7 | 16713,0 | 11882,2 |

| OF THEM to: | |||

| national issues | 2131,6 | 1257,1 | 749,7 |

| national defense | 2828,4 | 2827,0 | 4,2 |

| national security and law enforcement | 2110,5 | 1971,6 | 139,6 |

| national economy | 4442,9 | 2402,1 | 2468,4 |

| from it to: | |||

| fuel and energy complex | 57,0 | 13,3 | 51,0 |

| agriculture and fishing | 365,8 | 225,7 | 273,6 |

| transport | 798,8 | 254,0 | 560,0 |

| road management (road funds) | 1607,3 | 704,0 | 1051,9 |

| communications and computer science | 143,9 | 47,9 | 97,6 |

| applied scientific research in the field of national economics | 186,9 | 185,9 | 0,9 |

| other issues in the field of national economics | 1076,2 | 829,0 | 330,2 |

| Department of Housing and Utilities | 1324,1 | 148,8 | 1213,5 |

| socio-cultural events | 20382,8 | 6089,0 | 7153,8 |

| servicing state and municipal debt | 916,1 | 806,0 | 111,4 |

| interbudgetary transfers of a general nature to the budgets of the budget system of the Russian Federation | — | 1095,4 | 0,4 |

| Shortage | 3035,6 | 2741,4 | 510,3 |

Consolidated budget of the Russian Federation in 2021

Consolidated budget of the Russian Federation and budgets of state extra-budgetary funds in 2021, according to the Federal Treasury.

Values are given in billions of rubles.

| Budget income and expenses | Consolidated budget of the Russian Federation and budgets of state extra-budgetary funds, billion rubles | out of him: | |

| federal budget, billion rubles | consolidated budgets of the constituent entities of the Russian Federation, billion. rubles | ||

| INCOME - total | 28181,5 | 13460,0 | 9923,8 |

| OF THEM: | |||

| corporate income tax | 2770,3 | 491,0 | 2279,3 |

| personal income tax | 3018,5 | — | 3018,5 |

| insurance contributions for compulsory social insurance | 6326,0 | — | — |

| Value added tax: | |||

| for goods (work, services) sold on the territory of the Russian Federation | 2657,7 | 2657,4 | 0,3 |

| for goods imported into the territory of the Russian Federation | 1913,7 | 1913,6 | 0,1 |

| excise taxes on excisable goods (products): | |||

| produced on the territory of the Russian Federation | 1293,9 | 632,2 | 661,7 |

| imported into the territory of the Russian Federation | 62,1 | 62,1 | — |

| taxes on gross income | 388,5 | — | 388,5 |

| property taxes | 1117,1 | — | 1117,1 |

| taxes, fees and regular payments for the use of natural resources | 2951,8 | 2883,0 | 68,9 |

| income from foreign economic activities | 2606,0 | 2606,0 | — |

| income from the use of property in state and municipal ownership | 1744,9 | 1283,4 | 379,7 |

| payments for the use of natural resources | 272,7 | 236,7 | 36,1 |

| income from the provision of paid services (work) and compensation of state costs | 200,0 | 142,4 | 49,9 |

| income from the sale of tangible and intangible assets | 211,4 | 88,6 | 122,8 |

| gratuitous receipts | 122,8 | 152,1 | 1634,5 |

| COSTS - total | 31323,7 | 16416,4 | 9936,4 |

| OF THEM to: | |||

| national issues | 1849,9 | 1095,6 | 625,0 |

| national defense | 3777,6 | 3775,3 | 4,7 |

| national security and law enforcement | 2011,4 | 1898,7 | 113,6 |

| national economy | 3889,8 | 2302,1 | 2002,5 |