Hello! In this article we will tell you why a 2-NDFL certificate is required at a new place of work.

Today you will learn:

- What data in the certificate is important for an accountant;

- In what cases is it not necessary to bring 2-NDFL to a new job;

- Differences between salary certificate and 2-NDFL.

Why do you need a 2-NDFL certificate for a new job?

When you leave your job and move to a new organization, you provide some documents for employment. The list of papers may also include a 2-NDFL certificate. It may be required by the accounting department. It is not always clear to employees why a new employer needs it.

The fact is that taxes are deducted for each employee. Personal income tax of 13% is deducted from your monthly earnings. The accounting department does this for you, and you receive in your hands the amount from which the obligatory payment to the tax office has already been deducted.

When paying personal income tax, there are certain deductions that reduce the tax base. That is, you have the right to pay tax not on the entire amount of earnings, but on the remainder after deduction. This discount is provided to some employees, and the amount depends on the preferential categories of citizens specified in the laws.

Deductions are calculated monthly until the amount of your earnings for the reporting year exceeds 350,000 rubles. As soon as this limit adds at least a ruble, deductions are no longer allowed. Then you will pay tax on all income.

In order for the accountant to figure out what deductions you used at your previous place of work and to view the total amount of your earnings for the reporting period, you must provide a 2-NDFL certificate. This way, the accounting department will be aware of your accruals and will be able to apply a deduction to you if it is due.

Features and deadlines for submitting a certificate to the tax office

Organizations that are tax agents (i.e., those that have hired employees) are generally required to submit 2-NDFL to the tax office at the location of the company no later than April 1 annually. The report confirms information about the employee’s income for the previous year, taking into account deducted and transferred income tax.

If the number of employees at the enterprise exceeds 10 people, then the organization is obliged to submit a report to the tax authorities via telecommunication channels (in electronic format through a secure connection with an electronic digital signature). Organizations with no more than 10 employees can submit data to the tax authorities on paper.

What deductions can you expect?

For officially employed employees, the state has developed a system of deductions that reduce the tax base and reduce the tax amount.

These include:

- 400 rubles – provided to everyone who has not worked since the beginning of the year (those who do not receive other deductions);

- 500 rubles – for persons involved in liquidation of the consequences of the Chernobyl accident, participants of the Second World War, disabled people of groups 1 and 2;

- 1400 rubles – for the first child and the second;

- 3000 rubles – for citizens who have received radiation exposure, as well as families with more than two children;

- 6000 rubles – for a disabled child.

Example: if your earnings are 20,000 rubles, then tax deductions will be: 20,000 * 13% = 2,600 rubles. You will receive 17,400 rubles in your hands. If a standard deduction of 400 rubles is applied to you, then the income will be: 20,000-(20,000-400)*13% = 17,452 rubles. Of course, the amount changed to only 52 rubles, but the higher the deduction, the more you get in your hands.

When a certificate is not needed

Not in all cases, a 2-NDFL is required for a new job.

It will not be needed if:

- You did not receive any income during the reporting period;

- You have not worked anywhere before;

- You do not claim any deductions;

- You started a new job on the first day of the year.

If you were not accrued any income at your previous place of employment, the new employer can still ask for a certificate. He needs to check the accuracy of your words. Even if 2-NDFL turns out to have empty lines, it is still taken into account. This means that you can count on all the deductions that are due to you.

If you do not have the right to reduce the tax base, then you are not required to bring a certificate. In this case, the accountant will not ask her.

When you are hired for a new position on the first working day of January, the reporting year begins for you in the new company. This means that it is the new employer who will provide you with deductions in the new year, and you do not need to bring a certificate.

“Fake” income certificate

Dmitry KOPYLOV, Dmitry SATIN

An employee of your company decided to take out a loan. But here’s the problem: the employee’s “white” salary does not meet the bank’s requirements. To obtain a certificate with large incomes, an employee can use not only requests, but also threats. And no matter what decision you make, you may be in trouble. If you issue a “fake” certificate, you can expose both yourself and the company. If you refuse, you will come into conflict with the employee.

Where might this come up?

First, let’s figure out when the fact of issuing a “false” certificate may come to light.

Almost every bank has its own security service. The task of its employees is to weed out future defaulters. A “white” salary will be an additional guarantee for the bank. After all, if the borrower does not repay the loan on time, the bank will try to persuade him for a couple of months, and then go to court. The defaulting borrower will pay the debt according to the writ of execution. But judges will only take into account “white” earnings. This means that the bank, if it gets its money, will not be soon enough. Therefore, bank employees try to check whether the income shown in the certificate corresponds to reality.

Igor Efimov, a security officer at one of the Moscow banks, told us how they do this: “If the loan amount is more than five thousand dollars, bank employees will most likely study the activities of the company where the potential borrower works. First, they will simply call you to check if the person needing the loan is actually your employee. They might even ask him to answer the phone. If the loan amount is large, bank employees may ask for a meeting with the company management. They will want to study your company's financial documents to understand how real your employee's income indicated in the certificate is. This could be a balance sheet, a profit and loss statement, payments under the Unified Social Tax, personal income tax, and account turnover. They can also ask for registration documents - from them they will find out how long the company has been operating. In addition, they will be interested in the company’s employment contract with the employee, which will also indicate the time of his work in the company. If the bank does not receive the necessary information, the company employee may be denied a loan.”

Please note that the security service does not always carry out such a strict check. Sometimes its employees limit themselves to a few calls to work, and after making sure that the company is real and the borrower really works there, they don’t “dig” any further. In this case, they most likely will not reveal the unreliability of the certificate. This means that the “fake” certificate will be used and the employee will receive a loan based on it.

What is the threat?

So everything will end well? - you ask. Yes, but only if your employee pays his obligations accurately. And, of course, no one can guarantee this.

“If the borrower does not pay the loan, the bank will sue him,” says Igor Efimov. – And at the trial, a certificate of income signed by you will definitely come up. This is where it turns out that your employee’s official income does not correspond to what is indicated in the certificate.”

In this case, you, as the chief accountant, may be fined under Article 292 “Official forgery” of the Criminal Code. The maximum penalty for this violation is imprisonment for two years. “True, for this, the judges must prove your personal interest,” lawyer Alexander Vekovishchev commented to us on this criminal article. “In this case, the judges may consider this to be, for example, friendly relations or gratitude.” But even if you are not convicted, the hassle of dealing with court cases will forever discourage you from issuing “fake” certificates.

Now imagine this situation: an employee was fired, no matter for what reasons. If at the same time he has not yet been paid part of his salary, the chances of a conflict increase. Such an employee may well sue, deciding to take revenge and get money from the company. And to prove his real salary, he can use a certificate issued for the bank. And on it is your signature and seal.

In addition, the “offended” employee can file a complaint with law enforcement agencies. By the way, both the injured bank and the judges can do the same. There is no need to describe the troubles that the police can cause. For an accountant, such a “knock” can result in a criminal case under Article 199 of the Criminal Code.

We charm our teeth

There is only one way to avoid all these problems: you need to convince the employee that he does not need a “fake” certificate at all. The following arguments can be used.

- Illegal receipt of a loan is punishable by law. Although the fine is small, only 1–2 thousand (Article 14.11 of the Administrative Code), the employee will have to pay this amount from his own pocket.

- A large salary amount on a certificate is not the only way to prove your creditworthiness. The bank will also take into account other income. For example, from part-time work, renting out an apartment, interest on deposits and others. Many banks also take into account the income of the “other half” of the borrower. If this is a valuable employee, you can use the promissory note scheme to increase his “white” income (read about it in the April issue of “Calculation” on page 80).

- Of course, a small salary amount will not allow the employee to receive a large loan amount. But only in one bank. Nothing prevents him from going to another one and taking out a loan there too. At the moment, banks do not have the ability to exchange information about loans issued with each other.

- Many banks also issue loans against “black” salaries. To do this, potential clients fill out multi-page questionnaires, according to which bank employees assess their social status and real creditworthiness.

- An employee can also confirm his income if he regularly transfers “black” money to the bank. For example, he puts them on his credit card. An account statement will confirm the employee's monthly income.

- If an employee fits the “Portrait of an Ideal Borrower” (see note), his chances of getting a decent loan increase.

Portrait of an ideal borrower

So, an employee’s chances of getting a loan will be higher if:

- He has a promising profession, a good track record, a position in a reputable company, and has a higher education. The bank will take this data into account first of all;

- He is 25–45 years old. The closer he is to retirement age, the shorter the loan period he will be given;

- He seems like a good family man and has children. It is generally accepted that such people will be more responsible in repaying the loan on time;

- He has substantial property: a car, an apartment, a dacha;

- He has ever taken out a loan and paid it off carefully. This is called a “positive credit history.”

Where is 2-NDFL issued?

If an accountant from a new place of duty requires you to bring a 2-NDFL certificate, you need to contact your former employer.

For these purposes you can:

- Leave a request by phone;

- Visit the accounting department in person.

The simplest option is when the employer and the head office for issuing certificates are located in the same city, or better yet, in the same building. In this case, you will not have any problems obtaining 2-NDFL.

It is prepared within three days and delivered to you. The validity period of the document is one month. If for some reason you did not have time to pick it up and provide it to a new accountant, it is considered overdue and is not subject to accounting. Then it will need to be issued again.

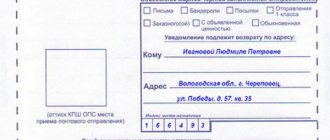

In large companies, certificates are often issued only at the head offices, which may be located in another region of the country. Here everything is much more complicated. To get a certificate, you need to go to the branch of your city and express your request to the manager. He will leave a request.

The certificate also takes three days to prepare, but it may arrive in a few weeks. It all depends on the speed of postal services. The main thing is to get it on time.

In what cases is 2-NDFL required?

The document contains information about the individual’s source of income and confirms the timely payment of taxes. This information may be needed in many situations. The most common:

- finding a new job;

- registration of tax deductions;

- pension calculation;

- obtaining a targeted housing loan;

- visa application;

- trial;

- determining the amount of alimony payments;

- registration of social benefits.

Almost all official authorities will accept an electronic version of the certificate downloaded from the website of the Federal Tax Service of the Russian Federation. An exception may be banks - to obtain a loan, most likely, you will need a paper document.

What is 2-NDFL?

The certificate is printed on A4 sheet and contains your data, including:

- FULL NAME.;

- Your tax number (TIN);

- Registration address;

- Lines with the amounts of income for each month starting from January (if you did not receive income, the lines will be empty. Your monthly earnings are taken into account here + all other transfers for sick leave, vacation, etc.);

- Applicable deductions and their size;

- The total amount of your income;

- Amount of tax paid.

This document may be needed not only in accounting, but also in:

- Tax office to obtain property deductions;

- To a credit institution to apply for a loan.

2-NDFL has a uniform design standard; no errors, amendments or inaccuracies are allowed.

In addition to information about the employee, it contains information about your former employer:

- Name;

- INN, OGRN.

Typically, such certificates do not contain any errors, since they are compiled on a computer with a specially installed program. But if you notice any incorrect data, then immediately bring this to the attention of the accountant from your previous place of duty. Otherwise, discrepancies in information will lead to invalidity of the document.

Confirmation of income when applying for a bank loan

For banks, the relevance of the information specified in the certificate is of great importance. Bankers need to make sure that the client currently has a source of stable income sufficient to repay the loan. Therefore, most financial institutions require proof of income for the last 6 months. There cannot be such data on the tax website. This is explained by the reporting deadlines established for employers. Data on employee income for the past year is transferred to the Federal Tax Service only at the beginning of April of the current year. And in users’ personal accounts, the received information is displayed even later - by June. Therefore, you will have to contact the accounting department to obtain a certificate to obtain a loan from a bank.

2-NDFL not for all occasions

Often, an organization may ask you to provide a certificate of income. It differs in content from 2-NDFL. The latter is intended specifically for studying your tax deductions. It can be used to determine how much taxable income you received during the reporting period.

But the certificates do not always contain information about such earnings from which the amount of payment to the tax office is debited. There is a document confirming only your income.

Example: women on maternity leave receive monthly benefits to care for their children. This income is not taxed. Therefore, no deductions are applied. Therefore, a 2-NDFL certificate is not needed here, since it reflects other information.

The salary certificate, unlike personal income tax, includes only monthly income amounts. It can be formed not only for the reporting year, but also for any period.

For example, you can request such a document for the last three months. This certificate is most often provided to social security authorities. It confirms that your income does not exceed the established limit and you are entitled to receive certain benefits from the government.